Market Analysis and Insights:

The market for Global Nuclear Decommissioning was estimated to be worth USD 4.19 billion in 2021, and from 2022 to 2030, it is anticipated to grow at a CAGR of 5.31%, with an expected value of USD 6.33 billion in 2030.

.jpg)

The nuclear decommissioning market is primarily driven by a combination of economic, policy, and environmental factors. On the economic front, the ageing nuclear power plants and the need to ensure safe and secure decommissioning processes generate demand for specialized services and technologies. This creates opportunities for companies involved in project management, engineering, e-waste management, and environmental remediation. Additionally, strict regulatory frameworks and smart government policies aimed at promoting the safe closure and decommissioning of nuclear facilities further drive the market. Concerns over public safety, potential environmental risks, and the need to manage radioactive waste effectively also contribute to the growth of the market. Moreover, increasing public awareness and focus on renewable energy sources and phasing out nuclear power in some countries create a need for decommissioning existing facilities.

Nuclear Decommissioning Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 6.33 billion |

| Growth Rate | CAGR of 5.31% during 2022-2030 |

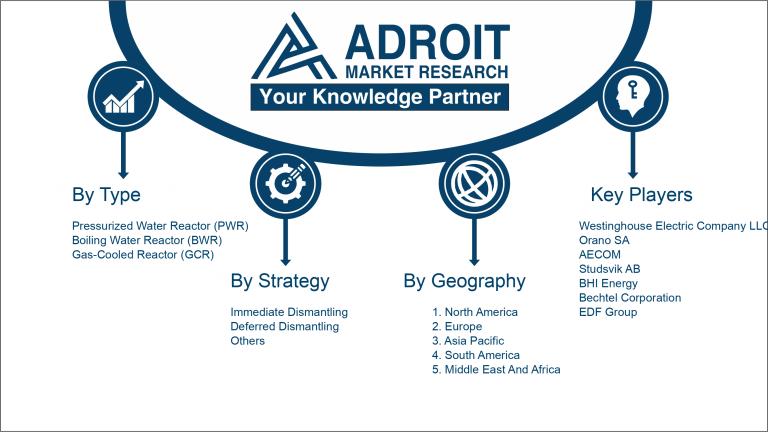

| Segment Covered | By Reactor Type, By Strategy, By Capacity, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Westinghouse Electric Company LLC, Orano SA, Studsvik AB, Bechtel Corporation, AECOM, BHI Energy, and EDF Group. |

Market Definition

Nuclear decommissioning refers to the process of safely dismantling and removing a nuclear power plant or radioactive facility and securely managing its radioactive waste, to ensure the protection of human health and the environment.

Nuclear decommissioning is a vital process that aims to dismantle and safely remove nuclear power plants and their radioactive materials. This practice is essential for several reasons. Firstly, it ensures the elimination of potential environmental hazards posed by ageing or damaged nuclear facilities, preventing radioactive leakage into the environment. Secondly, decommissioning allows for the effective management and disposal of radioactive waste, minimizing the risks to human health and future generations. Additionally, it supports the development of cleaner, sustainable alternatives by repurposing the site for renewable energy generation or other productive uses. Lastly, decommissioning provides economic opportunities through job creation and technology advancements, spurring innovation and growth in the renewable energy sector. Overall, nuclear decommissioning is a critical process for safeguarding the environment, and public health and promoting a sustainable future.

Key Market Segmentation:

Insights On Key Reactor Type

PWR (Pressurized Water Reactor):

Among the different reactor types in the global nuclear decommissioning market, the PWR (Pressurized Water Reactor) segment is expected to dominate. PWRs are widely used in nuclear power plants across the world due to their efficiency and safety features. However, as these reactors near the end of their operational life, they require decommissioning to ensure safety and proper disposal of radioactive waste. The dominance of the PWR segment can be attributed to the large number of PWR reactors currently in operation globally and the increasing number of PWRs reaching the end of their operational life.

