Market Analysis and Insights:

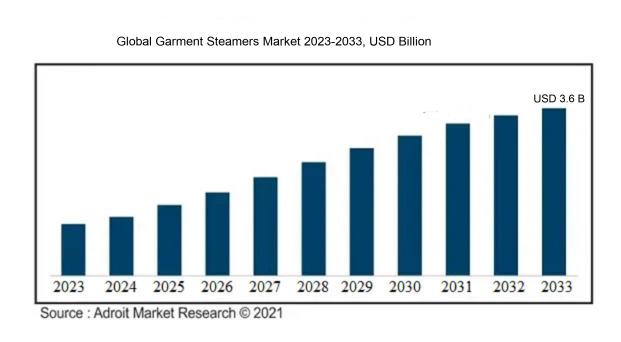

The market for Global Garment Steamers was estimated to be worth USD 2.1 billion in 2023, and from 2023 to 2033, it is anticipated to grow at a CAGR of 3.9%, with an expected value of USD 3.6 billion in 2033.

The growth of the garment steamers market is driven by a surge in consumer and professional demand for effective and efficient fabric care solutions. As people's lives become more hectic, there is a growing preference for swift and convenient cleaning options, which in turn enhances the appeal of steamers as an alternative to traditional ironing methods. Furthermore, increasing awareness of steam cleaning's advantages—such as its ability to remove bacteria and odors without relying on harsh chemicals—contributes significantly to market expansion. The textile sector's focus on preserving garment quality stimulates interest in steamers across multiple categories, including travel, home, and commercial applications. Technological advancements have resulted in the development of more compact, energy-efficient, and multifunctional steaming devices, attracting a wider audience. Additionally, the rise of e-commerce has simplified access to these products, strengthening their presence in the market. With an increasing emphasis on sustainability, consumers are also leaning towards steamers due to their lower energy usage compared to traditional ironing techniques.

Garment Steamers Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2020-2023 |

| Forecast Period | 2023-2033 |

| Study Period | 2022-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 3.6 billion |

| Growth Rate | CAGR of 3.9% during 2023-2033 |

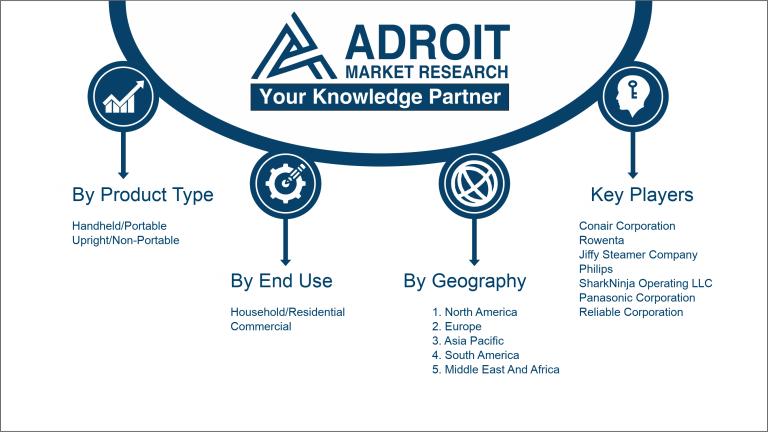

| Segment Covered | By Product Type, By End Use, By Power, By Water Tank Capacity, By Material, By Sales Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Conair Corporation, Rowenta, Jiffy Steamer Company, Philips, SharkNinja Operating LLC, Panasonic Corporation, Reliable Corporation, Electrolux AB, Sunbeam Products, Inc., Black+Decker, Bissell Homecare, Inc., Proctor Silex, Steamfast, and Tefal, which is a division of Groupe SEB. |

Market Definition

Garment steamers are portable or standing appliances that release steam to eliminate creases from textiles. These devices offer a practical substitute for conventional ironing, typically engineered for swift and effective clothing maintenance.

