Manufacturing Automation Market Analysis and Insights:

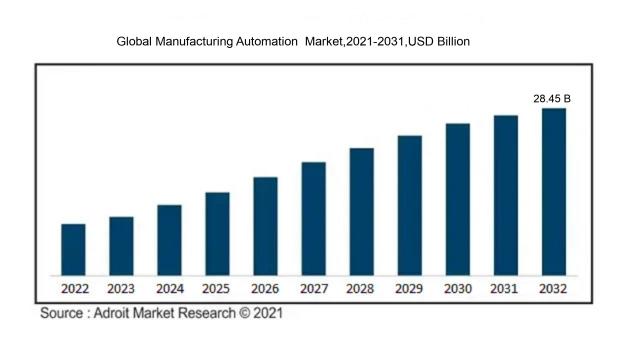

In 2023, the size of the worldwide Manufacturing Automation market was US$ 12.33 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 9.73% from 2024 to 2032, reaching US$ 28.45 billion.

The Manufacturing Automation Industry is propelled by various crucial elements that significantly enhance both operational efficiency and productivity. A primary driving force is the escalating demand for enhanced output and efficiency within manufacturing processes. Companies also face mounting pressure to cut operational expenses and reduce error rates. Advances in technology, especially with the integration of the Internet of Things (IoT) and artificial intelligence (AI), facilitate real-time monitoring and predictive maintenance, which contribute to more efficient operations.

The global transition towards Industry 4.0 promotes the establishment of intelligent manufacturing environments that utilize automated systems. Additionally, increasing labor costs and a shortage of skilled workers drive manufacturers to implement automation technologies to remain competitive. Compliance with safety and quality regulations further encourages the adoption of automation solutions. Furthermore, the rising consumer expectation for customization and flexibility in production demands automated systems capable of swiftly adjusting to changing market needs, thus propelling market growth across various sectors, including automotive, electronics, and consumer products.

Manufacturing Automation Market Definition

Manufacturing automation involves the application of advanced technologies and systems to oversee production activities while minimizing the need for human involvement. This concept includes the seamless integration of equipment, software solutions, and operational procedures aimed at improving efficiency, accuracy, and overall productivity within manufacturing settings.

The automation of manufacturing processes plays a vital role in boosting operational efficiency, lowering costs, and enhancing the quality of products. The incorporation of cutting-edge technologies like robotics, the Internet of Things (IoT), and artificial intelligence allows manufacturers to optimize workflows, reduce mistakes associated with manual tasks, and increase production speed. These enhancements result in greater production volumes and foster improved management of resources and energy consumption. Furthermore, automation facilitates the gathering and analysis of data, which offers valuable insights for ongoing improvements. In a highly competitive landscape, these benefits empower organizations to quickly adapt to consumer needs, accelerate innovation, and sustain a significant presence in the market, ultimately contributing to economic development and environmental sustainability.

Manufacturing Automation Market Segmental Analysis:

Insights On Component

Hardware

The Hardware component is expected to dominate the Global Manufacturing Automation Market since includes various physical components such as machinery, sensors, and robotics. While it remains vital for manufacturing operations, the market's growth in hardware is largely dependent on innovation and integration with software solutions. As factories strive for automation, the need for modern, efficient hardware has become crucial. However, compared to the advances in software, hardware growth tends to lag, primarily due to higher initial costs and longer lifecycles tied to capital investments. Nevertheless, hardware is fundamental for enabling automation processes in various industries, thus maintaining a steady demand.

Software

The Software component is expected to grow in the Global Manufacturing Automation Market due to increasing reliance on data-driven solutions and the demand for advanced analytics and optimization. Software enables real-time monitoring, predictive maintenance, and process control, which significantly enhance operational efficiency and reduce costs. The ongoing digital transformation in manufacturing is propelling the adoption of software solutions that integrate with existing hardware and automate various processes. This trend is further supported by the growing need for Industry 4.0 technologies, which focus on connectivity, automation, and data analytics, making software a critical driver for enhancing productivity across manufacturing sectors.

Services

The Services category encompasses a range of offerings that support manufacturing automation, including consulting, implementation, and system integration. Although this is essential for ensuring the successful application of automation technologies, it often serves a secondary role compared to more tangible components like software and hardware. However, as manufacturing organizations seek to optimize their operations, the demand for specialized services is steadily increasing. Companies are recognizing the need for expert guidance in implementing automation strategies effectively, leading to a growing market for both consulting and managed services within this space.

