Plug In Hybrid Electric Vehicles Market Analysis and Insights:

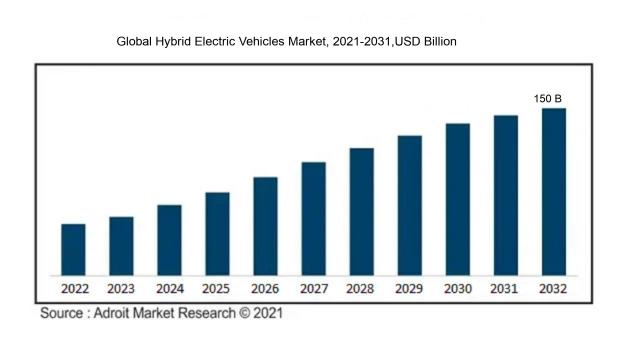

In 2023, the size of the worldwide Plug-In Hybrid Electric Vehicles market was US$ 38.2 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 16.23 % from 2024 to 2032, reaching US$ 150 billion.

The market for Plug-In Hybrid Electric Vehicles (PHEVs) is largely fueled by a ened awareness of environmental issues and rigorous governmental regulations aimed at curbing carbon emissions. Progress in battery technologies plays a critical role in this transition toward sustainable transport, improving both the efficiency and overall performance of PHEVs. As fuel costs soar and electric vehicle technologies become increasingly competitive, more consumers are inclined to explore energy-efficient options. Additionally, favorable government initiatives, such as tax breaks and subsidies for the purchase of electric vehicles, are further propelling market expansion. The growth of charging networks, alongside enhanced range capabilities of PHEVs, is broadening their appeal to a diverse range of consumers. Lastly, escalating concerns about urban air quality and health problems associated with vehicle emissions are steering consumers towards hybrid options that combine both electric and gasoline power, thus offering greater flexibility and a reduced ecological footprint.

Plug In Hybrid Electric Vehicles Market Definition

Plug-in Hybrid Electric Vehicles (PHEVs) merge traditional internal combustion engines with electric motors, enabling them to recharge through an external electricity supply. This dual power capability allows for operation on either the electric motor, the internal combustion engine, or a combination of both, resulting in enhanced fuel efficiency and lower emissions when juxtaposed with standard vehicles.

Plug-In Hybrid Electric Vehicles (PHEVs) are vital in the shift towards sustainable mobility by integrating the advantages of electric propulsion with conventional internal combustion engines. They effectively lower greenhouse gas emissions, enhance fuel economy, and provide the convenience of electric power for shorter journeys, while maintaining a gasoline engine for extended travels. This hybrid approach fosters electric driving behaviors in consumers, mitigating the range anxiety commonly linked to fully electric vehicles. Moreover, PHEVs can diminish reliance on fossil fuels, facilitate the incorporation of renewable energy, and improve air quality in metropolitan areas.

Plug In Hybrid Electric Vehicles Market Segmental Analysis:

Insights On Powertrain Type

Series Hybrid

The series hybrid is anticipated to dominate the Global Plug-In Hybrid Electric Vehicles (PHEVs) market as this option utilizes an electric motor primarily to drive the vehicle, while an internal combustion engine functions solely as a generator to recharge the battery. This design maximizes electric driving range and efficiency, making it a favorable choice for urban driving where stop-and-go conditions are prevalent. However, the complexity and cost of the system, combined with less versatility on highways compared to its series-parallel counterpart, limits its market share. Consumers looking for predominantly electric experiences with auxiliary combustion support may still find series hybrids appealing; however, overall adoption remains lower in comparison to more adaptable powertrain alternatives.

Series-Parallel Hybrid

The series-parallel hybrid is anticipated to grow in the Global Plug-In Hybrid Electric Vehicles (PHEVs) market due to its versatile design that integrates the benefits of both series and parallel systems. This configuration allows for enhanced fuel efficiency and the ability to operate on electric power alone in certain driving conditions, greatly appealing to consumers seeking eco-friendly options. Additionally, the adaptability of series-parallel hybrids caters to various driving environments, making them suitable for both urban and highway settings. The growing emphasis on sustainability and the increasing number of government incentives for low-emission vehicles are further contributing to the strong performance and popularity of this type within the market.

