Hydrogen Generation Market Analysis and Insights:

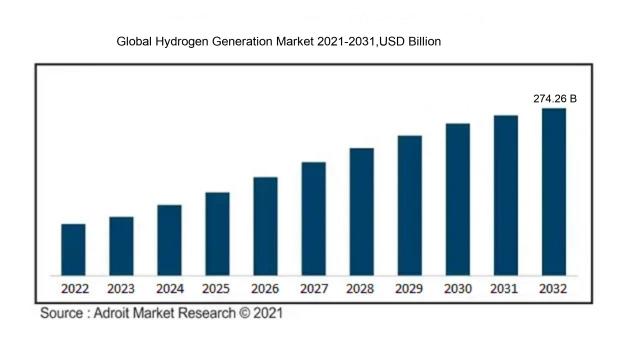

In 2023, the size of the worldwide Hydrogen Generation market was US$167.68 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.83% from 2024 to 2032, reaching US$ 274.26 billion.

The Hydrogen Generation Market is shaped by several pivotal factors. Foremost among these is the rising demand for sustainable energy solutions, spurred by global initiatives aimed at minimizing carbon emissions, which in turn fuels investment in hydrogen production technologies. Government incentives and policies that advocate for hydrogen as a renewable energy alternative significantly bolster market development. Moreover, the automotive sector's transition toward hydrogen fuel cell vehicles plays a crucial role in amplifying demand, driven by the quest for eco-friendly transportation options. Enhancements in production techniques, including electrolysis and steam methane reforming, are yielding greater efficiencies and reducing costs. The expanding application of hydrogen in various sectors, including refining, ammonia synthesis, and energy storage, further promotes market growth. Finally, collaborative efforts and strategic alliances among various stakeholders, such as energy firms and technology innovators, are driving advancements, thereby enhancing the infrastructure and capability required for large-scale hydrogen production.

Hydrogen Generation Market Definition

The hydrogen production sector is dedicated to generating hydrogen gas through a range of techniques, such as electrolysis, steam methane reforming, and biomass gasification. This industry is essential for advancing clean energy efforts and minimizing carbon emissions in various sectors.

The market for hydrogen generation holds significant importance as it possesses the capability to revolutionize the global energy framework by offering a clean and adaptable energy solution. Hydrogen is integral to the pursuit of carbon neutrality and minimizing reliance on fossil fuels. Its usage extends across multiple industries, including manufacturing, transportation, and electricity production, enabling energy storage and supporting decarbonization initiatives. With nations increasingly prioritizing sustainable development and environmentally friendly technologies, the hydrogen economy is experiencing rapid growth, drawing investments and stimulating innovation. This sector not only tackles energy security issues but also contributes significantly to efforts against climate change and the advancement of environmental sustainability.

Hydrogen Generation Market Segmental Analysis:

Insights On Key Type

On Site

The On Site type is expected to dominate the Global Hydrogen Generation Market. It refers to hydrogen generation systems that are installed at fixed locations, typically industrial facilities or large-scale energy plants. While this category may not hold the dominant position in the market, it remains crucial for large-scale hydrogen needs, offering economies of scale and consistent production. Industries that require hydrogen in significant volumes, such as petrochemicals and refining, utilize on-site systems due to lower long-term operational costs and immediate supply. This option is particularly advantageous for organizations looking to minimize transportation costs and logistical complexities associated with hydrogen delivery.

Portable

The Portable type is expected to expand in the Global Hydrogen Generation Market. One of the primary reasons for this trend is the increasing demand for hydrogen in various applications, including transportation and energy storage. Portable hydrogen generation systems provide flexibility and convenience, enabling users to produce hydrogen on-the-go without the need for permanent infrastructure. Additionally, advancements in technology have made portable units more efficient and cost-effective, appealing to both industrial and consumer markets. As sustainable energy solutions grow in importance, the portability of these systems allows for easier adoption across diverse sectors, further driving market growth.

Insights On Key Technology

Steam Methane Reforming

Steam Methane Reforming (SMR) is poised to dominate the Global Hydrogen Generation Market due to its high efficiency and established infrastructure. Currently accounting for a significant portion of the hydrogen produced worldwide, SMR uses natural gas as a feedstock, making it economically favorable amid rising hydrogen demand. The process is well-integrated within existing industrial frameworks and provides a relatively low-cost solution for large-scale hydrogen production. Additionally, advancements aimed at reducing carbon emissions associated with SMR are giving it increased viability as industries look to align with sustainability goals. As a result, the practicality and economic attractiveness of SMR position it as the leading choice in the hydrogen generation landscape.

