IED Detection System Market Analysis and Insights:

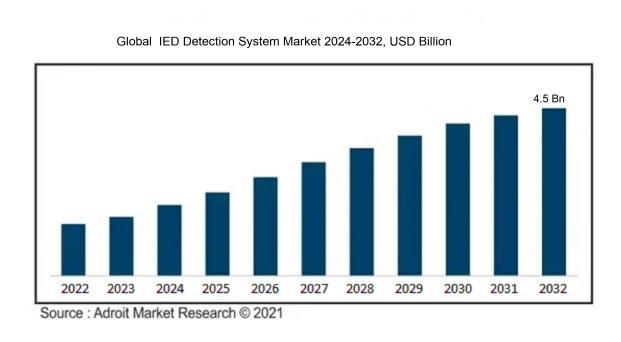

The market for IED (improvised explosive device) detection systems is expected to be worth USD 2.8 billion globally as of 2023. With a cumulative annual growth rate (CAGR) of 7.95%, this industry is expected to reach USD 4.5 billion by 2032.

The market for IED Detection Systems is largely fueled by rising fears concerning terrorism and the spread of improvised explosive devices in both conflict regions and urban locales. Innovations in sensor and detection technologies significantly bolster the capability of these systems, leading to a growing preference among military and security organizations. Furthermore, increased government funding for defense and public safety programs is spurring market expansion. The prevalence of asymmetric warfare strategies and the urgent need for swift response mechanisms highlight the necessity for advanced detection technologies. Additionally, the incorporation of artificial intelligence and machine learning within these systems enhances their performance and dependability, drawing in a broader range of users. Regulatory frameworks and international partnerships focused on counter-terrorism also play a vital role in driving the demand for cutting-edge IED detection solutions across multiple sectors, such as transportation, critical infrastructure security, and event management.

IED Detection System Market Definition

An IED Detection System refers to a sophisticated technology or approach aimed at pinpointing and identifying improvised explosive devices (IEDs) in order to enhance security in both military and civilian settings. These systems employ a range of sensors and methodologies for prompt detection, thereby reducing the dangers linked to concealed explosives.

The detection systems for Improvised Explosive Devices (IEDs) are vital for improving safety and security in both military and civilian contexts. These technologies are engineered to locate potential explosive hazards, facilitating prompt action that can protect lives and avert injuries. Given that IEDs have emerged as a common method of assault in both warfare and terrorism, the development of reliable detection methods is crucial for ensuring the protection of individuals and facilities. Through the incorporation of sophisticated sensors and analytical capabilities, IED detection systems enhance situational awareness and markedly shorten response durations, thereby bolstering counter-terrorism initiatives and fostering safer operational settings.

IED Detection System Market Segmental Analysis:

Insights On Technology

Ground-Penetrating Radar

Ground-Penetrating Radar (GPR) is projected to dominate the Global IED Detection System Market. This technology excels in penetrating the ground and providing detailed subsurface images, effectively detecting buried explosive threats. Its capability to identify various types of materials and detect anomalies makes GPR indispensable in counter-IED efforts. Additionally, given its high accuracy, real-time data provision, and the increasing requirement for advanced detection systems in military and security operations worldwide, the reliance on Ground-Penetrating Radar will likely strengthen, ensuring its leading position in the market. The growing investments in defense and security technology further underscore the prominence of GPR in enhancing safety measures.

Infrared

Infrared technology plays a crucial role in the detection of IEDs by identifying heat signatures from explosive materials or their components. Its ability to see through smoke or dust under various environmental conditions adds to its effectiveness, particularly in surveillance and reconnaissance missions. Infrared systems are increasingly integrated into drones and portable devices for enhanced mobility and operational efficiency. As the demand for versatile and efficient detection technologies rises, infrared is expected to capture a significant share of the market, particularly in tactical and urban operations.

Acoustic

Acoustic detection technologies are gaining traction in the IED detection arena due to their ability to analyze sound waves generated by anomalies in the environment. This system utilizes microphones to detect the unique sound signatures that arise from the detonation process or the movement of certain materials associated with explosives. Although still growing in adoption compared to more established technologies, acoustic solutions can complement other detection systems, ultimately improving situational awareness and response strategies during potential threats. Their effectiveness in specific environments, such as urban areas, further enhances their relevance in the market.

Laser

Laser-based detection technology stands out for its precision and non-contact nature in identifying explosives. By employing laser beams to identify and analyze materials, this method allows for real-time monitoring and assessment. The ability to discern chemical compositions from a distance makes laser systems invaluable, especially in securing sensitive locations or during large-scale events. Despite being less prevalent than other technologies, ongoing advancements and integrations into comprehensive detection systems will likely bolster its market position as organizations seek enhanced detection capabilities in counter-terrorism efforts.

