Light Sensor Market Analysis and Insights:

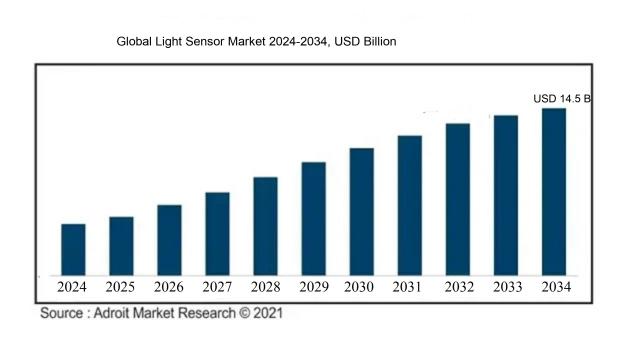

The market for Light Sensors was estimated to be worth USD 4.2 billion in 2023, and from 2024 to 2034, it is anticipated to grow at a CAGR of 12.0%, with an expected value of USD 14.5 billion in 2034.

The light sensor market is predominantly influenced by the surging need for energy-efficient lighting systems and intelligent technologies across multiple industries, including automotive, consumer goods, and residential settings. As global consciousness around environmental sustainability ens, there is an increasing focus on minimizing energy usage, which drives the uptake of advanced light management systems that incorporate sensors. Moreover, the rise of the Internet of Things (IoT) is enabling the seamless incorporation of light sensors into smart home devices and urban smart solutions, improving automation and user experience. Innovations in technology, such as the miniaturization of sensors and enhancements in their sensitivity, further contribute to the market's expansion. Additionally, governmental initiatives that advocate for energy-efficient solutions and the embrace of renewable energy play a crucial role in the widespread adoption of light sensors across various sectors. In summary, the interplay of environmental imperatives, technological progress, and supportive regulatory frameworks is promoting significant growth in the light sensor market.

Light Sensor Market Definition

A light sensor is an instrument designed to identify and quantify the intensity of illumination in its surroundings. It transforms light into an electrical signal, facilitating diverse uses, including the automation of lighting systems and the observation of environmental conditions.

Light sensors serve as essential elements in numerous applications by precisely gauging surrounding light intensity to improve energy efficiency and user interactions. In gadgets such as smartphones and cameras, they regulate screen brightness and exposure levels, which enhances visibility and image clarity. Within smart homes, these sensors facilitate automated lighting solutions, optimizing energy use through intelligent management of illumination based on both occupancy and the presence of natural light. Furthermore, they are indispensable in agricultural contexts, where they track sunlight exposure to support optimal plant development, as well as in security systems, where they activate alarms in dim environments. In summary, light sensors profoundly enhance functionality and sustainability across a wide range of industries.

Light Sensor Market Segmentation:

Insights On Key Function

Ambient Light Sensing

Ambient Light Sensing is expected to dominate the Global Light Sensor Market due to its widespread application across various industries, particularly in consumer electronics, automotive, and smart lighting. As technology advances, more devices are being equipped with this feature to enhance user experience by automatically adjusting screen brightness, contributing to energy savings. This functionality is integral in smartphones, tablets, and laptops, making it a priority for manufacturers. Moreover, the rising demand for energy-efficient solutions, coupled with increasing consumer awareness regarding environmental sustainability, positions Ambient Light Sensing as the leading choice among the different function categories.

Proximity Detection

Proximity Detection is gaining traction in applications where touchless functionality is key, particularly in mobile devices and automotive safety systems. It facilitates user interaction without physical contact, which has become vital during instances like the COVID-19 pandemic. The increasing adoption of Internet of Things (IoT) technology is also pushing Proximity Detection forward, as it plays a critical role in smart home devices, thereby enhancing the overall user experience.

RGB Color Sensing

RGB Color Sensing is becoming essential for applications that require precise color detection and measurement, particularly in photography, display technologies, and industrial automation. Its ability to accurately identify and replicate colors makes it valuable in design and manufacturing processes. As industries focus on quality assurance and product differentiation, the demand for RGB Color Sensing continues to grow, especially in the realms of consumer electronics, textiles, and automotive interiors.

Gesture Recognition

Gesture Recognition is increasingly popular due to its interactive nature, facilitating hands-free operation in various devices, including gaming consoles and smart home devices. With the rise of augmented and virtual reality technologies, the demand for Gesture Recognition is anticipated to grow significantly. By enabling seamless navigation and control, this technology offers a more intuitive user experience, appealing to tech-savvy consumers looking for innovative solutions.