Water Electrolysis

Water Electrolysis is gaining traction as a sustainable method for hydrogen production, especially with the increasing emphasis on renewable energy sources. This technology uses electricity to split water into hydrogen and oxygen, making it an attractive option for zero-emission hydrogen generation. The growing investment in renewable power generation, such as wind and solar, supports the scalability of water electrolysis as producers seek to utilize excess energy. However, the current high operational costs compared to traditional methods like SMR present challenges for mass adoption. Nonetheless, ongoing technological advancements and decreasing costs of electrolyzers are pushing water electrolysis toward becoming a more mainstream solution.

Partial Oil Oxidation

Partial Oil Oxidation involves the conversion of hydrocarbon feedstock into hydrogen and carbon monoxide, representing a less dominant but important technology in the hydrogen production arena. While it can be used effectively in certain applications and can derive hydrogen from heavier hydrocarbons, this process is limited by its complexity and the need for more refined management of byproducts. The relatively lower carbon intensity compared to other fossil fuel methods gives it some competitive edge. However, regulatory pressures and the growing trend toward cleaner energy solutions may hinder its future commercialization and adoption rates within the hydrogen market.

Coal Gasification

Coal Gasification is a traditional method of hydrogen production that involves converting coal into gas, composed mainly of hydrogen and carbon dioxide. Although it historically has been significant in hydrogen production, its prominence is waning due to environmental concerns surrounding carbon emissions and the availability of cleaner alternatives like SMR and water electrolysis. The process is capital-intensive and often criticized for its carbon footprint, which has led many industries to seek greener technologies as part of their long-term strategies. As a result, while coal gasification remains a viable option in regions rich in coal resources, it is unlikely to maintain a leading position in the evolving hydrogen generation market.

Insights On Key Application

Ammonia Production

Ammonia production is anticipated to dominate the Global Hydrogen Generation Market due to its significant role in industrial applications, particularly in fertilizers. Hydrogen is a crucial feedstock in the Haber-Bosch process, wherein nitrogen and hydrogen are combined to produce ammonia. As global food production needs grow, the demand for ammonia fertilizers rises, leading to increasing hydrogen consumption. Moreover, the push for sustainable agriculture is driving interest in producing green hydrogen, which is derived from renewable sources, thus impacting ammonia production directly. This combination of established practices and emerging eco-friendly methodologies positions ammonia production as the leading application in this market.

Petroleum Refinery

Petroleum refining is a substantial application for hydrogen, primarily used in processes such as hydrocracking and hydrotreating. Here, hydrogen is essential for removing sulfur and other impurities from crude oil, making it a vital element in producing cleaner fuels. As environmental regulations tighten globally, demand for hydrogen in refineries is projected to grow to meet stricter quality standards. Furthermore, the transition towards lower-carbon fuels is also likely to boost hydrogen requirements in this sector.

Methanol Production

The production of methanol also plays a significant role in the hydrogen generation market. Hydrogen serves as a crucial feedstock in converting natural gas to methanol, which is increasingly recognized for its potential as a clean fuel alternative and a chemical feedstock for various applications. As the methanol market expands alongside the pursuit of sustainable fuel options, the reliance on hydrogen is anticipated to rise, thus highlighting its importance. Innovations in producing methanol from renewable hydrogen sources further underscore the growing relevance of this application within the hydrogen market.

Transportation

The transportation sector is on the cusp of significant transformation with the increasing adoption of hydrogen fuel cell technology. Hydrogen is utilized as a clean energy carrier, particularly in fuel cell electric vehicles (FCEVs). Governments worldwide are shifting their focus towards reducing greenhouse gas emissions, promoting hydrogen as a zero-emission alternative to traditional fossil fuels. The development of hydrogen infrastructure, including refueling stations, further supports its growth in the transport sector, contributing to a shift towards greener transportation systems in the coming years.

Power Generation

In power generation, hydrogen is gaining traction as a clean energy source for various technologies, including fuel cells and hydrogen combustion turbines. The potential of hydrogen to generate electricity without carbon emissions positions it as an attractive option for utilities and energy producers. As countries aim to transition towards renewable energy sources, investing in hydrogen-based power systems is increasingly central to energy strategies. The ability to use hydrogen to store excess renewable energy also enhances its viability and integration into modern power grids, making it a significant aspect of the energy transition.

Others

Within the 'others' category, hydrogen applications extend to several sectors, including industrial processes, metal refining, and chemical manufacturing. While not as dominant as ammonia production or petroleum refining, these applications highlight the versatility of hydrogen in a range of uses. Industries like glass and electronics also utilize hydrogen as a reducing agent, underscoring its multifaceted role. The increasing recognition of hydrogen's potential in decarbonizing various sectors contributes to its relevance, although it currently occupies a smaller share compared to the leading applications discussed above.

