Halal Empty Capsules Market Analysis and Insights:

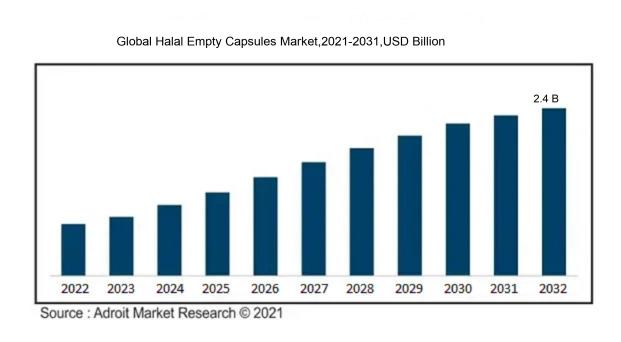

In 2023, the size of the worldwide Halal Empty Capsules market was US$ 1.1 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.2 % from 2024 to 2032, reaching US$ 2.4 billion.

The market for Halal Empty Capsules is significantly influenced by the increasing preference for halal-compliant dietary supplements and pharmaceuticals among Muslim consumers, who seek adherence to Islamic dietary guidelines. The ened focus on health and the awareness of the advantages of vegetarian and gelatin-based capsules are driving this sector forward, as individuals look for options that resonate with their ethical and religious values. Furthermore, the expansion of both the pharmaceutical and nutraceutical markets is boosting the demand for these capsules, with manufacturers responding to a spectrum of consumer needs. Advances in capsule technology, including the introduction of plant-derived alternatives and improved functionalities, are also propelling market expansion. Additionally, supportive regulations for halal certification across various nations are enhancing consumer trust and broadening market accessibility. Together, these elements create a dynamic environment for the Halal Empty Capsules Market, attracting a wide range of consumers committed to health and ethical purchasing practices.

Halal Empty Capsules Market Definition

Halal empty capsules are either gelatin or plant-based capsules manufactured in adherence to Islamic dietary principles, guaranteeing the exclusion of any haram (forbidden) components. These capsules cater to Muslims who wish to take supplements or medications that conform to their religious beliefs.

Halal empty capsules play a vital role in meeting the dietary and religious obligations of Muslim individuals who wish to remain faithful while using supplements or medications. These capsules are crafted from ingredients that adhere to halal guidelines, guaranteeing that they contain no forbidden substances or animal-derived components. This dedication to ethically sourced materials enhances consumer confidence and broadens market prospects within the rapidly expanding health and wellness industry. Furthermore, as an increasing number of consumers emphasize the importance of transparency and responsible consumption, halal capsules appeal to a wide range of users, promoting inclusivity and understanding across various dietary needs and cultural contexts.

Halal Empty Capsules Market Segmental Analysis:

Insights On Product Type

Vegetarian Capsules

Vegetarian capsules are anticipated to dominate the Global Halal Empty Capsules Market due to a surge in consumer preference for plant-based and sustainable products. Health-conscious individuals and those adhering to ethical dietary practices are increasingly choosing vegetarian options, driven by concerns about animal welfare and the environment. The rising awareness of vegetarian lifestyles coupled with an increase in the Muslim population seeking halal-certified products further contributes to the expected dominance of this. Moreover, innovations in plant-based ingredients and advancements in manufacturing techniques facilitate the production of vegetarian capsules that meet diverse consumer demands, solidifying their position in the market.

Gelatin Capsules

Gelatin capsules are a well-established choice in the empty capsule market; however, their growth is hampered by the rising demand for halal alternatives that align with vegetarian values. While gelatin, derived from animal sources, remains popular for traditional applications, it faces scrutiny from consumers who prioritize ethical considerations. Nevertheless, gelatin capsules cater to various pharmaceutical and nutraceutical applications, appealing to those who do not prioritize vegetarianism. Their availability, effectiveness in covering unpleasant tastes, and rapid digestibility continue to support their presence in the market, even as vegetarian capsules attract a wider audience.

