Pharmaceuticals Logistics Market Analysis and Insights:

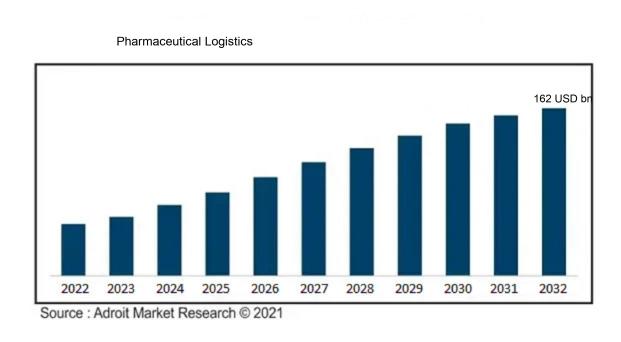

The market for Global Pharmaceuticals Logistics was estimated to be worth USD 85.4 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 6.8%, with an expected value of USD 162 billion in 2032.

The Pharmaceuticals logistics sector is primarily influenced by numerous pivotal elements, such as the rising need for Pharmaceuticals products, the expansion of the global healthcare sector, and the increasing prevalence of chronic illnesses that demand effective drug distribution methods. Furthermore, technological innovations, including real-time tracking systems and temperature-sensitive logistics solutions, are improving supply chain operations and ensuring adherence to regulatory standards. The focus on cold chain logistics for delicate Pharmaceuticalss—like vaccines and biologics—significantly drives market development. Additionally, the burgeoning e-commerce trend in Pharmaceuticalss, fueled by the desire for convenience and accessibility, is transforming conventional distribution frameworks. Regulatory demands for enhanced safety and traceability in the drug supply chain, combined with the necessity for streamlined processes and cost efficiency, are also pivotal in the growth and transformation of the Pharmaceuticals logistics industry. Together, these elements contribute to a constantly evolving environment that influences strategies and operations within this field.

Pharmaceuticals Logistics Market Definition

Pharmaceuticals logistics encompasses the specialized coordination and transport of medications and healthcare products from producers to medical facilities, adhering to regulatory requirements. This process prioritizes maintaining temperature control, ensuring traceability, and facilitating prompt delivery, all of which are crucial for preserving the effectiveness and quality of the products.

Pharmaceuticals logistics is essential for the secure and effective delivery of medications and healthcare products while adhering to regulatory requirements. This field involves overseeing the complete supply chain, from production to distribution, and guarantees that Pharmaceuticalss are stored under suitable conditions to preserve their effectiveness and safety. It also significantly contributes to waste reduction and inventory management via temperature-sensitive transportation and monitoring systems. By ensuring prompt delivery, Pharmaceuticals logistics has a direct effect on patient health outcomes, enhances healthcare efficiency, and upholds the integrity of public health, particularly during crises or epidemics when there is an increase in demand.

Pharmaceuticals Logistics Market Segmental Analysis:

Insights On Key Type

Cold Chain Logistics

Cold chain logistics is expected to dominate the Global Pharmaceuticals Logistics Market primarily due to the increasing demand for temperature-sensitive products, such as vaccines, biologics, and certain Pharmaceuticalss that require strict temperature control during storage and transportation. The rise in global health initiatives to provide vaccines, especially during pandemics, has significantly propelled the need for efficient cold chain solutions. Moreover, advancements in technology, such as IoT-enabled monitoring systems, have enhanced visibility and control over temperature-sensitive shipments, further driving investment in cold chain infrastructure. As regulatory frameworks become more stringent regarding the transport of Pharmaceuticals products, the necessity for cold chain logistics becomes paramount to ensure compliance, safety, and efficacy of medications.

Non-Cold Chain Logistics

Non-cold chain logistics plays a vital role in the Pharmaceuticals industry, focusing on transportation and storage of products that do not require temperature regulation. While this sector may not experience the explosive growth seen in cold chain logistics, it remains essential for drugs with stable temperature profiles and does not necessitate refrigeration. The efficiency and speed in the distribution of non-temperature-sensitive medications contribute to overall market demand. Additionally, innovations in packaging and supply chain management processes for non-cold chain products are still catering to the diverse needs of healthcare providers, ensuring timely access to medications.

