Market Analysis and Insights:

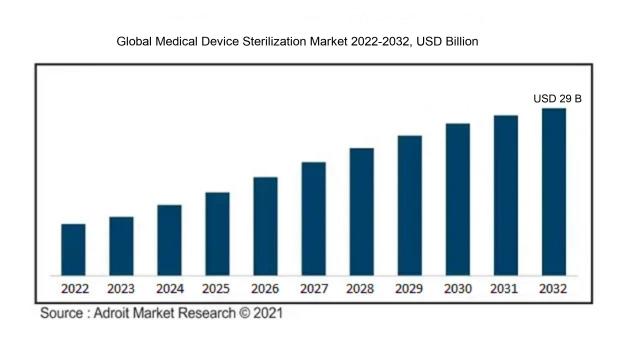

The market for Global Medical Device Sterilization was estimated to be worth USD 14 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 8%, with an expected value of USD 29 billion in 2032.

The growth of the Medical Device Sterilization Market is significantly influenced by the ened need for safe and effective medical instruments, a response to elevated healthcare standards and an increase in hospital-acquired infections. Stricter regulatory frameworks surrounding sterilization processes compel manufacturers to implement advanced sterilization technologies to meet these rigorous requirements. The burgeoning healthcare sector, especially in developing nations, further amplifies the demand for sustainable and effective sterilization solutions. Key technological innovations, such as ethylene oxide and gamma radiation sterilization, contribute markedly to the market's expansion by facilitating more efficient sterilization methods. Additionally, the aging population and the rise in surgical interventions elevate the need for sterile medical devices, driving market demand even higher. An increasing emphasis on sustainable and environmentally-friendly sterilization practices is also shaping market trends. Collectively, these interrelated elements foster innovation and growth within the medical device sterilization sector.

Medical Device Sterilization Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 29 billion |

| Growth Rate | CAGR of 8% during 2024-2032 |

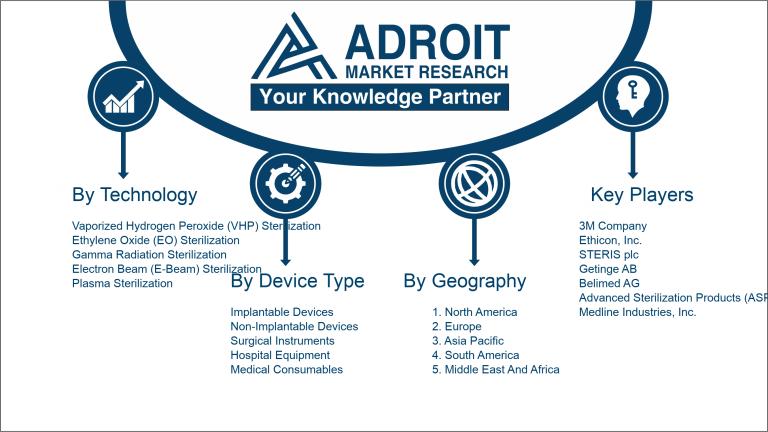

| Segment Covered | By Technology, By Device Type, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | 3M Company, Ethicon, Inc. (a division of Johnson & Johnson), STERIS plc, Getinge AB, Belimed AG, Advanced Sterilization Products (ASP), Medline Industries, Inc., Ecolab Inc., Synergy Health Plc, and Becton, Dickinson and Company (BD). |

Market Definition

Sterilization of medical devices involves the thorough eradication of all forms of microbial life, encompassing bacteria, viruses, and spores, from surgical instruments and healthcare equipment. This process is crucial for ensuring that these devices are safe for application in medical environments, thereby significantly reducing the potential for infections.

Sterilization of medical devices is essential for protecting patient health and reducing the likelihood of infections during healthcare procedures. Devices that are not properly sterilized can harbor pathogens, which may result in serious issues such as surgical site infections or even systemic illnesses. Healthcare institutions can successfully eradicate all types of microbial organisms by employing techniques such as autoclaving, ethylene oxide gas, or radiation. This essential process not only protects patients but also improves the overall effectiveness of medical treatments. Additionally, following established sterilization protocols is vital for meeting regulatory standards, thereby fostering trust among both healthcare providers and patients in the safety and quality of medical devices.

