Market Analysis and Insights:

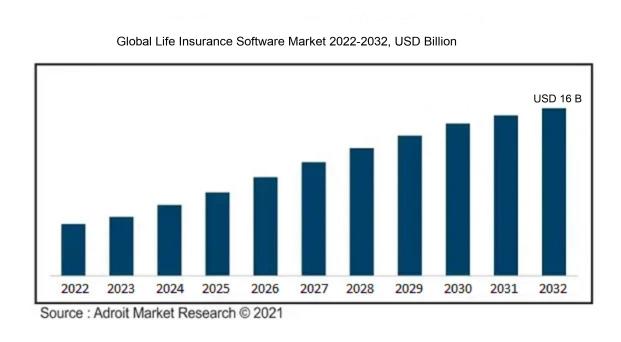

The market for Global Life Insurance Software was estimated to be worth USD 9.0 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 7%, with an expected value of USD 16 billion in 2032.

The Life Insurance Software Market is significantly influenced by a variety of fundamental factors. A primary driver is the escalating push for digital transformation within the insurance industry, which is vital for boosting operational efficiency and enhancing customer interaction. As insurance products grow increasingly complex, there is a pressing need for advanced software tools that facilitate effective policy management and claims processing. In addition, the need to comply with regulatory standards urges insurers to implement robust software systems that align with the continuously evolving requirements of the industry.

The advent of data analytics and artificial intelligence further enhances this landscape, allowing firms to refine risk assessment methods and tailor their product offerings. Additionally, the expanding global insurance arena, spurred by increases in disposable income and greater consumer awareness regarding insurance options, accelerates the uptake of life insurance software solutions. Finally, the shift towards remote work and online sales of policies—particularly in the aftermath of the pandemic—has ened the demand for advanced, scalable software tools that support smooth customer interactions and optimize business processes.

Life Insurance Software Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 16 billion |

| Growth Rate | CAGR of 7% during 2024-2032 |

| Segment Covered | By Component, By Deployment Mode, By Enterprise Size, By Application, By End-User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Accenture, Oracle Corporation, SAP SE, DXC Technology, Benivo, Cognizant Technology Solutions, FIS Global, Guidewire Software, Magellan Health, Sapiens International Corporation, Stone River, Verisk Analytics, Vitech Systems Group, eBaoTech, and Finaeo. |

Market Definition

Life insurance software comprises tailored applications aimed at optimizing multiple functions within the life insurance sector, including management of policies, processing of claims, and handling of customer relationships. These solutions not only boost operational effectiveness but also enhance the overall experience for both insurers and their clients.

Life insurance software plays a vital role in improving operational efficiency and precision in managing policies, underwriting, and processing claims. By automating routine activities, it reduces the likelihood of human errors and simplifies workflows, enabling agents and insurers to concentrate on enhancing customer service and engagement. This software includes functionalities for data analysis, risk evaluation, and adhering to regulatory standards, which empowers companies to quickly respond to evolving market conditions. Additionally, it fosters stronger customer relationship management through tailored communication and service options. In conclusion, life insurance software not only boosts operational productivity but also leads to better financial results for insurers and enriched experiences for policyholders.

Key Market Segmentation:

Insights On Key Component

Software

The software portion of the Global Life Insurance Software Market is expected to dominate due to its critical role in automating operations, enhancing customer experience, and ensuring regulatory compliance. As life insurance companies increasingly adopt digital solutions to streamline claims processing, policy management, and underwriting, the demand for robust and sophisticated software solutions continues to rise. More investments are being made in this area as a result of the necessity for businesses looking to enhance their operational efficiency and decision-making processes to incorporate cutting-edge technologies like artificial intelligence and big data analytics into insurance software.

Services

The services component of the Global Life Insurance Software Market plays a significant role in supporting the implementation and ongoing maintenance of software solutions. This includes consulting, integration, training, and technical support, which are crucial for ensuring that life insurance companies maximize the value they derive from their software investments. While not dominating the market, the services remains essential for facilitating smooth transitions to new systems and for adapting existing software to evolving market needs. The growing emphasis on customer service and personalized offerings also underscores the importance of high-quality support services alongside software solutions.

Insights On Key Deployment Mode

Cloud-Based

The Cloud-Based deployment mode is anticipated to dominate the Global Life Insurance Software Market due to its flexibility, scalability, and cost-effectiveness. Organizations increasingly prefer cloud solutions as they allow easy access to software and data from multiple devices without the need for extensive on-premises hardware investments. Additionally, the cloud model facilitates quicker updates and integrations with third-party applications, which enhances operational efficiency. Security improvements in cloud services have also mitigated earlier concerns, making it a preferred choice for insurance providers seeking to streamline operations while ensuring compliance with regulatory standards. Consequently, the adaptability and modern capabilities of cloud-based solutions position them as the leading approach in life insurance software deployment.

