Market Analysis and Insights:

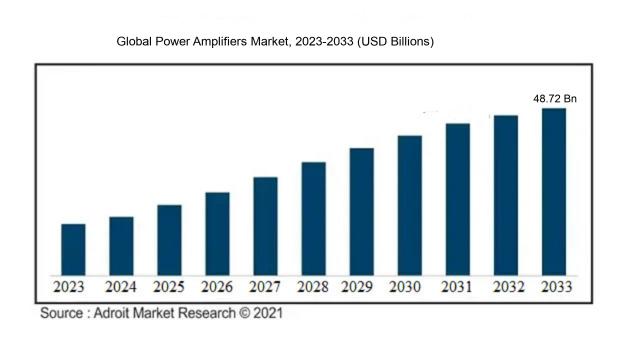

The market for Power Amplifiers was estimated to be worth USD 25.41 billion in 2023, and from 2023 to 2033, it is anticipated to grow at a CAGR of 6.03%, with an expected value of USD 48.72 billion in 2033.

The power amplifiers industry is influenced by various significant factors. Primarily, the surging market for consumer electronics, including smartphones, tablets, and smart devices, is propelling the necessity for power amplifiers to elevate audio quality and enrich overall audio experiences. Furthermore, the increasing integration of high-speed data communication technologies, such as 5G, is fostering the demand for power amplifiers to accommodate the escalating data transmission speeds effectively. In addition, the expanding utilization of power amplifiers within the automotive sector for purposes like in-car entertainment systems and advanced driver assistance systems is driving the market's expansion. Moreover, the ened requirement for proficient and high-capacity electronic equipment across sectors like aerospace and defense, healthcare, and industrial automation is fueling the need for power amplifiers. Finally, the introduction of cutting-edge technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) is anticipated to play a crucial role in advancing the power amplifiers market, given that these innovations demand sophisticated electronic components for their deployment. In summary, the growth of the power amplifiers market is underpinned by the increasing demand for consumer electronics, the adoption of advanced communication technologies, the utilization of power amplifiers in automotive settings, the need for efficient electronic devices across diverse industries, and the emergence of novel technologies.

Power Amplifiers Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2033 |

| Study Period | 2018-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 48.72 billion |

| Growth Rate | CAGR of 6.03% during 2023-2033 |

| Segment Covered | By Class, By Product Type, By Vertical, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Qualcomm Technologies Inc., Texas Instruments Inc., Analog Devices Inc., STMicroelectronics N.V., Maxim Integrated, NXP Semiconductors, Infineon Technologies AG, Broadcom Inc., |

Market Definition

Power amplifiers are sophisticated electronic instruments designed to enhance the strength of an initial signal to a magnitude appropriate for energizing high-power output mechanisms like loudspeakers. These devices find extensive utility across audio setups, communication networks, and a range of other scenarios demanding a substantial boost in signal potency.

Power amplifiers hold a vital role in diverse electronic systems by effectively amplifying electrical signals with precision and efficiency. They work to increase the power of weak signals to a level suitable for driving output devices such as loudspeakers, antennas, or other components. Commonly utilized in audio systems, wireless communication setups, radar systems, and other applications necessitating top-notch signal amplification, power amplifiers enhance sound clarity, facilitate longer communication ranges, and elevate radar detection capabilities. Moreover, these amplifiers contribute significantly to preserving signal fidelity and minimizing distortion and noise, thereby upholding the integrity of the original input. Hence, power amplifiers are indispensable for optimal system performance and the delivery of superior output quality across a range of electronic applications.

Key Market Segmentation:

Insights On Key Class

Class A

Class A is expected to dominate the Global Power Amplifiers Market. This part is characterized by low distortion and high linearity, making it ideal for applications that require high-fidelity audio amplification. Class A amplifiers operate in a linear mode throughout the entire input signal range, resulting in superior sound quality. While Class A amplifiers are known for their efficiency, they consume a significant amount of power and generate a substantial amount of heat. Despite these drawbacks, the demand for Class A power amplifiers remains high in the audio industry, especially in high-end consumer audio systems, professional audio equipment, and studio applications. The dominance of Class A amplifiers is driven by the need for exceptional audio performance, where fidelity is prioritized over energy efficiency.

Class B

Class B power amplifiers operate in a push-pull configuration, where one transistor amplifies the positive half of the input signal and another transistor amplifies the negative half. This design provides higher efficiency than Class A amplifiers as the transistors are only active when the input signal requires amplification. However, the drawback of Class B amplifiers is that there is a small amount of crossover distortion when transitioning between the positive and negative halves of the input signal. This distortion can be minimized by using Class AB amplifiers, which are a variation of Class B amplifiers that introduce a small bias current to eliminate crossover distortion. Despite the higher efficiency of Class B amplifiers, they are not expected to dominate the global power amplifier market due to the presence of other parts that offer better audio quality and reduced distortion.

