Polymers Market Analysis and Insights:

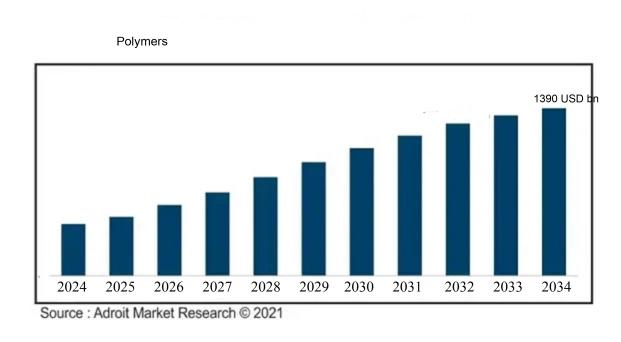

The Global Polymers Market was estimated to be worth USD 800 billion in 2024, and from 2025 to 2034, it is anticipated to grow at a CAGR of 5.0%, with an expected value of USD 1390 billion in 2034.

The market for polymers is principally influenced by several vital elements, notably the growing demand from diverse sectors such as automotive, packaging, construction, and electronics. Simultaneously, the surge in consumer goods, along with changing packaging demands, has amplified the necessity for innovative polymer solutions characterized by durability and adaptability.

Advances in polymer processing and recycling technologies are significantly bolstering market expansion by improving product performance and supporting circular economy initiatives. Additionally, population growth and urbanization are driving infrastructure projects, resulting in a ened use of polymer materials in the construction industry. Lastly, stringent environmental regulations are compelling manufacturers to explore bio-based and biodegradable polymer options, thereby impacting market trends. In summary, these interconnected factors collectively reshape the dynamics of the polymers market.

Polymers Market Definition

Polymers are extensive molecules made up of recurring structural components known as monomers, linked together through covalent bonds. These substances can be found in nature, exemplified by proteins and cellulose, or can be artificially created, as seen in materials like plastics and rubber.

Polymers are integral to contemporary life, owing to their adaptability and extensive use across various sectors. These large molecules, made up of repetitive s, are ubiquitous in daily products, spanning from packing materials and domestic goods to parts for vehicles and healthcare technologies. Their distinct attributes, including strength, flexibility, and chemical resistance, render them essential in fields such as construction, electronics, and medical care. Furthermore, progress in polymer science has facilitated the emergence of biopolymers, eco-friendly substitutes that help lessen dependence on fossil resources. Consequently, the significance of polymers resides in their capacity to improve functionality while simultaneously tackling sustainability issues.

Polymers Market Segmental Analysis:

Insights on Product Type

Thermoplastics

Thermoplastics are expected to dominate the Global Polymers Market due to their versatility and wide-ranging applications across multiple industries, including automotive, packaging, and electronics. Their properties, such as excellent moldability, recyclability, and ability to be reprocessed, make them highly attractive to manufacturers and consumers. The growing demand for lightweight materials, combined with stringent regulations regarding emissions, is further driving the adoption of thermoplastics.

Thermosets

Thermosets are characterized by their irreversible curing process, which imparts superior thermal stability and mechanical strength. They find significant application in industries such as aerospace, automotive, and electrical, where durability and heat resistance are paramount. However, they are less favored in certain sectors due to their permanent form post-curing, limiting reforming options. Despite this, the increasing demand for high-performance materials is likely to maintain a steady interest in thermosets, particularly in specialized applications where their properties can be fully exploited.

Elastomers

Elastomers are highly elastic materials used extensively in applications that require flexibility and resilience, such as seals, gaskets, and automotive components. The demand for elastomers is growing, especially in the automotive and construction industries, driven by the need for products that can withstand varying temperatures and mechanical stress. Although they represent a smaller portion of the overall polymers market compared to thermoplastics, elastomers are becoming increasingly significant due to innovations in manufacturing techniques and the rising requirement for advanced performance features in consumer products.