Key Market Segmentation:

Insights On Key Technology

Vaporized Hydrogen Peroxide (VHP) Sterilization

Vaporized Hydrogen Peroxide (VHP) Sterilization is expected to dominate the Global Medical Device Sterilization Market due to its effectiveness, rapid cycle times, and compatibility with various materials used in medical devices. VHP sterilization employs hydrogen peroxide vapor to achieve sterilization, a method recognized for its ability to penetrate porous materials and diffuse into complex geometries, thus ensuring comprehensive sterilization without leaving harmful residues. Its growing adoption in healthcare settings can be attributed to increased awareness of infection control, regulatory support, and the rising demand for sustainable and environmentally friendly sterilization techniques. Furthermore, VHP's versatility in application across diverse medical devices solidifies its position as the preferred technology in the market.

Ethylene Oxide (EO) Sterilization

Ethylene Oxide (EO) Sterilization remains a widely utilized method in the healthcare sector, primarily due to its effectiveness in sterilizing heat-sensitive medical devices. EO can penetrate various materials and configurations, making it suitable for delicate instruments that cannot withstand high temperatures. However, regulatory constraints around its use, due to concerns about EO's toxic properties and environmental impact, are driving a gradual decline in its prevalence and pushing the industry towards alternative technologies. Despite these challenges, EO sterilization still holds significant market share because of its proven efficacy and established infrastructure within healthcare facilities.

Gamma Radiation Sterilization

Gamma Radiation Sterilization is used predominantly for sterilizing single-use medical devices and supplies, like syringes and sutures. This method uses gamma rays emitted from radioactive isotopes to kill microorganisms effectively. It is favored for its ability to penetrate dense materials and ensure uniform coverage, albeit at a higher cost compared to other techniques. Although it is effective and regulatory bodies have established guidelines for its safe application, the capital-intensive nature of gamma facilities limits its scalability. Furthermore, there are growing concerns regarding the environmental impact and sustainability of radiation-based methods, which complicate its overall market adoption.

Electron Beam (E-Beam) Sterilization

Electron Beam (E-Beam) Sterilization is recognized for its rapid processing times, making it attractive for manufacturers seeking efficiency. Particularly beneficial for sterilizing small and discrete products, this method involves directing electrons at high velocities towards medical devices, leading to effective microbial deactivation. While E-Beam offers significant advantages over other sterilization methods, such as the absence of toxic residues and minimal environmental concerns, its setup costs and limitations in large-scale processing can restrict its broader application. As the demand for quick turnaround times in the supply chain increases, E-Beam may experience enhanced adoption among specific s of the medical device industry.

Plasma Sterilization

Plasma Sterilization offers a unique alternative for heat and moisture-sensitive medical instruments, utilizing low-temperature plasma technology to achieve effective sterilization. It employs a combination of gaseous hydrogen peroxide that transforms into plasma state, leading to rapid microbial deactivation while ensuring that no harmful residues are left behind. Its quick processing times and low temperature make it particularly appealing for modern healthcare settings that prioritize both sterility and material compatibility. However, the technology is still developing, and adoption may face challenges related to the cost of equipment and the need for further validating effectiveness across diverse device materials.

Insights On Key Device Type

Surgical Instruments

Surgical instruments are expected to dominate the Global Medical Device Sterilization Market due to a variety of factors. The increasing number of surgical procedures worldwide necessitates effective sterilization methods to prevent infections and ensure patient safety. Surgical instruments require high levels of sterility as they directly come into contact with patients during operations. As healthcare regulations tighten and patient safety becomes a more pressing concern, the demand for reliable sterilization processes for surgical tools has surged. Additionally, advancements in sterilization technologies are enhancing efficiency, thereby further solidifying the dominance of this category in the medical device sterilization market.

Implantable Devices

Implantable devices, such as pacemakers and orthopedic implants, require rigorous sterilization processes due to their direct insertion into the body. Given the critical nature of these devices, any contamination could lead to severe complications, making effectiveness in sterility paramount. As the aging population increases and chronic diseases become more prevalent, the need for surgical interventions involving implantable devices is expected to grow, which will, in turn, increase the demand for robust sterilization solutions.