Class C

Class C power amplifiers are known for their high efficiency, making them suitable for applications that require power amplification with low power consumption. However, Class C amplifiers are more commonly used in RF (radio frequency) applications rather than audio amplification. This part is not expected to dominate the global power amplifier market as the demand for Class C amplifiers is mainly driven by specific industries and applications, such as wireless communication systems, radar systems, and radio transmitters. The limited applicability of Class C amplifiers in the audio industry hinders their dominance in the overall power amplifier market.

Class D

Class D power amplifiers, also known as switching amplifiers, have gained significant popularity in recent years due to their high efficiency and compact size. These amplifiers use pulse-width modulation (PWM) to convert the audio signal into a square wave, which is then filtered to reconstruct the original analog signal. Class D amplifiers offer high power efficiency by rapidly switching the transistors between on and off states, resulting in minimal power dissipation and heat generation. The increasing demand for portable audio devices, automotive audio systems, and home theater systems has contributed to the growth of Class D amplifiers. While Class D amplifiers are expected to experience substantial growth, they are not projected to dominate the global power amplifier market entirely.

Others

The Others includes power amplifier classes beyond Class A, B, C, and D. This category encompasses less popular or niche amplifier designs, such as Class E, F, G, H, T, and S. These amplifier classes offer unique characteristics and advantages that cater to specific application requirements. However, they are not anticipated to dominate the global power amplifier market due to their limited adoption and specialized use cases. The dominant parts within the power amplifier market are expected to be Class A, Class B, and Class D, with each offering distinct features and targeting different market needs.

Insights On Key Product Type

RF Power Amplifiers

RF Power Amplifiers are expected to dominate the Global Power Amplifiers Market. These amplifiers are specifically designed for radio frequency applications, making them essential components in wireless communication systems. With the increasing demand for wireless devices and the growing adoption of advanced technologies such as 5G, the need for RF Power Amplifiers is skyrocketing. Additionally, RF Power Amplifiers are crucial in various industries including telecommunications, aerospace, defense, and automotive. The ability of RF Power Amplifiers to provide high output power, efficiency, and reliability makes them the preferred choice in these applications. Therefore, RF Power Amplifiers are expected to be the dominating part in the Global Power Amplifiers Market.

Audio Power Amplifiers

Audio Power Amplifiers, on the other hand, are also a significant player in the Global Power Amplifiers Market. These amplifiers are widely used in consumer electronics such as home audio systems, car audio systems, and professional audio equipment. The increasing demand for high-quality sound systems in both residential and commercial settings is driving the growth of audio power amplifiers. Moreover, the rising popularity of smart speakers, portable audio devices, and home theater systems further contributes to the demand for audio power amplifiers. While RF Power Amplifiers are expected to dominate the market, audio power amplifiers hold a considerable share due to the strong consumer demand for audio solutions in various applications.

Insights On Key Vertical

Telecommunication

The Telecommunication component is expected to dominate the Global Power Amplifiers Market. This is due to the increasing demand for high-quality and high-speed data transmission in the telecommunications industry. With the advent of technologies such as 5G, there is a need for power amplifiers that can handle higher frequencies and deliver improved signal quality. Power amplifiers are essential components in mobile base stations, routers, and other telecommunication equipment. As the telecommunication industry continues to expand globally and embrace advanced technologies, the demand for power amplifiers is expected to grow significantly in this part.

Consumer Electronics

In the Consumer Electronics, power amplifiers play a crucial role in various devices such as smartphones, televisions, audio systems, gaming consoles, and wearable devices. The increasing adoption of these consumer electronics products globally is driving the demand for power amplifiers. However, the Consumer Electronics part is not expected to dominate the Global Power Amplifiers Market as the telecommunication part holds a more significant share of the market due to its growing demand for high-speed data transmission.

Industrial

The Industrial component is another important area where power amplifiers find application. They are used in industries such as manufacturing, automation, robotics, and process control. Power amplifiers are required to boost signals in industrial equipment and machinery, enabling efficient and reliable operations. However, the Industrial part is not expected to dominate the Global Power Amplifiers Market as the telecommunication part holds a more significant share of the market due to the increasing demand for high-speed data transmission.

