IT Outsourcing Market Analysis and Insights:

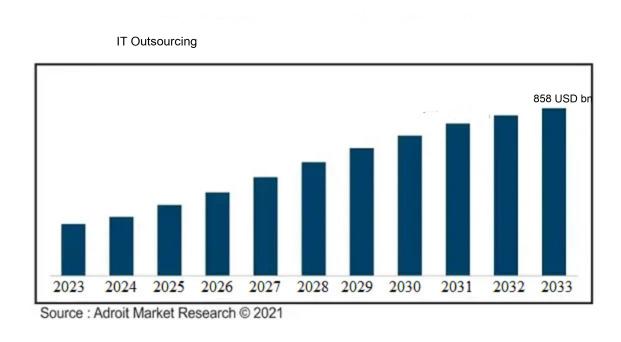

The market for IT Outsourcing was estimated to be worth USD 615 billion in 2024, and from 2026 to 2033, it is anticipated to grow at a CAGR of 3.85%, with an expected value of USD 858 billion in 2033.

The IT outsourcing landscape is shaped by multiple critical elements. Primarily, organizations are motivated by the need to reduce expenses and enhance operational efficiency, tapping into the lower labor costs found in countries with strong IT capabilities. The escalating requirement for specialized expertise, especially in cutting-edge domains such as artificial intelligence, cloud technologies, and cybersecurity, drives firms to outsource in order to acquire skilled professionals. Moreover, as companies aim to concentrate on their core functions, the trend towards outsourcing non-essential tasks becomes more pronounced. The swift evolution of technology requires organizations to stay flexible, leading them to pursue adaptable outsourcing models that facilitate quick responses to shifting market demands. Additionally, the dynamics of globalization promote cross-border cooperation, ensuring efficient communication and project execution. The recent COVID-19 pandemic has further expedited the transition to digital solutions, motivating businesses to adopt remote IT services, thereby broadening the scope of outsourcing possibilities. Together, these elements foster a thriving environment for the expansion of the IT outsourcing industry.

IT Outsourcing Market Definition

IT outsourcing involves engaging external firms or contractors to handle and provide technology services, including software development, technical support, and infrastructure management.

IT outsourcing plays a vital role in allowing businesses to concentrate on their primary strengths while utilizing the specialized knowledge and resources provided by external vendors. By delegating IT tasks, companies can lower operational expenses, improve their ability to scale, and tap into cutting-edge technology without the burden of hefty initial expenditures. This strategic choice fosters greater agility, allowing organizations to swiftly respond to shifts in the market and advancements in technology. Furthermore, IT outsourcing enhances service quality and innovation, thanks to a variety of skill sets and experiences that contribute to a competitive edge and support growth in an ever-changing digital environment.

IT Outsourcing Market Segmental Analysis:

Insights On Service Type

Data Analytics And Business Intelligence

Data Analytics and Business Intelligence is expected to dominate the Global IT Outsourcing Market. The increasing volume of data generated by organizations across various sectors necessitates advanced analytical tools to extract meaningful insights. Companies are keenly investing in data-driven decision-making processes to enhance their operational efficiency, customer engagement, and strategic planning. With the growing demand for actionable insights, service providers that specialize in data analytics are positioned to lead this market. Additionally, the surge in cloud computing and big data technologies further amplifies the significance of data analytics, making it a central component of modern IT outsourcing solutions.

Application Development And Maintenance

Application Development and Maintenance services are critical for businesses aiming to create and sustain software solutions tailored to their operational needs. These services encompass the entire application lifecycle, including design, implementation, updates, and support. Organizations heavily rely on these offerings to ensure their applications remain relevant and functional amidst evolving technological landscapes. As businesses continue to seek innovation and efficiency, the demand for tailored application solutions grows, confirming the vital role of this category in the outsourcing framework.

Infrastructure Management Services

Infrastructure Management Services play a pivotal role in maintaining the essential IT systems that support business operations. This includes managing servers, networks, storage, and other critical infrastructures that are fundamental to seamless organizational functioning. As companies increasingly move towards remote work and virtualization, the need for effective infrastructure management has grown.

Quality Assurance And Testing

Quality Assurance and Testing services are indispensable for organizations looking to maintain high-quality standards in their software products. These offerings involve systematic processes designed to ensure that software solutions meet specified requirements and are free of defects. As competition intensifies and user expectations rise, businesses prioritize delivering flawless products to maximize customer satisfaction and loyalty. This focus ensures a steady demand for testing services, establishing it as a significant element within IT outsourcing.