Parallel Hybrid

The parallel hybrid system allows both the electric motor and internal combustion engine to provide power directly to the wheels. This flexibility results in improved performance and fuel efficiency, particularly at higher speeds, making it attractive for consumers who prioritize driving dynamics. Despite its advantages, parallel hybrids often require more complex management systems to balance the two power sources effectively. Additionally, the reliance on gasoline engines in varying driving conditions may not align with the increasing consumer shift towards more sustainable, fully electric options, limiting its long-term market competitiveness compared to series-parallel hybrids and other innovative designs.

Insights On Battery Capacity

10-20 kWh

The expected to dominate the Global Plug-In Hybrid Electric Vehicles (PHEVs) market is the 10-20 kWh range. This capacity is ideal for balancing electric-only driving with efficient usage of internal combustion engines. Vehicles in this category typically offer sufficient range for daily commutes without needing frequent recharging, appealing to consumers who desire a practical and flexible driving experience. The demand for longer electric-only ranges, along with government incentives and growing environmental consciousness, drive the popularity of this capacity. As manufacturers increasingly design models around everyday consumer needs, the 10-20 kWh battery capacity becomes a preferred choice for many buyers.

Below 10 kWh

Battery systems under 10 kWh are primarily focused on lighter and more compact vehicles. While they are not as prevalent for hybrid electric platforms due to limited electric range, they provide a cost-effective entry point into the PHEV market. Consumers opting for these vehicles often value affordability over electric range. Their applications tend to cater to urban markets and short-distance travel, where less battery capacity satisfies everyday requirements. However, this faces stiff competition from those offering more extensive electric capabilities, limiting its growth potential in a rapidly evolving marketplace.

20-30 kWh

The 20-30 kWh capacity range represents a growing interest in extended electric-only driving without sacrificing the benefits of hybrid technology. Vehicles in this category strike a balance between reasonable pricing and enhanced electric performance, further enticing environmentally conscious consumers. This battery capacity allows for longer trips between charges, making it more appealing for family-oriented or long-distance driving scenarios. Additionally, advancements in technology could lead to reduced costs in the future, making this a more viable option as consumer preferences shift towards enhanced range and efficiency.

Above 30 kWh

Vehicles equipped with battery capacities greater than 30 kWh tend to focus on high-performance models or premium brands that appeal to a niche market. While the advantages include significant electric-only ranges, this category often comes with a higher price point, limiting mass-market adoption. Consumers in this group typically value luxury features and extensive driving ranges, particularly for longer journeys. However, as charging infrastructure continues to grow and the push for sustainability increases, there could still be potential for growth. Nevertheless, this capacity is currently more specialized and may not dominate the broader PHEV market.

Insights On Vehicle Class

Compact

The Compact is anticipated to dominate the Global Plug-In Hybrid Electric Vehicles (PHEV) market as it offers smaller, city-friendly vehicles designed to navigate urban environments efficiently. This class appeals particularly to young professionals and urban dwellers who appreciate the lower ecological footprint and fuel savings. Although the Compact vehicles have lower power and interior space compared to larger categories, their affordability and suitability for daily commutes position them positively in the market. However, the growth potential for Compacts could be overshadowed by the more versatile Midsize vehicles, which provide a better balance of practicality and performance for average consumers.

Midsize

The Midsize vehicle category is growing in the Global Plug-In Hybrid Electric Vehicles (PHEV) market due to its balance of affordability, space, and fuel efficiency. Midsize vehicles cater to a broad audience, appealing to families and commuters who seek practicality without sacrificing performance. This class offers sufficient interior room and cargo capacity while also making use of advanced hybrid technology, aligning perfectly with emerging consumer trends focused on sustainability and economical operation. Moreover, the growing collaboration among automotive manufacturers to enhance PHEV offerings in the Midsize will contribute significantly to its market leadership.