Insights on Material

Polyethylene

Polyethylene is anticipated to dominate the Global Polymers Market due to its widespread versatility, cost-effectiveness, and extensive range of applications across multiple industries. As one of the most commonly produced plastics, it is used in packaging, consumer goods, and industrial applications. With the growing demand for sustainable and recyclable materials, polyethylene's characteristics like lightweight and durability make it an attractive option for manufacturers aiming to reduce environmental impact. The increasing need for packaging solutions, especially in e-commerce and food preservation, coupled with innovations in production, is propelling polyethylene's growth, allowing it to maintain its market-leading position.

Polypropylene

Polypropylene is recognized for its high tensile strength and resistance to heat and chemicals, making it ideal for automotive parts, textiles, and packaging materials. Additionally, the versatility and low production cost enhance its appeal across numerous applications, including consumer goods and medical devices. Given the rising emphasis on lightweight and durable materials, polypropylene remains a strong contender, although it faces competition from more sustainable alternatives.

Polyvinyl Chloride (PVC)

Polyvinyl Chloride (PVC) is extensively used in construction and electrical applications due to its durability and resistance to moisture. The growing global infrastructure development presents opportunities for PVC, particularly in the production of pipes, windows, and doors. However, its environmentally negative perception and associated health concerns have led to regulatory challenges, which could impact its growth trajectory. Yet, advancements in manufacturing processes aimed at reducing the environmental impact of PVC production could mitigate some of these concerns and keep it relevant in the market.

Polyethylene Terephthalate (PET)

Polyethylene Terephthalate (PET) is primarily recognized for its role in the beverage and food packaging sectors, especially for bottles and containers. The increasing trend toward recycling, specifically PET recycling, has gained a significant foothold, encouraging sustainability initiatives in various industries. Nevertheless, it's heavily dependent on the beverage sector's performance, which faces challenges from shifting consumer preferences toward alternative packaging solutions. As the push for eco-friendly materials continues, PET has opportunities for growth, particularly if new sustainable practices are adopted more broadly.

Polystyrene

Polystyrene is commonly used in packaging and insulation applications, particularly in the food service industry. Its lightweight yet sturdy nature makes it a favored choice for disposable containers and protective packaging. The material's price sensitivity can affect demand, as fluctuations in raw material costs may deter manufacturers. Moreover, growing environmental concerns surrounding single-use plastics challenge polystyrene's broad acceptance and could lead to restrictions on its use in some markets. However, its utility in thermal insulation presents a niche opportunity that can support its growth amidst regulatory pressures.

Polyurethane

Polyurethane possesses excellent elasticity, durability, and insulation properties, making it valuable in various applications ranging from automotive parts to furniture. However, its dependence on isocyanates, which face scrutiny over health effects, could pose challenges. Transformations in manufacturing processes to enhance safety and sustainability will be crucial for polyurethane to maintain its competitive edge in a shifting market landscape, particularly as manufacturers seek more environmentally friendly options.

Insights on Application

Packaging (Rigid and Flexible)

Packaging is anticipated to dominate the Global Polymers Market due to an increase in consumer demand for innovative, sustainable, and convenience-driven packaging solutions. The growing trend of e-commerce, along with ened awareness regarding food safety and preservation, has spurred the need for versatile packaging materials. Rigid and flexible plastics are indispensable for food and beverages, pharmaceuticals, and various consumer products. Furthermore, advancements in biodegradable and recyclable materials foster a shift towards eco-friendly packaging, aligning with global sustainability goals. The ongoing efforts towards reducing packaging waste and optimizing supply chains only solidify the packaging’s dominance in the polymers market.

Building and Construction (Roofing, Windows, Flooring, and Others)

The Building and Construction sector utilizes polymers extensively in roofing, windows, flooring, and insulation applications. Materials like PVC and composite polymers are favored for their durability, weather resistance, and low maintenance requirements. The rising demand for sustainable building practices enhances the use of polymers that are energy-efficient and contribute to eco-friendly construction. As urbanization accelerates globally, the need for innovative construction solutions pushes this to grow, particularly as industries increasingly seek materials that meet stringent regulatory standards for energy efficiency.

