Physical Vapor Deposition Market Analysis and Insights:

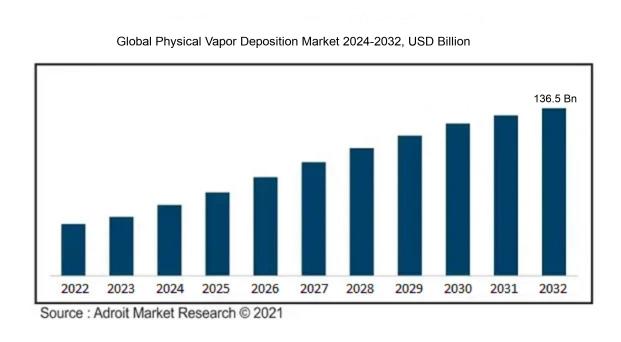

The size of the worldwide building integrated photovoltaics market was estimated at USD 25.02 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 22.5% from 2024 to 2032, from USD 30.03 billion in 2024 to USD 136.5 billion by 2032.

The market for Physical Vapor Deposition (PVD) is largely propelled by technological innovations that improve the efficacy and accuracy of coating techniques. The rising need for thin film applications across various industries, including electronics, automotive, and aerospace, plays a significant role in driving market expansion, given that PVD processes are essential for enhancing both durability and performance. Moreover, the increased use of PVD in the production of high-performance parts, along with a growing emphasis on sustainable and environmentally friendly coating solutions, further facilitates market growth. The swift advancement of consumer electronics, marked by the trend towards more compact and energy-efficient devices, amplifies the demand for sophisticated coatings offered by PVD technology. The flourishing field of nanotechnology and ongoing investigations into new materials also strengthen the market, as different sectors continually aim for cutting-edge solutions. Additionally, regulatory demands for higher quality benchmarks in manufacturing compel stakeholders to allocate resources toward PVD technologies, contributing to consistent market dynamism.

Physical Vapor Deposition Market Definition

Physical Vapor Deposition (PVD) is a technique conducted under vacuum conditions, primarily designed for applying thin layers of material onto various surfaces. This method entails the actual transformation of a substance from a solid state to a vapor, which subsequently condenses back into a solid form on the target substrate.

Physical Vapor Deposition (PVD) plays a pivotal role in numerous industries by facilitating the creation of high-performance thin films characterized by superior adhesion and consistency. This approach is extensively employed in fields like semiconductor fabrication, optical coatings, and aesthetic finishes, significantly boosting both efficiency and durability. Various PVD methodologies, such as sputtering and evaporation, allow for meticulous control over the material's thickness and composition. Such accuracy is essential for optimizing electronic device performance, enhancing optical characteristics, and delivering protective layers. The adaptability and efficacy of PVD establish it as a fundamental component in sophisticated manufacturing operations across a wide array of sectors.

Physical Vapor Deposition Market Segmental Analysis:

Insights On Technology

Sputtering

Sputtering is anticipated to dominate the Global Physical Vapor Deposition Market due to its versatility and effectiveness in producing high-quality thin films. The process is widely utilized in various industries such as electronics, optics, and materials due to its ability to deposit metals, alloys, and compounds onto substrates. Additionally, the higher deposition rates and uniform film thickness achievable through sputtering make it ideal for applications requiring precision and reliability. As technology advances, the demand for more intricate electronic components and enhanced optical devices ensures that sputtering will continue to be at the forefront of the PVD market.

Thermal Evaporation

Thermal evaporation is a widely-used technique within the Physical Vapor Deposition domain, primarily favored for its simplicity and effectiveness in depositing organic materials and metals onto substrates. This method works best for applications requiring thin film coatings like OLEDs in the electronics industry. Nonetheless, it generally has limitations concerning the thickness and uniformity of films, making it less suitable than other methods for high-performance uses. However, its ability to produce high-purity coatings and compatibility with various materials ensures it maintains a strong presence in specific niche applications.

Ion Plating

Ion plating combines physical vapor deposition with ion-assisted deposition, offering enhanced film adhesion and density compared to traditional methods. This technique is especially valuable in industries that demand high-performance coatings, such as aerospace and medical devices, as it produces films that are harder and more resistant to wear. However, because ion plating typically has a slower deposition rate and involves more complex equipment compared to sputtering, it occupies a smaller of the market. Nonetheless, its unique advantages make it a preferred choice for specialized applications where performance outweighs cost considerations.

