Market Analysis and Insights:

The size of the global market for insulin pen needles was estimated at around USD 3.03 billion in 2023 and is projected to increase at a compound annual growth rate (CAGR) of 10% to reach roughly USD 5.05 billion by 2032.

.jpg)

The market for insulin pen needles is largely influenced by the increasing global rates of diabetes, resulting in a higher demand for effective and user-friendly insulin delivery methods. As the number of individuals diagnosed with diabetes continues to rise, there is a growing emphasis on managing the condition and mastering self-injection techniques, which significantly supports market expansion. Innovations in needle technology, including the introduction of ultra-thin and comfort-oriented designs, enhance patient adherence and overall satisfaction. Furthermore, the improvement of healthcare facilities and the accessibility of insulin pens in both developed and developing countries add to the market's growth. Initiatives by governments to promote diabetes awareness and management are essential, as is the rising disposable income observed in many emerging markets. Additionally, the shift towards home healthcare solutions has increased the demand for convenient and safe drug delivery alternatives, further driving the insulin pen needles market.

Insulin Pen Needles Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2020-2023 |

| Forecast Period | 2023-2032 |

| Study Period | 2022-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 5.05 billion |

| Growth Rate | CAGR of 10% during 2023-2032 |

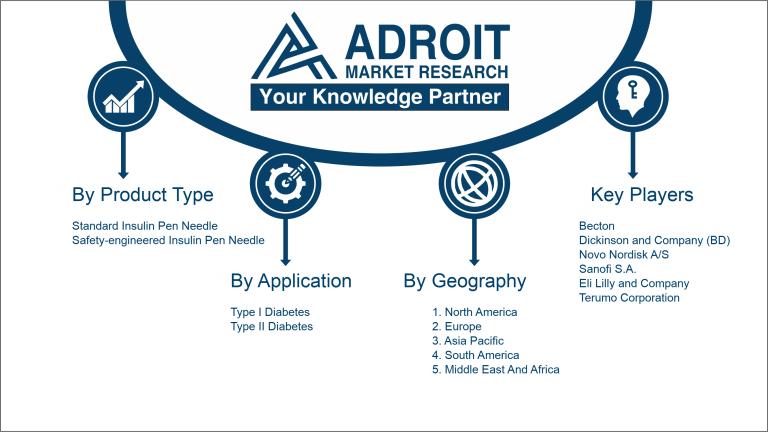

| Segment Covered | By Product Type, By Application, By Distribution Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Becton, Dickinson and Company (BD), Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Terumo Corporation, Owen Mumford Ltd., Medtronic plc, Ypsomed AG, Smiths Medical, and Accu-Chek (Roche). Other significant entities include UltiMed, Inc., Diabetestalk, Pharma Tech Solutions, and HMD Pharma. |

Market Definition

Insulin pen needles are slender, sterile instruments specifically crafted for use with insulin pens, enabling individuals to deliver accurate doses of insulin in a simple and comfortable manner. These needles are available in multiple lengths and gauges to suit various injection preferences and requirements.

Insulin pen needles play a vital role for those managing diabetes, ensuring that insulin is delivered both safely and effectively. Their engineering allows for accurate dosing, which helps reduce the likelihood of infection and alleviates discomfort during administration. Available in multiple lengths and gauges, these needles can be tailored to suit individual preferences and needs, thereby improving adherence to insulin therapy. Additionally, their ease of use and portability promote consistent use, which is crucial for maintaining optimal blood sugar control. When utilized correctly, insulin pen needles can greatly influence overall health outcomes by averting complications linked to inadequate diabetes management. Consequently, they are an indispensable element in the everyday regulation of blood glucose levels.

Key Market Segmentation:

Insights On Key Product Type

Safety-engineered Insulin Pen Needle

The Global Insulin Pen Needles Market is expected to be dominated by safety-engineered insulin pen needles. This is gaining popularity owing to increased awareness surrounding patient safety and the rise in diabetes prevalence worldwide. Safety-engineered needles are designed to reduce the risk of needlestick injuries, which is a significant concern for both patients and healthcare providers. Regulatory bodies are also increasingly favoring the adoption of safer medical devices, prompting manufacturers to enhance their product offerings with engineered safety features. Furthermore, the growing emphasis on minimizing healthcare-associated infections is driving demand, making safety-engineered needles the preferred choice in many healthcare settings.