Others

The category labeled "Others" encompasses a range of innovative methods and technologies that may not yet be mainstream in the IED detection market but are developing rapidly. This can include newer electromagnetic techniques, advanced robotics, and artificial intelligence applications, which all aim to enhance detection accuracy and efficiency. As the landscape of IED threats evolves, diverse methodologies could emerge as critical components of multi-faceted detection strategies. Consequently, while this category may not dominate at present, its potential for growth and innovation could yield significant contributions to the IED detection technology landscape in the near future.

Insights On Component

Hardware

The hardware component is expected to dominate the Global IED Detection System Market due to its crucial role in ensuring the effectiveness of these systems. Hardware includes vital components like sensors, detection units, and communication devices, which are essential for real-time threat identification and mitigation on the ground. With the increasing emphasis on national security and the evolving nature of threats, investments in high-performance and reliable hardware solutions are a priority for defense and security agencies. Furthermore, advancements in technology, such as miniaturization and integration of AI capabilities into hardware, are driving growth within this sector, making it a focal point for innovation in IED detection.

Software

The software component, while not leading, plays an essential role in enhancing the efficiency of IED Detection Systems. It primarily focuses on data processing, analysis, and management, enabling operators to interpret the information gathered by the hardware effectively. Advanced software solutions provide critical functionalities such as real-time monitoring, predictive analytics, and threat modeling, which are integral for timely decision-making and response. The ongoing development of artificial intelligence and machine learning algorithms further augments the capability of software to analyze large datasets, allowing for a more comprehensive understanding of potential threats in various environments.

Services

The services aspect encompasses support, maintenance, and consulting related to the deployment of IED Detection Systems. While it does not lead in terms of market share, services are vital for the longevity and operational readiness of the systems in use. This includes training personnel, providing technical support, and ensuring regular updates to both hardware and software components. Increased focus on service contracts and maintenance agreements indicates a commitment from organizations to maintain peak efficiency and adaptability against emerging threats. This dependence on skilled services solidifies their importance within the broader market, ensuring that hardware and software operate optimally in challenging conditions.

Insights On End-User

Military

The military is anticipated to dominate the Global IED Detection System market. This is primarily driven by the increasing necessity for advanced defense capabilities and protection for troops in conflict zones. Global military forces are continuously upgrading their equipment and technologies to counteract evolving threats, particularly improvised explosive devices (IEDs). Moreover, rising military budgets in various countries have facilitated investments in cutting-edge detection technologies, driving demand. The ened emphasis on operational effectiveness and soldier safety is a strong catalyst for military adoption, positioning it as the leading end-user in this market sphere.

Homeland Security

The homeland security is growing significantly, fueled by rising terrorist threats and domestic safety concerns. Governments are investing heavily in advanced detection systems to enhance security measures for public safety. Various incidents have highlighted the need for improved capabilities in identifying and mitigating explosive threats in civilian areas. This also benefits from collaboration between regional governments and commercial entities to deploy innovative solutions, ensuring that security agencies can swiftly respond to potential threats. The increasing emphasis on national security will keep driving growth in this portion of the market.

Commercial

The commercial sector is also showing growth potential, primarily driven by the increasing awareness of safety and security among businesses and public spaces. Corporations have started to implement IED detection systems as preventive measures against potential threats, especially in high-risk areas. The rise of terrorism and targeted attacks on public venues has prompted organizations to invest in security technologies to protect their assets and personnel. However, compared to military and homeland security, the commercial 's growth is slower due to budget constraints and a focus on other operational investments, which limits its overall dominance in the IED detection system market.

Insights On Deployment

Handheld

The Handheld deployment method is expected to dominate the Global IED Detection System Market due to its unprecedented versatility, mobility, and ease of use in various operational environments. Increasing demands for quick response times in hostile situations necessitate lightweight and portable equipment, making handheld devices ideal for military personnel, law enforcement, and emergency responders. As urban areas become prone to insurgency and terrorism, the need for compact detection systems that can be operated by a single individual is escalating. Furthermore, technological advancements have improved the efficiency and accuracy of handheld devices, allowing operators to scale their effectiveness in diverse settings such as crowded public spaces or narrow urban areas.

Vehicle-Mounted

Vehicle-Mounted platforms serve as a crucial alternative in the IED Detection System Market, primarily benefiting from their deployment in high-risk environments. These systems provide enhanced detection capabilities, enabling larger and more sophisticated equipment to be integrated for extensive area coverage. Military operations often utilize vehicle-mounted systems as they offer superior protection and robustness against explosive threats. Additionally, their ability to constantly patrol and conduct surveillance from a safe distance makes them invaluable for maintaining situational awareness and minimizing risk to personnel during missions.

