Human Grade Pet Food Market Analysis and Insights:

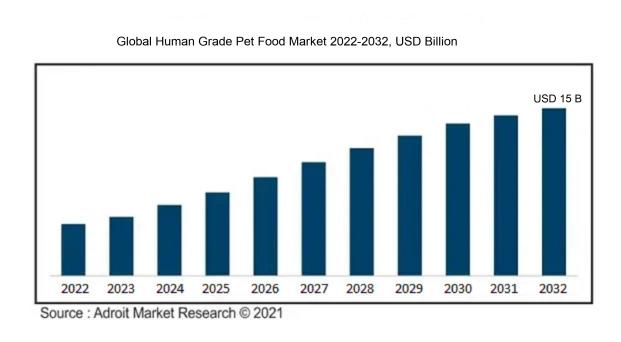

The Human Grade Pet Food Market was estimated to be worth USD 5 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 12%, with an expected value of USD 15 billion in 2032.

The human-grade pet food market is propelled by several significant factors. Growing recognition among pet owners about the necessity of high-quality nutrition for their animals has led to an increased demand for products that meet human food standards. As pets are increasingly seen as integral members of the family, there is a notable trend towards foods that prioritize natural ingredients and ensure transparency in their sourcing. Furthermore, the trend of premiumization in the pet food industry, coupled with effective marketing strategies that emphasize the health advantages of human-grade options, plays a crucial role in the sector’s expansion. Legislative changes promoting improved safety and quality standards for pet food have also shifted consumer preferences toward trustworthy brands. Additionally, movements such as the humanization of pets, increased disposable income levels, and a transition to environmentally sustainable packaging are strongly aligned with the human-grade pet food market, creating a competitive advantage in this dynamic industry.

Human Grade Pet Food Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 15 billion |

| Growth Rate | CAGR of 12% during 2024-2032 |

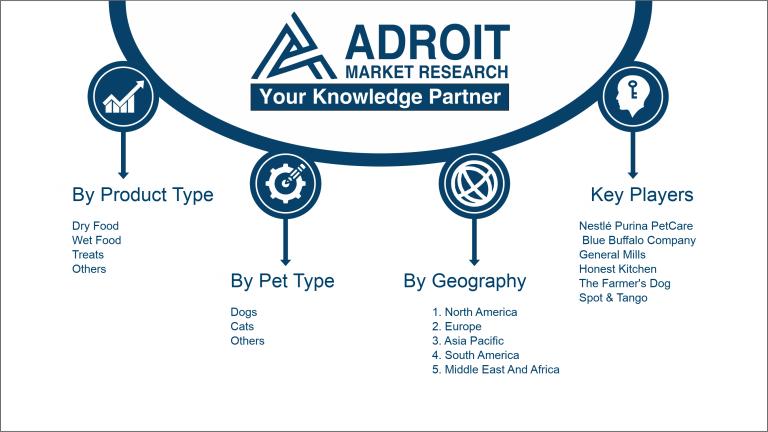

| Segment Covered | By Product Type, By Pet Type, By Distribution Channel, By Ingredient Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nestlé Purina PetCare, Blue Buffalo Company, General Mills (Nature's Recipe), Honest Kitchen, The Farmer's Dog, Spot & Tango, Ollie, PetPlate, Canidae, and Weruva. |

Human Grade Pet Food Market Definition

Human-grade pet food consists of ingredients recognized as safe and acceptable for human consumption. Such products are manufactured in facilities that adhere to the same rigorous standards as those used for human food production, thereby guaranteeing enhanced quality and safety.

Pet food labeled as human grade is important as it guarantees that its components meet the same quality and safety standards set for human consumption, thereby enhancing the health and wellbeing of animals. Typically, this category of pet food is made with wholesome, natural ingredients, free from harmful additives or preservatives, which minimizes the chances of allergies and digestive problems. With a rising trend among pet owners to choose healthier alternatives for their pets, human grade pet food exemplifies an increasing dedication to transparency and high standards in pet nutrition. In conclusion, it fosters a healthier lifestyle for pets, aiding in their longevity and overall happiness.

Key Market Segmentation:

Insights On Key Product Type

Wet Food

Wet food is anticipated to dominate the Global Human Grade Pet Food Market due to its higher appeal among pet owners seeking high moisture content, which not only contributes to hydration but also enhances palatability. Pets often prefer wet food for its flavorful profile, making it more attractive to picky eaters. The perception of wet food as a premium product, along with increasing awareness regarding pet nutrition, bolsters its popularity. Additionally, trends focusing on natural ingredients and fresh formulations align well with the wet food category, further driving its demand in the market. This category is expected to see robust growth, surpassing others owing to its unique advantages.

