Micro and Mini LED displays Market Analysis and Insights:

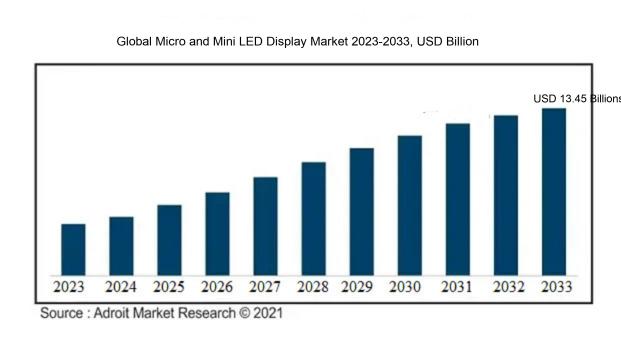

The market for Micro and Mini LED Display was estimated to be worth USD 5.69 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 10.2%, with an expected value of USD 13.45 billion in 2033.

The market for Micro and Mini LED displays is significantly influenced by several pivotal factors, notably the escalating demand for high-quality visual output in consumer electronics, technological advancements in display solutions, and a broadening range of applications in industries such as automotive, healthcare, and retail. The trend toward miniaturizing device components encourages manufacturers to integrate Micro LED technology, which offers greater brightness and energy efficiency over conventional LCD and OLED displays. Additionally, the expansion of augmented and virtual reality technologies is driving the need for displays that are not only compact and lightweight but also deliver superior color fidelity and contrast. Moreover, the growing focus on large-format digital signage and the innovation of display technologies tailored for ambient computing environments are further fueling market expansion. Investments from government entities in smart city initiatives and a commitment to enhancing energy-efficient technologies are also playing a crucial role in the rising implementation of Micro and Mini LED displays across various sectors, indicating a bright outlook for this of the market.

Micro and Mini LED displays Market Scope:

| Metrics | Details |

| Base Year | 2022 |

| Historic Data | 2020-2022 |

| Forecast Period | 2024-2033 |

| Study Period | 2022-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 13.45 billion |

| Growth Rate | CAGR of 10.2% during 2024-2033 |

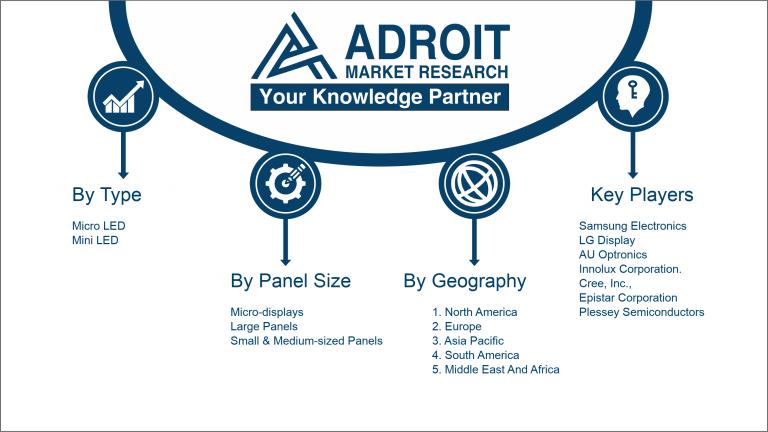

| Segment Covered | By Type, By Application, By Technology, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Samsung Electronics, LG Display, AU Optronics, Innolux Corporation, Cree, Inc., Epistar Corporation, PlayNitride Inc., Plessey Semiconductors, Micro Led Technologies, and Wistron NeWeb Corporation. |

Micro and Mini LED displays Market Definition

Micro LED screens are composed of minute, self-emitting LEDs that generate light and color, resulting in exceptional brightness, contrast, and efficiency. In contrast, Mini LED displays utilize smaller LED backlighting to boost brightness and contrast in LCD screens, elevating the overall image quality while maintaining a slimmer profile.