Automotive

In the Automotive component, power amplifiers are used in various applications, including audio systems, infotainment systems, and advanced driver assistance systems (ADAS). With the increasing demand for connected cars and the integration of advanced features, the demand for power amplifiers in the automotive industry is expected to grow. However, the Automotive part is not expected to dominate the Global Power Amplifiers Market as the telecommunication part holds a more significant share of the market due to the growing need for high-speed data transmission.

Other Industry Vertical

The Other Industry Vertical component represents industries beyond consumer electronics, telecommunication, industrial, and automotive sectors. This includes sectors such as healthcare, aerospace, defense, and energy. Power amplifiers find application in various equipment and systems in these industries, depending on their specific requirements. However, the Other Industry Vertical part is not expected to dominate the Global Power Amplifiers Market as the telecommunication part holds a more significant share of the market due to the increasing demand for high-speed data transmission.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the global power amplifiers market. This region has witnessed rapid industrialization and urbanization, leading to the increased demand for consumer electronics, automotive, telecommunication, and other end-use industries. Moreover, Asia Pacific is home to major economies like China, Japan, and South Korea, which are known for their technologically advanced manufacturing capabilities. These factors, coupled with the rising disposable income and growing population, are driving the demand for power amplifiers in the region. Additionally, the adoption of 5G technology and the expansion of smart homes and smart cities further contribute to the dominance of Asia Pacific in the global power amplifiers market.

North America

North America is one of the key regions in the global power amplifiers market. The region is characterized by the presence of several major players in the semiconductor industry and a significant consumer base. The increasing demand for consumer electronics, wireless communication devices, and automotive applications are driving the growth of power amplifiers in North America. Additionally, the advancements in 5G technology and the rapid adoption of Internet of Things (IoT) devices are expected to further fuel the demand for power amplifiers in the region.

Europe

Europe is a significant player in the global power amplifiers market. The region has a strong automotive industry and is known for its emphasis on technological advancements. The demand for power amplifiers in Europe is primarily driven by the automotive sector, as power amplifiers are crucial components in vehicle infotainment systems. Moreover, the growing need for high-speed data transmission and the increasing adoption of smart devices contribute to the demand for power amplifiers in the region.

Latin America

Latin America is a developing region in the global power amplifiers market. While the market in this region is relatively smaller compared to Asia Pacific and North America, it is showing promising growth opportunities. The increasing penetration of smartphones, rising disposable income, and expanding consumer electronics industry are driving the demand for power amplifiers in Latin America. Furthermore, the region's focus on improving communication infrastructure and the growing popularity of audiovisual systems further contribute to the growth potential of the power amplifiers market in Latin America.

Middle East & Africa

The Middle East & Africa region is also witnessing growth in the global power amplifiers market. The region's increasing population, rising urbanization, and the growing middle-class are driving the demand for consumer electronics, telecommunication devices, and various end-use applications that require power amplifiers. Additionally, the development of smart cities and the expansion of the automotive industry in the Middle East and Africa contribute to the demand for power amplifiers in the region. While it is expected to show significant growth potential, it is relatively smaller compared to other regions in the global market.

Company Profiles:

Prominent actors within the worldwide power amplifiers industry are accountable for creating, advancing, and producing top-quality amplification systems utilized across telecommunications, consumer electronics, and automotive industries.These entities hold significant importance in propelling technological progress, delivering inventive resolutions, and keeping up with the expanding need for effective amplification systems. They are instrumental in molding the general expansion and competitiveness of the global power amplifiers sector.

Leading companies in the Power Amplifiers sector comprise Qualcomm Technologies Inc., Texas Instruments Inc., Analog Devices Inc., STMicroelectronics N.V., Maxim Integrated, NXP Semiconductors, Infineon Technologies AG, Broadcom Inc., Renesas Electronics Corporation, and Mitsubishi Electric Corporation. These entities play a vital part in the industry through the creation, production, and dissemination of power amplifiers for diverse sectors like consumer electronics, telecommunications, automotive, and medical equipment, among others. The fierce competition within this group spurs innovation and advances in power amplifier solutions, fostering market expansion and addressing the changing needs of clients worldwide. These organizations remain deeply engaged in research and development to harmonize their offerings with industry benchmarks, provide top-notch power amplifiers, and uphold a competitive advantage.

COVID-19 Impact and Market Status:

The global power amplifiers market has experienced a notable impact from the Covid-19 pandemic, with a decrease in demand attributed to supply chain disruptions and decreased consumer expenditures.

