Liquid Flavors Market Analysis and Insights:

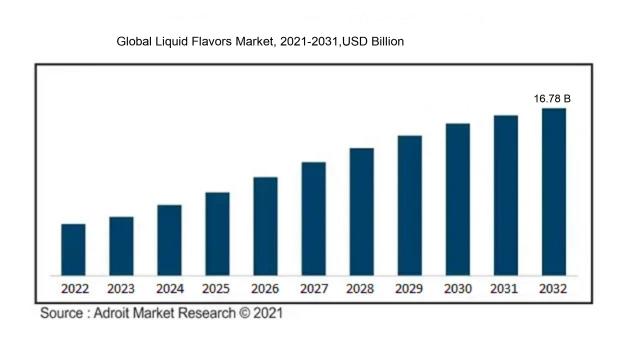

In 2023, the size of the worldwide Liquid Flavors market was US$ 11.82 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 4.4 % from 2024 to 2032, reaching US$ 16.78 billion.

The market for liquid flavors is primarily influenced by several important elements, such as the increasing consumer preference for a variety of flavors in food and beverages, along with the broader utilization of liquid flavors in industries like confectionery, dairy, and baked goods. Heightened awareness of health issues has resulted in a greater demand for natural and organic flavor options, prompting manufacturers to develop innovative clean-label products. The booming beverage sector, especially in areas such as functional drinks, cocktails, and non-alcoholic choices, significantly enhances market dynamics. Furthermore, advancements in flavor technology and the rise of e-commerce platforms for distribution bolster market expansion. Regulatory changes that advocate the safe use of flavoring agents motivate industry players to experiment with new formulations, creating a wider array of products and improved options for consumers. Together, these factors contribute to a vibrant and rapidly changing environment for liquid flavors.

Liquid Flavors Market Definition

Liquid flavorings are concentrated agents designed to elevate the taste of food and drinks, available in liquid form. These flavor enhancers may originate from either natural or synthetic sources and are versatile in their culinary uses.

Liquid flavors are integral to the culinary and food sectors, elevating simple meals into sophisticated culinary creations by enhancing taste and fragrance. Their adaptability allows chefs and food producers to craft a diverse array of items, spanning from drinks to confections. Furthermore, liquid flavors facilitate exact flavor management, ensuring uniformity across different production runs. Given their concentrated formulation, only a minimal quantity is needed to produce a substantial effect, which helps lower manufacturing costs and decrease waste. The increasing inclination for personalized and distinctive flavor experiences has rendered liquid flavors vital for fostering innovation and standing out in a competitive landscape.

Liquid Flavors Market Segmental Analysis:

Insights On Type

Synthetic Flavors

Synthetic flavors account for a significant portion of the liquid flavors market and are expected to dominate the Global Liquid Flavors Market. They are favored due to their cost-effectiveness and consistency in flavor profile, making them a popular choice for large-scale production in the food and beverage industry. Brands may utilize synthetic flavors to create unique tastes that are perfectly replicated and can be produced in bulk without the variability that natural sources might introduce. However, increasing health-conscious consumer sentiment and regulatory scrutiny poses a challenge to sustained growth in this category.

Natural Flavors

The growing consumer preference for clean-label products, health-conscious choices, and organic ingredients has significantly shifted the focus towards natural flavors. This trend is fueled by increased awareness about the potential health risks associated with synthetic additives and artificial ingredients. Additionally, the rising demand for unique and authentic taste experiences in food and beverages has led manufacturers to opt for natural sources, such as fruits, vegetables, and herbs, which provide depth and complexity to flavors. With regulations becoming stricter around synthetic substances, the natural flavors is set to capture a larger market share.

Insights On Flavor

Fruit

The Fruit flavor category is expected to dominate the Global Liquid Flavors Market due to increasing consumer preference for natural and healthy options. As consumers become more health-conscious, there is a stronger demand for flavors derived from real fruits, which are perceived to be more beneficial than artificial alternatives. The versatility of fruit flavors also allows them to be widely used across various applications including beverages, confectionery, and dairy products, further enhancing their market presence. Additionally, innovations in flavor extraction technologies have made it easier to produce authentic fruit flavors, thereby increasing their popularity in the marketplace.