I.R. Detection

I.R. Detection remains pertinent in applications related to security, automotive, and healthcare. It is used for motion detection and thermal imaging, proving critical in environments where safety is paramount. As smart technologies are integrated into more devices, the applications for I.R. Detection are expanding, particularly in smart buildings and surveillance systems. The focus on security combined with advancements in sensor technology assures that I.R. Detection will maintain its importance in a range of sectors.

Insights On Key Output

Digital

The Digital is anticipated to dominate the Global Light Sensor Market due to its versatility and increasing adoption in various applications. Digital light sensors offer several advantages, including higher accuracy, flexibility in integration with digital systems, and real-time data processing capabilities, which are essential in modern electronic devices. As technology advances, there is a growing demand for smart and connected devices that require precise light measurements for adaptive lighting solutions, display adjustments, and automated systems. Furthermore, the rising popularity of smart home appliances and IoT devices is fostering the shift towards digital output solutions. This trend hints at a robust growth trajectory for the Digital in the light sensor marketplace.

Analog

The Analog also plays a significant role in the Global Light Sensor Market. It is generally characterized by lower costs and straightforward output signaling, which can be beneficial in less complex applications or traditional devices. Analog sensors are widely utilized in various industries, including automotive and consumer electronics, where simplicity and reliability are crucial. Although the may not experience the rapid growth that digital solutions are seeing, its foundational nature in legacy systems keeps it relevant for continued use in specific applications requiring basic light sensing without the need for advanced processing capabilities.

Insights On Key Integration

Combination

The Combination category is expected to dominate the Global Light Sensor Market due to its versatility and integration capability in various applications. This category allows multiple light sensing technologies to work together, enhancing the sensor's functionality and improving the accuracy of measurements. With the rise of smart devices and automation, the demand for advanced sensors that can deliver multifaceted data is increasing. Furthermore, Combination sensors can reduce costs by integrating multiple sensor functions into a single unit, making them appealing to manufacturers looking to optimize production. Their ability to serve a variety of sectors, such as consumer electronics, automotive, and industrial automation, reinforces their market dominance.

Discrete

Discrete light sensors are standalone components that provide specific functionality and ease of integration into various systems. However, their limitation lies in the necessity of multiple discrete sensors to achieve functionalities offered by Combination sensors. This can lead to increased costs and complexity in designs, as multiple components may be needed for certain applications. Despite this, discrete sensors are often preferred in simpler applications where basic light detection is adequate or where space constraints limit the use of more complex multi-functional sensors.

Insights On Key Type

Photo Voltaic Cells

Photo Voltaic Cells are expected to dominate the Global Light Sensor market due to their unique ability to convert light energy into electrical energy efficiently. This capability makes them highly applicable in renewable energy sources, especially in solar power generation. As industries and consumers increasingly turn to sustainable solutions, demand for devices that leverage this technology is surging. Furthermore, advancements in manufacturing processes have improved the efficiency and affordability of photo voltaic cells, making them more accessible for widespread use. With the global shift towards smart lighting systems and the Internet of Things (IoT), the significance of photo voltaic cells is projected to rise significantly.

Photo Conductive Cells

Photo Conductive Cells are characterized by their ability to change resistance based on light exposure. These devices have been widely used in applications requiring light detection, such as alarm systems and street lights. They offer a relatively simple and cost-effective solution for light sensing needs. However, their response time and sensitivity to various light conditions can limit their effectiveness in more advanced applications compared to their counterparts. As industries increasingly demand rapid and precise light measurement, the growth of photo conductive cells is expected to be steady yet limited, overshadowed by the growing prominence of photo voltaic cells.

Photo Junction Diodes

Photo Junction Diodes operate based on the principle of creating a voltage when exposed to light, making them effective in a range of electronic applications. Their compact size and efficiency make them suitable for miniaturized devices, which is crucial in the current trend of portable electronics. However, while they find uses in optical communications and consumer electronics, their market presence might not be as strong as photo voltaic cells. Despite their benefits, Photo Junction Diodes face challenges in competing against the rising technologies that integrate better with modern automation and IoT functionalities, thus limiting their overall market dominance.