BWR (Boiling Water Reactor):

The BWR (Boiling Water Reactor) segment within the By Reactor Type category is another significant part of the global nuclear decommissioning market. BWR reactors work on the principle of using boiling water to generate steam, which drives the turbine to produce electricity. The BWR segment holds a substantial market share due to the presence of BWR reactors in several countries and their contribution to the overall nuclear power generation capacity.

GCR (Gas Cooled Reactor):

While PWRs and BWRs dominate the global nuclear decommissioning market, the GCR (Gas Cooled Reactor) segment also plays a notable role. GCR reactors use carbon dioxide incubators or helium as coolants, which transfer heat from the nuclear fuel to the power cycle. Although less common than PWRs and BWRs, GCRs are employed in some countries for nuclear power generation. As these reactors reach the end of their operational life, decommissioning becomes necessary, contributing to the market for nuclear decommissioning services in this segment. While the GCR segment may have a smaller market share compared to PWRs and BWRs, it still represents a significant portion of the global nuclear decommissioning market.

Insights On Key Strategy

Immediate Dismantling

Immediate dismantling is expected to dominate the global nuclear decommissioning market. Immediate dismantling refers to the decommissioning strategy where nuclear facilities are dismantled soon after shutdown. With the increasing number of obsolete nuclear facilities worldwide, the demand for immediate dismantling is expected to be high, driving the growth of this segment in the global market.

Deferred Dismantling

Deferred dismantling is another key segment of the global nuclear decommissioning market. In deferred dismantling, nuclear facilities are kept in a safe storage state for an extended period before dismantling. This strategy allows for a longer period of monitoring activities and assessment of potential hazards, ensuring that the decommissioning process is carried out under the best possible conditions. The demand for deferred dismantling is expected to rise due to the need for careful planning and cost optimization in the decommissioning process.

Others

The "Others" segment includes alternative strategies for nuclear decommissioning that are less commonly used compared to immediate and deferred dismantling. One such strategy is phased dismantling, where the decommissioning process is carried out in multiple stages, allowing for the gradual and systematic removal of equipment and structures. Another strategy is safe enclosure, which involves maintaining the nuclear facility in a safeguarded state without immediate decommissioning. These alternative strategies offer flexibility and adaptability in addressing specific decommissioning requirements and challenges. Although the demand for these strategies may be relatively lower compared to immediate and deferred dismantling, they still hold significant potential in niche applications and unique decommissioning scenarios.

Insights On Key Capacity

Dominating Part: Above 1000MW

The segment "Above 1000MW" is expected to dominate the Global Nuclear Decommissioning market. Nuclear power plants with a capacity above 1000MW are generally larger and more complex, requiring extensive decommissioning processes. As these plants reach the end of their operational lives, the demand for nuclear decommissioning services is projected to increase significantly. The decommissioning of larger plants involves various challenges and regulatory requirements, necessitating specialized expertise and advanced technologies.

Up to 800MW

The segment "Up to 800MW" is an important component of the Global Nuclear Decommissioning market. Nuclear power plants falling in this capacity range are widespread across many countries and account for a considerable share of global nuclear energy production. As these plants age and face economic or safety concerns, the need for decommissioning arises. The decommissioning of such plants involves dismantling and safe disposal of radioactive materials, as well as site remediation. The "Up to 800MW" segment is expected to witness steady growth as more plants in this capacity range approach the end of their operational lives.

801MW-1000MW

The segment "801MW-1000MW" is another significant segment within the Global Nuclear Decommissioning market. Nuclear power plants falling within this capacity range are typically larger than those in the "Up to 800MW" segment but smaller than the ones in the "Above 1000MW" segment. These plants require similar decommissioning processes, including the safe removal of radioactive materials and site remediation. The "801MW-1000MW" segment is projected to witness a moderate market share, driven by the retirement of older plants and the adoption of alternative energy sources in certain regions.

Others

The segment "Others" comprises nuclear power plants with capacities that do not fall within the defined ranges of up to 800MW, 801MW-1000MW, or above 1000MW. This segment generally includes smaller nuclear facilities that may vary greatly in capacity. While the market size for this segment is considerably smaller compared to the dominant "Above 1000MW" segment, it still plays a role in the overall Global Nuclear Decommissioning market. The decommissioning requirements for these smaller plants are typically less complex and may involve the decommissioning of research reactors or other specialized nuclear facilities. The "Others" segment is expected to have a minor but important presence in the Global Nuclear Decommissioning market.

