Medical Display Market Analysis and Insights:

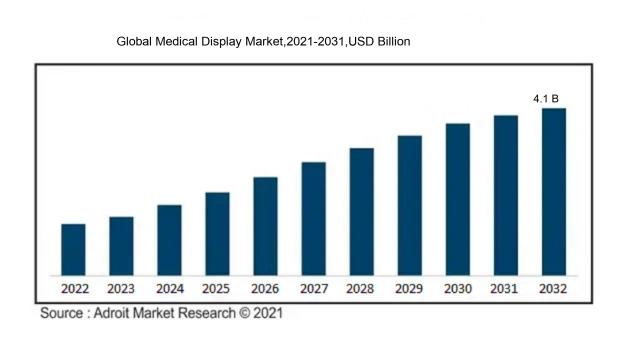

In 2023, the size of the worldwide Medical Display market was US$ 2.6 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 4.86 % from 2024 to 2032, reaching US$ 4.1 billion.

The Medical Display Market is primarily propelled by technological innovations, especially those pertaining to enhanced display resolution, color precision, and overall image quality, all of which significantly bolster diagnostic capabilities. The increasing incidence of chronic illnesses creates a demand for effective medical imaging solutions, driving the need for high-quality displays within healthcare facilities. The surge in minimally invasive surgical techniques further underlines this trend, as specialized displays are essential for superior visualization during operations. In addition, stringent regulatory standards and compliance mandates for medical devices en the demand for certified displays in imaging contexts. The post-pandemic rise in telemedicine has amplified the requirement for high-quality medical displays to support remote diagnostics and consultations. Moreover, continuous investments in healthcare infrastructure, especially in developing regions, stimulate market expansion by enhancing access to state-of-the-art imaging technologies. Together, these elements highlight the indispensable function of medical displays in enhancing healthcare delivery and outcomes.

Medical Display Market Definition

A medical display refers to a dedicated monitor specifically engineered for the examination and interpretation of medical imaging and data. It ensures exceptional image clarity and accurate color representation, which are crucial for accurate diagnoses. These displays are frequently utilized in healthcare environments, including hospitals and clinics, to facilitate radiological assessments and surgical procedures.

Medical displays play an essential role in healthcare environments by offering the high-resolution imagery and precision required for effective diagnosis and treatment. These advanced screens are specifically engineered for various medical imaging techniques, including MRI, CT scans, and ultrasound, enabling healthcare providers to examine fine details crucial for patient management. The incorporation of calibrated colors and brightness levels improves the discernibility of slight variations in tissues, facilitating the early identification of abnormalities. Moreover, medical displays comply with rigorous regulatory standards, guaranteeing that the images produced fulfill the clinical criteria necessary for sound medical decision-making. Their dependability significantly influences patient safety and outcomes.

Medical Display Market Segmental Analysis:

Insights On Device

Mobile

Based on current data and trends, the mobile is expected to dominate the Global Medical Display Market. The rise in telemedicine, mobile health applications, and increasing demand for portable diagnostic devices have significantly increased the adoption of mobile medical displays. Mobile devices offer unparalleled flexibility and convenience, allowing healthcare professionals to access critical data and imaging on-the-go, which is essential for improving patient care. With advancements in technology enabling better resolution and functionality in mobile displays, as well as integration with other digital health platforms, this is poised for substantial growth in the coming years.

Desktop

The desktop category remains a significant part of the Global Medical Display Market, primarily due to its reliability and superior performance in clinical settings. Many healthcare facilities still rely on desktop displays for in-depth diagnostic tasks that require detailed image analysis. These displays are commonly used in radiology and pathology departments, where high-resolution images are crucial for accurate diagnoses. While mobile devices are gaining traction, desktops provide a stable and consistent operating environment that many healthcare professionals prefer for lengthy examinations and consultations.

All-in-one

The all-in-one is also an emerging player in the Global Medical Display Market, offering a unique blend of versatility and operational efficiency. All-in-one displays combine the computing unit and the screen into a single device, making them less cluttered and easier to use in limited workspace environments. Their sleek design and ease of integration into existing hospital workflows make them appealing, particularly in outpatient clinics and smaller healthcare settings. Although their market share is currently smaller compared to desktops and mobiles, the demand for user-friendly, space-saving solutions suggests a potential for growth in this area.

