Market Analysis and Insights:

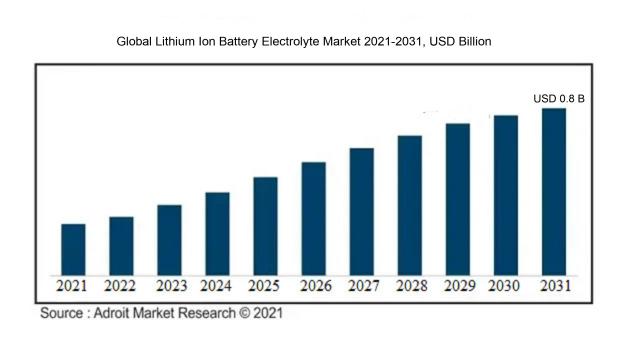

The market for Global Lithium Ion Battery Electrolyte was estimated to be worth USD 0.4 billion in 2023, and from 2024 to 2031, it is anticipated to grow at a CAGR of 5%, with an expected value of USD 0.8 billion in 2031.

The Lithium Ion Battery Electrolyte Market is influenced by several key factors, primarily the growing need for electric vehicles (EVs) and the storage of renewable energy, both of which depend on sophisticated battery technologies. As the world moves towards more eco-friendly energy solutions, there is a surge in funding for battery advancements, thereby increasing the demand for reliable and efficient electrolytes. Furthermore, the expansion of consumer electronics, including devices like smartphones and laptops, amplifies this growth as producers strive to offer batteries with extended longevity. Innovations in electrolyte composition that improve essential characteristics like ionic conductivity and thermal stability are pivotal in drawing investment to this field. In addition, government policies that encourage clean energy initiatives, along with the development of charging infrastructure, enhance market dynamics, fostering a robust environment for lithium-ion technology. As sectors continue to emphasize sustainability and energy efficiency, the requirement for high-quality electrolytes is expected to rise, significantly impacting the market's trajectory going forward.

Lithium Ion Battery Electrolyte Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2031 |

| Study Period | 2023-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 0.8 billion |

| Growth Rate | CAGR of 5% during 2024-2031 |

| Segment Covered | By Type, By Component, By Form, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BASF SE, LG Chem Ltd., Mitsubishi Chemical Corporation, Panasonic Corporation, Johnson Controls International plc, 3M Company, Solvay S.A., Arkema S.A., Ube Industries, Ltd., Fuji Chemical Industry Co., Ltd., Zhongke Sanhuan Chemical Co., Ltd., Kanto Chemical Co., Inc., Yanchang Petroleum Chemical Co., Ltd., Shenzhen Capchem Technology Co., Ltd., and Dongguan Kaijin New Energy Technology Co., Ltd. |

Market Definition

In a lithium-ion battery, an electrolyte is a conductive substance that, typically in liquid or gel form, allows lithium ions to be transferred between the anode and cathode during both the charging and discharging processes. This component is critical for the electrochemical interactions that support the storage and release of energy within the battery.

The electrolyte in lithium-ion batteries is essential for enabling the movement of lithium ions between the anode and cathode during both charging and discharging phases. Its properties directly impact key performance metrics such as energy density, lifespan, and safety of the battery. An effectively engineered electrolyte boosts ionic conductivity, reduces resistance, and supports stable functioning across a range of temperatures. Additionally, it plays a pivotal role in electrochemical stability and the interaction with electrode materials, which in turn affects the battery's efficiency and durability. Innovating advanced electrolytes that can endure high voltage and resist degradation under operational conditions is crucial for enhancing lithium-ion battery technology for various applications.

Key Market Segmentation:

Insights On Key Type

Dimethyl Carbonate

The dominating component of the Global Lithium Ion Battery Electrolyte Market is expected to be Dimethyl Carbonate. This is primarily driven by its favorable electrochemical stability, excellent conductivity, and compatibility with various electrode materials, making it a popular choice among manufacturers. Dimethyl Carbonate enhances the overall energy density and performance of lithium-ion batteries, which are crucial attributes in the rapidly advancing electric vehicle and portable electronics industries. As innovations in battery technology continue to evolve, the demand for high-performance electrolytes will further solidify Dimethyl Carbonate's leading position in the market.