Full-size

The Full-size category in the PHEV market is characterized by larger vehicles that provide additional power and towing capabilities. While they typically consume more energy compared to smaller classes, advancements in battery technology are making them increasingly appealing. Consumers looking for spacious interiors, comfort, and enhanced features often lean towards Full-size vehicles, particularly for family ownership. However, their higher price point may limit broader adoption compared to other classes, making it a niche yet lucrative primarily favored by larger families or businesses requiring more capacity.

Luxury

The Luxury category in the PHEV market presents high-end vehicles with top-notch features and impressive performance capabilities. This attracts buyers looking for not just eco-friendly options but also premium experiences, aided by advanced technologies like personalized connectivity and superior driving dynamics. Nevertheless, the Luxury market's profitability is closely tied to economic conditions, as consumers in this space may restrict purchases during economic downturns. Nonetheless, as environmental consciousness grows, Luxury PHEVs may find a dedicated consumer base that prioritizes sustainability without compromising their status.

Insights On Charging Type

Home Charging

Home Charging is poised to dominate the Global Plug-In Hybrid Electric Vehicles market. And remains a vital option for many electric vehicle users, particularly those with off-street parking. It offers convenience and cost-effectiveness for daily use, as owners can charge their vehicles overnight in the comfort of their residences. Despite its advantages, the faces challenges, such as the variability of residential charging capabilities and the limitation of individuals living in apartments or urban areas without designated parking spaces. However, advancements in home charging technology and the decreasing cost of installation are likely to enhance its attractiveness for consumers who prefer a stable and personal charging experience.

Public Charging

Public Charging is growing rapidly in the Global Plug-In Hybrid Electric Vehicles market. This is primarily due to the increasing necessity for accessible and convenient charging options for urban dwellers who may not have dedicated home charging installations. With the rapid development of infrastructure, including the rise of fast-charging stations in locations, public charging solutions are becoming more widespread. As more consumers opt for plug-in hybrid vehicles as their primary transportation means, the demand for reliable public charging options will rise. Furthermore, many governments are incentivizing public charging infrastructure to support EV adoption, further propelling its significance in the market.

Fast Charging

Fast Charging is witnessing growing attention as a component of the electric vehicle landscape. This method significantly reduces charging time, making it more appealing for drivers who require quick top-ups, particularly during longer trips. The widespread deployment of fast-charging stations is essential for the acceptance of plug-in hybrid vehicles among users who value efficiency and convenience. While it is gaining popularity, the installation of fast chargers typically comes at a higher cost, both for the infrastructure and the electricity used, which may deter some consumers. Still, fast charging remains crucial for addressing range anxiety among prospective hybrid vehicle owners.

Global Plug In Hybrid Electric Vehicles Market Regional Insights:

Asia Pacific

The Asia Pacific region is poised to dominate the Global Plug-In Hybrid Electric Vehicles (PHEV) market due to several factors. Firstly, strong government policies and incentives favoring electric vehicles (EVs) are prevalent in countries like China and Japan, encouraging manufacturers and consumers alike to adopt PHEVs. Secondly, the rapid urbanization and rising disposable incomes in emerging markets, such as India and Southeast Asia, are increasing the demand for eco-friendly transportation alternatives. Moreover, strong investments in charging infrastructure and advancements in battery technology further support the growth of the PHEV market in this region, solidifying its position as the market leader.

North America

North America also plays a significant role in the PHEV market, with the United States being a player. The region benefits from a robust automotive sector and consumer awareness regarding environmental issues. Incentives such as tax rebates and green loans encourage consumers to choose PHEVs. However, the market is somewhat dependent on government policy stability, significantly impacting future growth.

Europe

Europe has a strong push towards sustainable transportation, with many countries setting ambitious targets for emissions reductions. The European Union has stringent regulations on CO2 emissions for vehicles, which boosts the adoption of PHEVs among automakers. Moreover, the growing infrastructure for electric vehicle charging in urban areas supports this trend, making Europe a significant player in the PHEV market.