Professional Services

Professional Services within Manufacturing Automation primarily include consulting and advisory tasks that assist organizations in their automation journey. These services are instrumental in providing tailored solutions and strategic insights necessary for maximizing the adoption of automation technologies. Despite being crucial for implementation success, the demand for professional services is primarily fueled by the necessity for ongoing support and expertise rather than being a primary growth driver within the market. As companies encounter challenges in automation, professional services play a critical role in facilitating smoother transitions and ensuring that potential benefits are realized.

Managed Services

Managed Services refer to the outsourcing of specific IT functions related to manufacturing automation, such as system monitoring and maintenance. Although this is gaining traction due to the increasing complexity of automation systems, it continues to play a supporting role. Organizations pursue managed services to reduce operational burdens and enhance system performance, which allows in-house teams to focus on core competencies. However, this sector remains less dominant compared to software, which inherently drives the automation processes. The growth in managed services is expected to continue but at a comparatively slower pace.

Insights On Technology

Programmable Logic Controllers (PLC)

Programmable Logic Controllers (PLC) play a crucial role in the automation landscape and are projected to dominate the Global Manufacturing Automation Market. PLCs are primarily focused on controlling machinery and processes in manufacturing setups. They excel at performing repetitive tasks, allowing for reliability and ease of integration with existing systems. However, as industries evolve towards more sophisticated automation technologies, the limitations in flexibility and adaptability of PLCs compared to robotics may hinder their growth. Despite still being integral to industrial processes, PLCs are increasingly seen as one component of a more comprehensive automated solution rather than the primary driver.

Robotics

Robotics is projected to grow due to its capacity for enhancing productivity, precision, and the ability to perform complex tasks in various industrial applications. As industries increasingly shift toward automation, robotics provides advanced solutions such as collaborative robots (cobots) and autonomous mobile robots (AMRs), which streamline operations, reduce labor costs, and create safer work environments. The ability to integrate robotics with artificial intelligence further strengthens its appeal, driving innovation and efficiency across multiple sectors, including automotive, electronics, and consumer goods. With the growing demand for smart manufacturing solutions, robotics will continue to lead the adoption in the automation market.

Insights On Deployment

On-premise

On-premise solutions still have a significant presence in the manufacturing automation market, particularly among large enterprises with stringent security and compliance requirements and are expected to dominate the Global Manufacturing Automation Market. Companies that manage sensitive data often prefer on-premise installations since these systems allow for complete control over data storage and management. Furthermore, integrating on-premise solutions with existing factory operations is often more straightforward for businesses that have already heavily invested in traditional automation systems. The ability to customize hardware and software to meet unique operational needs also makes on-premise solutions appealing to certain manufacturers aiming for precise functionality tailored to their processes.

Cloud-based

Cloud-based solutions are rapidly gaining traction due to the increasing emphasis on digital transformation within the manufacturing sector. Manufacturers are utilizing cloud platforms to streamline operations, enhance collaboration, and reduce costs associated with traditional IT infrastructure. With the advent of the Internet of Things (IoT), cloud computing enables seamless connectivity between devices, offering real-time insights and performance analytics. The ability to access data from anywhere around the globe further empowers organizations to implement agile manufacturing practices and respond quickly to market changes. The growing acceptance and trust in cloud technologies among manufacturers indicate that this approach is steadily becoming a fundamental element in modern manufacturing strategies

Insights On Industrial

Automotive

The automotive industry is poised to dominate the Global Manufacturing Automation Market due to its increasing demand for advanced technologies and efficiency in production processes. As vehicles become more complex with the integration of smart technologies, automation systems are essential. The push for electric vehicles (EVs) and autonomous driving technology has also ened the need for automated solutions in manufacturing. The automotive sector exhibits a strong focus on precision, speed, and adaptability, driving significant investments in automation to enhance operational capabilities. Furthermore, the competitive nature of the automotive market compels manufacturers to adopt automation solutions to maintain a competitive edge, making this industry the frontrunner in the global landscape of manufacturing automation.

Consumer Electronics

The consumer electronics sector is also significant, driven by rapid technological advancements and changing consumer preferences. With continuous product innovation, manufacturers are compelled to streamline production lines and enhance efficiency. The growing demand for smart appliances, wearables, and other connected devices necessitates automation in both assembly and quality control processes. As consumer electronics companies strive to reduce production costs while improving product quality and turnaround times, they increasingly turn to automation technologies. This competitive environment encourages investments which contribute to notable growth in manufacturing automation, especially in response to fluctuating market demands and shorter product life cycles.

