Market Analysis and Insights:

The market for Global Pipeline Pigging Services was estimated to be worth USD 10 billion in 2025, and from 2025 to 2037, it is anticipated to grow at a CAGR of 5%, with an expected value of USD 19 billion in 2037.

The market for pipeline pigging services is primarily fueled by an increasing need for effective maintenance, adherence to safety regulations, and improved operational performance across various sectors, notably in oil and gas, water transport, and chemical industries. The emphasis on reducing operational downtime and prolonging the service life of pipeline infrastructure is leading to greater utilization of pigging services, which aid in the cleaning, assessment, and oversight of pipelines. Additionally, strict regulatory requirements aimed at environmental preservation and safety are pushing organizations to invest in modern pigging technologies. The growth of global infrastructure projects and the expansion of pipeline systems, particularly in developing regions, are further driving market expansion. Moreover, advancements in technology, including the adoption of IoT and smart pigging systems for real-time monitoring, are improving the efficiency of these services, thereby escalating demand in the industry. Together, these interrelated factors foster a dynamic environment for the pipeline pigging services market.

Pipeline Pigging Services Market Scope :

| Metrics | Details |

| Base Year | 2025 |

| Historic Data | 2021-2024 |

| Forecast Period | 2025-2037 |

| Study Period | 2024-2037 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2037 | USD 19 billion |

| Growth Rate | CAGR of 5% during 2025-2037 |

| Segment Covered | By Technology, By Application, By End Use, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

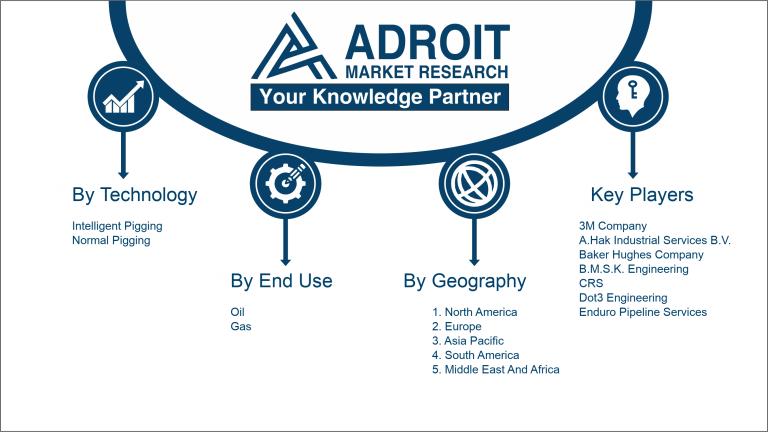

| Key Players Profiled | 3M Company, A.Hak Industrial Services B.V., Baker Hughes Company, B.M.S.K. Engineering, CRS (Corrosion Resistant Solutions), Dot3 Engineering, Enduro Pipeline Services, Intero Integrity Services GmbH, Innospection Ltd, Magma Products, NDT Global, Pipeline Pigging Products, Pipeliners Ltd, Pure Technologies, Schaefer, and T.D. Williamson, Inc. |

Market Definition

Pipeline pigging services utilize specialized instruments known as pigs to perform cleaning and maintenance of pipelines. This process involves the elimination of debris, corrosion, and accumulation within the pipelines. By employing these services, operational efficiency is improved, and the integrity of pipeline systems across diverse industries is upheld.

Pipeline pigging services play a crucial role in ensuring the effective operation and safety of pipeline networks. This process utilizes advanced tools referred to as "pigs" to both clean and assess pipelines, eliminating contaminants, corrosion, and buildup of sediments. By performing pigging regularly, the likelihood of blockages and leaks is significantly reduced, which in turn improves flow efficiency and lowers maintenance expenses. Additionally, inspections carried out during the pigging process enable operators to detect potential problems such as fractures or weak areas, allowing for prompt repairs and prolonging the lifespan of the pipeline. Therefore, efficient pipeline pigging is vital for protecting the environment, adhering to regulatory standards, and enhancing the dependability of energy transmission systems.