Garment steamers are essential in contemporary clothing maintenance, offering a practical and efficient method for eliminating wrinkles and revitalizing fabrics without the potential harm that traditional irons may cause. Their design prioritizes ease of use and portability, making them perfect for swift touch-ups at home or on the go. In addition to wrinkle removal, steamers are effective at removing odors and bacteria, promoting better garment hygiene. Their adaptability allows for use on a variety of materials, including delicate fabrics that could be damaged by direct heat. Ultimately, garment steamers contribute to both the lifespan and visual appeal of clothing, solidifying their status as a vital addition to any wardrobe.

Key Market Segmentation:

Insights On Key Product Type

Handheld/Portable

Handheld or portable garment steamers are expected to dominate the Global Garment Steamers Market due to their convenience, ease of use, and growing consumer preference for compact appliances. These devices are perfect for modern lifestyles, as they allow users to quickly freshen up clothes on the go—ideal for business travelers and busy individuals. The increasing trend towards minimalism and smaller living spaces has also boosted demand for lightweight, portable solutions that deliver effective results without taking up much space. Additionally, advancements in technology and design have enhanced their performance, making them a preferred choice for consumers seeking efficiency without compromising quality.

Upright/Non-Portable

Upright or non-portable garment steamers serve a different niche in the market, appealing mainly to households and businesses that prioritize efficiency in larger-scale garment care. They generally offer more powerful steam output and can accommodate a greater volume of clothing, making them suitable for daily use in settings such as retail or dry-cleaning establishments. Their ability to handle heavier fabrics and massive quantities of garments positions them favorably for large-scale operations and ensures a high return on investment in commercial applications. However, their bulkiness may limit their appeal for personal use in smaller living spaces.

Insights On Key End Use

Commercial

The commercial of the Global Garment Steamers Market is expected to dominate due to the increasing demand from retail and hospitality industries. Businesses such as hotels, dry cleaners, and clothing retailers are adopting garment steamers for their efficiency and ability to provide quick, high-quality results in garment care. The rise in fashion trends, coupled with the expansion of online shopping, has led to an increased need for professional garment care solutions. Additionally, the emphasis on presentation in commercial settings drives up the necessity for effective steaming solutions that enhance the aesthetic appeal of garments. As a result, commercial applications are becoming pivotal in propelling market growth.

Household/Residential

The household/residential sector is characterized by the growing trend towards convenience and ease of use among consumers. Many households are increasingly opting for garment steamers over traditional irons due to their ability to quickly smooth wrinkles without the hassle of setting up an ironing board. This inclination is particularly evident among busy professionals and families seeking efficient solutions for garment care. Product innovations, such as compact and portable designs, are also appealing to consumers with limited storage space, further contributing to the demand within this. Moreover, the rise of fashion consciousness among individuals elevates the presence of garment care products in the home environment.

Insights On Key Power

1000-1300 Watt

The 1000-1300 Watt category is expected to dominate the Global Garment Steamers Market due to its optimal balance between power efficiency and steam output. This range provides sufficient heating capabilities for effective garment steaming without excessive energy consumption. Consumers often favor this power band as it meets diverse needs, whether for regular home use or professional settings. The convenience in handling and the versatility of functioning at this wattage further contribute to its popularity among both casual users and businesses that require reliable steaming solutions. As such, product innovation in this range can lead to significant market traction.

Below 730 Watt

The Below 730 Watt category appeals primarily to consumers looking for lightweight and portable solutions. These models tend to be more affordable and are suitable for those engaging in light steaming tasks or frequent travelers. While this range caters to a niche market that values portability, it often lacks the steam power needed for heavy-duty or extensive garment preparation. Consequently, although popular for certain user profiles, its overall market share remains limited compared to more powerful options.

730-1000 Watt

The 730-1000 Watt category offers a middle ground for users who desire more steam output than the lower range, yet prefer to maintain energy efficiency. Products in this range are often recognized for their compact design and adequate steaming capabilities, making them ideal for casual users and smaller households. However, the limited power may not satisfy users seeking a more robust garment care solution, thus inhibiting wider adoption in commercial or professional sectors.

1300-2300 Watt

The 1300-2300 Watt category is generally favored in commercial settings or by users needing fast and efficient steaming for multiple garments. These steamers offer high steam pressure and output, enabling quick wrinkle removal and efficient fabric care. However, their higher energy consumption and bulkier design may deter some consumers focused on portability and energy efficiency for personal use. As a result, while suitable for specific markets, the adoption rate in the consumer market is somewhat moderated.

