The global polymer foam market was estimated at USD 130.80 billion in 2018, owing to the increasing demand for polyurethane foams in chemical, electronics, automotive, construction, and furniture industries.

Polymer foams are exceptionally versatile, lightweight, highly robust & durable, and dermatologically-friendly. Such properties make polymer foam safe for use in various applications such as building and construction, automotive, and marine industries. Polymer foams can be of different types such as polyurethane (PU), polystyrene (PS), polyvinyl chloride (PVC), phenolic, polyolefin, melamine, and others. Polymer foam market is expected to grow at a CAGR of 5.3%, in terms of value in the coming years owing to its energy-efficient nature and unique properties.

The size of the global polymer foams market was estimated to be US$ 135.22 billion in 2022 and is expected to reach approximately US$ 236.5 billion by 2032. During the forecast period of 2023 to 2032, the market is expected to grow at a compound annual growth rate (CAGR) of 5.8%.

.jpg)

Polyurethane (PU) foams are widely used in various passenger car headrests, gasket seals, seat cushions, armrests, airbags, cushioned instrument panels, and other parts to produce fuel-efficient, lightweight, and durable automobiles. PU foams are recyclable and highly resistant to corrosion and vibration owing to which they are used in most of the industries such as buildings, construction, furniture, flooring, marine, composite wood, medical, packaging, automotive, and aerospace industries. Flexible polyurethane foam is majorly used during the manufacturing of various commercial and consumer products, such as automotive interiors, bedding, carpet underlay, furniture, and packaging to provide cushioning. Flexible foams can be shaped as per the requirements as it is very durable, light, comfortable, and supportive on account of which polyurethane foams are projected to witness significant demand in the automotive industry.

Polymer foams offer exceptional properties such as flexibility, low heat transfer, low density, low weight, and softness. Polymer foams are efficient and affordable owing to which they are being used in the packaging industry. Increasing per capita income and growing technological innovations in developing economies such as India, China, and Indonesia are driving the growth of several industries such as automotive, building and construction, packaging, bedding, and furniture. Polymer foams are majorly used for thermal and acoustic insulation in the building & construction of new houses and renovation for current houses. Traditional foams use more energy and polymer foams reduce energy consumption and maintain constant temperature owing to which the market is expected to experience a positive shift.

Manufacturers are coming up with innovations and creating various types of polymer foams for advanced industries. The global polymer foam market is very fragmented in nature, with the presence of a large number of global players such as BASF, Armacell International S.A, Synthos, Borealis AG, JSP Corporation, Arkema Group, Polymer Technologies, Inc, DuPont, Zotefoams plc, SEKISUI ALVEO AG.

Polymer Foam Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 236.5 billion |

| Growth Rate | CAGR of over 5.8% during 2023-2032 |

| Segment Covered | by Structure Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

| Key Players Profiled | Arkema Group; Armacell International S.A; BASF SE; Borealis AG; Fritz Nauer AG; Koepp Schaum GmbH; JSP Corporation; Polymer Technologies; Inc.; Recticel NV; Rogers Corporation; SEKISUI ALVEO AG; Synthos S.A.; DowDuPont; Inc; Trelleborg AB; Zotefoams plc; Woodbridge Foam Corporation; Sealed Air Corporation |

Key segments of the global polymer foam market

Types Overview (USD Billion)

- Polyurethane Foam

- Polystyrene Foam

- PVC Foam

- Phenolic Foam

- Polyolefin Foam

- Melamine Foam

- Others

Application Overview, (USD Billion)

- Packaging

- Building & Constructions

- Furniture & Bedding

- Automotive

- Others

Regional Overview, (USD Billion)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- Rest Of APAC

- Central & South America

- Middle East & Africa

Frequently Asked Questions (FAQ) :

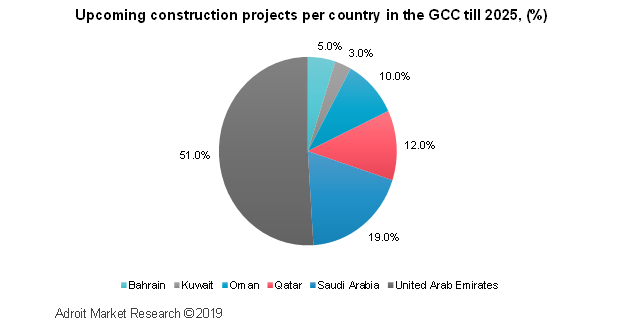

With the growing building and construction activities, there is a growing demand for polymer foams which offer exceptional properties and can sustain in harsh environments. Polyurethane foams are widely used in construction applications owing to their excellent properties such as high strength-to-weight ratio, good insulation properties, versatility, and durability. Modern homes demand the use of affordable and comfortable materials that are strong, lightweight, durable, easy to install, and versatile, owing to which there is a high demand for polymer foams in this segment.

- In March 2019, NatureWorks developed a new biodegradable polymer PLA formulation under the brand name Ingeo for 3D printing support on dual extrusion printers.