Insights On Key Component

Transportation

Transportation is expected to dominate the Global Pharmaceuticals Logistics Market due to the increasing demand for efficient and reliable movement of Pharmaceuticals products. As more companies expand their reach globally, the need for effective transportation solutions that can ensure timely delivery while maintaining the integrity of sensitive products like vaccines and biologics becomes paramount. Efficient logistics play a crucial role in minimizing spoilage, complying with regulations, and meeting patient needs, thus making transportation a critical component of the Pharmaceuticals supply chain. This is further boosted by advancements in technology, which enhance tracking, route optimization, and overall supply chain efficiency.

Storage

Storage is an essential aspect of the Pharmaceuticals logistics market, providing the necessary infrastructure to ensure that products remain viable until delivery. Warehouses equipped with climate control systems and advanced inventory management technologies enable companies to maintain the stability of temperature-sensitive items like vaccines and biologics. As regulatory demands en and product lifecycles shorten, effective storage solutions support the longevity and efficacy of the Pharmaceuticalss, making it crucial for companies aiming to optimize their supply chains. While not leading, this remains vital as the quality assurance of drugs hinges on proper storage conditions.

Monitoring Components

Monitoring components play a significant role in ensuring the quality and safety of Pharmaceuticals products during transit and storage. These tools, which include temperature and humidity sensors as well as tracking systems, are essential for compliance with stringent regulations imposed by health authorities. The growing focus on maintaining product integrity throughout the supply chain drives investment in these technologies. Although this is not leading, its importance is amplified as companies increasingly integrate monitoring systems into their logistics operations to mitigate risks associated with spoilage and to enhance traceability throughout the transportation and storage phases.

Insights On Key Procedure

Retrieval Systems

Among the various procedures in the Global Pharmaceuticals Logistics Market, Retrieval Systems are projected to dominate. Increasing demand for efficiency in inventory management and the need to minimize errors during the retrieval process are key drivers for this growth. Companies are investing heavily in technologies that allow for faster, more accurate retrieval of Pharmaceuticals products, ensuring that medications can be accessed quickly and efficiently. Additionally, the rise in automated retrieval systems and smart warehousing solutions is a significant contributing factor. As the Pharmaceuticals industry emphasizes on real-time data and advanced tracking methods, Retrieval Systems are positioned to lead the way in transforming supply chain logistics.

Picking

Picking, which involves selecting and gathering the right Pharmaceuticals products from inventory, is crucial in operations but is expected to experience moderate growth. While advancements like automated picking systems are helping reduce errors and increase speed, the process remains labor-intensive. The rising demand for customization and individualized orders in Pharmaceuticalss may lead to increased complexity in picking operations, requiring more sophisticated tools. However, despite these innovations, they may not yet overtake the benefits offered by more enhanced methods like retrieval systems, making picking relatively less dominant.

Storing

Storing is essential for maintaining the integrity and efficacy of Pharmaceuticals products, particularly temperature-sensitive items. However, this area is anticipated to see moderate growth compared to others. While controlled-storage environments and climate management systems are gaining traction, they often require significant investment in infrastructure. Innovations are occurring, but storing processes tend to focus more on compliance and safety regulations rather than speed or efficiency, which might limit their competitive edge against more dynamic solutions in the retrieval domain.

Handling Systems

Handling Systems are critical in the logistics process, focusing on the movement and transfer of Pharmaceuticals products within warehouses. However, this area is expected to show steady growth rather than dominating the market. While operational efficiency is vital, the direct impact on speed is often overshadowed by advancements in retrieval and picking technologies. As companies invest in robotics and automated systems to improve handling efficiency, the overall progress may not match the rapid growth seen in other logistical aspects. Thus, while handling is important, it is not primed to take the lead in the market landscape.

Insights On Key Application

Bio-Pharma

Bio-Pharma is poised to dominate the Global Pharmaceuticals Logistics market primarily due to the increasing demand for biologics and advanced therapies that require specialized handling and transportation methods. The complexity of these products, which include monoclonal antibodies and gene therapies, necessitates strict temperature control, customized supply chains, and regulatory compliance. As the bio-Pharmaceuticals sector continues to grow rapidly, investment in logistics solutions designed to accommodate the unique requirements of biologics is expected to see a substantial increase. Additionally, advancements in cold chain technology and traceability are further bolstering this, making it the leading application area in the Pharmaceuticals logistics landscape.

Chemical Pharma

Chemical Pharma involves the production and distribution of conventional drugs, which have historically dominated the Pharmaceuticals industry. While this benefits from established logistics networks, its growth is stabilizing due to market saturation and the rise of tailored therapies in other areas. Nevertheless, the efficiency of chemical manufacturers' distribution models and their lower transportation and storage demands compared to biologics allows the chemical pharma sector to remain a significant player in logistical operations, although its growth rate is slower in comparison to the burgeoning bio-pharma sector.

