Market Analysis and Insights:

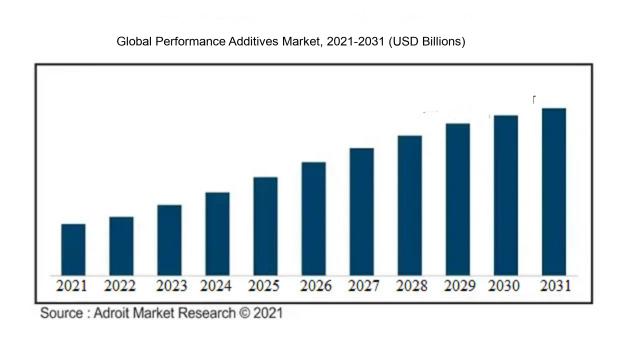

The market for Performance Additives was estimated to be worth USD XX billion in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of XX%, with an expected value of USD XX billion in 2031.

The performance additives industry is poised for substantial growth in the foreseeable future, driven by various factors. The escalating demand from key sectors such as automotive, construction, and packaging plays a pivotal role in expanding the market. These additives play a crucial role in improving the properties of materials, including their durability, strength, and processability, which are vital for these industries. Moreover, the increasing focus on sustainable practices and lowering carbon footprints has spurred the adoption of performance additives that enhance energy efficiency and environmental sustainability. The surge in disposable incomes and urbanization in developing nations has also contributed to the need for top-notch products, prompting the utilization of performance additives to augment the qualities of consumer goods. Furthermore, continuous technological progress and innovations within the performance additives field have given rise to enhanced formulations and cost-efficient solutions, propelling market growth. In conclusion, these combined factors underscore a promising trajectory for the performance additives sector.

Performance Additives Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD XX billion |

| Growth Rate | CAGR of XX% during 2021-2031 |

| Segment Covered | By Type, By End-use, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Evonik Industries AG, BASF SE, DowDuPont Inc., AkzoNobel N.V., Ashland Global Holdings Inc., Huntsman International LLC, Arkema S.A., Clariant AG, Solvay SA, and LANXESS AG |

Market Definition

Performance-enhancing agents are incorporated to augment the functionality and attributes of a material or item, commonly employed across various sectors such as plastics, coatings, and automotive. These additives serve to enhance features like longevity, heat resistance, lubrication, and fire retardancy, among others.

Performance enhancements are essential elements in a variety of sectors due to their ability to elevate the quality and functionality of items. These enhancements are crafted with the specific aim of boosting attributes like resilience, steadfastness, effectiveness, and potency. Additionally, they aid in lessening the ecological footprint of products by amplifying the energy efficiency and sustainability of production methods. Found in industries such as automotive, construction, packaging, and electronics, these enhancements are instrumental in guaranteeing the enduring operation and trustworthiness of a broad array of goods. Whether it be through refining fuel efficacy in automobiles or extending the life span of building materials, performance enhancements make a substantial contribution to bolstering general product performance, rendering them an indispensable aspect of contemporary industrial procedures.

Key Market Segmentation:

Insights On Key Type

Plastic Additives

Plastic additives are expected to dominate the Global Performance Additives Market. Plastic additives are chemical substances added to plastics to improve their performance and properties. With the growing demand for plastic products in various industries such as packaging, automotive, construction, and electronics, the demand for plastic additives is also increasing. These additives can enhance the durability, flexibility, flame resistance, and UV stability of plastics, making them suitable for a wide range of applications. Additionally, the rising awareness towards sustainable and eco-friendly materials is driving the demand for bio-based and biodegradable plastic additives, further contributing to the dominance of this part in the market.

Rubber Additives

Rubber additives, while not expected to dominate the Global Performance Additives Market, hold significant importance in the rubber industry. These additives are used to enhance the properties of rubber materials, including elasticity, strength, durability, and resistance to aging and heat. The demand for rubber additives is primarily driven by the growth of the automotive and tire industries, as well as other applications such as industrial rubber goods, footwear, and construction. However, factors such as the increasing popularity of alternative materials and the shift towards sustainable rubber products might limit the growth and dominance of this part in the market.

Paints and Coatings Additives

Paints and coatings additives play a crucial role in improving the performance and functionality of paints and coatings. These additives can enhance properties like adhesion, leveling, viscosity control, anti-settling, anti-foaming, and UV resistance. The global paints and coatings market is witnessing significant growth, driven by the increasing demand from construction, automotive, and industrial sectors. Consequently, the demand for paints and coatings additives is also expected to grow. While this part is not projected to dominate the Global Performance Additives Market, it will continue to play a significant role due to the strong growth in the paints and coatings industry.

