Home Medical Equipment Market Analysis and Insights:

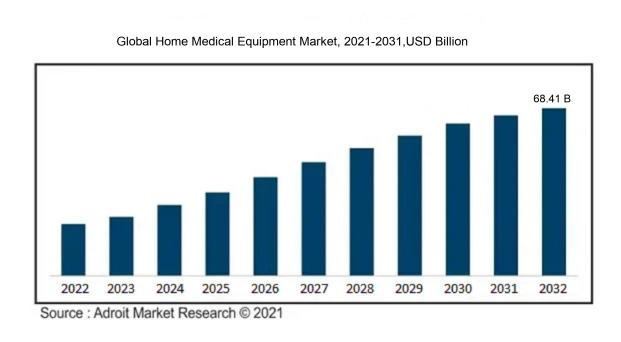

In 2023, the size of the worldwide Home Medical Equipment market was US$ 35.26 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 7.63 % from 2024 to 2032, reaching US$ 68.41 billion.

The market for Home Medical Equipment (HME) is influenced by several pivotal elements that facilitate its expansion. Foremost, the global increase in the elderly population requires enhanced home healthcare solutions, leading to a ened demand for equipment that supports autonomy in daily living. Additionally, growing awareness regarding chronic health issues, such as diabetes and respiratory diseases, intensifies the necessity for home-based monitoring and treatment options. Innovations in HME, notably the introduction of smart technology and the integration of telehealth services, improve patient care and ease of use, further stimulating market growth. Moreover, the transition towards value-driven healthcare systems promotes home care as a more economical substitute for hospital care, thereby attracting investment in HME innovations. Supporting this trend are favorable reimbursement structures and governmental efforts that advocate for home healthcare services, ensuring patients have access to vital medical equipment within their residences. In summary, these various factors contribute to a dynamic environment conducive to ongoing growth within the HME sector.

Home Medical Equipment Market Definition

Home Medical Equipment (HME) encompasses a range of medical devices and supplies intended for use in a residential setting to facilitate health management and caregiving. This category of equipment often consists of items like wheelchairs, respiratory apparatus, and monitoring systems that improve patient comfort and promote independence.

Home medical equipment (HME) is vital in improving patient care and elevating the quality of life for those with chronic conditions or disabilities. By facilitating the delivery of medical services within the home environment, HME minimizes the need for hospital admissions and readmissions, which helps to decrease overall healthcare expenses. Devices such as oxygen concentrators, mobility support tools, and health monitoring instruments promote autonomy, enabling patients to take control of their health management. Furthermore, HME enhances health outcomes by encouraging adherence to prescribed treatments and providing essential support for caregivers. This availability fosters a sense of dignity among individuals, allowing them to live more meaningful and satisfying lives.

Home Medical Equipment Market Segmental Analysis:

Insights On Functionality

Patient Monitoring Equipment

The Patient Monitoring Equipment category is expected to dominate the Global Home Medical Equipment Market. The increasing prevalence of chronic diseases and the growing elderly population drive demand for devices that allow for continuous health monitoring from home. Technological advancements such as wireless connectivity and mobile health applications have enhanced the effectiveness of these devices, making them more appealing to consumers. The trend towards telehealth and remote patient monitoring, especially highlighted during the pandemic, has further cemented the importance of this category. As healthcare shifts towards home-based solutions, patient monitoring equipment stands out as a key player in improving patient outcomes and convenience.

Therapeutic Equipment

Therapeutic Equipment plays an essential role in the healthcare landscape, especially for patients requiring long-term treatment. This category includes devices that assist in pain management, respiratory therapy, and physical rehabilitation. The growing emphasis on preventive healthcare and rehabilitation is driving the demand for these devices as they provide significant health benefits. Additionally, increasing awareness about chronic conditions and a surge in home care services contribute to the growing adoption of therapeutic machines, enhancing both patient experience and outcomes, even though it does not outperform patient monitoring equipment.

Mobility Assist

The Mobility Assist sector offers critical solutions for individuals facing physical limitations. This includes products such as wheelchairs, walkers, and canes that significantly enhance a person's independence and quality of life. With the rising aging population and the increasing occurrence of mobility-related disorders, this category sees consistent growth. Yet, while essential for patient mobility, it does not capture the same expansive market share or technological advancement as patient monitoring, which ultimately places it in a supportive role within the broader home medical equipment market.

Patient Support Equipment

Patient Support Equipment provides vital services that improve patient comfort and care during recovery at home. This includes a range of products like hospital beds, bed rails, and bathing aids. The increasing number of home care patients along with advancements in customizable solutions are contributing to the growth in this area. However, while important for basic patient needs, this category lacks the advanced capabilities and continuous engagement that patient monitoring equipment offers, which is better adapted to the current trends in healthcare technology and consumer demand.