Healthcare

The healthcare industry is gaining traction in manufacturing automation, primarily due to the need for accuracy and compliance in producing medical devices and pharmaceuticals. As healthcare technologies evolve, various stakeholders are realizing that automation not only enhances efficiency but also improves patient outcomes. Therefore, the push towards automated systems in healthcare manufacturing contributes significantly to the market landscape.

Transportation and Logistics

In the transportation and logistics sector, the rise of e-commerce and the expansion of supply chains are fueling the adoption of automation technologies. Automated warehousing solutions facilitate inventory management, order processing, and distribution, thereby improving operational efficiency. As supply chains become increasingly complex, the implementation of automated systems is critical to ensure timely deliveries and enhance overall productivity.

Others

The "Others" category, encompassing various industries such as food and beverage, textiles, and machinery, is also adopting automation technologies, albeit at a differing pace. Each of these sectors has unique requirements driving their automation needs, such as improved hygiene standards in food production or efficiency in textile manufacturing. While these industries are not the primary drivers of the manufacturing automation market, they are leveraging automation to modernize operations and enhance productivity. Investments in specialized automation solutions to address specific challenges within these industries contribute to a consistent growth trajectory, adding to the overall market dynamics.

Insights On Solution

Robotics and Autonomous Systems

Robotics and Autonomous Systems are expected to dominate the Global Manufacturing Automation Market due to their increasing capability to enhance efficiency and productivity. The rise of Industry 4.0, combined with rapid advancements in artificial intelligence and machine learning, allows robots to perform complex tasks with precision. Industries are increasingly adopting robotic automation to reduce labor costs and improve safety, particularly in hazardous environments. With the need for flexible manufacturing processes, automation solutions with robotics enable businesses to quickly adapt to changing consumer demands. The ability to integrate autonomous systems into various production lines positions this category as the leader in the manufacturing automation landscape.

Control Systems

Control Systems play a crucial role in the automation of manufacturing processes by enabling precise management and coordination of machinery operations. These systems consist of hardware and software that monitor and control industrial equipment, ensuring optimal performance. As industries strive for higher efficiency and reduced downtime, enhancing control systems becomes imperative. Their significance in managing various processes, from temperature regulation to quality control, makes them indispensable in manufacturing settings. While not the leading category, Control Systems remain essential in optimizing operations and ensuring reliable performance across manufacturing facilities.

Monitoring and Diagnostics

Monitoring and Diagnostics are vital for maintaining the operational integrity of manufacturing processes. These technologies offer real-time insights into equipment performance, allowing for predictive maintenance and reducing the risk of unexpected failures. As manufacturers move towards smart factories, the implementation of advanced monitoring and diagnostic tools is crucial in maximizing uptime and operational efficiency. Although this sector does not have the same level of adoption as Robotics and Autonomous Systems, the need for effective monitoring solutions drives continuous innovation and integration in the automation framework, ensuring they remain a component of modern manufacturing strategies.

Insights On Enterprise size

Large Enterprises

Large enterprises are expected to dominate the Global Manufacturing Automation market due to their substantial resources, ability to invest in advanced technologies, and the necessity for efficiency at scale. These companies often have more complex manufacturing processes that require extensive automation to optimize productivity, reduce costs, and achieve competitive advantages. The integration of innovative technologies such as IoT, AI, and robotics is more feasible for large organizations that have sizable budgets and a dedicated team for implementing and maintaining automated systems. Furthermore, as the manufacturing sector focuses increasingly on sustainability and operational efficiency, large enterprises are better positioned to make the required investments, thereby reinforcing their leading role in the market.

SMEs

Small and medium-sized enterprises (SMEs) face constraints compared to their larger counterparts, often limited by budget, resources, and access to cutting-edge technology. However, the interest in manufacturing automation among SMEs is growing due to the rising availability of affordable automation solutions that cater specifically to smaller businesses. This increasing awareness of the benefits of automation, including enhanced productivity and quality control, makes SMEs an attractive for market growth, albeit still smaller in representation compared to large enterprises. The focus on improving competitive edge through modest but effective automation tools positions SMEs as an important, albeit secondary, player in the market.