Micro and Mini LED displays are at the forefront of advancements in visual technology, offering significant advantages in brightness, energy efficiency, and color precision over conventional LCD and OLED displays. Their capability to produce ultra-fine pixel pitches results in remarkably detailed visuals, making them suitable for numerous applications such as televisions, mobile devices, and large-scale advertising. Furthermore, their modular architecture allows for flexibility in display dimensions and configurations, catering to a wide range of environments from residential entertainment to commercial settings. With an increasing consumer demand for high-quality and immersive viewing experiences, Micro and Mini LED technology marks a transformative progression in the display industry.

Micro and Mini LED displays Market Segmentation:

Insights On Key Type

Micro LED

The Micro LED is expected to dominate the Global Micro and Mini LED Display Market due to its superior characteristics, such as higher brightness, better energy efficiency, and improved color accuracy compared to its counterpart, Mini LED. The Micro LED technology utilizes microscopic light-emitting diodes, allowing for better pixel control, which results in enhanced display quality. This is particularly advantageous for applications requiring high resolution and clarity, such as virtual reality and high-end televisions. Furthermore, the increasing demand for advanced display solutions in sectors like gaming, automotive, and commercial displays is driving investments towards Micro LED technology, positioning it as the leading choice in the market.

Mini LED

The Mini LED category is making strides in the display market, primarily due to its ability to provide improved backlighting and contrast ratios over traditional LED technologies. Mini LEDs consist of smaller diodes that enhance local dimming capabilities, making them suitable for a range of applications, including televisions and monitors. Though it may not match the performance levels of Micro LEDs, Mini LEDs offer a more cost-effective solution, which appeals to a broader audience. The expansion in the consumer electronics sector and the increasing adoption of Mini LED technology in various displays lend it a significant presence in the market.

Insights On Key Applications

Smartphones & Tablets

The dominating category in the Global Micro and Mini LED Display Market is expected to be Smartphones & Tablets. This reflects the increasing consumer demand for high-resolution displays, enhanced color accuracy, and energy efficiency, which micro and mini LED technology can offer. The integration of such advanced display technologies in smartphones enhances user experience significantly, catering to gaming, video streaming, and social media applications. Moreover, the market for tablets is also rising as they become more popular for work and education, amplifying the need for superior display performance. Given the rapid proliferation of mobile devices and the continuous innovation in displays, this category is anticipated to lead the market.

NTE Devices

NTE (Near-to-Eye) Devices are steadily gaining traction in the market due to the rise in augmented reality (AR) and virtual reality (VR) applications. Micro and Mini LED displays provide the necessary high pixel density and brightness that these devices require for an immersive user experience. The advancements in gaming and immersive experiences for training and education add to their demand. As the technology progresses, the quality of NTE devices improves, thereby attracting more consumers and businesses, which enhances the market potential for this application area.

Televisions

Televisions are witnessing significant advancements with the incorporation of micro and mini LED technology, providing better image quality and energy efficiency. As the demand for ultra-high-definition content rises, manufacturers are increasingly adopting this display technology to deliver brighter images with superior color accuracy and contrast. The trend of larger screen sizes also drives the need for these advanced displays, catering to consumers seeking enhanced home entertainment experiences. This evolution in television display technology contributes positively to the overall market, although it may not dominate as strongly as smartphones and tablets.

Monitors and Laptops

Monitors and laptops are seeing an incremental increase in the adoption of micro and mini LED displays driven by a growing need for better visual performance in professional environments. Graphic designers, gamers, and content creators seek displays that offer precise color reproduction and higher refresh rates, pushing manufacturers to explore these advanced technologies. Additionally, the rise of remote work has led to an increased demand for high-quality displays in laptops, supporting productivity. The competition in this sector is strong, but it does not yet harbor the same level of consumer base as the smartphone category.