Insights On Key Applications

Brightness Control

Among the various applications within the global light sensor market, Brightness Control is anticipated to dominate. The increasing demand for energy-efficient lighting solutions in residential and commercial spaces has significantly fueled the growth of this application. Brightness control systems not only enhance comfort by adjusting lighting according to the natural light available but also play a crucial role in energy savings. With the rise of smart homes and IoT, brightness control functionalities have become integral, leading to an increase in their incorporation in smart lighting systems. This trend highlights the competitive edge that brightness control has over other applications, reinforcing its position as the leading category in the market.

Placement Detection

Placement Detection is an important application of light sensors, particularly in automated environments such as warehouses and factories. This functionality helps to optimize the positioning of goods and equipment by detecting light levels that inform operators about the best locations for placement. Although it represents a smaller portion of the market compared to brightness control, the importance of efficient logistics and inventory management means that placement detection will continue to see gradual growth. As industries increasingly invest in automated systems, this application will gain relevance in driving overall market efficiency.

Security

The security application of light sensors is crucial for enhancing surveillance and monitoring systems. Light sensors are increasingly utilized in outdoor security systems, allowing for adaptive lighting that enhances visibility and helps deter intruders. As safety concerns rise globally, demand for advanced security solutions will likely bolster this market. However, its growth rate may not match the momentum of brightness control, as it encompasses more niche applications primarily focused on security rather than the broader range of lighting management.

Planning

The planning application in light sensors is often associated with urban development and smart city initiatives. This involves using light sensors for planning infrastructure that maximizes natural light usage while minimizing energy consumption. Although gaining traction, this area lags behind brighter applications like brightness control, which offers immediate benefits to consumers. Planning is essential for long-term environmental sustainability; its impact is substantial but tends to manifest more slowly, making this application less dominant in the current market landscape.

Agriculture

In agriculture, light sensors play a pivotal role in the optimization of crop yield through monitoring light levels. These sensors help in controlling greenhouse environments and enhancing photosynthesis processes by ensuring that plants receive an adequate amount of light. While agriculture is vital for food production, its reliance on light sensors may not generate growth comparable to the brightness control application, which caters to a broader consumer base. Despite this, as precision farming techniques continue to evolve, the agricultural may see increased demand for light sensors in the coming years.

Insights On Key End users

Consumer Electronics

The Consumer Electronics sector is anticipated to dominate the Global Light Sensor Market due to the significant demand for innovative technologies in smartphones, tablets, laptops, and smart home devices. As these electronic devices continue to evolve, manufacturers are increasingly integrating light sensors to enhance user experience and device performance. Light sensors enable automatic brightness adjustment, optimizing battery usage and providing better visual comfort for users. With the rapid proliferation of smart devices and rising consumer preference for automated and interactive functionalities, the Consumer Electronics industry is expected to be the leading driver of growth in this market.

Automotive

In the Automotive, light sensors are becoming essential for advanced driver-assistance systems (ADAS), contributing to improved safety and navigation. These sensors enable automatic headlight control, adaptive lighting, and even traffic sign recognition. As the industry moves toward autonomous vehicles, the reliance on sophisticated light sensing technology will increase. Furthermore, compliance with expanding safety standards and the growing trend of integrating smart technologies into vehicles will further boost the adoption of light sensors within this sector.

Industrial

The Industrial sector has been utilizing light sensors for automation purposes, enhancing efficiency, and improving resource management. These sensors are deployed in various applications such as machine vision systems, quality inspection, and monitoring of environmental lighting. The push for operational efficiency and sustainability in industrial processes has generated a significant demand for these sensors as they facilitate better control and reduce energy consumption, ultimately leading to cost savings and improved productivity.

Healthcare

Within the Healthcare industry, light sensors play a crucial role in various medical devices, including imaging equipment and patient monitoring systems. Their ability to detect ambient light conditions and automatically adjust device performance is vital for ensuring accuracy in diagnostics and patient care. As healthcare technology evolves, the demand for high-precision and reliable monitoring devices will lead to increased uptake of light sensing technologies. The growing focus on telehealth and remote patient monitoring solutions will also positively influence this market.

Entertainment

In the Entertainment sector, light sensors are utilized primarily in devices such as cameras, projectors, and gaming consoles to enhance user experience and visual quality. Their application in immersive technologies, including augmented and virtual reality, is gaining momentum. Increasing consumer interest in high-definition entertainment and interactive gaming experiences is expected to drive the adoption of light sensors in this space. As this continues to develop, so too will the need for advanced light sensing solutions that optimize visual performance and energy efficiency.