Insights On Application

Material Handling Automation

Material Handling Automation is expected to dominate the Global Manufacturing Automation Market. This sector focuses on the efficient movement, protection, storage, and control of goods throughout the manufacturing process. With the rise of e-commerce and the need for faster delivery times, businesses are increasingly investing in automated equipment such as conveyors, robotic arms, and automated guided vehicles. These technologies enhance productivity, reduce labor costs, and minimize human error, making material handling automation a critical area for manufacturers looking to remain competitive. The growth of smart factories and Industry 4.0 technologies further boosts the demand for advanced material handling solutions, ensuring its leading position in the market.

Assembly Line Automation

Assembly Line Automation is a significant component of manufacturing processes, facilitating the efficient assembly of products in high-volume production settings. This approach utilizes robotic systems and automated machinery to streamline workflows, enhance precision, and reduce cycle times. Industries such as automotive and electronics heavily rely on assembly line automation due to its capability to improve product quality and labor efficiency. As companies seek to optimize operations and enhance production capabilities, the adoption of advanced assembly line technologies continues to grow, thereby contributing to the overall evolution of the manufacturing sector.

Welding and Fabrication Automation

Welding and Fabrication Automation have become increasingly relevant as industries prioritize safety, speed, and quality. Automated welding technologies, including robotics and laser welding systems, enable precise metal joining while reducing operator risks. The rise in manufacturing complexity and the demand for customized solutions drive investment in these automated processes. Their ability to maintain consistent quality and repeatability makes them essential for sectors like aerospace and construction. Companies are continuously seeking innovative welding solutions to enhance operational efficiency and product integrity, ensuring this area remains vital in the manufacturing landscape.

Transportation and Logistics

Transportation and Logistics in the manufacturing sector focus on optimizing the movement of goods from suppliers to consumers. Automation technologies, such as autonomous vehicles, drones, and software solutions, are revolutionizing this area by improving delivery speed and reducing costs. With global supply chains becoming more intricate, manufacturers are implementing automated systems to track shipments, manage inventory efficiently, and minimize delays. The increasing demand for just-in-time delivery and higher service levels further stimulates the growth of automation in transportation and logistics, making it a crucial component for competitive manufacturers.

Packaging Automation

Packaging Automation involves the use of technology to automate packaging processes, enhancing efficiency and reducing operational costs. Industries across food and beverage, pharmaceuticals, and consumer goods are adopting automated packaging solutions to ensure product safety while improving throughput. Innovations such as robotic palletizing and smart packaging solutions are gaining traction, allowing for greater flexibility and responsiveness to market changes. With sustainability becoming increasingly important, automated packaging processes also support environmentally friendly practices, helping businesses adapt to consumer demands for greener solutions while optimizing their production lines.

Insights On End Use

Discrete Manufacturing

Discrete Manufacturing is expected to dominate the Global Manufacturing Automation Market. This can be attributed to the extensive adoption of automation technologies across various industries, such as automotive, electronics, and consumer goods. The discrete manufacturing sector benefits from the need for high precision, flexibility, and short production cycles, which drives the demand for automation tools, robotics, and integrated solutions. Moreover, the increasing focus on reducing operational costs and improving efficiency is propelling the growth of automation in discrete manufacturing. As industries evolve and adopt smart manufacturing practices, this portion of the market will likely experience robust growth.

Process Manufacturing

Process Manufacturing, while significant, tends to focus on industries like chemicals and pharmaceuticals, which are known for their continuous production model. The market growth in this area is driven by regulatory compliance and safety requirements, leading to investment in automation technologies. However, its reliance on standardized processes limits the agility that is often sought in today’s rapidly changing manufacturing environments. As a result, despite being essential, it does not match the dynamic growth witnessed in the discrete manufacturing sector, where customization and rapid adaptability are required.

Global Manufacturing Automation Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Manufacturing Automation market, driven primarily by the rapid industrialization and robust economic growth seen in countries like China, India, and Japan. The region is witnessing substantial investments in advanced technologies, including robotics and artificial intelligence, to enhance productivity and efficiency in manufacturing processes. Additionally, the presence of major manufacturing hubs and a large pool of skilled labor further consolidate Asia Pacific's leadership in this sector. With a growing trend towards automation to cater to increasing demand for customized products, the region is well-positioned to retain its dominance in the global landscape of manufacturing automation.