Non-Implantable Devices

Non-implantable devices encompass a wide range of medical tools, including diagnostic equipment and therapeutic devices. The emphasis on hygiene and safety in healthcare settings drives up the demand for sterilisation solutions for these devices. Continuous innovations and regulatory standards drive the need for effective sterilisation protocols. However, compared to surgical instruments, the requirements for non-implantable devices might be less critical, which could limit their market influence.

Hospital Equipment

Hospital equipment, which includes a vast array of tools such as beds, monitors, and wheelchairs, requires regular sterilization to maintain a clean and safe environment. The increasing awareness of hospital-acquired infections has intensified the need for effective sterilization methods. However, the demand for hospital equipment sterilization is often overshadowed by the critical nature of surgical instruments, leading to a more balanced market share among sterilization methods.

Medical Consumables

Medical consumables, including gloves, syringes, and IV bags, are essential in-patient care and also require sterilization to prevent contamination. The rise in outpatient procedures and the frequent use of disposable items in healthcare settings drive the demand for sterilization. Nevertheless, since these items are often single-use, the urgency for elaborate sterilization processes is typically less compared to surgical instruments, which may affect their overall market dominance.

Insights On Key Application

Terminally Sterilized Products

The dominating part of the Global Medical Device Sterilization Market is undoubtedly Terminally Sterilized Products. This is primarily due to the increasing demand for devices that require a higher level of sterility assurance, particularly in surgical and clinical settings where patient safety is paramount. Terminally sterilized products ensure that all microbial life is eliminated before distribution, which is crucial for implants, surgical instruments, and other critical devices. With the growing prevalence of healthcare-associated infections (HAIs) and the rise in surgical procedures worldwide, the focus on ensuring that medical devices are terminally sterilized has intensified, leading to this category's dominance in the sterilization market.

Aseptically Processed Products

Aseptically Processed Products are crucial in situations where the use of sterilized items cannot guarantee product sterility post-manufacturing. This category includes products that are processed in a clean environment and packaged in sterile conditions. The growing trend toward minimally invasive procedures and the demand for customizable medical devices further drive this 's growth. Moreover, advancements in aseptic processing technologies enhance the reliability and efficiency of this method, making it increasingly preferred in the medical field, especially in pharmaceuticals and biotech applications, where the integrity of the product is essential.

Heat Sensitive Products

Heat Sensitive Products represent another important area in the medical device sterilization landscape. These items are often made from materials that cannot withstand high-temperature sterilization methods like autoclaving. The rising number of innovative medical devices, especially those using polymers and sensitive electronics, has led to a growing need for specialized sterilization techniques, such as ethylene oxide (EtO) or low-temperature plasma systems. This demand is driven by advances in technology aimed at improving patient outcomes while ensuring the safety and efficacy of less durable components.

Radiation Sensitive Products

Radiation Sensitive Products require careful handling due to their susceptibility to various sterilization processes, such as gamma radiation or e-beam sterilization. The market for these products is evolving, primarily in response to the growing utilization of radiation in the sterilization of single-use medical devices. As the industry moves towards more sustainable practices and eco-friendly sterilization methods, these products highlight the challenges and innovations related to maintaining product quality while ensuring safety. Increased awareness of patient safety standards also pushes manufacturers to invest in advanced radiation-based sterilization methods, which may impact this positively.

Packaging for Medical Devices

Packaging for Medical Devices plays a critical role in ensuring the sterility and integrity of medical products until the point of use. Advances in materials science and packaging methods are propelling this market as regulations tighten around medical device packaging requirements. This category has gained traction due to the increasing number of single-use medical devices and the need for robust packaging solutions that can withstand various sterilization techniques while protecting the product from external contaminants. As the focus on supply chain efficiencies and sustainability grows, packaging is more integral to overall sterilization strategy, though it remains less dominant compared to terminally sterilized products.

Insights on Regional Analysis:

North America

North America is expected to dominate the global medical device sterilisation market due to its strong healthcare infrastructure, widespread adoption of advanced sterilisation technologies, and stringent regulatory requirements for medical devices. The presence of major industry players, as well as increased investment in R&D, strengthen the region's leadership position. Furthermore, North America's strong emphasis on patient safety and infection control practices drives the demand for effective sterilisation solutions in hospitals and clinics. The integration of innovative sterilization methods such as ethylene oxide, vaporized hydrogen peroxide, and radiation technology contributes significantly to market growth, allowing North America to maintain a competitive edge in this sector.

