Market Analysis and Insights:

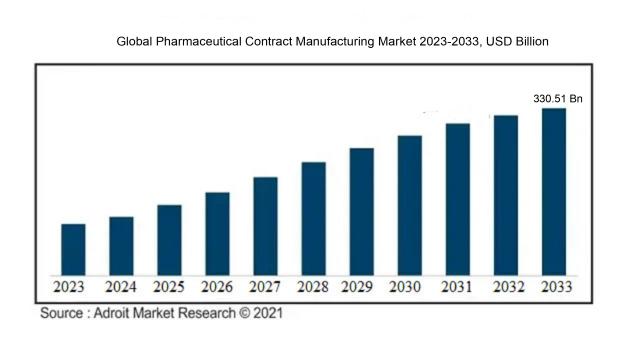

The market for pharmaceutical contract manufacturing was estimated to be worth USD 172.01 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 6.81%, with an expected value of USD 330.51 billion in 2033.

The pharmaceutical contract manufacturing sector experiences the influence of various key factors. Primarily, the rising demand for generic drugs stands out as a notable driver of market progression. With the imminent patent expiration of numerous popular drugs, pharmaceutical firms opt to outsource their manufacturing processes to contract manufacturers to cut expenses and sustain profitability. Moreover, the increasing complexity of drug compositions and the necessity for specialized manufacturing competencies propel market growth. Contract manufacturing entities often possess cutting-edge technologies and proficiency in producing intricate drugs, making them appealing to pharmaceutical companies in need of specialized services.

Additionally, the trend of outsourcing research and development (R&D) activities plays a significant role in driving the market forward. Pharmaceutical firms are progressively entrusting their R&D undertakings, such as clinical trials and formulation development, to contract manufacturing organizations (CMOs), further fueling the expansion of the contract manufacturing domain.

Lastly, the requirement for adaptable and scalable manufacturing capacity also fuels market advancement. Contract manufacturing enables pharmaceutical companies to adjust their production capacity in line with market requirements, thereby reducing risks and enhancing operational efficiency. Collectively, these elements foster the growth and evolution of the pharmaceutical contract manufacturing landscape.

Pharmaceutical Contract Manufacturing Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2033 |

| Study Period | 2018-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 330.51 billion |

| Growth Rate | CAGR of 6.81% during 2024-2033 |

| Segment Covered | By Service ,By End User,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Lonza Group Ltd., Catalent Pharma Solutions, Thermo Fisher Scientific Inc., Boehringer Ingelheim International GmbH, Evonik Industries AG, Famar SA, Jubilant Life Sciences Limited, Recipharm AB, Fareva Holding SA, |

Market Definition

Pharmaceutical contract manufacturing entails a pharmaceutical company outsourcing the production of its products to an external manufacturer. This manufacturer adheres to the company's instructions and standards to create the medications, guaranteeing cost-effectiveness and adaptable production capacities.

Pharmaceutical contract manufacturing plays a pivotal role in the healthcare sector, providing essential support in the production of pharmaceuticals and medical equipment. Its significance lies in the ability to tap into external knowledge and resources, enabling pharmaceutical firms to concentrate on their core functions like research, development, marketing, and distribution. This strategy of outsourcing helps in cost reduction, efficiency improvement, and faster introduction of new products to the market. Moreover, contract manufacturing provides adaptability and scalability, empowering pharmaceutical companies to swiftly react to market dynamics and changes in production demands. In essence, pharmaceutical contract manufacturing is indispensable for sustaining a competitive pharmaceutical industry, ensuring the availability of reliable and efficient medications to address global healthcare needs, all the while fostering innovation and driving progress.

Key Market Segmentation:

Insights On Key Service

Pharmaceutical Manufacturing Services is expected to dominate the Global Pharmaceutical Contract Manufacturing market due to its wide range of services offered, including formulation development, active pharmaceutical ingredient (API) manufacturing, and finished dosage form (FDF) manufacturing. This part caters to the overall manufacturing needs of pharmaceutical companies and is expected to witness steady growth.

Pharmaceutical API Manufacturing Services provide specialized manufacturing of APIs, which are crucial components in the development of pharmaceutical drugs. This part focuses on producing high-quality APIs efficiently and is expected to experience considerable demand.

