Market Analysis and Insights:

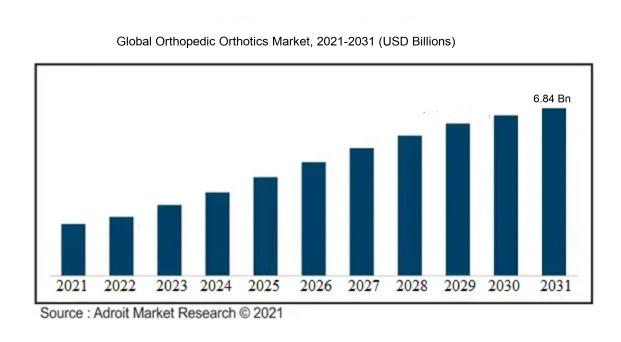

The market for Global Orthopedic Orthotics was estimated to be worth USD 4.31 billion in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 5.48%, with an expected value of USD 6.84 billion in 2031.

The market for orthopedic orthotics is predominantly influenced by various significant factors. One key driver is the escalating prevalence of orthopedic ailments like arthritis, osteoporosis, and injuries from sports activities. These conditions necessitate orthotic interventions to alleviate pain, provide support, and ensure proper alignment, thereby increasing the demand for orthopedic orthotics. Moreover, the global increase in the elderly population, who are more susceptible to orthopedic issues and chronic illnesses, is further boosting market growth. Technological advancements and the use of advanced materials in orthotics are also playing a role in enhancing their longevity, comfort, and efficacy, driving demand. Additionally, the surge in sedentary lifestyles and work-related risks leading to musculoskeletal disorders is propelling the market. The rising awareness among individuals about the advantages of using orthotics as a preventive measure against foot and gait-related issues is also fostering market expansion. In conclusion, these driving forces portend a promising outlook for the orthopedic orthotics market, offering potential prospects for innovation and expansion.

Orthopedic Orthotics Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 6.84 billion |

| Growth Rate | CAGR of 5.48% during 2023-2031 |

| Segment Covered | By Product, By Application, By Material, By Posture, By Manufacturing, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Zimmer Biomet Holdings Inc., Össur hf., DJO Global Inc., Breg Inc., Bauerfeind AG, Ottobock SE & Co. KGaA, DeRoyal Industries Inc., medi GmbH & Co. KG, Becker Orthopedic, and Fillauer LLC. |

Market Definition

Orthopedic orthotics are specialized medical instruments crafted to assist in maintaining proper anatomical alignment, offering stability and reducing discomfort in the lower extremities. These personalized devices are created by orthopedic experts to optimize mobility and enhance the well-being of those affected by a range of musculoskeletal issues.

Orthopedic orthotics play a crucial role in healthcare by providing support and alignment to individuals with orthopedic issues. These specially crafted medical devices aid in correcting foot and ankle abnormalities, enhancing body posture and balance. They effectively absorb shock, lessen joint pressure, and facilitate proper biomechanics during movement. By evenly distributing weight across the feet, orthotics alleviate pain and discomfort caused by conditions like plantar fasciitis, flat feet, and bunions. Moreover, they help prevent further deformities and injuries while improving mobility and athletic performance. Ultimately, orthopedic orthotics contribute significantly to reducing discomfort, enhancing functionality, and improving the quality of life for individuals with orthopedic conditions.

Key Market Segmentation:

Insights On Key Product

Lower-limb Orthotics

Lower-limb orthotics is expected to dominate the global orthopedic orthotics market. This part includes braces, supports, and splints that are designed for the lower limbs, such as the knees, ankles, and feet. Lower-limb orthotics are widely used to provide support, stability, and alignment for individuals with various lower limb conditions, including fractures, sprains, arthritis, and sports injuries. The rising prevalence of musculoskeletal disorders and the growing aging population are key factors driving the demand for lower-limb orthotics. Additionally, advancements in technology and materials used in lower-limb orthotics, such as carbon fiber composites, are further contributing to their dominance in the market. Overall, lower-limb orthotics are expected to have the highest market share in the global orthopedic orthotics market.

