Market Analysis and Insights:

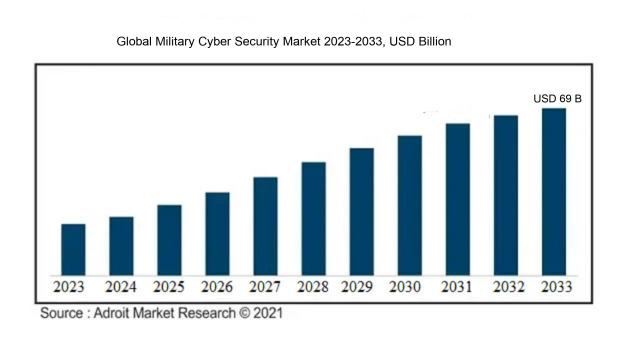

The market for Global Military Cyber Security was estimated to be worth USD 15 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 15%, with an expected value of USD 69 billion in 2033.

The growth of the Military Cyber Security Market is significantly influenced by escalating cyber threats and increasing geopolitical conflicts, which necessitate the implementation of strong cybersecurity protocols to safeguard sensitive defense-related information and infrastructure. The military's growing dependence on cutting-edge technologies such as the Internet of Things (IoT), artificial intelligence (AI), and cloud computing intensifies the requirement for all-encompassing cybersecurity measures, given that these innovations can introduce new vulnerabilities. Moreover, government-led initiatives aimed at establishing cybersecurity frameworks and financial support programs to bolster national security are propelling market advancement. There is also a ened demand for sophisticated threat intelligence solutions and security incident response services, as military entities strive to proactively address potential cyber threats. Additionally, the incorporation of machine learning and AI in cybersecurity strategies is improving the efficacy of threat detection and response, further reinforcing investments in this domain. These elements collectively drive the dynamic evolution of the military cybersecurity sector.

Military Cyber Security Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2033 |

| Study Period | 2023-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 69 billion |

| Growth Rate | CAGR of 15% during 2024-2033 |

| Segment Covered | By Offering, By Security, By Deployment Model, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, BAE Systems PLC, Booz Allen Hamilton Holding Corporation, Thales Group, General Dynamics Corporation, IBM Corporation, Cisco Systems, Inc., McAfee Corp., Palantir Technologies Inc., Cyberbit Ltd., FireEye, Inc., CrowdStrike Holdings, Inc., and Dell Technologies Inc. |

Market Definition

Military cyber security involves safeguarding military information systems and networks from cyber threats and intrusions. This field includes both defensive and offensive strategies aimed at ensuring the security of national interests and the effectiveness of military operations in the digital landscape.

The realm of military cybersecurity plays a pivotal role in safeguarding vital national security information and essential defense frameworks from cyber threats that could jeopardize military operations and strategic superiority. As dependence on digital technologies and networks grows, adversaries may take advantage of weaknesses to interfere with communication channels, extract classified information, or carry out assaults on military resources. A strong cybersecurity infrastructure is essential for preserving the integrity, confidentiality, and accessibility of data, all of which are crucial for informed decision-making and preparedness for operations. Furthermore, as conflict increasingly extends into cyber domains, it becomes imperative for military organizations to emphasize cybersecurity to protect national interests and sustain a strategic advantage over potential adversaries.

Key Market Segmentation:

Insights On Key Offering

Services

Among the offerings categorized under the Global Military Cyber Security Market, services are expected to dominate. This is primarily due to the evolving nature of cyber threats, which necessitates ongoing support, consultations, and real-time solutions. Military organizations heavily rely on experts to sift through the complexities of cyber threats that continuously evolve, thus creating a massive demand for tailored services. Furthermore, the ability of service providers to implement, manage, and improve upon existing cyber defense systems ensures a sustained market focus on services over one-time solutions. As military entities strive for robust cyber capabilities, the preference for flexible, adaptive services is crucial.

