The size of the global market for Malaysia Online Food Delivery is expected to reach USD 63,246.1 million by 2029, expanding at a compound annual growth rate (CAGR) of 5.7%.

.jpg

)

Malaysia online food delivery market size was estimated at USD 66.3 million in 2017. With the fast-paced lives, online food delivery has a priority audience of the millennials for food delivery services as they tend to spend the greater share of their budgets on prepared food in comparison with the other generations.

Inevitably with the bigger spending power and changing lifestyles, consumers’ appeal towards the approach of online food ordering is increasing considerably. In this digital age, most of the work is being managed online and consumers are too busy to go to the restaurant and wait in long queues. Instead, from their perspective, convenience is having the restaurant come to them. These factors are expected to drive the Malaysia online food delivery market which is expected to grow at a rate of 18.6% from a period of 2018- 2025.

Key segments of the Malaysia online food delivery market

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | $ 63,246.1 million |

| Growth Rate | CAGR of 5.7 % during 2019-2029 |

| Segment Covered | By Service, By Organization size, By Vertical, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Accenture Plc., Bain & Company, Booz Allen Hamilton, Deloitte Consulting, Ernst & Young, International Business Machines Corporation, KPMG, McKinsey & Company, Pricewaterhouse Coopers, Boston Consulting Group. |

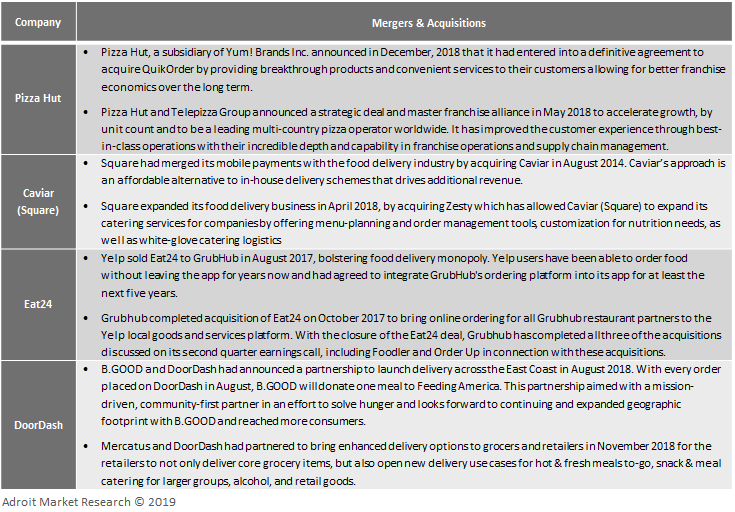

Type Overview, (USD Million)

- Restaurant-to-consumer delivery

- Platform-to-consumer delivery

Consumer Age Overview, (USD Million)

- Generation Z

- Millennials

- Generation X

- Baby Boomers

Gender Overview, (USD Million)

- Male

- Female

Income Level Overview, (USD Million)

- Low Income

- Medium Income

- High Income

Frequently Asked Questions (FAQ) :

Online food delivery is outpacing the overall dine-in restaurant industry growth owing to changing consumer lifestyle coupled with the millennial population. Consumers living in metropolitan cities are more inclined towards online delivery platforms owing to their convenience over menus, prices and peer reviews across the restaurant also with the simpler modes of payments. With the increase in working population coupled with long working shifts and prolonged commuting hours, consumers tend to order food online and get it delivered at their doorstep. Also, consumers prefer getting hot prepared meals other than buying frozen meals from food stores all the time. In the coming years, with the increase in online food delivery companies, there will be a tougher competition between domestic services and the third party delivery services with companies offering both healthier and high-quality food.

Consumer satisfaction is the most important criteria for an online food delivery market which needs to have ease in using the app along with their choice of restaurants highlighting the best seller menus. The on-time delivery of the order is also a major attribute for consumer satisfaction which plays a significant role in this market coupled with complaint resolution of the consumers. Optimizing consumer satisfaction is directly connected to the delivery process. For instance, although the cost of delivery is higher for the captive delivery fleet as compared to 3PL and restaurant delivery, captive delivery is in the leading position for higher customer satisfaction by minimizing the delivery time and by being order compliant.