Insights On Size

Size 00

Size 00 is expected to dominate the Global Halal Empty Capsules market due to its versatility and widespread utilization in the pharmaceutical and nutraceutical industries. This size is ideal for a range of formulations, accommodating various types of powders and granules. Its popularity stems from the capacity to encapsulate sufficient dosage while ensuring ease of swallowing for consumers. The increasing demand for dietary supplements and halal-certified products has pushed manufacturers to prioritize Size 00 capsules, aligning them with consumer preferences for quality and efficacy. The combination of these factors positions Size 00 as the leading choice in the market.

Size 0

Size 0 holds a significant position within the Global Halal Empty Capsules market primarily due to its balance between capacity and ease of consumption. It is frequently chosen for a variety of applications, including pharmaceutical, vitamin, and herbal formulations. The size's compatibility with a range of fillers and excipients enhances its attractiveness to manufacturers. However, while it performs well, it does not quite reach the popularity of Size 00, primarily because it caters to slightly different consumer preferences regarding dosage and swallowing ease.

Size 000

Size 000 is also notable in the Global Halal Empty Capsules market, primarily because of its larger volume capacity. This size is often preferred for formulations that require higher dosages. Nutraceutical companies and supplement manufacturers utilize Size 000 to cater to consumers seeking concentrated health benefits. Despite its larger size potentially limiting swallowability for some individuals, its demand remains steady within specific s focused on therapeutic use or high-potency formulations, which strengthens its presence in the market.

Size 1

Size 1 serves a niche in the Global Halal Empty Capsules market, as it is well-suited for a wide range of powdered formulations. This size is preferred not just for its convenience in terms of swallowability, but also for its ability to accommodate moderately dosed products. Its acceptance in the market stems from the willingness of consumers to opt for a size that balances volume with ease of intake, thus finding utility across dietary supplements and over-the-counter pharmaceuticals.

Size 2

In the Global Halal Empty Capsules market, Size 2 has established itself as a viable option, particularly for herbal supplements and medications that require moderate dosages. Its manageable size allows for easy consumption, appealing to the health-conscious demographic that may be less inclined to use larger capsules. Moreover, the flexibility in formulation options for Size 2 makes it attractive to manufacturers looking to deliver effective health solutions without compromising on consumer preferences.

Size 3

Size 3 makes its mark in the Global Halal Empty Capsules market, primarily catering to herbal and natural dietary supplements, where lower dosages are often preferred. This size is popular among niche manufacturers focused on targeting specific health benefits with easy-to-swallow capsules. It reflects a growing of health-conscious consumers who prioritize convenience and digestibility, supporting its steady demand and consistent presence in the market.

Size 4

Size 4 occupies a smaller niche within the Global Halal Empty Capsules market, appealing mainly to those who require smaller doses. This size is often sought after for pediatric formulations, homeopathy, and specific herbal supplements where smaller sizes enhance the experience for users. While its overall market share is less than larger sizes, Size 4 plays a crucial role in catering to specialized needs and consumer preferences for smaller, more manageable capsules, demonstrating its importance in the broader landscape of halal empty capsules.

Others

The "Others" category in the Global Halal Empty Capsules market includes sizes that are less commonly utilized or tailored for unique applications not covered by the standard sizes. This may comprise specialty capsules designed for unique formulations or targeted marketing strategies aimed at specific demographic groups. While this group does not dominate the market, it serves an essential function, allowing manufacturers to be innovative and respond to niche demands in the evolving health supplement industry.

Insights On Distribution Channel

Online Stores

Online Stores are anticipated to dominate the Global Halal Empty Capsules Market due to the increasing consumer preference for digital shopping. The convenience of online shopping, coupled with a wider range of products and competitive pricing, makes it an attractive choice for consumers. Additionally, online platforms often provide detailed product information and customer reviews, enhancing the purchasing experience. With the growing penetration of the internet and smartphones, more customers are opting for the convenience of shopping from home. This trend is further accelerated by the increasing adoption of e-commerce among health-conscious consumers seeking Halal products, thereby solidifying the online channel's leading position in the market.