Solution

In contrast, the solution aspect of the includes specific products and technologies designed to provide cybersecurity for military operations. While it is critical, the offering tends to be more static, with systems requiring periodic upgrades rather than ongoing adjustments. Solutions often include software products or platforms, which can be essential for addressing immediate cybersecurity needs, but may not cover the breadth of threats over time. With technology advancing rapidly, military entities will depend on these established solutions to meet specific compliance and operational needs, though the demand is generally lower compared to the hunger for continuous support.

Insights On Key Security

Network Security

Network security is expected to dominate the Global Military Cyber Security Market due to its critical role in protecting military networks from potential threats and attacks. With the increasing reliance on network infrastructure for operational effectiveness and communication, military organizations are investing significantly in advanced network security technologies. This area covers various security solutions designed to defend the integrity, confidentiality, and availability of data and network resources. As cyber threats become more sophisticated and persistent, the focus on fortifying network defenses, alongside the integration of artificial intelligence and machine learning for enhanced threat detection, solidifies network security's leading position in military cyber cybersecurity strategies.

Cloud Security

Cloud security plays an essential role in ensuring the safety of data and applications deployed on cloud environments, which have become increasingly popular within military operations. As defense organizations adopt cloud solutions for their flexibility, scalability, and cost-effectiveness, the need for robust security measures to protect sensitive information stored off-premises grows. Cloud security encompasses various strategies to safeguard against data breaches and unauthorized access, making it indispensable for military cyber operations, particularly as cloud technologies evolve and offer more advanced capabilities.

Wireless Security

Wireless security is vital for military communication systems, given the significance of secure and reliable wireless connections in operational scenarios. As military operations often rely on wireless networks for real-time data transmission, ensuring the integrity and confidentiality of these communications against intercepts and eavesdropping is crucial. Various technologies and protocols are employed to enhance wireless security, including encryption and secure authentication methods. However, challenges such as evolving threats and the increasing complexity of wireless systems remain, requiring continued emphasis on advanced wireless security measures.

Application Security

Application security is increasingly significant as military cyber operations and IT environments become more intricate. This area involves measures taken to improve the security of applications, particularly those used in military software systems that handle sensitive information. Vulnerabilities in applications can become entry points for cyberattacks, highlighting the importance of developing secure coding practices and implementing regular assessments and testing. As the number of applications deployed across military platforms grows, so does the focus on ensuring their resilience and resistance against potential exploits, positioning application security as a vital concern for military cyber defense strategies.

Others

The "Others" category encompasses security measures that do not fit neatly into established classifications like network, cloud, wireless, or application security. This category can include physical security measures, endpoint protection, and component security that may be necessary for a military context. While these aspects are important, they often serve a niche function rather than forming the backbone of overall cyber security strategies. The impact and dominance of this group are generally overshadowed by more defined areas, but they are important for a comprehensive approach to cybersecurity, ensuring every possible vulnerability is addressed.

Insights On Key Deployment Model

Cloud

Based on comprehensive research and recent trends in the military cyber security landscape, the Cloud deployment model is expected to dominate the Global Military Cyber Security Market. The increasing need for flexibility, scalability, and cost-effectiveness in managing military operations drives armed forces to adopt cloud solutions. Cloud platforms enable real-time threat detection, efficient data processing, and seamless collaboration among military units. Additionally, the rapid advancement of cloud technologies, along with robust security frameworks, enhances trust in their ability to handle sensitive military data. Governments globally are prioritizing cloud-based cyber security solutions, leading to a substantial shift from traditional on-premises systems.

On-Premises

The On-Premises model has its own set of advantages, particularly in terms of control and customization. Military organizations that prioritize strict compliance with security protocols and maintain sensitive data often prefer on-premises solutions. This model allows for fortified infrastructure and tailored security protocols, thus ensuring that critical information remains within the organization's premises. However, the initial costs and maintenance overhead can be significant. Despite these challenges, there’s still a significant demand for on-premises deployments, especially in regions with stringent data sovereignty laws or where legacy systems are prevalent.