Insights on Regional Analysis for Light Sensor Market:

Asia Pacific

Asia Pacific is expected to dominate the Global Light Sensor market due to its rapidly growing electronics industry, strong investments in smart technologies, and increasing demand for automation across various sectors. Countries like China, Japan, and South Korea are leading players in manufacturing and adopting light sensors for applications such as automotive lighting, security systems, and smart home devices. The region benefits from a large consumer base, ongoing urbanization, and a shift towards energy-efficient solutions, further accelerating the demand for advanced light sensors. Additionally, government initiatives promoting the adoption of IoT and smart city projects are likely to bolster market growth in this region.

North America

North America is poised to be a significant player in the Global Light Sensor market, driven by advanced technological adoption and a strong emphasis on research and development. The presence of major market participants and well-established infrastructure supports a growing demand for light sensors in sectors such as automotive, healthcare, and consumer electronics. Moreover, the increasing focus on smart lighting solutions and energy efficiency has spurred innovation in the region, thus supporting market expansion.

Europe

In Europe, the light sensor market benefits greatly from stringent regulatory measures focusing on energy efficiency and environmental sustainability. The increasing deployment of smart lighting in urban areas, along with the emphasis on reducing carbon footprints, drives significant growth. Countries like Germany and the UK are at the forefront, investing in innovative technologies for both commercial and residential applications, ensuring that the region remains a vital contributor to the global market for light sensors.

Latin America

Although Latin America is not currently a dominant market for light sensors, it is witnessing gradual growth due to rising technological adoption and investments in infrastructure projects. The region's developing economies are beginning to embrace smart technologies in sectors like agriculture and automotive. Increased governmental focus on renewable energy sources also serves to boost the light sensor demand, paving the way for potential market expansion in the coming years as the region seeks to modernize its technology landscape.

Middle East & Africa

The Middle East & Africa region is gradually emerging as a potential market for light sensors, driven by growing interest in energy-efficient solutions and smart technologies. Increasing investments in smart city initiatives and modernization of infrastructure are key factors contributing to this growth. While the market is still in its infancy stage, the rising adoption of light sensors in applications like security, building automation, and consumer electronics indicates promise for future development as the region focuses on enhancing technological capabilities.

Light Sensor Market Company Profiles:

Leading entities in the global light sensor market, including Texas Instruments and STMicroelectronics, are at the forefront of innovation by leveraging cutting-edge technological advancements and forming strategic alliances. These efforts enhance performance across diverse applications. Their partnerships with manufacturers, along with sustained investments in research and development, are crucial for stimulating market expansion and addressing the evolving needs of consumers.

Prominent companies in the light sensor industry comprise Texas Instruments, Analog Devices, ROHM Semiconductor, STMicroelectronics, Omron Corporation, Vishay Intertechnology, Honeywell International Inc., Broadcom Inc., Infineon Technologies AG, NXP Semiconductors, Panasonic Corporation, Sharp Corporation, Siemens AG, ON Semiconductor, and Lite-On Technology Corporation.

COVID-19 Impact and Market Status for Light Sensor Market:

The Covid-19 pandemic had a profound impact on the Global Light Sensor market, resulting in supply chain disruptions and shifts in consumer demand, which caused a short-term reduction in growth rates.

The COVID-19 pandemic had a profound impact on the light sensor industry, primarily by disrupting supply chains, halting manufacturing processes, and altering consumer preferences. Initially, widespread lockdowns hindered production and created labor shortages, which resulted in delays in the supply of light sensor components. Nevertheless, the ened focus on health and environmental concerns spurred the demand for innovative lighting solutions, notably smart lighting systems and automation technologies. Additionally, the rise in outdoor activities during the pandemic brought increased attention to effective street lighting and smart city projects, directly influencing the demand for light sensors. In response, companies transitioned towards online sales and prioritized product development to meet shifting consumer requirements. Ultimately, although the pandemic presented significant challenges, it also opened up avenues for growth within the light sensor market, especially as industries began to adopt automation and energy-efficient technologies in the aftermath of COVID recovery.

Light Sensor Market Latest Trends and Innovation:

- In September 2023, ams OSRAM launched the AS7265x series of light sensors designed for advanced color sensing applications, enhancing performance in industrial and consumer markets with improved accuracy and reliability.

- In June 2023, Silicon Labs acquired the light sensor technology of the Dutch company, TeraXion, to bolster their portfolio in smart lighting solutions and IoT devices, aiming to enhance the integration of light sensors in their product offerings.