Insights On Application

Microelectronics

The Microelectronics category is expected to dominate the Global Physical Vapor Deposition Market due to the growing demand for miniaturized electronic devices and advances in semiconductor technology. As electronics continue to evolve, the need for high-efficiency, precision coating processes for semiconductors and integrated circuits has skyrocketed. Additionally, the shift towards energy-efficient products and the increased production of consumer electronics potentiates the microelectronics domain, making it the leading application for physical vapor deposition processes. The consistent innovation in microelectronics drives manufacturing capabilities, thereby augmenting the market demand for physical vapor deposition techniques.

Data Storage

The Data Storage sector is witnessing notable growth in the Physical Vapor Deposition Market driven by advancements in storage technology. As companies look to enhance data capacity and speed, the demand for high-performance storage solutions, including hard drives and solid-state drives (SSDs), increases. PVD processes enable thin-film technology integration within storage devices, facilitating greater energy efficiency and miniaturization. Therefore, PVD plays a crucial role in the modern data storage solutions, making this category a strong competitor in the market.

Solar Products

Solar Products represent another growing application of Physical Vapor Deposition technology, primarily because of the rising emphasis on renewable energy solutions. PVD is utilized in the manufacturing process of photovoltaic cells, improving their efficiency and lifespan. The increasing investment in solar technology and the global push for sustainable energy sources has led to greater adoption of PVD techniques in solar products. As solar energy becomes a crucial part of energy strategies worldwide, this section is projected to grow steadily.

Cutting Tools

In the Cutting Tools category, physical vapor deposition plays an essential role in enhancing the performance and durability of various cutting tools. The increasing demand in industries such as manufacturing and construction for high-performance materials continues to fuel the need for advanced coatings. By utilizing PVD coatings, companies can significantly improve the longevity, efficiency, and productivity of cutting tools. This market is expected to grow due to increasing automation and technological advancements in machining processes.

Medical Equipment

The Medical Equipment sector utilizes Physical Vapor Deposition to enhance the performance of various medical tools and devices. The implementation of PVD coatings offers improved biocompatibility, hardness, and chemical resistance, which are critical for surgical instruments and implants. Moreover, the rise in healthcare investments and technological innovations in the medical field contribute to greater demand for high-quality and durable medical equipment. Consequently, this application is experiencing growth, although it is currently overshadowed by sectors like microelectronics.

Others

The 'Others' category encompasses unique applications of Physical Vapor Deposition that do not fit strictly within the primary s listed. This may include decorative coatings, optical coatings, and various specialized industrial applications. While this sector exhibits potential growth, it remains relatively small compared to the more dominant areas like microelectronics and solar products. The diverse applications within 'Others' may experience advancements, but currently, they do not rival the major players in the market.

Insights On End-User Industry

Electronics

The Electronics sector is expected to dominate the Global Physical Vapor Deposition Market owing to the high demand for advanced materials in electronic devices. The growing need for miniaturization and efficiency in electronic components, such as semiconductors, displays, and photovoltaic cells, has significantly increased the application of physical vapor deposition (PVD) techniques. Furthermore, the rise of innovative technologies like 5G, AI, and IoT drives extensive research and production of high-performance electronic equipment. As a result, the Electronics industry not only represents a large portion of the PVD market but also requires continuous technological advancements that further solidify its dominating role.

Automotive

The Automotive industry is witnessing a significant increase in the adoption of physical vapor deposition technologies, primarily due to the growing emphasis on lightweight materials and improved performance for vehicles. With the integration of electronic components in automobiles and the shift towards electric vehicles, automotive manufacturers are focusing on enhancing durability and functionality through PVD applications. Moreover, the trend toward more efficient energy use in cars is augmenting PVD to create better coatings for engine parts and components, contributing to the industry's overall growth, although it remains a smaller part compared to Electronics.

Aerospace

In the Aerospace sector, physical vapor deposition is increasingly utilized for coating critical components to enhance wear and corrosion resistance. The production of lightweight yet durable materials is paramount in aerospace applications, which often involve extreme conditions and high-performance requirements. Although the demand for PVD in aerospace is growing steadily, it faces limitations due to stringent regulatory standards and lengthy certification processes. Still, the ongoing advancements in materials technology and a focus on sustainable solutions promise some growth for PVD applications within this sector.

Healthcare

The Healthcare industry is leveraging physical vapor deposition for its applications in medical devices and equipment, particularly in the development of biocompatible coatings. PVD technologies enable the creation of sterile, durable, and functional surfaces that help improve the performance and longevity of medical instruments and implants. However, the scale of PVD application in Healthcare is limited compared to Electronics and Automotive due to relatively smaller market size and specific regulatory guidelines. Nevertheless, there is potential growth as the demand for advanced medical technology continues to rise.

