Market Analysis and Insights

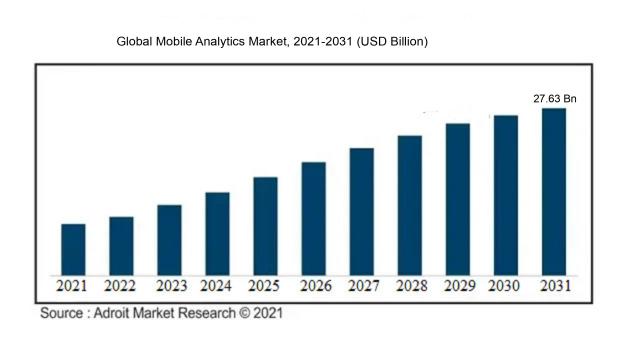

According to projections, the global market for mobile analytics was valued at USD 4.76 billion in 2021 and will increase at a CAGR of 19.7% from 2022 to 2031 to reach USD 27.63 billion.

During the projection period, a number of reasons are projected to support market expansion, including an increase in disposable income and a change in lifestyle, a rise in smartphone applications and internet usage, and the need to comprehend consumer behavior.

Mobile Analytics Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 27.63 billion |

| Growth Rate | CAGR of 19.7% during 2022-2031 |

| Segment Covered | by Offering ,by Application ,by Industry Vertical, by Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | AT Internet,Microsoft Corporation,Teradata Corporation, Micro Focus,TIBCO Software Inc.,Microstrategy Incorporated, Webtrends, Google LLC, Mixpanel,SAS Institute Inc.,Oracle Corporation, Adobe, Salesforce.com,Inc., Comscore, Inc., SAP SE, Splunk Inc., and International Business Machines Corporation |

Market Definition

Mobile analytics tracks app use in addition to app analytics, such as installations, events, versions, screens, launches, taps, user retention, flows, funnel analytics, and more.

The same user metrics that web analytics collects and evaluates for mobile platforms, such as the number of users, geographic location, device type, and IOT operating system version, are likewise gathered and evaluated for mobile platforms. Due to the market's growing use of smartphones and the need for fresh, insightful consumer data, there is a rising need for mobile analytics globally.

In addition, since mobile advertising has increased and big data and data analytics have been introduced, the market for mobile analytics has also expanded. On the other hand, new opportunities are predicted to present themselves during the expected time as more companies enter the market and provide cutting-edge solutions. When examining their sales funnels, crash rates, demographics, customer profiles, customer retention, open app rates, or any other data that is pertinent to their business, such as users who slack off, time spent on the app, or the most frequent routes to an in-app purchase, organizations are highly worried.

Key Market Segmentation

Insights on Component

Insights on Region

The North America Region Accounted for the Highest Share

The mobile analytics industry was led by North America. North America presently dominates the mobile analytics market and is predicted to retain this trend over the forecast period due to the significant acceptance rate of mobile analytics solutions due to scalability and cost-effectiveness. Additionally, in North America, retail companies are spending money on cutting-edge technology to improve corporate operations. The performance of retail sales and customer management is enhanced by the use of mobile analytics. The adoption of cloud-based mobile analytics is also increased by strong telecommunications infrastructure in nations like the United States and Canada.

Key Company Profiles

The key players operating in the mobile analytics market include AT Internet, Microsoft Corporation, Teradata Corporation, Micro Focus, TIBCO Software Inc., Microstrategy Incorporated, Webtrends, Google LLC, Mixpanel, SAS Institute Inc., Oracle Corporation, Adobe, Salesforce.com, Inc., Comscore, Inc., SAP SE, Splunk Inc., and International Business Machines Corporation

COVID-19 Impact and Market Status

People spend greater time using mobile devices for leisure, communication, and job-related activities as lockdowns, stay-at-home policies, and remote work became more common. This rise in app usage may have raised the need for mobile analytics tools to analyze user behavior.

