Infusion Pump Market Analysis and Insights:

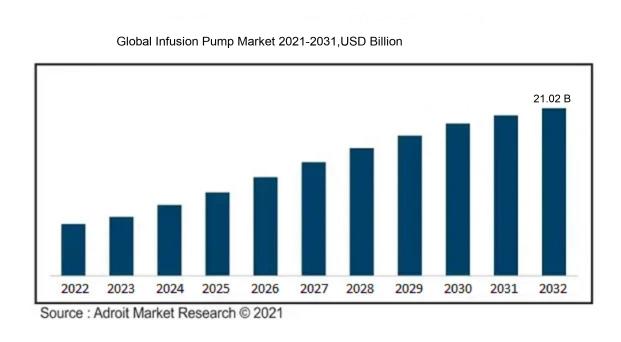

In 2023, the size of the worldwide Infusion Pump market was US$ 11.10 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2032, reaching US$ 21.02 billion.

The infusion pump sector is propelled by a multitude of factors, notably the escalating incidence of chronic illnesses such as diabetes, cancer, and cardiovascular diseases that necessitate ongoing care and accurate drug administration. Innovations in infusion technologies, particularly the emergence of smart pumps that incorporate enhanced safety mechanisms, automation, and wireless capabilities, significantly improve treatment outcomes and facilitate patient monitoring, thus driving market progression. Moreover, the surge in demand for home healthcare options is promoting the uptake of compact and intuitive infusion devices. Additionally, the approval of new infusion pump technologies by regulatory bodies is further stimulating market growth. The increasing focus on patient safety and the need to mitigate medication errors are encouraging healthcare providers to invest in superior infusion systems. Lastly, an aging demographic coupled with rising healthcare costs is playing a crucial role in advancing the infusion pump market.

Infusion Pump Market Definition

An infusion pump is a sophisticated medical apparatus that administers exact quantities of fluids, drugs, or nutrients directly into a patient's circulatory system. This device is frequently utilized across multiple healthcare environments to guarantee the precise delivery of therapeutic interventions.

Infusion pumps serve as vital medical apparatuses that administer exact volumes of fluids, drugs, and nutrients straight into a patient’s circulatory system, thereby optimizing therapeutic efficacy. These devices are especially crucial within hospital environments, where consistent medication delivery is necessary for treatments like chemotherapy, pain relief, and critical care interventions. By ensuring precision in infusion rates, these pumps significantly reduce the potential for complications arising from either insufficient or excessive dosing, thereby enhancing patient safety. Additionally, contemporary infusion pumps frequently incorporate sophisticated functionalities such as alarms and programmable features, enabling healthcare providers to track patient reactions and modify treatments instantaneously, thereby improving clinical results.

Infusion Pump Market Segmental Analysis:

Insights On Key Type

Insulin pumps

Insulin pumps are expected to dominate the Global Infusion Pump Market due to the increasing prevalence of diabetes worldwide. As more individuals seek effective and efficient ways to manage their blood glucose levels, the adoption of insulin pumps is on the rise. Furthermore, advancements in technology, such as the integration of continuous glucose monitoring and automated insulin delivery systems, enhance the appeal of insulin pumps to both patients and healthcare providers. These devices offer personalized treatment, improve patient compliance, and significantly reduce the burden of managing diabetes, making them a first choice in the infusion pump sector.

Volumetric pumps

Volumetric pumps are widely utilized in hospitals and healthcare settings for delivering large volumes of fluids, making them critical in patient care, particularly for administering intravenous medications and nutrition. Their precision and ability to deliver constant flow rates ensure that patients receive the required amount of fluids over specific time frames. As healthcare facilities prioritize patient safety and efficient medication delivery systems, volumetric pumps remain heavily utilized, although they may not match the growth rate of specialized devices like insulin pumps.