Insights On End User

Hospitals

The hospitals category is expected to dominate the Global Home Medical Equipment Market and remains a critical aspect of the Global Home Medical Equipment Market, as they play a significant role in the provision and administration of medical devices and equipment. While the focus on homecare increases, hospitals are key players in the referrals for home medical equipment usage. Essential treatments often start in a hospital setting, necessitating specific equipment that can later transition to at-home care. The integration of advanced technologies within hospitals ensures that patients can be educated on using certain equipment before being discharged, which reinforces the ongoing importance of hospital systems in the overall healthcare framework.

Homecare Settings

The Homecare settings category is growing rapidly due to several factors that align with current healthcare trends. The increasing preference for at-home healthcare, driven by an aging population and the growing incidence of chronic diseases, has fueled the demand for medical equipment that can facilitate care in the comfort of home. Innovations in technology, such as telemedicine, have also made it easier for patients to receive care at home while using advanced medical devices. Moreover, the cost-effectiveness of home care compared to hospital stays is attracting more patients and families, allowing for inexpensive yet efficient management of health conditions outside traditional settings.

Emergency Clinics

Emergency clinics are essential for providing immediate care, yet their impact on the home medical equipment market is less pronounced than that of hospitals or homecare. These clinics focus on acute conditions and often refer patients to hospitals for further treatment. Although they do utilize certain home medical equipment for immediate diagnosis and short-term care, their role in promoting long-term home healthcare solutions is limited. The equipment used in emergency settings is typically designed for quick interventions, which does not have a lasting influence on the demand dynamics of the home medical equipment market.

Global Home Medical Equipment Market Regional Insights:

North America

North America is set to dominate the Global Home Medical Equipment market due to a combination of factors such as a high prevalence of chronic diseases, a well-established healthcare infrastructure, and robust reimbursement policies. The aging population is driving the demand for home medical equipment as more individuals prefer receiving care at home. Furthermore, technological advancements in home health monitoring devices, including telehealth services, have gained significant traction, allowing patients to manage their health conditions effectively from the comfort of their homes. Additionally, the presence of key market players and increased investment in healthcare technology significantly contribute to North America's leadership in this sector.

Latin America

Latin America shows a growing interest in the home medical equipment sector, spurred by increasing healthcare spending and a rising aging population. However, the market remains fragmented with varying regulations across countries, which can hinder growth. Generally, urban areas are adopting home healthcare solutions more quickly than rural ones, where access to healthcare services is limited. The potential for expansion exists due to a gradual improvement in healthcare infrastructure, but it still trails in comparison to more developed regions.

Asia Pacific

Asia Pacific is witnessing rapid growth in the home medical equipment market, largely driven by robust economic development and increasing awareness about home healthcare solutions. Countries like China and India are experiencing a surge in demand due to their massive populations and growing prevalence of chronic diseases. However, the market is challenged by differing healthcare policies and regulations across nations. Urbanization and the rising middle class are pivotal trends boosting the adoption of advanced home medical devices, but the region is still in the process of establishing a comprehensive healthcare framework.

Europe

Europe exhibits a mature home medical equipment market, characterized by a high acceptance of advanced technologies and a strong focus on elderly care. Government initiatives to promote home healthcare and reduce hospital admissions are stimulating growth. However, regulatory hurdles and cost constraints can limit rapid expansion. There is a notable trend towards personalized healthcare solutions, leading to increased innovation in the sector. While countries like Germany and the UK are leading, the disparity in market readiness across European nations poses challenges for uniform growth.

Middle East & Africa

The Middle East & Africa region is at an emerging stage in its home medical equipment market due to various socio-economic challenges and less developed healthcare systems. Some countries are focusing on improving healthcare access through technology. There is a growing awareness of home healthcare benefits, particularly in urban areas. However, significant barriers such as limited investment in healthcare infrastructure and high costs of advanced medical equipment still hinder substantial market growth. Accelerating efforts to enhance healthcare services can lead to considerable market potential in the future, albeit it remains a secondary player in the global context.

Home Medical Equipment Market Competitive Landscape:

The principal actors within the Global Home Medical Equipment sector, which encompass manufacturers, distributors, and healthcare providers, work together to foster innovation, manufacture, and supply vital medical devices, thereby improving patient care and accessibility. The establishment of strategic alliances and the implementation of technological advancements propel market expansion and enhance health outcomes for patients receiving home-based care.

Prominent participants in the Home Medical Equipment sector encompass Invacare Corporation, Philips Healthcare, Medtronic, ResMed, Arjo, Graham-Field Healthcare Products, occupancy management solutions, B. Braun Melsungen AG, Drive DeVilbiss Healthcare, Cardinal Health, 3M Company, Amedisys, Inc., Hill-Rom Holdings, Inc., Baxter International Inc., and Sunrise Medical.

Global Home Medical Equipment Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly increased the need for home medical devices, as numerous patients turned to at-home care options to reduce their hospital visits and effectively oversee their health issues from a distance.

