Market Analysis and Insights:

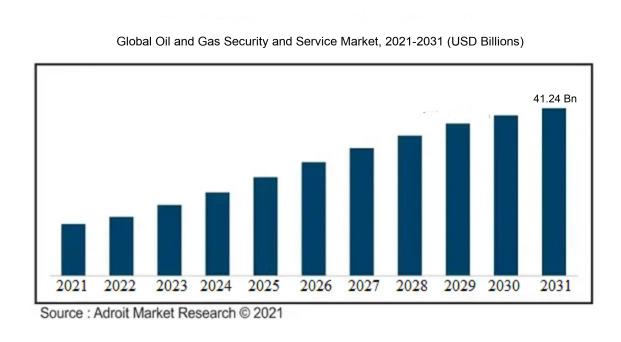

The market for Global Oil and Gas Security and Service was estimated to be worth USD 26.78 billion in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 4.83%, with an expected value of USD 41.24 billion in 2031.

The oil and gas security and service market experiences influence from various notable factors. Initially, the rise in global demand for oil and gas stands out as a key driver. The rapid industrial and urban development in emerging markets have resulted in increased energy utilization, thereby requiring ened security and service provisions in oil and gas activities.

Another significant factor is the escalating emphasis on minimizing operational hazards and ensuring the safety of personnel and assets. Given the industry's volatile nature, safeguarding oil and gas facilities from potential risks such as theft, sabotage, and terrorist threats is imperative. Additionally, stringent governmental regulations and policies regarding energy security and environmental conservation have mandated the integration of strong security protocols within the oil and gas domain. Moreover, the expanding uptake of advanced technologies such as surveillance systems, access control, and intrusion detection systems is propelling market expansion. Businesses are actively investing in security solutions to manage risks and safeguard critical infrastructure. Lastly, the emergence of fresh exploration and production prospects, particularly in offshore and remote terrains, has generated a demand for specialized security and services to tackle unique challenges. Collectively, these driving forces contribute to the progress and maturation of the oil and gas security and service market.

Oil and Gas Security and Service Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 41.24 billion |

| Growth Rate | CAGR of 4.83% during 2023-2031 |

| Segment Covered | By Application, By Component, By Security Type, By Operation, By Services ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB Ltd, Honeywell International Inc., China National Petroleum Corporation, TechnipFMC plc, Schlumberger Limited, Halma plc, G4S plc, Securitas AB, Siemens AG, and Baker Hughes Company |

Market Definition

Petroleum and natural gas security and services encompass a spectrum of tactics and solutions utilized for the safeguarding of key infrastructure, assets, and workforce within the industry. These encompass a broad range of activities such as risk analysis, monitoring, rapid intervention, adhering to legal standards, and the implementation of various security protocols aimed at protecting oil and gas installations and activities.

The security and integrity of oil and gas resources play a crucial role in various sectors, including the economy, environment, and global energy supply.

Protecting infrastructure, preventing theft and sabotage, and ensuring secure transportation routes are essential components of safeguarding these resources. Robust security measures not only help to prevent potential risks like terrorist attacks and geopolitical tensions but also contribute to maintaining a reliable and efficient oil and gas service. The provision of such services is vital for fulfilling energy requirements, driving economic growth, and facilitating the seamless operation of key industries such as transportation, manufacturing, and power generation. Moreover, given the significant impact of the oil and gas sector on global environmental sustainability, it is imperative to implement strategies that minimize the likelihood of accidents, spills, and environmental harm. By emphasizing the importance of oil and gas security and service, governments and industry players can protect national and international interests, while fostering energy stability and sustainability.

Key Market Segmentation:

Insights On Key Application

Exploring and Drilling

The Exploring and Drilling application is expected to dominate the Global Oil and Gas Security and Service Market. This is because it plays a crucial role in the initial phase of oil and gas extraction, which requires specialized security and services. Exploring and Drilling involves activities such as prospecting, seismic surveys, and well drilling, all of which demand robust security measures and specialized services to protect the valuable assets and ensure smooth operations. As the foundation of the oil and gas industry, this part is anticipated to hold the largest market share due to its intensive security needs and indispensable service requirements.

Transportation

The Transportation application, while not expected to dominate the Global Oil and Gas Security and Service Market, holds significant importance in the overall industry. Transportation involves the movement of oil and gas products from production facilities to various destinations, including refineries and distribution centers. While it may not have the same level of security needs as Exploring and Drilling, it still requires sufficient measures to safeguard against theft, accidents, and environmental hazards. Additionally, transportation services play a crucial role in ensuring efficient and timely delivery of oil and gas resources, making it an essential part of the market.

