Insulation Market Analysis and Insights:

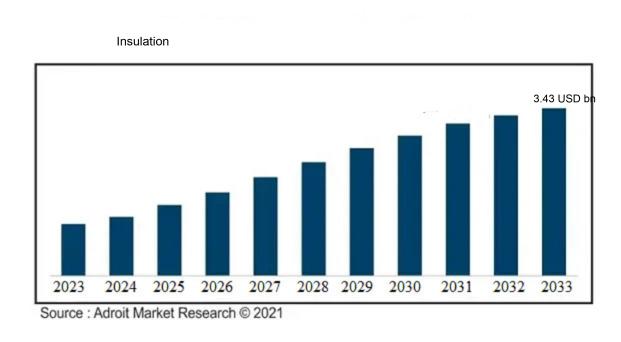

The market for Global Insulation was estimated to be worth USD 1.73 billion in 2024, and from 2025 to 2033, it is anticipated to grow at a CAGR of 7.8%, with an expected value of USD 3.43 billion in 2033.

The insulation sector is primarily influenced by several fundamental factors, such as the escalating regulations on energy efficiency, ened awareness regarding energy conservation, and a growing preference for eco-friendly building materials. Initiatives from governments aimed at curbing greenhouse gas emissions and boosting energy efficiency in both residential and commercial properties have significantly encouraged the uptake of insulation. The trend toward sustainable architecture and the enforcement of rigorous building standards are also critical, as they highlight the significance of thermal performance and energy savings. Additionally, advancements in insulation technologies, including innovations in reflective and spray foam materials, are improving both performance and durability, propelling market expansion. Lastly, varying energy costs and the rising expense of fossil fuels are motivating consumers and businesses alike to invest in insulation solutions to lower their long-term energy expenditures.

Insulation Market Definition

Insulation encompasses various materials or systems engineered to minimize the transfer of heat, sound, or electrical energy across distinct environments. The main objective of insulation is to boost energy efficiency and enhance comfort by regulating and sustaining preferred temperature conditions.

Insulation plays a vital role in improving the energy efficiency of structures by limiting the transfer of heat, which helps sustain pleasant indoor climates throughout all seasons. This, in turn, reduces energy expenses by decreasing reliance on heating and cooling systems, a significant advantage in areas with severe weather fluctuations. Furthermore, adequate insulation supports environmental sustainability by lowering the carbon emissions linked to energy use. It also functions as a sound barrier, enhancing sound quality indoors and adding to the overall comfort of the environment. Additionally, effective insulation minimizes moisture accumulation, which can mitigate the potential for mold growth and structural deterioration, ultimately increasing both the lifespan and market value of a property.

Insulation Market Segmental Analysis:

Insights On Product

Polyurethane

Polyurethane is anticipated to dominate the Global Insulation Market due to its exceptional thermal performance and versatility in application across various sectors, including residential, commercial, and industrial. Its high R-value per inch, light weight, and resilience make it an ideal choice for energy-efficient structures. The rising awareness towards energy conservation, combined with stringent building codes and regulations globally, is driving the demand for polyurethane insulation.

Glass Wool

Glass wool is a popular insulation material known for its sound-dampening properties and thermal performance. It is primarily used in residential buildings and commercial applications due to its non-combustible nature and resistance to moisture, which helps in preventing mold growth. Furthermore, glass wool is lightweight and easy to handle, contributing to its attractiveness in construction projects, especially for insulation in walls, roofs, and floors. Advancements in manufacturing technology are also improving its efficiency and sustainability, leading to increased adoption and usage in various sectors.

Mineral Wool

Mineral wool, consisting of rock or slag fibers, offers excellent fire resistance and durability, making it a preferred choice for industrial and commercial insulation. It is highly effective in high-temperature applications typical in the petrochemical and manufacturing sectors. Additionally, mineral wool contributes to superior acoustic performance, helping mitigate sound transmission in commercial buildings.

EPS

Expanded Polystyrene (EPS) is an economical and lightweight insulation material predominantly used in residential and commercial applications. Its inherent moisture resistance and R-value make it suitable for various insulation needs, particularly in walls, roofs, and foundations. The growing construction market in developing countries is expected to fuel EPS demand as builders seek cost-effective insulating solutions. However, concerns regarding its environmental impact due to non-biodegradability may challenge its long-term acceptance and drive the industry towards more sustainable alternatives.

XPS

Extruded Polystyrene (XPS) is known for its high thermal insulation properties and moisture resistance, making it a popular choice for below-grade applications, such as foundations and roofing. Its closed-cell structure provides effective insulation while limiting moisture absorption. The increasing awareness of energy-efficient building practices and sustainability is supporting the growth of XPS in the market. Nevertheless, challenges related to its manufacturing process and environmental impact may hinder its progress against more eco-friendly insulation materials.

