Offshore Wind Energy Market Analysis and Insights:

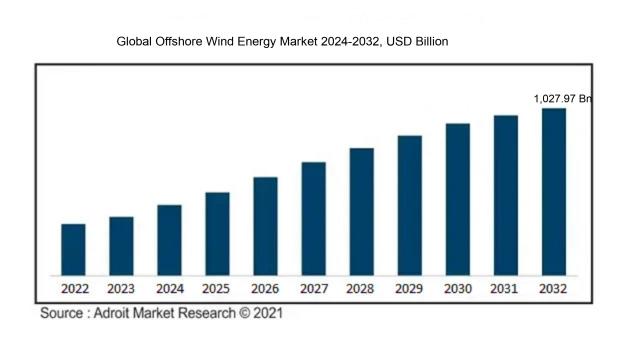

In 2022, the offshore wind energy market was projected to be worth 98.30 billion USD. The offshore wind energy market is projected to expand at a compound annual growth rate (CAGR) of around 28.50% from 2024 to 2032, from 125.21 billion USD in 2023 to 1,027.97 billion USD in 2032.

The offshore wind energy sector is influenced by several fundamental drivers, chief among them being the escalating global appetite for renewable energy as a means to address climate change and lower carbon footprints. Innovations in technology have greatly enhanced the functionality and dependability of offshore wind turbines, rendering them increasingly economical. Furthermore, government initiatives, including financial incentives and support mechanisms such as subsidies and feed-in tariffs, are essential in promoting investment in offshore wind initiatives. The desire for energy autonomy and security is inspiring nations to broaden their energy portfolios, with offshore wind presenting considerable opportunities in coastal areas. Concerns regarding environmental sustainability and widespread public endorsement for clean energy projects further reinforce the market's growth. Additionally, the surge in investments from both governmental and private entities, along with international partnerships, plays a vital role in progressing the industry, as countries work towards fulfilling their renewable energy goals and shifting to a more sustainable energy paradigm.

Offshore Wind Energy Market Definition

Offshore wind energy involves the production of electricity using wind turbines situated in aquatic environments, primarily oceans. This form of renewable energy leverages the robust and steady winds found at sea, offering a cleaner energy solution compared to numerous onshore options.

Offshore wind energy is pivotal in advancing the shift towards renewable energy sources, providing significant advantages for ecological sustainability and energy reliability. By leveraging the strong and consistent winds found over the seas, offshore wind installations can produce considerable electricity while emitting minimal carbon, thus playing an important role in efforts to combat climate change. Furthermore, these projects stimulate economic development by creating jobs across manufacturing, installation, and maintenance domains. Offshore wind energy also aids in diversifying power generation, decreasing dependence on fossil fuels, and strengthening energy autonomy for countries. As technological innovations progress, the capacity of offshore wind to supply clean and dependable energy continues to expand, establishing it as a vital component in future energy planning.

Offshore Wind Energy Market Segmental Analysis:

Insights on Key Turbine Capacity

6-10 MW

The 6-10 MW category is expected to dominate the Global Offshore Wind Energy Market due to its optimal balance between efficiency and energy output. Turbines in this range offer significant capacity, allowing for greater power generation while still being feasible for offshore installations. Advances in technology have enabled wind turbine manufacturers to enhance the performance and reliability of these mid-sized turbines, making them increasingly attractive to energy developers. As countries invest heavily in renewable energy and set ambitious targets for offshore wind capacities, the demand for 6-10 MW turbines is likely to surge, positioning them as the leading choice in the market.

Up to 3 MW

The Up to 3 MW category has been historically popular, particularly for smaller projects and regions with limited space or wind resources. However, while still relevant, this is gradually losing ground as technological advancements push the boundaries of turbine capacity. These smaller turbines often have lower energy outputs, which can hinder their competitiveness against larger models that provide better scalability and efficiency. Consequently, while this range may continue to see some deployment in specific niche markets, its overall influence is diminishing in the face of growing demand for larger turbine capacities.

3-6 MW

The 3-6 MW range serves as a transitional option, appealing primarily to developers aiming for a balance between cost and power output. These turbines have found traction in many established offshore energy markets, often used in scaling projects that initially utilize smaller capacities. They may experience moderate growth as new projects seek a compromise between budget constraints and performance. However, the increasing trend toward larger installations means this category is likely to see constrained growth opportunities in the long run, as industry focus shifts to more powerful systems.

