Market Analysis and Insights:

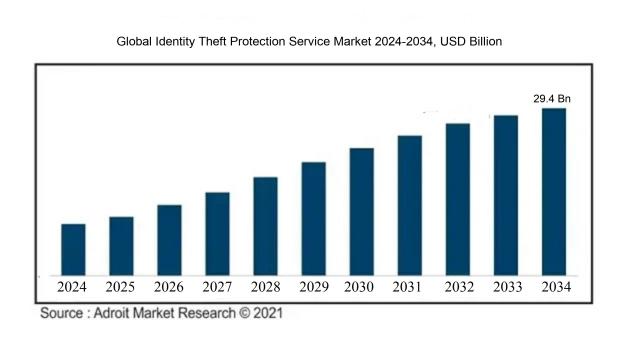

It is projected that the worldwide market for Identity Theft Protection Services will reach a valuation of USD 12.41 billion by 2024. Between 2024 and 2034, the market is expected to expand at a compound annual growth rate (CAGR) of 9.41%, culminating in a projected market size of USD 29.4 billion by 2034.

Numerous significant factors drive the market for identity theft protection services. A primary factor is the increasing occurrence of cyber threats and data breaches, which have raised both individual and corporate awareness about the importance of securing personal and sensitive information. This has led to a growing demand for services that provide proactive monitoring and alerts to detect suspicious activity. Additionally, the rise in the use of digital platforms and online transactions has increased vulnerability to identity theft, further underscoring the need for these services..

Identity Theft Protection Service Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2034 |

| Study Period | 2018-2034 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2034 | USD 29.4 billion |

| Growth Rate | CAGR of 9.41% during 2024-2034 |

| Segment Covered | By Type ,By End-Use,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Experian PLC, Equifax Inc., TransUnion LLC, Lifelock Inc., IdentityForce Inc., Identity Guard, NortonLifeLock Inc., EZShield, AllClear ID, and IdentityIQ Holdings LLC. |

Market Definition

Services aimed at identity protection focus on securing personal information to prevent identity theft. They typically include features such as monitoring credit activities, tracking identity usage, and offering assistance in resolving issues related to identity theft.

In today's digital age, the threat of identity theft has become more pronounced due to an increase in online transactions and extensive storage of personal data across various digital platforms. The critical need for identity theft protection services is evident as they play a crucial role in defending individuals from the drastic consequences of identity theft. These consequences include financial losses, adverse effects on credit scores, and emotional distress. Such services are essential for continuously monitoring personal information, sending alerts on unusual activities, and providing help during identity theft incidents, thereby offering individuals peace of mind by protecting their personal and sensitive information.

Key Market Segmentation:

Insights On Key Type

Credit Card Fraud

The sector of the Global Identity Theft Protection Service market focusing on credit card fraud is expected to lead. This dominance is attributed to a global rise in credit card fraud incidents and an increase in the usage of credit cards for online purchases. Enhanced awareness about the necessity for protective measures against credit card fraud is also driving the market demand. Additionally, technological advancements, including sophisticated encryption methods and biometric authentication, are anticipated to propel the growth of the market in this area.

Employment & Tax Related Fraud

Employment and Tax-Related Fraud is a considerable aspect of the Global Identity Theft Protection Service market. This fraud type involves using someone’s personal details for illegal employment or to evade taxes. With global employment and tax laws becoming more complex, there has been an increase in the instances of identity theft in these areas. Governments and businesses are recognizing the urgency for strong identity theft protection strategies to protect personal and financial information from such fraud.

Phone or Utility Fraud

Phone or Utility Fraud represents a significant segment within the Global Identity Theft Protection Service market. This fraud type includes unauthorized access and use of someone's personal information to obtain phone or utility services illicitly. The fast growth of the telecommunications sector and increased reliance on mobile and utility services have exposed individuals to potential fraud risks. As a result, the demand for identity theft protection services that can prevent and address such risks is on the rise.

Bank Fraud

Bank Fraud is another significant part of the Global Identity Theft Protection Service market. This type of fraud involves the fraudulent use of an individual's identity to access and manipulate their banking and financial accounts. With the increasing digitization of banking services and the rise in online transactions, the risk of bank fraud has ened. Identity theft protection services play a crucial role in safeguarding individuals' financial information and preventing unauthorized access to their bank accounts. The growing awareness about the potential threats of bank fraud is expected to drive the demand for identity theft protection services in this part.