Chocolate

The Chocolate flavor category holds significant appeal among consumers due to its universal popularity and indulgent qualities. Often associated with comfort and pleasure, chocolate is a staple in various products, including desserts, beverages, and confectioneries. As more brands introduce innovative chocolate blends and gourmet options, the demand for this flavor continues to rise. Furthermore, the growing trend of premium products in the market creates opportunities for unique chocolate flavors which attract a niche audience willing to pay a premium for high-quality offerings.

Vanilla

The Vanilla flavor category is one of the most recognized and widely used flavors in various products worldwide. It serves as a core flavor in many essential culinary applications, including ice creams, baked goods, and beverages. Vanilla’s ability to blend well with other flavors enhances its utility and preference among both consumers and manufacturers. Additionally, the rising trend toward natural and organic products has increased the demand for natural vanilla flavors, further solidifying its position in the market as a beloved flavoring option.

Nut

The Nut flavor category caters to a specific of consumers who enjoy the rich and roasted flavors associated with nuts. This category has gained traction due to its incorporation in snacks, desserts, and premium beverages. The growing trend towards healthy snacking has also boosted the demand for nut flavors, as they are often associated with rich nutritional profiles. Moreover, the unique taste profiles found in various nuts have led to innovation in the flavoring applications, making nut flavors a favorable choice among consumers seeking new and exciting taste experiences.

Caramel

The Caramel flavor category is a beloved choice among consumers who enjoy rich, sweet, and buttery flavors. Its widespread popularity can be attributed to its extensive use in desserts, coffee, and confectionery products. The increasing consumer preference for indulgent flavors has elevated the demand for caramel in various applications. Moreover, innovations in caramel formulations, such as salted and flavored varieties, have expanded its usage and appeal, making it a favored and sought-after flavor option in the rapidly evolving food and beverage market.

Other

The Other flavor category encompasses a diverse range of flavors that do not fall under the traditional categories of fruit, chocolate, vanilla, nut, or caramel. This includes unique flavors such as mint, spices, and herbal blends, appealing to niche markets and adventurous consumers. The growing trend of experimentation with flavors has resulted in a notable increase in the demand for unique and exotic flavor profiles. Products aiming to offer distinct sensory experiences often incorporate these unconventional flavors, catering to consumers seeking novelty in their food and beverage choices.

Insights On Application

Beverages

The Beverages is expected to dominate the Global Liquid Flavors Market due to several factors. The growing demand for flavored drinks, including soft drinks, energy drinks, and alcoholic beverages, highlights consumers' desire for innovative and diverse flavor profiles. Additionally, the health-conscious movement has spurred an increase in flavored water and functional beverages, further driving market growth. The versatility of liquid flavors in enhancing taste and consumer experience in drinks makes this a focal point for market players. With ongoing advancements in flavor technology and the increasing trend of customization in beverage offerings, the Beverages sector is well-positioned to lead the market.

Dairy Products

The Dairy Products category holds a significant position in the Global Liquid Flavors Market. The ongoing trend of product diversification in yogurt, milk, and other dairy items encourages manufacturers to incorporate unique flavors that cater to consumer preferences. Additionally, the rising popularity of dairy alternatives, such as almond and soy milk, is creating further opportunities for innovative flavoring solutions. As consumers seek healthier and tastier dairy options, the incorporation of appealing flavors is crucial for enhancing the overall sensory experience.

Bakery and Confectionery

The Bakery and Confectionery sector represents an influential part of the Global Liquid Flavors Market. The demand for flavored baked goods and confections continues to rise, driven by consumer desires for more diverse and appealing flavors. Liquid flavors are essential in achieving desired taste profiles in products like cakes, cookies, and candies. Furthermore, the trend toward artisanal and gourmet bakery products often incorporates innovative flavors, which is expected to fuel growth in this as consumers seek unique, memorable taste experiences.

Savory and Snacks

The Savory and Snacks category is a growing player in the Global Liquid Flavors Market. The increasing demand for flavored snacks, such as chips and popcorn, underscores consumers' pursuit of exciting taste experiences. Manufacturers are continually experimenting with liquid flavors to create appetizing and bold profiles that differentiate their products in a competitive market. As snacking habits evolve, flavored savory products are likely to attract more attention, making this increasingly relevant to flavor producers aiming to meet consumer expectations for variety and innovation.

Other

The Other category encompasses a range of applications in the Global Liquid Flavors Market that do not fit neatly into the primary s. This can include flavors used in sauces, dressings, or even specialty foods. Although it may not dominate the market, this plays a critical role by offering unique flavoring solutions for niche and gourmet items. The trend toward culinary exploration and international flavors can enhance the demand for liquid flavors in this category, creating opportunities for specialized producers to cater to emerging consumer preferences.

