Power Generation Market Analysis and Insights:

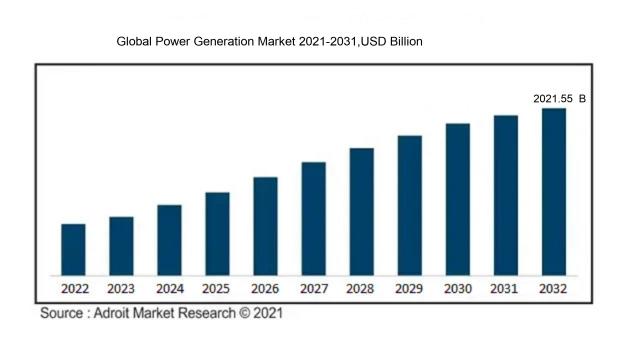

In 2023, the size of the worldwide Power Generation market was US$ 941.17 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.37% from 2024 to 2032, reaching US$ 2021.55 billion.

The power generation sector is shaped by a multitude of pivotal factors that contribute to its growth and transformation. A significant driver is the escalating global demand for energy, fueled by population increases and economic progress, which urges investments in a variety of energy sources. Innovations in renewable technologies, including solar, wind, and hydroelectric power, are significantly improving efficiency and lowering expenses, thereby enhancing their competitiveness against conventional fossil fuels. Additionally, rigorous regulatory policies focused on decreasing carbon emissions and fostering sustainability are promoting a transition towards more environmentally friendly energy alternatives. The pursuit of energy security and autonomy is prompting nations to broaden their energy portfolios. Moreover, the rise of smart grid technologies is streamlining energy distribution and management. Together, these factors are collectively redefining the power generation landscape, spurring innovation and investment across different energy sectors.

Power Generation Market Definition

The power generation sector includes the industry responsible for generating electrical energy through diverse sources such as fossil fuels, nuclear power, and renewable options. This sector features an array of technologies, businesses, and regulatory structures that support the production and distribution of electricity.

The electricity generation sector is fundamental to the global economy, providing a dependable supply of power necessary for industrial, commercial, and residential functions. This sector stimulates technological innovation, fosters employment opportunities, and supports economic development. As countries pivot towards renewable energy to address climate change, the landscape of power generation is transforming, leading to increased investment in sustainable solutions such as solar, wind, and hydroelectric power. Moreover, the focus on energy security and the diversification of energy resources is becoming a priority in national strategies, highlighting the significance of this sector for both environmental sustainability and economic resilience in a constantly evolving world.

Power Generation Market Segmental Analysis:

Insights On Key Source

Renewable

The Renewable sector is projected to dominate the Global Power Generation Market due to an increasing global emphasis on sustainable energy practices and a rapid shift away from fossil fuels. Governments and institutions worldwide are implementing policies and investing heavily in renewable technologies to mitigate climate change and reduce carbon footprints. The enhanced efficiency of renewable energy technologies, particularly wind and hydroelectric power, combined with declining costs and rising energy demands, positions this sector favorably. As countries commit to net-zero emissions targets, renewable energy sources are expected to see accelerated growth, making them the backbone of future power generation.

Non Renewable

The Non-Renewable category, which includes coal, oil, and natural gas, remains a significant part of the Global Power Generation Market. This has historically provided a substantial percentage of global energy supply due to the established infrastructure and technology behind fossil fuel extraction and processing. However, as nations seek to transition towards greener energy alternatives, growth in this area is expected to slow. Regulatory pressures and environmental concerns play a crucial role in diminishing its attractiveness, while fluctuations in fuel prices also impact its long-term viability. Despite its current significance, the trajectory indicates a downward trend.

Solar PV

The Solar PV sector is witnessing robust growth within the renewable energy space, buoyed by technological advancements, reducing installation costs, and increasing efficiency rates of solar panels. This has gained widespread consumer acceptance and government encouragement worldwide, making it an attractive investment for both residential and commercial applications. The rise in distributed generation, where consumers generate electricity for their own use, contributes significantly to its appeal, as does the potential for grid independence. As storage technologies evolve, the attractiveness of Solar PV will likely continue to expand, promising a bright future in the energy landscape.

Others

Within the energy spectrum, the "Others" category encompasses various forms of power generation, such as geothermal, biomass, and hydroelectric. While these sources contribute positively to overall energy diversity, they often lack the market share and recognition achieved by their larger counterparts. Hydroelectric power remains a significant contributor globally; however, its growth potential faces limitations due to geographic constraints and environmental impacts. Alternatively, biomass is gaining attention for its sustainability benefits, yet technological and regulatory challenges still exist. Though important, this category faces obstacles to achieve dominance in a market increasingly driven by renewable sources like wind and solar.