Cybersecurity Services

Cybersecurity Services are increasingly critical given the rising incidence of cyber threats across industries. Organizations are more aware than ever of the risks associated with data breaches, ransomware attacks, and other cyber vulnerabilities. Outsourcing these services allows businesses to leverage specialized expertise and advanced technologies to protect sensitive information and maintain compliance with regulations. The imperative nature of cybersecurity makes it a vital component of the IT service offerings landscape.

Cloud Services

Cloud Services have emerged as a transformative force in the IT landscape, enabling businesses to access scalable computing resources via the internet. The shift towards cloud-based solutions has accelerated due to the need for flexibility, cost efficiency, and remote accessibility. Organizations are increasingly outsourcing their cloud infrastructure management to take advantage of these benefits without the burden of substantial upfront investments. This trend underlines the growing importance of cloud services in the overall IT outsourcing portfolio.

ERP Services

ERP Services play a crucial role in streamlining business processes by integrating various functions into a single system. Organizations rely on these services to ensure that their ERP solutions are customized, implemented, and maintained effectively. The increasing complexity of business operations and the need for real-time data access drive the demand for specialized ERP services.

Mobility Solutions

Mobility Solutions are essential for businesses looking to enhance their operational agility and reach a broader audience through mobile platforms. As consumer behavior shifts towards mobile-first interactions, organizations are more inclined to develop and maintain mobile applications that cater to their customers’ needs. The outsourcing of mobility solutions enables companies to tap into expert developers and ensure that their apps are user-friendly and feature-rich, thereby improving customer experience and engagement.

AI and ML Services

AI and ML Services are at the forefront of technological advancement, allowing businesses to harness the power of artificial intelligence and machine learning for improved decision-making and automation. Companies are eager to outsource these capabilities to gain a competitive edge and optimize their operations, further solidifying the importance of this area within IT outsourcing.

Insights On Location

Offshore

Offshore IT outsourcing is expected to dominate the Global IT Outsourcing Market due to several compelling factors. Companies increasingly seek cost-effective solutions, which is a significant advantage of offshore outsourcing. Organizations can access a global talent pool with specialized skills, particularly in fields like software development and IT services. Additionally, countries with favorable labor costs and economic incentives, such as India and the Philippines, provide significant value. As businesses expand globally, they also prefer offshore partnerships to operate in diverse time zones, ensuring that their services are available around the clock.

Onshore

Onshore outsourcing, while not expected to dominate, offers distinct advantages that appeal to particular businesses. One of the main reasons companies might choose onshore providers is the proximity and ease of communication. Cultural similarities and time zone alignments lead to fewer misunderstandings and easier collaboration. Furthermore, some businesses prioritize data privacy and security, which may lead them to prefer onshore services where legal regulations can be more directly managed.

Insights On Organization Size

SMEs

The SMEs (Small and Medium Enterprises) is expected to dominate the Global IT Outsourcing Market due to their increasing adoption of technology services aimed at improving operational efficiency and scalability. SMEs often face resource constraints, making it crucial for them to leverage outsourcing to access specialized expertise, enhance productivity, and focus on core business functions. Additionally, the growing availability of flexible pricing models and scalable IT solutions tailored for SMEs enables them to optimize costs while still benefiting from advanced IT capabilities. This trend is further amplified by the digital transformation initiatives undertaken by SMEs to remain competitive in an evolving market landscape.

Large Enterprises

Large Enterprises are significant players in the Global IT Outsourcing Market, driven by their need for comprehensive IT support, risk management, and robust infrastructure. These organizations often have vast resources, enabling them to invest in complex outsourcing arrangements that can include multi-vendor strategies and global partnerships. They seek to enhance their operational efficiency by outsourcing non-core IT functions, allowing them to focus on strategic initiatives. Furthermore, as these enterprises often deal with vast amounts of data and complex projects, outsourcing becomes a viable solution for managing those demands while ensuring compliance and security.