Specialized Pharma

Specialized Pharma encompasses a range of advanced therapies tailored for specific health conditions, often involving highly targeted treatment regimens. Though this application area is gaining traction, it's still relatively niche compared to both chemical and bio-pharma s. The logistics requirements for specialized Pharmaceuticalss often cater to unique delivery mechanisms and patient monitoring, which can complicate distribution processes. While this sector is expanding due to the rise in personalized medicine and treatment plans, it does not currently exhibit the same level of growth dynamics or market influence as the bio-pharma category.

Insights On Key Operations

Airways

Airways is projected to dominate the Global Pharmaceuticals Logistics Market due to its unmatched speed and efficiency, which is critical for the timely delivery of temperature-sensitive products such as vaccines and biologics. The growing demand for rapid shipment, especially in light of recent health crises, has highlighted the need for air transport in Pharmaceuticalss. Countries are increasingly establishing stringent regulations around the shipment of drugs, amplifying the role of air freight logistics to ensure compliance while minimizing the risk of spoilage or degradation due to time sensitivity. As a result, air transportation is expected to be the go-to choice for the Pharmaceuticals industry in delivering products globally.

Roadways

Roadways play a significant role in the logistics of Pharmaceuticalss, particularly for last-mile delivery. They provide a flexible transport solution, allowing for efficient access to remote and urban areas. With the rise of e-commerce in the Pharmaceuticals sector, reliable road networks are essential for timely home deliveries. Additionally, road transport enables the integration of multichannel distribution strategies, wherein Pharmaceuticalss can be efficiently transferred from warehouses to healthcare facilities or directly to consumers, boosting overall supply chain efficiency.

Railways

Railways offer an economical solution for transporting large volumes of Pharmaceuticals goods over long distances. While not as fast as air transport, rail provides a sustainable alternative for bulk shipments, particularly for non-urgent Pharmaceuticalss. They are increasingly being adapted to meet the temperature-controlled requirements of sensitive drugs, allowing for specialized rail cars equipped with refrigeration systems. This makes rail a valuable option for transporting Pharmaceuticalss across regions with well-developed railway networks.

Seaways

Seaways are generally utilized for transporting bulk Pharmaceuticalss and raw materials internationally, leveraging their cost efficiency over long distances. Shipping by sea is particularly advantageous for less time-sensitive Pharmaceuticalss, where large quantities are shipped in containers under regulated temperature conditions. However, the longer transit times associated with sea transportation can be a drawback for highly perishable products, making it less favorable than air or even road transport for urgent deliveries, yet essential for cost-effective logistics in certain scenarios.

Storage

Storage facilities are critical within the Pharmaceuticals logistics framework, ensuring that products are kept at optimal conditions until they are distributed. They often integrate advanced temperature control and monitoring systems to maintain the integrity of sensitive Pharmaceuticalss. As the Pharmaceuticals industry expands and more products require specific storage solutions, investing in sophisticated storage facilities becomes increasingly important. These storage units speak to the necessity of safeguarding health products along every stage of the supply chain, particularly given the rising concern over product recalls due to improper handling and storage practices.

Services

Various services supporting Pharmaceuticals logistics, such as temperature monitoring, risk assessment, and supply chain management, are essential for a seamless distribution process. These services enhance operational transparency and facilitate compliance with regulatory demands. A growing emphasis on ensuring product integrity and safety in transport has made these services vital, as they help address challenges such as spoilage or contamination. Additionally, effective service options can improve overall customer satisfaction by ensuring timely and safe deliveries of Pharmaceuticals goods to end-users.

Global Pharmaceuticals Logistics Market Regional Insights:

North America

North America is expected to dominate the Global Pharmaceuticals Logistics market, primarily due to its advanced healthcare infrastructure, high demand for Pharmaceuticals goods, and stringent regulatory requirements that necessitate efficient logistics operations. The region is home to leading Pharmaceuticals companies and innovative startups that drive the market with cutting-edge technologies and distribution strategies. Furthermore, the increasing emphasis on temperature-sensitive products, particularly biologics and vaccines, has spurred investments in specialized logistics capabilities, such as cold chain management. The robust e-commerce landscape and the rising consumer demand for personalized medicine further amplify the region's leading role in this sector.