Upper-limb Orthotics

Upper-limb orthotics, which include braces, supports, and splints for the upper limbs, such as the shoulders, elbows, and wrists, are another significant sector of the global orthopedic orthotics market. These orthotics are commonly used to provide support and stability for individuals with conditions such as fractures, tendonitis, arthritis, and nerve injuries. While upper-limb orthotics have a substantial market share, they are not expected to dominate the market as compared to lower-limb orthotics. This is primarily due to the higher prevalence of lower limb conditions and injuries, as well as the greater focus on rehabilitation and mobility improvement in lower-limb injuries.

Spine Orthotics

Spine orthotics, which consist of braces and supports for the spine, play a crucial role in the management of spinal conditions such as scoliosis, kyphosis, and spinal fractures. Although spine orthotics are essential for individuals with spinal disorders, they are not expected to dominate the global orthopedic orthotics market. This is because spinal conditions and injuries are relatively less prevalent as compared to lower and upper limb conditions. Moreover, advancements in minimally invasive surgical procedures and alternative treatments have reduced the reliance on spine orthotics, further limiting their market dominance.

Others

The Others category includes orthotics that are designed for other body parts apart from the lower limbs, upper limbs, or spine. This part comprises a diverse range of orthotics such as foot orthotics, neck braces, and hand orthotics. While these orthotics cater to specific conditions and injuries, they are not expected to dominate the global orthopedic orthotics market. The market for these orthotics is relatively smaller in size compared to lower-limb and upper-limb orthotics, mainly due to the lower prevalence of conditions requiring orthotic intervention in these areas. However, they still hold significance in niche markets and cater to specific patient needs.

Insights On Key Application

Fractures

The Fractures application is expected to dominate the Global Orthopedic Orthotics Market. Fractures are a common condition that often requires orthotic intervention for proper healing and support. Orthopedic orthotics, such as braces or casts, are commonly used to immobilize the affected area and promote healing. With the increasing incidence of fractures due to factors like accidents, sports injuries, or age-related conditions, the demand for orthopedic orthotics for fractures is likely to be high. Moreover, advancements in orthotic technologies have made it possible to provide customized and comfortable orthotics for fracture management. Therefore, the Fractures part is expected to dominate the Global Orthopedic Orthotics Market.

Neuromuscular And Musculoskeletal Disorders

The Neuromuscular And Musculoskeletal Disorders is another significant application of the Global Orthopedic Orthotics Market. These disorders, such as cerebral palsy, muscular dystrophy, or spinal cord injuries, often require orthotic devices for support, stability, and improved mobility. Orthopedic orthotics play a crucial role in managing these conditions by providing appropriate alignment, reducing muscle spasticity, and enhancing function. As the prevalence of neuromuscular and musculoskeletal disorders continues to rise due to various factors like aging population and sedentary lifestyle, the demand for orthopedic orthotics for these conditions is also expected to increase.

Sports Injuries

The Sports Injuries application holds significant potential in the Global Orthopedic Orthotics Market. Sports injuries are quite common among athletes and individuals participating in physical activities. Orthopedic orthotics are commonly used for the prevention, support, and rehabilitation of sports-related injuries. These orthotics provide stability, protect vulnerable areas, and aid in the recovery process. With the growing participation in sports and the increasing awareness of injury prevention, the demand for orthopedic orthotics for sports injuries is likely to expand.

Others

The Others category encompasses various orthopedic orthotics applications that do not fall within the categories of fractures, neuromuscular and musculoskeletal disorders, or sports injuries. This part includes conditions like arthritis, osteoporosis, or postoperative care. While these applications may not dominate the Global Orthopedic Orthotics Market compared to fractures or neuromuscular and musculoskeletal disorders, they still hold a significant market share due to the prevalence of these conditions and the need for orthotic intervention. The demand for orthopedic orthotics for these other conditions will continue to rise, albeit at a comparatively lower scale.