Insights On End User

Retail & E-commerce

Retail & E-commerce is projected to dominate the Global IT Outsourcing Market due to its rapid digital transformation and the growing demand for personalized shopping experiences. With consumers increasingly shifting towards online platforms, businesses require robust digital infrastructures to manage extensive inventories, customer data, and transaction systems efficiently. The COVID-19 pandemic accelerated this trend, making retail companies invest heavily in IT solutions to enhance their online presence, streamline operations, and improve customer engagement. As a result, the sector is likely to continue leading the market as organizations increasingly seek specialized IT services to maintain competitiveness and adapt to consumer preferences.

BFSI

The Banking, Financial Services, and Insurance (BFSI) sector increasingly relies on IT outsourcing to improve operational efficiency and enhance security measures. With the rising threats of cyberattacks and the need for regulatory compliance, financial institutions are outsourcing their IT operations to specialized firms that can offer advanced security solutions and the latest technology. Additionally, BFSI organizations are focused on integrating digital banking options and personalized financial services, which necessitates robust IT support. This sustained demand for digital transformation and security makes BFSI a significant contributor to the IT outsourcing market.

Healthcare

The Healthcare industry is experiencing a surge in IT outsourcing due to the growing need for technology-driven healthcare solutions. With the advent of telemedicine, electronic health records (EHR), and data analytics, healthcare providers seek IT services to streamline operations and improve patient outcomes. Outsourcing allows healthcare institutions to focus on core healthcare services while leveraging the expertise of IT firms to enhance digital capabilities. Additionally, regulatory compliance and data protection are critical in this sector, prompting healthcare organizations to collaborate with IT vendors that specialize in security and compliance-related services.

Media & Telecommunications

The Media & Telecommunications sector increasingly demands IT outsourcing for handling vast amounts of data and enhancing customer engagement through advanced technologies. Service providers are investing in IT solutions that facilitate better content distribution, network management, and communication technologies. Outsourcing allows companies in this sector to stay competitive by enabling them to focus on creativity and content while leveraging external IT experts for digital solutions. The continuous evolution of technology within media and telecommunications exemplifies the need for efficient IT management, making it a relevant player in the IT outsourcing landscape.

Transportation and Logistics

The Transportation and Logistics sector is turning to IT outsourcing to enhance operational efficacy and manage logistics complexities. As e-commerce grows, companies in this sector require sophisticated IT systems for real-time tracking, supply chain management, and inventory control. By outsourcing their IT services, transportation firms can deploy advanced technologies that increase efficiency and reduce costs. Furthermore, the growing demand for sustainable and optimized logistics solutions necessitates expert IT capabilities, pushing the sector to adopt more outsourcing practices to achieve these goals.

Manufacturing

The Manufacturing sector is progressively adopting IT outsourcing to streamline production processes and implement smart factory solutions. The rise of Industry 4.0 has prompted manufacturers to seek specialized IT services that can support automation, data analytics, and IoT integration. Outsourcing IT functions allows companies to enhance operational efficiency, manage supply chains more effectively, and reduce downtime through advanced technology. As manufacturers strive to remain competitive in a global market, they increasingly rely on IT partners to provide cutting-edge solutions that enable innovation and efficiency.

Energy and Utilities

The Energy and Utilities sector is witnessing a significant shift towards IT outsourcing as organizations look to modernize and adapt to changing regulations and consumer demands. With the increasing emphasis on renewable energy and smart grids, companies require advanced IT systems that can enhance data management, optimize resources, and improve maintenance operations. By partnering with IT service providers, energy companies can leverage their expertise in data analytics, cybersecurity, and IoT technologies to improve operational performance and remain compliant with regulatory requirements.

Global IT Outsourcing Market Regional Insights:

Asia Pacific

Based on thorough analysis of current trends and market dynamics, the Asia Pacific region is set to dominate the Global IT Outsourcing market. This region is characterized by a robust pool of highly skilled technical talent and cost-effective services that attract businesses worldwide. Major countries such as India, China, and the Philippines serve as hubs for software development, IT services, and business process outsourcing, contributing significantly to the region's market share. Additionally, the growing adoption of digital transformation strategies across various industries has accelerated demand for IT outsourcing solutions, cementing Asia Pacific's leadership position. Their emphasis on innovation and technological advancements further enhances their appeal, making them the go-to choice for companies seeking outsourcing partners.