Above 10 MW

The Above 10 MW category is gaining traction due to the push for utility-scale projects and ambitions to maximize energy output. This is characterized by several emerging technologies aiming for even greater efficiencies and capabilities. While the initial investment for these turbines is significant, the long-term benefits in terms of energy yield and operational cost-effectiveness drive interest. Nevertheless, the logistical challenges of installation and maintenance in offshore environments can limit widespread adoption in the short term. Thus, while it represents the future of turbine technology, its current market penetration remains comparatively low.

Insights on Key Water Depth

Transitional

The Transitional category (50-200 meters) is expected to dominate the Global Offshore Wind Energy market due to its advantageous positioning that balances economic viability and technical efficiency. Projects in this depth range are more cost-effective to develop and maintain compared to deeper installations while maximizing energy output from favorable wind conditions. The ability to harness wind energy efficiently at this level allows for a more stable investment environment, attracting numerous stakeholders and leading to a surge in project development. With advancements in turbine technology specifically tailored for these depths and a focus on reducing costs, the Transitional’s growth will significantly overshadow the competition from shallow and deep options.

Shallow

The Shallow category (0-50 meters) is characterized by easier installation processes and lower infrastructure costs. Many earlier offshore wind installations were founded in these depths, establishing a robust operational experience and a proven technological base. However, as the market matures, developers are gravitating towards deeper waters, prompted by limited space and wind resource quality in coastal areas. While the shallow zone still plays a role in current projects, future growth will likely be stifled as potential is recognized in deeper waters with better wind profiles.

Deep

The Deep category (>200 meters) offers an opportunity for substantial energy gains owing to stronger and more consistent winds that occur farther offshore. Although these zones promise high yields, they face challenges including higher construction and maintenance costs, along with the complexity of technology deployment in harsher marine conditions. Due to these economic barriers, developments in deep waters have not gained the same momentum as other categories, resulting in comparatively fewer projects. The entry of innovative floating wind turbine technologies could change this landscape, but as of now, it lags behind the more favorable Transitional .

Insights On Key Foundation Type

Monopile

Monopile foundations are anticipated to dominate the Global Offshore Wind Energy Market due to their cost-effectiveness, ease of installation, and suitability for a majority of offshore sites, especially in shallow waters. They have become the go-to choice for many wind farm developers as they require simpler logistics and construction processes compared to other foundation types. Moreover, advancements in monopile design, such as larger diameters and improved manufacturing technologies, have further enhanced their performance and viability in challenging offshore conditions. This growing preference is evidenced by many new projects adopting monopile foundations, reinforcing their leading position in the industry.

Jacket

Jacket foundations are typically used in deeper waters, which makes them essential for offshore wind farms located in such environments. Their design allows for better stability and resistance to harsh sea conditions, which complements the increasing trend of wind turbine installations in deeper locations. However, the higher complexity and cost of installation are barriers that may restrict their widespread use compared to monopile foundations. While they offer distinct advantages, particularly for large turbines in deep waters, current market momentum favors the simpler monopile foundations.

Tripile

Tripile foundations are a relatively newer concept and are primarily deployed for specific applications such as high-load scenarios and complex seabed conditions. Their design offers a balance between the advantages of monopile and jacket foundations. However, their adoption is still limited due to the lack of extensive operational experience and a higher installation cost. As innovations develop within the offshore wind sector, tripile foundations may gain traction in niche applications but are unlikely to outperform the dominant monopile models in broad market scenarios.

Gravity-based

Gravity-based foundations rely on their weight to stay in position, which is advantageous in rocky and irregular seabed conditions. While they provide excellent stability, they face significant challenges related to logistics and installation. Their overall cost can be higher than other options due to the significant transportation and deployment resources required. This type has historically been used in certain instances but is now becoming less favorable in the face of increased deployments of monopile and jacket foundations, which are more adaptable to various marine settings.

Insights on Key Voltage Level

220 kV

The 220 kV voltage level is expected to dominate the Global Offshore Wind Energy Market. This provides a balance between infrastructure cost and energy transmission efficiency, making it an attractive choice for developers and utilities alike. The growing demand for higher capacity and longer-distance transmission connections means that 220 kV systems are often preferred, especially in regions with limited grid infrastructure. Moreover, advancements in technology have made it feasible to implement these systems, which allows for optimal integration of offshore wind projects into the existing energy grid. The combination of technical adaptability and economic viability positions the 220 kV level as the leading choice among industry stakeholders.