Global Hydrogen Generation Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Hydrogen Generation Market due to its rapid industrialization, heavy investments in renewable energy technologies, and supportive government initiatives aimed at reducing carbon emissions. Countries like China, Japan, and South Korea are leading the way in hydrogen production capabilities, driven by an increasing demand for clean energy sources. Moreover, the region's bustling automotive industry, particularly in hydrogen fuel cell vehicles, fuels the need for sustainable hydrogen solutions. The focus on hydrogen as a viable energy carrier, alongside significant advancements in related technologies, positions Asia Pacific solidly at the forefront of the global market.

North America

In North America, the hydrogen generation market is significantly driven by strong governmental support and investments in clean energy technologies. The United States, particularly, is focusing on hydrogen as a means to decarbonize various sectors, including transportation and heavy industry. Furthermore, collaborative efforts between private and public entities emphasize infrastructure development, making the region a crucial player in hydrogen initiatives. The region’s abundant natural resources also facilitate cost-effective hydrogen production, enhancing its competitive edge in the global market.

Latin America

Latin America presents a developing landscape for the hydrogen generation market. While still emerging, the region holds considerable potential due to its vast renewable energy resources, particularly hydro and solar energy. Government initiatives in countries like Brazil and Chile are beginning to focus on green hydrogen production, aligning with global energy transition goals. However, challenges such as infrastructure and technological advancements may limit immediate growth. Nonetheless, collaboration with international partners may foster innovations that could increase the region's market share in the future.

Europe

Europe is making notable strides in the hydrogen generation market, driven by ambitious decarbonization goals and a strong policy framework supporting clean energy transition. The European Green Deal and recent hydrogen strategies underscore the regional commitment to becoming a leader in hydrogen technologies. However, despite the robust initiatives, competition from other regions and the necessity for sophisticated infrastructure may hinder its ability to dominate the market. Still, developments in countries like Germany and the Netherlands exemplify the potential for significant contributions to the global hydrogen landscape.

Middle East & Africa

The Middle East & Africa region is gradually recognizing the strategic significance of hydrogen generation, particularly in the context of transitioning from traditional fossil fuels to more sustainable energy solutions. Countries like Saudi Arabia and the UAE are investing heavily in hydrogen production as part of their long-term vision for economic diversification and sustainability. However, the region faces challenges concerning infrastructural limitations and the need for technological innovations. Still, its natural resource wealth presents opportunities for growth, and partnerships with international firms could bolster the region's presence in the global hydrogen market.

Hydrogen Generation Market Competitive Landscape:

The principal actors in the Global Hydrogen Generation Market are pivotal in promoting innovation and advancing technology. Their emphasis lies on developing efficient production techniques and promoting sustainability. By cultivating collaborations and making strategic investments, they aim to strengthen supply chains and broaden their market presence within the changing energy sector.

Prominent contributors in the market for hydrogen generation encompass Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Siemens AG, Green Hydrogen Systems A/S, Thyssenkrupp AG, Nel ASA, Plug Power Inc., Ballard Power Systems Inc., Cummins Inc., Hydrogenics Corporation, ITM Power plc, Toshiba Energy Systems & Solutions Corporation, Enel Green Power S.p.A., and Ceres Media.

Global Hydrogen Generation Market COVID-19 Impact and Market Status:

The Covid-19 pandemic caused significant interruptions in supply chains and postponed various projects, momentarily stalling the expansion of the Global Hydrogen Generation Market, all while highlighting the urgent demand for more sustainable energy solutions.

The COVID-19 pandemic had a profound effect on the hydrogen generation sector, presenting both hurdles and new avenues for growth. At first, the disruption of supply chains and a downturn in industrial operations led to a decrease in hydrogen consumption, notably in industries like transportation and oil refining. However, the pandemic ened public consciousness around sustainable energy alternatives, rekindling interest in hydrogen as a viable clean fuel. In response, governments began to acknowledge the critical role of hydrogen in meeting energy transition objectives, which triggered increased funding toward green hydrogen innovations. Furthermore, advancements in electrolysis and various hydrogen production techniques gained traction, with the aim of lowering costs and boosting efficiency. As the global economy slowly rebounds, the hydrogen generation sector is projected to expand, fueled by supportive policies and technological progress that resonate with the growing emphasis on decarbonization and sustainable energy initiatives. Therefore, despite the substantial challenges posed by the pandemic, it also acted as a catalyst for a transition towards a more sustainable hydrogen-based economy.

