Market Analysis and Insights:

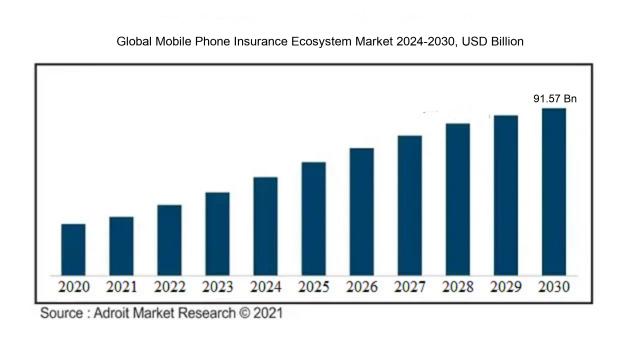

The market for Global Mobile Phone Insurance Ecosystem was estimated to be worth USD 26.8 million in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 12.55%, with an expected value of USD 91.57 billion in 2030.

The growth of the mobile phone insurance ecosystem market is driven by several key factors. A primary catalyst is the widespread embrace of smartphones globally, which has resulted in ened requirements for insurance safeguards to preserve these valuable gadgets.

Additionally, the growing occurrences of accidental damages, theft, and loss of smartphones have also played a crucial role in driving market growth. Consumers are increasingly realizing the necessity of insurance in safeguarding their devices from potential risks. Furthermore, the increasing awareness of the advantages of mobile phone insurance, such as prompt repair or replacement services and big data security, is further stimulating market expansion. The availability of affordable mobile phone insurance plans is also attracting a broader customer base, particularly among the younger population. Given the continuous technological advancements, the growing significance of smartphones in our daily lives, and the imperative need for device protection, the mobile phone insurance ecosystem market is anticipated to maintain its upward growth trend in the foreseeable future.

Mobile Phone Insurance Ecosystem Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 91.57 billion |

| Growth Rate | CAGR of 12.55% during 2024-2030 |

| Segment Covered | By Product ,By Application , By Coverage, By Pricing Model,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Allianz, Assurant, Aviva, Marsh, Asurion, Vodafone, Tenexx, Liberty Mutual, AIG, Hollard Group, Chubb, SoftBank, Orange, Plantronics, Three, Telefonica, Zurich, NTT Docomo, Xiaomi, Samsung, Apple, and Huawei. |

Market Definition

The mobile phone insurance system encompasses a network of interconnected entities and services dedicated to offering insurance coverage for mobile devices. This system involves insurance companies, retailers, phone manufacturers, repair facilities, and customers collaborating to provide safeguard and assistance for mobile device owners.

The Mobile Phone Insurance Ecosystem plays a significant role in various aspects. Initially, it offers customers a sense of assurance by safeguarding their costly mobile devices from damages, theft, or misplacement. This serves to mitigate financial uncertainties and motivates individuals to invest in premium smartphones. Additionally, the insurance ecosystem drives innovation and competitiveness among smartphone manufacturers as they aim to deliver superior devices with improved durability and customer-focused features. Moreover, it bolsters the expansion of repair services and secondary markets, leading to job creation and contributing to economic progress. Ultimately, the mobile phone insurance ecosystem cultivates reliability and commitment in consumers towards their selected insurance providers and the broader mobile phone industry, reinforcing the relationship between customers and businesses.

Key Market Segmentation:

Insights On Key Product

Wireless Carriers

The dominating part in the Global Mobile Phone Insurance Ecosystem market is the Wireless Carriers. This is primarily due to the fact that wireless carriers have direct access to a large customer base and can easily integrate insurance services into their existing offerings. They can also leverage their network infrastructure and customer relationships to effectively market and sell insurance policies. Additionally, wireless carriers often bundle insurance plans with their mobile phone plans, providing convenience and simplicity for consumers.