Digital Signage

Digital signage leverages micro and mini LED technology for vibrant and eye-catching displays essential in retail, advertising, and public information applications. The flexibility of installation and the ability to create large, seamless displays make this technology ideal for dynamic content presentation. As businesses shift toward more engaging customer experiences, the demand for advanced digital signage solutions is expected to rise. While this market is promising, it remains a niche compared to the robust consumer electronics categories like smartphones and tablets.

Smartwatches

Smartwatches are integrating micro and mini LED technology primarily for their benefits in energy efficiency and display brightness, which are crucial for wearable devices. Users favor wearables with improved display capabilities that enhance visibility in different lighting conditions. As activity tracking, notifications, and health monitoring features become more prominent, the need for crisp displays is intensifying. However, this category faces limitations compared to larger screen applications like smartphones, affecting its market dominance in the broader context of micro and mini LED technology adoption.

Heads-up Display

Heads-up displays (HUDs) are gradually adapting micro and mini LED technology to enhance visibility and readability while maintaining safety during vehicular operations. Industries such as automotive and aviation benefit from these displays, using them for navigation and performance metrics. The ability to display relevant information without distraction significantly contributes to user experience and safety. Nevertheless, the scale of this market remains smaller relative to the consumer electronics s like smartphones, offering innovative applications but lacking the widespread adoption seen in larger markets.

Insights On Key Panel Size

Large Panels

The Global Micro and Mini LED Display Market is expected to be dominated by the large panels category. This growth can be attributed to increasing demand for large-scale display solutions in various applications, especially in commercial and public spaces such as advertising, entertainment, and event venues. Furthermore, large panels provide superior brightness, better color accuracy, and enhanced viewing angles compared to traditional display technologies. These advantages drive manufacturers to focus on developing advanced large panel displays utilizing Micro and Mini LED technology. As a result, the combination of high resolution and large screen sizes appeals to both end-users and businesses, making large panels the leading category in this market.

Micro-displays

Micro-displays represent a significant and emerging category in the micro and mini LED display market. These small-form-factor displays are known for their compact size and exceptional resolution, which makes them ideal for applications in augmented reality (AR) and virtual reality (VR) gaming. As AR and VR adoption continues to grow, the demand for high-quality micro-displays is expected to see a corresponding increase. Moreover, advancements in technology allow for improved brightness and color accuracy in micro-displays, which further enables a captivating user experience and drives their market penetration.

Small & Medium-sized Panels

The small and medium-sized panel category in the micro and mini LED display market is experiencing steady interest, primarily for consumer electronics, signage, and control rooms. These panels effectively bridge the gap between compact form factors and larger displays, catering well to industries that require flexibility in installation and use. As the demand for versatile screens grows, particularly in applications such as automotive infotainment systems and handheld devices, small and medium-sized panels are positioned for robust growth. However, they face stiff competition from larger panels which offer more immersive user experiences.

Insights On Key Vertical

Consumer Electronics

The Consumer Electronics vertical is expected to dominate the Global Micro and Mini LED Display Market due to the growing demand for high-resolution displays in personal devices such as smartphones, televisions, and tablets. As consumers increasingly seek superior picture quality, enhanced brightness, and energy efficiency, manufacturers are leaning towards micro and mini LED technologies to meet these expectations. The ability of these displays to provide better color reproduction and deeper blacks places them in a strong position within the competitive landscape. Furthermore, the ongoing innovation in this sector will likely stimulate consumer interest and adoption, solidifying its leading role in the market.

Entertainment & Advertisement

In the Entertainment & Advertisement vertical, micro and mini LED technologies are gaining traction because of their superior visual appeal and versatility. With the rise of digital signage and immersive environments in theme parks and theaters, there is a significant opportunity for businesses to leverage these displays. These technologies enable vibrant and dynamic advertising formats, enhancing viewer engagement and providing a competitive edge in advertising effectiveness.

Automotive

The Automotive sector presents a growing opportunity for micro and mini LED displays, especially as vehicles become increasingly reliant on advanced technology. These displays are ideal for instrument clusters, head-up displays, and infotainment systems due to their clarity, energy efficiency, and ability to function under various lighting conditions. The push towards smarter vehicles has led manufacturers to explore cutting-edge display technologies to enhance user experience and safety.

