Market Analysis and Insights:

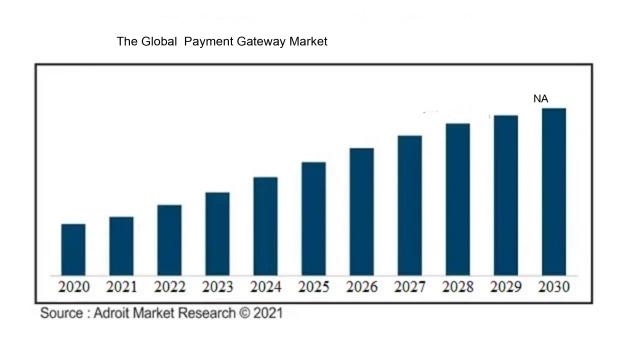

The worldwide payment gateway market is estimated to develop at a CAGR of 22.3% USD 26.78 billion (in 2022) between 2023 and 2030.

The market expansion is being driven by the increasing use of online and mobile payments, the increasing acceptance of e-commerce, and a growing need for safe and easy payment solutions. A payment gateway is an application that provides safe and rapid processing of transactions for electronic commerce and other internet enterprises. It functions as a bridge between the website of the seller and the banks that are involved in payment processing. The payment gateway market has been a critical component of the fast-increasing e-commerce industry, allowing businesses to take numerous forms of online payments, including credit and debit cards, online wallets, and more.

Payment Gateway Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | NA |

| Growth Rate | CAGR of 22.3% during 2022-2030 |

| Segment Covered | By Product, By Application, Region |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Adyen, Amazon Payments, Authorize Net, Braintree, PayPal, PayU, Stripe, Verifone, and WePay are among |

Market Definition

A payment gateway is a safe and secure online service that enables businesses to take credit cards, debit cards, and other kinds of payment from their customers. It functions as a go-between for the customer and merchant banks, processing payments and transferring monies. The payment gateway industry is quickly expanding, due to the increasing acceptance of mobile payments and the increasing acceptance of online shopping. To protect client data, a payment gateway must be extremely safe. To prevent deception and data breaches, it must employ encryption and other safety precautions. A payment gateway must be simple to use for companies as well as consumers. It must have an easy-to-use interface. A payment gateway must be adaptable enough to satisfy the needs of organizations of various sizes. To suit various enterprises, it must provide a variety of characteristics and payment ways. A payment gateway must be economical for businesses of all sizes. It must provide affordable prices and transparent fees.

Key Market Segmentation:

Insights on Key types:

Hosted payment gateways are the most common sort of payment gateway in the industry. They are the most popular option for organizations of all sizes because they are simple to set up and use and provide a good blend of safety and adaptability. The most common sort of payment gateway is the hosted payment gateway. Businesses do not need to conduct any growth or integration work to use them because they are stored by the payment gateway provider. As a result, they are an excellent choice for firms that lack the resources to establish their own processing payments system.

Integrated Payment Gateways Integrated payment gateways are more difficult to set up than dedicated payment gateways, but they provide greater flexibility and customization. Businesses can embed the payment gateway within their site or application, giving them greater control over the process of checkout. Integrated payment gateways, on the other hand, might be costlier than hosted payment processors and require more technical skills to set up and manage. API-Based Payment Gateways Payment gateways that use APIs are the most secure sort of payment gateway. They interact with the vendor web page or application via APIs, making them harder to hack. API-based payment gateways, on the other hand, are the most complicated to set up and use. They necessitate an in-depth knowledge of API Management and safety procedures on the part of organizations.

Insights on Key Applications:

E-commerce is the most common application for payment gateways. Payment gateways are vital for businesses who wish to sell their goods or services online, as electronic commerce constitutes one of the world's fastest-expanding industries. Payment gateways are required for e-commerce enterprises to receive online payments from clients. They allow firms to make use of debit cards, credit cards, PayPal, and other payment methods.