Latin America

In Latin America, the market for PHEVs is in a nascent stage but shows potential for growth. Governments are beginning to implement initiatives to foster electric vehicle adoption, though economic challenges and limited charging infrastructure hinder rapid expansion. Nonetheless, countries like Brazil and Mexico are identified as markets with increasing consumer interest in hybrid vehicles.

Middle East & Africa

The Middle East & Africa region presents unique challenges to the PHEV market, primarily due to a heavy reliance on fossil fuels and limited infrastructure for electric vehicles. However, there are opportunities for growth, especially in more developed nations within the region. Government initiatives promoting renewable energy could spur interest in PHEVs, but significant market penetration is not expected in the near term.

Plug In Hybrid Electric Vehicles Market Competitive Landscape:

Leading entities in the Worldwide Plug-in Hybrid Electric Vehicle (PHEV) sector, encompassing prominent automakers and tech companies, propel progress through the creation of sophisticated battery systems and the optimization of vehicle performance. Their cooperation within supply chains and formation of strategic alliances fosters the growth of PHEV alternatives, advancing eco-friendly transport solutions.

The prominent entities in the Plug-In Hybrid Electric Vehicle (PHEV) sector are Toyota Motor Corporation, Ford Motor Company, BMW AG, Honda Motor Co., Ltd., General Motors Company, Volkswagen AG, Hyundai Motor Company, Kia Corporation, Nissan Motor Co., Ltd., Volvo Car Corporation, Mitsubishi Motors Corporation, and Subaru Corporation. In addition to these, players such as Mercedes-Benz AG, Audi AG, Porsche AG, Fisker Inc., Rivian Automotive, and Tata Motors Limited are also influential in shaping the PHEV landscape. Other essential contributors include BYD Auto, Polestar, and Geely Automobile Holdings Limited, all of which are crucial for fostering growth and innovation in the plug-in hybrid market.

Global Plug In Hybrid Electric Vehicles Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly hastened the global transition towards Plug-In Hybrid Electric Vehicles (PHEVs), driven by ened environmental consciousness and a move towards sustainable transport solutions, particularly in response to health apprehensions linked to conventional fossil fuel vehicles.

The COVID-19 pandemic had a profound effect on the market for Plug-In Hybrid Electric Vehicles (PHEVs). Initially, sales experienced a downturn due to disruptions in manufacturing and a drop in consumer expenditures during lockdown phases. Nevertheless, this crisis also expedited the transition towards environmentally friendly transportation solutions, as both governments and consumers grew more conscious of ecological issues and the necessity of lowering carbon emissions. Various government initiatives and incentives aimed at fostering green technologies played a vital role in the resurgence of the PHEV market. Furthermore, the pandemic underscored the importance of versatile mobility options, resulting in an increased inclination towards hybrid vehicles that merge the advantages of electric and conventional engines. As economies began to rebound, the appetite for PHEVs surged, fueled by a mix of ecological awareness, regulatory encouragement, and breakthroughs in battery technology. In summary, while the pandemic presented immediate hurdles, it ultimately served as a catalyst for a favorable long-term trajectory in the PHEV sector.

Latest Trends and Innovation in The Global Plug In Hybrid Electric Vehicles Market:

- In September 2023, Ford Motor Company announced a $50 billion investment plan to accelerate its electrification strategy, which includes the development of next-gen plug-in hybrid electric vehicles (PHEVs) and expanding its EV portfolio by 2026.

- In July 2023, BMW Group launched the 2024 BMW X5 xDrive50e, a plug-in hybrid offering improved electric range and advanced technology features, emphasizing the brand’s commitment to sustainable driving.

- In March 2023, Hyundai Motor Company revealed plans to launch the all-new 2024 Tucson Plug-In Hybrid, highlighting advancements in efficiency and performance with a more powerful electric motor and larger battery capacity.

- In January 2023, Toyota Motor Corporation unveiled its updated plug-in hybrid RAV4 Prime with enhanced electric range and improved charging capabilities during the Consumer Electronics Show (CES) in Las Vegas.