Insights On Key Material

Plastic

Plastic is expected to dominate the Global Orthopedic Orthotics Market. Plastic materials are widely used in orthopedic orthotics due to their versatility, durability, and cost-effectiveness. They can be molded into various shapes and sizes, making them ideal for the production of orthotic devices that cater to different patient needs. Additionally, plastic materials offer excellent strength, flexibility, and resistance to wear and tear, making them suitable for long-term use. The advancements in plastic manufacturing technologies have further enhanced the quality and functionality of orthotic devices, driving their adoption in the market.

Carbon Fibres

Carbon fibers are gaining traction in the Global Orthopedic Orthotics Market. While they may not dominate the market, their demand is rising due to their exceptional strength, lightweight properties, and high resistance to corrosion. Carbon fiber-based orthotic devices are widely used in sports and athletic activities, providing superior performance, support, and stability to athletes and patients. These materials offer excellent stiffness-to-weight ratio, allowing for precise control and alignment of the joints. However, the relatively high cost of carbon fibers limits their widespread adoption, making them a niche part within the orthotics market.

Rubber

Rubber materials have a limited presence in the Global Orthopedic Orthotics Market. While rubber provides excellent cushioning and shock absorption properties, it is not extensively used as the primary material for orthotic devices due to its lack of rigidity and stability. Rubber-based orthotics are primarily used in the manufacturing of insoles and padding for additional comfort and support. However, the increasing prevalence of more advanced and durable materials, such as plastic and carbon fibers, has restricted the growth potential of rubber part in the orthotics market.

Metal

Metal materials play a minor role in the Global Orthopedic Orthotics Market. Metal-based orthotic devices, such as braces and splints, are less common compared to other parts due to their limitations in terms of weight, comfort, and flexibility. While metals like titanium or stainless steel offer high strength and durability, they are predominantly used in specific cases where rigidity is required, such as in the construction of external fixators or joint replacements. However, the heavy and restrictive nature of metal materials limits their widespread adoption in orthotic devices.

Others

The Others category encompasses various miscellaneous materials used in the Global Orthopedic Orthotics Market, such as composites, fabrics, and natural materials. These materials have a minimal market presence due to their limited applications and specific use cases. Composite materials, for instance, combine the properties of different materials to create custom orthotic devices tailored to individual patient needs. Fabrics are used primarily in orthotic braces and garments for flexibility and comfort, while natural materials like leather and cork are used in specialized orthotic products. Although these materials offer unique characteristics, their overall market share remains small compared to plastic, carbon fibers, and other dominant parts in the orthotics market.

Insights On Key Posture

Dynamic orthotic devices

Dynamic orthotic devices are expected to dominate the Global Orthopedic Orthotics Market. These devices have gained significant popularity due to their ability to provide adjustable support and mobility. Dynamic orthotic devices are designed to adapt to the movements and changing needs of the wearer, making them more versatile and customizable compared to static orthotic devices. They offer a wide range of applications, including joint stabilization, gait correction, and pain relief. Moreover, advancements in technology have led to the development of innovative dynamic orthotic devices, such as motorized orthotics and smart braces, further driving their market dominance. With a growing focus on personalized healthcare and the rising prevalence of orthopedic conditions, the demand for dynamic orthotic devices is expected to increase substantially in the coming years.

Static orthotic devices

Static orthotic devices, on the other hand, may not dominate the Global Orthopedic Orthotics Market as much as dynamic orthotic devices. Static orthotic devices are designed to provide rigid support and immobilization, typically used for conditions like fractures or spinal deformities. They offer stability and alignment but lack the adaptability and customization offered by dynamic orthotic devices. However, static orthotic devices still hold importance in certain orthopedic cases where immobilization is necessary.

Other

As for the Other category within the Posture category, it is difficult to determine its potential dominance without specific information or data on the specific types of orthotic devices included in this part. The "Other" part could encompass a variety of orthotic devices that may have their own unique applications and advantages. Therefore, a thorough analysis of the specific devices falling under this part is required to evaluate their dominance in the market.