Latin America

Latin America is witnessing gradual growth in the medical device sterilization market, driven by increasing healthcare expenditures and improvements in medical facilities. The demand for sterilization solutions is being propelled by rising awareness of infection control among healthcare providers and patients alike. However, the market faces challenges due to regulatory hurdles and variability in healthcare standards across countries in the region. Despite these challenges, emerging economies like Brazil and Mexico are investing in modern healthcare infrastructure, rendering the sterilization market poised for growth in the coming years.

Asia Pacific

Asia Pacific has significant potential in the medical device sterilisation market, with countries like China, India, and Japan leading the way in healthcare innovation. The rising population and increasing prevalence of infectious diseases are driving demand for efficient sterilisation processes. Government initiatives to improve healthcare access and safety standards are also contributing to market growth. While cost-effective sterilization methods are favored, the gradual integration of advanced technologies presents opportunities for growth among manufacturers aiming for higher quality and efficiency in sterilization practices.

Europe

Europe is a vital market for medical device sterilization, driven by stringent regulations and high standards for healthcare safety. The European Union's emphasis on quality assurance in medical devices leads to robust demand for effective sterilization methods. Innovative sterilization technologies such as low-temperature sterilization are gaining traction, responding to the region's need for environmentally friendly practices. However, slower market growth is observed in certain Western European nations due to high competition and market saturation, prompting companies to concentrate on strategic collaborations and advancements to secure their positions.

Middle East & Africa

The medical device sterilisation market in the Middle East and Africa is gradually expanding, owing to increased healthcare investments and rising infection control awareness. Healthcare facilities in countries like the UAE and South Africa are upgrading their sterilisation technologies to meet international standards. However, challenges such as economic insecurity and inadequate healthcare infrastructure in various parts of Africa limit the market's potential. Despite these challenges, the region presents unique opportunities, especially as governments focus on improving healthcare conditions and implementing stringent sterilization protocols.

Company Profiles:

The major contributors within the Global Medical Device Sterilization market, comprising producers, service providers, and regulatory bodies, play a crucial role in guaranteeing the safety and effectiveness of medical instruments via cutting-edge sterilization methods and adherence to stringent industry regulations. Their partnership fosters innovation, sustains product dependability, and improves overall public health results.

Prominent entities in the Medical Device Sterilization Market encompass 3M Company, Ethicon, Inc. (a division of Johnson & Johnson), STERIS plc, Getinge AB, Belimed AG, Advanced Sterilization Products (ASP), Medline Industries, Inc., Ecolab Inc., Synergy Health Plc, and Becton, Dickinson and Company (BD). Furthermore, other essential participants include Infection Control Technologies, Matsushita Healthcare, Merck KGaA, Cantel Medical Corp, and Hu-Friedy Mfg. Co., LLC. In addition, noteworthy contributors such as DePuy Synthes (a subsidiary of Johnson & Johnson), Life Science Automation (previously a part of Mettler-Toledo), and Cardinal Health are significant players within this sector.

COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly intensified the need for sterilization solutions for medical devices, spurred by enhanced protocols for infection control and a surge in the manufacturing of medical apparatus.

The COVID-19 pandemic has notably influenced the market for sterilizing medical devices, leading to a surge in demand for sterilization services as awareness around infection prevention grew and the need for safety in medical environments became urgent. The rise in the production and utilization of medical equipment, such as ventilators, personal protective gear, and diagnostic instruments, compelled healthcare providers to implement effective sterilization methods to reduce the possibility of transmitting pathogens. Furthermore, the crisis accelerated regulatory changes and spurred innovations in sterilization technologies, including ethylene oxide and hydrogen peroxide plasma methods. Although initial disruptions in the supply chain presented obstacles, the long-term prospects appear optimistic, with investments in healthcare infrastructure and a sustained focus on sterilization practices likely to foster market growth. As healthcare institutions prioritize strict hygiene standards in the aftermath of the pandemic, the medical device sterilization industry is anticipated to flourish, driven by changing regulations and advancements in technology.

Latest Trends and Innovation:

- In May 2022, Cardinal Health announced the acquisition of the medical device sterilization business from a leading third-party sterilization provider, enhancing their portfolio and capacity in sterilization services.