On-Premises

On-Premises deployment mode continues to be utilized by certain organizations that prioritize full control over their systems and data. This traditional approach allows companies to manage their hardware and software in-house, thereby adhering to specific regulatory and compliance requirements that necessitate tighter scrutiny of data management. Typically favored by larger insurance firms or those with legacy systems, this model offers stability and long-established processes. However, new entrants who are more likely to embrace cloud technologies due to their operational agility may be discouraged by the high initial capital expenditure and continuous maintenance costs associated with on-premises solutions.

Insights On Key Enterprise Size

Large Enterprises

Large Enterprises are expected to dominate the Global Life Insurance Software market due to their substantial financial resources, advanced technological requirements, and larger customer bases. These organizations often seek comprehensive and integrated life insurance software solutions, which can enhance their operational efficiency and customer management capabilities. Their need for robust systems that offer support for complex policy transactions, compliance management, and risk assessment drives a greater demand for innovative software solutions. Furthermore, large enterprises are more likely to invest in customized software to fulfill their unique needs, thus leading to a higher growth rate in the, compared to smaller counterparts.

Small and Medium Enterprises

Small and Medium Enterprises (SMEs) are characterized by their dynamic nature and adaptability, often leveraging innovative technologies to stay competitive. While SMEs face budgetary constraints, they increasingly recognize the value of life insurance software to streamline operations and improve customer service. The growth of cloud-based solutions has made it feasible for SMEs to adopt life insurance software, allowing for scalability and flexibility. This trend capitalizes on the growing acknowledgment that efficient digital systems can significantly enhance their business processes, although they are not the leading drivers of market demand as compared to larger organizations.

Insights On Key Application

Claims Management

Based on the latest research and data, Claims Management is expected to dominate the Global Life Insurance Software Market. This is primarily due to the increasing complexity of claims processes and the demand for faster resolutions to improve customer satisfaction. The software solutions enable insurers to automate claims processing, thereby reducing manual errors and enhancing efficiency. Additionally, the integration of machine learning and predictive analytics within claims management systems helps in effective fraud detection, increasing operational integrity. With more policyholders expecting seamless claims experiences, companies are investing heavily in advanced claims management tools to maintain their competitive edge.

Policy Management

Policy Management plays a crucial role in the life insurance sector by facilitating the issuance, renewal, and adjustment of insurance policies. The tools and solutions in this area enable insurers to manage policyholder information accurately, ensuring compliance with regulatory standards. As companies aim to improve customer engagement through personalized offerings, the demand for efficient policy management solutions has surged. These systems not only streamline workflows but also provide analytics that aid in strategic decision-making, thus making them a significant component of an insurer's operational framework.

Underwriting

Underwriting is another essential aspect of the life insurance software market. This procedure entails evaluating the risk of possible policyholders, which has an immediate effect on premium costs. Cutting-edge underwriting software uses analytics and big data to quickly make well-informed decisions. As more insurers shift toward digital transformation, they are investing in automated underwriting systems that can analyze vast amounts of data in real-time. This leads to faster turnaround times for policy issuance and a more accurate assessment of risk levels, positively influencing profitability.

Customer Relationship Management

Customer Relationship Management (CRM) in the life insurance market focuses on enhancing the relationship between insurers and policyholders. CRMs facilitate communication, track customer interactions, and manage client information effectively. With a rising emphasis on personalized customer experiences, the adoption of advanced CRM systems is increasing. These solutions empower insurers to offer tailored services and promotions based on clients' profiles and behaviors. Retention strategies can be identified with the aid of efficient CRM systems, which will ultimately increase customer satisfaction and loyalty.

Others

The "Others" category encompasses various applications that do not neatly fit into the primary classifications. This includes tools for reporting, compliance tracking, or innovative technology integrations. While these applications may not dominate the market like the prioritized areas, they are essential for supporting specialized operations within life insurance companies. As the industry evolves, niche solutions continue to gain traction, particularly those that address unique challenges faced by insurers, thereby playing a supportive role within the broader life insurance software ecosystem.