Insights On Key Manufacturing

Custom Fitted

Custom Fitted orthotic devices are expected to dominate the Global Orthopedic Orthotics Market. Custom Fitted orthotic devices are specifically designed and fabricated to meet the unique anatomical needs and requirements of individual patients. They offer a higher level of customization and personalization compared to prefabricated orthotic devices and custom fabricated orthotic devices. Custom Fitted orthotics provide better support, comfort, and functionality, thereby improving patient outcomes and enhancing overall treatment effectiveness. With increasing awareness about the benefits of custom fitted orthotic devices among healthcare professionals and patients, this part is expected to witness significant growth in the global market.

Prefabricated orthotic devices

Prefabricated orthotic devices, although not expected to dominate the global market, still hold a significant share in the orthopedic orthotics market. Prefabricated devices are pre-made and readily available, offering a cost-effective and convenient solution for patients with less complex orthotic needs. They are designed to provide general support and can be easily adjusted to fit various individuals. Prefabricated orthotic devices are commonly used in non-severe cases or as a temporary solution before custom-fitted or custom-fabricated options are obtained. While they may not offer the same level of customization as custom-fitted or custom-fabricated orthotics, they remain a popular choice due to their affordability and immediate availability.

Custom Fabricated

Custom Fabricated orthotic devices represent another important sector within the orthopedic orthotics market. These devices are made using molds or scans of a patient's anatomy and then manufactured with specific materials and modifications to address their unique orthotic requirements. Custom Fabricated orthotics offer a higher degree of customization compared to prefabricated devices, but may not provide the same level of personalization and fit as custom-fitted orthotics. They are often used for more complex cases that require specialized design and materials. Although not expected to dominate the global market, Custom Fabricated orthotic devices play an essential role in addressing the diverse needs of patients with orthopedic conditions.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Orthopedic Orthotics market. The region's dominance can be attributed to several factors. Firstly, North America has a high prevalence of orthopedic conditions such as arthritis and osteoporosis, which necessitates the use of orthotic devices. Additionally, the region is known for its technologically advanced healthcare infrastructure and high disposable income levels, which enable patients to afford orthopedic orthotics. Moreover, there is a strong presence of key market players in North America, driving product innovation and development. These factors combined make North America the leading region in the Global Orthopedic Orthotics market.

Latin America

Latin America is expected to witness significant growth in the Global Orthopedic Orthotics market. This can be attributed to the increasing healthcare spending, growing awareness about orthopedic conditions, and a rise in disposable income in the region. Additionally, the region has a large population, which offers a sizable customer base for orthopedic orthotics manufacturers. However, compared to North America, the market penetration of orthopedic orthotics in Latin America is relatively lower, which presents opportunities for market expansion in the future.

Asia Pacific

Asia Pacific is anticipated to experience substantial growth in the Global Orthopedic Orthotics market. The region has a large aging population, increasing prevalence of orthopedic conditions, and rising healthcare expenditure, which are driving the demand for orthopedic orthotics. Additionally, rapid urbanization and the adoption of sedentary lifestyles in countries like China and India have contributed to a surge in musculoskeletal disorders, further propelling the market growth for orthopedic orthotics. However, certain factors such as the presence of counterfeit products and limited access to advanced healthcare facilities in some parts of the region may hinder market growth.

Europe

Europe is expected to show significant growth in the Global Orthopedic Orthotics market. The region has a well-established healthcare system and a high prevalence of orthopedic conditions, which drives the demand for orthopedic orthotics. Additionally, technological advancements, favorable reimbursement policies, and the presence of key market players in Europe contribute to the growth of the market. However, the market in Europe is relatively mature, with a high penetration rate of orthopedic orthotics, which may limit the scope for further expansion at the same pace as emerging economies.