The COVID-19 outbreak has brought about a mix of favorable and unfavorable outcomes for the power amplifiers sector. There has been a notable upsurge in the demand for power amplifiers as a consequence of the ened reliance on remote work and online education, creating an increased need for robust and efficient communication systems. Furthermore, the growing integration of wireless communication systems across various industries such as telecommunications, automotive, and consumer electronics has also contributed to the expansion of the market. Conversely, the global pandemic has disrupted supply chains worldwide, resulting in delays in manufacturing processes and shortages of essential components, hindering the production of power amplifiers. Additionally, the economic downturn has led to a decrease in consumer expenditure and investments in infrastructure projects, subsequently dampening the demand for power amplifiers. Notwithstanding these challenges, the power amplifiers market is anticipated to gradually recover as the global economy stabilizes post-pandemic, particularly with the increasing need for rapid data transfer and connectivity.

Latest Trends and Innovation:

- In January 2021, Infineon Technologies AG announced the acquisition of Cypress Semiconductor Corporation, expanding its power amplifier portfolio.

- In March 2021, NXP Semiconductors N.V. introduced the MRF13750H Power LDMOS Transistor, providing improved performance and efficiency for wireless infrastructure applications.

- In April 2021, Qorvo Inc. announced the completion of its acquisition of Decawave, a leading provider of ultra-wideband (UWB) technology.

- In May 2021, Broadcom Inc. unveiled the BCM85100, a 400G 8:16 power amplifier switch, delivering enhanced performance and scalability for data centers.

- In June 2021, Texas Instruments Incorporated introduced the LM3881-Q1, a robust, low-quiescent-current power distribution switch for automotive applications.

Significant Growth Factors:

The expansion of the power amplifiers industry can be linked to various factors including the growing need for consumer electronics, advancements in wireless communication technologies, and the increasing implementation of 5G networks.

The power amplifiers industry is poised for substantial growth in the foreseeable future, propelled by a multitude of factors. Primarily, the burgeoning demand for consumer electronics and audio-visual systems, encompassing devices like smartphones, tablets, and home theaters, is serving as a key driver for market expansion. Power amplifiers assume a critical role in these gadgets, amplifying and enriching audio signals to enhance the overall sound experience. Furthermore, the increasing adoption of wireless communication technologies such as 5G is amplifying the need for power amplifiers, especially in cellular base stations for signal amplification and transmission across extended distances. Additionally, the escalating interest in electric and hybrid vehicles is another pivotal factor fostering market growth. Power amplifiers are instrumental in enhancing audio systems in vehicles, delivering superior sound quality while conserving energy. Moreover, the surge in the entertainment sector and live events is spurring the demand for power amplifiers, widely employed in sound reinforcement systems and concert venues.

The intensifying focus on research and development endeavors to boost the efficiency and performance of power amplifiers is anticipated to be a significant growth driver. Nevertheless, challenges such as high production costs and the presence of counterfeit products may impede market progress to a certain extent. Market players are actively investing in technological innovations and strategic partnerships to maintain a competitive edge. Ultimately, the vibrant growth of sectors like consumer electronics, automotive, and entertainment is poised to steer the power amplifiers market towards bright prospects in the years ahead.

Restraining Factors:

Factors that are impeding the expansion of the Power Amplifiers Market encompass fierce competition, rapid technological progress, and elevated manufacturing expenses.

The power amplifiers industry has experienced significant growth in recent times, yet it encounters various impediments. A primary issue is the exorbitant cost associated with power amplifiers, constraining their adoption in particular sectors and applications. Moreover, the intricate nature of power amplifier technologies and the requisite expertise needed to operate and maintain them present further challenges. Additionally, the bulkiness and weight of power amplifiers may render them unsuitable for portable and compact devices, restricting their applicability in such scenarios. Furthermore, continuous advancements in digital signal processing and integrated circuit technologies offer alternative solutions to power amplifiers, intensifying market competition. Furthermore, strict regulations and standards that govern power amplifier performance and efficiency can also hinder market expansion. Despite these obstacles, there are promising prospects to consider. The escalating demand for wireless communication systems like 5G networks and IoT devices is poised to create growth opportunities for the power amplifiers market. The increasing necessity for enhanced signal strength, improved connectivity, and efficient power amplification will fuel the requirement for high-performance power amplifiers across multiple industries. Consequently, manufacturers are expected to invest in research and development to overcome existing barriers and leverage the expanding market potential.

Key Segmentation:

Class Overview

• Class A

• Class B

• Class C

• Class D

• Others

Product Type Overview

• Audio Power Amplifiers

• RF Power Amplifiers

Vertical Overview

• Consumer Electronics

• Industrial

• Telecommunication

• Automotive

• Other Industry Verticals

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America