Syringe pumps

Syringe pumps offer high accuracy and are essential for delivering small volumes of medication, making them particularly valuable in critical care units. Their versatility in various clinical applications, including anesthesia and palliative care, maintains their relevance in the healthcare environment. Despite being a smaller market compared to insulin pumps, syringe pumps are integral for specific treatment protocols requiring precise dosing, affirming their ongoing presence in infusion systems.

Enteral pumps

Enteral pumps are designed for delivering nutrition directly into the gastrointestinal tract, catering primarily to patients with swallowing difficulties or requiring nutritional support. Their growth is fueled by the rising awareness of malnutrition in hospital settings, coupled with an increase in home care for enterally-fed patients. While they have a loyal user base, the need for specialized devices like insulin pumps may overshadow their market expansion.

Elastomeric pumps

Elastomeric pumps are disposable devices used for continuous drug delivery, favored for their simplicity and patient-friendly design. They are commonly used in outpatient care, especially for chemotherapy and pain management. The convenience of these devices and the increase in home infusion therapy may support their niche growth; however, they are less recognized compared to insulin pumps in terms of market dominance, limiting their overall impact on the infusion pump market.

Implantable pumps

Implantable pumps are innovative solutions often utilized for chronic pain management or specific hormone therapies, offering a sustained release of medication directly at the site of action. While they are beneficial for particular disorders, their market is limited by the complexity of implantation procedures and concerns related to invasiveness. Consequently, although implantable pumps fulfill essential needs, their potential for mass market adoption remains restricted when compared to other types, making them less dominant in the overall landscape.

PCA pumps

Patient-controlled analgesia (PCA) pumps allow patients to administer their pain relief medication according to their own needs, enhancing patient autonomy in pain management. These pumps are widely used in postoperative settings and pain management protocols, demonstrating their utility in delivering timely medication. Nevertheless, their market penetration is impacted by the wide availability of oral and other non-invasive pain relief options, rendering them less dominant relative to specialized pumps like insulin pumps in the broader infusion market.

Insights On Key Application

Diabetes

The diabetes application is expected to dominate the Global Infusion Pump Market significantly. This is primarily due to the rising prevalence of diabetes globally, particularly Type 1 and Type 2 diabetes. Increasing incidences of obesity, sedentary lifestyles, and an aging population act as catalysts for diabetes, necessitating effective management solutions. Infusion pumps provide precise insulin delivery, making them highly sought after for glucose control. Additionally, advancements in technology, such as smart insulin pumps and continuous glucose monitoring systems, enhance patient adherence and ease of use, further propelling the growth of this application and ultimately establishing its position as the leading category in the market.

Oncology

Oncology represents a critical application area in the Global Infusion Pump Market. The increasing incidence of cancer worldwide drives the demand for effective drug delivery systems, including chemotherapy. Infusion pumps ensure the accurate and controlled administration of potent anti-cancer medications, which is vital to improve patient outcomes and minimize side effects. Furthermore, the ongoing advancements in oncology treatments, such as targeted therapies and personalized medicine, also contribute to the growth in this area. The rising number of cancer treatments and increasing healthcare investment in oncology enhance the demand for sophisticated infusion devices tailored specifically for these therapies.

Pain Management

The pain management application forms a significant part of the Global Infusion Pump Market. Reports indicate that an increase in chronic pain conditions, post-operative pain management requirements, and cancer-related pain drives the demand for infusion pumps in pain management settings. These pumps allow for controlled delivery of analgesics directly into the bloodstream, ensuring rapid relief for patients. Furthermore, the growing focus on improving patient comfort and satisfaction during hospital stays prompts healthcare providers to adopt advanced technologies like infusion pumps for pain alleviation. Thus, the need for effective pain management solutions fosters the growth of this application sector.

Others

The 'Others' category encompasses additional applications of infusion pumps outside of diabetes, oncology, and pain management. This includes uses in areas like nutrition and fluid management, hormone therapy, and surgical settings. However, this 's growth tends to be overshadowed by the other primary areas. While the demand for infusion pumps in these applications does exist, the lacks the direct influence and urgency that the aforementioned applications present. Despite the steady usage, its overall market share and growth rate are significantly slower due to lower overall healthcare focus in these specific areas, positioning it as a lesser priority when compared to the leading applications.