Others

The category identified as "Others" encompasses various industries such as energy, textiles, and optics, which use physical vapor deposition minimally compared to the primary sectors. While there is some application in decorative coatings and functional layers, the overall contribution of these industries to the PVD market remains small. The growth potential exists primarily in niche applications, but the impact on the overall market is limited when juxtaposed against the more dominant sectors like Electronics and Automotive, which drive the bulk of the demand.

Global Physical Vapor Deposition Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Physical Vapor Deposition (PVD) market due to several factors, including rapid industrialization, an enormous consumer base, and significant advancements in technology. Key countries such as China, Japan, and South Korea are at the forefront of manufacturing and electronics, driving substantial demand for PVD coatings in industries like semiconductors, automotive, and consumer electronics. The growing trend of miniaturization in electronic devices, alongside regulatory frameworks favoring eco-friendly manufacturing processes, boosts the adoption of PVD technology in this region. Moreover, an increase in investments in renewable energy applications is expected to further enhance growth in the PVD market within Asia Pacific.

North America

North America follows closely in the PVD market landscape, primarily driven by an advanced technology sector and high research and development investments. The presence of leading companies in the aerospace, medical devices, and electronics sectors significantly contributes to the demand for PVD processes, primarily due to their ability to improve product durability and performance. Furthermore, the region’s focus on developing innovative manufacturing solutions aligns with the shift towards sustainable practices, fostering the growth of the PVD market.

Europe

Europe contributes significantly to the Global PVD market, primarily due to stringent regulations regarding product quality and environmental sustainability. Various industries, including automotive, aerospace, and healthcare, rely heavily on high-performance coatings offered by PVD technology. Europe’s commitment to sustainable production processes and materials has amplified the adoption of PVD techniques. Additionally, the presence of manufacturers investing in advanced coating technologies is anticipated to fuel market growth in this region.

Latin America

Latin America, while not as dominant as other regions, is experiencing gradual growth in the PVD market, driven by increasing industrialization and expanding manufacturing capabilities. Countries such as Brazil and Mexico are key players in automotive and electronics sectors, where PVD is becoming essential for improving product performance and lifespan. Moreover, the region's focus on energy-efficient technologies and sustainable solutions reinforces the adoption of PVD coatings, although it is still overshadowed by more advanced markets.

Middle East & Africa

The Middle East & Africa region shows potential for growth in the PVD market, although it remains in the nascent stage compared to other regions. Factors such as increasing industrial development, especially in the oil and gas sector, are driving the demand for advanced coating technologies. However, challenges such as limited investment in advanced manufacturing and lower awareness of PVD applications hinder market expansion. Nonetheless, with ongoing infrastructure projects and investments in diversifying economies, the region offers opportunities for the evolution of the PVD market in the coming years.

Physical Vapor Deposition Competitive Landscape:

Prominent stakeholders in the worldwide Physical Vapor Deposition (PVD) market are pivotal in fostering technological progress and innovation, concentrating on the enhancement of deposition techniques and materials. Their contributions are vital in broadening the scope of applications across diverse sectors, such as electronics, automotive, and solar energy, thereby boosting market expansion and fostering competitiveness.

Prominent entities in the Physical Vapor Deposition (PVD) sector encompass Applied Materials, Inc., SENTECH Instruments GmbH, ULVAC, Inc., Veeco Instruments Inc., TSMC, Oerlikon Balzers Coating AG, Tokyo Electron Limited, Denton Vacuum LLC, AJA International, Inc., CVD Equipment Corporation, Heraeus Nexensos, Maschinenfabrik Schilling GmbH, and Pfeiffer Vacuum Technology AG.

Global Physical Vapor Deposition COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the global Physical Vapor Deposition (PVD) market, leading to disruptions in supply chains, a decline in manufacturing capacity, and alterations in demand trends across multiple sectors.

The COVID-19 pandemic had a profound effect on the Physical Vapor Deposition (PVD) market, primarily through the disruption of global supply chains and manufacturing operations. The enforcement of lockdowns and safety protocols in various regions led to a significant slowdown in production capacities, resulting in delays for both PVD equipment and necessary materials. Additionally, the downturn in capital investments across numerous sectors, especially aerospace and automotive, adversely affected the demand for PVD coatings, which are vital for improving the functionality and lifespan of components. On the other hand, the pandemic spurred the rapid integration of cutting-edge technologies within industries such as electronics and renewable energy, prompting a transition towards more efficient PVD systems. As industrial activities began to resume and economies started to recover, there was a ened focus on innovation and sustainability. As a result, the PVD market is anticipated to experience a resurgence, with expectations of growth as sectors increasingly channel investments into advanced coating technologies to enhance material performance and durability.

