The global LNG Storage Tank market worth USD $17.72 billion by 2028, growing at a CAGR of 4.25%

.jpg

)

The global LNG storage tank market revenue was valued at >USD 11.0 Billion in 2019. This can be attributed to the increasing liquefied natural gas demand in energy, power, steel, and other end user industries. Rising liquefied natural gas trade globally followed by increasing number of regasification units and floating storage is expected to increase LNG storage tanks market penetration over the coming years. Moreover, rising infrastructure development in developing economies such as India, China, Southeast Asia, and Brazil coupled with rising opportunities in marine transport will fuel the market growth in coming years. However, high installation cost associated with LNG storage tanks and liquefied natural gas leakage is expected to be the major market challenges.

LNG storage tank used to store liquefied natural gas. Ability to store liquefied natural gas at a very low temperature -260 degree Fahrenheit is the major characteristic of LNG storage tank. LNG storage tanks contains insulation materials in outer container and liquefied natural gas in inner container. The LNG storage tanks can be found in LNG carriers, above ground, and on the ground. LNG storage contains different design types such as buried concrete, spherical metal, and in-ground frozen cloud storage gateway. Over the past few years, the double wall type LNG storage tank has gained momentum.

LNG Storage Tank Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD $17.72 billion |

| Growth Rate | CAGR of 4.25% during 2018-2028 |

| Segment Covered | Material Type, Applications, Storage Capacity, Installation Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Vijay Tanks and Vessels Ltd., Corban Energy Group, Luxi New Energy Equipment Group Co. Ltd., Vinci Construction, MHI Engineering and International Project India Ltd., Lloyds Energy, Transtech Energy Llc., Cryocan, Cryogas Equipment Pvt. Ltd., and Whessoe |

Key Segment Of The LNG Storage Tank Market

By Application Type, (USD Billion)

• Potable Water

• Water Conservation

• Wastewater

• Industrial Wastewater

• Fire Protection

• Plumbing & Engineering Solution

By Material Type, (USD Billion)

• Fiberglass

• Steel

• Concrete (Built In Place And Precast)

• Polymer

• Others

By Storage Capacity, (USD Billion)

• Less Than 5

• 000 Liters

• 5

• 001 To 50

• 000 Liters

• 50

• 001 To 250

• 000 Liters

• Above 250

• 000 Liters

By End Use, (USD Billion)

• Municipal

• Industrial

• Commercial

• Residential

By Installation Type, (USD Billion)

• Above Ground

• Under Ground

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Increasing liquefied natural gas demand for steel, energy, power, and other industries are expected to open new avenues for LNG storage tanks manufacturers to increase their manufacturing in order to cater increasing industry requirement. The global liquefied natural gas demand in 2019 was valued at 359 million tons; 12.5% increased as compared to 2018.

Over the past few years, increasing energy demand followed by rising greenhouse gas emission have created need for green energy solutions. Government initiatives, favorable policies towards clean energy solutions, and increasing adoption of renewable energy sources are expected to open new opportunities for liquefied natural gas over the coming years; which in turns is expected to increase demand for LNG storage tanks.

Increasing population, rising energy demand & emission, rising industrialization, and unsafe air quality is expected to increase liquefied natural gas market concentration over the coming years. Additionally, natural gas and renewable energy sources are expected to replace coal in the global energy mix in coming years. Currently, China, India, USA, Brazil, Indonesia, Japan, South Korea, Thailand, Kazakhstan, and Vietnam are leading coal and solid fuel using countries in industrial sector. Increasing government regulations in these countries governing low carbon emission and renewable sources of energy will open new opportunities for LNG industry.

Type Segment

Based on the type, the market is segmented into self-supporting and non-self-supporting. The self-supporting type segment leads the market growth in 2019 and it is anticipated to hold its position during the forecast years. The market growth of this segment is mainly attributed to the growing liquefied natural gas demand in power and energy industry followed by increasing LNG trade over the past few years. Moreover, increasing transportation of liquefied natural gas through ships are expected to further drive self-supporting type LNG storage tank market over the coming years. Furthermore, as compared to other traditional LNG storage tanks, the construction period for self-supporting LNG storage tanks are less.

Material Segment

Based on the material type, steel, 9% nickel steel, aluminum alloy, and others are the key segments of the global storage tanks market. In 2019, steel material segment accumulated the major market share and it is expected to do so over the forecast years. Excellent toughness, durability, low thermal conductivity, and resistance to corrosion properties make steel ideal material for LNG storage tanks. Additionally, steel adoption has increased for creating extremely cold temperature condition and refrigeration for liquified natural gas.

Apart from steel, 9% nickel steel is also expected to contribute significant market share in coming years. Maximum safety of storage tanks is achieved by using nickel steel. Nickel steel alloys material meet all the necessary conditions for low temperature followed by temperature resistance and reduced wall thickness properties are expected to increase its market concentration over the coming years. However, manufacturing of LNG storage tanks from nickel steel alloys can be expensive.

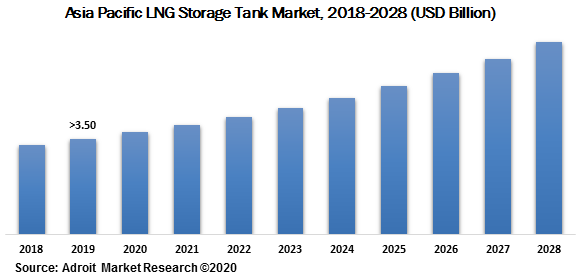

2019 was record break year for liquified natural gas; 40 million tons of additional LNG supply was recorded in 2019. The Asia Pacific region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2018-2028. Additionally, the region is anticipated to gather the highest growth over the forecast years. The market growth in this region is mostly ascribed to the growing urbanization and industrialization in China, India, Japan, and Southeast Asia. Besides, increasing liquified natural gas adoption in different end user industries such as power, energy, and steel industry is expected to further propel the market growth.

North America and Europe will also be expected to see remarkable market opportunities over the coming years. Initiatives taken by Europe countries to reduce dependence on nuclear power by 2040 is expected to open new avenues for liquified natural gas over the coming years; which in turns is expected to add LNG storage tank market growth.

The major players of the global LNG storage tank market are Vijay Tanks and Vessels Ltd., Corban Energy Group, Luxi New Energy Equipment Group Co. Ltd., Vinci Construction, MHI Engineering and International Project India Ltd., Lloyds Energy, Transtech Energy Llc., Cryocan, Cryogas Equipment Pvt. Ltd., and Whessoe. Moreover, the market comprises several other prominent players in the LNG storage tank market that are Bechtel, Karbonsan, Sener Group, Maverick Engineering Inc., and Cryoteknik. The LNG storage tank market consists of well-established global as well as local players. In addition, the previously recognized market players are coming up with new and advanced strategic solutions and services to stay competitive in the global market.