Market Analysis and Insights:

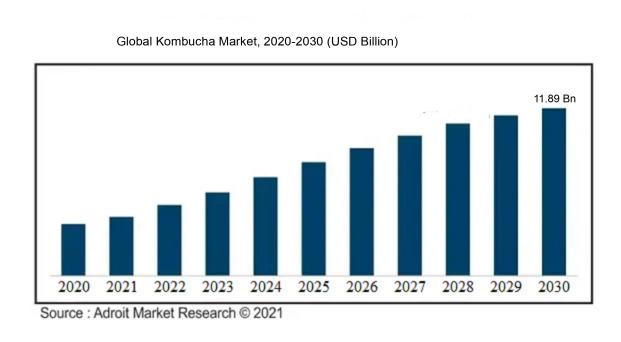

The global kombucha market was valued at USD 2.63 billion in 2021 and is projected to soar to USD 11.89 billion by 2030, with a CAGR of 15.12% over the forecast period.

The increased knowledge of the health advantages of kombucha, such as better digestion, enhanced immunity, and weight loss, is credited to market expansion. Furthermore, the increased popularity of health-conscious foods and beverages is fuelling kombucha demand.

Kombucha Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 11.89 billion |

| Growth Rate | CAGR of 15.12% during 2020-2030 |

| Segment Covered | By Product, By Type , By Microbial,By Distribution Channel,by Region |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | GT's Living Foods, Health-Ade Kombucha, Suja Juice, Brew Dr. Kombucha, Happy Kombucha, KeVita, Live Kombucha, Humm Kombucha, Rowdy Mermaid Kombucha, Unity Vibration Kombucha, kombucha kombucha, and Boochcraft Kombucha. |

Market Definition

Kombucha is a fermented beverage made from sweetened tea that is typically consumed for its potential health benefits and refreshing taste. Kombucha is popular as a probiotics-rich beverage with possible health advantages such as enhanced digestion and immunological support. It comes in various flavours and is sometimes infused with fruits, herbs, or spices to enhance its taste and aroma.

The global kombucha market refers to the overarching economic landscape and dynamics surrounding the production, distribution, and consumption of kombucha, a fermented tea beverage with probiotic properties. This market is characterized by a rising demand for healthier and functional beverages, as consumers seek alternatives to traditional sugary drinks. Key drivers include increasing health consciousness and the search for natural, low-sugar, and gut-friendly beverages. Market trends involve product innovation, diverse flavours, and strategic partnerships. However, challenges like regulatory hurdles and limited shelf life persist. The global kombucha market's future is anticipated to witness sustained growth, driven by evolving consumer preferences, expanding distribution channels, and the continuing popularity of health and wellness trends. This market's landscape is dynamic, reflecting shifts in consumer behaviours and preferences, making it crucial for businesses and investors to stay abreast of emerging opportunities and risks.

Key Market Segmentation

Insights on Product

The organic segment emerged as the most lucrative

This is due to the rising demand for organic and clean-label products among consumers. Organic tea kombucha is made with certified organic ingredients, which are free from harmful pesticides and herbicides. Consumers see this as a more nutritious choice, which is fueling the rise of the organic kombucha category. Organic products' nutritional advantages are becoming more widely known, and the public is ready to pay an extra price for them as well.

During the projection period, the inorganic kombucha sector is also predicted to develop at a reasonable rate. Inorganic kombucha is made with non-certified organic ingredients. This is a more affordable option than organic kombucha, which is making it popular among budget-conscious consumers.

Insight on Type

The Flavored category is the most significant and rapidly developing section of the global kombucha market.

This is because consumers are increasingly demanding new and innovative flavours of kombucha. Flavoured kombucha is available in a wide variety of flavours, including herbs and spices, flowers, fruits, and coconut. Flavoured kombucha is typically sweeter and more diverse in taste than natural kombucha, and it can appeal to a wider range of palates. The extra components may give other health benefits or provide distinct flavour qualities.

In 2022, the original/regular kombucha category accounted for a sizable part of the worldwide kombucha market. This is because original kombucha is the most traditional and authentic form of kombucha, and it is also the most affordable. Original kombucha has a tart, slightly sour taste, and it is often described as being similar to apple cider vinegar.

It's important to note that flavoured kombucha often has a higher sugar content compared to natural kombucha, as the added ingredients contribute to sweetness. The second fermentation process in flavoured kombucha also results in increased carbonation.

