Hard Seltzer Market Analysis and Insights:

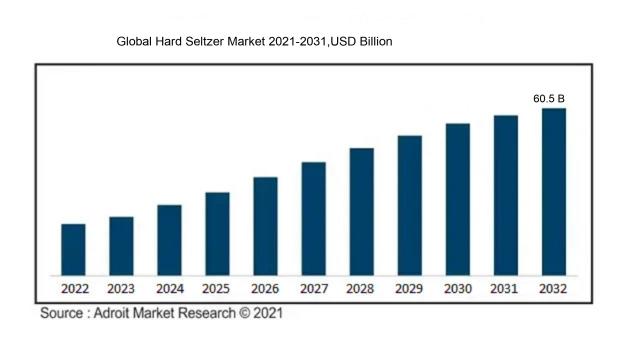

In 2023, the size of the worldwide Hard Seltzer market was US$ 22.7 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 19.3% from 2024 to 2032, reaching US$ 60.5 billion.

The hard seltzer industry is flourishing due to a blend of health-oriented consumer trends, unique flavor offerings, and changing societal attitudes toward alcohol consumption. As more individuals become aware of the benefits of a healthier lifestyle, there is a rising demand for alcoholic beverages that offer lower calories, are gluten-free, and contain reduced sugar compared to conventional options. The wide variety of flavors available from different brands attracts a diverse customer base, encouraging experimentation among consumers. Furthermore, the increasing prevalence of social gatherings and outdoor events, combined with the practicality of hard seltzers as a light and convenient beverage, enhances their appeal. Effective marketing strategies that focus on distinctive branding, sustainable practices, and alignment with lifestyle choices also play a vital role in the industry's expansion, appealing to consumers who prefer products that reflect their values and life experiences. Consequently, the hard seltzer market continues to grow, particularly among younger audiences eager for innovative and refreshing beverage alternatives.

Hard Seltzer Market Definition

The hard seltzer sector consists of alcoholic drinks that integrate carbonated water, ethanol, and various flavorings. This has surged in popularity due to its crisp, refreshing characteristics and the belief that it offers healthier alternatives to conventional alcoholic beverages.

The hard seltzer sector has emerged as a noteworthy player in the beverage industry, characterized by its swift expansion and attraction to a varied consumer demographic, especially younger individuals who are on the lookout for low-calorie, refreshing alcoholic options. This trend aligns with a broader movement towards health-conscious choices and a preference for lighter alcoholic drinks. The popularity of hard seltzers is further fueled by their innovative flavors and adaptability in social environments, which serve to boost consumer demand and foster market growth. Additionally, as more consumers emphasize sustainability and the use of natural ingredients, hard seltzer brands are adapting by incorporating eco-friendly practices into their production processes. This market's transformation highlights shifting consumer preferences in the beverage landscape, establishing it as a vital area for investment and trend monitoring.

Hard Seltzer Market Segmentation:

Insights On Key By ABV Content

5.0% to 6.9% ABV

The 5.0% to 6.9% ABV category is expected to dominate the Global Hard Seltzer Market due to the growing preference among consumers for beverages that provide a slightly stronger alcoholic content while still being light and refreshing. This range has become particularly popular among millennials and health-conscious drinkers who seek to enjoy indulgence without overwhelming calories. The balance it provides allows consumers to experience a satisfying level of alcohol while enjoying the refreshing nature of hard seltzers, making it the preferred choice. Marketing strategies and product innovation from brands have further supported the rise of this, cementing its leading position in the market.

1.0% to 4.9% ABV

The 1.0% to 4.9% ABV range offers a lighter option for consumers, appealing primarily to those who are more health-conscious or are looking for a low-alcohol alternative. This attracts individuals who prefer to enjoy drinks in social settings without the effects of higher alcohol content. Additionally, the rise of this category has been supported by various products marketed as “sessionable,” allowing consumers to consume them over extended periods without feeling too intoxicated. While this range garners interest, it is often regarded as less favored among millennials seeking a bolder experience.

Others

The "Others" category encompasses hard seltzers that exceed 6.9% ABV or do not fit into the typical classification. This tends to cater to niche markets, such as craft hard seltzers or those infused with additional flavors and alcoholic ingredients. While this category may attract certain consumers looking for unique or artisanal options, it remains a smaller player in the overall market. The trend tends to veer more towards traditional styles and flavors found in the main ABV categories, leading to less mass appeal compared to the more dominant ranges of 5.0% to 6.9% and 1.0% to 4.9% ABV products.