In reaction to the epidemic, several companies intensified their attempts to transition into digital enterprises. This could have boosted the use of mobile applications and, as a result, the demand for analytics tools to track and improve app performance.

Physical store limits led to a rise in demand for online shopping. For e-commerce companies to track user journeys, examine conversion rates, and enhance mobile buying experiences, mobile analytics would have been essential.

Fitness, meditation, and health monitoring applications are being used more often as a result of the pandemic's spurred interest in health and wellness. Developers may have adapted these applications to users' tastes with the use of mobile analytics. The pandemic's effects on the economy may have affected plans to invest in technology, especially analytics tools. It's possible that some companies have cut back on spending on optional software.

Latest Trends

1. To identify user opinions and feelings based on their app interactions, certain analytics systems now include sentiment analysis. Businesses may use this to appropriately adjust content and features.

2. When examining app interactions, contextual analytics takes into account outside variables like location, time of day, and user context. With this method, user behavior may be understood in more detail.

3. Data visualizations that are both interactive and aesthetically appealing are becoming more and more crucial for stakeholders to swiftly understand significant trends and insights.

4. Mobile analytics solutions are concentrating on monitoring app performance, crash rates, latency, and other technical indicators in addition to user behavior to guarantee a flawless user experience.

Significant Growth Factors

Mobile app usage has increased dramatically as a result of the widespread use of smartphones and other mobile devices, driving up the demand for analytics tools that can be used to better analyze user behavior and improve app experiences.

Data is becoming a more important tool for businesses when making choices. Mobile analytics gives organizations useful information about user preferences, engagement trends, and app performance, enabling them to customize their plans.

By monitoring user interactions that result in conversions, analytics tools play a critical part in in-app monetization strategies, enabling organizations to optimize income sources. Mobile analytics assists developers in identifying pain spots, areas for development, and user preferences to improve the entire app experience, which is crucial to the success of any app. Higher user engagement and retention rates are the result of personalized user experiences.

In order to measure user interactions inside these particular settings, specialized analytics solutions are needed due to the emergence of emerging app categories like virtual reality (VR), augmented reality (AR), and Internet of Things (IoT) apps.

Restraining Factors

Greater openness in data usage may be required in response to growing concerns about user data privacy and compliance with laws (such as the CCPA and GDPR).

Technically speaking, implementing and administering mobile analytics solutions can be challenging, especially for startups or organizations without technical staff. Businesses may become overwhelmed by the volume of data gathered by analytics technologies, making it difficult to glean useful insights from the information at hand.

Smaller companies could experience resource limitations in terms of time, money, or technological know-how needed to deploy and use mobile analytics technologies. While mobile analytics can produce a multitude of data, it can be difficult to effectively evaluate the data and turn it into actionable insights.

Recent Developments in the Global Mobile Analytics Market: A Snapshot

• The firm AskData, which specializes in search-driven analytics, was acquired by SAP, according to a statement from July 2022. By making it simple to explore, collaborate, and engage with real-time data, Askdata's intellectual property will be incorporated into SAP's Business Technology Platform to benefit customers of SAP Analytics Cloud Solutions.

• SAS acquired the worldwide financial software business Kamakura Corporation in June 2022. By integrating SAS technology with Kamakura's risk analytics and credit models, SAS would be able to provide an exceptional range of integrated risk solutions, primarily for asset liability management (ALM) and other facets of the financial services sector. Its range of risk solutions would also get stronger as a result of this purchase.

Key Segments Mobile Analytics Market

by Offering

• Offering Solution

• Service

by Application Overview

• Mobile advertisement

• marketing analytics

• Targeting and Behavioral analytics

• Application performance analytics,

• Others

by Industry Vertical Overview

• BFSI,

• Retail & E-commerce,

• Healthcare,

• Government,

• Travel & Hospitality

• IT & Telecom

• Media & Entertainment

• Others

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America