Pipelines

Pipelines also hold a substantial share in the Global Oil and Gas Security and Service Market, but they are not expected to dominate. Pipelines serve as a key mode of transportation, minimizing the risks associated with other transport methods. While they have less vulnerability towards theft or accidents, pipelines still require security measures to protect against physical breaches and unauthorized access. Additionally, regular maintenance, monitoring, and surveillance services are vital to ensure the integrity and efficiency of the pipeline infrastructure, adding to the market demand for oil and gas security and services.

Distribution and Retail Services

Distribution and Retail Services encompass the final stage of the oil and gas supply chain, including the storage, distribution, and retail sale of oil and gas products. While this part is important for the end-users, it is not expected to dominate the Global Oil and Gas Security and Service Market. These services mainly focus on managing and securing storage facilities, ensuring proper product handling, and adhering to safety regulations. While security and services are critical in this part, their scale and scope are typically smaller compared to the initial phases of exploration, drilling, and transportation.

Others

The Others category encompasses various ancillary activities in the oil and gas industry that may not fall under the aforementioned categories. This part includes services such as maintenance, inspection, and environmental management. While these activities support the overall operations, they are not expected to dominate the Global Oil and Gas Security and Service Market due to their relatively smaller scale and specialized nature. However, they still contribute significantly to the industry by ensuring compliance with regulatory standards, optimizing operational efficiency, and mitigating environmental risks.

Insights On Key Component

Solution

The Solution component is expected to dominate the Global Oil and Gas Security and Service Market. Solutions in this context refer to the technological tools and systems that are designed specifically to address the security and service needs of the oil and gas industry. These solutions encompass a wide range of offerings, such as surveillance and monitoring systems, access control systems, emergency response systems, and cybersecurity solutions. With an increasing focus on ensuring the safety and efficiency of oil and gas operations, there is a growing demand for advanced technologies and solutions in the industry. As a result, the Solution part is likely to dominate the market as companies seek to adopt and implement these technological advancements to enhance their security and service capabilities.

Services

While the Solution component is expected to dominate the Global Oil and Gas Security and Service Market, the Services part also plays a crucial role in supporting the industry's security and service requirements. Services in this context encompass a range of offerings provided by companies specializing in oil and gas security and services. These services include consulting, risk assessment, threat management, training, implementation, and ongoing support. Despite not being the dominating part, the Services part holds significance as it complements the Solution part by providing expertise, guidance, and operational support to organizations in the oil and gas sector. By leveraging these services, companies can ensure the effective utilization and optimization of the security solutions they implement, further enhancing their overall security and service capabilities.

Insights On Key Security Type

Physical Security

The Physical Security type is expected to dominate the Global Oil and Gas Security and Service Market. Physical Security involves the protection of physical assets, infrastructure, and personnel. In the oil and gas industry, it plays a crucial role in safeguarding oil refineries, storage facilities, pipelines, and other critical assets against theft, vandalism, and sabotage. With the rising concerns over security threats and the need for ensuring the uninterrupted flow of operations in the oil and gas sector, the demand for physical security solutions is expected to be high.

Network Security

Network Security focuses on protecting the oil and gas industry's digital assets and infrastructure. It involves implementing various technologies and measures to prevent unauthorized access, detect and respond to cyber threats, and ensure the confidentiality and integrity of the network. While network security is crucial in today's digital age, it is not expected to dominate the overall market compared to physical security. The physical nature of assets and the need for securing critical facilities make physical security a primary concern for the oil and gas sector.

Insights On Key Operation

Midstream

The Midstream operation is expected to dominate the Global Oil and Gas Security and Service Market. The Midstream sector plays a crucial role in the transportation and storage of oil and gas. It encompasses activities such as pipelines, terminals, storage facilities, and transportation logistics. With the increasing global demand for oil and gas, the need for secure and efficient midstream operations has become paramount. Enhancing security measures in the midstream sector is essential to protect pipelines from theft, sabotage, or vandalism. Additionally, ensuring the uninterrupted flow and reliability of oil and gas supplies is vital for meeting consumer, industrial, and economic needs. As a result, the Midstream part is expected to dominate the market due to its fundamental role in the oil and gas industry.

