In 2017, the global hyperscale data center market size was valued at USD 583 billion and is expected to see a significant growth in the foreseeable future. A tremendous shift towards cloud computing technologies across various industries and geographies will the demand for highly scalable data centers. Hence the hyperscale data center market is poised to grow significantly in the forecast period.

At a compound annual growth rate of 27%, the size of the worldwide Hyperscale Data Center market is projected to reach $ 96 Billion in 2030.

.jpg)

- Key factors impacting the global hyperscale data center market

As the appetite for data remains almost insatiable, there is a requirement for increasingly large facilities. With data storage accounting for between 5-15% of data center space, the expanding amount of data to be stored means that storage requirements are growing at 40% per annum (Cisco, 2016). Simply put, larger facilities are required to store these larger volumes of data. With growing demand for cloud technology, the pressure on data center companies to provide seamless service has grown tremendously over past few years. This has led to the advent of hyperscale data center trend. According to the Cisco Global Index report 2016, the amount of annual global data center traffic was estimated to be around 6.8 ZB and is expected to triple by 2021.

Internet of Things (IoT) has been the major talking point over past few years. In the future, many industry experts believe that the number of connected devices would rise up to 26 billion by 2020. The volume of data generated by these connected devices will require a huge storage capacity. IoT will drive companies to adopt cloud technologies as they will need to rely on the expertise, agility and speed that managed hosting providers offer. These providers will need to stay ahead of developing technologies to deal with increased volumes of data as well as increased demand for speed. Hence, hyperscale data centers will come into the picture to meet these requirements.

The rapid growth of AI and its applications are contributing to the demand for powerful high performance computing hardware. AI typically requires significant data storage capacity, which at present is a constraint to its adoption for the vast majority of organizations. Hence, this requirement of AI data storage will have a positive influence on the growth of hyperscale data centers in the coming years.

Hyperscale Data Center Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | $96 Billion |

| Growth Rate | CAGR of 27 % during 2022-2030 |

| Segment Covered | By Solution, By Type, By Vertical, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Intel Corporation (U.S.), Cisco Systems Inc. (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Telefonaktiebolaget LM Ericsson (Sweden), Marvell (U.S.), IBM (U.S.), NVIDIA Corporation (U.S.), Amazon Web Services, Inc. (U.S.), Equinix, Inc. (U.S.), Apple Inc. (U.S.), NTT Communications Corporation (Japan), Microsoft (U.S.), Dell (U.S.), VIAVI Solutions Inc. (U.S.), QTS Realty Trust, Inc. (U.S.), Inspur (China), Western Digital Corporation (U.S.), Schneider Electric (France), and Broadcom (U.S.) among many others. |

Key Segments of the Global Hyperscale Data Center Market

Solution Overview, 2015-2025 (USD Billion)

- Server

- Storage

- Networking

- Software

- Services

Workload Overview, 2015-2025 (USD Billion)

- Enterprise

- Consumer

Regional Overview, 2015-2025 (USD Billion)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East & Africa

Frequently Asked Questions (FAQ) :

Increased use of mobile devices, especially the consumption of video and growth of sensors data part of Internet of Things (IoT) has driven the trend of edge computing across the globe. According to a recent study conducted by the AFCOM State of the Data center Industry, edge solutions are the top areas to focus for the data center end users. Among the data center players around the world, forty percent of the players say that they have already installed some form of edge computing capacity or will be adopting it in the coming years.

The success of 5G will enable the movement of data between locations, which has always been good for the data center business. 5G transition is forcing a key shift to software defined infrastructure, with telecom providers upgrading their infrastructure to support a “cloud-native” computing model. Due to this, most of the telecom companies have incorporated the Open Compute Project (OCP) to deploy switches which run sophisticated SDN software and low cost servers. With 5G, technologies such as virtual reality (VR), augmented reality (AR), and connected cars will really start to take hold in our daily lives and will lead to data explosion. This will drive the hyperscale data center market.

According to Forbes, U.S. data centers alone contributed for the consumption of 90 billion kilowatt-hours of electricity in 2017. Also, globally the carbon emission footprint by the data centers was more than four percent in 2018. And it is only going to increase in the future unless a power efficient and eco-friendly methods are not introduced. Unfortunately, the easiest and most feasible efficiency changes have been already implemented a long ago, leading the overall efficiency trend line to flatten in recent years.

Hyperscale data centers require heavy capital investment to set up and have high level of depreciation which makes the entry for any new player, very difficult. On an average the capex cost per MW is USD 10 million and could not be lower enough for players to easily enter the market. All the hyperscalers in the market are multi-billion dollar companies including Facebook, Google, Amazon and others.

The future for hyperscale data centers has taken a bit of wobble due to the slowdown in building their own data centers by the major cloud operators. Recent trend shows that these cloud operators are shifting their focus into leasing the data center capacity. Additionally, the prices for lease space have dropped to a certain extent, making it less attractive for players who looking to invest in new space.