Insights On Panel Size

27.0–41.9-inch

The 27.0–41.9-inch category is expected to dominate the Global Medical Display Market. This is primarily due to the increasing need for larger displays that can offer better resolution and detail, which are essential for clinical diagnosis and surgical procedures. Larger screens are particularly advantageous in operating rooms and diagnostic imaging, where multiple practitioners may need to view the information simultaneously. The growing adoption of digital imaging technologies, including CT, MRI, and ultrasound, drives the demand for high-quality, large-panel displays that support enhanced image clarity and detail. This trend indicates that medical facilities are moving towards larger displays as standard equipment, thus solidifying the position of this category within the market.

Up to-22.9-inch

The Up to-22.9-inch category caters to portable and ultra-compact medical displays that are typically used for basic patient monitoring and in mobile applications. These smaller displays are easy to transport, which is essential in emergency settings and during patient transport within hospitals. Given their size, they are often utilized in less complex diagnostic procedures, where high portability is more critical than screen size. However, the limitation on resolution and detail can hinder their use in more demanding clinical environments, which makes them less favorable compared to larger models.

23.0–26.9-inch

The 23.0–26.9-inch range serves as a middle ground, utilized for various medical applications such as outpatient clinics and consultation rooms. These displays are large enough to provide a clear view of images and data while still maintaining the flexibility of size needed for smaller spaces. While they do offer enhanced resolution compared to smaller models, they lack the expansive viewing capabilities that larger screens provide, which often makes them a transitional option rather than a long-term solution for high-stakes clinical settings.

Above-42-inch

The Above-42-inch range is mostly utilized in specialized settings such as surgical theaters and advanced imaging centers. Although this size facilitates remarkable detail and clarity, its application is limited due to high costs and space requirements. The Greater expense involved in establishing these large displays can deter their widespread adoption—especially in smaller or financially constrained medical facilities. Additionally, larger screens may require more elaborate mounting and support structures, which can pose logistical challenges. Hence, while useful in certain high-end applications, this size is less dominant in the overall market compared to the 27.0–41.9-inch category.

Insights On Resolution

Above 8MP

The expected to dominate the Global Medical Display Market is "Above 8MP". This is primarily due to the increasing demand for high-resolution imaging in various medical fields such as radiology, surgery, and dermatology. Advanced imaging techniques require displays that offer superior detail, enabling more accurate diagnoses and treatment planning. Moreover, the healthcare industry's shift towards digitalization and the emphasis on precise visualization of complex medical images solidify the growth of this. As technology progresses and new imaging modalities are introduced, displays above 8MP are becoming crucial for healthcare professionals, leading to their predicted dominance in the market.

4.1 to 8MP

The "4.1 to 8MP" category showcases solid growth potential as healthcare facilities continue to adopt more detailed imaging solutions. This range provides a balance between high-resolution imaging and cost efficiency, making it appealing to a broad range of medical practitioners. It is especially beneficial for applications requiring detailed image assessments, such as radiology and pathology. As healthcare providers seek to enhance patient outcomes while managing operational costs, displays in this category are likely to remain a popular choice, catering to institutions that require clarity without investing as heavily as those opting for more advanced resolutions.

2.1 to 4MP

The "2.1 to 4MP" serves as a practical entry point for many healthcare facilities transitioning to digital imaging. Displays in this range are often more affordable and offer adequate resolution for general diagnostic applications, including ultrasound and basic CT imaging. As hospitals and clinics look to upgrade their systems without excessive expenditures, there is a significant market for this resolution category. Additionally, with healthcare providers focusing on improving efficiency and expanding service offerings, these displays are appealing for routine imaging practices, ensuring their continued relevance in the market.

Up to 2MP

The "Up to 2MP" category generally provides the most basic level of imaging quality in the medical display market. It is often used in less specialized environments, such as general practice and small clinics, where advanced imaging is not a constant requirement. While this holds a reliable customer base due to cost-effectiveness, the trend towards enhanced imaging for improved diagnostic capabilities and patient care is diminishing its growth prospects. As more healthcare facilities prioritize high-resolution displays, the demand for this is gradually decreasing, positioning it behind its higher-resolution counterparts in terms of market relevance.

