Market Analysis and Insights:

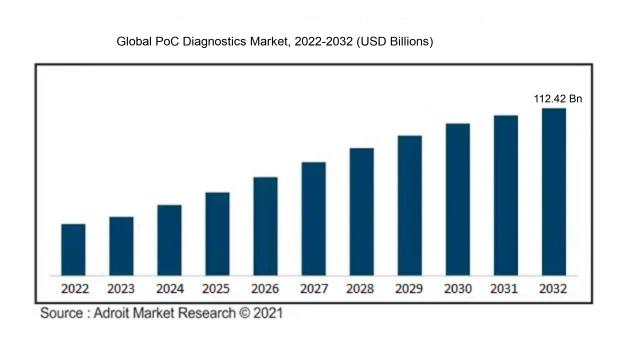

The market for Global PoC Diagnostics was estimated to be worth USD 48.73 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 9.28%, with an expected value of USD 112.42 billion in 2032.

The market for Point-of-Care (PoC) diagnostics experiences growth and ened demand due to various contributing factors. One significant driver is the escalating incidence of infectious diseases and chronic conditions like diabetes and cardiovascular ailments. The necessity for prompt and precise diagnostics directly at the point of care is essential for optimal disease management. Furthermore, the increasing elderly population, which is more prone to diverse health concerns, propels the demand for PoC diagnostics.

Innovations in technology have facilitated the creation of user-friendly and portable PoC diagnostic tools, empowering healthcare providers to conduct tests swiftly and effectively. Additionally, the market is bolstered by the rising emphasis on personalized medicine and tailored healthcare, with PoC diagnostics playing a crucial role in delivering timely and targeted interventions. Moreover, the requirement for rapid diagnostics in remote and under-resourced regions further intensifies the need for PoC diagnostics. In summary, the driving forces behind the PoC diagnostics market comprise the growing prevalence of diseases, technological advancements, increasing elderly population, personalized medicine initiatives, and the necessity for efficient diagnostics in remote regions.

PoC Diagnostics Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 112.42 billion |

| Growth Rate | CAGR of 9.28% during 2024-2032 |

| Segment Covered | By Product, By Platform, By Sample, By Mode of Purchase, By End-user, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Abbott Laboratories, Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., Cepheid Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Hologic, Inc., Johnson & Johnson, QIAGEN N.V., Siemens Healthineers AG, and Thermo Fisher Scientific Inc. |

Market Definition

PoC Diagnostics, an abbreviation for Point-of-Care Diagnostics, pertains to medical assessments conducted in proximity to or at the patient's site with the aim of delivering prompt and convenient outcomes, thereby assisting in expedited identification and treatment determinations. This practice proves to be an essential asset in healthcare environments by facilitating effective and easily reachable healthcare provision.

Point-of-care (PoC) diagnostics are instrumental in the field of healthcare by offering immediate and precise test results, which in turn support timely decision-making for patient treatment. The expedited testing and diagnostic processes associated with PoC diagnostics contribute to the early detection and treatment of illnesses, thereby enhancing patient outcomes. These compact and intuitive devices prove especially beneficial in environments where access to centralized laboratories is restricted due to limited resources.

Furthermore, PoC diagnostics play a key role in swiftly identifying and monitoring infectious diseases, thereby assisting in disease prevention and control efforts. With the evolution of technology, the significance of developing and embracing PoC diagnostics is steadily growing to ensure the delivery of effective and efficient healthcare services on a global scale.

Key Market Segmentation:

Insights On Key Product

COVID-19 Test Products

The COVID-19 test products part is expected to dominate the Global PoC Diagnostics Market. This is primarily due to the ongoing global pandemic and the high demand for COVID-19 testing, both for diagnostic purposes and for screening individuals. The rapid spread of the virus has led to the development of various PoC diagnostic tests, including antigen and antibody tests, which can quickly detect the presence of the virus in individuals. With the significant investment in research and development and the increasing adoption of PoC COVID-19 testing worldwide, this part is expected to witness substantial growth in the coming years.