Insight on Microbial

The bacteria segment emerged as the most lucrative

This is due to the presence of beneficial bacteria such as Acetobacter and Lactobacillus in kombucha. These bacteria help to ferment the tea and sugar and produce acetic acid and lactic acid, which give kombucha its characteristic sour taste and health benefits.

During the anticipated time frame, the yeast sector is likely to become responsible for a sizable market share. Yeast is required for fermentation and creates carbon dioxide, which provides kombucha with its effervescent texture.

During the time frame of the forecast, the mould sector is predicted to have the least market share. This is because mould can produce harmful toxins if it is not properly controlled. However, some kombucha brewers do use mould cultures in their products, as they can add complexity to the flavour and aroma of the kombucha.

The other segment includes microbial cultures such as kefir grains and SCOBYs (symbiotic cultures of bacteria and yeast). These cultures are used to ferment a variety of foods and beverages, including kombucha.

Insights on the Distribution Channel

The Supermarket Segment Accounted for the Highest Share

This is due to the wide availability of kombucha brands and flavours in supermarkets, as well as the convenience of one-stop shopping. Additionally, supermarkets often offer kombucha at competitive prices, which makes it an affordable option for consumers.

Health stores are another important distribution channel for kombucha, as they cater to consumers who are specifically looking for healthy and functional beverages. Health stores typically offer a wider range of kombucha brands and flavours than supermarkets, including many craft and artisanal brands. Additionally, health store staff are often knowledgeable about the health benefits of kombucha and can help consumers choose the right product for their needs.

Convenience stores are becoming increasingly popular as a distribution channel for kombucha, as they offer consumers a convenient and accessible way to purchase the beverage. Convenience stores typically stock a limited selection of kombucha brands and flavours, but they often offer kombucha in single-serve bottles and cans, which makes it a convenient option for on-the-go consumption.

Online retailers are also a growing distribution channel for kombucha. Online retailers offer consumers a wide selection of kombucha brands and flavours, as well as the convenience of home delivery. Additionally, online retailers often offer kombucha at competitive prices and may offer discounts and promotions.

Other distribution channels for kombucha include restaurants, cafes, and bars. These channels are typically more expensive than supermarkets and health stores, but they offer consumers a convenient way to purchase kombucha while dining out or socializing.

Insights on Region

The North America Region Accounted for the Highest Share

North America is the largest market for kombucha, accounting for a share of 47.8% in 2021. The market in this region has grown drastically, resulting in consumers seeking a premium, nutritious soft drink substitute to enjoy the drink. The United States is the largest kombucha marketplace in North America, closely followed by Canada.

Europe is the second-largest market for kombucha, accounting for a share of 35.2% in 2021. The market in this region continues to grow, owing to a surging consumer consciousness of the health advantages of kombucha and an increasing appetite for functional refreshments. The United Kingdom is Europe's largest kombucha market, followed by Germany and France.

Asia Pacific is the most rapidly evolving kombucha market, with a CAGR of 20.5% predicted between 2022 and 2030. increased urbanization, increased financial flexibility, and expanding knowledge of the health advantages of kombucha are driving the industry in the area. China is Asia Pacific's largest kombucha market, followed by Japan and Australia.

LAMEA is the smallest kombucha market, but it is predicted to increase considerably in the next years. The region's market is being pushed by increased consumer awareness of kombucha's health advantages and growing demand for utilitarian beverages. Brazil has the largest kombucha market in LAMEA, next to Mexico and Argentina.

Key Company Profiles

The key players in the global kombucha market include GT's Living Foods, Health-Ade Kombucha, Suja Juice, Brew Dr. Kombucha, Happy Kombucha, KeVita, Live Kombucha, Humm Kombucha, Rowdy Mermaid Kombucha, Unity Vibration Kombucha, kombucha kombucha, and Boochcraft Kombucha.

COVID-19 Impact and Market Status

The COVID-19 pandemic had a mixed impact on the global kombucha market. On the one hand, it disrupted supply chains and led to a decline in on-premise consumption. On the other hand, it increased consumer demand for healthy and functional beverages, which benefited the kombucha market.

There was a kombucha scarcity in the early days of the pandemic owing to supply chain interruptions and increased demand. However, the market quickly rebounded as manufacturers adapted to the new environment. The epidemic also drove the increase in online kombucha sales. Consumers flocked to internet vendors to obtain their favourite beverages since they were restricted to their houses. This pattern is likely to persist in the post-pandemic era.