Insurance Specialists

Insurance specialists, although not dominating the market, play a significant role in the Global Mobile Phone Insurance Ecosystem. These firms focus exclusively on providing insurance services and have expertise in crafting tailored insurance policies. They can offer comprehensive coverage options and provide personalized assistance to customers when it comes to claims and policy management.

Device OEMs

Device Original Equipment Manufacturers (OEMs) are also part of the Mobile Phone Insurance Ecosystem market. These companies manufacture and sell mobile devices along with insurance as an add-on service. While they may not dominate the market, they have the advantage of a direct customer relationship and brand loyalty. Device OEMs can leverage their reputation and customer trust to offer insurance plans specific to their devices, providing added value to customers.

Retailers

Retailers, while not holding dominance, constitute a significant segment of the Global Mobile Phone Insurance Ecosystem market. They serve as intermediaries connecting customers with insurance providers, retailing insurance packages alongside mobile devices. Retailers often collaborate with insurance specialists or wireless carriers to offer coverage options to customers at the point of sale. They provide convenience and accessibility to insurance services, allowing customers to bundle insurance with their mobile phone purchase.

Insights On Key Application

Physical Damage

Physical Damage is expected to dominate the global mobile phone insurance ecosystem market. This is mainly due to the high incidence of accidents resulting in physical damage to mobile phones. With the increasing usage of smartphones and their susceptible nature to physical damage, it has become crucial for consumers to protect their devices against mishaps such as drops, spills, and breakages. As a result, the demand for insurance coverage for physical damage is significantly higher compared to other parts.

Theft & Loss

The part of Theft & Loss is also a significant part of the global mobile phone insurance ecosystem market. Mobile phone thefts and accidental loss are common occurrences, especially in urban areas and crowded places. Furthermore, the value and portability of smartphones make them attractive targets for theft. Consequently, insurance coverage for theft and loss is highly sought after by consumers to safeguard against financial loss in such unfortunate events.

Accidental Damage

Accidental Damage is another part that holds considerable prominence in the mobile phone insurance ecosystem market. Accidents such as dropping phones, liquid spills, and unintentional damage are everyday occurrences that can lead to costly repairs or device replacement. As consumers become more aware of the potential risks, the demand for insurance coverage against accidental damage continues to grow.

Software Malfunction

Although significant, the part of Software Malfunction is not expected to dominate the global mobile phone insurance ecosystem market. While software malfunctions and technical issues are common concerns for smartphone users, they are not as financially burdensome as physical damage or theft. Many software malfunctions can be fixed or resolved through software updates, resets, or device troubleshooting. Thus, insurance coverage specifically for software malfunctions may not be as widely sought after by consumers compared to other parts.

Insights On Key Coverage

Replacement

The Replacement part is expected to dominate the Global Mobile Phone Insurance Ecosystem market. With the increasing number of smartphone users worldwide and the high risk of accidental damages or theft, the demand for replacement coverage is rising. Consumers are seeking insurance plans that offer quick and hassle-free replacement of their damaged or stolen mobile phones. The Replacement part provides a convenient solution for customers who want to get a replacement device swiftly, ensuring they can stay connected at all times.

Repair

The Repair part is another significant part of the Global Mobile Phone Insurance Ecosystem market. While the Replacement part may dominate in terms of overall market share, the Repair part plays a vital role as a cost-effective and environmentally friendly option. Many customers prefer repairing their damaged phones instead of replacing them entirely, as it is more financially feasible and reduces electronic waste. Repair coverage ensures that smartphone users can have their devices fixed in case of accidental damage or malfunction, providing them with a more affordable solution.

Extended Warranty

Although the Replacement and Repair parts hold more prominence in the Global Mobile Phone Insurance Ecosystem market, the Extended Warranty part also plays a significant role. Extended warranty coverage offers customers an extended period of protection beyond the manufacturer's warranty. This part appeals to consumers who want added security and peace of mind in case their mobile phones encounter hardware or software issues. While it may not dominate the market, the Extended Warranty part caters to a specific target audience seeking prolonged coverage for their devices.