Insights On Technology

Light Emitting Diode (LED)

Based on current research, Light Emitting Diode (LED) technology is expected to dominate the Global Medical Display Market. This dominance is attributed to various factors including superior energy efficiency, longer life span, and enhanced image quality. LED displays offer better brightness and contrast, which are essential for medical imaging where accurate diagnostics are critical. Additionally, the growing demand for high-resolution displays in healthcare facilities further drives the adoption of LED technology. The integration with advanced imaging systems and lower operational costs solidify LED's position as the preferred choice in medical displays.

Backlit Liquid Crystal Display

Backlit Liquid Crystal Display (LCD) technology has been a strong player in the medical display market owing to its established presence and reliability. While it does not offer the same level of image quality as LED or OLED, it is cost-effective and provides adequate performance for many medical applications. The backlighting enhances visibility, making it suitable for environments where traditional viewing might fall short. However, increasing regulations and the demand for better image quality may limit its growth potential in the long run.

Organic Light Emitting Diode (OLED) Display

Organic Light Emitting Diode (OLED) displays are gaining traction in the medical display market for their high contrast ratios, vibrant colors, and faster response times. These characteristics make them particularly useful in high-definition imaging applications, such as radiology and surgery. OLED technology can be more expensive to produce and implement compared to other types; however, as production costs decrease due to advancements in technology, their adoption rate may increase. Their flexibility in design also offers opportunities for innovative display solutions in medical environments.

Cold Cathode Fluorescent Light (CCFL)

Cold Cathode Fluorescent Light (CCFL) technology represents an older display technology that is gradually losing ground in the medical display market. While CCFL displays can deliver good brightness and color accuracy, they are significantly overshadowed by the advancements in LED and OLED technologies. The energy efficiency and longevity of CCFL are notably inferior, leading to higher operational costs. As healthcare facilities aim to reduce energy consumption and improve display performance, the use of CCFL technology is expected to decline further in favor of more efficient alternatives.

Others

The "Others" category in the medical display market encompasses various niche technologies that are typically less mainstream than the prominent display types. These can include emerging display technologies or specialized displays designed for specific medical applications. While they may offer unique features or functionalities, the overall demand for these technologies remains limited compared to LED, OLED, and traditional LCD technologies. As healthcare trends evolve, very few of these alternatives are anticipated to significantly impact the market unless they can demonstrate substantial advantages in terms of performance, cost, or functionality.

Insights On Application

Digital Pathology

The Digital Pathology application is expected to dominate the Global Medical Display Market due to its increasing adoption by healthcare providers for enhanced diagnostic accuracy and efficiency. The shift towards digital formats facilitates collaboration among pathologists and other specialists, streamlining workflows and improving patient outcomes. As healthcare institutions increasingly invest in cloud technology and artificial intelligence, Digital Pathology will likely take precedence, driven by the demand for high-resolution imaging and data analysis capabilities. The exponential growth in the volume of pathology data, combined with the need for better integration into electronic medical records, underscores the importance of customized displays tailored for this application.

Multi-modality

Multi-modality refers to the integration of multiple imaging techniques, such as MRI, CT, and ultrasound, within a single display system. This approach is becoming increasingly valued in clinical settings, as it allows healthcare professionals to gain a comprehensive view of patient data from various imaging sources. The ability to analyze and compare images simultaneously enhances diagnostic precision and promotes better treatment planning. As the complexity of medical cases grows, the necessity for versatile display solutions in Multi-modality applications is expected to increase, driving market growth in this area.

Surgical

In the Surgical application, medical displays play a critical role in enhancing surgeon performance and patient safety during operations. These displays provide high-definition imagery, which is crucial for real-time visualization of intricate surgical procedures. As minimally invasive techniques become more prevalent, the demand for specialized surgical displays with advanced features, such as 3D imaging and augmented reality, is rising. The focus on patient-centered care and improved surgical outcomes is expected to support continued investments in this, albeit at a slower rate compared to Digital Pathology.