Dry Food

Dry food remains a significant category in the Human Grade Pet Food Market, primarily due to its convenience and longer shelf life. Many pet owners appreciate dry food for its ease of storage and feeding, as it can be left out without spoiling. Furthermore, dry food is often considered cost-effective, making it an appealing option for budget-conscious consumers. The ease of portion control associated with dry food also adds to its attractiveness, as it can contribute to maintaining ideal body weight for pets. Though not leading, dry food maintains a solid and loyal customer base.

Treats

The treats category is gaining traction within the Human Grade Pet Food Market due to the growing trend of pampering pets. Owners increasingly view treats as a way to enhance the bond with their pets, often opting for healthier, human-grade options. Treats also serve as training tools, with a focus on high-quality ingredients resonating with health-conscious consumers. The diversification of flavors and textures in the treats market caters to various preferences, appealing to pet owners who prioritize quality and nutrition. While it’s not expected to dominate, the treats is showing robust growth and strong brand loyalty.

Others

The Others category includes various niche products such as raw food, freeze-dried meals, and specially formulated diets. Although smaller in size compared to the main categories, this is attracting attention from a specific consumer group that values unique feeding options for their pets. As pet owners increasingly seek to provide diverse dietary choices, products falling under this category are gaining popularity. However, the overall market share remains limited compared to established categories like wet and dry food. This is expected to grow steadily as consumers continue to explore and prioritize high-quality pet nutrition.

Insights On Key Pet Type

Dogs

The related to dogs is expected to dominate the Global Human Grade Pet Food Market due to several compelling factors. Dogs are one of the most popular pets globally, serving as loyal companions, which drives the demand for high-quality, nutritious food. Pet owners are becoming increasingly conscious of the health benefits associated with premium pet food, leading them to invest significantly in human-grade options. Additionally, the growing trend of treating pets as family members has bolstered the willingness to pay a premium for quality dog food. Furthermore, marketing strategies targeting dog owners, combined with a wider array of products catering specifically to canine dietary needs, enhance this 's viability in the pet food industry.

Cats

The concerning cats also shows significant potential in the Global Human Grade Pet Food Market. Cat ownership has risen steadily, prompting a ened focus on their nutritional needs. Pet owners increasingly seek out high-quality, human-grade options for their feline companions, reflecting a trend toward premiumization in pet food. The unique dietary requirements of cats, being obligate carnivores, further highlight the importance of specialized formulations, encouraging owners to invest in superior nutrition. However, while growing, this does not eclipse the dominance of the dog food category.

Others

The "Others" category, which includes various pets beyond dogs and cats, represents a much smaller but growing in the Global Human Grade Pet Food Market. This group encompasses animals such as birds, reptiles, and small mammals, each with distinct dietary requirements. Although there is an increasing trend among owners of these pets to seek high-quality nutrition, the overall market share remains limited compared to dogs and cats. The demand for human-grade food in this is primarily fueled by niche markets and dedicated pet owners looking for premium options, but it is unlikely to rival the leading positions of dog and cat food categories.

Insights On Key Distribution Channel

Online Stores

The Online Stores channel is expected to dominate the Global Human Grade Pet Food Market due to the increasing trend of e-commerce and the growing preference among pet owners for the convenience of online shopping. With factors like easy access to various brands, competitive pricing, and the ability to read reviews and conduct price comparisons, pet owners find purchasing pet food online more appealing. Furthermore, the COVID-19 pandemic has accelerated the shift toward online shopping, leading to higher consumer demand for home deliveries. Brands are also investing in user-friendly platforms and effective digital marketing strategies to capture a larger online market share, contributing to the anticipated dominance of this channel.

Supermarkets/Hypermarkets

Supermarkets and hypermarkets play a significant role in the distribution of human-grade pet food due to their extensive reach and accessibility. Many consumers prefer shopping for pet food in these large retail environments, where they can find a wide variety of products under one roof. The combination of convenience and household shopping allows pet owners to easily include pet food in their regular grocery run. Additionally, in-store promotions and discounts can effectively encourage impulse purchases, making this channel a strong contender, despite the growing trend towards online shopping, as many pet owners still value the tactile experience of evaluating products in-person.

Specialty Pet Stores

Specialty pet stores cater to a niche market that values high-quality and premium products for their pets. These stores often provide a carefully curated selection of human-grade pet food, focusing on health-conscious consumers looking for specific dietary needs for their pets. The expertise of staff in specialty stores can effortlessly guide pet owners towards informed purchasing decisions, which is a key advantage. However, with limited geographic presence compared to larger retail chains, the overall share of this distribution channel remains smaller. These stores thrive on strong relationships with devoted pet owners who prioritize quality over price.