Insights On Key Pricing Model

One-time Payment

One-time payment models are expected to dominate the global mobile phone insurance ecosystem market. This is primarily due to the convenience and affordability that one-time payments offer to consumers. With this model, customers can make a single payment at the time of purchasing their mobile phone insurance, providing them with coverage for a specific period. This pricing model appeals to a wide range of consumers, including those who prefer a one-time financial commitment and those who may not use their phone extensively, making it the dominating option in the market.

Subscription

The subscription model represents another substantial component of the global mobile phone insurance ecosystem market. This pricing structure enables consumers to remit a recurring fee at regular intervals, usually monthly or annually, in return for ongoing insurance protection. It appeals to customers who prefer the flexibility of bundled services, consistent protection, and the ability to easily manage their insurance payments. While the subscription model is not the dominating choice, it still holds a significant market share due to its popularity among certain consumer s.

Pay-per-use

Although not expected to dominate the market, the pay-per-use pricing model remains a notable part within the global mobile phone insurance ecosystem. With this model, customers pay for insurance coverage based on their actual usage or the specific services they require. This dynamic pricing approach allows consumers to have more control over their insurance expenses and can be particularly attractive to individuals who use their phones sparingly or for specific purposes. While the pay-per-use model may not hold the dominant position, it still caters to a niche market within the mobile phone insurance ecosystem.

Insights on Regional Analysis:

North America

North America stands out as the leading region in the global mobile phone insurance ecosystem market. This can be attributed to the elevated rate of smartphone adoption, alongside the growing desire for mobile phone protection plans in the area. Moreover, the presence of prominent smartphone manufacturers and insurance providers contributes significantly to market expansion in North America.

Latin America

Latin America exhibits significant potential for growth in the mobile phone insurance ecosystem market. The region is experiencing a rise in smartphone penetration and an increasing need for device protection. Furthermore, the expansion of mobile network coverage and the introduction of affordable smartphones contribute to the growing demand for insurance plans in Latin America.

Asia Pacific

Asia Pacific is a fast-growing market for mobile insurance ecosystems. The region's large population, combined with increased smartphone adoption, creates enormous growth opportunities. Furthermore, growing awareness of the benefits of mobile phone protection plans fuels market demand in Asia Pacific. Emerging economies and advancements in mobile technology all contribute to the market's growth.

Europe

Europe showcases substantial growth potential in the mobile phone insurance ecosystem market. The region's high smartphone penetration rate and the increasing demand for advanced mobile devices drive the need for insurance coverage. Additionally, the presence of established insurance providers and the growing awareness of device protection contribute to the market's expansion in Europe.

Middle East & Africa

The Middle East & Africa region presents a growing market for mobile phone insurance ecosystems. The rising smartphone adoption rate and the need for secure device protection drive the market's growth in this region. Additionally, the increasing popularity of advanced mobile services and the evolving insurance landscape contribute to the expansion of mobile phone insurance in the Middle East & Africa.

Company Profiles:

Prominent participants in the Global Mobile Phone Insurance Ecosystem sector comprise mobile virtual network operator, insurance providers, and mobile device manufacturers. Mobile network operators furnish insurance solutions to their clients, insurance firms deliver various coverage packages with seamless claim handling, and mobile device manufacturers contribute to the ecosystem by providing essential technical support and replacement services.

Major participants within the Mobile Phone Insurance Ecosystem Market consist of leading companies such as Allianz, Assurant, Aviva, Marsh, Asurion, Vodafone, Tenexx, Liberty Mutual, AIG, Hollard Group, Chubb, SoftBank, Orange, Plantronics, Three, Telefonica, Zurich, NTT Docomo, Xiaomi, Samsung, Apple, and Huawei.

COVID-19 Impact and Market Status:

The outbreak of the Covid-19 virus has resulted in a notable decrease in the need for mobile phone insurance, as customers focus on essential expenses and restrain from non-essential buying.

