Inductor Market Analysis and Insights:

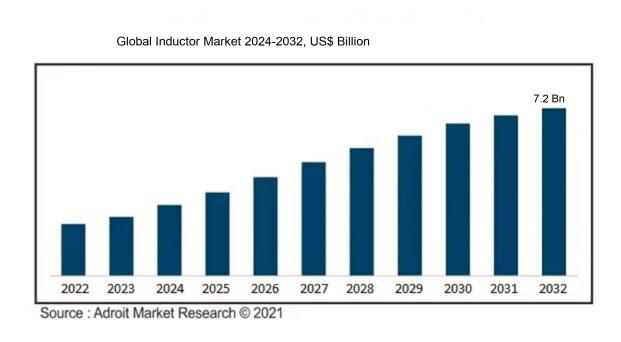

In 2023, the worldwide inductor market was valued at US$3.10 billion. The market is expected to develop at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2032, reaching US$ 7.2 billion, according to Adroit Market Research Group.

The growth of the Inductor Market is largely fueled by the ened need for electronic devices across various industries, particularly in automotive, telecommunications, and consumer electronics. The advent of electric and hybrid vehicles calls for sophisticated inductive components to enable effective power management. Furthermore, the widespread adoption of wireless technology and Internet of Things (IoT) devices drives demand for inductors that support signal integrity and energy storage capabilities. A growing focus on energy efficiency and renewable energy technologies also stimulates market expansion, as inductors play a vital role in systems such as inverters and converters. In addition, innovations in inductor designs, including the creation of low-profile inductors for space-constrained applications, are aiding market growth. In response to customer expectations for more portable and effective products, businesses are placing a greater emphasis on miniaturization and improved performance. Additionally, the escalating adoption of automation and intelligent technologies across various sectors is further increasing the need for inductors within advanced electronic circuits.

Inductor Market Definition

An inductor is a passive electronic device that accumulates energy within a magnetic field as electrical current passes through it. Its main role is to oppose fluctuations in current, which makes it crucial for a range of electronic functions, including filtering and transformer operations.

As electrical current flows through them, inductors, which are crucial parts of electrical circuits, store energy in the form of a magnetic field. Applications including signal modulation, energy storage, and filtering depend on this feature. They are commonly employed in power supply systems to mitigate voltage variations, in radio frequency circuits for tuning purposes, and in transformers to facilitate effective energy transfer. Furthermore, their inherent resistance to fluctuations in current is important for safeguarding delicate components against voltage surges. In summary, inductors significantly contribute to improving the performance, stability, and efficiency of a wide range of electronic applications.

Inductor Market Segmental Analysis:

Insights On Type of Inductor

Ferrite Core Inductors

Among the various types of inductors, ferrite core inductors are expected to dominate the Global Inductor Market. This is primarily because they exhibit excellent magnetic properties, making them highly efficient in transferring energy and minimizing losses. Additionally, ferrite cores are small and light, which fits with the growing need for electronics to be smaller. Furthermore, the growing adoption of ferrite core inductors in high-frequency applications, such as in communication devices, power supplies, and automotive electronics, reinforces their market dominance. As industries continue to seek effective solutions for energy efficiency and performance enhancement, ferrite core inductors are well-positioned to lead the market.

Air Core Inductors

Air core inductors are characterized by the absence of a magnetic core, which leads to minimal losses and a wide range of inductance values. Because they can withstand high power without becoming saturated, they are frequently utilized in high-frequency applications, particularly in radio frequency circuits. Despite their advantages, air core inductors tend to be larger than other types, which limits their use in compact applications. As demand for high-performance RF systems increases, air core inductors will retain a niche in specific markets but are likely to be overshadowed by more compact solutions.

Iron Core Inductors

Iron core inductors are recognized for their ability to provide high inductance in a relatively small volume, making them suitable for power applications. They are commonly used in transformers, chokes, and filters. However, their primary drawback is the higher core losses due to eddy currents compared to ferrite cores, which limits their effectiveness at higher frequencies. Consequently, while iron core inductors serve essential functions in various applications, the ongoing trend toward higher frequency and efficiency is expected to diminish their market share over time.