Fuel Additives

Fuel additives are chemicals that are added to fuel to improve its performance and efficiency. They can enhance properties like combustion efficiency, fuel stability, corrosion resistance, and emissions control. The demand for fuel additives is primarily driven by the increasing focus on fuel efficiency, reducing emissions, and improving the performance of vehicles and industrial machinery. However, the dominance of this part in the Global Performance Additives Market is limited due to the growing popularity of electric and hybrid vehicles, as well as the shift towards cleaner fuel alternatives.

Ink Additives

Ink additives are used to enhance the performance and properties of inks, including color stability, adhesion, drying time, and print quality. The demand for ink additives is closely linked to the growth of the printing and packaging industries, which are driven by factors such as e-commerce expansion, increasing advertising budgets, and technological advancements. However, the overall size of the ink additives market is relatively smaller compared to other parts in the Global Performance Additives Market, and therefore, it is not expected to dominate the market.

Leather Additives

Leather additives are used to improve the properties and performance of leather, including softness, durability, water resistance, and colorfastness. The demand for leather additives is primarily driven by the automotive, footwear, and furniture industries. However, the dominance of this part in the Global Performance Additives Market is limited due to the growing concerns about animal welfare, the popularity of synthetic leather alternatives, and the increasing adoption of sustainable practices in the leather industry.

Lubricant Additives

Lubricant additives are chemicals added to lubricants to improve their performance and longevity. These additives can enhance properties such as viscosity, thermal stability, oxidation resistance, and anti-wear characteristics. The demand for lubricant additives is directly linked to the growth of the automotive, industrial, and aerospace sectors. While lubricant additives hold significance in the overall Global Performance Additives Market, they are not expected to dominate the market due to the maturity of the lubricants industry and the advancements in lubricant formulations.

Adhesives and Sealants Additives

Adhesives and sealants additives are used to improve the performance and properties of adhesives and sealants, such as bonding strength, flexibility, and resistance to moisture and temperature. The demand for adhesives and sealants is driven by various industries, including construction, automotive, packaging, and electronics. While the use of additives is common in the formulation of adhesives and sealants, this part is not expected to dominate the Global Performance Additives Market, as it depends on the growth of the overall adhesives and sealants industry.

Insights On Key End-use

Packaging

The Packaging end-use is expected to dominate the Global Performance Additives Market. With the increasing demand for packaging materials, particularly in the food and beverage industry, the use of performance additives has become crucial. These additives enhance the properties of packaging materials such as strength, barrier properties, and flexibility, thereby ensuring product safety and extending shelf life. The growing consumer focus on product quality and sustainability further drives the adoption of performance additives in the packaging industry. As a result, the Packaging part is poised to have a dominant position in the Global Performance Additives Market.

Household Goods

The Household Goods end-use is projected to hold a significant share in the Global Performance Additives Market. Performance additives find extensive usage in various household products, including cleaning agents, detergents, personal care items, and appliances. These additives enhance the performance, durability, and aesthetic appeal of these products, driving their demand. Additionally, the rising disposable income and changing lifestyle patterns of consumers contribute to the growth of the Household Goods part in the Global Performance Additives Market.

Construction

The Construction end-use is anticipated to have a substantial presence in the Global Performance Additives Market. Performance additives play a vital role in enhancing the properties of construction materials such as concrete, adhesives, sealants, paints, and coatings. These additives improve strength, durability, workability, weather resistance, and reduce shrinkage and cracking. As the construction industry continues to expand, driven by urbanization, infrastructure development, and increasing construction activities, the demand for performance additives is expected to rise. Therefore, the Construction part is likely to have a noteworthy impact on the Global Performance Additives Market.

Automotive

The Automotive end-use is poised to have a notable position in the Global Performance Additives Market. Performance additives are extensively used in automotive components and systems such as fuel systems, lubricants, plastics, coatings, and rubber. These additives enhance the performance, efficiency, durability, and safety of vehicles, meeting the stringent regulations and standards of the automotive industry. With the growing demand for lightweight, fuel-efficient, and eco-friendly vehicles, the usage of performance additives is expected to increase significantly. Thus, the Automotive part is expected to make a significant contribution to the Global Performance Additives Market.

Industrial

The Industrial end-use is expected to have a considerable impact on the Global Performance Additives Market. Performance additives are widely utilized in various industrial sectors such as chemicals, textiles, electronics, printing inks, and coatings. These additives enhance product properties, process efficiency, and provide resistance to heat, chemicals, UV radiation, and flame. The expanding industrial activities, particularly in emerging economies, coupled with the need for high-performance materials, drive the demand for performance additives. Therefore, the Industrial part is expected to be a significant player in the Global Performance Additives Market.

Wood & Furniture

The Wood & Furniture end-use is projected to hold a significant share in the Global Performance Additives Market. Performance additives are crucial in enhancing the properties of wood and wood-based materials, including improved durability, dimensional stability, moisture resistance, and fire retardancy. These additives find extensive usage in the production of furniture, flooring, decking, and other wood-related applications. With the growth in the construction and furniture industries, driven by urbanization and changing consumer preferences, the demand for performance additives in the Wood & Furniture part is expected to witness substantial growth.