Pharmaceutical FDF Manufacturing Services involve the manufacturing of finished dosage forms, such as tablets, capsules, injectables, and oral solutions. This part plays a significant role in transforming APIs into final products for distribution and is expected to grow alongside the overall contract manufacturing market.

Drug Development Services offer comprehensive assistance throughout the entire drug development process, encompassing preclinical and clinical testing, regulatory compliance, and strategies for commercialization. While not dominating the market, this part is expected to see consistent demand as pharmaceutical companies seek assistance in their drug development efforts.

Biologic Manufacturing Services specialize in contract manufacturing of biologic drugs, including monoclonal antibodies, vaccines, and cell-based therapies. This sector caters to the increasing demand for biologics and is anticipated to experience substantial growth within the contract manufacturing market.

Biologic API Manufacturing Services focus on the manufacturing of APIs specific to biologic drugs. As biologic therapies gain prominence, this part is likely to experience increased demand for the production of high-quality biologic APIs.

Biologic FDF Manufacturing Services involve the manufacturing of finished dosage forms for biologic drugs. This part plays a crucial role in the commercialization of biologics and is expected to see growth as the biologic contract manufacturing market expands.

Insights On Key End User

Major pharmaceutical firms are anticipated to lead the global pharmaceutical contract manufacturing market. With substantial financial resources and established infrastructure, they are well-equipped to manage extensive outsourcing agreements. These companies often delegate manufacturing tasks to specialized contract manufacturing organizations (CMOs) to enhance efficiency, lower expenses, and concentrate on core activities like research and development. With their significant market share and high demand for contract manufacturing services, big pharmaceutical companies are likely to dominate the market.

Small & Mid-Sized Pharmaceutical Companies are another important in the Global Pharmaceutical Contract Manufacturing market. These companies may lack the resources and capabilities to handle manufacturing in-house and often rely on contract manufacturing for their production needs. Contract manufacturing provides them with the necessary expertise, flexibility, and cost efficiencies to bring their products to market. While not expected to dominate the market, small and mid-sized pharmaceutical companies represent a significant portion of the contract manufacturing demand.

Generic Pharmaceutical Companies also play a significant role in the Global Pharmaceutical Contract Manufacturing market. With the growing demand for affordable generic drugs, these companies often outsource their manufacturing to contract manufacturers. Contract manufacturing enables generic pharmaceutical companies to access cost-effective manufacturing solutions while complying with regulatory requirements. Although they may not dominate the market, generic pharmaceutical companies drive a substantial portion of the contract manufacturing demand.

The Other of the Global Pharmaceutical Contract Manufacturing market consists of various players that do not fall into the big pharmaceutical, small & mid-sized pharmaceutical, or generic pharmaceutical categories. This encompasses niche pharmaceutical companies, biotechnology firms, and contract development and manufacturing organizations (CDMOs). Although their presence is significant, this sector is not projected to dominate the market. Nonetheless, the diverse range of companies in the Other category contributes to the overall growth and competitiveness of the contract manufacturing market.

Insights on Regional Analysis:

North America

North America is poised to lead the global pharmaceutical contract manufacturing market. This region boasts a mature pharmaceutical industry, advanced technological infrastructure, and substantial investments in research and development. Furthermore, the presence of major pharmaceutical companies and a favorable regulatory environment further solidify North America's dominance in the market. These factors, coupled with the increasing demand for outsourcing pharmaceutical production, make North America the leading region in the global pharmaceutical contract manufacturing market.

Latin America

In Latin America, there is a growing trend of outsourcing pharmaceutical manufacturing services due to the region's lower production costs and the availability of skilled labor. The market in Latin America is also benefiting from increasing investments in healthcare infrastructure and the presence of favorable government policies. These factors, along with the region's geographic proximity to North America, make Latin America an attractive destination for pharmaceutical contract manufacturing. Despite these advantages, Latin America is anticipated to hold a smaller market share compared to North America.

Asia Pacific

The Asia Pacific region is experiencing significant growth in the pharmaceutical contract manufacturing market. Key factors driving this growth include the region's low labor and production costs, availability of a skilled workforce, and a large consumer base. Furthermore, countries like China and India have well-developed pharmaceutical industries and a strong manufacturing base, making them attractive destinations for outsourcing. Due to rising investments in healthcare infrastructure and a notable transition towards contract manufacturing, Asia Pacific is forecasted to command a substantial market share in the global pharmaceutical contract manufacturing market.