Radiology

Radiology displays are essential in diagnosing and analyzing medical images such as X-rays, CT scans, and MRIs. The growing volume of imaging studies and the need for accurate diagnostic interpretation have made high-quality displays indispensable in radiology departments. With advancements in imaging technology and the rise of tele-radiology, the demand for specific display solutions that can efficiently handle large datasets and deliver precise visualizations will continue to influence market growth. However, the sector faces competition from emerging technologies that allow for remote diagnostics and shared imaging resources.

Mammography

Mammography displays are specialized for the detection of breast abnormalities through high-resolution imaging. With a rising emphasis on early detection and preventative care for breast cancer, there is a growing demand for advanced mammography systems. This includes features such as enhanced contrast, sharper imagery, and digital interfaces for better interpretations. However, while the need for these displays remains significant, the may not experience robust growth when compared to the rapid advancements seen in Digital Pathology, which addresses a broader spectrum of diagnostic needs.

Others

The "Others" category encompasses a range of applications beyond the primary ones, including but not limited to dermatology, ophthalmology, and dental imaging. Though the growth potential in these areas exists, the overall market share is relatively smaller compared to more dominant applications like Digital Pathology. The diverse nature of these other applications means they can appeal to niche markets where specialized display technologies are still developing. As healthcare providers embrace new imaging techniques within these fields, there is potential for growth, yet it remains limited relative to stronger s.

Insights On End User

Hospitals

Hospitals are expected to dominate the Global Medical Display Market due to their extensive need for advanced imaging technologies and highly specialized equipment to support a wide range of medical services. As a primary healthcare provider, hospitals require medical displays for various applications, including surgery, radiology, and diagnostic imaging, necessitating high-resolution displays that ensure precise interpretations. The growing emphasis on high-quality patient care and the increasing adoption of digital solutions, such as telemedicine, dramatically influences hospitals' demand for advanced medical displays. Furthermore, ongoing advancements in display technologies, such as 4K and 8K resolutions, are expected to enhance the capabilities of medical displays used in hospital settings, leading to their anticipated dominance.

Diagnostic Centres

Diagnostic Centres offer targeted services primarily focused on conducting tests and evaluations to support disease diagnosis. The demand for medical displays in this sector is significant as accurate diagnostic imaging is crucial for providing reliable test results. These centres typically use high-resolution medical displays to visualize scans and images for better assessment and facilitate the communication between healthcare professionals and patients. Although they may have a more specialized demand compared to hospitals, their growth prospects are linked to the increasing prevalence of health issues and the need for efficient diagnostic processes, thereby enhancing their role in the medical display market.

Community Healthcare

Community Healthcare operates on a more localized healthcare delivery model, often focusing on preventive care and health education. Though they represent a smaller of the medical display market, their growing relevance is attributed to the increasing emphasis on community-centered care and efforts to improve healthcare accessibility. The use of medical displays in this is mainly for training, patient education, and telehealth applications. As community healthcare continues to evolve with technological advancements, they are likely to see incremental growth in their demand for medical displays, but they still remain less dominant compared to hospitals and diagnostic centres.

Global Medical Display Market Regional Insights:

North America

North America is poised to dominate the Global Medical Display market, primarily due to its advanced healthcare infrastructure, increasing adoption of digital technologies, and significant investments in medical imaging solutions. The region boasts a high concentration of leading medical display manufacturers and professionals, which fosters innovative developments and enhances product quality. Additionally, the growing prevalence of chronic diseases necessitates improved diagnostic tools and imaging systems, further driving the demand for sophisticated medical displays. The U.S. healthcare systems' focus on enhancing patient outcomes through advanced imaging technologies contributes to North America's leadership in this sector.

Latin America

Latin America is experiencing steady growth in the medical display market, driven by the increasing investment in healthcare infrastructure and a rising awareness of health issues among the population. However, challenges such as economic instability and varying regulatory environments hinder rapid market progression. Small to medium-sized enterprises (SMEs) are gradually adopting medical display technologies to enhance diagnostic capabilities, creating opportunities for growth in specific markets. Nonetheless, the region remains primarily focused on essential healthcare services rather than advanced imaging solutions, limiting its overall market share.