Middle East & Africa0

The Middle East & Africa region is expected to witness moderate growth in the Global Orthopedic Orthotics market. The region has an increasing prevalence of orthopedic conditions and a growing geriatric population, which are drivers for market growth. However, the market in this region is still developing, and factors such as limited access to healthcare facilities and low awareness about orthopedic orthotics may hinder market growth. Nevertheless, increasing healthcare expenditure and rising awareness about orthopedic conditions and treatment options are expected to contribute to the growth of the market in the Middle East & Africa.

Company Profiles:

Prominent stakeholders in the worldwide Orthopedic Orthotics industry are engaged in the production and distribution of orthotic equipment, including braces, supports, and personalized orthotics. These aids are tailored for individuals with musculoskeletal disorders, contributing to enhancing their movement abilities and general well-being. The participants in this sector are pivotal in meeting the escalating requirement for orthopedic orthotic solutions through the delivery of cutting-edge and research-driven products.

Prominent companies in the Orthopedic Orthotics industry comprise Zimmer Biomet Holdings Inc., Össur hf., DJO Global Inc., Breg Inc., Bauerfeind AG, Ottobock SE & Co. KGaA, DeRoyal Industries Inc., medi GmbH & Co. KG, Becker Orthopedic, and Fillauer LLC. Zimmer Biomet is renowned worldwide in musculoskeletal healthcare, while Össur excels in non-surgical orthopedic treatment. DJO Global is dedicated to enhancing patient outcomes with innovative orthopedic remedies, and Breg provides a diverse array of supportive orthopedic products. Bauerfeind specializes in orthopedic braces, supports, and compression stockings, whereas Ottobock is a leading global healthcare solutions provider. DeRoyal Industries is recognized for its manufacturing of various medical goods, and medi is a specialist in medical bracing and support systems. Becker Orthopedic specializes in the design of orthopedic and prosthetic components, and Fillauer focuses on delivering orthotic and prosthetic solutions.

COVID-19 Impact and Market Status:

The global orthopedic orthotics market has been adversely affected by the Covid-19 pandemic, resulting in a decrease in demand and disruptions in supply chains.

The orthopedic orthotics market has been significantly impacted by the global COVID-19 pandemic. The widespread transmission of the virus and the subsequent enforcement of lockdown measures by governments around the world have resulted in the postponement or cancellation of elective surgeries and non-essential medical procedures. As a result, there has been a decrease in the demand for orthopedic orthotics. Concerns about contracting the virus in healthcare settings have also deterred patients from seeking medical assistance, further impacting the market. Furthermore, disruptions in the international supply chain have caused shortages of essential raw materials and components required for the production of orthopedic orthotics.

Challenges related to manufacturing, distribution, and workforce availability have been encountered by the orthotics industry due to various restrictions and safety protocols. However, there is a growing trend toward utilizing telehealth services, presenting potential opportunities for remote consultations and fittings of orthotic devices. While the orthopedic orthotics market is anticipated to gradually recover as the world adapts to the ongoing pandemic, a return to pre-pandemic growth levels may require a considerable amount of time.

Latest Trends and Innovation:

- In July 2021, Össur, a leading provider of non-invasive orthopedic products, announced the acquisition of College Park Industries, a prosthetic foot manufacturer based in Michigan.

- In May 2021, DJO Global, a global provider of medical technologies, completed the acquisition of Trilliant Surgical, a manufacturer of foot and ankle orthopedic implants.

- In March 2021, Otto Bock HealthCare, a global leader in orthopedic technology, announced the acquisition of Freedom Innovations, a developer and manufacturer of lower limb prosthetics.

- In February 2021, Hanger, Inc., a provider of orthotic and prosthetic patient care services, announced a strategic partnership with ATLAS Healthcare Partners, a specialist in the delivery and management of orthotic and prosthetic care.

- In January 2021, Össur introduced Rheo XC, an advanced microprocessor-controlled knee solution for above-knee amputees.

- In November 2020, Stryker Corporation, a leading medical technology company, completed the acquisition of Wright Medical Group, a global orthopedic medical device company.