Aerospace & Defense

In the Aerospace & Defense vertical, the demand for high-performance displays is significant due to rigorous standards for reliability and performance. Micro and mini LED displays are well-suited for this sector as they offer bright, high-resolution imagery that can withstand extreme conditions. Applications include cockpit displays and tactical equipment, where compact size and durability are crucial, enhancing operational efficiency.

Retail

The Retail sector is increasingly adopting micro and mini LED technologies for digital signage and in-store promotions. These displays offer exceptional visual quality that captures customer attention effectively. As retailers strive to create unique shopping experiences, the dynamic and customizable nature of these displays places them at the forefront of modern marketing strategies, allowing for real-time updates and captivating visual content.

Healthcare

In the Healthcare vertical, micro and mini LED displays offer advantages for medical imaging and device interfaces. These technologies deliver high-resolution imagery essential for accurate diagnoses and analysis. As healthcare facilities adopt more advanced imaging systems, the need for mature display solutions that provide clarity and reliability will grow, making these technologies pivotal in enhancing patient outcomes and operational efficiency.

Government

The Government sector is gradually embracing micro and mini LED display technologies for applications such as monitoring systems, command centers, and public information displays. These technologies provide the robustness and clarity required for vital communication channels. As governments focus on improving transparency and information dissemination, the utilization of high-quality displays will become increasingly important in public service initiatives and civic engagement efforts.

Others

Various 'Others' applications encompass industries such as education, hospitality, and transportation, where the visual performance of micro and mini LED displays can significantly enhance user experience. In educational settings, for example, high-quality displays improve learning outcomes and engagement. As more sectors realize the potential of these advanced display technologies, they are likely to contribute to the overall growth of the micro and mini LED display market.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Micro and Mini LED Display market due to its rapid technological advancements, significant investments in research and development, and a robust consumer electronics industry. Countries like China, Japan, and South Korea are at the forefront of display technology, driving the adoption of Micro and Mini LED displays in products such as televisions, smartphones, and automotive displays. The rising demand for high-resolution displays combined with the increasing use of Micro and Mini LED technologies in a wide range of applications will further consolidate Asia Pacific's leading position, as it accounts for the majority of production and consumption in the global market.

North America

North America follows closely behind in the Micro and Mini LED Display market, characterized by a robust appetite for innovative technology and premium consumer electronics. The presence of several leading technology firms and research institutions helps drive advancements in display technologies. Moreover, the region's focus on gaming, augmented reality (AR), and virtual reality (VR) applications has fostered growth in demand. Companies in North America are increasingly investing in next-generation displays for high-performance applications, which could enhance the region's influence in this competitive market landscape.

Europe

Europe is emerging as a significant player in the Micro and Mini LED Display market, largely driven by shift towards sustainability and energy-efficient solutions. The region's stringent regulatory frameworks promoting green technology are encouraging the adoption of next-generation display technologies across various sectors, including automotive, consumer electronics, and advertising. Additionally, strong collaborations among European technology companies and continuous innovation in display solutions are leading to an increase in market share. However, competition from the Asia Pacific market poses challenges to its growth.

Latin America

In Latin America, the Micro and Mini LED Display market is gradually gaining momentum, although it remains overshadowed by North America and Asia Pacific. Economic growth in countries such as Brazil and Mexico, coupled with increasing consumer demand for high-quality display technologies, presents opportunities for market expansion. However, issues such as limited adoption rates and infrastructure challenges may hinder rapid growth. Over time, advancements in technology and better accessibility to Micro and Mini LED displays could support growth in this region.