Key Market Segmentation:

Insights On Key Technology

Intelligent Pigging

The dominant portion of the Global Pipeline Pigging Services Market is expected to be intelligent pigging. This is primarily due to the increasing focus on pipeline integrity management and the need for advanced monitoring technologies. Intelligent pigging utilizes smart devices equipped with sensors and data analytics capabilities, enabling operators to gather valuable real-time information about the pipeline conditions, defects, and leaks. As regulations become more stringent and environmental considerations grow, companies are willing to invest in intelligent pigging services to ensure compliance and optimize operational safety, efficiency, and reliability. The technological advancements and cost-efficiency of integrated data solutions further strengthen the prevalence of intelligent pigging solutions in the market.

Normal Pigging

Normal pigging is a traditional method utilized for cleaning pipelines and removing residue that can impede flow efficiency. While it remains important, its growth has been somewhat stagnant compared to its more advanced counterparts. Normal pigging is often preferred for less complex systems where basic cleaning and maintenance suffice. The need for routine cleaning in industries such as oil and gas ensures that this method has a degree of reliability and cost-effectiveness. However, the limitations in monitoring capabilities and the inability to provide comprehensive data make it less appealing for companies looking for long-term solutions and proactive pipeline management.

Insights On Key Application

Metal Loss/Corrosion Detection

The Metal Loss/Corrosion Detection application is expected to dominate the Global Pipeline Pigging Services Market. This is primarily due to the growing emphasis on infrastructure integrity and safety in various industries, especially in oil and gas, where corrosion poses a significant risk. Corrosion can lead to catastrophic failures, environmental hazards, and financial losses. As a result, investment in advanced detection technologies like pigging services for assessing pipeline conditions and addressing corrosion issues continues to rise. Additionally, stringent regulations and standards concerning safety and environmental protection are pushing companies to adopt effective monitoring solutions, further solidifying the prominence of this application within the market.

Internal Cleaning

Internal Cleaning is a crucial application that enhances the performance and longevity of pipelines. Over time, pipelines accumulate scale, sludge, and other materials that can restrict flow and reduce efficiency. By employing pigging services for internal cleaning, companies can maintain optimal flow rates and reduce the risk of blockages. This application serves not only to improve operational efficiency but also to extend the life of pipelines, thereby capitalizing on cost savings in the long run. While it plays an essential role, its focus is more on maintenance than the proactive identification of the potential failures, making it secondary to corrosion detection currently.

Crack & Leakage Detection

Crack & Leakage Detection represents another essential area in pipeline pigging services. Identifying and addressing cracks is crucial to preventing leaks that can lead to hazardous situations and significant environmental impact. This application has gained traction due to increasing regulatory scrutiny over pipeline safety and the need for rapid response to potential hazards. However, while important, it is often seen as part of a broader inspection regime, with companies prioritizing corrosion detection as it frequently poses a more immediate threat to infrastructure integrity and safety.

Geometry Measurement & Bend Detection

Geometry Measurement & Bend Detection is vital for ensuring pipeline integrity, especially in the context of structural anomalies that can cause failures. This application focuses on the physical dimensions of pipelines, identifying deformations, bends, and misalignments that can lead to operational inefficiencies. Companies using pigging services for this purpose can adhere to safety standards and avoid unplanned shutdowns. Although important for maintenance practices, this application currently ranks lower than corrosion detection since it tends to be more of a supplementary inspection process aimed at confirming the overall health of the pipeline rather than addressing imminent risks.

Others

The category of Others encompasses various niche applications related to pipeline pigging services. These may include specific technological advancements or specialized monitoring solutions tailored to unique pipeline systems. While innovative, this grouping often doesn't command substantial market share and remains less significant than the major applications. The diversity in this category can lead to specialized services, but the overall impact on the market is limited compared to the more core applications focused on metal loss and corrosion detection, which hold greater relevance given industry demands for reliability and safety.

Insights On Key End Use

Oil

The oil sector is poised to dominate the Global Pipeline Pigging Services Market due to its extensive infrastructure and the critical need for maintenance and cleaning to ensure optimal efficiency and safety. The oil industry relies on pipelines for the transportation of crude oil and refined products, making pigging services essential for operational integrity. With increasing investments in exploration and production activities, the demand for pigging services within this sector is expected to rise sharply to manage flow assurance, reduce operational downtime, and comply with stringent regulatory requirements aimed at environmental protection. This combination of factors positions the oil industry as the leading contributor to the growth of the pipeline pigging services market.

