Market Analysis and Insights:

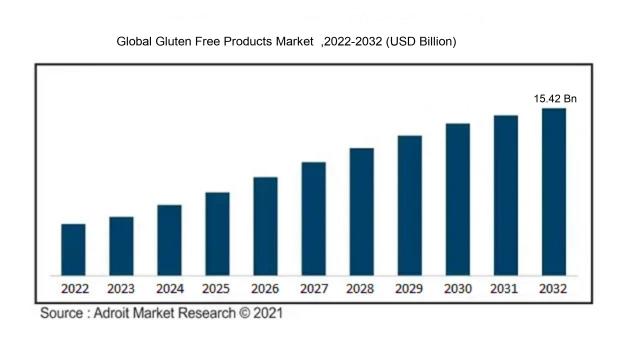

The market for Gluten Free Products was estimated to be worth USD 7.1 billion in 2023, and from 2023 to 2032, it is anticipated to grow at a CAGR of 9.2%, with an expected value of USD 15.42 billion in 2032.

The market for gluten-free products has experienced notable growth in recent years due to several significant factors. A primary driver has been the ened awareness and diagnosis of gluten intolerance and celiac disease, resulting in an increased demand for gluten-free alternatives. Additionally, there is a growing emphasis on healthy eating, with many individuals perceiving gluten-free options as a healthier choice. The impact of social media and digital platforms has also been instrumental in popularizing gluten-free diets and products, generating greater consumer interest. Furthermore, the range and availability of gluten-free products have expanded, with food manufacturers and retailers offering a broader selection. This enhanced variety has made it simpler for individuals with gluten sensitivity or those opting for a gluten-free diet to find suitable choices. Lastly, the proliferation of distribution channels, such as online retailers and specialty stores, has further propelled the growth of the gluten-free market, making these products more widely accessible to a diverse consumer population.

Gluten Free Products Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 15.42 billion |

| Growth Rate | CAGR of 9.2% during 2023-2032 |

| Segment Covered | By Source, By Distribution Channel, By Type, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | General Mills Inc., The Hain Celestial Group Inc., Kellogg Company, Pinnacle Foods Inc., Hero Group AG, Freedom Foods Group Ltd., Enjoy Life Foods LLC, Boulder Brands Inc., Aleia's Gluten Free Foods LLC, and Bob's Red Mill Natural Foods Inc. |

Market Definition

Gluten-free items are food products that are free of gluten, a protein present in wheat, barley, and rye. These items are ideal for people with gluten-related conditions or those opting for a gluten-free diet for health purposes.

Gluten-free items hold significant importance for a variety of reasons. Primarily, gluten intolerance and celiac disease impact a substantial portion of the global population, resulting in adverse effects upon consuming gluten, which is commonly found in wheat, barley, and rye. By providing gluten-free options, individuals with these conditions can enjoy a broad spectrum of food choices without concerns about digestive issues or other related health complications. Moreover, gluten-free products are increasingly popular among individuals following a gluten-free diet for diverse health considerations or personal preferences. This surge in demand for gluten-free items has led to improved accessibility and a wider array of choices in the market. Additionally, the availability of gluten-free products enables individuals to sustain a well-rounded and diverse dietary intake, mitigating the potential for nutrient deficiencies linked to limited food selections. In essence, the significance of gluten-free products lies in their capacity to cater to the needs and desires of individuals with gluten intolerance and those opting for a gluten-free lifestyle, thereby fostering inclusivity and dietary variety.

Key Market Segmentation:

Insights On Key Source

Plant Source

The plant source is expected to dominate the Global Gluten Free Products Market. This is primarily due to the growing consumer preference for plant-based diets and the increasing awareness of the health benefits associated with plant-based ingredients. Plant sources such as rice, corn, soy, quinoa, and almond have gained popularity as alternatives to gluten-containing grains like wheat, barley, and rye. Moreover, advancements in food processing technologies have allowed for the development of innovative plant-based ingredients and products that closely mimic the taste and texture of gluten-containing foods. As a result, the plant source is projected to experience significant growth and dominate the Global Gluten Free Products Market.

Animal Source

While the plant source is poised to dominate the market, the animal source is also expected to play a significant role in the Global Gluten Free Products Market. Animal source ingredients, such as eggs and dairy products, are naturally gluten-free and are widely used in both traditional and gluten-free food products. These ingredients provide unique textures, tastes, and nutritional profiles that cannot be replicated by plant-based alternatives.

Therefore, although the animal source may not dominate the market like the plant source , it will continue to hold a substantial market share due to its versatility and consumer preference for animal-based products.