Pharmacies

Pharmacies play a critical role in the distribution of Halal empty capsules as they serve as trusted points of access for health-related products. Customers often rely on pharmacies for recommendations on health supplements, driven by their need for assurance about product integrity and safety. The presence of qualified pharmacists adds a layer of credibility, ensuring that consumers feel secure about their purchases. Additionally, many pharmacies maintain a selection of Halal-certified products, catering to the specific dietary needs of their community, which helps maintain their steady customer base despite the growing prominence of online shopping.

Health Stores

Health Stores are important for the distribution of Halal empty capsules, as they are specifically tailored to cater to health-conscious consumers. These stores often carry a range of specialized products, including organic and natural options, which aligns with the dietary preferences of many who seek Halal certification. The personalized customer service in health stores allows for direct interaction and education regarding the benefits of specific products. Furthermore, the focus on holistic health and wellness promotes a loyal customer base that values the availability of Halal choices, thereby ensuring a significant presence in the market landscape.

Others

The "Others" category, which includes specialty shops and supermarkets, contributes to the availability of Halal empty capsules but holds a smaller share of the market. While these locations may offer Halal options, they are often overshadowed by more focused distribution points like pharmacies and health stores. Specialty shops may occasionally have niche products that attract certain consumer s, but they lack the comprehensive selection and convenience that online stores provide. Supermarkets may stock Halal products, but the lack of emphasis on health and dietary specifics results in a less robust market presence compared to more specialized retailers.

Insights On End User

Pharmaceutical Companies

Pharmaceutical companies are expected to dominate the Global Halal Empty Capsules Market due to the increasing demand for halal-certified products in the healthcare sector. With a significant rise in the Muslim population globally and growing awareness regarding the religious dietary laws, pharmaceutical companies are actively seeking halal options to cater to this consumer base. Furthermore, the stringent regulations and quality standards in medicine production necessitate the use of halal-certified materials to ensure compliance and consumer trust. As more pharmaceutical companies invest in halal-certified formulations and expand their product lines, they are projected to lead the market significantly.

Nutraceutical Companies

Nutraceutical companies are also investing heavily in halal-certified empty capsules to address the growing consumer demand for health products that align with specific dietary laws. The rising inclination of health-conscious consumers towards natural supplements and functional foods poses a market opportunity. Moreover, the ongoing trend of using dietary supplements for wellness and preventive health measures is pushing nutraceutical manufacturers to innovate and provide more halal-certified options, capturing a substantial share of the market.

Cosmetic Industry

The cosmetic industry demonstrates a growing interest in halal empty capsules, particularly for skincare and beauty products. With consumers increasingly seeking cosmetics that align with their values, especially in predominantly Muslim regions, companies are adapting to this shift by formulating halal-compliant beauty products. This trend reflects a broader acceptance of halal lifestyle choices and is leading to innovations within cosmetic formulations that incorporate halal-certified ingredients.

Others

This category encompasses a variety of industries that may utilize halal empty capsules, including food and beverage sectors and dietary supplements not strictly categorized under pharmaceuticals or nutraceuticals. While this is currently smaller than the primary markets mentioned earlier, there is notable growth potential as consumer interest in halal products continues to rise across diverse sectors. Manufacturers in these areas are beginning to explore halal options to meet the demands of a changing consumer landscape that values transparency and adherence to halal standards.

Global Halal Empty Capsules Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the global halal empty capsules market due to its large Muslim population and increasing awareness about halal-certified products. This region hosts countries like Indonesia, Malaysia, and India, where the demand for halal products is witnessing significant growth. Additionally, the presence of a burgeoning pharmaceutical and nutraceutical industry in countries like China and India is anticipated to further propel the demand for halal empty capsules. The cultural acceptance and growing consumer preference for halal products across various demographics in the Asia Pacific make it the leading market for halal empty capsules in the upcoming years.