Middle East & Africa

The Micro and Mini LED Display market in the Middle East & Africa is still in its nascent stage but shows promising potential due to growing investments in various sectors such as entertainment, advertising, and smart technology. Increasing urbanization and a young, tech-savvy population are driving demand for innovative display solutions. However, challenges such as lower disposable incomes and less developed infrastructure can limit immediate large-scale adoption. As the region continues to modernize, the adoption of Micro and Mini LED Display technology is likely to increase, albeit at a slower pace compared to other regions.

Micro and Mini LED displays Market Company Profiles:

Prominent entities within the global Micro and Mini LED display sector are fostering innovation by focusing on technological advancements and forming strategic alliances. This approach facilitates enhancements in both display effectiveness and energy efficiency. Their influential role in production and market outreach significantly influences industry patterns and encourages consumer acceptance of advanced display technologies.

Prominent contributors to the Micro and Mini LED Display Market encompass entities like Samsung Electronics, LG Display, AU Optronics, Innolux Corporation, Cree, Inc., Epistar Corporation, PlayNitride Inc., Plessey Semiconductors, Micro Led Technologies, and Wistron NeWeb Corporation. Noteworthy companies also comprise VueReal Inc., QD Vision (currently integrated into a larger entity), Sony Corporation, Panasonic Corporation, WiseChip Semiconductor, and ROHM Semiconductor. Other important participants are Aledia, Sanan Optoelectronics, and JBD Inc. Collectively, these companies play a vital role in pioneering and commercializing micro and mini LED technologies, fostering significant advancements and innovations in the display industry.

COVID-19 Impact and Market Status:

The Covid-19 pandemic notably affected the Global Micro and Mini LED Display market by disrupting supply chains and altering consumer preferences, leading to a greater inclination towards home entertainment solutions.

The COVID-19 pandemic had a profound effect on the micro and mini LED display industry, primarily disrupting supply chains and manufacturing due to factory shutdowns and workforce constraints. As global reliance on electronic devices escalated during lockdowns, manufacturers encountered significant hurdles in efficiently satisfying this ened demand.

Furthermore, the pandemic catalyzed a shift toward remote work and increased digital interaction, leading to a growing interest in high-quality display technologies across various platforms, such as televisions, monitors, and mobile devices. The healthcare industry also experienced an amplified demand for sophisticated display solutions, particularly for telemedicine and diagnostic purposes. Nonetheless, the recovery phase post-pandemic has ushered in renewed investments and innovations within the micro and mini LED markets, as companies adjust to evolving consumer needs and technological advancements. In summary, while the initial pandemic phase presented notable challenges, the longer-term outlook appears promising, with the potential for significant growth driven by the rising demand for enhanced display technologies.

Micro and Mini LED displays Market Latest Trends and Innovation:

- In January 2023, Samsung Electronics introduced its new Micro LED display technology at CES, demonstrating advancements in resolution, color rendition, and energy efficiency for large-scale displays.

- In March 2023, LG Display announced a significant investment of $2.6 billion to expand its OLED and Mini LED production capabilities, aiming to enhance its competitive edge in the premium display market by 2025.

- In June 2023, AU Optronics launched a new series of Mini LED backlit displays aimed at gaming and professional monitors, highlighting their high brightness and HDR capabilities for improved visual performance.

- In August 2023, TCL unveiled its new 8K Mini LED TV lineup at IFA 2023, showcasing cutting-edge technology that aims to push boundaries in color accuracy and contrast for home entertainment.

- In September 2023, BOE Technology Group announced a partnership with several smartphone manufacturers to integrate Micro LED screens into next-generation mobile devices, emphasizing their commitment to advancing display technologies.

- In October 2023, Apple confirmed reports of using Micro LED technology in upcoming product lines, aiming to deliver better energy efficiency and display performance in their wearable devices and future iPhones.

Micro and Mini LED displays Market Significant Growth Factors:

The expansion of the Micro and Mini LED display sector is fueled by innovations in display technology, a rising consumer appetite for high-definition screens, and a broadening range of applications across diverse industries including electronics, automotive, and advertising.