CMS Fibers

CMS (cellulosic manmade fiber) insulation is derived from recycled materials and offers an eco-friendly alternative to traditional insulation products. It is especially suitable in residential and light commercial applications due to its thermal performance and safety features, including non-combustibility. As green construction practices gain popularity, the demand for CMS fibers for insulation purposes is expected to grow. Furthermore, this type of insulation is easy to install and often provides excellent acoustic insulation properties, making it a competitive choice.

Calcium Silicate

Calcium silicate is widely recognized for its high-temperature insulation properties, making it particularly useful in industrial applications, including oil and gas pipelines and power plants. Its durability and resistance to moisture and chemicals extend its lifespan, offering long-term benefits for insulation projects requiring performance in extreme environments. The demand for calcium silicate is driven by the expanding industrial sector and increased awareness of energy-efficient designs, contributing to its growth in the insulation market.

Aerogel

Aerogel is an innovative insulation material known for its ultra-lightweight, high thermal insulation properties, and unique aesthetic appeal. While its application is still relatively niche due to higher costs, its usage in high-end commercial and industrial sectors, as well as in niche residential projects, is on the rise. Advances in production technology could lead to reduced prices, potentially expanding its market share. Its ability to stand up to extreme temperature variations ens its attractiveness for specialized applications, making it a promising option for the future.

Cellulose

Cellulose insulation, made from recycled paper products, is an eco-friendly alternative favored for its sustainability and thermal performance. With growing demand for green building materials, cellulose is increasingly popular in residential constructions and retrofitting projects. However, cellulose requires careful installation and moisture management to avoid issues related to settling and mold, which can influence consumer choice in insulation products.

PIR

Polyisocyanurate (PIR) insulation is known for its exceptional thermal performance and is often favored for roof insulation in commercial buildings. Its closed-cell structure means it has a lower thermal conductivity than other insulation materials, thus providing higher R-values. As demand for energy-efficient construction grows, the sealed, rigid form of PIR accommodates applications in both new builds and retrofits. Its fire resistance properties also contribute to its widespread acceptance in the market. However, growing competition from alternative materials could influence its market positioning moving forward.

Phenolic Foam

Phenolic foam insulation is distinguished by its excellent fire-resistant properties and low thermal conductivity. It is widely used in applications requiring rigorous fire safety standards, such as in commercial buildings and industrial settings. While it offers superior thermal efficiency and durability, the high cost of production may limit its adoption in some markets. Nonetheless, as regulatory demands for energy efficiency and fire safety en, phenolic foam insulation could see increased use in specialty applications requiring enhanced performance.

Insights On End Use

Construction

The construction sector is expected to dominate the global insulation market due to several critical factors, including the continued growth of residential and commercial building projects around the world. The increasing emphasis on energy efficiency and sustainability has led to a higher demand for insulation materials that perform well in thermal management, thereby reducing energy costs for heating and cooling. The growing trend towards green building practices also enhances the importance of insulation in new developments, solidifying construction's position as the leading sector in the insulation market.

Industrial

The industrial sector remains a significant player in the insulation market, primarily driven by the need for energy-efficient systems and processes. Industries such as petrochemical, food processing, and manufacturing require high-performance insulation materials to improve operational efficiency and minimize energy loss. Additionally, stringent regulations regarding emissions and energy use are propelling industrial facilities to adopt advanced insulation solutions. The continuous expansion of industrial activities, especially in emerging markets, further bolsters the demand for insulation materials, ensuring that this sector maintains a steady and critical presence in the insulation market.

HVAC & OEM

The HVAC & OEM is crucial for the insulation market due to the increasing requirements for energy efficiency in heating, ventilation, and air conditioning systems. As energy costs escalate and environmental regulations become stricter, manufacturers are focusing on producing equipment that utilizes high-quality insulation materials to enhance thermal performance. This demand is particularly pronounced in both residential and commercial applications, where effective insulation solutions can significantly reduce energy consumption. Consequently, investments in HVAC and original equipment manufacturing (OEM) are expected to foster continual growth in this area, thereby solidifying its relevance in the insulation industry.

Transportation

The transportation industry, particularly in automotive, marine, and aerospace sectors, plays a vital role in driving insulation market dynamics. Insulation materials are essential for controlling temperature, noise, and vibrations within vehicles and vessels, contributing to overall comfort and energy efficiency. Moreover, the expansion of electric and hybrid vehicles is further boosting the need for lightweight yet effective insulation solutions, establishing transportation as a noteworthy sector within the insulation market landscape.