Toroidal Core Inductors

Toroidal core inductors are known for their doughnut-shaped core, which minimizes electromagnetic interference and enhances efficiency. They are widely used in power supplies and audio equipment due to their ability to deliver clean power with reduced noise. However, their larger size may pose constraints in applications requiring miniaturization. While toroidal core inductors have favorable performance characteristics, the increasing demand for smaller and more efficient designs may hinder their growth as other types of inductors take precedence.

Multilayer Inductors

Multilayer inductors play a crucial role in compact electronic designs, integrating multiple layers of conductive material on a single substrate. This allows for higher inductance values in a smaller package and is particularly beneficial for high-density applications such as smartphones, tablets, and wearables. The demand for miniaturization in consumer electronics is driving the growth of multilayer inductors. However, these inductors may face limitations in high-current applications where larger bulk inductors are still preferred for better thermal management and power handling.

Variable Inductors

Variable inductors offer tunability, allowing them to adjust inductance depending on application requirements, which is vital for tuning circuits in radio applications. They find specialized use in oscillators and filters, where precise control is necessary. However, their complexity and the need for physical adjustment can limit their broader application. As technologies advance toward automation and efficiency, the demand for variable inductors is expected to remain steady but not lead the market, as fixed inductors generally meet the majority of industrial needs.

Insights On Material

Ferrite

Ferrite is expected to dominate the Global Inductor Market due to its high permeability and low cost, making it suitable for a wide range of applications, including power electronics and telecommunications. Ferrite materials exhibit low core losses at high frequencies, which is essential for efficient energy management and electromagnetic interference suppression. Their lightweight nature and high resistivity add to their appeal in compact devices, ensuring that they meet the increasing demand for smaller and more efficient inductive components. As industries continue to innovate and push for advanced electronic solutions, ferrite is well-positioned to lead the market due to its versatility and performance advantages.

Iron

Iron is another commonly used material in inductors, primarily due to its abundance and excellent magnetic properties. Iron core inductors are typically appreciated for their affordability and ability to handle high current applications. However, they are prone to core losses at high frequencies, which limits their utility in modern electronic devices. While iron-based inductors still find applications in transformers and lower frequency circuits, the demand is comparatively less aggressive in the rapidly advancing electronics sector, which tends to favor more efficient materials.

Powdered Iron

Powdered iron is notable for its ability to minimize eddy current losses, making it suitable for applications requiring higher efficiency. The unique processing of powdered iron allows for customizable magnetic characteristics and higher saturation levels than traditional iron. While it is advantageous in certain applications such as RF and high-frequency inductors, it is often considered niche compared to ferrite. Its use in applications that balance performance and cost is critical, but the overall market share is typically overshadowed by ferrite.

Ceramic

Ceramic materials are used primarily in high-frequency applications, as they exhibit low losses and excellent thermal stability. Ceramic inductors often cater to smaller, lower wattage devices, making them popular in consumer electronics. They show advantages in maintaining performance at various temperatures, yet their brittle nature can limit their use in rugged conditions. While the ceramic has steady applications, its overall market presence is limited compared to ferrite-based inductors, which dominate due to versatility across multiple frequency ranges.

Air

Air-core inductors are favored for their ability to eliminate core losses, allowing for high-frequency applications with minimal energy dissipation. They are commonly used in RF circuits and audio applications, where linear performance is paramount. However, the limitations in inductance levels and size constraints restrict their mainstream acceptance. The production costs are higher due to larger sizes needed to achieve desired inductance values, making them less common in compact applications compared to ferrite inductors.

Laminated Steel

Laminated steel inductors are effective in reducing eddy current losses, making them suitable for high-power applications. These inductors are typically used in transformers and inductive heating applications. Though efficient at lower frequencies, these materials are likely to face competition from ferrite options, especially in the light of advancements in high-frequency technology. The market growth for laminated steel is steady, but its niche application limits widespread use compared to the dominant position of ferrite in various electronic applications.

Others

The "Others" category includes materials like amorphous steel and various composite materials that sometimes find niche uses in the inductor market. These materials generally have specific magnetic properties or cost advantages for quite specialized applications. However, they struggle to compete with the established leading materials like ferrite. While they may show growth in specific use cases, their overall share of the market is minor compared to the prevalent use of ferrite for mainstream applications in modern electronics.