The Micro and Mini LED Display Market is witnessing remarkable expansion, driven by a multitude of factors. Primarily, the surge in demand for high-resolution screens in consumer electronics—such as smartphones, TVs, and wearable technology—fuels the adoption of these cutting-edge display technologies, which provide enhanced brightness, contrast, and energy efficiency over conventional LCDs. Additionally, the growing utilization of Micro and Mini LEDs in industries like automotive displays, gaming, and virtual reality is broadening the market landscape.

Advancements in manufacturing techniques and declining production costs are also making these displays more obtainable for a diverse array of consumers and enterprises. The increasing preference for sleeker, lightweight display designs further supports market growth, as Micro and Mini LED technologies inherently meet these specifications. Environmental factors significantly influence the market as well, given that these displays consume less energy and boast longer lifespans than earlier models, attracting eco-conscious consumers and manufacturers alike.

Furthermore, ened investment in research and development, coupled with strategic partnerships among technology companies aimed at improving display innovation, plays a crucial role in the market's overall growth. Together, these elements strategically position the Micro and Mini LED Display Market for substantial growth in the upcoming years, backed by continuous technological progress and shifting consumer demands.

Restraining Factors:

Major obstacles facing the Micro and Mini LED display market involve elevated production expenses, restricted access to essential raw materials, and intricate challenges in the manufacturing and integration processes.

The Micro and Mini LED display sector encounters various obstacles that may impede its growth and widespread acceptance. A primary concern is the substantial manufacturing costs linked to these sophisticated display technologies, which may lead manufacturers to prefer traditional options like LCD or OLED. Additionally, the intricate production process and the requirement for specialized machinery can deter small to mid-sized enterprises from entering the market. Moreover, the scarcity of essential raw materials poses a risk of supply chain interruptions and ened expenses. The current lack of industry standardization may also result in compatibility problems among devices, restricting market development. As consumer knowledge regarding the advantages of Micro and Mini LED displays continues to evolve, the pace of market adoption may be sluggish. Nevertheless, with ongoing technological progress and decreasing costs, the distinctive benefits of Micro and Mini LED displays—such as superior color precision, better energy efficiency, and ened brightness—are likely to foster innovation and pique consumer interest, contributing to a favorable outlook for the market's future growth trajectory.

Key Segments of the Micro and Mini LED Display Market

By Type

• Micro LED

• Mini LED

By Applications

• Smartphones & Tablets

• NTE Devices

• Televisions

• Monitors and Laptops

• Digital Signage

• Smartwatches

• Heads-up Display

By Panel Size

• Micro-displays

• Large Panels

• Small & Medium-sized Panels

By Vertical

• Consumer Electronics

• Entertainment & Advertisement

• Automotive

• Aerospace & Defense

• Retail

• Healthcare

• Government

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :

Micro LED is the most discussed and popular topic in the display industry. Most players such as San’an Optoelectronics, Epistar are focusing on spending huge capital to develop next-generation display technology. Though, from the technical point of view, the bulk production of micro LED is still facing numerous challenges such as LED uniformity and the yield rate of mass transfer, etc. Few of the manufacturers have thus diverted their development focus to mini LED as its architecture is comparable to that of LED and LCD displays and not many changes in the design are needed. It is expected that before micro-LED is ready for mass production, commercialization of mini LED is anticipated to penetrate with the effective rate in the display market. Companies are projecting that Mini LED will become a transitional product between LCD, LED and micro-LED. mini LED is certain to face direct competition from OLED. Consumer electronics, for instance, TVs, smartphone consumers have progressively presumed that OLED is another word for high-end products. Also with its stability in production, OLED will have additional advantages in terms of production in the coming years, so the display industry is finding out new applications of Mini LED.

Few companies are expected to launch Micro LED television in this year itself. For instance, in 2019, Samsung Electronics is planning to launch a consumer Micro-LED TV of 75 inches. This product is developed using LED chips and technologies from a Taiwan based company PlayNitride. The company is also expected to invest more in PlayNitride to assist the company to increase its production capacity.