Insights On Key End-User

Insurance Companies

The global life insurance software market is expected to be dominated by insurance companies. These organizations are increasingly implementing advanced software solutions to improve operational efficiency, customer engagement, and claims management processes. This adoption is driven by the need for competitive differentiation in a saturated market and the growing demand for personalized insurance services. Furthermore, insurance companies are focusing on digital transformation initiatives that necessitate robust software infrastructure to meet regulatory requirements, improve risk assessment, and streamline policy management. Their considerable size and volume of transactions make them the primary consumers of life insurance software solutions, establishing their dominance in this market.

Brokers

Brokers also play a significant role in the life insurance software market, as they act as intermediaries between insurance companies and consumers. Their reliance on software solutions has been growing, driven by the need for efficient client management, streamlined policy comparisons, and superior customer service capabilities. Brokers benefit from analytics-driven tools that help them understand market trends and customer preferences, thereby enhancing their sales strategies. However, they generally leverage software less extensively than direct insurance providers due to their relatively smaller operational scale.

Others

The 'Others' category includes various stakeholders such as third-party administrators, reinsurers, and consultancy firms that are involved in the life insurance ecosystem. While these entities utilize life insurance software solutions for specific operational needs, their overall market presence is lower compared to insurance companies and brokers. Their focus tends to be more niche, often requiring bespoke software solutions tailored to their unique operational demands. This translates to a limited yet important role within the life insurance software market, supporting specific functions rather than driving overarching market trends.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Life Insurance Software market due to the region's technological advancements, established insurance infrastructure, and high investment in digital transformation. The presence of key market players and robust competition enhances innovation and the adoption of cutting-edge software solutions. Furthermore, a higher penetration of life insurance products and the growing trend of utilizing Artificial Intelligence and machine learning within financial services contribute to a compelling ecosystem for life insurance software development. Regulatory frameworks, risk management, and compliance needs also drive demand for automated and efficient solutions in the North American market.

Latin America

While Latin America is experiencing growth in the life insurance sector, it still trails North America in software adoption. The region's emerging markets are beginning to recognize the value of digital solutions as policymakers push for better coverage and regulatory advancements. However, challenges like infrastructure gaps and limited technological resources slow adoption rates, making it less competitive overall when compared to North America.

Asia Pacific

The Asia Pacific region is rapidly evolving, with significant potential for growth in the life insurance software market. Countries like China and India are seeing increased investments in technology, driven by a rising middle class and expanding insurance needs. However, the market is still fragmented, and many local companies lag behind in terms of adopting advanced software solutions, positioning them behind their North American counterparts in overall dominance.

Europe

Europe presents a stable but slow-growing market for life insurance software. The region is characterized by stringent regulatory requirements, which necessitate the adoption of sophisticated software solutions. While companies are investing in digital transformation, market maturity and a conservative approach to innovation indicate the region will maintain a supportive role but not dominate compared to North America’s aggressive technology push and market size.

Middle East & Africa

The Middle East & Africa region, while showing promising growth in financial services, remains underdeveloped in the life insurance software. Cultural factors and varying levels of economic development hinder widespread adoption. However, increasing foreign investments and infrastructural improvements signify a potential for future growth. At present, it lacks the competitive edge necessary to challenge North America's dominance effectively.

Company Profiles:

Prominent entities in the global life insurance software sector are pioneering cutting-edge technological solutions aimed at improving operational effectiveness and customer interaction for insurance providers. These companies are also prioritizing the incorporation of sophisticated analytics and automation to optimize processes such as underwriting, claims handling, and policy administration.

The life insurance software industry is shaped by key players recognized for their impactful contributions and technological advancements. These include Accenture, Oracle Corporation, SAP SE, DXC Technology, Benivo, Cognizant Technology Solutions, FIS Global, Guidewire Software, Magellan Health, Sapiens International Corporation, Stone River, Verisk Analytics, Vitech Systems Group, eBaoTech, and Finaeo. Each of these companies brings unique expertise, driving innovation and progress across the life insurance software landscape.

COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly hastened the integration of digital technologies within the worldwide life insurance software sector, leading to an increased necessity for advanced tools aimed at improving customer interaction and optimizing policy administration.

The COVID-19 pandemic has profoundly influenced the life insurance software industry, accelerating the transition towards digitalization and automation. As remote work became prevalent, insurance firms increasingly turned to cloud-based solutions to enhance their operational efficiency and foster customer engagement. This transition has led to a surge in demand for cutting-edge software that supports digital underwriting, policy administration, and claims handling. Additionally, a greater awareness of health-related risks has led consumers to reevaluate their insurance needs, creating an urgent need for providers to implement agile and responsive software systems. Consequently, companies in the life insurance software sector have made substantial investments in technologies like artificial intelligence and data analytics to improve risk assessment and tailor their offerings. In summary, the pandemic has not only altered consumer behaviors but has also initiated a technological evolution likely to persist beyond the current crisis, driving continued growth in the industry.