Latest Trends and Innovation in The Global Physical Vapor Deposition Market:

- In May 2022, Applied Materials announced its acquisition of Akrion Systems, a provider of advanced wet processing equipment for the semiconductor industry, enhancing its capabilities in the physical vapor deposition space.

- In June 2022, Von Ardenne secured a contract with a leading automotive manufacturer to supply PVD systems for the production of advanced coatings, demonstrating the growing demand for PVD technology in automotive applications.

- In September 2022, ULVAC Inc. launched a new series of PVD systems specifically designed for optical film coatings, aimed at improving energy efficiency and performance in optical applications.

- In March 2023, IHI Corporation developed a novel modular PVD coating system for flexible electronics, combining flexibility and high-throughput capabilities, targeting the rapidly expanding wearable electronics market.

- In August 2023, Oerlikon completed the integration of TCS Coating Technologies, which focuses on PVD solutions for the aerospace sector, thereby strengthening Oerlikon’s foothold in high-performance coatings for demanding applications.

- In November 2023, Sputtering Equipment International (SEI) introduced a state-of-the-art PVD system that features advanced automation and AI-driven process controls, designed to enhance production efficiency and reduce material waste.

Physical Vapor Deposition Market Growth Factors:

The expansion of the Physical Vapor Deposition (PVD) market is propelled by innovations in semiconductor production, ened requirement for coatings in electronic devices, and the growing use of PVD in renewable energy solutions.

The Physical Vapor Deposition (PVD) industry is witnessing notable expansion, fueled by several pivotal elements. Primarily, the escalating need for advanced materials across sectors such as electronics, automotive, and aerospace significantly contributes to this growth; PVD methods facilitate the creation of high-performance coatings that enhance both durability and efficiency. The rising incorporation of PVD technology in the production of semiconductors and thin-film solar panels further accelerates market development, as these industries strive for more effective processes to boost productivity.

Moreover, the increasing focus on energy conservation and sustainability has prompted manufacturers to prefer PVD techniques over conventional coating applications due to their reduced environmental footprint and increased resource efficiency. Innovations in PVD coating materials and equipment are also a driving force behind market growth, leading to improvements in adhesion and control over coating thickness.

In addition, the growing trend of miniaturization and the need for more precise components across various applications necessitate the utilization of sophisticated PVD methods. Lastly, the growth of the manufacturing sector in developing economies presents substantial opportunities for industry players, as businesses aim to implement cutting-edge surface engineering solutions to remain competitive and adhere to stringent regulatory requirements. Collectively, these dynamics are contributing to the vigorous development of the PVD market.

Physical Vapor Deposition Market Restaining Factors:

Major inhibiting elements in the Physical Vapor Deposition (PVD) industry encompass substantial equipment expenditures and a pronounced need for specialized technical knowledge.

The Physical Vapor Deposition (PVD) sector encounters multiple barriers that could hinder its progress. Significant obstacles encompass the substantial costs associated with equipment and operation, which may discourage smaller enterprises from embracing PVD technologies. Furthermore, the necessity for highly trained personnel to manage intricate PVD systems can result in a deficiency of skilled labor, negatively impacting production efficiency. Stringent environmental regulations regarding emissions and waste management pose additional challenges for producers, as adherence requires investments in eco-friendly practices that can elevate operational costs. Additionally, the swift evolution of technology can make current PVD machinery outdated, necessitating ongoing financial commitment towards updates and innovations. The presence of competing coating techniques, such as Chemical Vapor Deposition (CVD), also plays a role in shaping market dynamics, as certain sectors might opt for these alternatives for particular applications. Nonetheless, in spite of these difficulties, the PVD market is poised to gain from the increasing demand for sophisticated materials across various industries, including electronics and automotive, thereby fostering opportunities for growth and innovation. Amplified research and development initiatives, along with technological enhancements, are expected to propel future expansion, leading to an overall positive outlook for the PVD market.

Key Segments of the Physical Vapor Deposition Market

By Technology

• Thermal Evaporation

• Sputtering

• Ion Plating

By Application

• Microelectronics

• Data Storage

• Solar Products

• Cutting Tools

• Medical Equipment

• Others

By End-User Industry

• Electronics

• Automotive

• Aerospace

• Healthcare

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America