Glucose Monitoring Products

The glucose monitoring products is a significant sector of the Global PoC Diagnostics Market. With the rising prevalence of diabetes and the need for continuous monitoring of blood glucose levels among diabetic patients, the demand for PoC glucose monitoring products has been steadily increasing. These products provide quick and accurate results, enabling individuals to monitor and manage their blood sugar levels effectively. The convenience and portability of these devices make them highly sought after by both patients and healthcare professionals. Although not expected to dominate the market, the glucose monitoring products part will continue to play a crucial role in PoC diagnostics.

Cardiometabolic Monitoring Products

Cardiometabolic monitoring products are designed for the diagnosis and management of various cardiovascular and metabolic conditions. This part includes devices such as blood pressure monitors, cholesterol testing kits, and lipid profile analyzers. While cardiovascular diseases and metabolic disorders are prevalent worldwide, the dominance of this part in the Global PoC Diagnostics Market is relatively low compared to others. Nonetheless, the increasing awareness about heart health and the need for early detection and monitoring of cardiometabolic conditions will contribute to the growth of this part.

Infectious Disease Testing Products

Infectious disease testing products are vital in the diagnosis and monitoring of various infectious diseases, such as HIV, hepatitis, and sexually transmitted infections. These tests help identify the presence of pathogens or their antibodies in the body, enabling timely treatment and prevention of the spread of diseases. Although the demand for infectious disease testing products is significant, it is not expected to dominate the Global PoC Diagnostics Market due to the strong competition from COVID-19 test products and other parts with broader applications.

Coagulation Monitoring Products

Coagulation monitoring products are used to assess and monitor blood clotting functions in patients with bleeding disorders or those taking anticoagulant medications. While essential in certain medical conditions, the coagulation monitoring products part is relatively niche and not expected to dominate the Global PoC Diagnostics Market. The demand for these products is mainly driven by patients with specific medical needs rather than a widespread market demand.

Pregnancy & Fertility Testing Products

Pregnancy and fertility testing products play a crucial role in reproductive health. These tests allow individuals to determine pregnancy or assess fertility status conveniently at home or in a clinical setting. Despite the importance of these products, they are unlikely to dominate the Global PoC Diagnostics Market due to the limited scope of their application compared to other parts.

Tumor/Cancer Marker Testing Products

Tumor/cancer marker testing products are used to detect and monitor the presence of certain biomarkers associated with various cancers. While cancer diagnostics are of utmost importance, the tumor/cancer marker testing products part does not have a dominating presence in the Global PoC Diagnostics Market. The broader range of cancer diagnostics, such as imaging techniques and molecular diagnostics, contributes to the shared market among various parts within the oncology diagnostics field.

Urinalysis Testing Products

Urinalysis testing products enable the analysis of urine samples for the detection of various health conditions, such as urinary tract infections, kidney diseases, and metabolic disorders. While urinalysis is a routine diagnostic test conducted in healthcare settings, the urinalysis testing products part is not expected to dominate the Global PoC Diagnostics Market. The broader application of urinalysis in non-PoC settings and lower demand compared to other parts contribute to its limited dominance.

Cholesterol Testing Products

Cholesterol testing products are used to measure and monitor cholesterol levels in individuals, which are vital for assessing cardiovascular health. While the demand for cholesterol testing is significant due to the high prevalence of cardiovascular diseases, the cholesterol testing products part is not expected to dominate the Global PoC Diagnostics Market. The availability of cholesterol testing through multiple platforms, including laboratory-based testing, limits the extent of dominance of this part.

Hematology Testing Products

Hematology testing products involve the analysis of blood samples to evaluate various blood parameters, such as red blood cell count, white blood cell count, and hemoglobin levels. While essential in diagnosing and monitoring hematological disorders, the hematology testing products part is not expected to dominate the Global PoC Diagnostics Market. The complexity and specialized nature of hematology diagnostics limit its dominance compared to other parts with broader applications.