33 kV

The 33 kV voltage level is primarily utilized for connecting offshore wind farms to the local electricity grid. This voltage is typically employed in smaller wind farms or those that are located closer to shore. The advantages of 33 kV systems include lower installation costs and the ability to effectively support smaller-scale projects. However, its limitations in power transmission capacity restrict its scalability, making it less favorable for larger offshore projects that require more robust and efficient solutions to export the generated wind energy.

66 kV

The 66 kV voltage level serves as a transitional solution between lower and higher voltage levels in offshore wind applications. It can be seen as an optimal choice for mid-sized wind farms seeking to connect to the grid without incurring the higher costs associated with higher voltage systems. While it provides good efficiency for energy transmission over moderate distances, its application is diminishing as the industry transitions toward higher voltage levels that promise better energy output and enhanced grid integration capabilities.

132 kV

The 132 kV voltage level is emerging as a practical option for mid-tier offshore wind farms. It facilitates the transmission of larger volumes of energy over greater distances than lower voltage systems, providing effective integration into the grid. However, its adoption has been overshadowed by the rapid advancements and investment in 220 kV and 400 kV systems that promise even greater efficiencies and expanded connectivity. As the market evolves, 132 kV may find niche applications but is unlikely to dominate in a landscape that increasingly favors higher voltage levels.

400 kV

The 400 kV voltage level represents the pinnacle of high-capacity transmission for offshore wind energy projects. It is designed for very large wind farms that need to send substantial electricity over long distances efficiently. While it boasts advantages in terms of lowered transmission losses and increased capacity, it also requires significant investment in infrastructure, making it a less attractive option for smaller projects. As a result, while crucial for the largest developments, it does not dominate the offshore market compared to more pragmatically utilized voltage levels suited for a diverse range of projects.

Insights On Key Grid Connection Type

Grid-Connected via Offshore Grid

The "Grid-Connected via Offshore Grid" category is expected to dominate the Global Offshore Wind Energy Market. This offers significant advantages due to the advancements in technology and increasing investments in offshore grid infrastructure. The ability to connect multiple wind farms through a centralized offshore grid allows for efficient energy transmission and management, which is crucial as the demand for renewable energy surges globally. Moreover, this method enhances grid stability and promotes further integration of renewable sources. As countries aim for energy independence and lower carbon emissions, establishing robust offshore connections is becoming a priority, making this particularly attractive for future growth.

Direct Connect

The "Direct Connect" option, while a viable method of energy transmission, faces limitations in scalability compared to other grid connection types. It primarily connects individual wind farms directly to the local grid, restricting the potential to harness energy from multiple sources effectively. This method may still be used in areas with minimal development, but lacks the infrastructural support that is increasingly being prioritized in modern offshore wind projects. As such, it is not expected to lead the market, especially in regions focusing on larger-scale offshore wind farm developments.

Grid-Connected via Onshore Grid

The "Grid-Connected via Onshore Grid" choice is another acceptable method for linking offshore wind energy to shore. However, it often involves more complex arrangements and potential bottlenecks when transferring energy from offshore facilities to the onshore power grid. These complexities generally arise from higher costs associated with land acquisitions and the upgrading of existing grid systems to accommodate influxes of offshore energy. While this type of connection is important, especially in mature markets, it is less likely to dominate in comparison to the more efficient offshore grid connections being developed and supported by technology advancements in the current energy landscape.

Global Offshore Wind Energy Market Regional Insights:

Europe

Europe is expected to dominate the Global Offshore Wind Energy market due to a combination of strong government policies, significant investments, and technological advancements in renewable energy. Countries like the UK, Germany, and Denmark are leading in offshore wind installations, supported by ambitious targets for carbon reduction and energy diversification. The region benefits from established supply chains, skilled labor, and favorable geographic conditions, which make it conducive for large-scale offshore wind projects. With over 25% of global offshore wind capacity installed, Europe is set to maintain its leadership as it continues to innovate and expand its offshore capabilities.

North America

North America is seeing rapid growth in the offshore wind sector, primarily driven by the United States. Recent legislative support and ambitious targets for renewable energy are propelling markets forward. Coastal states like California and New York are setting goals for offshore wind capacity, and significant investments are being made in infrastructure. While still behind Europe, North America is poised for accelerated growth due to its vast coastline and abundant wind resources, indicating a pivotal shift toward cleaner energy sources.