Insights On Key Distribution Channel

Specialty Stores

Specialty Stores are expected to dominate the Global Gluten Free Products Market. These stores cater specifically to niche markets and often carry a wide range of specialty and specialized products, including gluten-free options. They typically offer a dedicated section or aisle dedicated to gluten-free products, making it easier for consumers seeking such products to find them. Specialty stores typically have knowledgeable staff who can provide guidance and recommendations to consumers, enhancing the shopping experience. Additionally, these stores often have stronger relationships with gluten-free product manufacturers and suppliers, ensuring a consistent supply and variety of gluten-free products. Overall, the focus and expertise of specialty stores in providing gluten-free options position them to dominate the market.

Convenience Stores

Convenience stores are also an important distribution channel for gluten-free products but are not expected to dominate the Global Gluten Free Products Market. While these stores provide convenient access to a variety of products, including some gluten-free options, their primary focus is on providing quick and accessible goods for on-the-go consumers. Convenience stores may carry a limited selection of gluten-free products, often focused on snacks, beverages, and ready-to-eat items. However, due to space limitations and a wider range of products, they may not have the same breadth and depth of gluten-free options as specialty stores. Nonetheless, convenience stores still play a significant role in ensuring accessibility to gluten-free products for consumers seeking convenience and immediate availability.

Drugstores & Pharmacies

Drugstores and pharmacies are also an important distribution channel for gluten-free products, but they are not expected to dominate the Global Gluten Free Products Market. These establishments primarily focus on health and wellness products, including over-the-counter medications, personal care items, and health-related supplements. While they may carry a limited range of gluten-free products, especially those related to dietary and nutritional needs, their main offerings may not be as diverse or comprehensive as specialty stores. Furthermore, drugstores and pharmacies tend to prioritize convenience and affordability, potentially leading to a narrower selection of gluten-free products. Nonetheless, they provide a valuable distribution channel for consumers seeking specific gluten-free options amidst their general health and wellness shopping.

Insights On Key Type

Snacks & RTE Products

Snacks and RTE products are anticipated to rule the global gluten-free products market among other categories.Snacks and ready-to-eat (RTE) products have gained popularity in recent years due to their convenience and on-the-go consumption. As consumers increasingly seek gluten-free alternatives, snacks and RTE products offer a wide range of options that cater to their dietary requirements. The demand for gluten-free snacks and RTE products has been driven by the rising number of individuals with gluten intolerance or sensitivity, as well as the growing trend towards healthier lifestyles. This is likely to dominate the market due to its versatility, wide product range, and increasing consumer demand.

Bakery Products

Bakery products are one more noticeable within the Global Gluten Free Products Market. As gluten is commonly found in wheat-based bakery products, the demand for gluten-free alternatives has increased. Individuals with gluten intolerance or celiac disease often look for gluten-free bakery products that can replace traditional bread, cakes, pastries, and other baked goods. The increasing awareness about the health benefits of a gluten-free diet has also contributed to the growth of this . Gluten-free bakery products offer options for individuals looking for healthier alternatives and have a strong presence in the market.

Pizzas & Pastas

Pizzas and pastas have long been staple food items with widespread popularity. In recent years, the demand for gluten-free options in this has grown significantly. As gluten is typically found in the dough used to make pizzas and pastas, gluten-free alternatives have emerged to cater to individuals with gluten intolerance or those who simply prefer a gluten-free diet. The availability of gluten-free pizza crusts, pasta noodles, and sauces has expanded, allowing consumers to enjoy their favorite dishes without compromising on taste or dietary needs. While pizzas and pastas are a significant of the market, they may not dominate as strongly as snacks and bakery products. Condiments & Dressings, Seasonings & Spreads, Desserts & Ice Creams, Rice, and Others

The remaining parts, including condiments & dressings, seasonings & spreads, desserts & ice creams, rice, and others, are also important s of the Global Gluten Free Products Market but are not expected to dominate like Snacks & RTE Products. These s cater to specific dietary preferences and have a dedicated consumer base. Condiments and dressings, including gluten-free sauces and salad dressings, provide flavor-enhancing options for individuals on a gluten-free diet. Seasonings and spreads, such as gluten-free spices and nut butters, offer variety and taste. Gluten-free desserts, ice creams, and rice products also provide alternatives for those with gluten intolerance. While these s contribute to the overall market, they may not dominate due to the strong presence of snacks and RTE products and bakery items.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Gluten Free Products market. The region is witnessing a growing demand for gluten-free products due to the increasing awareness about gluten intolerance and celiac disease among consumers. There is also a rising trend of adopting a healthier lifestyle, leading to a higher preference for gluten-free food options. Additionally, the presence of established players in the market and the availability of a wide range of gluten-free products contribute to the dominance of Europe in the global market. The region has well-developed distribution channels, ensuring easy access to gluten-free products for consumers. Moreover, stringent regulations and standards related to food labeling and gluten-content further drive the growth of the gluten-free products market in Europe.