Thyroid Stimulating Hormone (TSH) Testing Products

Thyroid stimulating hormone testing products are used to assess thyroid function by measuring the levels of TSH in the blood. Although thyroid disorders are prevalent worldwide, the TSH testing products part is not expected to dominate the Global PoC Diagnostics Market due to the limited scope of its application compared to other parts.

Drugs-of-Abuse Testing Products

Drugs-of-abuse testing products are used to detect the presence of illicit drugs or their metabolites in human biological samples. While the demand for drugs-of-abuse testing is significant in various settings, such as workplace drug testing and sports drug testing, this part is not expected to dominate the Global PoC Diagnostics Market. The niche application and regulatory constraints limit the dominance of drugs-of-abuse testing products.

Fecal Occult Testing Products

Fecal occult testing products are designed to detect hidden blood in stool samples, which can be an indicator of gastrointestinal disorders or colorectal cancer. While essential in the early detection of gastrointestinal conditions, the fecal occult testing products part is not expected to dominate the Global PoC Diagnostics Market. The availability of alternative screening methods, such as colonoscopy and non-invasive DNA-based tests, limits the dominance of this part.

Other PoC Products

Other PoC products include a wide range of diagnostic tests that do not fall into the specific parts mentioned above. These may include tests for respiratory diseases, sexually transmitted infections, autoimmune diseases, and more. Although these products cater to specific market needs, they do not have a dominating presence in the Global PoC Diagnostics Market compared to the parts with broader applications.

Insights On Key Platform

Lateral Flow Assays

Lateral Flow Assays are expected to dominate the Global PoC Diagnostics Market. Lateral Flow Assays are simple, user-friendly, and cost-effective diagnostic tools that provide rapid results for a wide range of diseases and conditions. They are widely used in point-of-care testing due to their simplicity and convenience. Lateral Flow Assays use capillary action to move fluids along a strip containing various test zones, enabling the detection of target analytes such as antigens or antibodies. These assays can be easily performed by non-specialized personnel, making them ideal for resource-limited settings and remote locations. With their widespread use in various healthcare settings and the increasing demand for rapid and accurate diagnostics, Lateral Flow Assays are expected to dominate the Global PoC Diagnostics Market.

Dipsticks

Dipsticks are another important player of the Platform category. Dipsticks are simple and cost-effective diagnostic tools that are widely used in point-of-care testing. They consist of a strip of paper or other material with different reagents or indicators that change color in the presence of a specific analyte. Dipsticks are commonly used for urine analysis and rapid screening tests for conditions such as pregnancy, glucose levels, and urinary tract infections. While Dipsticks hold a significant market share in the PoC Diagnostics Market, they are likely to face stiff competition from other parts such as Lateral Flow Assays, which offer more advanced features and capabilities.

Microfluidics

Microfluidics is an emerging platform in the field of PoC diagnostics. Microfluidic devices utilize small channels or channels on a microscale to manipulate tiny amounts of fluids and perform complex analytical tasks. These devices offer advantages such as high sensitivity, rapid analysis time, and the ability to integrate multiple functions into a single device. Microfluidic devices can be used for various diagnostic applications, including the detection of infectious diseases, cancer biomarkers, and genetic testing. While Microfluidics holds promise for the future of PoC diagnostics, it is still in the early stages of development and has yet to reach widespread adoption.

Molecular Diagnostics

Molecular Diagnostics is a highly specialized platform of the PoC Diagnostics Market. It involves the detection and analysis of DNA, RNA, proteins, and other molecules to diagnose diseases and conditions. Molecular Diagnostics offer high sensitivity and specificity, making them ideal for the detection of genetic disorders, infectious diseases, and cancer. However, Molecular Diagnostics currently face challenges in terms of cost, complexity, and the need for specialized equipment and skilled personnel. While this part holds great potential, it is not expected to dominate the PoC Diagnostics Market due to these challenges.