The COVID-19 crisis had a profound effect on the Home Medical Equipment (HME) industry, presenting both hurdles and new prospects. As healthcare facilities became inundated, there was a notable increase in the necessity for in-home care options, with many patients opting for treatment from the comfort of their residences. Essential items like oxygen concentrators, ventilators, and telehealth devices experienced ened demand due to the urgent need for respiratory support and management of chronic conditions. Although initial disruptions in supply chains impeded the availability of these devices, manufacturers promptly adjusted their logistics and production strategies. Additionally, the pandemic accelerated the widespread adoption of telemedicine and remote monitoring, spurring advancements in HME technology. Consequently, the HME market is expected to continue its upward trajectory following the pandemic, as more individuals acknowledge the value of home-based care in ensuring ongoing health management. Ultimately, COVID-19 has reshaped the HME sector, underlining its vital contribution to contemporary healthcare practices.

Latest Trends and Innovation in The Global Home Medical Equipment Market:

- In March 2023, Medtronic announced the acquisition of Mazor Robotics, a leader in surgical robotics, enhancing Medtronic's capabilities in the robotic-assisted surgery space, particularly in spinal surgeries.

- In April 2023, ResMed unveiled a new suite of digital health tools designed for patients suffering from sleep apnea, which integrates artificial intelligence for personalized therapy adjustments.

- In June 2023, Philips entered into a partnership with AliveCor to integrate remote cardiac monitoring into Philips' telehealth platform, aiming to improve patient outcomes in cardiac health management.

- In July 2023, Cardinal Health completed the acquisition of the medical supply company, Garfinkel's Healthcare, strengthening its position in the home medical equipment market and expanding its product offerings.

- In August 2023, Hillrom, now a part of Baxter International, released a new patient monitoring solution featuring advanced analytics that aids in proactive care management in home settings.

- In September 2023, Invacare Corporation announced a collaboration with Amazon to launch a portfolio of home medical equipment products available for direct purchase through Amazon's platform, enhancing accessibility for consumers.

- In October 2023, Drive DeVilbiss Healthcare launched a new line of portable oxygen concentrators equipped with improved battery life and weight reduction technology, catering to the growing demand for mobility in home oxygen therapy.

Home Medical Equipment Market Growth Factors:

The growth of the Home Medical Equipment Market is fueled by a rising elderly population, a higher incidence of chronic illnesses, and technological innovations that improve the quality of in-home patient care.

The Home Medical Equipment (HME) sector is on the brink of considerable expansion, driven by several pivotal elements. To begin with, the global increase in the elderly population is correlated with a rise in chronic illnesses, creating a ened demand for medical equipment and care that can be administered at home. Innovations in technology, particularly in the realm of equipment design, have led to the emergence of devices that are not only user-friendly but also compatible with remote monitoring, thereby improving accessibility and enhancing patient outcomes. Furthermore, the growing trend toward home healthcare services aligns with patient preferences for receiving care in a familiar environment.

The COVID-19 pandemic has significantly increased awareness and acceptance of telehealth solutions, further boosting the utilization of home medical devices. In addition, favorable reimbursement frameworks established by both governmental and private insurance entities have made accessing HME more straightforward, encouraging patients to opt for at-home care options. The rise of online shopping platforms has also streamlined the acquisition process, enabling consumers to easily obtain the necessary equipment. Lastly, a proactive approach to preventive healthcare is leading more patients to pursue in-home medical solutions, reinforcing the positive trajectory of the market. These interconnected factors suggest a strong growth potential for the HME industry in the near future.

Home Medical Equipment Market Restaining Factors:

Critical barriers in the Home Medical Equipment sector encompass elevated expenses, absence of reimbursement frameworks, and regulatory hurdles.

The market for Home Medical Equipment (HME) is confronted with various obstacles that could impede its expansion. A primary concern is the rigorous regulatory framework, which may complicate the process of obtaining approvals for new devices and result in delays in the introduction of innovative solutions. Moreover, reimbursement challenges, particularly limited coverage options from insurance companies, can hinder patient access to cutting-edge home medical technologies. This situation is further complicated by inconsistent policies across different geographic areas, creating uncertainty for both consumers and manufacturers. Additionally, the significant upfront costs associated with certain home medical devices may deter potential purchasers, especially within economically disadvantaged populations. Competition from alternative healthcare models, such as telehealth and mobile health applications, may also shift focus and financial resources away from conventional HME offerings. Furthermore, the shortage of qualified professionals to provide essential guidance on the effective use of equipment can lead to its underuse. Nevertheless, the increasing recognition of the advantages of home healthcare and technological advancements offer considerable prospects for the HME sector to innovate and grow, ultimately enhancing patient care and gaining broader acceptance within the healthcare ecosystem.

Key Segments of the Home Medical Equipment Market

By Functionality:

- Therapeutic Equipment

- Patient Monitoring Equipment

- Mobility Assist

- Patient Support Equipment

By End User:

- Hospitals

- Emergency Clinics

- Homecare Settings

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America