Insights On Key By Packaging

Metal Cans

Metal cans are expected to dominate the Global Hard Seltzer Market due to their convenience, lightweight nature, and superior portability. The trend of outdoor consumption, particularly during social gatherings and events, has driven the preference for easily transportable packaging. Additionally, metal cans offer excellent preservation qualities, including protection from light and oxygen, which maintain the beverages' flavor profile and carbonation levels. Sustainability is another crucial factor as many brands focus on using recyclable materials, making aluminum cans increasingly attractive to environmentally-conscious consumers. The cost-effectiveness of production and distribution further enhances their marketability, positioning metal cans as the preferred choice among manufacturers and consumers alike.

Glass Bottle

Glass bottles possess a classic appeal and connoisseur's authenticity that draws in premium consumers. Their perceived quality and ability to enhance the drinking experience are crucial in establishing brand prestige, especially among craft and artisan producers of hard seltzers. Additionally, glass is inert, ensuring that there is no interaction with the beverage it contains, which allows for a pure taste without any metallic aftertaste. Despite being heavier and more fragile than cans, glass bottles cater to markets that appreciate traditional packaging and are often associated with higher-end branding.

Insights On Key By Flavours

Flavoured

Flavoured hard seltzers are expected to dominate the Global Hard Seltzer Market due to evolving consumer preferences towards diverse and innovative flavors that appeal to younger demographics. The trend emphasizes the blending of traditional carbonated beverages with unique, fruity, or even exotic flavor profiles that enhance the drinking experience. Moreover, the growing inclination towards personalization and premiumization in beverage choices supports the appeal of flavored hard seltzers. As consumers increasingly look for exploratory tastes and refreshing alternatives to traditional alcoholic beverages, the variety in flavored options not only boosts market attractiveness but also reinforces brand loyalty among consumers seeking memorable experience.

Classic or Unflavoured

The classic or unflavoured of hard seltzers caters to a niche audience that appreciates simplicity and purity in their beverage choices. Often favored for its straightforward appeal, this category serves consumers who prefer a clean and crisp taste without any additives. While it may not trend as high as flavoured options, it has a loyal customer base, especially among health-conscious individuals seeking low-calorie and gluten-free options. This simplicity makes classic hard seltzers an excellent choice for mixers in cocktails, offering versatility to both casual drinkers and mixologists alike.

Insights On Key By Distribution Channel

On-Trade

The On-Trade distribution channel is expected to dominate the Global Hard Seltzer Market due to the increasing popularity of social drinking experiences and active lifestyle trends. Bars, restaurants, and other venues cater to a demographic that emphasizes unique and trendy beverage options. With the growing acceptance of hard seltzer as a fashionable choice among millennials and Gen Z consumers, on-trade establishments are essential for brands looking to build visibility and drive consumption. Additionally, promotional campaigns and tasting events in these venues further enhance consumer engagement, ensuring that On-Trade becomes a key revenue driver in the industry.

Off-Trade

The Off-Trade channel encompasses retail outlets, supermarkets, and online platforms where hard seltzers can be purchased for at-home consumption. This channel has seen significant growth due to the rise in demand for convenient and easily accessible alcoholic beverages. Consumers are increasingly purchasing hard seltzers to enjoy in private settings or during gatherings at home. Moreover, as the e-commerce sector expands, traditional retailers are adapting to online sales, further enhancing the Off-Trade channel's reach. However, while it is growing, it struggles compared to On-Trade in terms of brand engagement and promotional activities.

Insights on Hard Seltzer Market Regional Analysis:

North America

North America is expected to dominate the Global Hard Seltzer Market, driven primarily by consumer preferences for low-calorie, refreshing alcoholic beverages. The United States holds a significant share of the market, fueled by an increasing trend toward health-conscious drinking habits among millennials and Gen Z. Craft beverages, stronger marketing campaigns, and a wide array of flavor options contribute to its prominence. The robust distribution channels and established presence of major brands solidify North America’s leadership. Coupled with rising social media influence and the growing trend of home consumption, the region is poised for continued growth and market expansion.

Latin America

Latin America is experiencing a budding interest in hard seltzer, but it remains in the early stages compared to North America. However, rising disposable incomes and changing consumer preferences indicate a potential for growth. Major beverage companies are beginning to introduce hard seltzers tailored to local tastes and preferences, leveraging regional flavors and ingredients. With a younger demographic increasingly gravitating towards unique alcoholic options, there is optimism that Latin America may carve out a significant niche in the hard seltzer in the coming years.