Robotics

Robotics has increasingly gained traction in the IED Detection System Market due to its ability to operate in extremely hazardous environments. Robotic systems, such as drones or ground robots, can navigate complex terrains and approach potential threats without putting human life at risk. This technology plays a pivotal role in reconnaissance missions, as it reduces the likelihood of casualties while enhancing the efficiency of detection operations. Furthermore, ongoing advancements in robotic capabilities enable real-time data transmission, providing operators crucial information for informed decision-making.

Airborne

Airborne systems represent a niche but crucial element in the IED Detection System Market, primarily used for surveillance and reconnaissance from aerial platforms. These systems offer a unique vantage point, allowing for the overwhelming area coverage that can identify threats from above. While they are not as widely deployed as handheld or vehicle-mounted systems, the increasing emphasis on aerial surveillance for military and public safety operations can spur growth in this deployment method. Additionally, their synergy with other detection technologies can enhance situational awareness significantly, making them valuable in layered defense strategies.

Global IED Detection System Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global IED Detection System market due to a combination of factors such as increasing terrorist threats and military tensions in various countries. Nations like India, Japan, and Australia are investing heavily in upgrading their defense infrastructure, which includes advanced detection systems for improvised explosive devices (IEDs). The growing urbanization and infrastructure development in countries like China and Southeast Asian nations add to the complexity of security needs, driving demand for IED detection technologies. Furthermore, regional governments are forming strategic partnerships with tech developers to enhance the effectiveness of security measures, creating ample opportunities for market players.

North America

North America stands as a significant player in the IED Detection System market, primarily driven by the advanced technological capabilities and strong defense budgets of the United States and Canada. With a well-established military presence and a significant focus on counter-terrorism efforts, both nations actively seek to adopt state-of-the-art systems to enhance their security measures. The presence of numerous key market players and ongoing research and development further strengthen this regional market, though the pace of growth may be somewhat tempered compared to rapidly developing markets in Asia Pacific.

Europe

The European market for IED Detection Systems is characterized by a high degree of collaboration among NATO nations, focused on addressing emerging security threats. With the rise of asymmetric warfare and urban terrorism, there has been a pressing need for advanced detection technologies. Countries like the UK, Germany, and France are actively investing in defense systems, particularly for public safety and military applications. The regulatory landscape in Europe is also inching toward stricter standards for security measures, promoting the adoption of innovative technologies.

Latin America

In Latin America, the IED Detection System market is gradually evolving, propelled by growing concerns over organized crime and drug trafficking. Countries facing social unrest are increasingly investing in security measures, including IED detection to combat improvised explosive threats. However, the market remains constrained by budgetary limitations and lower technological advancement compared to North America and Europe. As governmental initiatives grow and international partnerships bloom, the demand for effective detection systems may see notable progress in future years, though it will take time to match the dominating markets.

Middle East & Africa

The Middle East & Africa region is facing critical security challenges, particularly with ongoing conflicts and terrorist activities posing significant threats. Countries like Iraq and Afghanistan have shown a high demand for IED detection systems due to the prevalent risks from terrorist groups and guerilla tactics. However, the market is impeded by economic instability and insufficient funding for advanced technological systems in many African nations. While the necessity for security solutions provides opportunity, such challenges mean that the region is currently lagging behind more developed markets.

IED Detection System Competitive Landscape:

Major contributors to the worldwide IED detection system market focus on creating and implementing cutting-edge technologies and solutions for the identification of explosive devices. Their responsibilities include research and development, alongside forming strategic collaborations to boost operational efficiency and enhance global security protocols.

The primary entities operating within the IED Detection System sector encompass Northrop Grumman Corporation, Thales Group, Textron Inc., Smiths Group plc, BAE Systems plc, Lockheed Martin Corporation, Elbit Systems Ltd., FLIR Systems, Inc., Raytheon Technologies Corporation, Chemring Group plc, L3Harris Technologies, Inc., ASaT, and IED Solutions Inc.

Global IED Detection System COVID-19 Impact and Market Status:

The COVID-19 pandemic substantially affected the global market for IED detection systems, causing supply chain challenges and postponements in the rollout of technologies. At the same time, it ened the need for improved security protocols across different industries.

The COVID-19 pandemic had a profound impact on the market for Improvised Explosive Device (IED) detection systems, primarily due to disruptions in supply chains, delays in project rollouts, and a reallocation of defense budgets. As nations prioritized urgent health issues and economic recovery efforts, there was a noticeable dip in funds directed towards defense technologies. Additionally, travel restrictions and limitations on gatherings impeded collaboration among defense contractors, which consequently slowed down the innovation and testing of advanced detection solutions. However, the increasing demand for security across various sectors has spurred a greater emphasis on improving technology for counter-terrorism applications. In the aftermath of the pandemic, as governments boost defense spending and emphasize national security, the market is anticipated to recover, with an intensified focus on incorporating advanced technologies such as artificial intelligence and machine learning into IED detection systems. This dual influence highlights the market's adaptability and its capacity to evolve in response to new threats and shifting defense priorities.