Insights On Mounting Type

Surface Mount Inductors (SMD)

Surface mount inductors (SMD) are expected to dominate the global inductor market due to their compact design, easy assembly, and high performance in modern electronic applications. The growing demand for miniaturized electronic devices, especially in consumer electronics such as smartphones, wearables, and automotive electronics, drives the preference for SMD inductors. Their ability to be mounted directly on printed circuit boards (PCBs) allows for better space utilization and improved electrical performance, as well as reduced parasitic effects. Additionally, advancements in manufacturing technologies yield higher quality SMD inductors, further propelling their adoption in various sectors, making them the leading choice in the global market.

Through-Hole Inductors

Through-hole inductors cater to a specialized of the market, primarily in applications where durability and stability are essential, such as in industrial and power electronic sectors. They are often preferred in situations requiring high power handling and reliability. However, their larger sizes restrict their use in compact devices. While they may not dominate the overall market, their unique advantages ensure a steady demand, particularly in legacy applications and environments where heavy-duty components are necessary.

Chassis Mount Inductors

Chassis mount inductors are primarily utilized in power supply units and high-power applications. The sturdy construction provides excellent thermal management and high current capacities, which are essential in environments dealing with significant electrical or thermal stress. Despite being less common in consumer electronics due to their size, they serve a vital role in industrial machinery and power distribution systems. Their distinguishing feature of mounting directly on a chassis provides stability and reduces vibration issues, appealing to specific industrial requirements.

Insights On Size/Form Factor

Miniature

Miniature inductors are expected to dominate the Global Inductor Market due to the increasing demand for compact electronic devices and the trend toward miniaturization in technology. As smartphones, wearable devices, and Internet of Things (IoT) products continue to evolve, the need for smaller form factors that conserve space and enhance performance grows. Miniature inductors offer higher efficiency and lower losses, making them ideal for high-frequency applications. Moreover, advancements in manufacturing processes have made it feasible to produce miniature inductors that meet the rigorous demands of modern electronics, thus driving their adoption across various industries.

Standard

Standard inductors have a significant presence in the Global Inductor Market, primarily catering to applications that require reliable performance and stability without the constraints of size. These inductors are widely used in consumer electronics, industrial equipment, and power management systems, where the balance between size and power handling is crucial. They offer a variety of inductance values and materials, allowing for flexibility in design. While the trend towards miniaturization poses a challenge, standard inductors remain essential for a variety of bulk applications, providing consistent performance at competitive costs.

Large

Large inductors play a critical role in specialized applications, particularly in power electronics and renewable energy systems. Though they are not as ubiquitous as miniature and standard inductors, they excel in high current and voltage applications, such as electric vehicles, industrial motors, and transformers. Their ability to handle significant power makes them indispensable in energy conversion and storage systems. However, the larger size limits their utilization in compact consumer products, leading to a narrower market presence. Despite this, the growth of industries focused on energy efficiency and renewable technologies continues to drive demand for large inductors.

Insights On Application

Power Inductors

Power inductors are expected to dominate the Global Inductor Market due to their essential role in a wide range of applications, particularly in power management systems. With the increasing demand for efficient power conversion and regulation in consumer electronics, automotive, and industrial sectors, power inductors have gained significant traction. Their ability to provide energy storage while minimizing energy loss makes them a critical component in a high-performance circuit. As industries continue to adopt advanced technologies like IoT devices and electric vehicles, the reliance on power inductors is projected to grow, solidifying their dominance in the Global Inductor Market.

RF Inductors

RF inductors serve a crucial function in radio frequency applications, where they help filter and stabilize signals. The rise of wireless communication technologies and increasing demand for Internet of Things (IoT) devices contribute to their growing importance. RF inductors are integral components in applications such as telecommunications, satellite communication, and highly functional RF circuits. Their specialized design ensures minimal losses and optimal performance in high-frequency scenarios, providing an advantage in a market that is increasingly reliant on wireless data transmission.

Coupled Inductors

Coupled inductors, often utilized in transformer applications, are gaining traction, especially in power supply circuits and energy conversion systems. These components allow for efficient energy transfer between their windings, which is essential for applications that require isolation or voltage step-up. As the push for more efficient power solutions continues, particularly in green technologies and renewable energy systems, the demand for coupled inductors is projected to increase. Their role in high-efficiency converters further underscores their significance in modern electronic systems.