Automotive (Engine, Tires, Body Panel, and Others)

In the Automotive arena, polymers are crucial for various components, including engine parts, tires, and body panels. Their lightweight nature significantly contributes to fuel efficiency and vehicle performance, which is essential as manufacturers aim for lower emissions. Innovations in polymer technology enhance mechanical properties, allowing for better performance under extreme conditions. The drive towards electric vehicles also presents an avenue for increased polymer usage as automakers look to reduce weight and enhance energy efficiency in design and manufacturing processes.

Electrical and Electronics

The Electrical and Electronics industry relies heavily on polymers for insulation and housing materials, ensuring safety and functionality in devices and appliances. These materials provide not only electrical insulation but also contribute to weight reduction in devices, thus improving portability and usability. The rapid evolution of smart technology and wearable devices necessitates the use of advanced polymers that enhance performance while complying with safety regulations. As consumer electronics evolve, the demand for polymers suited for high-tech applications continues to grow steadily.

Agriculture

In the Agriculture sector, the application of polymers spans from protective covers to mulch films, which enhance crop yield and sustainability. These materials provide essential benefits like UV protection, water retention, and soil enhancement. The increasing emphasis on modern farming techniques, such as greenhouses and hydroponics, drives the use of specialized polymers that improve agricultural outcomes. Additionally, innovative bio-based polymers are emerging, aligning with the industry's focus on reducing environmental impact and promoting sustainable agricultural practices.

Medical/Healthcare

The Medical and Healthcare sector utilizes polymers for a variety of products, including medical devices, drug delivery systems, and packaging for pharmaceutical products. Their biocompatibility and versatility make them indispensable in the healthcare field. The trend towards minimally invasive procedures and personalized medicine drives innovation in polymer applications, leading to more efficient medical products. As the demand for healthcare services escalates globally, the need for reliable, cost-effective, and adaptable polymer materials in medical applications is expected to grow.

Insights on Process

Injection Molding

Injection molding is poised to dominate the Global Polymers Market due to its versatility and efficiency. It enables the production of complex shapes with high precision and minimal waste. This process is highly suitable for mass production, offering significant economic advantages through lower per-unit costs. The growing demand for lightweight components in industries such as automotive, electronics, and consumer goods further drives its adoption. With the ability to utilize various polymer materials and the advancement of technologies that improve speed and accuracy, injection molding continues to capture a significant market share, making it a preferred choice among manufacturers and designers alike.

Extrusion

Extrusion holds a notable position in the Global Polymers Market, primarily due to its ability to create continuous shapes and profiles economically. This process is particularly favored for applications such as pipes, sheets, and films, which are essential in construction, packaging, and automotive sectors. The technological advancements in extrusion machinery have allowed manufacturers to improve efficiency and reduce production times. Additionally, the flexibility in material selection and the capability of processing a wide variety of polymers further underscore its relevance in the industry. However, it generally caters to a narrower range of applications compared to injection molding.

Others

The “Others” category encompasses various processes such as blow molding, rotational molding, and thermoforming, all of which play vital roles in specialized applications within the Global Polymers Market. While each process has its specific advantages, such as blow molding's efficiency in creating hollow objects and rotational molding’s suitability for large, durable items, these methods often cater to niche requirements. The market for these processes is growing yet remains overshadowed by dominant methods like injection molding and extrusion, which cover broader applications and benefit from economies of scale. Continued innovation may enhance the competitiveness of these alternative processes in the future.

Global Polymers Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Polymers Market due to several pivotal factors. The region is characterized by a rapid industrialization trend, a growing population, and a surge in urbanization that significantly fuels the demand for polymers across various sectors, including automotive, packaging, construction, and electronics. China and India are the forefront countries driving this growth, with an increasing number of manufacturing facilities and investments in innovative polymer applications. Additionally, the rise of e-commerce and changing consumer preferences are pushing for advanced packaging solutions, further solidifying Asia Pacific as the leading market for polymers in the coming years.