North America

In North America, the gluten-free products market is expected to witness significant growth. The region boasts a large population affected by gluten-related disorders and an increasing number of consumers opting for gluten-free diets as a of their healthy lifestyle choices. Moreover, consumers in North America are becoming more health-conscious and are willing to pay a premium for gluten-free products. The region also has a well-developed food industry that offers a wide variety of gluten-free alternatives in the market. The presence of major players and the availability of gluten-free products in various retail channels further contribute to the growth of this market in North America.

Asia Pacific

Asia Pacific is also showing promising growth potential in the gluten-free products market. The region has a growing population suffering from gluten-related disorders, and there is a rising awareness about gluten intolerance among consumers. Changing dietary patterns, urbanization, and the influence of Western food habits are driving the demand for gluten-free products in the region. However, the market is still relatively nascent in Asia Pacific compared to other regions, and the availability of a diverse range of gluten-free products may be limited. Despite these challenges, the increasing health consciousness and the entry of international brands in the market are expected to drive the growth of the gluten-free products market in Asia Pacific.

Latin America

Latin America is witnessing a gradual increase in the demand for gluten-free products. The region has a notable population of individuals with gluten-related disorders, and there is a growing awareness about gluten intolerance. However, the presence of gluten-free options in the market is relatively limited compared to other regions. The lack of variety and availability of gluten-free products, along with the relatively higher cost, may hinder the market growth in Latin America. Nonetheless, with increasing health consciousness and the adoption of gluten-free diets, the market is expected to witness steady growth in the region.

Middle East & Africa

The Middle East & Africa region lags behind in terms of market share for gluten-free products. Limited awareness about gluten-related disorders and relatively low adoption of gluten-free diets among consumers contribute to the slow growth in this region. Additionally, the availability of specialized gluten-free products may be limited in this region. However, with increasing health consciousness and a growing number of individuals diagnosed with gluten-related disorders, the market for gluten-free products in the Middle East & Africa is projected to witness gradual growth in the coming years.

Company Profiles:

Prominent entities like Nestle and General Mills are significant contributors in the Global Gluten Free Products sector, actively involved in the creation and production of an extensive array of gluten-free food items to meet the increasing needs of consumers with gluten intolerances. These entities prioritize product development, strategic marketing approaches, and efficient distribution networks to enhance their competitive edge within the market and deliver top-tier gluten-free options to those adhering to gluten-free regimens.

Prominent companies in the Gluten Free Products Industry encompass General Mills Inc., The Hain Celestial Group Inc., Kellogg Company, Pinnacle Foods Inc., Hero Group AG, Freedom Foods Group Ltd., Enjoy Life Foods LLC, Boulder Brands Inc., Aleia's Gluten Free Foods LLC, and Bob's Red Mill Natural Foods Inc.

COVID-19 Impact and Market Status:

The global market for gluten-free products has seen a significant growth boost due to the Covid-19 pandemic, driven by a growing consumer focus on health and well-being.

The gluten-free products market has experienced a notable shift due to the COVID-19 pandemic. The global crisis, marked by lockdowns, travel restrictions, and social distancing measures, has brought about significant changes in consumer behavior, resulting in various outcomes for the industry. The pandemic has driven an uptick in the sales of gluten-free products as individuals increasingly focus on their health and seek products that enhance their overall well-being. Additionally, the closure of many restaurants and the rise in home cooking have motivated consumers to explore gluten-free alternatives for their dietary needs. Conversely, the economic challenges brought on by the pandemic have placed financial strains on many consumers, leading to reduced purchasing power and a possible downturn in the demand for higher-priced gluten-free products. Moreover, disruptions in supply chains and manufacturing capabilities due to lockdowns have had adverse effects on the gluten-free products market. In light of these changes, businesses operating in this industry must be nimble in adapting to shifting consumer preferences and market dynamics to succeed in these uncertain times.

Latest Trends and Innovation:

- In October 2020, General Mills, a leading global food company, announced the acquisition of Gluten Free Bar (GFB), a gluten-free snacking company known for its protein bars and other gluten-free snacks.

- In February 2021, Nestlé's subsidiary, Nestlé Health Science, acquired Nuun, a hydration drink tablet company, to expand its portfolio of functional hydration products, including gluten-free options.