Asia Pacific

The Asia Pacific region is emerging as a strong contender in the offshore wind energy market, primarily led by China. The country has been investing heavily in renewable energy and aims to increase its offshore wind capacity significantly. Other countries in the region, like Japan and South Korea, are also beginning to develop their offshore wind resources. However, Asia Pacific is currently lagging behind Europe and North America in installed capacity but shows potential for substantial growth and technological advancements in the coming years.

Latin America

Latin America is still in the early stages of developing its offshore wind energy capabilities. While countries like Brazil have begun exploring renewable energy options, the region faces several challenges, including regulatory frameworks, market maturity, and limited technological infrastructure. There is potential for growth, but it remains largely undeveloped compared to Europe or North America. Investment and policy direction will be crucial in determining how quickly Latin America can integrate offshore wind energy into its energy portfolio.

Middle East & Africa

The Middle East & Africa region currently has minimal offshore wind energy developments, primarily due to a focus on traditional fossil fuels and limited infrastructure for renewables. However, there is growing interest in expanding clean energy sources to diversify energy portfolios, especially in countries like South Africa. Investments in wind technology and supportive policy frameworks could lead to future growth, but the region will likely remain a minor player in the global offshore wind energy market for the immediate future.

Offshore Wind Energy Competitive Landscape:

Prominent participants in the Global Offshore Wind Energy sector include manufacturers of turbines, project developers, and energy utility companies. These entities work together to foster technological innovations and enhance infrastructure. Through strategic alliances and financial commitments, they propel the advancement and effectiveness of offshore wind initiatives across the globe.

The offshore wind energy sector is notably influenced by prominent firms such as Ørsted A/S, Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, GE Renewable Energy, Nordex SE, and MHI Vestas Offshore Wind. Additional significant contributors to this industry include Senvion S.A., RWE Renewables, Iberdrola S.A., EDP Renewables, Equinor ASA, Enel Green Power, Shell plc, BP plc, and NextEra Energy Resources, LLC. Key players like Ørsted, Siemens Energy, and Ørsted Wind Power are also pivotal, alongside collaborative efforts and partnerships such as those between Siemens Gamesa and MHI Vestas. Furthermore, other relevant entities in this field consist of Clipper Windpower, Max Bögl Wind AG, and Fred. Olsen Seawind.

Global Offshore Wind Energy COVID-19 Impact and Market Status:

The Covid-19 pandemic caused significant disruptions to supply chains and project schedules within the Global Offshore Wind Energy sector. However, it also catalyzed a ened emphasis on investments in renewable energy as a key component of recovery strategies following the pandemic.

The COVID-19 pandemic had a profound impact on the offshore wind energy sector, presenting both obstacles and prospects. At the onset, the industry encountered significant challenges, including disruptions in supply chains, delays in construction, and a shortage of skilled labor, all of which affected project schedules and increased expenses. Nevertheless, the crisis also underscored the importance of renewable energy as governments turned their attention toward green investments to revitalize their economies. This new direction resulted in enhanced funding and stronger policy backing for offshore wind initiatives, making them more appealing as viable sustainable energy options. Additionally, the pressing need for energy security and reducing carbon emissions accelerated innovation and project deployment within the industry. In summary, despite the immediate operational difficulties faced, the long-term forecast for offshore wind energy appears strong, driven by a rising demand for clean energy and favorable regulatory environments in the aftermath of the pandemic.

Latest Trends and Innovation in The Global Offshore Wind Energy Market:

- In March 2023, Ørsted announced its acquisition of Brookfield Renewable Partners' 50% stake in the Hornsea Two offshore wind farm, enhancing its position as a leading player in the offshore wind sector.

- In June 2023, Siemens Gamesa launched its SG 14-222 DD offshore wind turbine, which boasts a capacity of 15 MW and features an expanded rotor diameter of 222 meters, aimed to increase efficiency and power generation in offshore projects.

- In August 2023, Vestas partnered with the Danish energy company Ørsted to develop a pilot project in the North Sea using their latest V236-15.0 MW turbine, targeting significant reductions in the cost of energy generated by offshore wind.

- In October 2023, Dominion Energy announced a merger with the Danish firm Orsted to jointly develop the Coastal Virginia Offshore Wind (CVOW) project, which will be one of the largest offshore wind plants in the United States upon completion.