Asia Pacific

The Asia Pacific region presents a promising horizon for the hard seltzer market, driven by an evolving beverage culture and an emphasis on innovative alcoholic beverages. Countries like Japan and Australia are witnessing a gradual increase in hard seltzer popularity as consumers seek low-calorie and refreshing alternatives. The growing trend of premiumization among alcoholic beverages, along with effective marketing strategies targeting younger consumers, positions the Asia Pacific region for steady market penetration, particularly as domestic manufacturers collaborate with international brands to diversify product offerings.

Europe

In Europe, the hard seltzer market is gradually emerging but still trails behind North America. The appeal of health-conscious drinking is becoming more relevant among European consumers, with brands experimenting with diverse flavors and targeting millennials and Gen Z. Regulatory challenges and varying alcohol consumption preferences across countries can be barriers but also contribute to a custom-tailored approach for various local markets. Brands focusing on sustainability and premium ingredients can find success in this complex landscape, ensuring gradual growth in presence.

Middle East & Africa

The Middle East & Africa region shows limited penetration of hard seltzer beverages, primarily due to cultural norms and regulatory constraints surrounding alcohol consumption. Nonetheless, urbanization and a growing expatriate population in certain regions are driving demand for alternative alcoholic beverages. Companies attempting to enter this market must navigate complex legal frameworks while adapting their marketing strategies to cater to local preferences. As consumer habits evolve and a younger demographic emerges, there is room for potential growth in this, but it remains heavily constrained compared to other regions.

Hard Seltzer Market Company Profiles:

Prominent participants in the Global Hard Seltzer Market, encompassing leading beverage corporations and dynamic startups, stimulate expansion by introducing a variety of flavors and attractive packaging designs. They employ strategic marketing techniques to engage consumer interest effectively. Partnerships with distributors and retailers also boost market accessibility, contributing to the increasing appeal of hard seltzer among health-conscious individuals.

Prominent contributors in the Hard Seltzer industry encompass Anheuser-Busch InBev, Boston Beer Company, Mark Anthony Brands (the parent company of White Claw), Molson Coors Beverage Company, Constellation Brands, Truly Hard Seltzer, and Corona Hard Seltzer (also under Constellation Brands). Other significant entities include High Noon Sun Sips, Simply Spiked Lemonade (affiliated with The Coca-Cola Company), Hardy Seltzer, Press Premium Alcohol Seltzer, and H2O Hard Seltzer. Additionally, notable brands such as Vizzy Hard Seltzer, Bon & Viv Spiked Seltzer, the Long Drink Company, National Beverage Corp. (known for LaCroix), and Swig Hard Seltzer play important roles. Emerging players like Cutwater Spirits and various local brands are also contributing to the growth of this vibrant market.

COVID-19 Impact and Market Status for Hard Seltzer Market:

The Covid-19 pandemic notably expedited the expansion of the worldwide hard seltzer market, driven by consumers' preference for healthier and more convenient alcoholic options amid lockdowns and social distancing protocols.

The COVID-19 pandemic had a profound impact on the hard seltzer industry, presenting both obstacles and new possibilities. As bars and restaurants faced closures or limited capacities during the crisis, sales in those sectors initially declined. However, this led to an increased focus on off-premise consumption, with retail sales experiencing a significant boost as consumers sought convenient and refreshing beverages in their homes. This shift enabled hard seltzer brands to capitalize on e-commerce and delivery services to connect directly with consumers. Additionally, the rise of social media marketing proved essential, as brands devised creative campaigns to position hard seltzers as ideal choices for home gatherings and online celebrations. In summary, while the pandemic disrupted established drinking habits, it also expedited the expansion of the hard seltzer category, reinforcing its presence in the alcoholic beverage market and encouraging brands to swiftly adapt to changing consumer trends.

Hard Seltzer Market Latest Trends and Innovation:

• In March 2021, Anheuser-Busch InBev launched its Bud Light Hard Seltzer, expanding its portfolio to compete directly with established brands like White Claw and Truly. The company aimed to gain market share by leveraging the Bud Light name, focusing on flavor innovation and a strong marketing campaign.

