Oilfield Services Market Analysis and Insights:

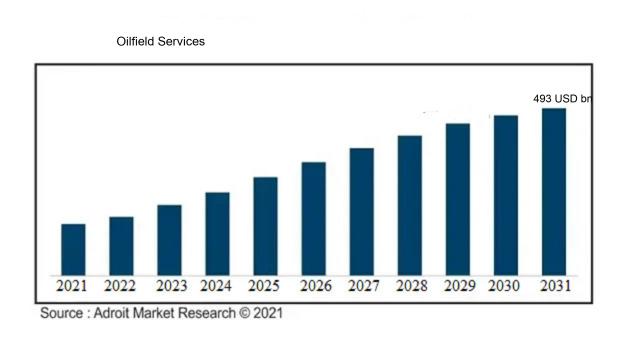

The market for Oilfield Services was estimated to be worth USD 271 billion in 2019, and from 2020 to 2032, it is anticipated to grow at a CAGR of 6.89%, with an expected value of USD 493 billion in 2032.

The Oilfield Services Market is fundamentally influenced by several critical elements, including the escalating global energy demand, advancements in technology, and the increasing importance of improved oil recovery methods. As nations work to secure their energy supplies to foster economic development, there is a noticeable uptick in exploration and production efforts, which in turn amplifies the need for oilfield services. Furthermore, the integration of innovative digital solutions and automation enhances operational efficiency and lowers costs, enabling companies to tap into intricate reservoirs more effectively. Environmental regulations and a shift towards sustainable practices are also impacting the sector, prompting investments in more eco-friendly extraction techniques. The state of geopolitical conditions in oil-exporting regions plays a significant role in shaping supply chain dynamics, while volatile oil prices can either incentivize or obstruct investments in exploration and production. Taken together, these factors create a fluid landscape for oilfield service companies to navigate and prosper.

Oilfield Services Market Definition

Oilfield services encompass a variety of specialized functions and products that facilitate the discovery, extraction, and production of oil and natural gas resources. These services include drilling operations, well upkeep, and various technical and logistical tasks that are essential to the oil and gas sector.

Oilfield services are vital to the processes of discovering, extracting, and producing petroleum and natural gas, profoundly influencing the worldwide energy landscape and economic framework. These services cover a broad spectrum of tasks such as drilling, well completion, and production assistance, all of which are critical for effectively reaching hydrocarbon reserves. They facilitate operational efficiency, cost reduction, and compliance with safety and environmental standards. By offering cutting-edge technologies and a skilled workforce, oilfield services boost productivity while meeting energy needs in a sustainable manner. Additionally, they play a significant role in local economies by creating jobs and bolstering associated industries, cementing their importance within the energy sector.

Oilfield Services Market Segmental Analysis:

Insights On Key Type

Field Operation

Field operation is expected to dominate the Global Oilfield Services Market due to its critical role in ensuring efficient and effective resource extraction. As exploration and production activities increase, companies are investing heavily in optimizing field operations for enhanced productivity and reduced operational costs. Furthermore, advancements in technology, including automation and remote monitoring, are streamlining these operations, making them more appealing. The necessity for precision and efficiency in drilling, well completion, and production optimization contributes to the predominance of the field operation sector within the overall market landscape. As a result, this domain is set to lead growth in the oilfield services industry.

Equipment Rental

Equipment rental plays a significant role in the oilfield services market as companies increasingly prefer renting rather than owning costly machinery. This trend enables organizations to maintain operational flexibility and reduce capital expenditures. Furthermore, as extraction technologies evolve, a growing array of specialized equipment becomes available for rental, enhancing operational efficiency while allowing companies to stay updated with the latest advancements. The rising emphasis on cost management and efficiency in the oil and gas sector supports the sustained growth of equipment rental services.

Analytical Services

Analytical services are gaining traction within the oilfield services market, driven by the increasing need for data-driven decision-making and operational efficiencies. These services help organizations analyze geological data, production metrics, and market trends, facilitating informed strategies for exploration and production. With the rise of big data analytics and machine learning, oil companies can optimize their operations, improve yield, and minimize risks. Although not dominating, analytical services are vital for enhancing overall performance and providing critical insights, making them an essential component of the oilfield services ecosystem.