Latest Trends and Innovation in The Global IED Detection System Market:

- In March 2023, Northrop Grumman announced the acquisition of the technology assets of Quantum Research Group, enhancing its capabilities in developing advanced detection systems for Improvised Explosive Devices (IEDs) and increasing its market share in the defense sector.

- In January 2023, Flir Systems launched the FLIR K55, a new thermal imaging camera designed for first responders, which includes advanced features to assist in detecting IEDs in various environments and situations.

- In November 2022, Chemring Group unveiled its new line of handheld and vehicle-mounted IED detection systems at the International Defense Exhibition and Conference (IDEX), showcasing improvements in speed and sensitivity over previous models.

- In September 2022, 3M completed the acquisition of the Permeation Technologies business from Luminus Devices, which enabled the integration of advanced sensor technology into its IED detection solutions to improve response times and accuracy.

- In August 2022, Raytheon Technologies announced a partnership with Carnegie Mellon University to develop cutting-edge AI-driven detection systems for IEDs, leveraging machine learning algorithms to enhance threat recognition.

- In June 2022, BAE Systems received a contract worth $60 million from the U.S. Department of Defense to supply its advanced IED detection systems for deployment in conflict regions, demonstrating continued demand for their technology.

- In April 2022, The Boeing Company collaborated with the U.S. Army to further develop its Ground-based Synthetic Aperture Radar (GBSAR) technology for detecting buried IEDs, marking a significant evolution in the use of radar systems in the field.

- In February 2022, Leonardo S.p.A. demonstrated its latest drone capabilities for IED detection during a major defense exhibition, highlighting the integration of aerial systems with ground-based detection techniques to improve operational efficiency.

IED Detection System Market Growth Factors:

The expansion of the IED Detection System Market is propelled by technological innovations, ened security apprehensions, and escalating financial commitments toward defense infrastructure development.

The market for IED detection systems is undergoing notable expansion, fueled by various critical factors. An uptick in terrorist activities and asymmetric warfare has significantly increased the need for sophisticated detection technologies aimed at countering the risks posed by improvised explosive devices (IEDs). In response, government entities and defense organizations are amplifying their financial commitments to bolster both homeland security and military capabilities, thereby ening the demand for advanced IED detection solutions.

Innovations in sensor technology, artificial intelligence, and data analytics are enhancing the precision of detection methods and improving operational effectiveness. The growing emphasis on public safety in urban settings, along with the escalating threats from non-state actors, further propels the market's growth. Partnerships between defense contractors and technology developers are driving the creation of more efficient detection systems, which additionally stimulates market development.

Regions experiencing geopolitical instability are also prioritizing safety measures, leading to increased demand for these detection systems. As military strategies evolve, the incorporation of drone and robotic technologies into IED detection frameworks is becoming increasingly prominent, opening up new avenues for industry participants. Finally, rising levels of awareness and training among military and law enforcement personnel regarding the effective use of these systems contribute to the ongoing growth of the market, ensuring preparedness against emerging security challenges.

IED Detection System Market Restaining Factors:

The primary constraints impacting the IED Detection System Market are the elevated expenses associated with cutting-edge technology and difficulties stemming from false alarm rates and varying environmental factors.

The market for IED detection systems encounters a range of challenges that may hinder its advancement. One of the principal obstacles is the high cost associated with development and operation, as sophisticated detection technologies demand considerable financial investment in both equipment and user training. Moreover, the intricate process of integrating these advanced systems with pre-existing security frameworks can lead to delays in their adoption by potential clients.

In regions with lower exposure to terrorist activities, there tends to be a lack of awareness and understanding regarding the benefits of IED detection technologies, which can further stifle market growth. Additionally, regulatory inconsistencies and diverse standards across various countries create complexities, complicating the implementation of these detection systems and intensifying operational challenges.

The fast-paced evolution of IED tactics also necessitates ongoing technological advancements in detection, which can be demanding in terms of resources. Nevertheless, the growing focus on security and anti-terrorism initiatives worldwide is catalyzing progress and investment within this industry. Governments and institutions are increasingly emphasizing the creation of robust IED detection solutions, facilitating potential growth and enhanced safety measures. With continuous innovations and rising awareness, the market is on the brink of significant transformation, presenting opportunities for improved security offerings.

Key Segments of the IED Detection System Market

By Technology

• Ground-Penetrating Radar

• Infrared

• Acoustic

• Laser

• Others

By Component

• Hardware

• Software

• Services

By End-User

• Military

• Homeland Security

• Commercial

By Deployment

• Vehicle-Mounted

• Handheld

• Robotics

• Airborne

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America