Ethylene Carbonate

Ethylene Carbonate holds a significant position in the Lithium Ion Battery Electrolyte Market due to its high dielectric constant and ability to solvate lithium salts. This compound improves ionic conductivity, making it a critical component for enhancing battery performance. Additionally, it's utilized as a co-solvent to optimize electrolyte formulations, contributing to the efficiency and longevity of lithium-ion batteries. Its broad usage across various applications, from consumer electronics to electric vehicles, ensures a steady demand, but it does not overshadow the advantages provided by Dimethyl Carbonate.

Diethyl Carbonate

Diethyl Carbonate is recognized for its balancing properties between viscosity and conductivity in electrolytes. Although it may not lead the market, its attributes allow it to effectively dissociate lithium salts, facilitating ionic mobility. This makes Diethyl Carbonate valuable in electrolyte formulations tailored for applications in energy storage systems. Its versatility and effectiveness in enhancing battery cycle life and performance cement its role as a reliable component in the market.

Ethyl Methyl Carbonate

Ethyl Methyl Carbonate is gaining traction in the Lithium Ion Battery Electrolyte Market due to its low viscosity and high dielectric constant. These properties improve the electrochemical properties of the electrolyte, thus enhancing battery performance. While it is a strong player in the market, it often acts in concert with other components rather than leading. Its role in optimizing performance in diverse battery systems is significant but still secondary to the likes of Dimethyl Carbonate.

Propylene Carbonate

Propylene Carbonate is frequently employed due to its higher boiling point and ability to dissolve a wide range of lithium salts. It's particularly noted for its thermal stability and compatibility with various anode and cathode materials. However, its use is sometimes limited by its high viscosity, impacting the overall performance of the electrolytes. Despite these challenges, Propylene Carbonate remains a valuable ingredient in some specialized applications, especially where its unique properties offer distinct benefits.

Others

The Others" includes a range of less common solvents and additives that enhance electrolyte performance, stability, and lifespan. These may include compounds like methyl acetate, fluoroethylene carbonate (FEC), and lithium bis(fluorosulfonyl)imide (LiFSI), which improve electrolyte conductivity and stability at extreme temperatures. Some additives also reduce the degradation of electrodes, which prolongs battery life. This category is essential for specialized applications, such as electric vehicles and high-capacity energy storage, where optimizing battery efficiency and reliability is crucial.

Insights On Key Component

Electrolytic Solution

The Electrolytic Solution is expected to dominate the Global Lithium-ion Battery Electrolyte Market due to its vital role in ensuring efficient ion transport within the battery. The increasing demand for electric vehicles and portable electronic devices is driving the need for high-performance electrolytes. Innovations in liquid and solid-state electrolytic solutions enhance battery safety and energy density, making them critical for next-generation applications. As manufacturers focus on improving energy efficiency and sustainability, advancements in electrolytic formulations are likely to take precedence, resulting in a robust growth trajectory for this component in the market.

Cathode

The cathode is another essential element of lithium-ion batteries, playing a crucial role in the battery’s overall performance. As manufacturers strive to enhance energy capacity and optimize charging speeds, improvements in cathode materials, such as nickel cobalt manganese (NCM) and lithium iron phosphate (LFP), are increasingly being explored. However, while innovation is ongoing, the cathode market is currently affected by potential supply chain issues and material sourcing challenges, which may constrain its growth relative to the dominance currently observed in electrolytic solutions.

Anode

The anode component is significant, primarily as a site for lithium-ion storage and release during charge and discharge cycles. Market players are exploring various materials such as graphite and silicon to improve performance metrics, including energy density and cycle life. However, there are longstanding challenges with anode materials, such as limited capacity and susceptibility to swelling, which poses future hurdles for engineers. While critical, the anode must keep pace with advancements in electrolytic solutions, which currently holds a stronger market position.

Others

The Others category includes various additional components like separators and additives, which, while essential for optimal battery function, often take a back seat in discussions about overall market share. Innovations in these areas can lead to improved safety and performance, but they lack the direct impact on battery capacity and efficiency that electrolytic solutions provide. As a result, this is likely to lag behind the more dominant components, as most growth and attention focus on the primary constituents of lithium-ion battery design.