Standard Insulin Pen Needle

Standard insulin pen needles continue to hold a significant share in the market, mainly due to their cost-effectiveness and widespread use in diabetes management. These needles are often available at a lower price point than their safety-engineered counterparts, making them attractive for budget-conscious consumers and healthcare systems. Additionally, standard needles have been widely utilized for many years, resulting in a considerable level of familiarity and trust among healthcare professionals and patients alike. While there is increasing interest in safety features, standard needles remain a go-to solution for a large of the population who may not prioritize the additional benefits that safety-engineered options provide.

Insights On Key Application

Type II Diabetes

The Type II Diabetes is expected to dominate the Global Insulin Pen Needles Market due to a higher prevalence of this form of diabetes compared to Type I. According to recent data, approximately 90-95% of diabetes cases are Type II, driven by rising obesity rates, sedentary lifestyles, and aging populations. The ease of use and the convenience that insulin pens provide are significant factors influencing the adoption of these products among patients managing Type II diabetes. Additionally, marketing strategies targeting the growing demographic of Type II diabetes patients further emphasize the demand for insulin pen needles, thereby strengthening this 's dominance in the market.

Type I Diabetes

The Type I Diabetes category exhibits a smaller but vital presence in the Global Insulin Pen Needles Market. This form of diabetes, which requires lifelong insulin management from a young age, is associated with a committed user base that relies heavily on insulin pens for daily administration. Advances in technology and increased awareness about the importance of continuous insulin therapy contribute to steadyization in this area. However, the overall prevalence of Type I diabetes is significantly lower than Type II, thus impacting its market share.

Insights On Key Distribution Channel

Online Pharmacies

The Online Pharmacies category is anticipated to dominate the Global Insulin Pen Needles Market. The increasing penetration of e-commerce, coupled with the convenience it offers, is driving the preference for online purchases among diabetic patients. Additionally, the ongoing digital transformation and the ability for consumers to compare prices and access a broader range of products contribute to the growth of this channel. Factors such as home delivery options, subscription models, and 24/7 accessibility, paired with a growing trend for remote consultation, are making online pharmacies highly appealing to consumers, especially during the ongoing pandemic, thereby positioning it as the leading channel.

Hospital Pharmacies

Hospital Pharmacies play a pivotal role in the healthcare system by ensuring that patients receive their medications effectively, particularly those with chronic conditions like diabetes. They provide tailored pharmaceutical services that include counseling and monitoring of patients who require insulin therapy. However, while their critical function supports clinical care, they tend to serve a more limited demographic compared to retail and online options, focusing primarily on inpatients and those with scheduled appointments. The rise of outpatient care has somewhat diminished the overall volume of prescriptions filled through hospital pharmacies, causing this channel to lag behind others in terms of market share.

Retail Pharmacies & Drug Stores

Retail Pharmacies and Drug Stores represent an essential and traditional distribution channel for insulin pen needles. These establishments provide comprehensive access to patients, allowing for immediate purchase without the delays associated with online orders. The familiarity and trust consumers have in their local pharmacies cannot be understated, as many prefer the personal interaction and immediate availability of products. However, with an increase in online shopping behaviors and convenience, this channel faces the challenge of keeping pace with more technologically advanced distribution methods. Nevertheless, retail pharmacies still maintain a steady market presence due to the essential requirement for accessibility and customer service.

Insights on Regional Analysis:

North America

North America is poised to dominate the Global Insulin Pen Needles market due to several key factors. The region is home to a high prevalence of diabetes, with millions of people requiring insulin therapy daily. Additionally, advancements in healthcare technology, coupled with the strong presence of major pharmaceutical companies and medical device manufacturers, contribute significantly to market growth. North America also boasts well-established healthcare infrastructure and strong reimbursement policies, making insulin pen needles more accessible to patients. The increasing awareness of diabetes management solutions further amplifies the demand for insulin pen needles in this region, solidifying its leading position in the market.