Gas

The gas, while not the dominant player, plays a significant role in the pipeline pigging services market. As natural gas continues to gain momentum as a cleaner energy source, investments in pipeline infrastructure are increasing. The need for regular maintenance, inspection, and cleaning of these gas pipelines is vital to prevent leaks and ensure regulatory compliance. Moreover, the rise of liquefied natural gas (LNG) and various gas projects worldwide is leading to a proportional demand for pigging services, making it a crucial aspect of maintaining the integrity of gas transportation systems.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Pipeline Pigging Services market due to its extensive pipeline infrastructure and the increasing need for maintenance and efficiency in oil and gas transportation. The region has seen significant investments in pipeline construction and upgrades, leading to higher demand for pigging services to remove obstructions and ensure optimal flow. Regulatory frameworks advocating for safety and efficiency also drive growth. With major players based in the U.S. and Canada, advancements in technology further enhance service offerings, providing a competitive edge. The combination of established operations and innovative solutions solidifies North America's market leadership.

Latin America

Latin America presents a growing opportunity in the Pipeline Pigging Services market, primarily driven by the increasing exploration and production activities in countries like Brazil and Argentina. The region experiences an expansion in oil and gas pipelines owing to the discovery of new reserves. However, the market is challenged by infrastructural limitations and the need for technological advancement. While there is significant potential, the focus remains on overcoming these hurdles to gain momentum in pigging services tailored for the region's unique pipeline requirements.

Asia Pacific

The Asia Pacific region is witnessing rapid urbanization and economic growth, which leads to increased demand for energy resources and consequently pipeline infrastructure. Countries such as China and India are major players investing in pipeline expansions. Despite this, the market for pipeline pigging services is still developing and varies significantly across countries due to differing regulations and infrastructure maturity. Regional discrepancies pose challenges, but the push for improved operational efficiency in energy transport could enhance market participation in the coming years.

Europe

Europe is a mature market for Pipeline Pigging Services with well-established regulations emphasizing operational safety and environmental concerns. Countries like Germany and the UK are investing in pipeline maintenance to enhance efficiency and minimize leaks. The growing shift towards renewable energy could influence the pipeline services landscape, as sectors diversify. However, high competition and the dominance of existing players hinder new entrants, leading to a saturated market. Nonetheless, innovations in pigging technologies could offer growth avenues as they seek to meet the stringent regulatory environment.

Middle East & Africa

The Middle East & Africa region holds significant potential for growth in the Pipeline Pigging Services market, driven by major oil-producing nations investing in new pipeline projects and upgrading existing infrastructure. While certain regions face political and economic uncertainties that could affect market stability, the demand for energy continues to soar, necessitating efficient pipeline operations. Investment in technology and a focus on improving operational efficiencies are crucial for realizing the market's potential. However, the varying levels of infrastructure development across the region present challenges to achieving uniform growth.

Company Profiles:

Influential entities within the Global Pipeline Pigging Services market, comprising both service providers and technology innovators, propel advancements and operational effectiveness through the provision of cutting-edge solutions for the upkeep and integrity assurance of pipelines. Their joint initiatives improve safety protocols and minimize operational interruptions across a range of industries dependent on pipeline logistics.

Prominent entities within the Pipeline Pigging Services industry encompass 3M Company, A.Hak Industrial Services B.V., Baker Hughes Company, B.M.S.K. Engineering, CRS (Corrosion Resistant Solutions), Dot3 Engineering, Enduro Pipeline Services, Intero Integrity Services GmbH, Innospection Ltd, Magma Products, NDT Global, Pipeline Pigging Products, Pipeliners Ltd, Pure Technologies, Schaefer, and T.D. Williamson, Inc.

COVID-19 Impact and Market Status:

The COVID-19 pandemic caused considerable upheaval in the Global Pipeline Pigging Services industry, resulting in project postponements, diminished operational capabilities, and enhanced health and safety measures that impacted the provision of services.

The COVID-19 pandemic had a profound effect on the market for pipeline pigging services, mainly due to interruptions in supply chains and diminished operational capacities across numerous sectors. As various companies reduced their activities or temporarily ceased operations, the demand for pigging services—essential for maintaining pipeline integrity and efficiency—witnessed a downturn. Furthermore, constraints on workforce availability and the enforcement of health measures impeded field activities, causing delays in project timelines. Nonetheless, as economies started to recover and infrastructure investments became a priority, there was a renewed demand for pipeline maintenance, highlighting the need for enhanced operational efficiency and safety standards. The pandemic also acted as a catalyst for the accelerated integration of digital technologies within the industry, leading to innovations that enhanced service delivery and monitoring processes. In summary, while the initial effects were adverse, the market is steadily recovering as industries adapt and innovate to address new operational challenges and evolving market conditions.