Others

The Others category, potentially including convenience stores and direct-to-home services, has a limited but relevant presence in the human-grade pet food market. While not dominating, these channels provide an alternative for pet owners who might need smaller, quicker purchases or prefer local shopping options. Convenience stores particularly serve on-the-go customers who may have time constraints and need immediate access to pet food. However, this channel's contribution is constrained by limited product variety and higher pricing compared to larger outlets, making their overall impact on the market relatively minor in comparison to the leading distribution channels.

Insights On Key Ingredient Type

Plant-Based

The plant-based category is expected to dominate the global human-grade pet food market due to the rising trend of pet owners seeking healthier, sustainable options for their pets. With an increasing number of consumers adopting vegan and vegetarian lifestyles, there is a strong inclination towards plant-based diets for pets as well. This shift is driven by concerns over animal welfare, environmental sustainability, and health benefits associated with plant-based ingredients. Moreover, advancements in food technology have enabled manufacturers to formulate nutritionally balanced pet food that meets the dietary needs of pets while being entirely plant-derived. The growing awareness of the benefits of such diets will significantly contribute to the continued growth and dominance of the plant-based in the market.

Animal-Based

The animal-based category, although not expected to dominate, maintains a significant presence in the human-grade pet food market. Pet owners often believe that animal protein provides the essential nutrients required for optimal pet health, making it a popular choice among consumers. This category leverages the perception that meat-based diets are more natural and satisfying for carnivorous pets. In addition, the incorporation of high-quality, ethically sourced meats resonates with consumers’ preferences, further driving the demand in this area. Many premium brands are capitalizing on this demand by offering gourmet options that appeal to owners who wish to provide high-quality nutrition to their pets.

Mixed

The mixed category, while less prominent than the aforementioned categories, caters to a niche market seeking balanced nutrition for their pets. This option typically blends both animal and plant-based ingredients, thereby appealing to pet owners concerned with providing a diverse diet. By incorporating both types of ingredients, this category aims to deliver a well-rounded nutritional profile that addresses various dietary needs. Furthermore, mixed formulations allow for the flexibility of recipes tailored to specific health requirements, enticing consumers who wish to avoid strict dietary limitations but still want to offer their pets a premium food experience.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Human Grade Pet Food market due to several factors. The region has a well-established pet food industry with a high per capita spending on pets, which drives demand for premium and human-grade products. Increasing pet ownership rates, combined with the growing trend of humanization of pets, where owners seek high-quality, nutritious options akin to human food for their pets, particularly contribute to this market’s growth. Additionally, key players in the U.S. and Canada are actively innovating to meet consumer preferences, enhancing the region's dominance further in the human-grade pet food sector.

Latin America

Latin America is showcasing an emerging interest in human-grade pet food, driven by rising disposable incomes and the increasing popularity of pet ownership. As consumers become more aware of the health benefits of quality pet nutrition, there’s a growing demand for organic and natural food options. However, the market is still developing, and while there is potential, it doesn’t yet compete on the same level as North America.

Asia Pacific

The Asia Pacific region is witnessing significant growth in the human-grade pet food market, attributed to rapid urbanization and changing lifestyles. Many households in countries like China and India are adopting pets, and pet owners are increasingly opting for high-quality food products. However, the market is diverse, with a mix of traditional and modern pet food approaches, and it still faces challenges like varying consumer awareness regarding human-grade offerings.

Europe

Europe's market for human-grade pet food is expanding as consumers become more health-conscious and demand quality ingredients for their pets. The region has established regulations regarding pet food safety, fostering market growth. However, competition and consumer price sensitivity can limit the potential for rapid expansion despite a burgeoning interest in premium pet food options across various European countries.

Middle East & Africa

In the Middle East & Africa, the human-grade pet food market is still nascent but shows signs of growth driven by increasing pet ownership and emerging trends in pet nutrition. Urbanization and improved access to premium products are contributing factors. However, the market faces significant challenges, including economic disparities and varied consumer education regarding the benefits of human-grade pet food, which may restrict its growth relative to other regions.

Company Profiles:

Prominent stakeholders in the international market for human-grade pet food play a vital role in maintaining product quality and safety standards, fostering innovation in ingredient procurement, and developing attractive formulations tailored to consumer preferences. Their cooperative efforts in supply chain management and marketing approaches significantly influence industry trends and contribute to broadening market presence.

Prominent companies in the market for human-grade pet food consist of Nestlé Purina PetCare, Blue Buffalo Company, General Mills (Nature's Recipe), Honest Kitchen, The Farmer's Dog, Spot & Tango, Ollie, PetPlate, Canidae, and Weruva.

COVID-19 Impact and Market Status:

The Covid-19 pandemic has led to a substantial increase in the global market for high-quality pet food, as pet owners have become more focused on providing health-oriented nutrition for their animals in response to ened health consciousness.