Immunoassays

Immunoassays are widely used in the PoC Diagnostics Market for the detection of antibodies or antigens in patient samples. Immunoassays utilize specific interactions between antibodies and antigens to enable the detection of disease markers. They are highly sensitive and can detect a wide range of analytes, making them valuable tools for diagnosis and monitoring of various diseases. Immunoassays are commonly used for infectious disease screening, hormone testing, tumor markers, and autoimmune disease diagnostics. While Immunoassays have a significant market share, they face competition from other parts such as Lateral Flow Assays, which offer simpler and more rapid testing options.

Insights On Key Sample

Nasal and Oropharyngeal Swabs Sample

Nasal and oropharyngeal swabs are expected to dominate the Global PoC Diagnostics Market. These samples are commonly used for diagnosing respiratory infections and diseases such as COVID-19. They offer a non-invasive and convenient way to collect samples, making them widely preferred in point-of-care diagnostics. Additionally, nasal and oropharyngeal swabs provide accurate results and can be easily processed using various PoC diagnostic devices. As respiratory illnesses continue to pose a global health challenge, the demand for PoC diagnostics utilizing nasal and oropharyngeal swabs is expected to rise significantly. These factors contribute to the dominance of this part in the Global PoC Diagnostics Market.

Blood Sample

While nasal and oropharyngeal swabs are expected to dominate the market, blood samples also play a crucial role in PoC diagnostics. Blood samples provide comprehensive information about a patient's overall health, including detecting infections, monitoring diseases, and assessing organ functioning. They are commonly used for analyzing various biomarkers and molecular tests, making them essential for diagnosing a wide range of conditions. The demand for blood sample-based PoC diagnostics will remain significant due to their versatility and the ability to provide accurate and comprehensive results.

Urine Sample

Urine samples are commonly used for diagnosing urinary tract infections, kidney-related disorders, and certain metabolic conditions. However, they are not expected to dominate the Global PoC Diagnostics Market compared to nasal and oropharyngeal swabs. Urine-based PoC diagnostics have their limitations in terms of detecting certain infectious diseases and may require additional tests for accurate diagnosis. This part will still hold importance in specific diagnostic scenarios but may not dominate the overall market.

Other Samples

The "other samples" category includes various types of samples such as stool, saliva, sputum, and cerebrospinal fluid. Although these samples have their applications in PoC diagnostics, they are not expected to dominate the Global PoC Diagnostics Market compared to nasal and oropharyngeal swabs. Each of these samples has specific uses in diagnosing gastrointestinal, oral health, respiratory, and central nervous system disorders. However, the market dominance is more likely to be driven by nasal and oropharyngeal swabs due to their widespread use and relevance in addressing respiratory infections.

Insights On Key Mode of Purchase

Prescription-based Products

Prescription-based products are expected to dominate the Global PoC Diagnostics market. This part consists of diagnostic products that require a prescription from a healthcare professional for purchase. These products are usually more specialized and cater to the specific needs of patients with complex health conditions. The dominance of prescription-based products can be attributed to the growing prevalence of chronic diseases and the need for accurate and reliable diagnostic tools for disease management. Additionally, the involvement of healthcare professionals in prescribing these products ensures proper guidance and interpretation of test results, enhancing patient safety and quality of care.

OTC Products

While prescription-based products are expected to dominate the Global PoC Diagnostics market, the OTC (Over-the-Counter) products mode holds its own significance. OTC products refer to diagnostic tools that can be purchased directly by consumers without the need for a prescription. These products are typically more accessible, convenient, and cost-effective for individuals who wish to monitor their health conditions at home or on-the-go. OTC PoC diagnostics offer quick results and ease of use, allowing individuals to take proactive measures in managing their health. This part serves as an alternative for individuals with less complex health conditions or those who prefer self-management without the involvement of healthcare professionals. The popularity of OTC products is also driven by the increasing consumer awareness of preventive healthcare and the demand for home-based diagnostic solutions.