Latin America

In Latin America, the Pharmaceuticals logistics market is growing but is still significantly influenced by various challenges, including inadequate infrastructure and regulatory hurdles. However, the region is witnessing a rise in investment from local and international Pharmaceuticals companies seeking to enhance their supply chain capabilities. This growth stems from improving healthcare access, increasing demand for medications, and the rise of local production facilities. While still developing, the potential is strong, making it an essential area of focus for logistics improvements and partnerships.

Asia Pacific

The Asia Pacific region is on an upward trajectory in the Pharmaceuticals logistics market, driven largely by rapid economic growth, an expanding middle class, and increasing healthcare spending. Countries like China and India are enhancing their logistics capabilities, driven by a surge in Pharmaceuticals manufacturing and exports. Investments in technology, particularly in e-commerce logistics and blockchain solutions for improved traceability, are also reshaping the landscape. Although challenges such as regulatory discrepancies exist, the overall growth potential makes the Asia Pacific a significant player in the global Pharmaceuticals logistics space.

Europe

Europe's Pharmaceuticals logistics market is characterized by a combination of mature markets and progressive regulations. The region benefits from strong regulatory frameworks that ensure the safety and efficacy of Pharmaceuticalss, necessitating sophisticated logistics systems. The presence of major Pharmaceuticals companies and research institutions also fosters innovation in supply chain solutions. Although Europe faces stiff competition from North America, its focus on sustainability in logistics, such as reducing carbon footprints and improving efficiency through automation, continues to drive growth in this vital of the market.

Middle East & Africa

The Middle East & Africa region presents a mixed picture for Pharmaceuticals logistics, with immense potential but significant challenges. Healthcare systems in many African countries are still developing, leading to logistical hurdles associated with drug distribution and storage. However, growing investments in healthcare and infrastructure improvement initiatives are expected to spur growth in the Pharmaceuticals logistics market. In the Middle East, increasing government spending on healthcare and ambitious initiatives, such as Vision 2030 in Saudi Arabia, are encouraging Pharmaceuticals logistics advancements. Overall, while promising, this region still lags behind others in terms of logistics maturity and implementation.

Pharmaceuticals Logistics Competitive Landscape:

Prominent participants in the worldwide Pharmaceuticals logistics sector—such as producers, distributors, and logistics companies—play a critical role in guaranteeing the safe and efficient transportation of Pharmaceuticalss from manufacturing sites to healthcare institutions. Their efforts center on managing cold chain processes, adhering to regulatory standards, and utilizing sophisticated tracking technologies to preserve product quality and improve visibility across the supply chain.

The primary stakeholders in the Pharmaceuticals logistics sector comprise DHL Supply Chain, AmerisourceBergen, UPS Supply Chain Solutions, FedEx Corp, Kuehne + Nagel International AG, DB Schenker, XPO Logistics, Catalent Inc., Cardinal Health, Owens & Minor, Maersk, L??, Panalpina, and Geodis.

Global Pharmaceuticals Logistics COVID-19 Impact and Market Status:

The Covid-19 pandemic drastically increased the necessity for Pharmaceuticals logistics, underscoring the importance of swift and effective supply chains to facilitate the worldwide distribution of vaccines and critical medications.

The COVID-19 pandemic has profoundly impacted the Pharmaceuticals logistics sector, instigating transformations that are expected to endure post-crisis. The exceptional rise in demand for vaccines and vital medications placed tremendous pressure on supply chains, prompting swift improvements in logistics solutions, such as temperature-sensitive storage facilities and optimized distribution systems. Organizations increasingly embraced digital technologies to enhance operational efficiency, enabling real-time monitoring and greater transparency throughout shipping activities. Furthermore, the pandemic underscored the necessity for strong contingency strategies and the capability to respond to abrupt market changes. Consequently, there was a notable increase in investments in cold chain logistics and final delivery networks, mirroring a broader shift toward resilience and streamlined supply chain management. Ultimately, the COVID-19 crisis acted as a catalyst for innovations and the redefinition of strategies within the Pharmaceuticals logistics realm, setting the stage for future expansion as readiness for health emergencies gains priority within global supply chain strategies.

Latest Trends and Innovation in The Global Pharmaceuticals Logistics Market:

- In September 2021, UPS announced the expansion of its temperature-controlled logistics services, enhancing its capabilities for shipping Pharmaceuticalss, particularly those requiring stringent temperature management during transport.