Latest Trends and Innovation in The Global Hydrogen Generation Market:

- In September 2023, Nel ASA announced its partnership with Eni to develop green hydrogen projects in Italy, focusing on using renewable energy to produce hydrogen for industrial use.

- In July 2023, Siemens Energy completed its acquisition of the hydrogen technology firm, Soladvent, expanding its capabilities in electrolyzers and enhancing its portfolio for green hydrogen solutions.

- In June 2023, Air Products and Chemicals, Inc. revealed plans to develop a large-scale green hydrogen production facility in Canada. The project aims to produce hydrogen from renewable resources and was earmarked for completion by 2025.

- In March 2023, Thyssenkrupp announced a collaboration with a major automotive manufacturer to supply electrolysis technology for a planned hydrogen production facility to support fuel cell vehicles.

- In January 2023, Plug Power Inc. acquired the hydrogen production assets of United Hydrogen Group, which aimed to strengthen its position in the hydrogen supply chain within North America.

- In October 2022, Linde plc signed a joint venture agreement with a major oil and gas company to establish a green hydrogen production hub in the Gulf Coast region of the United States, projected to be operational by 2024.

- In August 2022, Hyundai Motor Company revealed advancements in fuel cell technology aimed at boosting the efficiency of hydrogen-powered vehicles, reaffirming its commitment to the hydrogen economy.

- In May 2022, Cummins Inc. announced the acquisition of Hydrogenics Corporation, focusing on enhancing its hydrogen fuel cell technologies and production capabilities.

Hydrogen Generation Market Growth Factors:

The hydrogen generation market is experiencing significant growth driven by several key factors, including a rising need for eco-friendly energy alternatives, innovations in electrolysis techniques, and favorable government initiatives that advocate for hydrogen as a renewable fuel option.

The Hydrogen Generation Market is witnessing remarkable expansion driven by several pivotal factors. A primary catalyst is the global shift towards clean and renewable energy sources to address climate change concerns, which has sparked renewed interest in hydrogen as a viable sustainable fuel option. Innovations in hydrogen production techniques, particularly through methods like electrolysis and steam methane reforming, are enhancing both efficiency and cost-effectiveness in hydrogen generation. Moreover, supportive government initiatives and policies aimed at curbing carbon emissions are fostering the development of hydrogen infrastructure, facilitating its adoption across diverse sectors such as transportation and industry. The surging demand for hydrogen in industries like ammonia synthesis, fuel cell technology for vehicles, and electricity generation is further propelling market growth. Substantial investments from both private and public sectors in hydrogen technologies are also accelerating this expansion, with ongoing research and development concentrating on increasing production scalability and lowering expenses. Additionally, the rising focus on energy security and the need for diversified energy strategies among nations is stimulating investment in hydrogen as a credible alternative energy source. Together, these dynamics create a fertile landscape for the sustained growth of the hydrogen generation market as the world increasingly transitions towards greener energy solutions.

Hydrogen Generation Market Restaining Factors:

The Hydrogen Generation Market faces significant challenges primarily due to elevated production expenses, inadequate infrastructure, and regulatory hurdles.

The Hydrogen Generation Market is currently confronted with various obstacles that could impede its advancement. One major hurdle is the elevated production costs, particularly for green hydrogen obtained through electrolysis, which demands considerable capital investment in renewable energy infrastructures. Moreover, the insufficient development of hydrogen distribution and storage systems restricts its availability and usability across different regions. Safety issues associated with hydrogen's storage and transport are also significant, as its highly flammable nature necessitates specialized safety measures to address potential hazards. Additionally, the presence of competing energy sources, including natural gas and battery technologies, may deter interest in the hydrogen market. The landscape is further complicated by policy and regulatory inconsistencies among countries, which can hinder investments in hydrogen technologies due to a lack of uniform incentives and support structures. Nevertheless, there is a rising interest in the hydrogen generation market from both governmental bodies and industries focused on decarbonization efforts, driven by technological progress and deliberate initiatives aimed at fostering a sustainable energy future. With the increasing recognition of hydrogen as a viable clean energy option, the market is poised for significant innovation and growth, contributing to the establishment of a more sustainable, hydrogen-centric energy environment.

Key Segments of the Hydrogen Generation Market

By Type

• On Site

• Portable

By Technology

• Steam Methane Reforming

• Water Electrolysis

• Partial Oil Oxidation

• Coal Gasification

By Application

• Ammonia Production

• Petroleum Refinery

• Methanol Production

• Transportation

• Power Generation

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America