Insights On Key End-user

Clinical Laboratories

Clinical laboratories are expected to dominate the Global PoC Diagnostics Market due to their significant role in diagnosing and monitoring various medical conditions. These laboratories are equipped with advanced technologies and skilled professionals, allowing for accurate and efficient PoC testing. Additionally, clinical laboratories are often affiliated with healthcare facilities and play a crucial role in disease surveillance, public health, and research activities. Therefore, their extensive usage and high demand make clinical laboratories the dominating part in the Global PoC Diagnostics Market.

Ambulatory Care Facilities and Physician Offices

Ambulatory care facilities and physician offices are another important end-user segment for POC diagnostics. These settings often require rapid and accurate test results to make informed treatment decisions. The increasing adoption of POC tests in these settings is driven by factors such as the need for improved patient outcomes, the growing emphasis on preventive care, and the rising prevalence of chronic diseases.

Pharmacies, Retail Clinics, & E-commerce Platforms

Pharmacies, retail clinics, and e-commerce platforms are emerging as important end-user segments for POC diagnostics. These settings offer convenient access to POC tests, particularly for self-testing and monitoring purposes. The increasing adoption of POC tests in these settings is driven by factors such as the growing awareness of personal health, the rising prevalence of chronic diseases, and the increasing availability of user-friendly POC devices.

Hospitals

Hospitals are a key end-user segment for POC diagnostics. These settings often require rapid and accurate test results to make timely treatment decisions and improve patient outcomes. The increasing adoption of POC tests in hospitals is driven by factors such as the need for improved patient care, the growing emphasis on reducing healthcare costs, and the rising prevalence of chronic and infectious diseases.

Critical Care Centers

Critical care centers are another important end-user segment for POC diagnostics. These settings require rapid and accurate test results to manage critically ill patients effectively. The increasing adoption of POC tests in critical care centers is driven by factors such as the need for improved patient outcomes, the growing emphasis on reducing healthcare costs, and the rising prevalence of chronic and infectious diseases.

Urgent Care Centers

Urgent care centers are a key end-user segment for POC diagnostics. These settings often require rapid and accurate test results to manage acute conditions and prevent complications. The increasing adoption of POC tests in urgent care centers is driven by factors such as the need for improved patient outcomes, the growing emphasis on reducing healthcare costs, and the rising prevalence of chronic and infectious diseases.

Home Care & Self-Testing

Home care and self-testing are rapidly growing end-user segments for POC diagnostics. These settings offer convenience and flexibility for patients, particularly those with chronic diseases who require frequent monitoring. The increasing adoption of POC tests in these settings is driven by factors such as the growing awareness of personal health, the rising prevalence of chronic diseases, and the increasing availability of user-friendly POC devices.

Other End Users

Other end-user segments for POC diagnostics include research laboratories, veterinary clinics, and food testing facilities. These settings often require specialized POC tests to meet their specific needs and requirements.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global PoC Diagnostics market. The region has a well-established healthcare infrastructure and a high demand for advanced healthcare solutions. The presence of key market players, such as Roche Diagnostics, Siemens Healthineers, and Abbott Laboratories, further contributes to the dominance of Europe in the PoC Diagnostics market. Additionally, the increasing prevalence of chronic diseases, growing aging population, and rising healthcare expenditure in countries like Germany, France, and the United Kingdom are driving the adoption of PoC diagnostics in the region. Furthermore, favorable government initiatives and reimbursement policies are also supporting the growth of the PoC Diagnostics market in Europe.

North America

North America is a significant player in the Global PoC Diagnostics market. The region has a well-developed healthcare sector, advanced healthcare infrastructure, and a high adoption rate of innovative healthcare technologies. The United States, in particular, is witnessing rapid growth in the PoC Diagnostics market due to factors such as the presence of major market players like Abbott Laboratories, Quidel Corporation, and Becton, Dickinson and Company, and the increasing prevalence of chronic diseases. Additionally, favorable reimbursement policies and government support for healthcare innovations further contribute to the dominance of North America in the PoC Diagnostics market.