Insights On Key Service

Drilling

Drilling is expected to dominate the Global Oilfield Services Market due to the rising demand for oil and natural gas resources globally. The urgency to increase production from existing wells and explore new fields drives significant investments in drilling technologies. Advances in drilling techniques, including horizontal and offshore drilling, enhance efficiency and reduce costs, making this service indispensable. Additionally, as oil prices stabilize, exploration activities are ramping up, leading to increased drilling operations, particularly in untapped markets. These factors combined position the drilling as a crucial pillar in the oilfield services industry for years to come.

Geophysical

Geophysical services play a vital role in the oilfield services landscape by providing critical data that aids in the identification and exploration of hydrocarbon reserves. These services utilize advanced technology such as seismic surveys and subsurface imaging to gather essential geological information. As exploration becomes more complex, the reliance on accurate geophysical data grows. Companies are increasingly integrating geophysical services into their exploration phases to minimize risks and enhance the efficiency of resource identification. This increasing focus on data-driven decision-making bolsters the importance of geophysical services in the oilfield services market.

Completion & Workover

Completion and workover services are essential for maximizing production from oil and gas wells. They involve a series of specialized techniques to prepare a well for production and to enhance performance through ongoing intervention. As aging oilfields require more sophisticated maintenance and optimization, the demand for these services is on the rise. Furthermore, technological advancements in completion techniques are enabling operators to achieve better recovery rates. This growing emphasis on optimizing well output in a cost-effective manner solidifies the role of completion and workover services in the overall oilfield services sector.

Production

Production services encompass a broad array of activities crucial for the management and enhancement of oil and gas extraction processes. These services ensure that production flows smoothly and efficiently from the reservoir to the market. Given the increasing complexity of hydrocarbon extraction, especially from unconventional sources, demand for production services is experiencing a steady rise. Operators are focusing on effective production techniques to maintain profitability in a fluctuating oil market. Additionally, the incorporation of automation and digital technologies in production processes speaks to the importance of this service area in achieving operational excellence and sustainability.

Processing & Separation

Processing and separation services are integral to transforming raw hydrocarbons into market-ready products. These services involve the separation of oil, gas, water, and other impurities, ensuring compliance with environmental and quality standards. As regulations around emissions and waste management tighten globally, the demand for efficient processing systems is increasing. Companies are investing in advanced processing technologies to minimize waste and enhance yield from oil and gas, reflecting a growing emphasis on sustainability. The continuous evolution of processing and separation techniques underscores their pivotal role in ensuring that extracted resources meet the required specifications efficiently.

Insights On Key Application

Offshore

The offshore application is expected to dominate the Global Oilfield Services Market due to a variety of factors. Increasing demand for crude oil and natural gas, coupled with the depletion of onshore reserves, has motivated companies to shift their focus towards offshore exploration and production. Offshore drilling often allows access to larger reserves, enhanced productivity, and significant cost benefits over time. Additionally, advancements in deep-water drilling technologies and capabilities have further boosted investments in offshore projects, leading to an overall increase in offshore oilfield services. The global push for energy security, coupled with geopolitical factors, is also expected to strengthen this firmly.

Onshore

The onshore application, while not leading, still holds a significant position in the Global Oilfield Services Market. The rise in shale oil production, especially in countries like the United States, has made onshore extraction a priority for several oil and gas companies. Many firms are actively investing in onshore infrastructure to improve operational efficiencies and capitalize on the high production rates available from these sites. The cost-effectiveness of onshore drilling also appeals to operators, making it a viable alternative in various regions, particularly where transportation logistics and environmental considerations favor land-based operations.

Global Oilfield Services Market Regional Insights:

North America

Based on the current data and market trends, North America is expected to dominate the Global Oilfield Services market. This is primarily attributed to the significant presence of established oil and gas companies, advanced technological infrastructure, and continuing investments in exploration and production activities, particularly in unconventional resources such as shale oil and gas. The region is characterized by its strong regulatory framework and is home to some of the largest oil reserves in the world. The ongoing demand for enhanced oil recovery techniques and the rise of digital solutions in oil production are further driving the oilfield services market in North America, making it the leading region.