Overall, the COVID-19 outbreak benefited the global kombucha industry in the long run. It raised consumer knowledge of kombucha's health advantages and improved online sales. As a consequence, the worldwide kombucha market is predicted to rise at a 15.49% CAGR in the coming years.

Latest Trends

Increasing public understanding of kombucha's health advantages. Kombucha is a fermented tea drink that includes probiotics, which are good microorganisms that can help with gut health. Other possible health advantages of kombucha include immune system stimulation, digestive improvement, and inflammation reduction.

Functional drinks are becoming increasingly popular. Customers are increasingly seeking beverages that provide more than simply hydration and flavour. Kombucha is a functional beverage that provides a variety of health benefits, which is driving demand for the product.

Expanding the range of kombucha flavours and varieties. Kombucha is traditionally made with black or green tea, but there is now a wide range of kombucha flavours available, including fruit-flavoured kombucha, herbal kombucha, and even kombucha with added botanicals. This is helping to appeal to a wider range of consumers.

Growing popularity of kombucha on tap. Kombucha on tap is becoming increasingly popular in cafes, restaurants, and bars. This is making kombucha more accessible to consumers and is helping to drive sales.

Emerging kombucha product categories. In addition to traditional bottled kombucha, new kombucha product categories are emerging, such as kombucha beer, kombucha hard seltzer, and kombucha snacks. This is helping to expand the kombucha market and reach new consumers.

Recent Developments in the Global Kombucha Market: A Snapshot

In July 2023, the National Kombucha Brewers Association (NKBA) announced that it is launching a new certification program for kombucha products. The program is designed to help consumers identify kombucha products that are made with high-quality ingredients and meet certain standards of safety and quality.

In August 2023, Kombucha Brewers International (KBI) announced that it is partnering with the University of California, Davis to research the health benefits of kombucha. The research will focus on the gut health benefits of kombucha and its potential to improve digestion and immunity.

In September 2023, the Coca-Cola Company announced that it was acquiring Kombucha Wonder Drink, a leading Indian kombucha brand, owing to the big prominence of the market revenue share.

Significant Growth Factors

Increasing public understanding of kombucha's health benefits: Kombucha is a fermented tea beverage high in probiotics and other nutrients. It has been linked to a variety of health advantages, including better gut health, digestion, immunity, and energy levels. Consumers are becoming more aware of these advantages, which is fueling kombucha demand.

Growing interest in natural and functional beverage options: Kombucha is a natural and functional beverage, meaning that it is made with whole ingredients and provides health benefits beyond basic hydration.

Rising disposable incomes and expanding urbanization: Rising disposable incomes and expanding urbanization in developing countries are also contributing to the growth of the kombucha market. This is because consumers in these countries have more disposable income to spend on premium beverages, and they are also more likely to live in urban areas where kombucha is more readily available.

Product innovation and diversification: Kombucha brands are constantly innovating and diversifying their product offerings to meet the changing needs of consumers. For example, many brands are now offering flavoured kombucha, hard kombucha, and kombucha-infused products such as snacks and beverages. This product innovation is helping to drive demand for kombucha among a wider range of consumers.

Restraining Factors

Regulation of alcohol content: Regulatory bodies around the world are closely monitoring the alcohol content in kombucha, as it is a food product. This might make it challenging for kombucha makers to guarantee that all applicable requirements are met.

Difficulty in maintaining storage conditions: Kombucha is a fermented beverage, and it is important to store it properly to prevent spoilage. This can be difficult, especially for small-scale manufacturers and retailers.

High cost of inventories and distribution: The cost of storing and distributing kombucha can be high, as it is a perishable product. This can make kombucha more expensive than other beverages, such as soda and bottled water.

Although having these impediments, the worldwide kombucha industry is bound to continue to grow in the next years. This is due to the rising need for nutritious and utilitarian beverages, as well as increased knowledge of kombucha's health advantages.

Key Segments of the Global Kombucha Market

Product Overview (USD Million)

• Organic

• Inorganic

Type Overview (USD Million)

• Natural

• Flavored

Microbial Overview (USD Million)

• Bacteria

• Mold

• Yeast

• Others

Distribution Channel Overview (USD Million)

• Supermarkets

• Health Stores

• Convenience Stores

• Online Retailers

• Others

Regional Overview (USD Million)

North America

• U.S.

• Canada

• Mexico

Europe

• Germany

• France

• U.K.