Asia Pacific

Asia Pacific is a region with immense growth potential in the PoC Diagnostics market. The rising population, increasing healthcare awareness, and improving healthcare infrastructure are key factors driving the market growth in this region. Countries like China, India, and Japan are experiencing significant market expansion due to the growing geriatric population, high prevalence of infectious diseases, and rising demand for accessible and affordable healthcare solutions. Moreover, increasing investment in healthcare infrastructure development, government initiatives for disease screening and management, and collaborations with international market players are further fueling the growth of the PoC Diagnostics market in Asia Pacific.

Latin America

Latin America is a developing market that is witnessing steady growth in the PoC Diagnostics . The region's increasing healthcare expenditure, growing awareness about early disease detection, and the presence of major market players like Roche Diagnostics and Abbott Laboratories contribute to the development of the market in Latin America. Additionally, the rising prevalence of chronic diseases, such as diabetes and cardiovascular diseases, in countries like Brazil, Mexico, and Argentina is driving the demand for PoC diagnostics in the region. However, challenges such as a lack of healthcare infrastructure in rural areas and limited access to advanced diagnostic technologies may hinder the overall growth potential of the PoC Diagnostics market in Latin America.

Middle East & Africa

The Middle East & Africa region is gradually emerging as a potential market for PoC Diagnostics. The increasing healthcare expenditure, rising prevalence of chronic diseases, and improving healthcare infrastructure are key factors contributing to the growth of the market in this region. Countries like Saudi Arabia, the United Arab Emirates, and South Africa are witnessing significant market growth due to the modernization of healthcare facilities, the presence of leading market players, and government initiatives aimed at promoting healthcare access and quality. However, challenges such as a lack of awareness, limited healthcare resources in rural areas, and economic disparities across the region may impede the rapid expansion of the PoC Diagnostics market in the Middle East & Africa.

Company Profiles:

Prominent entities within the worldwide Point-of-Care (PoC) Diagnostics industry are pivotal in the advancement and production of cutting-edge diagnostic tools designed to facilitate swift and precise patient testing. Leveraging their profound knowledge and skills in research and technology, these entities actively enhance healthcare results on a global scale.

Major Key players in the PoC diagnostics industry comprise Abbott Laboratories, Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., Cepheid Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Hologic, Inc., Johnson & Johnson, QIAGEN N.V., Siemens Healthineers AG, and Thermo Fisher Scientific Inc. These organizations are actively engaged in the research, manufacturing, and distribution of point-of-care diagnostic tools that deliver prompt and precise test results directly at the patient's location. They provide a diverse array of PoC diagnostic solutions spanning various medical conditions like infectious diseases, cardiovascular ailments, pregnancy testing, and cancer diagnostics. These prominent industry players focus on continuous innovation and expansion of their product lines to address the rising demand for efficient and swift diagnostic testing methods in healthcare facilities worldwide.

COVID-19 Impact and Market Status:

The worldwide point-of-care (PoC) diagnostics industry faced a substantial decline as a result of the impact of the COVID-19 pandemic. Healthcare systems shifted their focus towards testing and handling the virus, resulting in a temporary reduction in the demand for various PoC diagnostic tests.

The COVID-19 pandemic has significantly influenced the Point-of-Care (POC) diagnostics sector. POC diagnostics are pivotal in the early detection of diseases and prompt administration of medical care, particularly in remote regions or areas with limited healthcare facilities. The outbreak of the new coronavirus has driven up the need for POC diagnostics as they facilitate swift and precise testing for COVID-19. This increased demand has led to a notable expansion in the global production and market size of POC diagnostics.

Furthermore, there has been a growing emphasis on creating groundbreaking POC diagnostic tools, including compact and handheld devices for COVID-19 detection. The healthcare sphere worldwide is shifting towards POC testing, not just for COVID-19 but also for other communicable diseases.