Many of the food delivery apps attract consumers by offering a flat off on their orders in specific restaurants. The consumers then have a variety of options to choose from and enjoy their services. This, in turn, adds more value to consumer satisfaction, thus, increasing sales of restaurants. Most managers strategize different aspects of mobile coupons promotions to enhance their redemption rates. Hence, enhancing mobile coupon redemption in fast food campaigns is a contributing factor for generating revenues.

The online food delivery market emphasizes on data-driven user experience optimization by combining both technology and data by using personalized profiles with recommendations and digital tracking along the process from preparation to the final delivery. Furthermore, the integration in an IoT environment to revolutionize voice-ordering in the near future is the trend that is driving this market. The food delivery apps will add virtual assistant systems that enable voice-ordering features. Companies are trying-out self-driving cars, drones, and robots to make conveyance simpler and more expedient. It is assumed that this market will anticipate substantial growth in the coming years and these services will further expand their businesses in capital cities and increase delivery coverage.

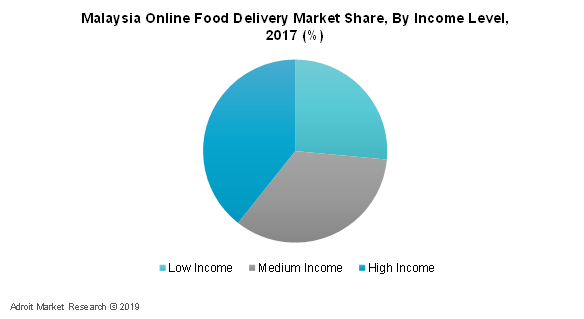

The income level is also a factor to be considered in this market, as ordering food online results in additional costs of components including delivery charges and taxes. The costs associated with ordering food online is sometimes not affordable to consumers with low income. Eventually, the high-income level consumers are more susceptible to order online food owing to their luxurious lifestyles. The median household income of high-income level is from a range of RM 13,148 to RM 11,610.

Taking into consideration the medium-income level, they may also have greater vulnerability towards ordering food online but not as much as the high-income level consumers. The medium income level includes an average salary of RM 6, 275 to RM 5,465.

Also, the high-income level consumers have more exposure to these advancements as compared to low-income level consumers owing to their lavish way of living. Hence, the market share of consumers with high-income levels is the highest in the Malaysian Online Food Delivery Market. The low-income level consumers in Malaysia earn nearly RM 3,000 to RM, 2,629.

The urge for timely on-demand delivery will always be a top requirement in this market, however, due to irregular rainy seasons in Malaysia, it may cause many issues for companies offering on-demand delivery. Therefore, food delivery service in Malaysia is not a capital-light business model but an on-going change to gauge supply with orders or customers. Especially in 2017, with the emergence of new players in the market, there was a great competition in this market owing to the demand for online food. Consumers in Malaysia residing in cities are more familiar with Uber Eats who joined the ride of online delivery in 2017, has benefitted food and beverages operators as they can offer more delivery options to its consumers.

The online food delivery market is also driven by the easy availability of mobile phone apps that provide various coupons at greater redemption rates. With the technological advancement in mobile phones, apps earn a profit by getting large amounts of business to the vendors and restaurants and, in addition to it, charging them with a commission over it. Since the app makes money from both vendors and restaurants, the revenue grows exponentially expanding the network of this market. The food delivery operators have high labor costs and hence high delivery costs. With the increase in the number of orders, there will be a need for more riders and, hence, an increase in capital investment for the food delivery operators. The food delivery services have altered consumer behavior according to their customer base especially in the metropolitan areas as there is a large crowd preferring prepared food in comparison to the consumer pool residing in other rural or inner-city areas.

Restaurants have started innovating from their end which has undoubtedly increased online food ordering due to their continuously growing internet presence. It basically gives consumers their own comprehensive service and flexibility to have control over their pace of ordering by limiting the amount of personal interactions they may encounter. Hence, the convenience of the consumers getting food on their doorstep will always drive this market.