Europe

Europe also holds a significant share in the global pharmaceutical contract manufacturing market. The region benefits from established pharmaceutical companies, advanced manufacturing technologies, and a robust regulatory framework. Additionally, Europe has a strong focus on research and development, which enhances its competitiveness in pharmaceutical contract manufacturing services. However, factors such as high labor and operational costs compared to other regions, stringent regulations, and increasing competition hinder the potential growth of the European market.

Middle East & Africa

The Middle East and Africa region are steadily emerging as significant contributors to the global pharmaceutical contract manufacturing market. Factors such as enhancements in healthcare infrastructure, escalating healthcare expenditure, and ened investments in the pharmaceutical sector all contribute to the region's growth potential. Additionally, government initiatives to promote local manufacturing capabilities attract international pharmaceutical companies for contract manufacturing partnerships. Despite its growth potential, the Middle East and Africa region is anticipated to possess a smaller market share compared to the dominant regions, primarily owing to the presence of established players in North America and Europe.

Company Profiles:

Key entities within the Global Pharmaceutical Contract Manufacturing sector play a pivotal role in offering manufacturing and packaging solutions to pharmaceutical firms, enabling them to subcontract their manufacturing requirements. Their primary responsibility involves facilitating the punctual and effective production of pharmaceutical goods, all while upholding stringent quality benchmarks.

Leading companies in the pharmaceutical contract manufacturing sector are Lonza Group Ltd., Catalent Pharma Solutions, Thermo Fisher Scientific Inc., Boehringer Ingelheim International GmbH, Evonik Industries AG, Famar SA, Jubilant Life Sciences Limited, Recipharm AB, Fareva Holding SA, and Piramal Pharma Solutions. These organizations are known worldwide for their specialized services offered to pharmaceutical firms. Their service portfolio includes formulation development, manufacturing, packaging, and distribution of pharmaceuticals. Through their advanced capabilities, extensive manufacturing facilities, and strategic collaborations with pharmaceutical companies, these key industry players have established themselves as market leaders. Their contributions are crucial to the pharmaceutical sector by ensuring efficient and cost-effective drug production, thus driving growth and success in the global pharmaceutical market.

COVID-19 Impact and Market Status:

The Global Pharmaceutical Contract Manufacturing market has experienced a favorable impact from the Covid-19 pandemic, prompting companies to seek external manufacturing services in order to fulfill the growing need for pharmaceutical products.

The pharmaceutical contract manufacturing industry has been significantly affected by the COVID-19 pandemic. The global outbreak has generated a ened demand for a wide range of medications and vaccines, necessitating a sharp increase in production capacities. Consequently, pharmaceutical firms have encountered difficulties in meeting these requirements and have turned to contract manufacturing services for support. These contract manufacturers have played a vital role in offering the essential expertise and resources needed to fulfill the escalating production needs.

However, the pandemic has also caused disruptions in worldwide supply chains, leading to shortages of raw materials, logistical challenges, and delays in manufacturing processes. The enforcement of social distancing protocols and nationwide lockdowns in various countries has further complicated the manufacturing landscape. Furthermore, the intense focus on developing treatments and vaccines for COVID-19 has diverted significant attention and resources away from other pharmaceutical products.

Nevertheless, despite these formidable challenges, the pharmaceutical contract manufacturing sector is poised for expansion in the forthcoming years as both companies and governments seek to establish a resilient and efficient healthcare infrastructure capable of effectively addressing potential future pandemics.

Latest Trends and Innovation:

- Pfizer announced the acquisition of Hospira on February 5, 2015

- Thermo Fisher Scientific acquired Patheon N.V. on August 28, 2017

- Catalent acquired Juniper Pharma Services on October 20, 2017

- Lonza Group acquired Capsugel on July 06, 2017

- Recipharm announced the acquisition of Sanofi's inhalation contract manufacturing business on September 29, 2017

- Baxter International acquired Claris Injectables Limited on July 15, 2017

- Aenova Holding GmbH acquired Haupt Pharma on March 06, 2015

- CordenPharma acquired Peptisyntha SA on September 26, 2018

- Cambrex announced the acquisition of Avista Pharma Solutions on May 29, 2018

Significant Growth Factors:

The Pharmaceutical Contract Manufacturing Market is experiencing growth due to the growing trend of outsourcing manufacturing activities, increasing need for specialized knowledge, and potential cost efficiencies for pharmaceutical firms.