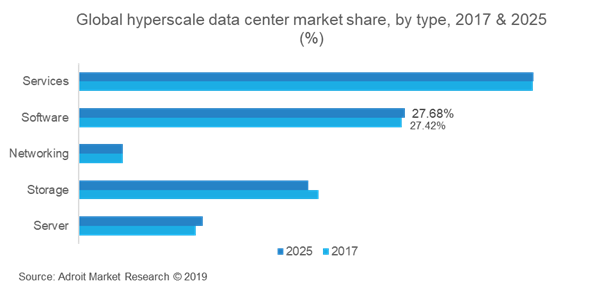

Based on the solution, the hyperscale data center market is segmented into- server, storage, networking, software and services. Among these solutions, software segment had the highest market revenue share in 2017 and is expected to dominate the market in until 2025. Hyperscale data centers are basically designed to optimize the overall efficiency of a typical data center. Thus, most of the power-consuming hardware is replaced by the software and simple management tools which not provide power and space efficiency, but also reduces the consumer cost. The demand for these energy efficient and less cost data centers is expected to increase in the forecast period owing to the growing concerns of carbon emissions and worldwide electricity consumption.

While the software segment keeps dominating the overall market, the server segment is expected to grow with the highest CAGR in the coming years. For the forecast period of 2018 to 2025, the server segment is expected to grow at 12.9%. The proliferation of Internet of Things (IoT) is putting pressure on the data center infrastructure like never before. Organizations have quickly started recognizing that data strategy is the business strategy for now. The growth of hyperscale data centers have driven the demand for servers across various regions. With various OEMs finding success in the server space, the ODMs as well have become the prime beneficiary of the quickly growing hyperscale server demand. In 2017, Intel launched new range of Skylake-era family server processers. Also, a platform called the Purley, was designed to support the Intel Xeon Scalable Platform, which was specifically designed to meet the requirements of A.I., cloud and networking applications. Epyc, Dell, HPE, New H3C Group, Inspur, Lenovo and Super Micro are some popular vendors which particularly supply to the hyperscalers such as Google, Equinix, Facebook, Microsoft and others.

Based on the workload, the global hyperscale data center market is further segmented into two sub-segments- Enterprise and Consumer. In 2017, the enterprise segment had the highest market revenue share and will continue to dominate until the forecast period owing to the growing trend of shifting IT from ‘Build’ to ‘Buy’. Enterprises have started planning to reduce the number of workloads which are housed on-premise and increase the reliance on cloud platforms. The growth in the enterprise segment is mainly seen from applications such as enterprise resource planning (ERP), analytics, collaboration and other digital applications. The notion of hyperscale has now transcended into consumer segment as well. Social networking, internet search, and streaming video are the most popular cloud applications. Among these, the video streaming is the major category which has most of the traffic. Cisco predicts that by 2021, video streaming will account for almost 85% of the data center traffic from data centers to the end users. Video has become the core of all applications, especially in the education sector. Traditional universities have started migrating classes to video and making more of their classes available through online portals such as Coursera.

Regionally, USA dominates the hyperscale data center market as vast majority of the cloud and internet data center sites are situated there. However, there has been a push to relocate the data centers to other countries such as China, Japan, Australia, UK and Canada. In 2017, North America ruled the hyperscale data center market by occupying almost 45% of the revenue share, followed by Europe and Asia-Pacific. USA is facing a major challenge of data center consolidation as the Federal Data Center Consolidation Initiative (FDCCI) have included in their goals to cut the operating, hardware and software costs by moving the applications and services to the cloud. This, in turn, is driving the demand for the hyperscale data centers in the North America region.

On the other hand, Asia-pacific region is showing good signs in driving the market growth in the forecast period owing to the highest smartphone and broadband penetration in the world. The data requirement in this region is growing day by day as most of the data center in this region are outsourced. Within this region, the major hyperscale data center markets include Hong Kong, Singapore, Sydney and Tokyo. According to our research Japan market is expected to be stable until 2025 and the market is expected to grow strong in countries such as India and Singapore. A number of new entrants are impacting the market dynamics in primary markets across Asia-pacific market. While, the existing players are exploring the market through mergers & acquisitions and local partnerships. The major players that are competing in the Asia-pacific market include AWS, Alibaba, Microsoft and Google. Looking at the industry verticals, the financial institutions are the key consumer group for outsourced data center services. For instance, in 2016, DBS contracted with Amazon Web Services to use its cloud services to scale their computing facility and overcome the shortage of data center capacity. The overall growth rate of Asia-pacific region is expected to be 13.9% in the forecast period, which is the highest of all the regions.

The second largest share in the global hyperscale data center market belonged to the Europe region in the year 2017. The major hubs in Europe region include London, Frankfurt, Paris and Amsterdam. The annual growth rate of this region is expected to be around 12.7% during the forecast period.

.png)