• Spain

• Italy

• Russia

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• South Korea

• ASEAN

• Australia

• Rest of Asia Pacific

Middle East & Africa

• Saudi Arabia

• UAE

• South Africa

• Egypt

• Ghana

• Rest of MEA

Latin America

• Brazil

• Argentina

• Colombia

• Rest of Latin America

Frequently Asked Questions (FAQ) :

Kombucha is manufactured using a starter enzyme, a symbiotic culture of bacteria and yeast (SCOBY). The other ingredients used for manufacturing kombucha include tea and sugar. There are a large number of tea and sugar suppliers across the world with a low-cost difference across regions. However, there are a few providers of SCOBY, which is essential for producing kombucha. Nonetheless, the number of SCOBY is increasing with the presence of several suppliers who procure the product for personal use. At present, the bargaining power of suppliers is high and is expected to be medium over the forecast period on account of the increasing number of suppliers.

There are a large number of consumers with them procuring it off the shelf or purchasing it online. In addition, there are a large number of consumers manufacturing kombucha for their personal use.

The global manufacturing is concentrated in North America and Europe with a large consumer base, with relatively less consumption in the Rest of the World. However, these consumers purchase one or more bottles on a weekly basis. Thus, the bargaining power of buyers is expected to be low over the forecast period.

There are a large number of beverages available in the market in fermented teas, kefir, and kombucha which have a high probiotic content. However, there is a vast difference in the availability and taste of these products. In certain ways, kombucha fares better than other beverages including higher probiotic content. Consumers that drink kombucha often find it difficult to switch to other drinks. However, high acid and caffeine content has resulted in consumers switching to non-fizzy drinks. Thus, the threat of substitute products is medium and expected to follow a similar trend over the forecast period.

Product Segment

Supermarkets and hypermarkets are the most widespread channels of distribution which are typically located in residential localities. The establishment of these hypermarkets and supermarkets in commercial spaces, over the past few years, has resulted in increasing the target audience catering to the working population. Strategies such as effective advertising, offers, and point of purchase displays lead to impulse buying.

Kombucha is witnessing high growth in supermarkets/hypermarkets owing to the easy availability of these drinks. Availability of a variety of flavors that are highly attracting customers is further boosting the market. As kombucha needs to be refrigerated at all times, supermarkets are proving to be the best solution.

Online retailers segment is likely to witness the fastest growth within the global kombucha market at a CAGR of 14.3% between 2018 and 2025, as it overcomes the geographical limitation of the product. Moreover, consumers can save time as no traveling is involved, compare different products sitting comfortably at home or office, avail offers & discounts and receive quick online support in case of any issues. These factors are playing a crucial role in driving the growth of online shopping. This has resulted in a significant increase in the number of online shoppers over the past few years. A wide assortment of kombucha sold through manufacturer websites and other online specialty stores help vendors to increase their product visibility and reach.

Europe was the second largest market for kombucha accounting for 25.2% of the global industry. Growing demand for functional beverages prepared using natural ingredients has been on the rise in the region over the past few years due to the rising consumer awareness regarding its health benefits.

Quick adoption of healthy food & beverages by consumers in the region is expected to result in driving the demand for kombucha over the next few years. Moreover, stringent labeling regulations providing detailed information about the ingredients such as place of origin and nutrition content is expected to have a positive impact on the sales.

Kombucha is a health drink and one of the fastest-growing segments in the beverages market. The Asia-Pacific kombucha market is mainly driven by the increasing consumer disposable income, rising health awareness, and changing lifestyles of consumers. Growing demand for healthy, natural, and fortified food & beverages and growing consumption of alcoholic beverages are some of the factors that support the demand for kombucha in the region. Growing incidences of chronic diseases like diabetes, cancer, high blood pressure, and osteoporosis are other key factors driving the kombucha market. Earlier, kombucha was popular only at tea bars and cafes, although, it has witnessed a significant penetration in supermarkets and retail outlets. Being a quirky tasting drink, kombucha is widely preferred in different flavors such as apple, orange, etc. along with vinegary notes.

Considered to be the most efficient functional beverage in China, kombucha sales are increasing tremendously, thus, carving its niche in the domestic beverage market. This is due to increasing consumer awareness regarding the health benefits associated with kombucha.

Some of the key health benefits of kombucha include weight loss, immune support, cancer prevention, reduced joint pain, improving liver function, increasing energy, digestion, and detoxification of the body. In addition, the rapid development of the functional beverage industry especially in India and China are some of the major aspects driving the growth of the global kombucha market.

.png)