North America

North America holds a significant position in the Global Manufacturing Automation market, largely due to its early adoption of technology and strong innovation capabilities. The presence of numerous players and a favorable business environment for R&D have led to the development of advanced automation solutions. The United States, in particular, showcases a mature manufacturing sector that increasingly integrates automation to boost efficiency and reduce operational costs. Furthermore, governmental initiatives supporting automation technologies highlight the region's commitment to maintaining competitiveness, but the current growth may be overshadowed by the rapid advancements occurring in the Asia Pacific region.

Europe

Europe remains a critical region in the Global Manufacturing Automation market, characterized by a mature industrial base and a strong focus on sustainability and green technologies. European nations such as Germany and France are at the forefront of implementing automation to enhance productivity while ensuring adherence to stringent regulatory standards regarding emissions and environmental impact. The presence of well-established norms around labor productivity and operational efficiency drives organizations to upgrade their facilities. Despite these factors, Europe faces strong competition from the rapid growth seen in Asia Pacific, which could limit its market share in the coming years.

Latin America

Latin America is gradually adopting manufacturing automation technologies, spurred by the need to improve efficiency and compete on a global scale. While the region has been slower to embrace automation compared to North America and Asia Pacific, investments are increasing in smart manufacturing and industrial automation solutions. Challenges such as economic instability and a lack of infrastructure currently hinder faster growth. However, as the region focuses on modernization, countries like Brazil and Mexico are making strides in establishing themselves as competitive players in the manufacturing automation landscape, which could lead to enhanced growth prospects in the future.

Middle East & Africa

The Middle East & Africa region is emerging as a potential player in the Global Manufacturing Automation market, driven by growing investments in industrial development and infrastructure. Although still in the nascent stages compared to more industrialized regions, there is a growing recognition of the need for automation to boost productivity amidst increasing regional demands. Countries like the UAE and South Africa are taking steps towards adopting automation in various sectors including oil, gas, and mining. However, significant challenges such as skill shortages and economic variations across countries could impede rapid growth, limiting the region's current market share in the manufacturing automation sector.

Manufacturing Automation Market Competitive Landscape:

Prominent entities in the worldwide manufacturing automation industry, including Siemens, Rockwell Automation, and ABB, spearhead advancements by providing cutting-edge technologies and solutions that improve productivity and efficiency. These corporations engage in cross-sector collaborations to deploy automation systems that streamline processes and lower operational expenses for manufacturers on a global scale.

Prominent entities in the Manufacturing Automation sector consist of Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, Mitsubishi Electric Corporation, ABB Ltd., Honeywell International Inc., Fanuc Corporation, Emerson Electric Co., KUKA AG, Bosch Rexroth AG, Mitsubishi Heavy Industries, Ltd., Omron Corporation, General Electric Company, Ideagen PLC, and Johnson Controls International plc.

Global Manufacturing Automation Market COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly propelled the implementation of automation technologies in manufacturing, as organizations aimed to improve operational efficiency and reduce reliance on human labor amid various disruptions.

The COVID-19 pandemic profoundly impacted the market for manufacturing automation, accelerating the integration of automated technologies across multiple industries. In response to workforce interruptions and the need for improved operational efficiency, companies increased their investments in robotics, artificial intelligence, and Internet of Things (IoT) solutions. Challenges in supply chains led manufacturers to automate processes, thus enhancing their flexibility and resilience. Additionally, new health and safety regulations prompted a demand for contactless operations, further boosting the need for automation systems that minimize human interaction. While the pandemic initially caused production disruptions and project delays, the future prospects for the automation market appear favorable. Businesses are now acutely aware of the necessity for advanced technologies to better prepare for potential crises. This transition not only improves efficiency and reduces costs but also facilitates digital transformation and supports Industry 4.0 initiatives, making automation a pivotal element of contemporary manufacturing strategies in a post-COVID landscape.

Latest Trends and Innovation in The Global Manufacturing Automation Market:

- In March 2023, Siemens announced the acquisition of Brightly Software, a leading provider of cloud-based asset management solutions, aimed at enhancing Siemens' digital offerings in the manufacturing automation sector.

- In July 2023, Rockwell Automation launched its new FactoryTalk InnovationSuite, integrating artificial intelligence and IoT capabilities, which allows manufacturers to enhance productivity and reduce downtime through advanced analytics.