North America

North America holds a significant share of the Global Polymers Market, primarily driven by its advanced technological infrastructure and high demand for specialized polymer applications in industries such as automotive, healthcare, and aerospace. The region's focus on innovation and research and development fosters the introduction of high-performance polymers that cater to specific needs. Furthermore, the presence of major polymer manufacturing companies and strong regulatory frameworks support market growth. However, growth is tempered by environmental regulations and competition from emerging markets.

Latin America

Latin America presents a growing but still developing market for polymers, influenced primarily by its agricultural and packaging sectors. Countries like Brazil and Mexico are key contributors, investing in sustainable practices and biodegradable polymer options. While the demand for polymers is rising due to urbanization and population growth, economic fluctuations and political instability can hinder consistent growth in the region. Nevertheless, investment in infrastructure and manufacturing capabilities holds potential for future growth in the Latin American polymer market.

Europe

Europe is a mature market for polymers characterized by strict environmental regulations and a strong emphasis on sustainability. The region is focused on developing advanced materials and recycling technologies, particularly in response to legislative measures aimed at reducing plastic waste. Major economies like Germany, France, and the UK are pushing for innovations in bio-based and biodegradable polymers, making the region a leader in sustainable practices. However, Europe faces challenges such as high production costs and competition from lower-cost manufacturers in other regions, impacting its overall market growth.

Middle East & Africa

The Middle East & Africa region is gaining traction in the Global Polymers Market, driven by increasing investments in infrastructure and construction sectors. Countries like the UAE and South Africa are focusing on enhancing their polymer production capabilities to meet growing local demand. Challenges such as political instability and limited technological advancements, however, continue to restrict market penetration. Nevertheless, ongoing development projects and the diversification of economies are creating opportunities for polymer applications in various industries, indicating potential growth for this region in the long term.

Polymers Competitive Landscape:

Major contributors in the worldwide polymers sector spearhead innovation and manufacturing, emphasizing eco-friendly solutions and the creation of cutting-edge materials. Their activities include research and development, broadening market access, and fostering partnerships across various industries to address a wide array of consumer demands.

Prominent participants in the polymers industry consist of BASF SE, Dow Inc., ExxonMobil Chemical Company, LyondellBasell Industries N.V., Sabic, DuPont de Nemours, Inc., Covestro AG, INEOS Group, Mitsubishi Chemical Corporation, Bayer AG, Arkema S.A., LG Chem, Reliance Industries Limited, Huntsman Corporation, Celanese Corporation, and Eastman Chemical Company.

Global Polymers COVID-19 Impact and Market Status:

The Covid-19 pandemic deeply impacted the worldwide polymers industry by leading to supply chain disruptions, varying demand across different sectors, and hastening the transition to eco-friendly materials.

The COVID-19 pandemic had a profound impact on the polymers industry, presenting a mix of challenges and opportunities. At the onset, widespread lockdowns severely disrupted supply chains, leading to production delays and decreased demand from sectors such as automotive and construction. Conversely, there was an increased demand for medical supplies, packaging, and consumer goods, which spurred growth in certain areas like polyvinyl chloride (PVC) and polyethylene. The ened awareness around hygiene and safety also fostered advancements in polymer formulations, particularly those with antimicrobial properties. Moreover, the crisis catalyzed a movement toward sustainability, with a growing interest in bio-based and recyclable polymers in alignment with global environmental priorities. As economies begin to recover, the polymers market is anticipated to flourish, driven by strong demand across various industries and shifts in consumer behavior resulting from the pandemic. In summary, the COVID-19 crisis has prompted significant evolution and resilience within the polymers sector.

Latest Trends and Innovation in The Global Polymers Market:

- In March 2023, BASF announced the opening of its new polycarbonate production facility in Zhangjiagang, China, which aims to bolster its leading position in the polycarbonate market and improve supply for the automotive and electronics sectors.

- In October 2022, Covestro AG completed its acquisition of the US-based company, Resins & Functional Materials, enhancing its portfolio in the specialty polymers sector and expanding its offerings in high-performance resins for automotive and industrial applications.