The COVID-19 pandemic has profoundly impacted the market for human-grade pet food, largely due to an increased consumer emphasis on the health and well-being of pets during times of confinement. With a surge in pet adoptions and more families spending time at home, there has been a growing awareness regarding the nutritional standards of pet food, which has resulted in ened demand for high-quality, human-grade options. Initially, supply chain challenges disrupted production and distribution networks, which led companies to pivot toward enhancing their online sales strategies and adopting direct-to-consumer approaches. The pandemic highlighted the critical need for transparency in ingredient sourcing and safety practices, prompting many brands to reinforce their dedication to quality. Additionally, as pet owners increasingly value their pets' diets, there has been a significant trend toward organic and natural products. In summary, the pandemic acted as a catalyst for expansion within this sector, paving the way for a more health-conscious and discerning consumer demographic in the pet food market.

Latest Trends and Innovation:

- In April 2023, Nestlé Purina PetCare announced the acquisition of Petaluma, a direct-to-consumer brand focusing on human-grade pet food, enhancing its portfolio in the premium pet food market.

- In January 2023, Freshpet launched a new line of fresh, human-grade dog food products aimed at meeting the growing consumer demand for healthier pet food options.

- In March 2023, The Farmer's Dog secured $40 million in Series D funding, which the company plans to use for expanding its product offerings and increasing its market presence in the human-grade pet food.

- In February 2023, Stella & Chewy's unveiled a new freeze-dried raw diet product range that includes human-grade ingredients, tapping into the trend towards more natural and minimally processed diets for pets.

- In June 2023, JustFoodForDogs entered into a partnership with Walmart to make its human-grade dog food products more accessible to consumers through retail expansion.

- In May 2023, Open Farm announced a significant upgrade to its production facilities to improve the quality and sustainability of its human-grade pet food offerings, emphasizing ethical sourcing of ingredients.

- In December 2022, PetPlate launched a subscription-based service for its human-grade dog meals, responding to the increasing trend of convenience in pet food shopping among consumers.

- In August 2023, Purina Pro Plan introduced a new line of high-protein, human-grade wet dog food, targeting health-conscious pet owners looking for premium nutrition for their pets.

Significant Growth Factors:

The expansion of the Human Grade Pet Food Market is driven by ened awareness among consumers regarding pet nutrition, a surge in popularity of high-quality pet products, and an increasing desire for clarity in the sourcing of ingredients.

The Human Grade Pet Food Market is witnessing remarkable expansion, influenced by several pivotal elements. Heightened consumer consciousness regarding pet health and nutrition plays a crucial role, as pet owners are increasingly selective about the quality and ingredients in their pets' diets. This growing awareness has fueled demand for products adhering to human food safety standards, indicating a clear transition towards more premium options. Furthermore, the rising trend of pet humanization leads owners to view their pets as family members, motivating them to spend more on high-quality food that aligns with their personal dietary principles.

Innovations in product development, particularly the incorporation of organic, natural, and ethically sourced ingredients, resonate with health-conscious consumers, thereby accelerating market growth. The rise of e-commerce has also enhanced the availability of premium pet food, enabling companies to effectively reach a wider audience. Moreover, regulatory endorsements and certifications for human-grade products bolster consumer confidence and acceptance.

Finally, the ongoing increase in pet populations and ownership rates across the globe intensifies the demand for superior pet food products, establishing a sustainable growth pathway for the market. Collectively, these dynamics create a thriving landscape for the human grade pet food industry in the years ahead.

Restraining Factors:

The primary constraints affecting the Human Grade Pet Food Market are elevated manufacturing expenses and a lack of consumer knowledge about the advantages of these products.

The Human Grade Pet Food Market encounters various challenges that may hinder its potential growth. A key issue is the considerably higher production expenses linked to using human-grade ingredients and specialized manufacturing processes, resulting in elevated prices for consumers and possibly limiting access, especially for price-conscious buyers. Moreover, differing regulatory frameworks and standards across regions can pose compliance difficulties for manufacturers, creating obstacles for new entrants. The notion that human-grade pet food does not necessarily provide enhanced nutritional value over traditional options might also dissuade some consumers. In addition, fluctuating trends in pet ownership and dietary choices can create variability in consumer demand. Supply chain issues, particularly in obtaining quality ingredients, further complicate product availability. Nonetheless, as pet owners increasingly seek high-quality ingredients and transparency in their pets' diets, opportunities for innovation and market growth remain significant. Companies that effectively handle these challenges and uphold their commitment to quality can prosper in this evolving market, appealing to a growing base of discerning consumers who prioritize their pets' health and well-being.

Key Segments of the Human Grade Pet Food Market

By Product Type

• Dry Food

• Wet Food

• Treats

• Others

By Pet Type

• Dogs

• Cats

• Others

By Distribution Channel

• Online Stores

• Supermarkets/Hypermarkets

• Specialty Pet Stores

• Others

By Ingredient Type

• Animal-Based

• Plant-Based

• Mixed

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America