Latin America

Latin America represents a growing market for insulin pen needles, driven primarily by an increasing prevalence of diabetes and changing healthcare policies that focus on access and affordability. The region is experiencing improvements in healthcare infrastructure, facilitating better diabetes management. However, market penetration remains slower compared to North America, as access to advanced medical devices is still limited in many areas. Economic fluctuations and varying levels of healthcare investment across countries also pose challenges, but there is potential for growth as awareness of diabetes rises and health systems enhance their capabilities.

Asia Pacific

Asia Pacific is witnessing a significant rise in diabetes cases, making it a key player in the insulin pen needles market. The region has a rapidly growing diabetic population, particularly in countries like China and India, where lifestyle changes have led to increased diabetes prevalence. However, the market faces challenges in terms of healthcare access and variations in regulatory frameworks across different countries. Nonetheless, urbanization and rising disposable incomes are expected to create opportunities for growth, making Asia Pacific a region of interest for manufacturers looking to expand their presence in emerging markets.

Europe

Europe is a strong contender in the Global Insulin Pen Needles market, characterized by a well-established healthcare system and high awareness of diabetes management. The region benefits from stringent regulations that ensure the safety and efficacy of medical devices, thereby maintaining high standards in product quality. Advanced healthcare infrastructure and widespread availability of insulin pen needles in pharmacies contribute to market growth. However, the market is also influenced by factors such as healthcare cost containment measures and fluctuating economic conditions that can affect purchasing behavior, creating a competitive landscape among manufacturers.

Middle East & Africa

The Middle East and Africa region is currently developing its market for insulin pen needles, driven by a rising prevalence of diabetes and governmental initiatives to improve healthcare access. However, the market faces significant challenges, including economic disparities and limited access to healthcare services in certain areas. Nevertheless, there is a growing recognition of the need for effective diabetes management solutions, which could stimulate demand for insulin pen needles. As healthcare infrastructures improve and awareness campaigns gain traction, this region holds promise for future market growth, but it will take time to establish a competitive presence compared to more developed markets.

Company Profiles:

Major contributors within the global market for insulin pen needles focus on the creation and production of cutting-edge, easy-to-use devices aimed at improving diabetes care. Additionally, they pursue strategic collaborations and leverage state-of-the-art technologies to enhance the design of needles and streamline distribution processes.

Prominent participants in the market for insulin pen needles encompass Becton, Dickinson and Company (BD), Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Terumo Corporation, Owen Mumford Ltd., Medtronic plc, Ypsomed AG, Smiths Medical, and Accu-Chek (Roche). Other significant entities include UltiMed, Inc., Diabetestalk, Pharma Tech Solutions, and HMD Pharma. Furthermore, the industry also includes players like 3M Company, Nipro Corporation, and LMD Biomedical.

COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the global market for insulin pen needles, leading to supply chain disruptions and changing the availability of healthcare services for patients, which in turn influenced consumption habits and demand levels.

The COVID-19 pandemic had a profound effect on the market for insulin pen needles, primarily due to interruptions in supply chains and healthcare operations. Initially, the implementation of lockdowns and various restrictions led to a decrease in diabetes management, as fewer patients were able to attend hospitals or keep up with their regular health check-ups. As a result, many individuals found themselves managing their diabetes with minimal professional assistance. On the flip side, the pandemic intensified awareness surrounding chronic conditions like diabetes, prompting more people to take an active role in monitoring their health. The rise in home healthcare options further escalated the demand for insulin pen needles, as patients increasingly opted for self-administration. Additionally, the growth of telemedicine played a crucial role in enabling ongoing patient education and follow-ups, further propelling market expansion. The focus on enhancing patient outcomes also spurred innovation and variety in insulin delivery mechanisms. In summary, although the pandemic introduced various challenges, it simultaneously opened up avenues for growth in the insulin pen needles market, enhancing access to diabetes care solutions.