The pharmaceutical contract manufacturing industry is on a growth trajectory propelled by various pivotal factors. An emerging trend among pharmaceutical firms is the inclination towards contracting out their manufacturing functions to specialized manufacturers. This strategic shift is primarily motivated by the imperativeness of cost reduction and enhancement of operational efficiency. By outsourcing manufacturing operations, pharmaceutical companies can hone in on their core proficiencies, such as drug development and marketing, while entrusting specialized manufacturers with the production of their pharmaceuticals.

Moreover, the burgeoning complexity of pharmaceutical products, encompassing biologics and personalized medicines, poses challenges for in-house manufacturing capabilities of pharmaceutical companies. Contract manufacturers offer a boon in this regard, as they harbor the requisite expertise and infrastructure to adeptly manage the intricate manufacturing processes demanded by these products, thus presenting a viable option for pharmaceutical companies.

Furthermore, the global biopharmaceutical sector is undergoing rapid expansion, fostered by factors like an aging populace, escalating incidence of chronic ailments, and advancements in biotechnology. This surge has sparked a ened demand for contract manufacturing services, as biopharmaceutical entities frequently opt to outsource manufacturing operations to leverage the specialized proficiencies of contract manufacturers.

In addition, the regulatory framework within the pharmaceutical realm is growing increasingly stringent, necessitating strict adherence to Good Manufacturing Practices (GMP) and other quality benchmarks. Contract manufacturers are well-equipped to meet these regulatory mandates, owing to their dedicated quality control mechanisms and adeptness in navigating the intricate regulatory milieu.

In sum, the noteworthy drivers of growth in the pharmaceutical contract manufacturing sector encapsulate the potential for cost savings, adeptness in managing intricate manufacturing processes, escalating demand for biopharmaceuticals, and the imperative of regulatory conformity.

Restraining Factors:

The pharmaceutical contract manufacturing sector faces challenges due to regulatory intricacies, significant initial capital requirements, and a scarcity of competent workforce.

The pharmaceutical contract manufacturing sector has experienced substantial growth recently, propelled by the rising demand for such services from pharmaceutical companies. Nevertheless, there exist certain obstacles that may impede the market's expansion. Among these challenges is the stringent regulatory environment governing the pharmaceutical field.

Government mandates, including the necessity to comply with Good Manufacturing Practices (GMP), can present compliance issues and increased expenses for contract manufacturers. Furthermore, the escalating intricacy of drug formulations and production methods is another hindrance. With pharmaceutical companies introducing more sophisticated pharmaceutical products, contract manufacturers are compelled to invest in cutting-edge technologies and specialized knowledge to fulfill the evolving demands. This can lead to elevated expenses, diminishing the appeal for companies to outsource their manufacturing operations. Moreover, the rising inclination towards internal manufacturing capabilities within pharmaceutical companies is a constraining factor. Some organizations might opt to enhance their manufacturing facilities to retain control over the entire production process and ensure quality standards are met. Despite these challenges, there are favorable aspects to contemplate. The pharmaceutical contract manufacturing sector still harbors growth prospects, fueled by the necessity for cost-efficient manufacturing solutions, particularly in burgeoning markets. Furthermore, as pharmaceutical companies concentrate on core competencies and efficiency enhancements, outsourcing manufacturing processes can convey significant benefits like scalability and adaptability. To surmount the impediments, contract manufacturers must continually adjust to meet regulatory standards, invest in technological progress, and effectively showcase their value proposition to pharmaceutical companies.

Key Segments of the Pharmaceutical Contract Manufacturing Market

Service Overview

- Pharmaceutical Manufacturing Services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Drug Development Services

- Biologic Manufacturing Services

- Biologic API Manufacturing Services

- Biologic FDF Manufacturing Services

End-User Overview

- Big Pharmaceutical Companies

- Small & Mid-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America