Asia Pacific

The Asia Pacific region demonstrates substantial potential in the medical display market, mainly due to rapid technological advancements and a surge in healthcare expenditures. Countries like China and India are investing heavily in modernizing their healthcare systems, leading to increased demand for advanced medical imaging technologies. However, the market faces hurdles such as regulatory complexities and varying healthcare standards across countries. Despite these challenges, the ongoing urbanization and growing aging population in the region may bolster the demand for medical displays in the coming years, promoting steady growth.

Europe

Europe holds a significant share of the medical display market due to its well-established healthcare systems and a strong emphasis on research and development in medical technologies. The region is home to several players in the medical display sector that prioritize quality and reliability. However, the market growth is somewhat restrained by stringent regulatory requirements and budget constraints faced by healthcare facilities. As European countries continue to adopt electronic health records and advanced imaging solutions, the medical display market is anticipated to grow steadily, in alignment with technological advancements.

Middle East & Africa

The Middle East & Africa region is slowly emerging within the medical display market, influenced by the increasing investments in healthcare infrastructure and technologies. Several countries are actively working to enhance their medical facilities to meet rising healthcare demands. However, economic disparities and political instability in certain areas can impede faster growth in this region. Despite these challenges, ongoing collaborations between healthcare providers and technology companies could open up new avenues for market expansion, particularly in urbanized areas seeking improved healthcare delivery systems.

Medical Display Market Competitive Landscape:

Major contributors to the worldwide medical display industry, including producers and technology developers, foster innovation by offering sophisticated imaging solutions while adhering to regulatory standards, thereby guaranteeing superior diagnostic accuracy. By partnering with healthcare institutions, they bolster clinical decision-making processes and elevate patient care outcomes.

Prominent participants in the medical display sector encompass Barco, EIZO Corporation, NEC Corporation, Sony Corporation, Philips Healthcare, Dell Technologies, LG Display, Siemens Healthineers, Fujifilm Holdings Corporation, Sharp Medical, ViewSonic Corporation, and Canon Medical Systems Corporation. Other significant firms include MEDRAY, Infinitt Healthcare, Axiomtek, Siemens AG, Advantech Co., Ltd., and Mindray Medical International Limited. Moreover, entities such as IMD (Industrial Medical Displays), RadiForce, and Civo also play a vital role in the marketplace.

Global Medical Display Market COVID-19 Impact and Market Status:

The Covid-19 pandemic has markedly increased the need for sophisticated medical display technologies, prompting advancements and greater integration in areas such as telemedicine, remote diagnostics, and improved imaging systems.

The COVID-19 pandemic had a profound effect on the medical display sector, catalyzing both growth and innovation. The urgent requirement for effective patient monitoring and telehealth services led to a significant rise in the demand for high-quality medical imaging displays within hospitals and remote care environments. Healthcare institutions swiftly integrated cutting-edge display technologies to enhance diagnostic accuracy and facilitate telehealth services, prompting increased investments in medical imaging apparatus. Additionally, the approval of telehealth solutions by regulatory bodies and the improvement of digital infrastructures further contributed to the market's expansion. Nonetheless, the pandemic brought about challenges, including disruptions in supply chains and changing resource allocation priorities, which initially impacted production capabilities. In spite of these hurdles, the enduring effects of COVID-19 have spurred a lasting interest in healthcare technologies, resulting in a more vigorous market for medical displays marked by ongoing innovation and responsiveness to new healthcare demands. Consequently, the future outlook for this sector appears bright, fueled by continuous advancements and the dynamic requirements of the healthcare landscape.

Latest Trends and Innovation in The Global Medical Display Market:

- In September 2023, Sony Medical Solutions Europe announced the launch of its new 4K LCD medical display monitor, the LMD-XH500, aimed at improving surgical visualization in operating rooms and diagnostics.

- In March 2023, Eizo Corporation unveiled its latest medical monitor, the RadiForce GXR-2D, designed for 3D imaging in radiology applications, providing enhanced visual performance for complex diagnostic procedures.

- In January 2023, NEC Corporation partnered with Fujitsu to develop next-generation medical display technology that leverages AI to enhance image quality for radiology applications, promising better diagnostic outcomes.

- In February 2023, Barco completed the acquisition of the medical imaging software company, Mako, which specializes in advanced display technology for radiology, intending to integrate Mako's software capabilities with its existing product line.