Insights On Key End-Use

Consumers

Individual consumers are predicted to be the predominant market force within the Global Identity Theft Protection Service sector. The rising frequency of identity theft and fraud among personal consumers has significantly boosted the demand for these protection services. Consumers are increasingly conscious of the associated risks and are actively seeking measures to protect their personal information. This trend, coupled with the broader adoption of digital services and the critical need for data protection, is stimulating market growth in this sector.

Enterprises

While enterprises form a substantial part of the Global Identity Theft Protection Service market, their market dominance is expected to be less pronounced compared to individual consumers. Enterprises across various sizes are increasingly adopting these services to protect their sensitive data and that of their employees. With the rising incidents of data breaches and identity theft targeting companies, enterprises are recognizing the vital need to invest in robust identity protection solutions. Although significant, the enterprise segment is anticipated to hold a smaller market share due to higher demand from personal consumers.

Insights on Regional Analysis:

North America:

North America is expected to be the leading region in the global Identity Theft Protection Service market. The region's high adoption rate of sophisticated technologies and digital services makes it a significant market for these solutions. The increase in identity theft and data breaches has further fueled the demand for comprehensive protection services. The presence of major industry players, robust IT infrastructure, and strict data protection laws also contribute to North America’s leading position in this market.

Europe:

Europe, with its strong emphasis on data protection regulations and privacy laws, is expected to be a significant player in the global Identity Theft Protection Service market. Stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) drive the adoption of identity theft protection services across various industries. Furthermore, the increasing digitalization and online transactions in countries like Germany, the UK, and France are creating a need for robust identity protection solutions, further fueling the market growth.

Asia Pacific:

The Asia Pacific region is witnessing rapid growth in the adoption of digital services and online transactions. This, coupled with a mounting number of data breaches and identity theft cases, is driving the demand for identity theft protection services. Developing economies like China and India are experiencing increasing instances of cybercrimes and identity theft, contributing to the growth of the market in this region. However, the market in Asia Pacific is still in its early stages, and factors like limited awareness and lower cybersecurity budgets may hinder its growth potential.

Latin America:

Latin America is gradually witnessing an increase in cybercrimes and identity theft cases. This, along with the rising internet penetration and digitalization of activities, is creating opportunities for the growth of the Identity Theft Protection Service market in the region. The governments in countries like Brazil and Mexico are implementing data protection regulations, which will further drive the demand for these services. However, challenges such as economic instability and limited awareness about identity theft risks may hinder the market growth to some extent.

Middle East & Africa:

The Identity Theft Protection Service market in the Middle East & Africa region is projected to experience moderate growth compared to other regions. The rising adoption of online services and increasing digital payment transactions in countries like the United Arab Emirates and South Africa are driving the demand for identity theft protection solutions. However, factors such as limited cybersecurity infrastructure, a lack of stringent data protection regulations, and low awareness about identity theft risks could hamper the market growth in this region. Thus, the Middle East & Africa region is not expected to dominate the global market.

Company Profiles:

Prominent organizations in the global Identity Theft Protection Service sector are tasked with providing comprehensive services that include credit monitoring, identity restoration, and fraud detection. These services are crucial for protecting clients from identity theft and financial fraud. The core offerings involve providing preventive measures and continuous monitoring to mitigate and manage the risks associated with identity theft.

Prominent enterprises in the Identity Theft Protection Service industry include Experian PLC, Equifax Inc., TransUnion LLC, Lifelock Inc., IdentityForce Inc., Identity Guard, NortonLifeLock Inc., EZShield, AllClear ID, and IdentityIQ Holdings LLC. These firms are at the forefront of developing innovative solutions that defend individuals’ personal information against cyber threats and identity theft. By employing state-of-the-art technologies and leveraging extensive industry expertise, they offer comprehensive services including credit monitoring, identity surveillance, identity restoration, and insurance coverage to ensure the privacy and security of their customers’ identities. These key players remain focused on enhancing their market presence and leadership through continuous research and development and strategic partnerships, thus reducing identity theft risks for both consumers and corporations.

COVID-19 Impact and Market Status:

The demand for Identity Theft Protection Services in the global market has risen due to the ened risk of identity theft brought on by the Covid-19 pandemic, thereby emphasizing the necessity for ened security protocols.