Insights on Regional Analysis:

North America:

North America is expected to dominate the global nuclear decommissioning market due to the presence of a large number of nuclear power plants and their significant contribution to the region's energy production. The United States, in particular, is a key player in this market, with numerous decommissioning projects planned or underway. Additionally, stringent regulatory frameworks and technological advancements further enhance the region's dominance in this industry.

Europe:

In Europe, the nuclear decommissioning market is projected to witness substantial growth. With many ageing nuclear power plants, countries like Germany, France, and the United Kingdom are actively engaged in decommissioning projects. Stringent safety regulations and the emphasis on renewable energy sources are driving the demand for decommissioning services in this region, creating ample opportunities for market players.

Asia Pacific:

The Asia Pacific region is also expected to experience noteworthy growth in the nuclear decommissioning market. Countries like Japan, South Korea, and China have a significant number of nuclear power plants that are either reaching the end of their operational life or require decommissioning due to safety concerns. Stringent regulatory measures, coupled with the shift towards renewable energy, are fueling the demand for nuclear decommissioning services in this region.

Middle East & Africa:

The Middle East & Africa region is still in the early stages of nuclear power generation and does not currently have many nuclear power plants. Therefore, the nuclear decommissioning market in this region is relatively limited. However, with the potential for future nuclear power development, countries like the United Arab Emirates and South Africa may have decommissioning requirements in the long term, presenting opportunities for market growth.

South America:

South America has a limited presence in the nuclear decommissioning market. Brazil is the only country in the region with active nuclear power plants, but they are relatively new and have not yet reached their end of life. As a result, the demand for decommissioning services in South America is currently minimal. However, with the potential for future nuclear power development in other countries, the market landscape may change over time, creating opportunities for market players.

Company Profiles:

1. The key players in the global nuclear decommissioning market play a pivotal role in providing expertise and services for the safe and efficient dismantling and closure of nuclear power plants, ensuring compliance with regulatory requirements.

2. These players offer comprehensive solutions, including project management, waste management, decontamination, and remediation, to properly handle the complex challenges associated with nuclear decommissioning and contribute towards a cleaner and safer environment.

Some of the key players in the Nuclear Decommissioning Market include Westinghouse Electric Company LLC, Orano SA, Studsvik AB, Bechtel Corporation, AECOM, BHI Energy, and EDF Group. These companies are recognized globally for their expertise in providing services related to the decommissioning of nuclear power plants and facilities. These industry leaders play a crucial role in ensuring the safe and efficient decommissioning of nuclear facilities, adhering to strict regulations and guidelines set by government authorities. With their extensive experience and technological capabilities, these key players contribute significantly to the advancement of the nuclear decommissioning market worldwide.

COVID-19 Impact and Market Status:

The COVID-19 pandemic has significantly impacted the global nuclear decommissioning market, causing delays and disruptions in project timelines and posing challenges for workforce management and international collaborations.

The implementation of lockdown measures and the subsequent decline in industrial activities have led to delays and disruptions in ongoing decommissioning projects. Restricted access to sites, supply chain disruptions, and reduced workforce availability have resulted in project delays and increased costs. Moreover, the economic uncertainty caused by the pandemic has led to a decline in investment in nuclear decommissioning projects, as companies prioritize short-term financial stability. The reduction in government budgets and the diversion of resources to address the immediate healthcare crisis has further compounded the challenges faced by the nuclear decommissioning market. However, as the world begins to recover from the pandemic, government stimulus measures and increasing awareness of the need for clean energy alternatives may provide opportunities for growth in the nuclear decommissioning market. Innovative technologies and improved safety measures will be crucial in overcoming the challenges posed by COVID-19 and ensuring the successful completion of decommissioning projects.