- In March 2021, The Kraft Heinz Company introduced a range of gluten-free varieties for their popular macaroni and cheese products, catering to the growing demand for gluten-free options among consumers.

- In May 2021, Pillsbury, a brand owned by General Mills, launched a new line of gluten-free baking mixes, offering consumers with gluten intolerance more options for baking at home.

- In June 2021, Boulder Brands, a subsidiary of Conagra Brands, announced the launch of new gluten-free frozen pizza crusts under their Udi's brand, catering to the increasing demand for gluten-free pizza options.

- In July 2021, Bob's Red Mill, a renowned producer of gluten-free and organic products, introduced a new gluten-free flour blend to its existing product line, providing consumers with a versatile gluten-free baking option.

- In August 2021, Hain Celestial Group, a leading organic and natural products company, expanded its gluten-free offerings by acquiring Clarks UK Ltd, a gluten-free food manufacturer based in the UK.

- In September 2021, Kellogg's, a well-known food company, launched a new gluten-free variation of their popular Eggo frozen waffles, catering to the increasing demand for gluten-free breakfast options.

- In November 2021, Enjoy Life Foods, a subsidiary of Mondelez International, introduced a new line of gluten-free protein bites, providing a convenient and gluten-free snacking option for consumers with specific dietary needs.

- In December 2021, Glutino, a brand under Boulder Brands, introduced a new line of gluten-free sandwich cookies, expanding their range of gluten-free snacks.

Significant Growth Factors:

Factors driving the expansion of the gluten-free products industry comprise ened understanding of gluten-related ailments, increasing consumer focus on well-being, and the escalating inclination towards clean-label and nutritious food alternatives.

The remarkable expansion of the Gluten Free Products Market can be linked to various crucial factors. Primarily, the increasing awareness and diagnosis of celiac disease and gluten intolerance have spurred the demand for gluten-free products. The market growth is also fueled by the growing health consciousness and the increasing number of individuals adopting specialized diets such as Paleo, Atkins, and low-carb diets. Additionally, the perception that gluten-free products are beneficial for health and weight management has boosted their popularity. The availability of a diverse range of gluten-free items, including bread, pasta, snacks, and beverages, has been instrumental in attracting consumers. Furthermore, enhancements in the taste and quality of gluten-free products have helped change the perception that they are bland and unpalatable, leading to greater acceptance and consumption. Factors such as rising disposable income, urbanization, and evolving consumer lifestyles have further contributed to the growth of the gluten-free products market. The emergence of online retail platforms has also played a pivotal role in providing consumers with easier access to a wide array of gluten-free products, thereby fostering market expansion. In essence, these combined factors have driven significant growth in the gluten-free products market, presenting lucrative opportunities for manufacturers and retailers in the sector.

Restraining Factors:

Constraints in the form of restricted accessibility and elevated costs of gluten-free commodities serve as impediments to the expansion of the gluten-free products sector.

The market for gluten-free products has experienced notable growth recently due to the increasing prevalence of gluten intolerances or sensitivities among individuals, along with a ened consumer understanding of the potential health advantages associated with adhering to a gluten-free diet. However, various factors continue to hinder the expansion of this market. One primary challenge is the typically higher cost of gluten-free items in comparison to their gluten-containing equivalents, which may discourage price-conscious consumers. Moreover, certain regions lack sufficient availability and diversity of gluten-free products, thereby restricting market penetration. Furthermore, the flavor and texture of gluten-free substitutes often fail to meet consumer expectations, resulting in a reluctance to transition from traditional gluten-containing products. Another obstacle faced by the gluten-free products sector is that some consumers may not fully grasp or appreciate the significance of adopting a gluten-free dietary regimen, thereby limiting the target audience. Despite these obstacles, there is a positive outlook for the market for gluten-free goods. Ongoing research and development initiatives are dedicated to enhancing the sensory characteristics of gluten-free alternatives to make them more appealing to consumers. Additionally, manufacturers are working to improve the accessibility and affordability of gluten-free products to cater to a broader consumer demographic. With increasing awareness and rising demand, the gluten-free products market shows considerable potential for the future.

Key Segments of the Gluten Free Products Market

Product Source Overview

• Animal Source

• Plant Source

Distribution Channel Overview

• Convenience Stores

• Specialty Stores

• Drugstores & Pharmacies

Product Type Overview

• Bakery Products

• Snacks & RTE Products

• Pizzas & Pastas

• Condiments & Dressings

• Seasonings & Spreads

• Desserts & Ice Creams

• Rice

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America