The mobile phone insurance sector has been significantly impacted by the COVID-19 pandemic. Global restrictions and social distancing measures implemented to control the virus's spread have resulted in reduced consumer spending and supply chain disruptions, leading to a decline in smartphone sales. Consequently, the demand for mobile phone insurance has also been affected, with consumers being more mindful of their expenses and hesitant to invest in device coverage. Moreover, the increased reliance on smartphones for communication and productivity due to the shift to remote work and online learning has created opportunities for insurance providers to offer specialized coverage for professional and educational purposes. Furthermore, the rise in remote work has resulted in an uptick in cyber security threats, increasing the need for insurance covering mobile phone-related cyber risks. Despite the challenges posed by the pandemic, there is potential for innovation and the expansion of coverage to meet changing consumer demands in the mobile phone insurance industry.

Latest Trends and Innovation:

- In September 2020, Allianz Partners announced a partnership with Orange Belgium to launch mobile phone insurance products in Belgium.

- T-Mobile launched its device protection program called Premium Device Protection Plus in May 2018.

- In February 2021, AT&T introduced a new insurance offering called AT&T Protect Advantage for 5G devices, providing coverage for mobile phones in the 5G era.

- In July 2020, Vodafone partnered with Asurion, a global mobile tech care company, to offer mobile phone insurance services to its customers in Germany.

- In November 2019, SquareTrade, a subsidiary of Allstate, launched a new specialty protection plan called "Multipurpose Warranty" covering mobile phones and other electronics.

- In June 2021, Verizon collaborated with Assurant to offer mobile phone protection plans to its customers, backed by their expertise and insurance services.

- In August 2020, AT&T announced the expansion of its insurance program to cover tablets, laptops, and wearables, in addition to mobile phones.

- In February 2019, Samsung partnered with Marsh, an insurance broker, to launch a smartphone insurance program in Malaysia, covering accidental damage, theft, and loss.

- In March 2021, Apple introduced AppleCare+, an extended warranty and insurance program for iPhones, offering coverage for accidental damage and device theft.

Significant Growth Factors:

The expansion drivers of the Mobile Phone Insurance Ecosystem Market encompass the escalating rates of smartphone adoption, ened consumer consciousness regarding device safeguarding, and the surging need for all-encompassing coverage schemes.

The mobile phone insurance sector is experiencing substantial expansion owing to various influential factors. Firstly, the global proliferation of smartphones has triggered a surge in the demand for mobile insurance services. As the prices of smartphones continue to rise, consumers are increasingly seeking safeguarding against accidents, theft, and damages, thereby fueling the need for insurance coverage. Secondly, the rapid evolution of technology has led to the introduction of more sophisticated and costly smartphones, characterized by fragile features, prompting consumers to opt for insurance protection. Moreover, the ened consumer awareness regarding the advantages of mobile insurance, such as seamless replacements and repairs, has also played a role in fostering market growth. Additionally, the proliferation of e-commerce platforms and the availability of convenient insurance options through online channels have simplified the process of acquiring mobile phone insurance for consumers. Furthermore, the introduction of innovative insurance solutions like device-specific coverage and bundled insurance packages has attracted a broader clientele. Lastly, strategic collaborations between mobile phone manufacturers and insurance firms have been instrumental in stimulating market expansion, offering integrated insurance services to consumers. In essence, these driving forces underscore the escalating significance of mobile phone insurance in an ever-changing digital environment.

Restraining Factors:

The growth of the mobile phone insurance ecosystem market faces limitations due to rising competition, inadequate consumer education, and complicated procedures for filing claims.