Latest Trends and Innovation:

- In April 2023, Salesforce announced the launch of its new Life Insurance Cloud, designed to streamline policy management and enhance customer engagement for life insurance companies. This platform incorporates artificial intelligence to provide personalized recommendations to life insurers.

- In March 2023, Guidewire Software acquired the life insurance software company, Cyence, to enhance its capabilities in risk assessment and analytics, enabling insurers to better understand and manage emerging risks in the market.

- In September 2022, FINEOS Corporation completed its acquisition of the digital claims management platform, FINEOS Claims, which focuses explicitly on life insurance claims, allowing insurers to leverage advanced technology for improved customer experience and operational efficiency.

- In January 2023, Dime Insurance announced the integration of machine learning algorithms into its life insurance underwriting process, significantly reducing the time required to assess applications and approve coverage.

- In November 2021, Oracle launched its Oracle Insurance Health and Life Analytics solution, enabling life insurance companies to utilize advanced analytics and data visualization tools to gain insights into their operations and customer behaviors.

- In December 2022, Sapiens International Corporation announced a partnership with Swiss Re to integrate advanced actuarial tools into its life insurance software offerings, aiming to enhance pricing precision and risk management for insurers.

- In February 2022, Valen Analytics formed a partnership with Sofer to provide life insurers with enhanced predictive analytics capabilities, allowing for better underwriting decisions and improved risk assessment methodologies.

Significant Growth Factors:

The expansion of the Life Insurance Software Market is fueled by the ongoing digital evolution within the insurance industry, a growing appetite for tailored insurance offerings, and the necessity for improved operational efficiency.

The market for life insurance software is witnessing remarkable growth, influenced by several fundamental elements. One prominent driver is the escalating push for digital transformation in the insurance industry, compelling firms to implement sophisticated software solutions that optimize operations and elevate customer satisfaction. The emergence of insurtech firms is catalyzing innovation, resulting in the creation of intuitive applications and platforms that facilitate efficient policy management and streamline claims processing.

Furthermore, the tightening of regulatory compliance measures demands the adoption of comprehensive software systems that safeguard against evolving requirements. As the emphasis on data analytics intensifies, insurers are utilizing large datasets for more individualized underwriting and risk evaluations, which leads to the design of enhanced policy offerings that cater to specific consumer preferences.

Additionally, a ened understanding of the vital role of life insurance, spurred by demographic shifts and economic changes, is amplifying the demand for insurance products and the corresponding technological support. The incorporation of artificial intelligence, machine learning, and automation into lifecycle management further bolsters operational effectiveness, significantly reducing costs and enhancing precision. Together, these factors create a vibrant and evolving environment for life insurance software, fostering ongoing market growth and advancement.

Restraining Factors:

Significant hindrances in the Life Insurance Software Market encompass difficulties in adhering to regulatory requirements and the substantial expenses linked to integrating systems.

The Life Insurance Software Market encounters various challenges that could hinder its growth potential. One prominent issue is the significant expenses linked to both software development and ongoing maintenance, which may discourage smaller insurance firms from adopting comprehensive solutions. Furthermore, the intricate nature of regulatory compliance across diverse regions requires continuous revisions and adjustments, thereby increasing operational expenses. Traditional insurance companies might show reluctance to adopt new technologies, favoring established systems instead, which can impede modernization efforts. Additionally, the handling of sensitive client data raises serious cybersecurity concerns, demanding stringent security protocols that complicate software implementation. The swift evolution of technology also necessitates regular updates to software, which can risk obsolescence and incur further costs. Nevertheless, the rising demand for digital transformation and improved customer experiences presents substantial growth opportunities for the life insurance software industry, as organizations recognize the importance of integrating cutting-edge technology to stay competitive and meet changing consumer needs. By embracing innovation, companies can enhance operational efficiency and deliver superior services, ultimately fostering a more promising future in the life insurance sector.

Key Segments of the Life Insurance Software Market

By Component

• Software

• Services

By Deployment Mode

• On-Premises

• Cloud-Based

By Enterprise Size

• Small and Medium Enterprises

• Large Enterprises

By Application

• Policy Management

• Claims Management

• Underwriting

• Customer Relationship Management

• Others

By End-User

• Insurance Companies

• Brokers

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America