- In July 2022, DuPont announced the launch of its new Bio-Engineering polyamide, designed for electrical insulation applications, leveraging its advanced materials science and technologies to meet the evolving demands of the electronics industry.

- In February 2023, SABIC unveiled its new range of circular polymers derived from recycled materials, aiming to lead in sustainability and contribute to the circular economy within the polymer industry.

- In August 2023, Eastman Chemical Company acquired the sustainable textile technology firm, Nanollose, enhancing its innovation capabilities in sustainable materials and strengthening its position in the performance materials market.

- In May 2022, Evonik Industries launched its new polymer, VESTAMID, specifically designed for use in automotive parts, which boasts improved performance under extreme conditions, showcasing the company’s commitment to innovation in high-performance materials.

- In December 2022, Lanxess finalized its purchase of the specialty polymers business from U.S.-based Company, BetzDearborn, significantly expanding its offerings in the specialty chemical sector and enhancing its competitiveness in the global market.

- In April 2023, Huntsman Corporation announced the investment of approximately $100 million for expanding its production capacity for advanced additive manufacturing materials, demonstrating its focus on growth in high-demand s like 3D printing.

Polymers Market Growth Factors:

The expansion of the polymers sector is propelled by increasing needs within the automotive, packaging, and construction fields, coupled with advancements in biopolymer development and recycling methods.

The polymers industry is witnessing remarkable expansion, influenced by several critical factors. Firstly, the rising requirement for lightweight yet robust materials in sectors such as automotive, aerospace, and construction is driving the adoption of polymers, which possess superior qualities compared to conventional materials. Furthermore, the growing consumer interest in sustainable products has accelerated the emergence of biodegradable and recyclable polymers, tackling issues related to environmental sustainability and increasing regulatory demands. Improvements in polymerization technologies and methodologies are also improving the performance attributes of these materials, resulting in a broader range of applications in diverse fields including electronics, healthcare, and packaging.

Additionally, the swift urbanization and infrastructure growth in developing nations are enhancing the demand for polymers in construction-related products, adhesives, and coatings. The expanding electronics market, spurred by innovations like flexible displays and wearable devices, further intensifies the requirement for specialized polymers. Finally, an uptick in investment directed towards research and development, combined with partnerships between academia and industry, is driving innovation and broadening the scope of polymer applications, thereby propelling the overall market forward. Collectively, these elements contribute to a vigorous forecast for the polymers sector, establishing it as a crucial element in the progress of global industry.

Polymers Market Restaining Factors:

The polymers industry encounters challenges such as volatile prices of raw materials and escalating environmental regulations pertaining to plastic waste management.

The polymers industry is confronted with various factors that may restrict its growth prospects. A primary concern is the increasing environmental awareness related to plastic waste, which has led to stricter regulations and ened demands from both governments and consumers regarding sustainable practices. Additionally, the instability of raw material prices, particularly for oil and natural gas, can adversely influence production expenses and profitability for industry players. Compounding this issue is the rising competition from bioplastics and other sustainable materials, as a growing number of consumers opt for eco-friendly alternatives.

Moreover, challenges in recycling technologies and inefficient waste management systems can impede the effective repurposing of polymers, worsening environmental challenges. Economic fluctuations or uncertainties in key markets further impact the demand for polymer products across several sectors, such as automotive, construction, and consumer goods. Nevertheless, advancements in polymer technology, especially in creating more sustainable and efficient manufacturing processes, offer avenues for growth. As businesses ramp up investments in research and development to produce biodegradable materials, the industry has the potential to adapt and prosper by reconciling the requirements for robust materials with environmental stewardship, ultimately yielding a favorable outlook for future development in the polymers market.

Polymers Market Key Segments:

By Product Type

- Thermoplastics

- Thermosets

- Elastomers

By Material

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Polystyrene

- Polyurethane

By Application

- Packaging (Rigid and Flexible)

- Building and Construction (Roofing, Windows, Flooring, and Others)

- Automotive (Engine, Tires, Body Panel, and Others)

- Electrical and Electronics

- Agriculture

- Medical/Healthcare

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America