Insights On Key Application

Industrial

The industrial application is expected to dominate the Global Power Generation Market due to the significant growth in manufacturing and production sectors worldwide. These industries are increasingly investing in efficient and reliable power generation to support their operations and maintain competitiveness. Heavy reliance on uninterrupted power supply for processes and machinery drives investment in diverse energy sources, including renewables, gas, and coal. Furthermore, initiatives aimed at reducing carbon footprints are compelling industries to adopt cleaner energy solutions, further propelling market growth. The intersection of technological advancements and increased demand for energy-efficient systems enhances the industrial sector's pivotal role in the power generation landscape.

Commercial

The commercial sector, which includes businesses, retail establishments, and office spaces, is also a significant player in the power generation market. Demand for energy-efficient solutions in this sector stems from the need to manage operational costs and comply with sustainability regulations. With the rise in smart building technologies and energy management systems, commercial enterprises are increasingly turning to renewable energy sources and optimizing their energy usage. This trend is anticipated to boost investments in power generation, making the commercial a crucial contributor to the overall market dynamics.

Residential

The residential market plays a vital role in the Global Power Generation Market, primarily driven by the increasing adoption of renewable energy solutions like solar panels and home energy storage systems. As homeowners become more environmentally conscious, there is a noticeable shift towards self-sufficiency in energy consumption. Furthermore, the ongoing rise in energy prices encourages households to explore alternative sources, increasing the market's potential. However, the residential remains comparatively smaller than commercial and industrial applications due to limitations in scale and energy demand.

Global Power Generation Market Regional Insights:

Asia Pacific

The Asia Pacific region is poised to dominate the Global Power Generation Market due to rapid industrialization, population growth, and increasing energy demand. Countries like China and India are investing heavily in expanding their power generation capacities through renewable sources and traditional fossil fuels. Moreover, the transition towards cleaner energy has gained momentum, driven by government policies aimed at reducing carbon emissions. The significant investments in infrastructure and technological advancements, particularly in solar, wind, and hydroelectric power, further strengthen Asia Pacific's leadership in the market. The combination of economic development and a burgeoning population ensures sustained energy requirements, making this region the clear frontrunner in power generation.

North America

North America is a significant player in the Global Power Generation Market, primarily driven by advancements in technology and a strong push towards renewable energy adoption. The United States and Canada are leading efforts in enhancing energy efficiency and reducing greenhouse gas emissions. The emphasis on natural gas as a cleaner alternative to coal also contributes to the region's growth. Furthermore, investments in smart grid technologies and energy storage systems position North America as an innovative hub in power generation, although challenges remain due to regulatory constraints and aging infrastructure that require modernization.

Europe

Europe remains a competitive region in the power generation market, characterized by ambitious renewable energy targets and strict environmental regulations. The European Union’s commitment to achieving a low-carbon economy has led to substantial investments in wind, solar, and biomass energy. Countries like Germany, the UK, and France are at the forefront of this transformation, transitioning away from fossil fuels. However, the reliance on imports for energy and varying energy policies across countries can impede uniform growth. Yet, Europe’s strong emphasis on sustainability continues to drive technological innovations, thereby maintaining its status in the market.

Latin America

Latin America is emerging as a growing in the Global Power Generation Market, largely driven by its rich natural resources for hydropower, which contributes significantly to the grid. Countries such as Brazil and Chile are enhancing their renewable energy sectors, focusing on hydro, wind, and solar power. However, the region faces challenges related to infrastructure constraints, political instability, and investment volatility, which can hinder aggressive growth. Despite these hurdles, regional initiatives to promote sustainable energy sources indicate a potential for future expansion in the power generation sector.

Middle East & Africa

The Middle East & Africa region presents unique dynamics in the Global Power Generation Market, heavily influenced by the availability of fossil fuels, particularly oil and gas, as well as a growing interest in renewable energy. Countries like Saudi Arabia and the UAE have initiated ambitious plans to diversify their energy mix while enhancing renewable energy investments as part of their economic transformation strategies. Moreover, continued urbanization and population growth in African nations will likely increase energy demand. However, challenges remain in terms of infrastructure development and investment, which may affect the pace of growth in the power generation market within this region.

Power Generation Market Competitive Landscape:

The primary participants in the Global Power Generation Market consist of utility companies and independent power producers responsible for the creation, management, and upkeep of energy infrastructures. Furthermore, technology vendors play a significant role by offering cutting-edge solutions that improve the efficiency and sustainability of energy generation processes.

Prominent companies operating in the power generation sector consist of General Electric (GE), Siemens AG, Mitsubishi Hitachi Power Systems, ABB Ltd., Schneider Electric SE, Hitachi Ltd., Toshiba Corporation, Vestas Wind Systems A/S, NextEra Energy, Dominion Energy, Duke Energy, Enel S.p.A., Électricité de France (EDF) SA, E.ON SE, RWE AG, Engie SA, First Solar, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., and Wärtsilä Corporation.