Customers may easily checkout and finalize their transactions as a result of this. In-app purchases Payment gateways are additionally employed in mobile app in-app purchases. This lets users buy digital goods and services including games, movies, and music without leaving the app. Subscriptions Payment gateways can be used to arrange recurring invoicing for subscriptions. Businesses can use this to collect money on an ongoing schedule, such as every month or annually. Donations Payment gateways may be employed to receive client donations. This is a popular method of fundraising for charity and non-profit organizations. Business-to-Business (B2B) Payments Payment gateways can also be used for business-to-business (B2B) payments. This enables businesses to swiftly and simply send and get payments from other firms.

Insights on Key Market Size

Small and medium-sized firms (SMEs) have no more than 250 staff members, whereas big companies have more than 250 people. In 2022, the larger enterprise category will account for more than 55% of the payment gateway market. This is because larger businesses want payment gateways that can manage high quantities of transactions and provide a variety of features and services. Payment gateways are often more expensive for SMEs than for large organizations. They may also lack the resources to operate a complicated payment gateway solution. As a result, SMEs frequently select hosted payment gateways over on-premise payment gateways since they are easier to set up and operate. Large Organisations Large organizations usually have a greater payment gateway budget as well as the resources to handle an intricate payment gateway solution. As a result, large corporations frequently choose onsite payment gateways, which provide greater adaptability and customization than hosted payment gateways.

Insights On End Users

Merchants are the most common consumers of payment gateways. They are the companies that receive payments from customers through payment gateways. Payment gateways allow businesses to accept a variety of payment methods, including debit and credit cards, and other kinds of payment. They also provide a variety of services and tools to help businesses improve their payment processes and increase revenue. Merchants are businesses that receive payments from clients through payment gateways. They can be people, small businesses, or major corporations. Customers They are people who use payment gateways to buy products and services from companies. Individuals, businesses, and even governments might be included. Payment Processors Payment processors are financial firms that assist businesses and customers in transferring cash. They collaborate with payment gateways to handle payments and ensure their security and dependability. Providers Of Payment Getaways Payment gateway suppliers are companies that provide merchants with payment gateway services. They provide the equipment and infrastructure that enables retailers to accept customer payments.

Insights on Regional Analysis:

During the projection period, Asia-Pacific is projected to take over the market.

According to the payment gateway industry regional research, Asia-Pacific is predicted to lead the market throughout the projection period. The region's phenomenal growth might be ascribed to things such as A growing number of government projects aimed at improving the region’s online payment infrastructure. E-commerce and internet purchasing are becoming increasingly popular in the region. Digital payment methods, debit cards, credit cards, and electronic wallets are growing increasingly prevalent. The region is home to a sizable number of medium and small-sized businesses. North America The payment gateway market in North America is the second largest. This region's market growth can be attributable to factors including high credit card and debit card penetration. E-commerce and online purchasing are getting more popular. A high number of large firms are present in the region. Europe Europe has the third-largest payment gateway market. This region's market growth can be attributable to factors such as increased acceptance of digital payment systems. E-commerce and online purchasing are getting more popular. The region is home to a significant amount of medium-sized and small-sized enterprises.Latin America, the Middle East, and Africa The payment gateway markets in Latin America, the Middle East, and Africa are the smallest. However, both markets are likely to rise rapidly within the forecast period. This market expansion can be attributable to factors such as increased acceptance of digital payment systems. E-commerce and internet purchasing are becoming increasingly popular. These regions are experiencing increased economic development.

The worldwide payment gateway market is extremely competitive. The major providers compete on characteristics, costs, and customer support. As the need for secure and simple payment options grows, the market is likely to expand more in the coming years. Adyen, Amazon Payments, Authorize Net, Braintree, PayPal, PayU, Stripe, Verifone, and WePay are among the major companies in the worldwide payment gateway business. These players are substantially investing in R&D to provide novel payment solutions that match the needs of companies and their customers.