North America

In North America, the halal empty capsules market is gradually expanding due to a rising Muslim population and increasing interest in dietary supplements. The growing health awareness among consumers is driving the demand for halal products, as many people are seeking dietary options that align with their cultural and ethical beliefs. While the market is relatively smaller compared to the Asia Pacific, the trend for clean-label and organic products is encouraging manufacturers to incorporate halal standards into their offerings, signaling a positive growth trajectory in the region.

Europe

Europe has a considerable demand for halal empty capsules, primarily driven by the significant Muslim population in countries like the United Kingdom and France. The increasing emphasis on health and wellness, along with the rising number of halal certifications among pharmaceuticals and dietary supplements, suggests consistent growth. Additionally, European consumers are becoming more conscious of ingredient sourcing, leading to an increase in preference for halal-certified products, thereby contributing to the region's developing market landscape.

Latin America

In Latin America, the halal empty capsules market is in its nascent stage, but it holds potential due to increasing consumer awareness and the growth of the Muslim population in specific countries. Nations like Brazil and Argentina are witnessing a gradual rise in halal product offerings, though the demand is still emerging. As awareness of health and wellness continues to grow among the general population, halal products are likely to see greater acceptance, laying the groundwork for future market expansion within the region.

Middle East & Africa

The Middle East & Africa region is expected to experience steady growth in the halal empty capsules market, largely influenced by the high percentage of the Muslim population in countries across the Middle East. The growing awareness of health-oriented products and dietary supplements that comply with halal standards contributes to increasing demand. However, economic factors and regulatory landscapes may present challenges that could affect market growth in certain areas. Nonetheless, as the region's halal industry expands, the potential for growth in the halal empty capsules remains significant.

Halal Empty Capsules Market Competitive Landscape:

Crucial participants in the Global Halal Empty Capsules sector, including producers and distributors, play an essential role in the creation of premium, standards-compliant capsules that adhere to religious guidelines. Additionally, they are instrumental in fostering innovation and broadening distribution networks to improve market access. Their commitment to regulatory compliance and quality control addresses the increasing consumer demand across various regions.

The prominent entities in the Halal Empty Capsules industry encompass ACG Worldwide, Capsugel (a subsidiary of Lonza), Qualicaps, Sunil Healthcare Limited, BRITA, Medi-Caps Limited, Rhea Food, The Empty Capsule Company, SIRC (Shah Rukh International Capsule), and D. B. Capsule. Other significant firms include Eligo Capsules, Suheung Co., Ltd., HealthCaps India Ltd., and Kuki & Co. Furthermore, DCC Health and DuPont de Nemours, Inc. also play vital roles in this sector.

Global Halal Empty Capsules Market COVID-19 Impact and Market Status:

The Covid-19 pandemic caused substantial upheaval in the Global Halal Empty Capsules market, disrupting production activities and supply chains. This resulted in demand variability and difficulties in obtaining raw materials.

The COVID-19 pandemic has profoundly influenced the market for Halal empty capsules, catalyzed by changes in consumer preferences and disruptions in manufacturing processes. As global health awareness rose, there was a corresponding increase in the demand for dietary supplements and nutraceuticals, which frequently incorporate Halal capsules to appeal to a wider range of consumers. Nonetheless, manufacturing faced hurdles, such as supply chain disruptions and factory shutdowns, resulting in shortages and delays in capsule production. Additionally, the halal certification process encountered significant challenges, which affected the introduction of new products. On the positive side, the pandemic shifted the market's focus towards online retail, enabling manufacturers to pivot and connect with consumers via e-commerce platforms. Consequently, while the demand experienced some growth, operational difficulties impeded the overall market development. Looking ahead, the Halal empty capsules market is anticipated to gradually rebound, with a stronger emphasis on quality, safety, and innovation in response to consumer trends that surfaced during the pandemic.

Latest Trends and Innovation in The Global Halal Empty Capsules Market:

- In October 2022, Capsugel, a subsidiary of Lonza Group, announced the launch of a new line of halal-certified capsules aimed at meeting the growing demand in markets such as Asia and the Middle East. This initiative highlighted their commitment to expanding their product range to cater to diverse dietary needs.