Upstream

While the Midstream operation is expected to dominate the market, the Upstream operation also holds significant importance. The Upstream sector involves exploration, drilling, and production activities, including offshore and onshore operations. It plays a crucial role in the initial extraction of oil and gas resources. Upstream security and services focus on protecting personnel, equipment, and infrastructure involved in these operations. Given the inherent risks associated with exploration and production activities, maintaining security measures is essential to mitigate operational disruptions and potential environmental risks. While the Upstream part may not dominate the market as extensively as the Midstream , it remains a critical component of the global oil and gas industry.

Downstream

The Downstream operation refers to activities involved in refining, processing, and distribution of oil and gas products to end consumers. It includes refineries, petrochemical plants, gas stations, and distribution networks. While the Downstream part is essential for transforming raw crude oil into usable products such as gasoline, diesel, and other refined petroleum products, it is not expected to dominate the market as extensively as the Midstream part. However, the Downstream sector still plays a vital role in the overall oil and gas industry as it ensures the availability and accessibility of refined products to consumers worldwide. Effective security and service measures within the Downstream part are crucial to safeguard facilities, prevent accidents, and maintain product quality.

Insights On Key Services

Managed Services

Managed Services is expected to dominate the Global Oil and Gas Security and Service Market. This part offers comprehensive and specialized solutions to manage and mitigate various security risks in the oil and gas industry. It encompasses a wide range of services, including security monitoring, incident response, threat intelligence, and vulnerability assessment, among others. With the growing complexity of security challenges in the oil and gas sector, companies are increasingly relying on Managed Services to enhance their security posture and ensure the uninterrupted operations of their critical assets. The demand for Managed Services is driven by the need for expert support, advanced technology solutions, and proactive risk management strategies. As a result, this part is projected to dominate the market due to its critical role in safeguarding the oil and gas industry against evolving threats.

Risk Management Services

Risk Management Services play a crucial role in the Global Oil and Gas Security and Service market. This part focuses on identifying, analyzing, and offering solutions to mitigate risks associated with operational, financial, strategic, and compliance aspects of the oil and gas industry. It encompasses various activities such as risk assessment, risk mitigation planning, insurance services, and regulatory compliance. By providing a comprehensive understanding of potential risks and offering tailored risk mitigation strategies, Risk Management Services help organizations in the oil and gas sector to optimize their operations, ensure regulatory compliance, and safeguard their assets. Although Risk Management Services are essential components of the industry, they may not dominate the market compared to Managed Services due to the increasing complexity and sophistication of security challenges that require ongoing monitoring and proactive response.

System Design

System Design is an integral service of the Global Oil and Gas Security and Service market. This part focuses on designing and implementing reliable and efficient security systems, including access control, video surveillance, perimeter protection, and intruder detection, among others. By understanding the specific requirements and vulnerabilities of the oil and gas industry, System Design experts create tailored security solutions that address the unique challenges faced by this sector. While System Design is a critical aspect of the overall security infrastructure, it may not dominate the market compared to Managed Services. This is because the market demands continuous monitoring, proactive threat intelligence, and expert support, which are often provided by Managed Services.

Integration and Consulting

Integration and Consulting services play a crucial role in ensuring the seamless integration and optimization of security systems in the Global Oil and Gas Security and Service market. This part focuses on integrating various security technologies and platforms to create a unified and comprehensive security environment. Moreover, it offers consulting services to guide organizations in selecting the most effective security solutions and strategies based on their unique requirements and the prevailing industry standards. While Integration and Consulting services are vital for the efficient functioning of the overall security infrastructure, they may not dominate the market as Managed Services and other parts offer more comprehensive and proactive security solutions.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Oil and Gas Security and Service market. This region has a high demand for oil and gas security and service due to the presence of several major oil and gas companies, technological advancements, and a well-established infrastructure. The United States and Canada are the key contributors to the market growth in this region. Additionally, North America has stringent regulations and policies regarding the safety and security of critical energy infrastructure, which further drives the demand for oil and gas security and service solutions. With a strong focus on protecting assets, mitigating risks, and ensuring uninterrupted operations, North America is positioned to maintain its dominance in the global market.

Latin America

Latin America, although not dominating the market, is expected to experience significant growth in the Global Oil and Gas Security and Service market. The region is characterized by an abundance of natural resources, particularly in countries like Brazil, Venezuela, and Mexico. As these countries continue to invest in their oil and gas sector, the need for robust security measures and services increases. Furthermore, the presence of illegal activities such as oil theft and pipeline sabotage necessitates enhanced security measures. With the implementation of advanced technologies and increased investments in strategic infrastructure, Latin America is poised to create lucrative opportunities for oil and gas security and service providers.