Insights On Key Application

Intelligence and Surveillance

Intelligence and surveillance is expected to dominate the Global Military Cyber Security Market due to the increasing necessity for real-time data collection and analysis to support national defense strategies. The rise of advanced threats from hostile actors necessitates robust cybersecurity measures to protect sensitive information. With militaries around the world investing heavily in intelligence capabilities, securing data from surveillance operations has become paramount. This ened focus on intelligence systems ensures that they remain operationally effective, leading to a substantial share of the military cyber security budget being allocated towards these areas. As nations face more sophisticated cyber threats, the urgency to safeguard intelligence and surveillance operations will continue to resonate throughout the defense community.

Command and Control Systems

Command and control systems are crucial for military operations, serving as the backbone for decision-making and coordination. Protecting these systems from cyber threats is essential, as any compromise can jeopardize military effectiveness and personnel safety. The increasing integration of technology into command structures means that vulnerabilities in these systems can be severely exploited. Therefore, investments in cybersecurity for command and control are rising, ensuring that military hierarchies can conduct operations smoothly and securely. As technological advancement continues to evolve, the emphasis on fortifying these systems against cyber-attacks is expected to grow correspondingly.

Communication Network

Communication networks are the lifeline for military operations, facilitating information exchange across various levels of command. Securing these networks from cyber threats is crucial as any disruption can impair operations and create vulnerabilities. Military forces are increasingly implementing advanced encryption methods and robust cybersecurity protocols to protect against threats. The rise of IoT devices within communication frameworks adds a layer of complexity, necessitating tailored cybersecurity solutions. As military operations demand seamless communication under various conditions, the significance of safeguarding these networks will escalate, influencing security strategies across the globe.

Weapon Systems and Platforms

Safety measures for weapon systems and platforms are critical, given that these systems are central to military capabilities. Cybersecurity in this sector focuses on preventing unauthorized access that could lead to catastrophic consequences. The growing complexity and connectivity of modern weapon systems en vulnerability levels, making them attractive targets for cyber adversaries. Consequently, military organizations are prioritizing investment in cybersecurity solutions tailored to protect these systems. As technology integrates with weaponry to enhance efficiency, this will increase attention and resources towards maintaining cybersecurity throughout their operational lifecycle.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Military Cyber Security market due to its advanced technological capabilities, significant investment in defense systems, and a robust infrastructure to counter cyber threats. The presence of key players, such as defense contractors and cybersecurity firms, in the region, amplifies research and development efforts aimed at building sophisticated military cyber security solutions. Furthermore, the U.S. government’s increasing focus on enhancing cyber defense capabilities in response to growing cyber threats has led to strategic initiatives and funding for military cyber security projects. This sustained investment and innovation make North America the leader in this market.

Latin America

In Latin America, the military cyber security market is gradually evolving, driven by a growing awareness of the importance of cybersecurity in defense sectors. Countries are beginning to invest in technology and strategic frameworks to protect their military networks from cyber threats. However, challenges such as budget constraints and varying levels of technological advancement across countries limit the overall market growth. As awareness and investments increase, the region may see incremental improvements but is currently lagging compared to North America.

Asia Pacific

Asia Pacific presents a rapidly growing opportunity in the military cyber security market, spurred by rising geopolitical tensions and the adoption of advanced technologies. Countries like China and India are heavily investing in enhancing their defense capabilities, including cybersecurity infrastructure. Despite this, regional disparity in technological maturity and cybersecurity practices amongst nations could hinder uniform growth across the region. Nevertheless, governments that prioritize cyber resilience and collaborate with global cybersecurity firms may accelerate their defense cybersecurity initiatives.