2300 Watt & above

The 2300 Watt and above category is specifically tailored for professional or industrial-grade use. This range delivers exceptional steam pressure and speed, making it indispensable for businesses such as dry cleaners or hotels where garment care is a high-volume task. Despite its powerful capabilities, these products are often overkill for household needs, limiting their appeal to average consumers. Consequently, while they hold significant value in specialized markets, their overall presence in the broader consumer market remains relatively limited.

Insights On Key Water Tank Capacity

1-2 Litre

The 1-2 Litre capacity option is expected to dominate the Global Garment Steamers Market owing to its optimal balance between size, convenience, and performance. Users typically prefer steamers that can hold enough water for prolonged use without frequent refills, and a 1-2 litre tank meets this requirement effectively. This capacity allows for effective steaming of garments while remaining portable, making it an attractive choice for both home users and travelers. Additionally, the increasing trend of urban living and smaller living spaces makes this size advantageous as it doesn't require excessive storage space while still providing ample steam duration, driving demand in various consumer s.

Below 300 ml

Garment steamers with a water tank capacity below 300 ml cater primarily to specific consumer needs such as portability and quick use. These models are ideal for travelers or those who need to refresh clothes quickly and do not require extended steam sessions. However, their limited capacity often restricts prolonged usage, making them less practical for regular home use. As a result, this category may experience steady demand among niche markets but lacks the comprehensive utility needed for dominating positions in everyday garment steaming.

300-1 Litre

The 300-1 litre capacity range serves as an entry-level option for many consumers, striking a balance between portability and functionality. These units offer adequate steam duration for quick pressing and are often seen as ideal for light use or smaller households. However, they may not suffice for consumers looking for deeper cleaning and extended steaming sessions, limiting their overall appeal. Their affordability can attract budget-conscious buyers, yet they still lag behind larger capacities in meeting diverse consumer needs.

2-3 Litre

The 2-3 litre category is positioned for users requiring a more robust option for steaming garments, especially for larger households or those needing to refresh multiple outfits at once. This capacity allows for extended steaming periods without frequent refills. However, the trade-off in size makes them less portable, which may deter customers seeking convenience and travel-friendly solutions. Therefore, while there is a market for these units among specific consumer groups, they do not dominate due to their bulkiness relative to other choices.

3-4 Litre

Models with a 3-4 litre capacity generally appeal to professional or high-usage environments such as boutiques or laundries. These provide prolonged steaming time and efficiency for bulk steaming tasks, making them suitable for commercial applications. However, their size and weight can be significant drawbacks for everyday consumers, limiting their market presence primarily to professional settings. While effective for particular uses, they do not resonate well with the average consumer market looking for a balance between practicality and capability.

4 Litre & above

Garment steamers with a capacity of 4 litres and above cater mainly to large-scale operations or specialized commercial settings where frequent heavy-duty steaming is necessary. This capacity ensures minimal downtime due to fewer refills and accommodates large volumes of garments efficiently. However, the substantial size and weight of these units make them impractical for home use and casual consumers. Thus, while they play a critical role in specific sectors, their niche applicability contributes to their limited dominance in the broader consumer market.

Insights On Key Material

Plastic

Plastic is expected to dominate the Global Garment Steamers Market due to its lightweight, durability, and cost-effectiveness. The majority of garment steamers incorporate plastic components, which are essential for housing and external parts where reducing weight is crucial for user-friendliness. Furthermore, advancements in plastic technology enhance its heat resistance properties, making it suitable for high-temperature applications such as steam generation. With the consumer trend towards portable and easy-to-use steamers, the flexible manufacturing processes associated with plastics provide manufacturers with an edge in producing innovative and versatile designs. Sustainable improvements in plastic materials also align with growing eco-conscious consumer behavior, further solidifying its leading role in this market.