Global Liquid Flavors Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Liquid Flavors market due to rapid modernization, increasing urbanization, and a significant rise in the food and beverage sectors across countries like China and India. The robust demand for flavored products among a young, dynamic population and growing disposable incomes will further drive the market. Additionally, the region's strong focus on innovation, coupled with increasing adoption of liquid flavoring in emerging markets, creates a fertile ground for growth. Such trends, along with the burgeoning e-commerce channel, significantly enhance the region’s potential for leading the liquid flavors market over the forecast period.

North America

North America, particularly the United States, holds a significant share of the Global Liquid Flavors market due to mature food and beverage industries. Consumer preferences for unique flavors and the growing trend of health-conscious products have increased demand for liquid flavors. Furthermore, the region benefits from substantial investments in research and development, paving the way for innovative flavor profiles that cater to diverse consumer palates. The presence of several players also bolsters the competitive landscape, ensuring robust market growth.

Europe

In Europe, the liquid flavors market is characterized by a diverse portfolio of flavors and a high level of product customization. The region’s strong regulatory framework ensures the highest quality and safety standards, which boosts consumer trust and brand loyalty. Increasing trends towards premium gourmet products and clean labels drive the market, as consumers are more informed and demand higher quality. The culinary arts culture in various European countries also supports the popularity of unique flavors, enabling stable market growth in traditional and modern application sectors.

Latin America

Latin America is witnessing a gradual increase in the Liquid Flavors market driven by growing urbanization and changing dietary preferences. The burgeoning food and beverage sector, coupled with a rising inclination towards flavored alcoholic beverages, plays a crucial role in market expansion. Although the market is still developing compared to other regions, there is potential for growth due to a young demographic that is increasingly seeking innovative and exotic flavor combinations for both personal consumption and social occasions.

Middle East & Africa

The Middle East & Africa region presents an emerging market for liquid flavors, primarily influenced by the rising food and beverage sector and evolving consumer preferences. Increased interest in packaged food products and the growing café culture contribute to a higher demand for various liquid flavors. However, market development may be hampered by economic volatility in some areas. Nonetheless, with a focus on increasing local production capacities and tapping into the expanding tourism sector, there is significant potential for growth in the liquid flavors market within this region.

Liquid Flavors Market Competitive Landscape:

Prominent participants in the worldwide liquid flavors industry consist of producers who create and formulate flavoring substances, as well as distributors who manage the supply chain, ensuring the timely delivery of these products to food and beverage enterprises. Their partnership fosters innovation and addresses the changing needs of diverse sectors.

Prominent participants in the Liquid Flavors Market consist of Givaudan SA, Firmenich International SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Mane SA, Sensient Technologies Corporation, Takasago International Corporation, and Frutarom Industries Ltd. (currently integrated with IFF). Other significant companies in this sector include T. Hasegawa Co., Ltd., as well as flavor manufacturers such as Bell Flavors and Fragrances, Robertet SA, and D.d. Williamson. In addition, noteworthy firms like Aromatech SAS, Wild Flavors GmbH (a division of Archer Daniels Midland Company), and LorAnn Oils, Inc. contribute to the industry's dynamics. The competitive field also features smaller and specialized entities, including Flavorchem Corporation and Flavor House.

Global Liquid Flavors Market COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the Global Liquid Flavors market by shifting consumer habits, resulting in a ened preference for home-cooked meals and packaged food items. This change, in turn, elevated the demand for a variety of flavoring alternatives.

The COVID-19 pandemic has had a profound effect on the liquid flavors market, leading to notable changes in consumer habits and market dynamics. The implementation of lockdowns and social distancing protocols resulted in a surge in home cooking and baking activities, which in turn spurred a greater demand for flavors utilized in homemade creations. However, the initial impact included disruptions in supply chains and the temporary closure of foodservice venues, leading to a downturn in demand from that sector. Furthermore, the pandemic expedited the shift towards online shopping, with consumers increasingly opting to purchase flavor products through e-commerce platforms. As health and wellness considerations gained traction, there was an escalating preference for natural flavors and products that feature clean labels, thereby shaping development strategies within the industry. In the post-pandemic landscape, the market is experiencing a recovery phase as foodservice businesses resume operations and consumer enthusiasm for innovative flavor solutions rises, signaling a move towards greater adaptability and resilience in product offerings. Overall, despite the challenges faced during the pandemic, the liquid flavors market is positioned for a gradual rebound and transformation.