Latest Trends and Innovation:

- On January 15, 2018, Westinghouse Electric Company, a leading nuclear energy company, announced an agreement with the Nuclear Decommissioning Authority (NDA) to transfer its interest in the UK Nuclear Decommissioning Limited (UKND) to NDA.

- On February 28, 2019, AECOM completed the acquisition of the remaining 49% equity interest in the U.S.-based joint venture, Nuclear Waste Partnership LLC (NWP), from EnergySolutions.

- On April 1, 2020, ENGIE announced the acquisition of a 40% stake in NuGeneration (NuGen), a British nuclear power development company, from Toshiba.

- On May 19, 2021, Orano Group, a global leader in nuclear fuel, announced the acquisition of Atomic Energy of Canada Limited (AECL)'s Applied Technology Division, strengthening its decommissioning and waste management capabilities.

- On July 7, 2021, BHI Energy, a leading provider of speciality services to the power generation industry, announced the acquisition of Coastal Gulf & International, an industry leader in nuclear decommissioning.

- On September 9, 2021, Veolia, a French transnational company, completed the acquisition of Kurion, a leading company in nuclear waste management and clean-up technologies.

- On December 14, 2021, NorthStar Group Services, a specialized energy services provider, announced the acquisition of Westinghouse Electric Company's Decommissioning Business Line, expanding its capabilities in nuclear decommissioning and environmental remediation.

Significant Growth Factors:

Firstly, the increasing number of ageing nuclear power plants worldwide is driving the demand for decommissioning services. As these plants reach the end of their operational lifespan, there is a need to safely dismantle and decontaminate them, leading to a surge in decommissioning projects. Additionally, the growing concerns over the safety and environmental risks associated with nuclear plants are pushing governments towards decommissioning initiatives. Stricter regulations and policies focused on reducing carbon emissions and promoting renewable energy sources are also influencing market growth as countries opt for the decommissioning of nuclear power plants. Moreover, advancements in decommissioning technologies and techniques are enabling safer and more efficient decommissioning processes, further driving market growth. The increasing focus on waste management and the emergence of specialized decommissioning service providers are also contributing to the market expansion. Finally, the need for skilled professionals in the nuclear decommissioning sector is creating job opportunities and generating economic growth.

Restraining Factors:

The nuclear decommissioning market faces several restraining factors that hinder its growth and efficiency. Firstly, one of the major challenges is the high cost associated with the decommissioning process. The procedures involved in decommissioning nuclear power plants are complex and require extensive safety measures, which significantly increase the overall cost. Additionally, the lack of technical expertise in handling and disposal of radioactive waste further adds to the expenses. Furthermore, the regulatory framework is also a limiting factor as it can lead to delays and uncertainty in the decommissioning process. The stringent regulations imposed by government authorities to ensure safety and environmental protection often result in lengthier approval processes and increased compliance requirements, thus impacting the market's growth. Moreover, public opposition towards nuclear energy and decommissioning activities can also hinder the progress of the market. Many individuals and environmental groups have concerns regarding the long-term impact and safety of decommissioning activities, leading to protests and legal challenges, further delaying the process. However, despite these challenges, the nuclear decommissioning market offers ample opportunities for growth and innovation. The development of efficient and cost-effective decommissioning methods, coupled with improved waste management techniques, will enable the industry to address the current limitations successfully. Therefore, although there are challenges to be addressed, the nuclear decommissioning market holds promise for a positive future.

Key Segments of the Nuclear Decommissioning Market

Market Overview

• By Reactor Type

- Pressurized Water Reactor (PWR)

- Boiling Water Reactor (BWR)

- Gas-Cooled Reactor (GCR)

• By Strategy

- Immediate Dismantling

- Deferred Dismantling

- Others

• By Capacity

- Up to 800MW

- 801MW-1000MW

- Above 1000MW

- Others

Distribution Channel Overview

• Insurance Intermediaries

• Insurance Companies

• Banks

• Insurance Brokers

• Insurance Aggregators

End-User Overview

• Senior Citizens

• Education Travelers

• Business Travelers

• Family Travelers

• Others

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America