COVID-19 Impact and Market Status

The epidemic of COVID-19 has had a tremendous influence on the payment gateway sector. As an outcome of the global lockdown, businesses were obliged to shut their doors to the community and move their operations online. This resulted in an increase in online purchasing, which raised the need for payment gateways. In numerous ways, the COVID-19 epidemic has hastened the expansion of the payment gateway sector. As a result, there has been a considerable increase in internet shopping. The lockdown limitations, which pushed consumers to shop the internet for vital goods and services, fueled this expansion. Mobile payments have grown in popularity as a result of the pandemic. Mobile payments are a simple and frictionless method of paying for products and services that have grown in popularity during the pandemic. Because of the pandemic, there is a greater need for contactless transactions. Contactless transactions are an easy and secure method to pay for products and services, and they have grown in popularity as technology has progressed. The epidemic of COVID-19 has had a huge influence on the payment gateway sector. However, the market's long-term forecast is good. In the future years, the growth of e-commerce, mobile money transactions, and contactless transactions will continue to boost demand for payment gateways.

Latest Trends and Innovation:

The following are the most recent advances in the payment gateway market in 2023:

? The increasing use of free banking, allows outside vendors to get direct access to client banking data from banks. This provides payment gateways with additional opportunities, such as the potential to deliver quick payments and more personalized payment experiences.

? The increasing acceptance of buy now, pay later (BNPL) services, enables customers to make purchases and pay for them in instalments afterwards. BNPL services are growing in popularity among online retailers since they can help raise conversion rates and typical order values.

? The increase of cryptocurrency payments, which are growing more common as the value of cryptocurrencies rises. Payment gateways are beginning to accept cryptocurrency payments, which can help firms access a new audience of clients.

? The creation of new payment technologies such as voice transactions and facial recognition transactions. These innovations are still in their early phases of development, but they have a chance to revolutionize the way we pay for goods and services.

Significant Growth Factors:

The expansion of e-commerce is the most dominant driver of growth in the payment gateway market. The global e-commerce business is rapidly expanding, producing an enormous need for payment gateways that may safely and efficiently process online payments. The global e-commerce market is expected to grow fast. This expansion will create a considerable need for payment gateways that can safely and quickly process online payments. As people embrace the simplicity of paying for goods and services using their cell phones, mobile payment methods are becoming increasingly popular. The global mobile banking market is expected to grow significantly. Contactless payments are an easy and secure method to pay for goods and amenities, and they have grown in popularity as the COVID-19 epidemic has progressed. The international contactless payment market is expected to grow substantially in the next years. Open banking is a contemporary financial technology that enables third-party companies to gain direct access to client banking data from banks. This provides payment gateways with additional opportunities, such as the potential to deliver quick payments and more personalized payment experiences. Consumers can use BNPL services to make purchases right away and pay for them in future instalments. BNPL services are growing in popularity among online retailers since they can help raise the rate of conversion and average purchase values. As the worth of cryptocurrencies rises, digital currency transactions are becoming more common. Payment gateways are beginning to accept cryptocurrency payments, which can help firms reach a new client base.

Restraining Factors:

Payment gateways are a popular subject for cybercriminals, and several significant breaches of data have occurred in recent years. This has prompted concerns about the security of payment gateways, which may deter some businesses from using them. Payment gateways often charge a fee to merchants for each transaction. These fees might be substantial, cutting into a company's earnings. Payment gateways can be difficult to configure and utilize. This can be a stumbling block for small firms and start-ups. Payment gateways must comply with several regulations, notably the Payment Card Industry Data Security Standard (PCI DSS). This can be a tedious and costly process, which may discourage some businesses from adopting payment gateways. Some organizations may be unaware of the advantages of employing a payment gateway or may be unsure how to use one. This could impede the market expansion. The payment gateway market is getting more competitive, which may result in cheaper pricing and fewer services for businesses. The payment gateway market varies by region around the world. Payment gateway companies may find it challenging to scale their company and reach a worldwide audience as a result of this. Despite these impediments, the payment gateway market is a fluid and growing business that is projected to increase in the next years.