Latest Trends and Innovation:

- In July 2022, Becton Dickinson and Company acquired Venclose, Inc., a company known for its innovative vascular technology, enhancing its capabilities in diabetes care and insulin delivery systems.

- In January 2023, Sanofi announced the launch of its new insulin delivery device, the SoloSTAR pen, which features an improved design aimed at enhancing patient satisfaction and adherence to insulin therapy.

- In March 2023, Novo Nordisk introduced the FlexTouch pen for insulin delivery, incorporating advanced technology to provide a more user-friendly experience for patients managing diabetes.

- In August 2023, Eli Lilly and Company entered into a collaboration with Glooko, a company specializing in diabetes data management solutions, to integrate data from Eli Lilly’s insulin pen devices with Glooko’s platform, aimed at improving patient outcomes.

- In September 2023, Ypsomed announced the expansion of its needle production facility in Switzerland, reinforcing its commitment to high-quality insulin pen needles and addressing increasing market demands.

- In October 2023, Terumo Corporation unveiled its new Ultra-Fine pen needle aimed at minimizing patient discomfort and improving the ease of use for individuals with diabetes.

Significant Growth Factors:

The market for insulin pen needles is growing significantly, driven by the increasing incidence of diabetes, ened awareness regarding self-care, and innovations in needle technology that improve both patient comfort and safety.

The market for insulin pen needles is undergoing substantial expansion, influenced by a range of pivotal elements. Foremost among these is the global increase in diabetes cases, specifically type 1 and type 2, which is elevating the need for effective insulin delivery solutions. As knowledge regarding diabetes management advances, a growing number of patients are choosing insulin pens due to their superior convenience, user-friendliness, and reduced discomfort when compared to conventional syringes.

Innovations in the design of insulin pen needles, including thinner gauge options and enhanced safety mechanisms, are enriching the overall experience for users and further motivating their adoption. Moreover, a rise in initiatives from healthcare bodies and government entities aimed at enhancing diabetes care is facilitating greater access to essential management tools for patients. The expanding elderly demographic, which is more vulnerable to developing diabetes, also contributes to the upward trend in this market.

In addition, the movement towards self-administration of insulin, bolstered by advancements in digital health applications and telemedicine, is transforming how patients engage with their treatment and adhere to it, subsequently increasing the demand for insulin pens and related needles. Lastly, the introduction of new products by leading companies, emphasizing features that cater to patient needs and sustainability practices, is anticipated to further accelerate market growth in the coming years. Together, these dynamics play a crucial role in the vigorous growth trajectory of the insulin pen needles market.

Restraining Factors:

The Insulin Pen Needles market is notably constrained by regulatory challenges and increasing manufacturing expenses.

The market for insulin pen needles encounters various obstacles that could impede its expansion. A major issue is the elevated price of insulin pen needles in contrast to conventional syringes, which might discourage patients, especially in economically disadvantaged areas, from choosing these pricier alternatives. Additionally, the rising inclination towards the use of disposable insulin syringes in specific regions may restrict the uptake of pen needles. Challenges regarding the accessibility of insulin delivery devices further complicate the situation, particularly in remote locations with inadequate healthcare systems. Moreover, a lack of awareness and education about the advantages of insulin pen needles, particularly among elderly demographics, serves as an impediment to market growth. Regulatory challenges and rigorous quality control standards could additionally hinder the entry of new competitors, affecting innovation in the sector. Despite these issues, progress in technology and the increasing incidence of diabetes are propelling the demand for more advanced and user-friendly insulin delivery systems. As healthcare providers and relevant stakeholders strive to overcome these challenges, the insulin pen needles market is likely to undergo a significant transformation, leading to enhancements in patient care and improved adherence to treatment regimens.

Key Segments of the Insulin Pen Needles Market

By Product Type

- Standard Insulin Pen Needle

- Safety-engineered Insulin Pen Needle

By Application

- Type I Diabetes

- Type II Diabetes

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies & Drug Stores

- Online Pharmacies

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America