Metal

Metal components, particularly aluminum and stainless steel, are integral to the sturdiness and effectiveness of garment steamers. They are commonly used in the essential parts like the steam plate and internal frameworks where robustness and heat retention are essential. Metal provides durability and boosts the appliance's professional appeal, making it a preferred choice for users expecting higher performance. Although metal is heavier than plastic, its ability to provide efficient steam distribution makes it an attractive option for high-end models. As a result, it captures a significant market share, particularly among professional users and consumers interested in long-lasting products.

Antilock Braking System (ABS)

ABS is primarily recognized for its applications in automotive manufacturing; however, its reduced weight, strength, and resistance to impact make it useful in garment steamer production. Steamers with ABS components tend to be more affordable while still maintaining a level of sturdiness. The prominence of ABS in entry-level steamers appeals to budget-conscious consumers seeking basic functionality. The lightweight nature of ABS also makes these steamers easy to maneuver, appealing to users desiring portability, thereby carving out a niche market leaning towards economical choices without significantly sacrificing quality.

Aluminium

Aluminum components are sought after for their lightweight properties and excellent thermal conductivity. In garment steamers, aluminum is often found in steam plates due to its ability to heat up quickly and distribute steam evenly across fabrics. While it competes closely with plastic for some applications, aluminum’s strength allows it to withstand higher temperatures, making it a popular choice for high-performance models. The use of aluminum can also appeal to consumers who prioritize speed and efficiency in fabric care, especially for those needing to iron smoothly and quickly, which can set brands apart in a crowded market.

Stainless Steel

Stainless steel is often favored for high-end garment steamers due to its durability, resistance to rust and corrosion, and ability to withstand prolonged exposure to heat. It is commonly used in the steam plate and inner components for professional-grade models, appealing to consumers looking for longevity and performance. Although heavier than plastic or aluminum, the quality perception associated with stainless steel can justify a higher price point, making it a preferred material for both consumers and brands targeting premium markets. Additionally, consumers concerned with hygiene appreciate stainless steel's easy cleaning and maintenance.

Cast Iron

Cast iron is less common in the garment steamer market compared to other materials, primarily due to its weight and slower heating properties. Nevertheless, some high-end steamers utilize cast iron in specific sections for its heat retention capabilities, which contribute to strong steam production. Consumers seeking traditional or high-performance ironing experiences may still find cast iron an attractive option for certain niche models. While it holds a smaller market share, it caters to a specialized consumer focused on exceptional fabric care qualities associated with heavier, more durable materials.

Ceramic

Ceramic materials are often utilized for their excellent heat distribution properties, making them suitable for steam plates and other internal components. While significantly present in other appliances, their use in garment steamers is more limited. However, products with ceramic coating tend to garner consumer attention due to non-stick qualities that allow fabrics to glide smoothly without snagging. Despite their advantages, ceramic components are often reserved for premium or specialized products, creating a smaller product category that targets an audience interested in advanced fabric care solutions that enhance user experience and convenience.

Insights On Key Sales Channel

Direct

The Direct sales channel is expected to dominate the Global Garment Steamers Market due to its ability to establish a direct relationship with consumers, allowing for better customer service and feedback. This approach enables manufacturers to showcase their products in a more controlled environment, enhancing brand loyalty and customer trust. Furthermore, the rise of e-commerce has facilitated direct sales, allowing brands to reach consumers directly through online platforms, leading to higher margins and reduced costs associated with intermediaries. The accessibility and convenience offered by direct sales channels are pivotal in meeting the growing consumer demand for garment steamers, thereby positioning this channel for dominance in this market.

Indirect

The Indirect sales channel, while not expected to dominate, still plays a crucial role in the Global Garment Steamers Market. Retailers, distributors, and online marketplaces serve as intermediaries that can provide extensive market reach and access to a broader audience. This method benefits smaller brands that may lack the resources for direct sales and helps traditional retail outlets maintain their relevance in an increasingly digital marketplace. By being part of established networks, companies can leverage existing relationships, driving sales through multiple consumer touchpoints.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is anticipated to dominate the Global Garment Steamers market, driven by rising disposable income, an increase in the middle-class population, and growing urbanization. The burgeoning fashion industry and a shift towards convenience in garment care amongst consumers in countries like China, India, and Japan contribute to the region's dominance. Moreover, the rapid expansion of e-commerce and retail infrastructure enhances market access and affordability, further boosting the adoption of garment steamers. Additionally, increasing awareness of garment care and maintenance is propelling demand, making Asia Pacific the leading region for garment steamer sales.