Latest Trends and Innovation in The Global Liquid Flavors Market:

- In September 2023, Givaudan acquired a majority stake in the flavor company Roullier Group to enhance its capabilities in the liquid flavors , thus expanding its portfolio in the beverage and food markets.

- In July 2023, Symrise announced the launch of its new line of innovative flavor formulations specifically targeting the growing demand for plant-based beverages, showcasing their commitment to sustainability and health trends.

- In June 2023, IFF (International Flavors & Fragrances) launched a digital platform that utilizes AI technology to aid beverage manufacturers in creating customized liquid flavor profiles, streamlining the product development process and enhancing consumer experience.

- In April 2023, Firmenich completed its merger with DSM's fragrance and flavor division, combining their strengths to create a more extensive and diverse offering of liquid flavors, particularly in the beverage sector.

- In February 2023, Mane opened a new production facility in the United States dedicated to the creation of liquid flavors, aimed at meeting the increasing demand from local manufacturers and improving supply chain efficiencies.

- In January 2023, T. Hasegawa announced the expansion of its liquid flavor manufacturing capabilities in Japan, investing in new technology to cater to the rising demand for natural and organic flavoring solutions.

- In December 2022, Aroma Chemicals launched a cutting-edge extraction technique specifically designed to enhance liquid flavor production, aiming to preserve the integrity of natural ingredients while improving yield efficiency.

Liquid Flavors Market Growth Factors:

The expansion of the liquid flavors market is fueled by a ened appetite for a variety of food and drink options, advancements in flavor technology, and a growing inclination towards personalized consumer choices.

The Liquid Flavors Market is currently undergoing robust expansion, fueled by several pivotal trends. Firstly, an increasing consumer appetite for flavored beverages—such as sodas, fruit juices, and energy drinks—is significantly driving market growth, as individuals seek out a variety of taste experiences. Furthermore, the burgeoning food sector, especially in areas like baking and sweets, is enhancing the utilization of liquid flavors to boost product attractiveness.

Health-oriented trends are also reshaping the market landscape, with consumers favoring natural and organic flavor options in pursuit of cleaner ingredient labels. The rise of online shopping platforms has further facilitated the availability of flavored products, leading to higher sales across different regions.

Advancements in flavor technology have enabled the creation of novel flavor blends and enhanced flavor stability, appealing to food manufacturers and consumers alike. This is particularly evident in the nicotine and vaping markets, where there's a ened demand for an array of liquid flavors to satisfy diverse preferences.

Additionally, the global shift toward vegan and plant-based lifestyles is encouraging the innovation and utilization of natural liquid flavors derived from fruits, herbs, and spices, promoting sustainable development within the industry. Together, these dynamics illustrate a vibrant market landscape, positioning the Liquid Flavors Market for significant growth in the upcoming years.

Liquid Flavors Market Restaining Factors:

The Liquid Flavors Market faces significant challenges due to strict regulatory requirements and variations in the prices of raw materials.

The Liquid Flavors Market encounters several obstacles that may hinder its expansion. A primary concern is the strict regulatory landscape surrounding food and beverage safety, particularly regarding flavoring substances, which can elevate compliance costs and restrict the launch of innovative products. Additionally, the volatility in raw material costs can affect production budgets, resulting in unpredictable pricing and profitability for producers. The growing preference for natural and organic options may also suppress the demand for synthetic flavors, as consumers lean towards products with clean labels. Furthermore, the intense rivalry among flavor producers can lead to reduced pricing, adversely affecting profit margins and funding for innovation. Additionally, ened awareness of health risks associated with artificial flavors is shifting consumer preferences, putting more pressure on the market. Nevertheless, amidst these challenges, the increasing interest in novel flavor experiences, alongside advancements in food and beverage innovations, offers avenues for adaptation and growth in the Liquid Flavors Market, indicating a promising future as brands strive to meet the evolving demands of consumers.

Segments of the Liquid Flavors Market

By Type

• Natural Flavors

• Synthetic Flavors

By Flavor

• Fruit

• Chocolate

• Vanilla

• Nut

• Caramel

• Other

By Application

• Beverages

• Dairy Products

• Bakery and Confectionery

• Savory and Snacks

• Other

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America