- In March 2023, Medline Industries unveiled their new Ethylene Oxide (EtO) sterilization facility in Georgia, aimed at increasing production efficiency and meeting the rising demand for sterilization services in the medical device sector.

- In October 2022, STERIS plc announced the launch of their new V-PRO maX Low Temperature Sterilization System, utilizing advanced vaporized hydrogen peroxide technology to provide effective sterilization for sensitive medical instruments and devices.

- In December 2022, the FDA granted 510(k) clearance for Trocar Express’s innovative sterilization device, which utilizes a proprietary method to ensure the sterile delivery of surgical instruments to healthcare facilities.

- In July 2023, Getinge announced a strategic partnership with a leading university hospital to develop and conduct studies on advanced sterilization techniques, including plasma and ethylene oxide methods, to enhance patient safety and surgical outcomes.

- In August 2023, 3M Company expanded its medical device sterilization portfolio by acquiring a smaller firm specializing in single-use sterilization technologies, enabling them to offer a broader range of solutions to healthcare providers.

- In September 2023, Becton Dickinson & Company (BD) launched a novel sterilization management platform designed to optimize the sterilization process, improve compliance, and streamline workflows in healthcare facilities across North America.

Significant Growth Factors:

The primary drivers propelling the expansion of the Medical Device Sterilization Market encompass the rising rigor of regulatory standards concerning medical device safety, innovations in sterilization technologies, and a notable increase in global healthcare spending.

The Medical Device Sterilization Market is witnessing notable expansion, buoyed by several critical drivers. Rising healthcare investments, especially in emerging economies, have spurred a growing demand for sophisticated medical equipment that necessitates stringent sterilization protocols to uphold patient safety. The increase in surgical interventions, combined with a rise in healthcare-associated infections (HAIs), underscores the imperative for efficient sterilization techniques. Furthermore, strict regulatory frameworks imposed by agencies such as the FDA and WHO are urging manufacturers to enhance their sterilization processes to meet established safety criteria. Innovations in sterilization technologies, including ethylene oxide (EtO), steam sterilization, and hydrogen peroxide methods, are advancing the market by boosting both efficiency and effectiveness. Additionally, the expanding population of elderly individuals, who are more prone to infections, broadens the market's potential. Growing awareness about infection control and a ened focus on quality assurance in healthcare settings are also vital factors driving the demand for sterilization services. Moreover, the increasing trend of reprocessing single-use medical devices introduces new opportunities, offering cost-effective solutions without compromising safety. Together, these elements are influencing the trajectory of the Medical Device Sterilization Market, promoting ongoing growth.

Restraining Factors:

Significant barriers in the Medical Device Sterilization Market consist of rigorous regulatory standards and the substantial expenses linked to sophisticated sterilization methods.

The Medical Device Sterilization Sector is contending with various obstacles that may hinder its growth potential. Prominent among these are the rigorous regulatory standards that differ across regions, complicating the approval processes for new sterilization technologies and devices. High expenses related to cutting-edge sterilization methods, such as ethylene oxide and gamma radiation, may also discourage smaller players from entering the market. Increasing apprehension regarding the environmental ramifications of certain sterilization approaches, especially those utilizing chemical agents, presents a considerable challenge as healthcare providers gravitate towards sustainable methods. Additionally, the rise of alternative sterilization techniques, including vaporized hydrogen peroxide and supercritical carbon dioxide, could disrupt traditional practices and lead to a fragmented market. The recent disruptions in global supply chains have contributed to shortages of crucial sterilization materials and equipment, putting additional pressure on operations. However, ongoing advancements in sterilization technologies, ened investment in healthcare infrastructure, and a strong focus on patient safety indicate potential avenues for growth, suggesting a promising future for stakeholders within the Medical Device Sterilization Sector.

Key Segments of the Medical Device Sterilization Market

By Technology

• Ethylene Oxide (EO) Sterilization

• Gamma Radiation Sterilization

• Electron Beam (E-Beam) Sterilization

• Plasma Sterilization

• Vaporized Hydrogen Peroxide (VHP) Sterilization

By Device Type

• Implantable Devices

• Non-Implantable Devices

• Surgical Instruments

• Hospital Equipment

• Medical Consumables

By Application

• Terminally Sterilized Products

• Aseptically Processed Products

• Heat Sensitive Products

• Radiation Sensitive Products

• Packaging for Medical Devices

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America