- In March 2023, Daxin Pharmaceutical released a report confirming its acquisition of a leading halal certification entity to enhance its production processes. This move was part of Daxin's strategy to strengthen its market position in halal pharmaceuticals.

- In July 2023, Herbalife Nutrition Ltd. unveiled its new halal-certified soft gel capsules, responding to increasing demand from consumers in predominantly Muslim regions. This innovation aims to broaden their product offerings while ensuring adherence to halal dietary laws.

- In August 2023, Suheung Co., Ltd. entered into a partnership with the Islamic Food and Nutrition Council of America (IFANCA) to expand its halal certification capabilities for its gelatin and non-gelatin capsules, emphasizing the company’s dedication to quality and compliance.

- In September 2023, ACG Capsules announced the successful launch of plant-based capsules that received halal certification, leveraging advancements in manufacturing technology to meet the demands of halal and vegetarian markets simultaneously.

- In October 2023, the global player BPS Products announced its strategic merger with a halal certification provider, enhancing its product portfolio and reinforcing its commitment to the halal market as consumer interest continues to rise.

Halal Empty Capsules Market Growth Factors:

The market for Halal empty capsules is witnessing an upward trajectory, fueled by a growing consumer interest in halal-certified dietary supplements and pharmaceuticals, as well as a ened understanding of religious dietary obligations.

The expansion of the Halal Empty Capsules Market is influenced by several elements. A notable increase in the global Muslim demographic, combined with ened awareness regarding dietary restrictions and the significance of Halal certification, has spurred demand for products that adhere to Halal standards. Furthermore, the shift towards plant-based and vegetarian capsules resonates with consumer inclinations for natural ingredients, thereby driving market growth.

Both the pharmaceutical and nutraceutical sectors are incorporating Halal empty capsules to cater to a diverse range of consumers, which in turn extends their market reach. Additionally, innovations in capsule manufacturing processes have resulted in improved quality and production efficiency, appealing to both producers and consumers.

Government efforts to endorse Halal standards and certifications serve to bolster market trust, while a rising focus on health and increased self-medication among consumers motivate the search for alternative health options, frequently available in capsule form. Finally, the booming e-commerce landscape enhances the distribution and accessibility of Halal products, meeting the growing consumer demand for convenient purchasing options. Collectively, these elements create a vibrant and rapidly transforming Halal Empty Capsules Market, reflecting important cultural values and contemporary global consumer behaviors.

Halal Empty Capsules Market Restaining Factors:

Critical obstacles in the Halal empty capsules sector comprise rigorous certification standards and a lack of consumer knowledge in areas with a non-Muslim majority population.

The Halal Empty Capsules Market encounters several challenges that may impede its expansion. A primary obstacle is the scarcity of raw materials that satisfy Halal certification requirements, complicating the procurement process for manufacturers. Furthermore, the diverse regulatory frameworks governing Halal certification across various nations can lead to inconsistencies in product availability, hindering companies' efforts to enter different markets successfully. Consumer knowledge regarding Halal products tends to be inconsistent, especially in areas where such dietary customs are less recognized, which may restrict market demand. Additionally, competition from non-Halal options could dissuade consumers who do not place a high importance on Halal certification, negatively affecting sales figures. The elevated production expenses linked to upholding Halal certifications and obtaining compliant materials may also limit price competitiveness. Nevertheless, as global awareness of health and dietary considerations grows, alongside an increasing Muslim demographic and rising interest in ethical consumer behavior, there exists considerable potential for growth within the Halal Empty Capsules Market. Businesses that adeptly navigate these challenges can seize emerging market opportunities, ultimately promoting innovation and offering diverse products that align with the changing preferences of consumers globally.

Segments of the Halal Empty Capsules Market

By Product Type

- Gelatin Capsules

- Vegetarian Capsules

By Size

- Size 000

- Size 00

- Size 0

- Size 1

- Size 2

- Size 3

- Size 4

- Others

By Distribution Channel

- Online Stores

- Pharmacies

- Health Stores

- Others

By End User

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmetic Industry

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America