Insights On Key Form

Liquid

Liquid electrolytes are expected to dominate the Global Lithium Ion Battery Electrolyte Market primarily due to their high ionic conductivity and ease of use in various battery applications. Their ability to easily form a wetting layer around the electrodes enhances the electrochemical reactions, leading to improved battery efficiency and performance. Liquid electrolytes also support a wider operating temperature range, making them suitable for high-performance and demanding applications like electric vehicles and portable electronics. Furthermore, advancements in liquid electrolyte formulations, such as the development of safer and more stable variants, are driving their continued dominance over other forms in the market.

Solid

Solid electrolytes are gaining attention for their potential to enhance battery safety and energy density while addressing some limitations associated with liquid electrolytes, such as volatility and leakage risks. Their solid-state nature enables the development of batteries that are inherently safer, reducing the risk of fires and improving overall longevity. However, challenges like lower ionic conductivity at room temperature and complex manufacturing processes hinder their wide-scale adoption. Despite these challenges, ongoing research and development efforts aim to improve the performance and scalability of solid electrolytes, making them a promising option for future lithium-ion technologies.

Gel

Gel electrolytes present a hybrid solution that combines properties of both solid and liquid forms, offering improved safety and conductivity. They tend to provide better mechanical properties than liquids and maintain a stable interface with electrodes, which enhances cycle life and reduces degradation. However, gel electrolytes can still face issues such as limited ionic conductivity compared to traditional liquid electrolytes and potential problems with thermal stability. While their use is increasingly explored in niche applications, they remain less prevalent in mainstream markets compared to liquid options. Ongoing innovations in polymer-based gels may improve their market position in the future.

Insights On Key Applications

Additive

Additives are expected to dominate the Global Lithium Ion Battery Electrolyte Market due to their importance in improving battery performance and safety. These compounds improve conductivity, stability, and overall electrochemical properties, making them critical for the widespread use of lithium-ion batteries in a variety of applications such as consumer electronics, electric vehicles, and renewable energy storage systems. As battery technologies progress, the demand for high-performance electrolytes with superior additives is expected to increase, positioning them as a pivotal element in the market landscape.

Emulsifier

Emulsifiers play a critical role in stabilizing mixtures of liquids that typically do not blend well, such as oils and water. Their application in lithium-ion battery electrolytes is mainly focused on enhancing the dispersion of additives and solid components. Although their demand is present, it remains secondary to that of additives, as emulsifiers are more specialized and mainly relevant in niche markets compared to the expansive applications of additives in the battery industry.

Fixer

Fixers, while essential for improving electrode adhesion and integrity in lithium-ion batteries, do not hold the dominant position when it comes to the electrolyte market. Their primary role lies in enhancing the physical attachment of materials within the batteries, which is crucial. However, compared to additives and other materials that directly enhance electrolyte performance, fixers are utilized less frequently and do not drive significant growth in the overall market.

Stabilizers

Stabilizers contribute to the longevity and performance of lithium-ion battery electrolytes by minimizing degradation reactions under various operational conditions. Nevertheless, their impact is overshadowed by the more critical role of additives, which directly enhance ionic conductivity and overall efficiency. Consequently, while stabilizers are important for ensuring reliable battery operation, they remain an auxiliary component within the broader electrolytic materials market.

Adhesive

Adhesives are mainly used to bond different components within lithium-ion batteries rather than being a primary focus for electrolyte formulations. Although they ensure structural integrity, their role is more limited compared to the vital functions performed by additives in boosting electrolyte performance. Due to this specialized use, adhesives are not expected to dominate the market as they serve a narrower application scope.

Antifungal Agents

Antifungal agents serve to prevent microbial growth within battery systems, contributing to the preservation of electrolyte integrity. However, their application in lithium-ion batteries is minimal compared to the necessity for performance-enhancing components like additives. As such, their demand is likely to be peripheral and specialized, reflecting a greater emphasis on improving battery efficiency rather than on addressing fungal contamination, thus making them less significant in market dominance.