North America

North America is experiencing steady growth in the garment steamers market due to a strong demand for high-quality home appliances. The region's consumers prioritize innovative and user-friendly products, leading to an increased focus on advanced steamers with multifunctional capabilities. Additionally, the rising trend of online shopping provides consumers with access to a wider range of garment care solutions. Despite the dominance of Asia Pacific, North America remains a lucrative market, with brand loyalty and premium products driving sales.

Europe

In Europe, the garment steamers market is characterized by a focus on sustainability and energy-efficient appliances. Consumers are increasingly aware of environmental impact and are gravitating towards products that promote eco-friendliness. The high standard of living and aesthetic value placed on apparel in countries like Italy and France further push the demand for garment care solutions. The European market remains competitive, with brands frequently innovating to meet consumer preferences for both style and functionality.

Latin America

Latin America's garment steamers market is on an upward trajectory, largely influenced by the growing fashion sense among consumers and an increase in formal garment usage. With the expansion of retail outlets and greater availability of consumer goods, more individuals are looking for safe and efficient ways to maintain their clothing. However, the market is still relatively nascent compared to Asia Pacific, and manufacturers are focusing on improving accessibility and affordability to drive adoption across diverse socio-economic s.

Middle East & Africa

The Middle East & Africa region shows potential for growth in the garment steamers market, influenced by a rising population and increasing urbanization. However, the market remains relatively underdeveloped due to limited consumer awareness and the high cost of household appliances. Education about garment maintenance and the benefits of steamers is essential for stimulating demand. As the region continues to modernize and develop its retail infrastructure, opportunities for growth will likely expand, although it currently lags behind other regions.

Company Profiles:

Prominent participants in the worldwide Garment Steamers market, such as producers and suppliers, propel innovation and advance product development. They also enhance their distribution channels to satisfy increasing consumer needs. By partnering with retailers and prioritizing sustainability efforts, they significantly impact market expansion and consumer choices.

The principal companies in the garment steamer industry consist of Conair Corporation, Rowenta, Jiffy Steamer Company, Philips, SharkNinja Operating LLC, Panasonic Corporation, Reliable Corporation, Electrolux AB, Sunbeam Products, Inc., Black+Decker, Bissell Homecare, Inc., Proctor Silex, Steamfast, and Tefal, which is a division of Groupe SEB. Additional prominent players include Maytag, Hamilton Beach Brands Holding Company, Braun, and Karcher.

COVID-19 Impact and Market Status:

The Covid-19 pandemic caused considerable upheaval in the worldwide garment steamers industry, resulting in reduced consumer demand as lockdown measures were implemented and priorities shifted towards essential goods over non-essential purchases.

The garment steamers market underwent considerable changes due to the COVID-19 pandemic, with lockdowns and shifts in consumer behaviors being primary factors. At the onset, production was hindered by disruptions in manufacturing and supply chains, leading to a significant decrease in the availability of steamers across numerous markets. As remote work became the norm and online meetings surged, there was an increased interest in maintaining a well-groomed appearance, thereby boosting the demand for garment care tools. Furthermore, the ened focus on cleanliness and sanitation highlighted the effectiveness of steamers in eliminating germs and viruses, thus increasing their perceived importance. As economies began to reopen, e-commerce emerged as a vital sales avenue, with consumers opting for online purchasing to reduce their risk of exposure. Additionally, the growing popularity of casual attire shifted market preferences, prompting customers to seek adaptable and easy-to-use cleaning solutions. As the market continues to stabilize in the post-pandemic landscape, these shifting trends are expected to play a key role in the future expansion of the garment steamers industry.

Latest Trends and Innovation:

- In June 2023, Rowenta announced the launch of its new steam iron technology that incorporates a high-precision steam delivery system, providing a more efficient and effective steaming experience for garment care.