Europe

Europe is a crucial player in the military cyber security market, with nations like the UK, France, and Germany leading the way in defense spending and cybersecurity innovations. The European Union’s emphasis on collective cybersecurity measures strengthens the region's strategic approach to counteract cyber threats. However, diverse regulatory landscapes and varying defense budgets among member states could pose challenges in creating a cohesive market strategy. Over time, enhanced collaboration among nations may help in fortifying military cyber defenses across Europe.

Middle East & Africa

The Middle East & Africa region is witnessing a growing interest in military cyber security solutions due to the escalating threat landscape brought about by geopolitical conflicts and cyber warfare. Nations in this region are increasingly recognizing the need to protect their defense infrastructures, resulting in investments in cyber defense technologies. However, challenges related to political instability and budget limitations may hinder rapid growth. As regional governments prioritize national security and invest in technology, this market is likely to gain momentum in the coming years but remains less developed than others.

Company Profiles:

Prominent entities in the Global Military Cyber Security sector, comprising defense contractors and technology companies, play a crucial role in crafting sophisticated security measures, performing threat analyses, and providing strategic assistance to protect military networks from cyber threats. Their partnership is vital in strengthening defense capabilities and bolstering resilience against the ever-changing landscape of cyberattacks.

Major participants in the military cybersecurity sector comprise Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, BAE Systems PLC, Booz Allen Hamilton Holding Corporation, Thales Group, General Dynamics Corporation, IBM Corporation, Cisco Systems, Inc., McAfee Corp., Palantir Technologies Inc., Cyberbit Ltd., FireEye, Inc., CrowdStrike Holdings, Inc., and Dell Technologies Inc.

COVID-19 Impact and Market Status:

The Covid-19 pandemic acted as a catalyst for the rapid integration of digital technologies in military activities, leading to a ened need for strong cybersecurity measures to protect essential infrastructure from escalating cyber risks.

The COVID-19 pandemic has profoundly impacted the military cybersecurity sector, propelling the integration of cutting-edge technologies and driving digital transformation efforts within defense agencies. As military operations increasingly shifted to remote frameworks, the necessity for strong cyber defense mechanisms intensified, aimed at safeguarding sensitive information and ensuring continuous operational capabilities. The rise in cyber threats, a consequence of the pandemic, led military organizations to bolster their investments in cybersecurity, focusing on areas such as threat detection, incident management, and enhancing network security infrastructures.

Moreover, the transition toward cloud computing and the utilization of artificial intelligence within military operations underscored the demand for improved security measures. As countries emphasized national safety in light of escalating cyber threats, the military cybersecurity market experienced an influx of funding and the formation of strategic alliances, fostering innovation and the creation of advanced solutions to address emerging cyber challenges. In summary, the pandemic has acted as a catalyst for change in military cybersecurity, significantly influencing its future direction and solidifying its role as an essential element of national defense strategies.

Latest Trends and Innovation:

- In March 2023, Northrop Grumman announced the acquisition of Optiv Security, expanding its capabilities in cyber defense and risk management solutions tailored for military applications. This move is intended to enhance Northrop Grumman's cyber resilience offerings within the defense sector.

- In January 2023, Palantir Technologies signed a contract with the U.S. Army valued at approximately $229 million. The contract focuses on utilizing Palantir's data integration capabilities to strengthen the military's cyber defense and operational effectiveness through improved decision-making processes.

- In September 2022, Boeing completed the acquisition of Ash Technologies, a firm specializing in advanced cybersecurity technology. This acquisition is aimed at securing Boeing's military platforms by integrating innovative cybersecurity solutions into its products.

- In July 2022, FireEye rebranded as Trellix after merging with McAfee Enterprise, reinforcing its position in the military cyber security market by offering enhanced threat detection and response capabilities tailored for defense forces.

- In May 2022, General Dynamics Information Technology formed a strategic partnership with CrowdStrike, focusing on providing enhanced cyber intelligence and protection solutions for military networks against sophisticated cyber threats.