Others

The Others category includes various materials that may be applied within the electrolyte formulation but do not fit into the primary categories of emulsifiers, fixers, additives, stabilizers, adhesives, or antifungal agents. This category may encounter niche applications, but overall, it reflects a limited influence on the driving forces within the market. Given the specialized nature and lower overall utilization, products within this bracket are expected to contribute less significantly to the growth and dynamics of the lithium-ion battery electrolyte sector.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Lithium Ion Battery Electrolyte Market due to its robust manufacturing capabilities, high demand for electric vehicles (EVs), and expansive consumer electronics sector. Countries like China and Japan lead in lithium-ion battery production, leveraging substantial investments in battery technologies and infrastructure development. Additionally, government initiatives promoting electric mobility and renewable energy sources have catalyzed growth within this region. The rapid urbanization and increasing energy storage needs further contribute to the rising demand for advanced battery solutions, solidifying Asia Pacific's position as a frontrunner in the global market.

North America

North America is also a significant player in the lithium-ion battery electrolyte market, primarily driven by sustainable energy initiatives and stringent regulations promoting EV adoption. The rise of major manufacturers such as Tesla, along with investments in battery technology, underlines the region's commitment to transitioning towards cleaner energy alternatives. Furthermore, the presence of several research institutions focused on battery innovation strengthens the region's market stance, although it still trails behind Asia Pacific in overall production.

Europe

Europe is experiencing growth in the lithium-ion battery electrolyte market, buoyed by a shift towards electric mobility and sustainability. The European Union is implementing regulatory frameworks aimed at reducing carbon emissions, leading to increased demand for electric vehicles and energy storage solutions. Major automakers in regions like Germany, France, and the UK are upping their ante on battery production, making strategic partnerships, and innovations to elevate local manufacturing capabilities. However, competing with Asia Pacific's production scale remains a challenge for Europe.

Latin America

Latin America’s role in the lithium-ion battery electrolyte market is primarily tied to its geopolitical resources, particularly lithium extraction in countries like Argentina and Chile. While the region holds significant lithium reserves, the market is burgeoning but not yet fully capitalized compared to Asia Pacific or North America. Various nations are beginning to foster partnerships and initiatives aimed at enhancing local manufacturing efforts, but it still lags on technology advancement and production readiness that would elevate its market position.

Middle East & Africa

The Middle East and Africa are currently the least active regions in the lithium-ion battery electrolyte market. However, this is expected to change gradually as nations in Africa begin to invest in renewable energy projects that may leverage lithium-ion batteries for energy storage. Although currently faced with challenges like limited infrastructure and lack of local manufacturing, the rich mineral resources of lithium in certain countries could shift the dynamics in the long run if harnessed effectively for global market participation.

Company Profiles:

The primary contributors to the global lithium-ion battery electrolyte market including producers, vendors, and researchers—are pivotal in fostering innovation and progressing advanced electrolyte formulations. They cultivate strategic alliances to broaden their market presence and optimize operational efficiency. These cooperative endeavors aim to enhance the performance, safety, and sustainability of lithium-ion batteries in diverse applications.

Major contributors to the lithium-ion battery electrolyte sector comprise BASF SE, LG Chem Ltd., Mitsubishi Chemical Corporation, Panasonic Corporation, Johnson Controls International plc, 3M Company, Solvay S.A., Arkema S.A., Ube Industries, Ltd., Fuji Chemical Industry Co., Ltd., Zhongke Sanhuan Chemical Co., Ltd., Kanto Chemical Co., Inc., Yanchang Petroleum Chemical Co., Ltd., Shenzhen Capchem Technology Co., Ltd., and Dongguan Kaijin New Energy Technology Co., Ltd.

COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the global market for lithium-ion battery electrolytes, leading to supply chain disruptions and production stoppages. At the same time, it spurred an increased demand for electric vehicles and solutions for renewable energy storage.

The COVID-19 pandemic significantly affected the lithium-ion battery electrolyte market, resulting in supply chain disruptions, production delays, and varied demand across different industries. During the initial phase of the pandemic, lockdown measures caused a notable downturn in manufacturing, especially within the automotive and electronics sectors, which are key users of lithium-ion batteries. Conversely, the crisis expedited the shift towards electric vehicles and renewable energy technologies, thereby ening the requirement for effective energy storage solutions. As economies started to rebound and businesses adjusted to new operational standards, there was a marked increase in demand for lithium-ion batteries, fueled by a rising focus on sustainable energy and advancements in technology. Furthermore, the difficulties within supply chains encouraged companies to rethink their sourcing approaches and bolster local production capabilities, thereby transforming the market landscape. In summary, despite the pandemic presenting immediate challenges, it also acted as a catalyst for enduring growth trends in the lithium-ion battery electrolyte arena.