Insights On Key End User

Hospitals and Clinics

The Global Infusion Pump Market is anticipated to be dominated by hospitals and clinics due to the rising number of surgical procedures and the growing prevalence of chronic diseases requiring infusion therapy. Hospitals and clinics represent the primary settings where patients receive critical care, which often necessitates the use of infusion pumps for medication delivery. With advancements in technology and increasing investment in healthcare infrastructure, hospitals are integrating more sophisticated infusion systems to enhance patient safety and optimize medication management. Moreover, as hospitals adopt automated and smart infusion pumps, the demand in this sector is expected to surge significantly.

Ambulatory Care Settings

Ambulatory care settings are becoming increasingly significant in the infusion pump market due to the shift towards outpatient care. These facilities provide patient-centered, cost-effective treatment options that reduce hospital admissions, allowing patients to receive therapies like infusion without being confined to a hospital. This trend is bolstered by advancements in outpatient care technologies, leading to innovations in infusion pumps designed for ease of use and mobility. The convenience of administering infusion therapy in ambulatory settings is expected to enhance patient experiences and contribute positively to market growth in this area.

Homecare Settings

The homecare is experiencing growth as healthcare continues to emphasize home-based treatments, driven by patient preference and the need for cost-effective care solutions. Infusion pumps designed for home use allow patients to manage their conditions independently, enhancing their quality of life. The rise in chronic diseases, coupled with an aging population requiring long-term infusion therapy, is propelling the adoption of infusion technologies in homecare environments. Healthcare providers are also increasingly supporting homecare initiatives, making this market a crucial player in the overall infusion pump industry.

Others

The "Others" category encompasses diverse applications for infusion pumps, including specialty clinics and long-term care facilities. While this does not hold a commanding market position, it plays a vital role in providing niche services that require tailored infusion solutions. Some specialized treatment areas, like palliative care and pediatric units, benefit from customized infusion systems. Although its share in the market is smaller compared to hospitals and clinics, the "Others" group reflects the evolving landscape of healthcare delivery, as specialized care demands unique infusion strategies to enhance patient outcomes.

Global Infusion Pump Market Regional Insights:

North America

North America is expected to dominate the Global Infusion Pump market, largely due to its advanced healthcare infrastructure, high prevalence of chronic diseases, and significant investments in medical technologies. The region's emphasis on innovation and regulatory support also contribute to its competitive edge. Major players in the infusion pump are based here, driving product advancements and creating synergy between healthcare providers and technology developers. Additionally, the growing geriatric population and rising patient awareness regarding effective treatment options fuel the demand for infusion pumps, ensuring North America remains at the forefront of the market.

Latin America

Latin America shows promising growth in the infusion pump market, driven primarily by the increasing awareness of advanced healthcare solutions and improvements in healthcare access. Emerging economies within this region are witnessing an uptick in healthcare investments, leading to the adoption of more sophisticated medical devices. However, challenges such as economic fluctuations and healthcare disparities can affect market growth. Nonetheless, a rise in chronic diseases and an accompanying demand for infusion therapies is anticipated to propel the market forward.

Asia Pacific

The Asia Pacific region is experiencing rapid growth in the infusion pump market, propelled by a combination of rising healthcare expenditure, increasing investments in healthcare infrastructure, and a booming population. Countries like China and India are witnessing a rise in healthcare facilities and initiatives aimed at improving patient outcomes. However, the market may face challenges related to regulatory hurdles and product awareness. Overall, the region is expected to continue growing steadily as it adapts to evolving healthcare needs.

Europe

Europe presents a robust market for infusion pumps, backed by a strong regulatory framework and high standards of healthcare quality. The region benefits from a well-established healthcare system that emphasizes patient safety and the use of advanced medical devices. Growing incidences of chronic diseases, coupled with a rising elderly population, drive demand for infusion therapies in this region. Furthermore, key players are focusing on developing sustainable products, which enhances the market growth potential. Nevertheless, variations in healthcare budgets across countries can create market disparities.