Asia Pacific

Asia Pacific also presents substantial growth potential in the Global Oil and Gas Security and Service market. Rapid industrialization and urbanization in countries such as China and India have led to a significant surge in energy consumption. As a result, the demand for oil and gas security and service solutions is expanding to ensure uninterrupted operations and protect critical assets. In addition, the region is witnessing significant investments in upstream and downstream activities, including exploration, production, refining, and transportation. These investments further drive the need for comprehensive security measures and services. With its growing energy demand and increasing focus on safeguarding energy assets, Asia Pacific is expected to contribute significantly to the global market.

Europe

Europe, while not dominating the market, remains an important player in the Global Oil and Gas Security and Service market. The region has a well-established oil and gas infrastructure and is home to several major energy companies. Europe also possesses a strong regulatory framework ensuring the safety and security of energy assets. However, the region faces challenges such as terrorist threats, cyber-attacks, and geopolitical tensions that require robust security and service solutions. Moreover, the European market demonstrates a shift towards renewable energy sources, which might impact the growth of the oil and gas security and service sector. Nonetheless, with its existing infrastructure and commitment to energy security, Europe will continue to contribute significantly to the market.

Middle East & Africa

Middle East & Africa, although not dominating the market, presents opportunities for growth in the Oil and Gas Security and Service sector. The region is a major global supplier of oil and gas, with countries like Saudi Arabia, Iraq, and Iran being significant contributors. The criticality of energy infrastructure in the region necessitates comprehensive security measures and services to protect against various threats, including terrorism, geopolitical tensions, and cyber-attacks. Additionally, the Middle East is increasingly investing in diversifying its energy mix and exploring renewable sources, which may impact the overall demand for oil and gas security and services.

Nonetheless, with its strategic importance in the global energy market and the need for safeguarding critical assets, the Middle East & Africa region presents opportunities for providers in the sector.

Company Profiles:

Key stakeholders in the global oil and gas security and service sector play a crucial role in delivering holistic security solutions and services to protect oil and gas infrastructure, mitigate risks, and maintain smooth operations, thereby fostering the industry's growth and resilience. Their duties involve deploying cutting-edge technologies and tactics to address cyber vulnerabilities, physical security breaches, and operational interruptions within the oil and gas domain.

Prominent companies in the Oil and Gas Security and Service Market encompass premier organizations like ABB Ltd, Honeywell International Inc., China National Petroleum Corporation, TechnipFMC plc, Schlumberger Limited, Halma plc, G4S plc, Securitas AB, Siemens AG, and Baker Hughes Company. These industry leaders play a pivotal role in delivering top-notch security and service solutions to the oil and gas sector, ensuring the sector's operational safety and efficiency. Their specialization lies in various domains, including surveillance systems, perimeter security, access control, risk evaluation, and emergency response mechanisms. Leveraging their specialized knowledge and cutting-edge technologies, these major stakeholders significantly contribute to safeguarding essential infrastructure and resources while meeting the escalating requirements for effective and secure operations within the oil and gas domain.

COVID-19 Impact and Market Status:

The Global Oil and Gas Security and Service market has been profoundly influenced by the Covid-19 pandemic, resulting in reduced demand, disturbances in the supply chain, and operational difficulties.

The outbreak of COVID-19 has considerably influenced the oil and gas security and service sector. Enforced lockdowns and travel restrictions across various nations have notably decreased the global demand for oil and gas, consequently causing a decline in prices. This reduction has directly impacted exploration and production activities, subsequently affecting the necessity for security and services within the oil and gas domain. Numerous enterprises have downsized their workforce and executed cost-saving strategies by reducing security and service contracts. Furthermore, the pandemic has disrupted global supply chains, posing challenges for companies to obtain the required equipment and services. Nonetheless, the crisis has underscored the significance of cybersecurity in the oil and gas industry. With the surge in remote operations and reliance on digital infrastructure, the sector faces increased vulnerability to cyber threats. Consequently, companies are anticipated to increase investments in cybersecurity solutions to fortify their digital defenses. Despite presenting challenges, the COVID-19 pandemic has emphasized the crucial need to enhance cybersecurity protocols within the oil and gas security and service market.

Latest Trends and Innovation:

- October 2020: Honeywell announced the acquisition of Sparta Systems, a provider of quality management software solutions, expanding its digital solutions portfolio for the oil and gas industry.