Latest Trends and Innovation:

- In August 2023, LG Chem announced a strategic partnership with Northvolt to develop advanced lithium-ion battery electrolytes, focusing on enhancing energy density and safety features for electric vehicles.

- In June 2023, BASF completed the acquisition of the battery materials division of 3M, a move aimed at strengthening its portfolio in lithium-ion battery electrolyte production and expanding its presence in the sustainable battery materials market.

- In April 2023, Tesla signed a multi-year supply agreement with Livent Corporation to secure lithium hydroxide for its battery production, emphasizing the importance of high-performance electrolytes in their upcoming battery cell innovations.

- In February 2023, Mitsubishi Chemical Corporation launched a new line of non-flammable electrolytes for lithium-ion batteries, significantly boosting safety in battery applications for consumer electronics and electric vehicles.

- In October 2022, Umicore and Samsung SDI entered into a joint venture to develop next-generation battery materials, including advanced electrolyte formulations aimed at improving the performance and lifecycle of batteries in electric vehicles.

Significant Growth Factors:

The expansion of the market for lithium-ion battery electrolytes is fueled by innovations in electric vehicle technologies, a rising need for renewable energy storage solutions, and continuous investigations into highly efficient materials.

The market for lithium-ion battery electrolytes is on the verge of considerable expansion, fueled by several critical drivers. The growing prevalence of electric vehicles (EVs) and the increased demand for portable electronic gadgets are significantly increasing the need for efficient energy storage solutions. Furthermore, ongoing advancements in battery technology are aimed at enhancing energy density, safety, and durability, which call for superior electrolytic materials to optimize performance. The rise of renewable energy systems, such as solar and wind, also ens the need for effective energy storage to accommodate fluctuations in supply.

In addition, government policies aimed at curtailing carbon emissions and promoting sustainable energy initiatives are stimulating investments in battery technologies, consequently energizing the electrolyte market. Innovations in solid-state electrolyte technologies are promising improvements in safety and functionality, creating new avenues for market development. The growing emphasis on recycling and environmentally sustainable practices in battery manufacturing is driving breakthroughs in electrolyte compositions to mitigate ecological impacts. Collectively, these dynamics position the lithium-ion battery electrolyte industry for substantial growth, facilitating the transition toward a more electrified and eco-friendly future.

Restraining Factors:

Increasing environmental issues associated with lithium extraction and its disposal present substantial obstacles for the Lithium Ion Battery Electrolyte Market.

The Lithium-Ion Battery Electrolyte Market encounters various challenges that may hinder its progress. A significant concern is the fluctuations in the costs of essential raw materials like lithium, cobalt, and nickel, which can drive up production expenses and impact manufacturers' pricing strategies. Furthermore, issues related to the flammability and thermal stability of liquid electrolytes raise safety concerns, leading some manufacturers to explore alternative options, potentially stalling market growth. Regulatory challenges regarding the safe handling and recycling of lithium-ion batteries create additional operational difficulties for producers, which can delay the launch of new products. Additionally, technological limitations in creating solid-state electrolytes with adequate conductivity and stability present a considerable obstacle, inhibiting innovation within the industry. Nonetheless, the rising demand for energy storage systems and electric vehicles, coupled with ongoing technological advancements, provides avenues to address these issues. By focusing on research and development to enhance safety and performance, and by engaging with emerging markets that have growing energy requirements, the industry can navigate these challenges effectively, fostering sustainable advancement in the lithium-ion battery electrolyte market.

Key Segments of the Lithium Ion Battery Electrolyte Market

By Type

• Ethylene Carbonate

• Diethyl Carbonate

• Dimethyl Carbonate

• Ethyl Methyl Carbonate

• Propylene Carbonate

• Others

By Component

• Cathode

• Anode

• Electrolytic Solution

• Others

By Form

• Solid

• Liquid

• Gel

By Applications

• Emulsifier

• Fixer

• Additive

• Stabilizers

• Adhesive

• Antifungal Agents

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America