Middle East & Africa

The Middle East & Africa region is gradually emerging as a market for infusion pumps, spurred by initiatives to improve healthcare services and increasing government investments in medical technology. Although the market is currently small compared to other regions, rising awareness of advanced healthcare solutions and a growing demand for chronic disease management are promising factors. However, obstacles such as economic instability and healthcare access disparities can limit growth. Over time, as healthcare systems continue to develop, the region may witness greater uptake of infusion pumps, contributing to long-term market expansion.

Infusion Pump Market Competitive Landscape:

Prominent entities within the worldwide infusion pump sector, including Medtronic, Baxter, and B. Braun, significantly contribute to the advancement of cutting-edge technologies, the improvement of safety protocols, and the adherence to regulatory standards to align with the changing demands of healthcare practitioners. Moreover, their partnerships with medical facilities and research organizations foster improvements in patient care and treatment efficacy.

The prominent participants in the infusion pump industry consist of Medtronic plc, B. Braun Melsungen AG, Baxter International Inc., Terumo Corporation, Fresenius Kabi AG, Smiths Medical, ICU Medical, Inc., Johnson & Johnson, and Pfizer Inc. (which was acquired by Hospira), along with C.R. Bard, Inc. Other key entities in this field are Mindray Medical International Limited, Abbott Laboratories, Roche Holding AG, Halyard Health, Inc., and Insulet Corporation. Additionally, Moog Inc., Zyno Medical, and Nipro Corporation also play significant roles in this market.

Global Infusion Pump Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly enhanced the urgency for infusion pumps, underscoring their essential function in the treatment of critical cases and prompting a surge in investments within the medical device industry.

The COVID-19 pandemic profoundly affected the infusion pump sector, underscoring the critical role these devices play in the care of patients with severe illnesses who require intensive treatment and support. The rise in patient admissions, coupled with an increased emphasis on critical care, led to a ened demand for sophisticated infusion systems capable of delivering medications, fluids, and nutritional support with accuracy. Manufacturers encountered challenges related to supply chain interruptions, complicating the processes of production and distribution. Nevertheless, the pressing need for dependable infusion solutions spurred innovations and hastened developments within the market. Additionally, the growth of telehealth during the pandemic intensified interest in portable and intelligent infusion devices. As healthcare systems transition to a post-pandemic environment, the infusion pump market is poised for ongoing transformation, driven by advancements in technology and the incorporation of automation and connectivity, ultimately improving patient safety and treatment effectiveness. In spite of initial challenges, the long-term prospects for this market remain optimistic, sustained by persistent healthcare demands and progress in medical technology.

Latest Trends and Innovation in The Global Infusion Pump Market:

- In September 2023, Baxter International Inc. acquired Hillrom Holdings, Inc., integrating Hillrom's advanced infusion systems and smart hospital technologies into Baxter’s portfolio, thus enhancing their capabilities in patient monitoring and infusion solutions.

- In August 2023, Medtronic launched its MiniMed 780G insulin pump system in Europe, featuring enhanced algorithms for insulin delivery and an automated adjustment feature, aimed at improving user experience and health outcomes for diabetes patients.

- In July 2023, Teleflex Incorporated announced the acquisition of Z-Medica, a company known for its innovative hemostatic devices, to expand its offerings in infection control and enhance supporting technologies for infusion pumps.

- In June 2023, B. Braun Melsungen AG introduced the Space 2 infusion system, featuring advanced safety features and customizable user interfaces, reflecting strong investment in technology to improve drug delivery and reduce medication errors.

- In May 2023, Fresenius Kabi launched the Volumat MC Agilia infusion pump in North America, incorporating new wireless connectivity features that enable real-time data transfer to electronic health records, improving overall hospital efficiency.