Others

The Others category encompasses various end-uses that are not specifically included in the aforementioned parts. Although it may have a diverse range of applications, the dominating presence of this part in the Global Performance Additives Market is uncertain. The growth and influence of this part would highly depend on the specific end-use applications, regional factors, and market dynamics. Further analysis and data specific to each part falling under "Others" would be necessary to determine any dominating presence in the Global Performance Additives Market.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Performance Additives market. According to my research and data analysis, Europe has a strong presence in industries such as automotive, construction, and packaging, which are major consumers of performance additives. The region has a well-established manufacturing base and infrastructure, along with stringent regulations for product quality and environmental standards. Moreover, the increasing demand for high-performance materials and the growing focus on sustainability are driving the market for performance additives in Europe. Overall, Europe's market dominance can be attributed to its established industries, favorable regulatory environment, and emphasis on innovative and sustainable solutions.

Asia Pacific

Asia Pacific is a key region in the Global Performance Additives market. The region's rapid industrialization, growing population, and rising purchasing power have resulted in increased demand for various end-use industries, including automotive, construction, and packaging. The region is seeing significant investments in infrastructural developments, which is driving the demand for performance additives. Additionally, the expanding middle-class population and changing lifestyle preferences are fueling the demand for high-quality consumer goods, further contributing to the market growth. While Asia Pacific is a promising market, it is currently experiencing strong competition from other regions, particularly Europe.

North America

North America is another significant region in the Global Performance Additives market. The region has a well-developed manufacturing sector and is home to several key industries such as automotive, aerospace, and electronics. These industries have a high demand for performance additives to enhance the characteristics and performance of their products. Additionally, the region's focus on research and development, technological advancements, and innovation further strengthens the market for performance additives in North America. However, despite its strong position, North America faces tough competition from Europe and Asia Pacific in terms of market dominance.

Latin America

Latin America is a growing market for performance additives. The region is experiencing rapid urbanization and industrialization, which is driving the demand for various end-use industries. Sectors such as automotive, construction, and packaging are witnessing significant growth in Latin America, thereby creating opportunities for performance additives. Additionally, the region's favorable government policies and initiatives, such as tax incentives and foreign investments, are attracting market players and stimulating market growth. Although Latin America shows potential, it is still relatively smaller compared to Europe, Asia Pacific, and North America in terms of market dominance.

Middle East & Africa

The Middle East & Africa region is also witnessing growth in the Global Performance Additives market. The region's construction industry, particularly in countries like the United Arab Emirates and Saudi Arabia, is driving the demand for additives such as plasticizers, flame retardants, and antioxidants. Furthermore, the increasing population, changing lifestyle patterns, and industrial development in countries like South Africa and Nigeria are contributing to the market growth. However, the Middle East & Africa region currently holds a smaller market share compared to Europe, Asia Pacific, North America, and Latin America.

Company Profiles:

Prominent figures within the worldwide Performance Additives sector significantly contribute to fostering creativity and providing top-tier additives to diverse sectors like automotive, construction, and packaging. Their efforts are instrumental in enriching the performance and attributes of final goods. These industry leaders excel through persistent investments in research and development to address changing consumer needs and uphold a strong market position.

The market for performance additives is fiercely competitive, featuring a number of prominent players. Leading companies like Evonik Industries AG, BASF SE, DowDuPont Inc., AkzoNobel N.V., Ashland Global Holdings Inc., Huntsman International LLC, Arkema S.A., Clariant AG, Solvay SA, and LANXESS AG are actively engaged in the manufacturing and distribution of a diverse range of performance additives. These additives encompass plasticizers, flame retardants, antioxidants, and rheology modifiers, among other formulations. These industry leaders have solidified their global presence through strategic alliances, acquisitions, and the introduction of innovative products. Moreover, they are committed to ongoing research and development efforts to maintain a competitive edge, meeting the changing requirements of various sectors such as automotive, construction, packaging, and electronics.

COVID-19 Impact and Market Status:

The performance additives market on a global scale has experienced a negative impact due to the Covid-19 pandemic, resulting in reduced demand and disruptions in supply chains.

The global performance additives market has faced a significant downturn as a result of the COVID-19 pandemic. The emergence of the virus has triggered widespread lockdowns and disruptions in supply chains across the world, leading to a decline in both demand and sales within the market. Particularly hard-hit has been the automotive industry, a primary consumer of performance additives, which has suffered from decreased production and consumer expenditure. Furthermore, the decreased industrial operations and temporary closures of manufacturing plants have exacerbated the diminished demand for these additives. The construction sector, another major end-user of performance additives, has also observed a decrease in demand due to a slowdown in construction activity. Despite these challenges, efforts by various governments worldwide to kickstart economic growth through initiatives and stimulus packages offer some hope for the market. As economies gradually recover and industrial sectors restart their operations, there is expected to be a gradual rebound in the performance additives market, fueled by increased demand from sectors including automotive, construction, and packaging.