Latin America

Latin America presents a developing environment for the oilfield services market, driven largely by the rich reserves found in countries like Brazil, Venezuela, and Argentina. Recent investments in exploration, along with governmental incentives aimed at increasing oil production, highlight the region's potential growth. However, political instability and varying regulatory frameworks may pose challenges for operators. The region's market is showing signs of recovery and stabilization, indicating a gradual increase in activity and investments as global oil prices stabilize.

Asia Pacific

The Asia Pacific region is witnessing a surge in demand for oilfield services due to rising energy needs driven by rapid economic growth and industrialization. Countries like China and India are increasing their investments in exploration and production to secure energy supplies, thus fostering market growth. However, the region faces challenges such as regulatory complexities and environmental concerns, which could impact operations. Despite these hurdles, the growing focus on energy security will continue to push investments into oilfield services, making Asia Pacific a vital player in the global landscape.

Europe

Europe's oilfield services market is characterized by technological advancements and the need for sustainable energy solutions. Although the region has significant offshore drilling activity, it currently faces challenges from the transition towards renewable energy sources and stricter environmental regulations. Additionally, geopolitical factors, especially concerning oil supply from Eastern Europe, impact the investment landscape. Moreover, the push for decarbonization and leading-edge technologies is reshaping the sector, driving demand for innovative, efficient methods in oilfield services.

Middle East & Africa

The Middle East and Africa region holds some of the largest oil reserves globally and is a critical hub for oil production. However, the market is often influenced by geopolitical tensions, fluctuating crude oil prices, and infrastructural challenges. While the region continues to attract global investment, efforts are also being made to diversify economies away from oil dependency. Despite these challenges, the potential for large-scale projects, especially in the Gulf Cooperation Council (GCC) countries, supports the growth of the oilfield services market, enhancing its relevance in the global context.

Oilfield Services Competitive Landscape:

Prominent figures in the global oilfield services sector, including Schlumberger, Halliburton, and Baker Hughes, deliver critical technologies and specialized knowledge for exploration, drilling, and production processes, thereby fostering efficiency and innovation within oilfield operations. By forming strategic alliances and investing in cutting-edge research and development, they bolster their service offerings and adapt to the evolving needs of the industry.

The principal entities operating within the Oilfield Services sector comprise Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, TechnipFMC plc, National Oilwell Varco, Inc., Superior Energy Services, Inc., Oceaneering International, Inc., Jindal Drilling and Industries Limited, Transocean Ltd., Nabors Industries Ltd., Petrofac Limited, CGG SA, and Saipem S.p.A. These firms are integral to various facets of the oilfield services industry, offering an extensive array of solutions that encompass exploration, production, and maintenance activities.

Global Oilfield Services COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Oilfield Services sector, causing a downturn in oil consumption, postponements of projects, and reductions in budgets. These factors collectively led to a notable decrease in both revenue and operational functions within the industry.

The oilfield services sector was profoundly affected by the COVID-19 pandemic, which led to a significant drop in demand for oil and gas triggered by severe travel restrictions and a worldwide economic downturn. With nations enforcing lockdown measures, oil prices collapsed, resulting in diminished exploration and production efforts. Service providers encountered various hurdles, including postponed projects, workforce layoffs, and disruptions in supply chains. Many operators responded by slashing capital investments and postponing new initiatives, which ened the competitive landscape within the industry. However, as economies began to recover and oil prices slowly rallied, there was a gradual increase in demand for oilfield services. Companies adapted by embracing digital technologies to enhance operational efficiencies and lower expenses, setting the stage for a potential resurgence in the post-pandemic landscape. Despite this cautious optimism, the market remains vigilant, with a strong focus on sustainability and a shift toward renewable energy sources shaping future investment and strategic decisions within the oilfield services domain.

Latest Trends and Innovation in The Global Oilfield Services Market:

- In December 2022, Halliburton announced its acquisition of the oil and gas technology company, Red Wing. This move was aimed at enhancing its digital offerings and providing clients with advanced analysis and insights regarding their operations.