North America

North America remains a significant player in the Global IT Outsourcing market, primarily driven by the presence of established tech giants and a strong demand for specialized IT services. The region's adoption of innovative technologies creates a high demand for outsourcing services that can provide efficient and scalable solutions. However, the ongoing shifts toward nearshoring due to concerns about data security and compliance regulations may affect the region’s competitiveness. North America is likely to maintain a considerable market share due to its advanced infrastructure, but it will face increasing challenges from cost-effective alternatives in Asia Pacific.

Europe

Europe showcases a diverse landscape for IT outsourcing, driven by multinational corporations and a strong emphasis on data compliance and regulatory frameworks. European countries invest significantly in high-quality IT service providers to meet the needs for cybersecurity and data protection. While the region is strong in certain niches, such as fintech and healthcare IT, it faces challenges related to cost compared to Asian competitors. However, close cultural ties and geographical proximity to clients provide European outsourcers with unique advantages that maintain their significance in the global market.

Latin America

Latin America is increasingly gaining attention in the IT outsourcing sector, primarily due to its proximity to North American markets and a growing number of skilled tech professionals. Countries like Brazil, Argentina, and Mexico are emerging as attractive options for businesses looking to outsource IT services, especially for what is known as nearshore outsourcing. The region offers cost-effective solutions and aligns with time zones that facilitate better communication and collaboration.

Middle East & Africa

The Middle East and Africa region is gradually evolving in the IT outsourcing landscape, driven by investments in technology hubs and innovation. While traditionally overshadowed by other regions, countries like South Africa and the UAE are making strides in attracting global outsourcing opportunities. The focus on digital transformation and government initiatives to improve tech ecosystems bode well for future growth. However, the overall market size remains smaller compared to other regions, and challenges such as varying levels of infrastructure and skills availability may limit immediate impact despite promising potential.

IT Outsourcing Competitive Landscape:

Prominent entities within the global IT outsourcing sector, including leading tech corporations and niche service providers, shape market dynamics through the introduction of cutting-edge solutions and attractive pricing models. Their collaborative alliances and financial commitments not only boost operational efficiency but also improve the quality of service provided to a variety of organizations around the globe.

The IT outsourcing sector is dominated by several major firms, including Accenture, IBM, Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies, Cognizant, Capgemini, DXC Technology, Tech Mahindra, Genpact, Fujitsu, Mphasis, NTT Data, and EPAM Systems. Additionally, significant contributors in this field include CGI, Atos, LTI (Larsen & Toubro Infotech), Unisys, Syntel, SoftServe, Zensar Technologies, and 3i Infotech. Other noteworthy entities shaping the global IT outsourcing arena are QBE Insurance Group, Altran, Mindtree, Virtusa, and Hexaware Technologies.

Global IT Outsourcing COVID-19 Impact and Market Status:

The Covid-19 pandemic hastened the transition to remote employment, leading to a marked rise in the reliance on IT outsourcing as organizations aimed to sustain their operations and improve their digital functionalities.

The abrupt transition to remote work led organizations to swiftly migrate their operations to the digital realm, resulting in a ened demand for IT solutions, especially in areas such as cloud services, cybersecurity, and software engineering. In response, many businesses opted for outsourcing as a strategy to control costs and tap into specialized skills, fostering increased collaboration with IT service providers. Nevertheless, the industry faced significant challenges, including disruptions to global supply chains, travel restrictions, and changing workforce dynamics. Companies grappled with issues surrounding service continuity and the security of data. As organizations adjusted to the altered landscape, they acknowledged the importance of digital transformation, which catalyzed a sustainable shift toward outsourcing as a strategic means for building resilience and fostering innovation. In essence, the pandemic has accelerated a transformation within the IT outsourcing arena, indicating a future characterized by ened automation and an emphasis on delivering adaptable, scalable solutions to align with changing market needs.

Latest Trends and Innovation in The Global IT Outsourcing Market:

- In August 2023, Accenture announced the acquisition of the UK-based consulting firm, Ekimetrics, which specializes in data science and analytics, to enhance its data-driven insights and marketing analytics capabilities.

- In July 2023, Tata Consultancy Services (TCS) launched a new cloud-based service called "TCS Cloud Exponential," aiming to help businesses accelerate their cloud adoption journey with advanced automation and artificial intelligence.

- In June 2023, Cognizant acquired Qualitest, a leading software testing and quality assurance firm, to enhance its capabilities in testing services, particularly in AI-driven quality assurance solutions.