- In April 2023, Honeywell acquired the software company Ectobox, enhancing its capabilities in industrial automation by integrating Ectobox's predictive maintenance and asset management technologies.

- In February 2023, Mitsubishi Electric expanded its collaborative robot (cobot) line with the debut of the MELFA AS-F series, featuring advanced vision and AI capabilities to improve manufacturing flexibility and efficiency.

- In January 2023, ABB introduced its new digital platform, ABB Ability Genix, aimed at providing manufacturers with enhanced data analytics and machine learning tools to optimize operations and enhance decision-making processes.

- In May 2023, Schneider Electric announced a strategic partnership with Amazon Web Services (AWS) to accelerate digital transformation in manufacturing by leveraging cloud-computing technologies for scalable manufacturing solutions.

- In August 2023, Fanuc Corporation extended its range of high-speed CNC controllers, providing enhanced processing power for industrial robots and machine tools, aiming to further innovate the automation landscape in manufacturing.

- In September 2023, Emerson Electric completed the acquisition of Open Systems International (OSIsoft), strengthening its position in industrial software and data analytics, to improve operational efficiencies in manufacturing environments.

Manufacturing Automation Market Growth Factors:

The manufacturing automation market is primarily driven by technological advancements, a growing need for enhanced efficiency and productivity, and the escalating embrace of Industry 4.0 methodologies.

The Manufacturing Automation Market has witnessed significant growth driven by several critical factors. Primarily, the escalating need for enhanced operational efficiency and productivity compels manufacturers to implement automation technologies, leading to minimized human errors and lower operational expenses. Additionally, swift technological advancements in areas such as artificial intelligence, the Internet of Things (IoT), and robotics improve automation functionalities, facilitating more intelligent and adaptable manufacturing systems. Moreover, the increasing focus on safety and compliance with regulations in manufacturing processes encourages investments in automated solutions that help reduce risks and uphold industry standards.

The emergence of Industry 4.0, marked by the integration of advanced technologies in manufacturing, further stimulates market growth by enabling real-time data analytics and flexible production methodologies. Furthermore, the global shift towards personalized manufacturing solutions ens the demand for automation to effectively navigate sophisticated production settings. The COVID-19 pandemic also expedited the transition to automation as businesses aimed to address workforce-related challenges and maintain operational stability. Lastly, governmental support and incentives that promote automation and technological enhancements in the manufacturing landscape significantly contribute to market expansion. Together, these elements position the manufacturing automation market for ongoing growth and innovation in the years ahead.

Manufacturing Automation Market Restaining Factors:

Significant challenges within the Manufacturing Automation Market encompass substantial upfront financial investments and the intricate process of assimilating new technologies with pre-existing systems.

The Manufacturing Automation Market encounters a variety of obstacles that may impede its expansion. One significant issue is the considerable upfront investment required, which can be prohibitive for small and medium-sized enterprises (SMEs) that may find it difficult to invest in sophisticated automation systems. Furthermore, the challenge of integrating new automated technologies into pre-existing manufacturing workflows can lead to operational interruptions and necessitate additional training for employees to adapt effectively. Cybersecurity concerns also present crucial risks, as interconnected systems are susceptible to potential data breaches and cyberattacks. Additionally, a lack of skilled labor, stemming from inadequate training in modern technologies, can further limit the growth of the market. Regulatory requirements and compliance challenges can create further complications, deterring manufacturers from embracing automation technologies. Nonetheless, as technology advances and the economic environment evolves, continuous innovations along with supportive government initiatives are making automation solutions more attainable. The increasing focus on efficiency, competitiveness, and sustainability heralds a bright outlook for the Manufacturing Automation Market, motivating businesses to adapt, invest, and succeed in an era of ened automation.

Segments of the Manufacturing Automation Market

By Component

- Hardware

- Software

- Services

- Professional Services

- Managed Services

By Technology

- PLC

- Robotics

By Deployment

- On-premise

- Cloud based

By Industrial

- Automotive

- Consumer Electronics

- Healthcare

- Transportation and Logistics

- Others

By Solution

- Control Systems

- Robotics and Autonomous Systems

- Monitoring and Diagnostics

By Enterprise Size

- SMEs

- Large Enterprises

By Application

- Assembly Line Automation

- Material Handling Automation

- Welding and Fabrication Automation

- Transportation and Logistics

- Packaging Automation

- Others

By End Use

- Discrete Manufacturing

- Process Manufacturing

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America