- In October 2022, FedEx completed the acquisition of the biotech logistics company, Manna Freight Systems, to bolster its specialized logistics capabilities for the Pharmaceuticals and healthcare industries, enabling better support for temperature-sensitive deliveries.

- In April 2022, Kuehne + Nagel launched its enhanced KN PharmaChain offering, which focuses on providing a continuous, end-to-end temperature-controlled supply chain solution for the Pharmaceuticals sector, further ensuring compliance with GDP and EU regulations.

- In August 2023, DHL Supply Chain announced a strategic partnership with the bioPharmaceuticals company Moderna to provide cold chain logistics solutions for expanding production and distribution efforts of mRNA vaccines and therapeutics.

- In November 2023, Cardinal Health and Tempus announced a joint venture aimed at using advanced technologies, including AI and machine learning, to optimize Pharmaceuticals supply chains for better inventory management and distribution efficiencies.

- In July 2023, Maersk launched a new service dedicated exclusively to the Pharmaceuticals industry, known as Maersk Pharma Logistics, which focuses on ensuring secure, controlled transportation of temperature-sensitive medicines across global markets.

- In March 2023, AmerisourceBergen completed the acquisition of the specialty pharmacy business of Lincare, enhancing its distribution capabilities and market presence within the Pharmaceuticals logistics space by improving access to critical medications.

Pharmaceuticals Logistics Market Growth Factors:

The expansion of the Pharmaceuticals Logistics sector is propelled by various factors, including a rising need for sophisticated Pharmaceuticals offerings, the development of international supply chains, and the necessity for temperature-sensitive distribution solutions.

The Pharmaceuticals logistics sector is witnessing remarkable expansion, fueled by multiple crucial influences. Primarily, the escalating demand for medications, spurred by an aging demographic and a rise in chronic health conditions, is enhancing the necessity for prompt and effective logistics services. Innovations in technology, especially within temperature-sensitive logistics, are essential to maintain the quality and safety of delicate Pharmaceuticals products. Furthermore, the globalization of the market and the surge in e-commerce activities related to Pharmaceuticalss amplify the need for solid logistics frameworks capable of managing international shipments proficiently.

Stringent regulatory requirements governing the transportation and management of Pharmaceuticalss introduce additional challenges in the distribution process, prompting organizations to collaborate with specialized logistics providers. The increasing inclination towards personalized medicine also calls for adaptable and responsive logistics networks that can handle diverse dosage requirements and delivery methods.

Moreover, the ened emphasis on supply chain visibility and traceability meets both regulatory standards and consumer demands, leading to increased investments in advanced tracking technologies. Finally, efforts to improve healthcare systems, particularly in developing regions, are further driving growth in Pharmaceuticals logistics, as companies aim to effectively establish their presence in these burgeoning markets. Collectively, these dynamics foster a vibrant environment for the ongoing development of the Pharmaceuticals logistics industry.

Pharmaceuticals Logistics Market Restaining Factors:

Critical limitations within the Pharmaceuticals Logistics Market involve rigorous regulatory standards and the challenges associated with managing temperature-sensitive products.

The Pharmaceuticals Logistics Market encounters numerous challenges that may hinder its development and operational effectiveness. Strict regulations concerning the storage and distribution of Pharmaceuticals products mandate adherence to Good Distribution Practices (GDP), which complicates logistics processes and raises expenses. Medications that require temperature control demand specialized handling and transport, thereby increasing logistical difficulties and associated risks. The substantial investment needed for the implementation of sophisticated tracking and monitoring technologies can be a significant burden, particularly for smaller enterprises. Furthermore, the intricate nature of global trade regulations and customs can result in delays, which is particularly critical in an environment where prompt access to medications is essential. Disruptions within the supply chain, often instigated by geopolitical issues or natural calamities, can intensify these complications. Nonetheless, the continuous advancement of technology and innovative logistics strategies offers noteworthy opportunities for the market to evolve and enhance efficiency. By integrating automation, data analytics, and real-time tracking, operational functions can be improved, leading to a more robust and adaptive Pharmaceuticals logistics sector ready for growth amidst a dynamic global environment.

Key Segments of the Pharmaceuticals Logistics Market

By Type

• Cold Chain Logistics

• Non-Cold Chain Logistics

By Component

• Storage

• Transportation

• Monitoring Components

By Procedure

• Picking

• Storing

• Retrieval Systems

• Handling Systems

By Application

• Chemical Pharma

• Bio-Pharma

• Specialized Pharma

By Operations

• Seaways

• Roadways

• Railways

• Airways

• Storage and Services

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America