• In August 2021, Constellation Brands announced the acquisition of the hard seltzer brand, VDC, known for its innovative flavors and positioning within the fast-growing category, further reinforcing Constellation’s stake in the hard seltzer market alongside its successful Corona Hard Seltzer line.

• In May 2022, Molson Coors Beverage Company unveiled a new line of hard seltzers called Coors Seltzer, featuring a blend of natural flavors and low-calorie options. This move was part of their strategy to diversify the product lineup and capture the health-conscious consumer.

• In July 2022, Boston Beer Company reported a strategic partnership with PepsiCo to co-create hard seltzer beverages that combine both companies' strengths, leading to the launch of the brand “Hard MTN DEW” later that year. This collaboration aimed at leveraging the growing interest in both hard seltzers and flavored alcoholic beverages.

• In October 2022, Diageo announced plans to develop a new range of flavored hard seltzers under the Smirnoff brand, aimed at younger consumers. The initial launch was part of a broader trend of major spirits companies entering the hard seltzer market.

• In February 2023, Truly Hard Seltzer, owned by Boston Beer Company, released a new line of hard seltzer cocktails, which included flavors crafted to appeal to consumers seeking the taste of classic cocktails in a seltzer format.

• In April 2023, Anheuser-Busch InBev revealed it would be repositioning its Bud Light Hard Seltzer to emphasize its lower-calorie offerings, responding to consumer trends favoring healthier alcoholic beverage options amidst rising competition.

• In June 2023, the hard seltzer brand High Noon made headlines with a successful expansion into several international markets, increasing their consumer base and solidifying their position in the rapidly evolving global hard seltzer landscape.

Hard Seltzer Market Significant Growth Factors:

The expansion of the hard seltzer industry is driven by a growing consumer preference for low-calorie alcoholic options and an emerging trend of health-oriented drinking habits.

The hard seltzer sector has seen remarkable expansion due to a variety of influential elements. Primarily, an increasing number of consumers are seeking healthier options in alcoholic beverages, which has resulted in ened interest in hard seltzers, known for their lower calorie and carbohydrate content compared to conventional beers and cocktails. The wide range of flavors and moderate alcohol levels further attract a diverse audience, especially younger consumers looking for refreshing alternatives. Furthermore, effective marketing strategies and creative branding have established hard seltzers as stylish lifestyle drinks, improving their presence in bars and retail outlets.

Moreover, the growth of distribution channels, such as online sales and home delivery, has significantly enhanced the accessibility of hard seltzers. Social media's rise has facilitated direct interaction between brands and consumers, fostering a community around these beverages. The COVID-19 pandemic has also shifted drinking patterns, leading to a preference for home consumption, which benefited the hard seltzer category. Additionally, the increasing focus on environmental sustainability has encouraged manufacturers to adopt eco-friendly packaging and ingredient practices, resonating with consumer values and further propelling market growth. Collectively, these dynamics have created a dynamic and flourishing hard seltzer industry.

Hard Seltzer Market Restraining Factors:

The Hard Seltzer industry encounters obstacles including rising competition, evolving consumer tastes, and regulatory challenges that could impede its expansion.

The hard seltzer industry is witnessing notable growth yet contends with several challenges that may hinder its ongoing advancement. A primary issue is market saturation; the influx of numerous brands has intensified competition, potentially leading to consumer exhaustion. Furthermore, shifts in consumer preferences toward healthier drink choices could divert interest away from alcoholic beverages, including hard seltzers. Regulatory hurdles also present significant complications, as varying regional laws surrounding alcohol can disrupt both distribution and marketing practices. Additionally, the perception of hard seltzers as merely a fleeting trend may jeopardize long-term investments and customer loyalty. Fluctuations in the costs of raw materials, particularly flavoring and sweetener ingredients, can severely affect production expenses and profit margins. Nonetheless, the sector remains vibrant, with brands innovating through distinct flavor offerings, reduced calorie options, and eco-friendly packaging strategies, aiming to capture new audiences and solidify hard seltzer's standing in the beverage market. With a focus on ongoing innovation and adaptability, the hard seltzer sector appears well-positioned for a robust future.

Key Segments of the Hard Seltzer Market

By ABV Content:

• 1.0% to 4.9% ABV

• 5.0% to 6.9% ABV

• Others

By Packaging:

• Glass Bottle

• Metal Cans

By Flavours:

• Classic or Unflavoured

• Flavoured

By Distribution Channel:

• Off-Trade

• On-Trade

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America