- In August 2023, Schlumberger launched its new digital platform called DELFI Advisor. This platform combines artificial intelligence with machine learning algorithms to optimize drilling and production processes for oil and gas companies.

- In April 2023, Baker Hughes entered into a strategic collaboration with Microsoft to incorporate cloud computing and artificial intelligence technologies into its oilfield service operations, intending to improve efficiency and reduce operational costs.

- In July 2022, Weatherford International PLC completed the acquisition of TETRA Technologies’ completion services unit. This acquisition was focused on expanding Weatherford's product offerings in the global completions market.

- In March 2023, TechnipFMC announced a significant merger with Subsea 7, aimed at creating a more integrated offering in subsea technologies and services, thereby enhancing their competitive edge in the global oilfield services market.

- In January 2023, NOV Inc. launched a new automation system designed for rig operations, enhancing real-time data acquisition and remote control, which aims to streamline drilling operations and improve safety protocols.

- In November 2022, Eni and Saipem announced a partnership to develop innovative solutions for carbon capture and storage technologies, reflecting the industry's shift towards sustainability within oilfield services.

- In September 2023, Pason Systems Inc. released an upgraded version of its drilling data management software, which focuses on improving data visualization and analysis for drilling operations, allowing operators to make faster and more informed decisions.

Oilfield Services Market Growth Factors:

The growth of the Oilfield Services Market is largely fueled by the rising demand for energy worldwide, innovations in extraction methods, and an expansion in offshore drilling operations.

The Oilfield Services sector is witnessing robust expansion, spurred by various critical factors. A resurgence in global oil consumption, linked to economic recovery and industrial advancements, is ening the demand for improved exploration and production services. Concurrently, innovations in technology, particularly in automation and digital processes, are bolstering operational efficiency and lowering expenditures, thereby making oilfield services more appealing to businesses. Firms are increasingly channeling investments into sophisticated drilling methods, such as hydraulic fracturing and horizontal drilling, which require specialized expert services.

Simultaneously, growing environmental regulations and a worldwide transition toward renewable energy are encouraging oil and gas firms to implement more sustainable practices. This shift opens up avenues for service providers to introduce eco-friendly solutions. Geopolitical dynamics, including unrest in oil-rich territories, can trigger supply fluctuations and increase exploration efforts in more stable regions. The escalating trend of offshore drilling also broadens the market, as it necessitates cutting-edge service offerings. Furthermore, the ongoing wave of mergers and acquisitions among service providers is enhancing their technological capabilities and market presence, thereby fostering growth. Collectively, these elements highlight a vibrant and evolving landscape for the Oilfield Services sector, emphasizing the need for companies to be adaptable and innovative to succeed in this industry.

Oilfield Services Market Restaining Factors:

The oilfield services sector is hindered by several challenges, including volatile oil prices, regulatory hurdles, and environmental issues that influence both investment decisions and operational effectiveness.

The Oilfield Services Market encounters a variety of challenges that may impede its growth. A primary concern is the unpredictability of crude oil prices, which can lead oil companies to cut back on capital investments, thereby affecting the demand for ancillary services. The sector also faces long-term difficulties due to ened focus on environmental sustainability and a shift towards renewable energy, which may redirect funds away from conventional oil exploration. Additionally, regulatory barriers pose significant challenges; strict environmental policies and geopolitical issues can cause delays in projects and elevate operational expenditures. The industry is further strained by a shortage of skilled labor, as an aging workforce limits the capacity to address increasing service demands. Moreover, competition from alternative energy sources such as solar and wind can diminish the appeal of the oilfield services market. Nevertheless, the sector shows resilience and adaptability, with companies increasingly prioritizing technological advancements such as automation and digitalization. These innovations not only improve operational efficiency but also facilitate a transition towards more sustainable practices, ultimately positioning the oilfield services industry favorably in the long run.

Key Segments of the Oilfield Services Market

By Type

• Equipment Rental

• Field Operation

• Analytical Services

By Service

• Geophysical

• Drilling

• Completion & Workover

• Production

• Processing & Separation

By Application

• Onshore

• Offshore

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America