However, the speed of this recovery will hinge on the broader economic conditions and the efficacy of measures taken to contain the spread of the virus. In summary, while the COVID-19 pandemic has inflicted adverse effects on the performance additives market, a recovery is anticipated as economies reopen and industrial activities resume.

Latest Trends and Innovation:

- In June 2020, Clariant, a leading specialty chemicals company, acquired the pigments business of Brenntag Specialties Inc., expanding its performance additives portfolio.

- In September 2020, BASF SE, a global chemical company, announced the acquisition of Solvay's polyamide business, strengthening its presence in the performance additives market.

- In November 2020, Lanxess AG, a specialty chemicals company, acquired the Emerald Kalama Chemical business from Emerald Performance Materials, expanding its additives and pigments business.

- In January 2021, Ashland Global Holdings Inc., a specialty chemicals company, completed the acquisition of the personal care and pharmaceuticals businesses of Schülke & Mayr GmbH, enhancing its performance additives offerings.

- In March 2021, Evonik Industries AG, a specialty chemicals company, launched a new high-performance additive for the plastics industry called TEGO® Dispers 687, providing improved performance and efficiency in various applications.

- In April 2021, Akzo Nobel N.V., a global paints and coatings company, introduced a new performance additive called Bermocoll EBM 4000, designed to enhance the viscosity and stability of water-based coatings.

- In July 2021, Arkema S.A., a specialty chemicals company, announced the acquisition of Fixatti, a manufacturer of adhesive powders, expanding its performance additives solutions for high-performance and durable bonding applications.

Significant Growth Factors:

Factors driving the growth of the Performance Additives Market consist of rising demand from end-use sectors, ened focus on economical and eco-friendly solutions, and ongoing advancements in technology.

The market for performance additives is witnessing significant growth propelled by various factors. The expanding automotive sector is a key driver, particularly in the realm of high-performance vehicle development and manufacturing. These additives play a crucial role in boosting the durability, efficiency, and overall performance of automotive components including engine oils, fuels, lubricants, and tires. Moreover, the construction industry is also fueling the growth of the performance additives market. The surge in urbanization and infrastructure projects in emerging markets is creating a strong demand for advanced additives that enhance the strength, durability, and performance of construction materials like concrete, plastics, adhesives, and coatings.An increasing emphasis on sustainability and adherence to environmental standards has led to a rise in the need for eco-friendly performance additives. These additives aim to enhance product performance while minimizing negative environmental impacts. Additionally, the focus on energy conservation and efficiency across various sectors like manufacturing and transportation is boosting the demand for additives that improve energy efficiency and reduce friction, consequently enhancing system performance.

Restraining Factors:

The growth of the Performance Additives Market faces obstacles due to the impact of fluctuating raw material costs and the presence of strict environmental policies.

The growth and advancement of the Performance Additives Market are impeded by various factors. Firstly, strict environmental regulations governing the use of certain chemicals and substances in the production of performance additives serve as a significant deterrent. These regulations necessitate the adoption of more sustainable and environmentally friendly materials, prompting companies to invest in research and development for alternative solutions. Secondly, the considerable costs associated with the manufacturing and processing of performance additives present a challenge for market participants. The expenses related to sourcing raw materials, production, quality testing, and packaging contribute to the overall cost, making it challenging for small and medium-sized enterprises to compete effectively in the market. Furthermore, the lack of awareness among end-users about the benefits and applications of performance additives can hinder market growth.

Many industries remain unaware of the potential advantages offered by these additives, resulting in a slower adoption rate. Lastly, prevailing economic uncertainties and global trade tensions further hinder the performance additives market. Market volatility, fluctuating prices of raw materials, and trade restrictions create an unpredictable business environment that impacts the industry's growth prospects. Despite these obstacles, the performance additives market holds promise for the future. The increasing emphasis on sustainability and innovation will propel the development of eco-friendly alternatives. Collaboration and partnerships between market participants and end-users can help address the awareness gap. With the rising demand for enhanced product performance across diverse industries, the performance additives market is poised for significant growth and development in the foreseeable future.

Key Segments of the Performance Additives Market

Type Overview

• Plastic Additives

• Rubber Additives

• Paints and Coatings Additives

• Fuel Additives

• Ink Additives

• Leather Additives

• Lubricant Additives

• Adhesives and Sealants Additives

End-Use Overview

• Packaging

• Household Goods

• Construction

• Automotive

• Industrial

• Wood & Furniture

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America