Appliances

The appliances sector also contributes markedly to the global insulation market, especially with the growing consumer demand for energy-efficient kitchen and home devices. Manufacturers are continually developing insulated appliances that can maintain consistent temperatures, thereby reducing energy consumption and operational costs for users. The pressure to comply with rising energy-efficiency standards has resulted in increased investment in insulation technologies, leading to the design of more sustainable and high-performance appliances. Continued innovation in this space is expected to drive growth, ensuring that appliances remain a relevant in the insulation market.

Furniture/Bedding

Within the furniture and bedding market, insulation materials are increasingly being recognized for their benefits beyond traditional applications. Products such as mattresses and upholstered furniture are now incorporating insulating features to enhance comfort, regulate temperature, and improve overall durability. As consumers become more aware of the benefits of insulated products, demand for innovative materials continues to rise. The focus on health and well-being in living spaces also encourages manufacturers to seek out advanced insulating solutions, highlighting the potential for growth in the furniture and bedding sector of the insulation market.

Packaging

The packaging sector is experiencing a growing recognition of the value provided by insulating materials, particularly in temperature-sensitive goods like food and pharmaceuticals. Effective insulation solutions can significantly extend the shelf life of perishables and maintain product integrity during transport. As this trend continues to gain momentum, the packaging industry will likely become an increasingly prominent player within the global insulation market.

Global Insulation Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the global insulation market due to rapid industrialization, urbanization, and upcoming construction projects across major countries like China and India. The region's increasing demand for energy-efficient buildings and growing regulations on energy consumption are significant drivers. In addition, the ongoing investment in infrastructure development and renewable energy projects further boosts the market for insulation materials. Furthermore, the rising awareness of sustainability among consumers is pushing manufacturers to develop advanced insulation technologies. This combination of factors places Asia Pacific as the leading region in the global insulation market for the foreseeable future.

North America

North America represents a substantial in the global insulation market, primarily driven by stringent building codes and regulations focused on energy efficiency. The region has a well-established construction industry that emphasizes the use of advanced insulation materials to enhance energy performance in residential and commercial buildings. Additionally, the growing trend toward green building practices and renovation projects in this region fosters demand for innovative insulation solutions. However, despite these strengths, North America currently trails behind the Asia Pacific in overall market share.

Europe

Europe's insulation market is characterized by a strong emphasis on sustainability and energy efficiency, driven by environmental regulations and policies that aim to reduce carbon footprints. The European Union's commitment to climate goals motivates both residential and commercial sectors to adopt high-performance insulation materials. Furthermore, advancements in technology and product innovation have led to an increase in demand for eco-friendly insulation solutions.

Latin America

In Latin America, the insulation market is gradually expanding, propelled by increasing infrastructure projects and urban development. Governments in several countries, including Brazil and Mexico, are starting to invest more in energy-efficient solutions, which bodes well for the insulation market. However, challenges such as fluctuating economic conditions and varying regulations across countries hinder the region's growth potential. The market is expected to grow but will likely remain a niche compared to the leading regions, especially Asia Pacific.

Middle East & Africa

The Middle East & Africa region's insulation market is emerging, driven by construction activities in countries like the UAE and South Africa. The push for energy-efficient buildings aligns with regional initiatives aimed at sustainable development and energy conservation. Nevertheless, this faces significant challenges such as economic disparities and lower construction volumes in certain areas, which could limit its growth. While investment in green projects may benefit the market, the region still trails behind others in terms of overall market presence.

Insulation Competitive Landscape:

Leading entities in the worldwide insulation industry, encompassing producers, vendors, and distributors, play a crucial role in fostering innovation and advancing product development while maintaining effective distribution networks. Their collaborative alliances and initiatives to broaden market reach profoundly impact the pricing, quality, and availability of insulation materials on a global scale.

The major participants in the insulation sector encompass Owens Corning, Rockwool International A/S, Johns Manville (part of Berkshire Hathaway), Saint-Gobain, Knauf Insulation, and Armacell International S.A. Furthermore, BASF SE, 3M Company, Covestro AG, and Groupe Parot also hold significant positions. Additional influential firms include the Insulation Corporation of America, Kingspan Group, CertainTeed (a Saint-Gobain subsidiary), PPG Industries, and Dow Inc. Other distinguished companies include Thermafiber (an Owens Corning brand), Glen Raven, Celotex, and Insulation Materials Corp., as well as contributors like U.S. GOST, EcoBatt Insulation, and Isofiber.

Global Insulation COVID-19 Impact and Market Status:

The Covid-19 outbreak had a profound impact on the worldwide insulation sector, resulting in supply chain complications, project delays in construction, and altered demand trends as industries adapted to evolving health regulations.