- In March 2022, Raytheon Technologies announced the opening of a new cybersecurity operations center in Maryland. This facility is dedicated to developing advanced cyber solutions specifically aimed at safeguarding military infrastructure from emerging threats.

- In February 2022, Lockheed Martin secured a multi-million dollar contract to enhance cyber defenses for a classified U.S. military project. This project aims to integrate state-of-the-art malware detection and prevention systems into military operations.

- In January 2022, the U.S. Department of Defense awarded a $10 billion contract to Microsoft for its Azure cloud services, which include specific enhancements to the security features directly supporting military cyber operations.

- In December 2021, Thales completed the acquisition of a cybersecurity start-up that specializes in artificial intelligence-driven threat detection, significantly boosting its tech portfolio aimed at military clients.

- In October 2021, IBM announced a partnership with the U.S. Army to implement their AI-based cloud solutions in order to upgrade and secure military cyber operations, thus improving the overall resilience of their cyber infrastructure.

Significant Growth Factors:

The Military Cyber Security Sector is witnessing expansion fueled by the escalation of cyber threats, technological advancements, and the growing demand for strong defense systems.

The Military Cyber Security Market is witnessing substantial expansion, driven by several pivotal factors. The rise in cyber threats targeting military systems forces governments to allocate resources toward developing comprehensive cyber defense strategies. Additionally, the growing dependency on cutting-edge technologies like artificial intelligence, machine learning, and the Internet of Things within military operations underscores the necessity for advanced cyber security solutions to protect critical data and networks.

Furthermore, the increasing emphasis on national security in light of geopolitical uncertainties propels military expenditures towards enhancing defense capabilities, specifically in cyber security. The need to comply with rapidly changing security regulations also drives the implementation of sophisticated cyber security protocols to safeguard military assets.

The ened awareness of the risks associated with digital warfare fosters innovation and research in new cyber defense technologies. As military operations increasingly adopt cloud computing, there is an urgent need for robust security frameworks to protect sensitive information against potential cyber intrusions.

Investment from both governmental and private sectors in cyber security education and skill development initiatives is essential to bridge the skills gap within the cyber workforce, ensuring preparedness against evolving cyber threats. Collectively, these elements are propelling the significant growth of the Military Cyber Security Market.

Restraining Factors:

Significant hindrances in the Military Cyber Security Market encompass financial limitations, the swift advancement of cyber threats, and difficulties associated with incorporating cutting-edge technologies into current defense infrastructures.

The Military Cyber Security Market encounters numerous challenges that may hinder its development and effectiveness. Primarily, the swiftly changing landscape of cyber threats demands ongoing modifications and enhancements to security protocols, which can place significant pressure on financial resources and manpower. Additionally, many military institutions are burdened with outdated systems that fail to align with contemporary security standards, complicating efforts to integrate newer technologies and fortify cybersecurity measures.

Moreover, the ever-increasing sophistication of cyber-attacks presents an ongoing obstacle, often requiring specialized skills and expertise that may not be readily available within the military workforce. Bureaucratic barriers can also delay procurement timelines, restricting the ability to swiftly address pressing cyber threats. The intricacies involved in collaborating within multinational coalitions further complicate issues related to information sharing and interoperability among diverse military cyber defense frameworks.

Lastly, the scarcity of qualified cybersecurity professionals intensifies these difficulties, as attracting and keeping talent in this fiercely competitive environment remains a significant challenge. Nevertheless, despite these impediments, ongoing investments in employee training, advancements in technology, and partnerships with private sector organizations are fostering a more robust military cyber defense strategy, ultimately enhancing national security against evolving cyber risks.

Key Segments of the Military Cyber Security Market

By Offering

- Solution

- Services

By Security

- Network security

- Cloud security

- Wireless security

- Application security

- Others

By Deployment Model

- On-premises

- Cloud

By Application

- Command and control systems

- Communication network

- Intelligence and surveillance

- Weapon systems and platforms

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America