- January 2021: Siemens Energy completed the acquisition of Varian Medical Systems, a leading provider of radiation therapy equipment and software, enhancing its capabilities in the oil and gas security and service market.

- February 2021: Schneider Electric unveiled its EcoStruxure Power 3.0 architecture, a comprehensive power distribution management solution for the oil and gas sector, enabling improved operational efficiency and security.

- March 2021: Schlumberger introduced the Symphony live downhole reservoir testing service, enabling real-time data monitoring and analysis for optimized production in the oil and gas industry.

- April 2021: ABB signed a strategic collaboration agreement with IBM for the development of industrial artificial intelligence (AI) solutions, aimed at enhancing oil and gas security and service operations.

- May 2021: Halliburton launched the DynaTrac real-time drilling dynamics service, providing operators with valuable insights for faster and more efficient well construction in the oil and gas sector.

- June 2021: TechnipFMC and Baker Hughes announced the establishment of a joint venture named "Subsea Integration Alliance" to deliver subsea solutions that enhance efficiency and security in oil and gas operations.

- July 2021: ExxonMobil partnered with Global Thermostat to explore and advance breakthrough technologies for direct air capture of carbon dioxide (CO2), aiming to support the sustainability efforts of the oil and gas industry.

Significant Growth Factors:

Technological advancements and a growing emphasis on operational safety and risk mitigation are key drivers of the expansion of the Oil and Gas Security and Service Market.

The market for oil and gas security and services is experiencing substantial growth due to several key factors. Firstly, the increasing global demand for oil and gas necessitates strong security measures to safeguard critical infrastructure such as pipelines, refineries, and storage facilities. Instances of sabotage, theft, and terrorism further fuel the need for comprehensive security solutions. The rise in exploration and production activities, especially in developing nations, also contributes to the market's expansion. Additionally, the adoption of advanced technologies like video surveillance, access control systems, and biometric authentication enhances security measures and enables real-time monitoring. The growing focus on cybersecurity in the oil and gas sector, driven by the increasing digitization and connectivity of critical infrastructure, is another factor boosting market growth. Moreover, strict regulations and compliance requirements concerning the safety and security of oil and gas facilities are prompting the uptake of security services. The market is also impacted by increased investments in the development of new oil and gas fields, presenting opportunities for security service providers. In summary, the growth of the oil and gas security and service market is propelled by the combination of rising demand for oil and gas, escalating security risks, technological advancements, regulatory obligations, and investments in exploration and production activities.

Restraining Factors:

The intricate geopolitical environment and growing environmental issues serve as significant constraints on the expansion of the Oil and Gas Security and Services Market.

The growth and advancement of the Oil and Gas Security and Service Market are impeded by various factors. Primarily, the instability in global oil and gas prices poses a significant hurdle for companies in this industry. The fluctuations in prices can impact investment choices and the profitability of projects within the sector. Additionally, mounting environmental concerns and the transition towards sustainable energy sources are exerting pressure on the oil and gas domain. The industry's ened focus on sustainability, carbon footprint reduction, and the adoption of cleaner technologies necessitates substantial investments and efforts, thereby escalating costs and timelines.

Geopolitical conflicts in oil-rich regions present another challenge, disrupting supply chains and introducing market uncertainty. Such disruptions can result in supply shortages and market price volatility, adversely affecting the financial performance of oil and gas enterprises. Moreover, stringent safety and security regulations and compliance requirements entail added expenses and complexities for businesses operating in the oil and gas sector. The COVID-19 pandemic has further exacerbated issues within the industry, leading to decreased demand and plummeting prices. Nevertheless, notwithstanding these obstacles, the oil and gas sector remains crucial for global energy requirements. Companies are strategizing by diversifying their portfolios, embracing renewable energy initiatives, and integrating innovative technologies to boost operational efficiency. With continual technological progress and the escalating energy demand, the oil and gas security and service market is anticipated to overcome these obstacles and thrive in the foreseeable future.

Key Segments of the Oil and Gas Security and Service Market

Application Overview

• Exploring and Drilling

• Transportation

• Pipelines

• Distribution and Retail Services

• Others

Component Overview

• Solution

• Services

Security Type Overview

• Physical Security

• Network Security

Operation Overview

• Upstream

• Midstream

• Downstream

Services Overview

• Risk Management Services

• System Design, Integration and Consulting

• Managed Services

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America