- In September 2020, DJO Global launched the Empowr 3D knee, a personalized knee brace utilizing 3D printing technology.

- In July 2020, Össur acquired Medi Prosthetics, a manufacturer of lower limb prosthetic components.

- In May 2020, Zimmer Biomet Holdings, a global leader in musculoskeletal healthcare, announced the acquisition of A&E Medical Corporation, a manufacturer of soft tissue repair devices.

Significant Growth Factors:

Factors driving the growth of the Orthopedic Orthotics Market comprise the higher incidence of orthopedic ailments, a rising elderly demographic, advancements in orthotic device technology, and increasing recognition of the advantages offered by orthopedic orthotics.

The market for orthopedic orthotics is witnessing a significant increase driven by several key factors. The escalating occurrence of orthopedic conditions such as arthritis, osteoporosis, and musculoskeletal injuries is fueling the demand for orthotic devices. These ailments are becoming more prevalent globally, leading to a ened requirement for orthopedic orthotics.

Moreover, the expanding elderly population worldwide is also contributing to the market's expansion as older individuals are more susceptible to orthopedic ailments. Advancements in technology and materials utilized in orthotic devices are further enhancing their efficacy and longevity, thereby boosting their adoption rates. The emergence of innovative products like smart orthotics embedded with sensors for data monitoring is appealing to consumers, particularly athletes and individuals with active lifestyles. Additionally, the increasing desire for personalized orthotic solutions, tailored to the specific needs and preferences of individuals, is propelling market growth. This individualized approach to orthotics ensures superior patient outcomes and ened comfort levels. Furthermore, supportive reimbursement policies in certain regions and the rising healthcare expenditure are bolstering market expansion. In conclusion, the future holds substantial growth prospects for the orthopedic orthotics market, propelled by the surge in orthopedic conditions, technological innovations, and the expanding aging demographic.

Restraining Factors:

Challenges faced by the orthopedic orthotics market include the elevated expenses of orthotic products, restricted insurance support, and insufficient knowledge among potential consumers, thereby impeding its growth.

The sector of orthopedic orthotics is experiencing rapid growth, yet it encounters various obstacles and limitations. One primary challenge is the considerable cost associated with orthotics. The expenses stem from the specific materials utilized, the need for customization, and the advanced technology integrated into these devices. As a result, affordability and accessibility to orthotics are restricted for many patients, especially in less developed regions with limited healthcare resources. Furthermore, a lack of awareness and education regarding orthotics hinders market expansion. Many individuals may not fully understand the advantages of orthotics or have access to healthcare professionals who can provide accurate diagnoses and prescriptions. This awareness gap can result in underutilization of orthotics, impeding market growth. In addition, the complex reimbursement procedures and strict regulations serve as further restraining factors for the orthopedic orthotics market. These factors can lead healthcare providers to hesitate in prescribing orthotics and create challenges for patients seeking coverage for these devices. Despite these obstacles, the orthopedic orthotics market exhibits significant growth potential. Advancements in technology and materials can potentially reduce costs and enhance the availability of orthotics.

Moreover, raising awareness through educational initiatives and campaigns could help bridge the knowledge divide and advocate for the benefits of orthotics to the wider population. With efforts to simplify reimbursement processes and regulatory structures by governments and healthcare institutions, the market is anticipated to expand further. Overall, although facing certain challenges, the orthopedic orthotics market holds promise for growth through the continued resolution of these issues.

Key Segments of the Orthopedic Orthotics Market

Product Overview

• Lower-limb Orthotics

• Upper-limb Orthotics

• Spine Orthotics

• Others

Application Overview

• Neuromuscular And Musculoskeletal Disorders

• Sports Injuries

• Fractures

• Others

Material Overview

• Carbon Fibres

• Rubber

• Metal

• Plastic

• Others

Posture Overview

• Static orthotic devices

• Dynamic orthotic devices

• Other

Manufacturing Overview

• Prefabricated orthotic devices

• Custom Fitted

• Custom Fabricated

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America