Multilayer Inductors

Multilayer inductors are widely used in compact electronic devices due to their small footprint and high inductance value. These inductors are particularly favored in smartphones, laptops, and other consumer electronics where space is at a premium. The trend towards miniaturization in electronics drives the demand for such inductors, as they deliver high performance without occupying excessive space. Multilayer inductors’ versatility in various applications further strengthens their position in the market, though they face competition from other types of inductors in specific use cases.

Other Specialized Inductors

Other specialized inductors encompass a range of designs tailored for specific applications, such as sensor systems and audio equipment. Although they represent a smaller portion of the market, their unique designs can address niche requirements more effectively than standard inductors. The growth in specialized applications, including automotive and aerospace, promotes innovation and the creation of custom inductors. As industries continue to explore tailored solutions for increasingly complex systems, the relevance of these specialized inductors in the Global Inductor Market remains significant, albeit less dominant compared to power inductors.

Insights On End-use Industry

Automotive

The Automotive sector is expected to dominate the Global Inductor Market due to the increasing electrification of vehicles, advancements in automotive technology, and the growing demand for Electric Vehicles (EVs). The integration of inductors in electric powertrains, battery management systems, and various electronic applications in vehicles has significantly boosted the demand in this industry. Additionally, the ongoing shift towards smart and connected vehicles further amplifies the need for efficient power management solutions, positioning Automotive as a leading contributor to the inductor market's growth. As automotive manufacturers increasingly focus on innovation and sustainability, the reliance on inductors will undoubtedly strengthen in this.

Consumer Electronics

The Consumer Electronics sector is another essential area for inductors, driven by the growing demand for high-performance electronic devices such as smartphones, laptops, and wearables. Inductors play a critical role in energy transfer and filtering applications, ensuring better efficiency and performance in electronic products. As technology continues to advance rapidly, the miniaturization of electronic components and the rise of smart devices are expected to bolster the need for effective inductive solutions. This continuous innovation in consumer electronics makes it a vital industry for inductor utilization.

Industrial

The Industrial sector utilizes inductors extensively within automation systems, power supplies, and control equipment. The push towards digitization and Industry 4.0 has resulted in increased investments in advanced manufacturing technologies, necessitating improved energy efficiency and reliability in industrial applications. Furthermore, the rising trend of renewable energy systems, like wind and solar power, which require inductive components for efficient operation, contributes significantly to the growth of this.

Telecommunications

The Telecommunications industry heavily relies on inductors for signal processing, power management, and electromagnetic interference (EMI) suppression in various devices such as routers, switches, and base stations. As the demand for faster and more reliable communication systems grows, particularly with the rollout of 5G networks, the importance of inductors will continue to rise. This trend is driven by the need for high-frequency performance and improved power efficiency across telecommunications equipment, ensuring a robust growth trajectory for this industry.

Aerospace and Defense

In the Aerospace and Defense sector, inductors are essential in ensuring stable power supplies and reliable performance of avionics, communication systems, and radar technologies. Given the stringent requirements for safety, reliability, and efficiency in this field, the demand for specialized inductors is on the rise. As technologies evolve and nations invest more in defense capabilities, the Aerospace and Defense industry presents significant opportunities for inductor growth, driven by advancements in aircraft and equipment.

Healthcare

The Healthcare industry incorporates inductors in various applications, including medical imaging, telemedicine devices, and portable medical equipment. The rising demand for sophisticated healthcare solutions, like diagnostics and patient monitoring systems, necessitates efficient power management and signal processing, where inductors play a pivotal role. As the healthcare sector increasingly incorporates advanced technologies and connectivity in its devices, there is significant potential for growth in the demand for inductors within this area.

Energy and Power

The Energy and Power sector relies on inductors for applications in renewable energy systems, such as solar inverters and wind turbines, where they are crucial for voltage regulation and energy conversion. The global transition towards sustainable energy sources significantly drives the demand for inductive components that enhance efficiency and reliability. As investments in clean energy technologies continue to increase, the Energy and Power sector will emerge as a key contributor to the overall growth of the inductor market.

Others

The Others category encompasses various industries that utilize inductors for specialized applications. While not the foremost contributor to market growth, sectors such as consumer appliances, lighting solutions, and smart home technology use inductors in their designs. As these industries evolve, introducing innovative technologies that require effective power management solutions, the need for inductors is expected to rise, albeit at a slower pace compared to the aforementioned keys.