- In September 2023, GE Renewable Energy confirmed the successful installation of its Haliade-X turbine model at the Dogger Bank Wind Farm in the North Sea, marked as the first prototype in operational conditions, significantly pushing the boundaries of offshore turbine technology.

- In May 2023, Iberdrola finalized the acquisition of the 600 MW Vineyard Wind 1 project in Massachusetts from Avangrid Renewables, reinforcing its commitment to the U.S. offshore wind market.

- In July 2023, BP and Equinor made a significant joint investment of $5 billion in a new offshore wind farm off the coast of New York, which is expected to generate up to 2.4 GW of energy, targeting operational status by 2027.

- In April 2023, TotalEnergies entered into a partnership with RWE to develop a floating offshore wind project in the Atlantic, aiming to leverage innovative technologies to harness wind resources in deeper waters.

- In January 2023, the UK government announced a £200 million investment to support offshore wind innovation projects, encouraging collaboration among companies like Shell, SSE, and EDF to develop next-generation technologies and solutions.

- In February 2023, the global offshore wind project portfolio of Eni increased significantly after the company secured development rights for a combined 3 GW from three new projects in the Atlantic region, strengthening its renewable energy strategy.

Offshore Wind Energy Market Growth Factors:

Crucial drivers propelling the offshore wind energy sector encompass technological innovations, ened financial backing, supportive governmental regulations, and an escalating need for sustainable energy alternatives.

The Offshore Wind Energy sector is witnessing remarkable expansion, attributed to several crucial elements. Firstly, the rising global demand for energy combined with the pressing necessity to switch to renewable alternatives is fueling investments in offshore wind initiatives. Nations are striving to fulfill carbon reduction commitments under global agreements such as the Paris Accord, with offshore wind technology emerging as a practical substitute for fossil fuels. Moreover, breakthroughs in turbine design have resulted in larger, more efficient models capable of producing energy at lower costs, thus improving the financial feasibility of offshore wind projects. Additionally, government incentives and subsidies play a significant role in promoting market development by alleviating financial challenges for developers. The decline in installation and operational expenses, alongside improved grid infrastructure that supports offshore wind energy, also greatly aids in market growth. Increased participation from private investors and partnerships provides additional funding for new projects. Finally, ened public awareness of climate change and the shift toward sustainable energy solutions has fostered a positive market atmosphere, encouraging engagement from various stakeholders in offshore wind ventures. Collectively, these dynamics are set to propel the offshore wind energy market forward in the upcoming years, establishing it as a fundamental aspect of the global renewable energy sector.

Offshore Wind Energy Market Restaining Factors:

The offshore wind energy sector faces several significant impediments, such as elevated installation expenses, regulatory hurdles, and rivalry from other renewable energy options.

The offshore wind energy sector is on the brink of significant expansion but encounters various challenges that could impede its advancement. The high initial capital investment required for the establishment of offshore wind farms constitutes a major obstacle, necessitating considerable financial resources for technology, infrastructure development, and ongoing maintenance. Furthermore, regulatory hurdles and environmental considerations can lead to delays in obtaining project approvals, complicating timelines for development. The complexities associated with the transportation of equipment and personnel to remote offshore locations also create operational difficulties. Moreover, this sector faces competition from alternative renewable energy sources like solar and onshore wind, which may present easier access and more straightforward installation requirements. The shortage of qualified professionals for specialized positions within this industry remains a potential limitation on project implementation. Nevertheless, an increasing number of governments are committing to carbon emission reduction and renewable energy promotion, leading to policies that could alleviate these issues. As innovations continue to decrease costs and improve efficiency, it is anticipated that the offshore wind sector will navigate these challenges, ultimately playing a more prominent role in the global energy landscape and contributing to a cleaner, sustainable future.

Offshore Wind Energy Market Key Segments:

By Turbine Capacity:

- Up to 3 MW

- 3-6 MW

- 6-10 MW

- Above 10 MW

By Water Depth:

- Shallow (0-50 meters)

- Transitional (50-200 meters)

- Deep (>200 meters)

By Foundation Type:

- Monopile

- Jacket

- Tripile

- Gravity-based

By Voltage Level:

- 33 kV

- 66 kV

- 132 kV

- 220 kV

- 400 kV

By Grid Connection Type:

- Direct Connect

- Grid-Connected via Offshore Grid

- Grid-Connected via Onshore Grid

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America