- In July 2022, Philips Healthcare launched the Brio 20 mobile surgical display, equipped with advanced networking capabilities and high-resolution imaging, aimed at supporting modern surgical theatre requirements.

- In June 2022, Siemens Healthineers introduced its new multi-purpose medical display series, MVF, which supports various imaging modalities and enhances workflow efficiency in clinical settings.

- In April 2022, LG Display announced advancements in OLED technology specifically designed for medical imaging, focusing on better color accuracy and reduced radiation exposure for patients.

- In November 2021, Benq Medical Technology achieved FDA clearance for its series of diagnostic imaging monitors, emphasizing improved DICOM compliance for better medical image visualization.

- In March 2021, Sharp Healthcare collaborated with various tech companies to create an integrated platform that combines cloud storage and advanced display technologies for improved telemedicine services.

Medical Display Market Growth Factors:

The expansion of the Medical Display Market is fueled by the rising implementation of sophisticated imaging technologies, ened demand for high-resolution screens in the healthcare sector, and regulatory improvements aimed at enhancing patient outcomes.

The Medical Display Market is currently witnessing robust expansion, driven by several pivotal factors. A primary catalyst for this growth is the soaring demand for high-definition imaging in healthcare environments, such as hospitals and diagnostic facilities, which highlights the need for advanced medical displays that offer superior clarity for radiological and surgical imaging. Furthermore, significant investments in healthcare infrastructure, particularly within developing regions, are facilitating the acquisition of cutting-edge medical technologies, including specialized display systems.

The increasing incidence of chronic illnesses—a factor that necessitates continuous imaging and monitoring—further accelerates market growth as healthcare providers aim to enhance diagnostic precision. Additionally, innovations in technology, notably the incorporation of artificial intelligence and augmented reality into medical imaging, are set to elevate market potential by improving diagnostic functions. The shift towards telemedicine, significantly intensified by the COVID-19 pandemic, has also generated a rising demand for high-quality displays that aid in remote diagnostics and consultations.

Moreover, regulatory requirements mandating compliant medical displays to ensure both patient safety and diagnostic accuracy contribute to market momentum. Together, these dynamics are transforming the Medical Display Market, paving the way for substantial growth prospects in the forthcoming years.

Medical Display Market Restaining Factors:

The expansion of the Medical Display Market is notably hindered by regulatory obstacles and the imperative for strict adherence to medical standards.

The Medical Display Market encounters a variety of challenges that could restrict its development. The significant expenses tied to sophisticated display technologies, such as OLED and 4K resolutions, may restrict accessibility for smaller healthcare providers and create financial limitations. Additionally, the swift pace of technological advancements necessitates regular updates, which can put a strain on resources and complicate purchasing processes. Regulatory hurdles and the need for compliance concerning medical devices may further delay the rapid rollout of new display innovations. Concerns surrounding data protection and patient confidentiality also pose obstacles to the integration of connected display systems within healthcare environments. Geographic imbalances in access to cutting-edge imaging technology may exacerbate disparities in healthcare services, particularly in less developed areas. Furthermore, ensuring that medical personnel receive adequate training and support to effectively use these intricate systems may lead to potential inefficiencies. Nonetheless, the increasing demand for superior imaging solutions, spurred by the growth of telemedicine and improved diagnostic abilities, signals a promising opportunity for substantial growth in the Medical Display Market, offering hope for ongoing advancements in healthcare technology and patient care.

Segments of the Medical Display Market

By Device

• Mobile

• Desktop

• All-in-one

By Panel Size

• Up to 22.9-inch

• 23.0–26.9-inch

• 27.0–41.9-inch

• Above 42-inch

By Resolution

• Up to 2MP

• 2.1 to 4MP

• 4.1 to 8MP

• Above 8MP

By Technology

• Light Emitting Diode (LED)

• Backlit Liquid Crystal Display

• Organic Light Emitting Diode (OLED) Display

• Cold Cathode Fluorescent Light (CCFL)

• Others

By Application

• Digital Pathology

• Multi-modality

• Surgical

• Radiology

• Mammography

• Others

By End User

• Hospitals

• Diagnostic Centres

• Community Healthcare

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America