Latest Trends and Innovation:

- In June 2021, Paradigm Oil and Gas Inc. announced the acquisition of Clearpath Energy Solutions, enhancing its pipeline pigging technology and service offerings to improve operational efficiency in their upstream operations.

- In August 2021, TDW (Team Industrial Services) launched a new suite of advanced pipeline inspection gauges (PIGs) that incorporate artificial intelligence for improved data analysis and predictive maintenance capabilities, aiming to enhance pipeline integrity management.

- In March 2022, Rosen Group completed the acquisition of the assets of Winger Contracting, allowing for expanded services in pipeline pigging and inspection across North America, thereby strengthening their market position.

- In November 2022, Intero Integrity Services introduced the latest version of their PIG tracking technology, which uses GPS and IoT sensors to provide real-time location data for pigging operations, significantly enhancing service reliability and safety.

- In February 2023, the merger between Enpro Industries and the Pipeline Pigging Company was finalized, combining expertise in pipeline cleaning and maintenance solutions, and creating a more robust portfolio to serve the oil and gas sector.

- In June 2023, Xylem Inc. announced a strategic partnership with NuGenTec to develop environmentally friendly pipeline cleaning solutions, focused on reducing the ecological impact of traditional pigging operations through innovative cleaning agents.

Significant Growth Factors:

The expansion of the Pipeline Pigging Services Market is propelled by ened investments in pipeline infrastructure, a growing need for maintenance and inspection services, and innovations in pigging technology.

The Pipeline Pigging Services Market is experiencing notable expansion, propelled by several crucial elements. Primarily, the escalated requirement for efficient and economically viable transportation methods in the oil and gas sector has intensified the demand for pigging services, which play a vital role in maintaining pipeline integrity and optimizing flow performance. Additionally, the ened focus on pipeline upkeep and evaluation, driven by more stringent regulatory frameworks and safety protocols, has accelerated the market’s growth.

Innovations in technology, particularly the introduction of smart pigs featuring advanced sensors and analytical tools, have significantly improved the efficiency of pigging operations, making them increasingly attractive to stakeholders within the industry. The rising commitment to environmental responsibility and minimizing operational interruptions also motivates companies to implement proactive maintenance approaches, including routine pigging activities.

Furthermore, the surging global energy needs, along with the expanding pipeline networks in developing nations, are anticipated to drive the demand for pigging services. The increased activity in oil and gas explorations in less accessible regions underlines the critical importance of sustaining pipeline efficiency, thereby fostering further market development. Collectively, these dynamics present a promising future for the pipeline pigging services sector in the years ahead.

Restraining Factors:

Significant barriers in the Pipeline Pigging Services Market encompass elevated operational expenses and complications associated with regulatory compliance, both of which may impede broader implementation.

The Pipeline Pigging Services Market encounters a number of challenges that could impede its expansion and acceptance. A primary obstacle is the substantial initial investment and ongoing operational expenses linked to sophisticated pigging technologies, which may discourage smaller enterprises from adopting these services. Additionally, the intricacy of pipeline infrastructures and the diverse regulatory frameworks across different regions can complicate the standardization of pigging practices, resulting in delays and elevated compliance expenditures. Furthermore, the emergence of alternative technologies for pipeline upkeep and evaluation may shift attention and resources away from conventional pigging services. Increasing environmental concerns regarding pipeline activities, particularly amid ened regulatory oversight, could adversely impact the market, as companies may aim to reduce their environmental impact. The scarcity of qualified personnel in pigging operations can also lead to inefficiencies and a higher likelihood of incidents, posing another hurdle to market development. Nevertheless, as the sector progresses and innovates to overcome these challenges, there is considerable potential for growth, especially given the rising need for effective and efficient pipeline maintenance solutions in a landscape that values regulatory compliance and environmental stewardship. This highlights the industry's capacity to adapt and flourish amid changing market dynamics.

Key Segments of the Pipeline Pigging Services Market

By Technology

• Intelligent Pigging

• Normal Pigging

By Application

• Metal Loss/Corrosion Detection

• Internal Cleaning

• Crack & Leakage Detection

• Geometry Measurement & Bend Detection

• Others

By End Use

• Oil

• Gas

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America