- In March 2023, Vishay Intertechnology introduced a new series of ambient light sensors that provide energy-efficient performance for use in smartphones and electronic devices, demonstrating significant advancements in power reduction capabilities.

- In February 2023, Sharp Corporation revealed its new generation of photoelectric sensors featuring enhanced sensitivity and compact design, specifically targeting applications in automation and robotics industries to improve operational efficiency.

- In January 2023, STMicroelectronics announced a partnership with the University of Toronto to develop innovative light sensor technology using artificial intelligence for smart city applications, highlighting the collaborative approach to research and development in the light sensor market.

- In October 2022, PixArt Imaging completed the acquisition of the light sensing division of the Taiwanese firm, Silead, allowing PixArt to expand its capabilities in optical sensing solutions and grow its market share significantly.

- In September 2022, ROHM Semiconductor announced the development of a new light sensor chip that integrates advanced features for augmented reality applications, marking a significant innovation in the AR and VR markets.

- In July 2022, Sony Corporation launched their latest generation of image sensors that include enhanced light sensitivity features, catering to both consumer-grade and professional devices, reflecting a commitment to advancing imaging technology.

- In April 2022, Texas Instruments expanded its light sensor offerings with a new product line optimized for automotive applications, addressing the growing demand for advanced lighting solutions in vehicles.

- In January 2022, OSRAM Opto Semiconductors introduced a series of high-efficiency light sensors aimed at the horticulture market, which are designed to optimize the growth conditions for plants, further innovating the intersection of technology and agriculture.

Light Sensor Market Significant Growth Factors:

The expansion of the light sensor market is propelled by a rising need for automated lighting solutions, innovations in smart technology, and an escalating emphasis on energy efficiency across multiple sectors.

The market for light sensors is witnessing remarkable expansion due to several pivotal drivers. Primarily, the surge in demand for energy-efficient technologies is leading to a wider acceptance of light sensors in a variety of applications, particularly in smart homes and Internet of Things (IoT) devices. As both consumers and enterprises work towards more efficient energy use, these sensors are vital for automating lighting systems, which ultimately helps lower electricity expenses. Furthermore, the swift advancement of smart city projects is fostering the incorporation of light sensors in areas such as street illumination, traffic control, and public safety mechanisms. A growing focus on environmental sustainability is also enhancing this trend, as light sensors aid in minimizing carbon emissions. Additionally, technological breakthroughs, including the creation of compact sensors and superior performance features, are broadening their usage across industries like automotive, healthcare, and consumer electronics. The increased prevalence of portable devices and wearables equipped with sophisticated sensing technologies further stimulates market growth, appealing to a modern, tech-inclined consumer demographic. Lastly, rising urbanization and the development of infrastructure are driving the demand for smart lighting solutions, reinforcing the indispensable nature of light sensors in contemporary settings. Overall, these factors are propelling the vibrant growth of the light sensor market.

Light Sensor Market Restraining Factors:

The expansion of the light sensor industry faces challenges due to elevated production expenses and the intricacies involved in integrating these sensors into current systems.

The Light Sensor Market is on a growth trajectory, yet it encounters a number of challenges that could impede its progress. A significant barrier is the elevated expense associated with cutting-edge light sensor technologies, which may discourage smaller manufacturers and restrict overall market growth. Moreover, issues related to compatibility and integration with current systems present obstacles to the broad adoption of these technologies across various sectors, including automotive and consumer electronics.

Additionally, the volatility in raw material prices can disrupt production processes, leading to fluctuations in costs and potential supply chain challenges. Regulatory requirements and compliance with industry standards often delay the entry of new companies into the market, particularly in jurisdictions with strict regulations. Furthermore, the rapid evolution of technology poses a risk of obsolescence, as consumers consistently demand more efficient and innovative products.

Despite these hurdles, the Light Sensor Market remains filled with opportunities, fueled by a rising appetite for smart lighting solutions and a commitment to energy-efficient technologies. Focusing on research and development could unlock innovative advancements that address these challenges, fostering a more dynamic and adaptable market environment in the future.

Key Segments of the Light Sensor Market

By Function:

- Ambient Light Sensing

- Proximity Detection

- RGB Color Sensing

- Gesture Recognition

- I.R. Detection

By Output:

- Analog

- Digital

By Integration:

- Discrete

- Combination

By Type:

- Photo Conductive Cells

- Photo Voltaic Cells

- Photo Junction Diodes

By Applications:

- Placement Detection

- Brightness Control

- Security

- Planning

- Agriculture

By End Users:

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Entertainment

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America