- In November 2022, Volkswagen AG completed its integration of the Electrify America charging network into its new PHEV models, enhancing convenience for users and supporting its broader electric vehicle strategy.

- In October 2022, Volvo Cars announced the completion of its new plug-in hybrid research and development center in Gothenburg, Sweden, aimed at fostering innovation in hybrid and electric technology, with a focus on sustainability.

- In September 2022, Subaru Corporation launched the 2023 Subaru Crosstrek Hybrid, which includes advanced driver-assistance systems and a more efficient hybrid powertrain, demonstrating the company’s commitment to hybrid technology.

- In July 2022, Mercedes-Benz AG introduced the EQE sedan, incorporating technologies from its plug-in hybrid models, showcasing a seamless transition to fully electric performance while preserving hybrid capabilities.

Plug In Hybrid Electric Vehicles Market Growth Factors:

The expansion of the Plug-In Hybrid Electric Vehicle (PHEV) sector is propelled by a rising consumer preference for environmentally sustainable transportation options, innovations in battery technologies, and favorable government initiatives that encourage sustainable mobility solutions.

The market for Plug-In Hybrid Electric Vehicles (PHEVs) is experiencing notable expansion, influenced by a range of factors. Primarily, ened environmental awareness and stricter governmental policies aimed at lowering carbon emissions are steering consumers towards more sustainable options like PHEVs, which combine the benefits of electric and gasoline power sources. Advances in technology are improving battery performance and range, making PHEVs increasingly attractive to consumers who desire longer driving capabilities devoid of the range anxiety often linked with fully electric vehicles. Furthermore, the growth of charging infrastructure and innovations in rapid charging solutions are facilitating easier vehicle charging for users, thereby promoting PHEV adoption. Financial incentives, including tax credits and governmental grants, are motivating potential buyers by reducing ownership costs. Increased consumer understanding of long-term savings from fuel efficiency and reduced maintenance expenditures is also propelling market growth. Furthermore, enhanced partnerships between automotive manufacturers and tech companies are driving innovation in the development and features of PHEVs, thereby expanding the potential consumer base and positively impacting market dynamics. Collectively, these elements foster a favorable climate for the continued growth of the PHEV market in the forthcoming years.

Plug In Hybrid Electric Vehicles Market Restaining Factors:

The primary obstacles hindering the growth of the Plug-in Hybrid Electric Vehicle market are the substantial upfront expenses, insufficient charging facilities, and apprehensions among consumers regarding the durability of batteries.

The market for Plug-In Hybrid Electric Vehicles (PHEVs) encounters various challenges that may impede its expansion. One significant obstacle is the elevated initial purchase price in comparison to traditional vehicles, which often leads consumers to view PHEVs as economically impractical, despite the potential for fuel savings over time. Moreover, the scarcity of charging infrastructure poses another issue; insufficient access to charging stations, particularly in less populated regions, can dissuade prospective buyers. There is also a general deficiency in consumer knowledge regarding the advantages of PHEVs, which negatively influences acceptance rates. Additionally, continuous improvements in battery technology may create uncertainties concerning the durability and efficiency of current PHEV models, which can cause hesitation among buyers. Regulatory factors also impact the market; should subsidies for electric vehicles diminish or be withdrawn, it could further hinder growth. Nonetheless, as technological advancements continue and the charging network expands, coupled with a rising eco-consciousness among consumers, the PHEV market holds significant promise. Companies are proactively tackling these obstacles, fostering innovation and enhancing the environment for PHEVs, which could ultimately lead to a more sustainable future in the automotive sector.

Segments of the Plug-In Hybrid Electric Vehicles Market

By Powertrain Type

- Series Hybrid

- Parallel Hybrid

- Series-parallel Hybrid

By Battery Capacity

- Below 10 kWh

- 10-20 kWh

- 20-30 kWh

- Above 30 kWh

By Vehicle Class

- Midsize

- Full-size

- Luxury

- Compact

By Charging Type

- Home Charging

- Public Charging

- Fast Charging

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America