Global Inductor Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Inductor Market due to several compelling factors. Rapid industrialization, particularly in countries like China, India, and Japan, is significantly driving demand for inductors in various applications, including automotive, consumer electronics, and telecommunications. The region's strong manufacturing base, coupled with a growing focus on advanced technologies such as electric vehicles and renewable energy systems, further propels the market. Additionally, the increasing adoption of smart devices and IoT applications has escalated the need for efficient components like inductors. The presence of leading manufacturers and a robust supply chain within the region significantly contributes to its dominance.

North America

North America is a key player in the Global Inductor Market, primarily driven by advancements in technology and research and development efforts. The region has a stronghold in sectors such as automotive and aerospace, where high-performance inductors are essential. However, the growth rate is moderate due to market saturation and stringent regulations. As companies increasingly focus on enhancing the efficiency of electronic devices, the demand for specialized inductors will likely increase, though it may not match the pace of the Asia Pacific region.

Europe

Europe is recognized for its contribution to the Global Inductor Market, especially in terms of innovation and high-quality production. The region's emphasis on sustainability and energy-efficient solutions in electronics has spurred demand for inductors in renewable energy applications. However, challenges such as high production costs and regional supply chain issues limit rapid market expansion. While Europe remains a significant market for inductors, its growth will likely be steady rather than explosive, primarily as companies shift toward greener technologies.

Latin America

Latin America is emerging as a developing market for inductors; however, it still lags behind in comparison to more advanced regions. Economic fluctuations and lower investments in high-tech manufacturing within countries like Brazil and Argentina present challenges to the growth of the inductor market. Despite these issues, the region's increasing mobile device usage and expansion in the electrical infrastructure sector could foster gradual market growth. The demand for inductors will be contingent on broader economic improvements and technology adoption strategies.

Middle East & Africa

The Middle East & Africa region shows potential in the Global Inductor Market, primarily driven by the oil and gas industry's applications and growing investments in telecommunications. However, the market remains underdeveloped compared to other regions due to infrastructural challenges and lower manufacturing capabilities. While there is a rising need for electronic solutions, the overall demand for inductors may remain limited. The future growth in this region will largely depend on improvements in technology and supply chain logistics to bolster electronics manufacturing.

Inductor Competitive Landscape:

Leading entities in the worldwide inductor market, including producers and providers, play a crucial role in fostering innovation and maintaining product accessibility. They also have a significant impact on pricing strategies and market dynamics. Through partnerships and technological progress, these players greatly enhance the industry's overall growth and evolution.

Prominent participants in the inductor industry encompass Vishay Intertechnology, Inc., Murata Manufacturing Co., Ltd., TDK Corporation, Wurth Elektronik GmbH & Co. KG, Infineon Technologies AG, NXP Semiconductors N.V., Fair-Rite Products Corp., Sumida Corporation, Coilcraft, Inc., Kemet Corporation, Bourns, Inc., Panasonic Corporation, MagnaChip Semiconductor Corp., Eaton Corporation plc, and American Semiconductor, Inc.

Global Inductor COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly impacted the global inductor market, resulting in supply chain disruptions and alterations in demand patterns. This led to production delays and a short-term reduction in consumption across multiple industries.

The COVID-19 pandemic had a profound effect on the inductor industry, stemming from disruptions in supply chains, a drop in production rates, and variable demand across different markets. The implementation of global lockdowns resulted in factory shutdowns and labor shortages within electronic manufacturing sectors, contributing to a decline in inductor output. Key sectors like automotive and consumer electronics—which heavily rely on inductors—saw a fall in sales due to diminished consumer spending and changing buying habits, further limiting demand. On the flip side, the pandemic expedited trends such as remote working and a surge in digitalization, leading to a ened need for electronic devices and, in turn, for inductors. As the world moves beyond the pandemic, the electronics sector is witnessing a revival in production and investment, with manufacturers adjusting to the evolving market dynamics and consumer preferences. Overall, the inductor market is expected to recover, reflecting a complex web of challenges and opportunities influenced by the pandemic.

Latest Trends and Innovation in The Global Inductor Market:

- In September 2023, Vishay Intertechnology announced the acquisition of Walsin Technology Corporation's inductor product line, expanding its portfolio and enhancing its manufacturing capabilities in electronic components.