- In September 2018, BASF developed particle foam based on PESU (polyethersulfone), Ultrason E, which is a natural flame retardant, high-temperature resistant, very strong & stiff, and extreme lightweight mainly suitable for complex-shaped components in airplanes, trains, and cars.

- In November 2018, BASF launched a mineral-based non-combustible insulation material known as Cavipor for the building & construction industry. This material will enable the double brick walls to become more energy efficient during renovations.

- Fraunhofer ICT’s foam technologies team is in the process of developing polymeric thermoplastic particles and foams made from renewable resources such as PLA (Polylactic Acid) for building and construction, packaging, automotive, and sports industries, to address the need to find alternatives for petrochemical products.

- VTT, the Technical Research Centre of Finland, is under the course of developing light foam biocomposites. These new fibrous foam have applications in surface panels of interior walls and façade and foamed bio-based thermoplastics for the interior wall’s middle layer.

Polyurethane (PU) polymer foam segment captured a big market share in 2018 and is anticipated to grow over the forecast period. Polyurethane foam is used in numerous home décor applications, such as cushions, furniture, and carpets. With the growing standards of living and the rise in demand for beautiful aesthetic homes, is expected to drive the market further for polyurethane foams. These foams exhibit superior qualities such as low heat and sound transfer, lightweight, good insulation, and high-energy dissipation. Growing demand for commercial and residential buildings in Southeast Asian countries, such as Indonesia, Singapore, and Korea, is further projected to fuel the demand for polyurethane foams in building and construction applications.

Polyurethane (PU) polymer foam segment captured a big market share in 2018 and is anticipated to grow over the forecast period. Polyurethane foam is used in numerous home décor applications, such as cushions, furniture, and carpets. With the growing standards of living and the rise in demand for beautiful aesthetic homes, is expected to drive the market further for polyurethane foams. These foams exhibit superior qualities such as low heat and sound transfer, lightweight, good insulation, and high-energy dissipation. Growing demand for commercial and residential buildings in Southeast Asian countries, such as Indonesia, Singapore, and Korea, is further projected to fuel the demand for polyurethane foams in building and construction applications.

Polystyrene foam is widely used in packaging applications due to its extreme lightweight and high strength to weight ratio, which saves transportation costs and consumes low fuel. It is also used in railway applications for the construction of railway embankments and station platform extensions. The growing railway infrastructure and construction projects in the Asia Pacific region in countries such as India is expected to boost the demand for polystyrene foam during the forecast period.

With the greatest and flexibility lowest density, polymer foams are used widely in the automotive sector. Most of the car body such as windows, doors, car seats, bumpers, ceiling sections, and spoilers use polyurethane foam. Polyurethane also offers added mileage by reduction in weight and increasing comfort, fuel economy, corrosion resistance, sound absorption and insulation which is expected to drive the market over the forecast period.

The advances in nanotechnology are expected to boost the advancement of more efficient materials such as nanocomposite foams coupled with new advanced foaming technologies, which have new emerging applications such as electromagnetic interference (EMI) shielding in electronics.

With the growing environmental impact of polyurethane foams, major competitions are focusing on the development of bio-based polymers and foams. In near future, biopolymer foam-structures and biocomposites are expected to replace fossil fuel-derived materials in major industries such as transportation, packaging, consumer appliances and construction which is expected to boost the demand for such foams in the coming years.

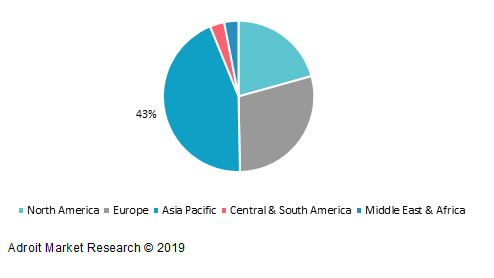

Global Polymer Foam Market, By Region, 2018 (%)

Growing population coupled with rapid urbanization is expected to bolster the demand for residential and commercial construction projects in Asian countries. Asia Pacific accounted for more than 40% of the total market share in 2018 and is projected grow during the forecast period. Increasing the construction of new homes, offices, and remodeling of existing structures is projected to boost the market demand of polymer foams owing to their exceptional properties. Economic development and rise in the per capita spending in countries such as India, China, Brazil, and Saudi Arabia is expected to offer a lucrative opportunity for polymer foams in the construction and packaging segment over the coming years.

Polyurethane foams are an important factor in major consumer appliances especially rigid foams, which are widely used for freezer and refrigerator thermal insulation systems. The market for polymer foams is expected to grow owing to their exceptional properties which meet the required energy ratings in consumer refrigerators and cost-effectiveness in the developing regions.

Additionally, polyurethane foams play a key role in the thermal insulation for highly insulated buildings. Recent research on thermal insulation by Caleb Management Services Limited has shown that thermal insulation plays a crucial role in the cost-effective reduction of carbon dioxide emissions. Therefore, retrofitting of existing buildings by injected or sprayed foam can make an important contribution to the protection of the environment, which is expected to drive the market for polymer foams in the coming years.