The identity theft protection service industry has experienced a notable impact from the COVID-19 pandemic. The shift towards increased digital transactions and the prevalence of remote working have raised the risk exposure of individuals and businesses to cyber threats and data breaches. This has led to a ened demand for robust protection measures against identity theft and related fraudulent activities. Amidst a more interconnected and vulnerable digital landscape, both individuals and businesses are actively seeking reliable services to protect their personal and financial information. However, the economic uncertainties triggered by the pandemic have forced many to cut back on non-essential expenses, including security services, tightening available budgets. Furthermore, intensified competition in the market has pressured service providers to innovate and offer competitive pricing. As a result, the identity theft protection service sector is traversing a complex terrain of both opportunities and challenges as it adapts to the changing circumstances brought about by the pandemic.

Latest Trends and Innovation:

- July 2020: Experian launched IdentityWorks(SM) Online Fraud Resolution to provide consumers with enhanced identity theft protection and support services.

- October 2020: Equifax acquired Kabbage, a leading financial technology company, to further its identity and business verification services.

- November 2020: NortonLifeLock unveiled enhanced features for its identity theft protection service, including an improved dark web monitoring capability.

- December 2020: TransUnion acquired Neustar, a leading identity resolution provider, to enhance its fraud prevention and digital ID verification capabilities.

- February 2021: ID Watchdog introduced a new mobile app, allowing its customers to monitor their identity theft protection in real-time.

- April 2021: LifeLock, a subsidiary of NortonLifeLock, launched a new service called Privacy Monitor, which helps individuals monitor and protect their personal information.

- May 2021: Experian partnered with InfoArmor, a pioneer in employee identity protection, to expand its identity theft protection services for businesses.

- July 2021: Equifax completed the acquisition of Kount, a leading provider of artificial intelligence-driven fraud prevention and digital identity solutions.

- August 2021: ID Watchdog announced a strategic partnership with Pay My Medical Bills, a medical cost reduction company, to offer identity theft protection services to healthcare providers and their patients.

- September 2021: TransUnion partnered with Ondot, a digital card services platform, to launch a new solution that provides real-time alerts and control for credit and debit cards to enhance identity theft prevention.

Significant Growth Factors:

The Identity Theft Protection Service Market is experiencing growth due to the rising incidents of data breaches and identity theft, which have created a higher need for strong security measures.

The identity theft protection services market is witnessing significant growth driven by various factors. The increasing frequency of identity theft incidents has underscored the need for such services. As more individuals engage in online activities and share sensitive information on the internet, the threat of identity theft becomes a pressing concern. This has led to ened consumer awareness and a surge in demand for protective measures.

Additionally, strict regulations and compliance requirements by governmental and regulatory bodies are pushing organizations to focus on securing personal data. Investment in identity theft protection services is growing as companies aim to safeguard customer data and prevent breaches. The introduction of cutting-edge technologies, such as biometric authentication, artificial intelligence, and machine learning, has greatly enhanced the capabilities of these services, enabling real-time monitoring and alerts. The widespread adoption of smartphones and e-commerce further supports the expansion of these services, as the increase in online transactions calls for comprehensive security measures against sophisticated identity theft tactics. Thus, the convergence of these dynamics is driving the expansion of the identity theft protection service market and boosting the demand for proactive identity safeguarding solutions.

Restraining Factors:

The effectiveness of identity protection services in mitigating the risks of identity theft may be compromised by technological advancements and complex cybercrimes, posing challenges to their integrity and reliability.

In recent years, the identity theft protection services market has seen substantial growth due to the rising incidence of identity theft and growing awareness among people about the importance of protecting their personal information. Despite this growth, several challenges hinder further expansion of the market. The high cost of these services often discourages many consumers, particularly those on tighter budgets, leading to a narrower customer base of proactive individuals who are willing to invest in security. The lack of uniform global regulations also stymies the growth of identity theft protection services, making it difficult for companies to offer consistent services internationally. Additionally, cybercriminals continually evolve their strategies alongside technological advances, presenting ongoing challenges for maintaining effective security measures. Concerns over privacy and potential misuse of personal data by providers also affect trust among prospective clients. Nonetheless, the market outlook remains positive.

The growing prevalence of identity theft is prompting governments and regulatory bodies to boost awareness and enforce stricter regulations, likely leading to a more regulated market. The increasing dependence on digital transactions is expected to sustain demand for identity theft protection services. Companies in this sector also have opportunities to enhance their offerings by incorporating advanced technologies like artificial intelligence and machine learning to better detect and counteract emerging threats. Despite existing challenges, the potential for growth and improved protection for individuals in the identity theft protection service market persists.

Key Segments of the Identity Theft Protection Service Market

Type Overview

- Credit Card Fraud

- Employment & Tax Related Fraud

- Phone or Utility Fraud

- Bank Fraud

End-Use Overview

- Consumer

- Enterprise

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America