The Mobile Phone Insurance Ecosystem Market exhibits rapid growth potential; however, it encounters several obstacles that could impede its expansion. One critical challenge is the elevated costs associated with mobile phone insurance premiums, rendering it impractical for many consumers, particularly in developing economies where financial constraints may deter investment in such insurance. Moreover, the intricate terms and convoluted claims procedures of insurance policies can dissuade potential clients from choosing mobile phone coverage. Additionally, the industry grapples with a rising prevalence of fraudulent claims, jeopardizing insurers' financial stability and potentially leading to increased premiums for policyholders. Furthermore, insufficient consumer awareness regarding the advantages of mobile phone insurance coupled with the lack of robust marketing campaigns by insurance providers present further hurdles for market growth. Lastly, the availability of alternative solutions such as extended warranties offered by manufacturers and retailers may divert individuals away from mobile phone insurance offerings.

Despite these inhibiting factors, the market possesses considerable promise. Through enhanced affordability, transparent policy frameworks, streamlined claims processes, and bolstered consumer education initiatives via effective marketing endeavors, the Mobile Phone Insurance Ecosystem Market can surmount these challenges and thrive in the future. This growth can foster a more secure and safeguarded mobile phone ownership landscape, enhancing the overall consumer experience.

Key Segmentation:

Key Segments of the Mobile Phone Insurance Market

Product Overview

- Wireless Carriers

- Insurance Specialists

- Device OEMs

- Retailers

Application Overview

- Physical Damage

- Theft & Loss

- Accidental Damage

- Software Malfunction

Coverage Overview

- Replacement

- Repair

- Extended Warranty

Pricing Model Overview

- Subscription

- Pay-per-use

- One-time Payment

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions (FAQ) :

Table of Contents

1. Introduction

1.1. Introduction

1.2. Units, Currency, Conversions, and Years Considered

1.3. Market Definition and Scope

1.4. Key Stakeholders

1.5. Key Questions Answered

2. Research Methodology

2.1. Introduction

2.2. Data Capture Sources

2.3. Market Size Estimation

2.4. Market Forecast

2.5. Data Triangulation

2.6. Assumptions and Limitations

3. Market Outlook

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. Porter’s Five Forces Analysis

3.4. PEST Analysis

4. Mobile Phone Insurance Ecosystem Market by Product

4.1. Wireless Carriers

4.2. Insurance Specialists

4.3. Device OEMs

4.4. Retailers

5. Mobile Phone Insurance Ecosystem Market by Application

5.1. Physical Damage

5.2. Theft & Loss

5.3. Accidental Damage

5.4. Software Malfunction

6. Mobile Phone Insurance Ecosystem Market by Coverage

6.1. Replacement

6.2. Repair

6.3. Extended Warranty

7. Mobile Phone Insurance Ecosystem Market by Pricing Model

7.1. Subscription

7.2. Pay-per-use

7.3. One-time Payment

8. Mobile Phone Insurance Ecosystem Market by Region

8.1. North America

8.1.1. US

8.1.2. Canada

8.1.3. Mexico

8.2. Europe

8.2.1. Germany

8.2.2. France

8.2.3. U.K

8.2.4. Rest of Europe

8.3. Asia Pacific

8.3.1. China

8.3.2. Japan

8.3.3. India

8.3.4. Rest of Asia Pacific

8.4. Middle East & Africa

8.4.1. Saudi Arabia

8.4.2. UAE

8.4.3. Rest of Middle East and Africa

8.5. Latin America

8.5.1. Brazil

8.5.2. Argentina

8.5.3. Rest of Latin America

9. Competitive Landscape

9.1. Allianz

9.2. Assurant

9.3. Aviva

9.4. Marsh

9.5. Asurion

9.6. Vodafone

9.7. Tenexx

9.8. Liberty Mutual

9.9. AIG

9.10. Hollard Group

9.11. Chubb

9.12. SoftBank

9.13. Orange

9.14. Plantronics

9.15. Three

9.16. Telefonica

9.17. Zurich

9.18. NTT Docomo

9.19. Xiaomi

9.20. Samsung

9.21. Apple

9.22. Huawei

10. Appendix

10.1. Primary Research Approach

10.1.1. Primary Interview Participants

10.1.2. Primary Interview Summary

10.2. Questionnaire

10.3. Related Reports

10.3.1. Published

10.3.2. Upcoming