- In April 2023, Smiths Medical reported a partnership with Daxor Corporation to integrate their infusion pump technologies with Daxor’s advanced blood volume monitoring systems, providing clinicians with better tools for managing fluid therapy.

- In March 2023, ICU Medical announced the acquisition of the swabable SmartSite needle-free connector technology from Medline Industries, reinforcing their position in innovative infusion systems and infection prevention.

- In February 2023, the US FDA approved CE-marked infusion pump technology from BD (Becton, Dickinson and Company), allowing the company to expand its market presence in Europe and leverage its expertise in drug delivery systems.

- In January 2023, QCore Medical launched the Q-Flow infusion pump, incorporating machine learning algorithms to optimize fluid management in critically ill patients, demonstrating the increasing importance of AI in healthcare technology.

- In December 2022, Calea announced collaboration with a UK-based research institution to develop new software for their infusion pumps to enhance patient safety features and streamline clinical workflows, showcasing commitment to innovation in the infusion space.

Infusion Pump Market Growth Factors:

The market for infusion pumps is set to expand, driven by a higher incidence of chronic illnesses, innovations in technology, and an increasing need for healthcare services in home settings.

The infusion pump sector is witnessing remarkable expansion, propelled by several pivotal elements. Firstly, the increasing incidence of chronic illnesses such as diabetes, cancer, and heart-related conditions is driving a ened demand for accurate medication delivery systems. Enhancements in technology, particularly advancements in smart infusion pumps and their compatibility with electronic health records, are improving the safety and efficiency of drug administration, thereby promoting further market development. Moreover, the rising inclination towards home healthcare solutions, fueled by an aging demographic, is creating a need for user-friendly, portable infusion devices.

Investments in healthcare infrastructure are rising, alongside ened awareness about the importance of medication adherence, both of which significantly contribute to market growth. Additionally, governmental initiatives encouraging the use of advanced medical technologies, along with a commitment to enhancing patient care outcomes, are further shaping a positive market environment. The growth of biopharmaceuticals and the demand for tailored therapeutic regimens amplify the need for sophisticated infusion systems adept at administering complex treatments. Finally, the increase in outpatient procedures is driving the demand for mobile and wireless infusion systems, which improve patient comfort and treatment effectiveness. Together, these dynamics highlight a strong growth trajectory for the infusion pump market in the coming years.

Infusion Pump Market Restaining Factors:

The expansion of the infusion pump market is being hindered by factors such as rigorous regulatory standards, elevated development expenses, and intricate technological challenges.

The infusion pump sector encounters a range of challenges that may obstruct its expansion and widespread implementation. The elevated costs linked to sophisticated infusion devices and their upkeep can restrict access, particularly for smaller medical facilities in developing nations. Furthermore, the intricate nature of operating these devices necessitates significant training for healthcare staff, potentially resulting in operational inefficiencies and increased risk of errors. Regulatory hurdles, notably rigorous approval processes from entities such as the FDA, can postpone the launch of cutting-edge products, thus affecting the market landscape. Additionally, the rising frequency of device recalls and safety issues related to infusion pumps can diminish consumer trust and hinder investment in emerging technologies. Risks such as hospital-acquired infections from improper handling also present challenges that healthcare providers need to address. Nevertheless, continuous technological advancements and an intensified emphasis on patient safety are contributing to enhancements in the design and functionality of infusion pumps, indicating a bright future for market growth. As healthcare professionals become more aware of the advantages offered by these devices and as solutions to previous issues evolve, the infusion pump market is expected to progress positively, promoting innovation and bettering patient care outcomes.

Key Segments of the Infusion Pump Market

By Type:

• Volumetric pumps

• Syringe pumps

• Enteral pumps

• Insulin pumps

• Elastomeric pumps

• Implantable pumps

• PCA pumps

By Application:

• Diabetes

• Oncology

• Pain management

• Others

By End User:

• Hospitals and clinics

• Ambulatory care settings

• Homecare settings

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America