In the beginning, lockdowns and interruptions in the supply chain resulted in postponed manufacturing and delayed construction projects, leading to a temporary slump in the demand for insulation products. However, with the introduction of government stimulus initiatives and a renewed focus on infrastructure growth, the market started to recover. The ened awareness surrounding energy efficiency and sustainability during this period also propelled the demand for superior insulation solutions. The pandemic also underscored the significance of indoor health and comfort, spurring innovations in insulation technologies that enhance air quality within buildings. In summary, although the insulation sector experienced short-term challenges, the future outlook is optimistic, fueled by shifting consumer demands and regulatory encouragement for energy-efficient construction practices.

Latest Trends and Innovation in The Global Insulation Market:

- In July 2022, Owens Corning announced its acquisition of a leading insulation manufacturer known for sustainable products, further strengthening its position in the insulation market and expanding its environmentally friendly offerings.

- In August 2022, Rockwool International A/S launched a new line of insulation products that incorporate recycled materials, aligning with the company's commitment to sustainability and circular economy principles.

- In September 2022, Kingspan Group acquired a manufacturer specializing in high-performance insulation products in North America, which enhanced Kingspan's product portfolio and market share in the region.

- In March 2023, CertainTeed, a subsidiary of Saint-Gobain, introduced a new line of blow-in cellulose insulation made from 85% recycled paper, reflecting the increasing consumer demand for eco-friendly building materials.

- In June 2023, BASF launched a new polyisocyanurate insulation board that offers superior thermal performance while being lighter and more environmentally friendly compared to traditional products, marking a significant innovation in the insulation sector.

- In August 2023, Johns Manville, a Berkshire Hathaway company, announced a partnership with a tech startup to develop smart insulation solutions that integrate IoT technology for better energy efficiency monitoring in buildings.

- In September 2023, GAF announced the acquisition of a leading manufacturer of foam insulation products, allowing GAF to enhance its roofing and insulation systems and provide integrated solutions for its customers.

Insulation Market Growth Factors:

The insulation sector is predominantly fueled by a surge in energy efficiency standards, an uptick in construction projects, and a ened consciousness regarding eco-friendly building methodologies.

Global governments are enacting rigorous regulations and offering incentives to minimize carbon footprints, thereby increasing the utilization of insulation materials across residential, commercial, and industrial settings. A growing awareness among consumers regarding energy conservation and climate change further stimulates demand, as high-quality insulation can significantly lower energy expenses.

Moreover, the expansion of the construction industry in developing nations is a key contributor to market growth, with a notable shift towards eco-friendly building practices. Innovations such as advanced insulating materials, including aerogels and intelligent insulation technologies, are bolstering performance and drawing investment. An increase in retrofitting initiatives aimed at enhancing energy efficiency in existing buildings is also pivotal, as property owners and businesses strive to upgrade their insulation systems. Additionally, growth in the industrial sector—particularly in manufacturing requiring effective thermal management—accentuates the necessity for improved insulation solutions. Collectively, these interconnected elements foster a conducive environment for the insulation market, encouraging ongoing innovation and extensive adoption across diverse industries.

Insulation Market Restaining Factors:

Significant constraints in the insulation sector encompass escalating expenses of raw materials and ened competition from other energy-efficient construction options.

One primary concern is the volatility in raw material costs, especially for insulation products derived from petrochemicals, which can inflate production expenses and influence pricing models and overall profitability. Furthermore, rigorous regulations surrounding construction materials, primarily motivated by environmental factors, may stifle innovation in insulation products, as manufacturers find it difficult to adhere to compliance requirements. The ongoing shortage of skilled labor within the construction sector adds another layer of complexity, likely resulting in delays in insulation projects and ened labor expenses. Additionally, the emergence of alternative materials, including eco-friendly insulation options, while advantageous for sustainability, could redirect funding away from conventional insulation methods. Economic recessions may also slow down construction activities, leading to a direct decline in the demand for insulation products. Nevertheless, despite these obstacles, the market is poised to adapt and progress, fueled by a growing emphasis on energy efficiency and sustainability. Technological advancements are anticipated to drive the creation of innovative insulation solutions that align with evolving consumer preferences, ultimately fostering a robust environment for growth within the insulation sector.

Key Segments of the Insulation Market

By Product:

- Glass Wool

- Mineral Wool

- EPS (Expanded Polystyrene)

- XPS (Extruded Polystyrene)

- CMS Fibers (Cellulose Mineral Structural Fibers)

- Calcium Silicate

- Aerogel

- Cellulose

- PIR (Polyisocyanurate)

- Phenolic Foam

- Polyurethane

By End Use:

- Construction

- Residential

- Non-Residential & Commercial

- Industrial

- HVAC & OEM (Heating, Ventilation, and Air Conditioning & Original Equipment Manufacturing)

- Transportation

- Automotive

- Marine

- Aerospace

- Appliances

- Furniture/Bedding

- Packaging

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America