Consequently, many prominent market participants have escalated their investments in research and development endeavors relating to POC diagnostics. However, the sector has encountered obstacles such as disruptions in the supply chain, scarcity of raw materials, and regulatory challenges, which have impacted the efficiency of manufacturing and distribution processes. Nonetheless, the overall effect of COVID-19 on the POC diagnostics industry has been favorable, marked by an increase in demand, innovation, and investments aimed at enhancing diagnostic technologies.

Latest Trends and Innovation:

- In January 2021, Abbott Laboratories announced the acquisition of Veropharm, a leading Russian pharmaceutical company. This acquisition will strengthen Abbott's presence in the diagnostics market.

- In February 2021, QIAGEN N.V. announced the launch of its QIAreach SARS-CoV-2 Antigen Test, a rapid point-of-care testing solution for COVID-19.

- In March 2021, Roche Diagnostics received Emergency Use Authorization from the U.S. FDA for its cobas SARS-CoV-2 Variant Set 1 Test, which detects various mutated strains of COVID-19.

- In April 2021, bioMérieux announced the acquisition of Invisible Sentinel Inc., a provider of molecular diagnostic solutions. This acquisition will enhance bioMérieux's portfolio in the foodborne pathogen testing market.

- In May 2021, Danaher Corporation completed the acquisition of Aldevron, a leading provider of biologics manufacturing capabilities. This acquisition will strengthen Danaher's position in the PoC diagnostics market.

- In June 2021, Becton, Dickinson and Company (BD) received CE marking for its BD FACSDuet automated flow cytometry system, providing highly accurate and automated diagnostic testing for infectious diseases.

- In July 2021, Sysmex Corporation announced the launch of its Xprecia Stride Coagulation Analyzer, a portable device for rapid and reliable point-of-care blood coagulation testing.

- In August 2021, Siemens Healthineers announced the acquisition of Varian Medical Systems, a leading provider of cancer care solutions. This acquisition will expand Siemens Healthineers' portfolio in oncology diagnostics and treatment.

Significant Growth Factors:

The growth drivers of the Point-of-Care (PoC) Diagnostics Market encompass a growing need for swift and precise diagnostic testing, progressions in technology, and an uptick in the incidence of infectious diseases.

The market for Point-of-Care (PoC) Diagnostics is experiencing rapid expansion driven by several key factors. Firstly, the global rise in infectious diseases and chronic illnesses has created a greater demand for fast and precise diagnostic solutions at the point of care. PoC diagnostics offer timely results, facilitating prompt initiation of suitable treatment, especially in remote or resource-constrained environments. Secondly, advancements in technology, such as miniaturization and enhanced connectivity, have made PoC devices more accessible, cost-effective, and user-friendly. These technological progressions have also led to the creation of portable and handheld devices, further enhancing their practicality and reach. Thirdly, the increasing elderly population and the rise in healthcare expenditure have increased the need for efficient and economical dia

Key Segments of the PoC Diagnostics Market

Product Overview

• COVID-19 Test Products

• Glucose Monitoring Products

• Cardiometabolic Monitoring Products

• Infectious Disease Testing Products

• Coagulation Monitoring Products

• Pregnancy & Fertility Testing Products

• Tumor/Cancer Marker Testing Products

• Urinalysis Testing Products

• Cholesterol Testing Products

• Hematology Testing Products

• Thyroid Stimulating Hormone (TSH) Testing Products

• Drugs-of-abuse Testing Products

• Fecal Occult Testing Products

• Other PoC Products

Platform Overview

• Lateral Flow Assays

• Dipsticks

• Microfluidics

• Molecular Diagnostics

• Immunoassays

Sample Overview

• Blood Sample

• Urine Sample

• Nasal and Oropharyngeal Swabs Sample

• Other Samples

Mode of Purchase Overview

• Prescription-based Products

• OTC Products

End-User Overview

• Clinical Laboratories

• Ambulatory Care Facilities and Physician Offices

• Pharmacies, Retail Clinics, & E-comm. Platforms

• Hospitals

• Critical Care Centers

• Urgent Care Centers

• Home Care & Self Testing

• Other End Users

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America