- In June 2023, Murata Manufacturing Co., Ltd. revealed significant advancements in multi-layer ceramic inductors, showcasing technology that improves temperature stability and current handling capabilities, appealing to high-performance applications in the automotive and industrial sectors.

- In February 2023, TDK Corporation launched a new series of high-frequency inductors designed for 5G applications, emphasizing improved efficiency and reduced size, catering to the increasing demand for compact components in telecommunications.

- In April 2023, Coilcraft, Inc. introduced a new line of power inductors optimized for high-efficiency power circuit designs, which supports both automotive and consumer electronics markets, gaining attention for their unique winding methods that minimize energy loss.

- In August 2023, Nippon Chemi-Con Corp entered a strategic partnership with a leading electric vehicle manufacturer to co-develop specialized inductors aimed at improving power efficiency in electric drivetrains.

- In July 2023, Samsung Electro-Mechanics expanded its production capabilities by investing in a new manufacturing facility dedicated to electric vehicle inductors, projecting to meet the growing demand due to the global transition to electric mobility.

- In November 2022, OMRON Corporation unveiled a breakthrough in inductor technology with the introduction of a new line of high-precision inductors for IoT devices, addressing the need for smaller and smarter components in the rapidly evolving tech landscape.

Inductor Market Growth Factors:

The expansion of the inductor market is fueled by a surging need for electronic devices, innovations in automotive technologies, and a growing integration of renewable energy systems.

The inductor market is witnessing considerable expansion, influenced by multiple factors. One of the primary drivers is the escalating demand for consumer electronics such as smartphones, laptops, and wearable devices, which increases the requirement for inductors in managing power efficiently. The growth of electric vehicles (EVs) and improvements in charging infrastructure also play a vital role, as inductors are essential for power conversion and mitigating electromagnetic interference (EMI). Moreover, the flourishing renewable energy sector, particularly in solar and wind technologies, calls for effective power management, with inductors being crucial components in energy storage systems.

The surge in investments related to the Internet of Things (IoT) and smart home innovations is further enhancing the inductor market, as these applications necessitate compact and effective electronic components. Additionally, the advent of new technologies such as 5G and artificial intelligence (AI) is creating a demand for advanced inductors that can handle high-frequency signals. Regulatory initiatives aimed at promoting energy efficiency and sustainability are encouraging manufacturers to pursue innovations, leading to the creation of more compact and efficient inductor designs. In summary, the convergence of technological progress, increased energy demands, and a focus on sustainable practices is reinforcing the growth potential of the inductor market in the coming years.

Inductor Market Restaining Factors:

Significant constraints influencing the inductor market involve variations in the prices of raw materials and the swift progression of alternative technologies that may reduce demand.

The inductor industry encounters various challenges that could impede its growth trajectory. A major obstacle is the rising expense of essential materials like ferrite and copper, which has a direct impact on production costs and overall profitability. Additionally, the swift evolution of alternative technologies, particularly in digital electronics, may diminish the need for inductors in certain applications, especially within simpler circuit configurations. Moreover, the trend towards miniaturization in contemporary devices increases the demand for smaller inductors, which can complicate manufacturing processes and affect performance. Stricter environmental regulations regarding electronic waste and lead content may also create additional barriers, complicating production and raising compliance expenses. Furthermore, market saturation in specific s can restrict growth prospects for manufacturers and intensify competition. Despite these hurdles, the escalated demand for electric vehicles, renewable energy solutions, and cutting-edge consumer electronics offers substantial opportunities for expansion within the inductor sector. By embracing innovative technologies and prioritizing product development, manufacturers have the potential to align with market trends and successfully navigate this dynamic environment.

Key Segments of the Inductor Market

By Type of Inductor

• Air core inductors

• Ferrite core inductors

• Iron core inductors

• Toroidal core inductors

• Multilayer inductors

• Variable inductors

By Material

• Ferrite

• Iron

• Powdered iron

• Ceramic

• Air

• Laminated steel

• Others

By Mounting Type

• Surface mount inductors (SMD)

• Through-hole inductors

• Chassis mount inductors

By Size/Form Factor

• Miniature

• Standard

• Large

By Application

• Power inductors

• RF inductors

• Coupled inductors

• Multilayer inductors

• Other specialized inductors

By End-use Industry

• Consumer electronics

• Automotive

• Industrial

• Telecommunications

• Aerospace and defense

• Healthcare

• Energy and power

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America