- In May 2023, IBM announced its acquisition of the software company, Red Hat's OpenShift, which aims to strengthen its hybrid cloud offerings by integrating Red Hat's Kubernetes platform with IBM’s cloud solutions.

- In April 2023, Wipro entered into a strategic partnership with ServiceNow to boost its digital transformation services, focusing on enhancing IT service management and automation solutions for clients.

- In March 2023, Capgemini completed the acquisition of Altran, bolstering its engineering and R&D capabilities, particularly in sectors such as automotive, aerospace, and telecommunications.

- In February 2023, Infosys launched "Infosys Topaz," an artificial intelligence platform designed to drive digital transformation for its global clients through integrated AI services.

- In January 2023, HCL Technologies announced a partnership with Google Cloud to enhance its capabilities in cloud-native application development and provide more robust data analytics services.

- In December 2022, NTT Data completed its acquisition of Everis, significantly expanding its consulting and technology services footprint in Europe and Latin America.

- In November 2022, Deloitte acquired the majority stake in the Canadian data-analytics firm, Analytics8, to strengthen its data and analytics service offerings across various industries.

IT Outsourcing Market Growth Factors:

The expansion of the IT outsourcing industry is propelled by a rising need for economical technological solutions, an emphasis on primary business functions, and progress in cloud computing and digital evolution.

The IT outsourcing sector is witnessing substantial expansion, influenced by several pivotal elements. Primarily, businesses aim to lower operational expenses and boost productivity, rendering outsourcing a compelling option. There is an increasing necessity for specialized technological expertise, especially in domains like cloud computing, artificial intelligence, and cybersecurity, which drives organizations to seek external specialists proficient in these fields. Moreover, the swift progression of technology introduces innovative services and solutions, urging companies to outsource in order to maintain competitiveness. The movement towards digital transformation intensifies this trend, requiring enterprises to access scalable IT resources for the rapid implementation of new technologies. Additionally, as organizations prioritize their core functions, they are prompted to outsource ancillary tasks, enabling them to concentrate on strategic objectives. The rise of adaptable engagement models, including project-based and managed services, caters to the varied requirements of different industries. Furthermore, geopolitical dynamics and the essentiality of business continuity have expedited the inclination towards outsourcing, as firms strive to diversify and secure their operations. Finally, the COVID-19 pandemic highlighted the significance of remote work and digital solutions, resulting in an increase in outsourcing as businesses adjust to the changing market conditions. Together, these elements are driving the continued growth of the IT outsourcing industry.

IT Outsourcing Market Restaining Factors:

Significant barriers to the IT outsourcing sector encompass apprehensions related to data protection and regulatory adherence, which can prevent organizations from fully engaging in outsourcing contracts.

The IT outsourcing sector is on the verge of expansion, but it contends with various significant challenges. Foremost among these are apprehensions about data security and safeguarding intellectual property, which may dissuade companies from engaging in outsourcing due to fears of security breaches and the potential loss of essential data.

Additionally, the swift evolution of technology presents a hurdle, as businesses find it increasingly difficult to acquire the necessary skills to manage outsourcing relationships proficiently. The variability of currency exchange rates further complicates matters, potentially disrupting cost management and creating unpredictability in budgeting for organizations that depend on global services.

Regulatory frameworks and governmental constraints in outsourcing destinations can add further complexity to operations, thereby increasing the legal challenges that firms must navigate. Economic recessions can also adversely affect outsourcing ventures, leading to budget reductions and a more cautious outlook toward such initiatives. Nonetheless, the IT outsourcing landscape remains dynamic, as it continually adapts and innovates by utilizing cutting-edge technologies and cultivating strategic alliances, thereby fostering resilience and promoting ongoing growth within the industry.

Key Segments of the IT Outsourcing Market

By Service Type:

- Application Development And Maintenance

- Infrastructure Management Services

- Quality Assurance And Testing

- Cybersecurity Services

- Cloud Services

- Data Analytics And Business Intelligence

- ERP Services

- Mobility Solutions

- AI and ML Services

- Others

By Location:

- Offshore

- Onshore

By Organization Size:

- Large Enterprises

- SMEs

By End User:

- BFSI

- Healthcare

- Media & Telecommunications

- Transportation and Logistics

- Manufacturing

- Retail & E-commerce

- Energy and Utilities

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America