- In September 2023, SharkNinja acquired the garment steamer brand, ZOZ, expanding its portfolio in the home appliance sector and enhancing its capabilities in fabric care innovation.

- In August 2023, Black+Decker unveiled a multi-functional garment steamer that combines steaming and ironing capabilities. The product aims to attract consumers looking for versatile home care solutions.

- In March 2023, Conair introduced a new line of garment steamers featuring a compact design and advanced nozzle technology, improving portability and steam distribution for targeted garment care.

- In July 2023, Philips announced its partnership with the textile industry to develop smart garment care solutions that utilize IoT technology, with plans for a pilot launch of connected steamers in 2024.

- In October 2023, Bissell expanded its garment care line by launching an eco-friendly garment steamer made with sustainable materials, responding to the increasing consumer demand for environmentally friendly home products.

- In February 2023, Rowenta received an award for its innovative steam technology that enables quick heating and powerful steam output, solidifying its position as a leader in the garment care market.

Significant Growth Factors:

The expansion of the garment steamers industry is fueled by a rising consumer preference for swift and effective clothing care options, ened awareness regarding the upkeep of fabrics, and an increasing inclination towards household convenience devices.

The market for garment steamers is witnessing remarkable expansion, driven by several significant trends. Firstly, the surge in urban living and fast-paced lifestyles has amplified the need for efficient home appliances, with garment steamers offering a rapid alternative for eliminating wrinkles compared to conventional ironing methods. In addition, ened awareness regarding fabric upkeep and preservation is incentivizing consumers to choose steamers, which are generally gentler on textiles than traditional irons.

Technological advancements, such as the development of portable and multifunctional steamers, are further enhancing this market, catering to both home users and travelers alike. The growing prominence of e-commerce and online retail has made these products more accessible, with various brands implementing targeted marketing strategies aimed at appealing to younger demographics.

Moreover, the shift towards environmentally friendly options is becoming a significant factor, as garment steamers typically consume less water and utilize no chemical agents, resonating with the increasing demand for sustainable choices. Finally, the dynamic nature of fashion trends has catalyzed the need for regular garment maintenance, reinforcing the significance of steamers within contemporary households. Together, these elements are driving robust growth in the garment steamer market in the foreseeable future.

Restraining Factors:

Significant challenges in the garment steamer industry stem from intense rivalry with conventional ironing techniques, along with diverse consumer attitudes towards clothing maintenance.

The Garment Steamers Market is confronted with various challenges that could impede its growth. One significant factor is the competition from conventional ironing methods and well-established iron appliances, as many consumers favor traditional irons due to their rapid heating capabilities and familiarity. Additionally, the comparatively higher price of garment steamers may deter budget-minded shoppers, particularly in regions where cost-effective clothing maintenance is prioritized. Concerns regarding the efficacy of steamers on specific fabric types and the potential difficulty in mastering their use can further undermine consumer confidence and willingness to adopt these products. The market also faces saturation issues, especially in developed markets, where an increasingly discerning customer base may lead to slower sales growth. Moreover, rising environmental considerations relating to water usage and energy consumption in garment steamers might diminish their attractiveness, given the growing emphasis on sustainability. Nevertheless, the rising popularity of casual wear and travel-friendly clothing, alongside a ened awareness of fashion, presents significant avenues for innovation and market growth. As consumers continue to look for effective and convenient garment care options, the industry is well-positioned for advancement through technological innovations and diversified product offerings.

Key Segments of the Garment Steamers Market

By Product Type:

- Handheld/Portable

- Upright/Non-Portable

By End Use:

- Household/Residential

- Commercial

By Power:

- Below 730 Watt

- 730-1000 Watt

- 1000-1300 Watt

- 1300-2300 Watt

- 2300 Watt & above

By Water Tank Capacity:

- Below 300 ml

- 300-1 Litre

- 1-2 Litre

- 2-3 Litre

- 3-4 Litre

- 4 Litre & above

By Material:

- Plastic

- Metal

- Antilock Braking System (ABS)

- Aluminium

- Stainless Steel

- Cast Iron

- Ceramic

By Sales Channel:

- Direct

- Indirect

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America