Global Power Generation Market COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the worldwide energy generation sector, leading to project delays, a decrease in energy consumption, and an expedited transition to renewable energy alternatives.

The COVID-19 pandemic had a profound impact on the energy generation industry, mainly due to interruptions in supply chains, a decline in energy consumption, and changes in regulatory frameworks. Lockdowns resulted in a significant drop in energy use by industrial and commercial sectors, causing a temporary surplus and a fall in electricity prices. The development of renewable energy projects faced hurdles such as funding difficulties and delays in construction, while fossil fuel power plants operated at reduced capacities. In response, governments around the globe launched stimulus initiatives that prioritized the transition to renewable energy, leading to ened interest and investment in sustainable sources. Simultaneously, the crisis exposed the weaknesses of conventional energy infrastructures, prompting a renewed focus on energy reliability and sustainability. As recovery progresses, a noticeable trend towards cleaner energy technologies is emerging, as utilities and investors seek to enhance the resilience of their systems. This shift is likely to alter market dynamics in the long term, creating a landscape that encompasses both challenges and new opportunities for stakeholders within the power generation sector.

Latest Trends and Innovation in The Global Power Generation Market:

- In September 2023, Siemens Energy announced the acquisition of SMS group’s Power and Energy Division, aiming to enhance its portfolio in the energy transition sector and improve its capabilities in sustainable energy technologies.

- In August 2023, General Electric announced that it had completed the merger of its Renewable Energy business with the energy division of Siemens Gamesa, creating a stronger competitor in the offshore wind market.

- In July 2023, NextEra Energy completed its purchase of Gulf Power Company from Southern Company for approximately $5 billion, expanding its clean energy footprint in Florida and boosting its renewable energy generation capabilities.

- In June 2023, Mitsubishi Power announced the launch of their new advanced gas turbine, the H-100, which aims to improve efficiency and reduce emissions in the power generation industry.

- In May 2023, Vestas Wind Systems secured a major contract to supply and install 200 MW of wind capacity for a new project in the United States, reinforcing its position as a leader in the wind energy market.

- In April 2023, Duke Energy unveiled plans to invest $1 billion in solar energy projects across the Carolinas, promoting the transition to renewable resources and aiming for net-zero emissions by 2050.

- In March 2023, Atlantica Sustainable Infrastructure announced its acquisition of a 78% stake in a 100-megawatt solar project in Brazil, underlining its commitment to expanding renewable energy assets in Latin America.

- In January 2023, Enphase Energy launched its new Ensemble Energy Management technology, designed to enhance the efficiency of solar energy systems and improve grid reliability.

- In December 2022, Ørsted finalized the acquisition of the 1,000 MW Ocean Wind project in New Jersey, significantly bolstering its presence in the U.S. offshore wind energy market.

- In November 2022, Renewable Energy Group was acquired by Chevron in a deal worth $3.15 billion, marking a significant move by the oil giant to diversify its energy portfolio and strengthen its biofuels business.

Power Generation Market Growth Factors:

Crucial drivers for the expansion of the power generation sector comprise a rising need for renewable energy solutions, innovations in technology, and government policies that foster sustainable energy development.

The power generation sector is undergoing notable expansion influenced by various critical elements. Primarily, the surging global energy demand, spurred by population growth and urban development, has led to increased investments in diverse power generation methods. The shift towards renewable energy options, including wind, solar, and hydropower, has become crucial due to ened environmental concerns and governmental policies focused on reducing greenhouse gas emissions. Advancements in technology have significantly enhanced the efficiency and practicality of deploying renewable energy systems, while also lowering costs, making these alternatives more viable compared to conventional fossil fuels. Moreover, the need for extensive upgrades and replacements of aging infrastructure in numerous areas is propelling investment in contemporary power solutions. The rise of smart grid technologies is further improving energy management, efficiency, and reliability in power distribution, promoting a more sustainable energy framework. Additionally, worldwide governmental programs and incentives are fostering the adoption of cleaner energy technologies, which in turn supports market expansion. As nations endeavor to accomplish their climate objectives, the diversification of energy resources and the adoption of innovative strategies will play a pivotal role. Collectively, these factors contribute to a transformative and dynamic environment within the power generation industry, driving both growth and change.

Power Generation Market Restaining Factors:

Critical limitations in the power generation sector involve regulatory hurdles, substantial capital expenditures, and environmental issues that affect the viability of projects.

The power generation sector is confronted with a variety of challenges that may hinder its growth and long-term viability. A primary obstacle is the substantial capital required for infrastructure development, which may discourage new companies from entering the market and restrict the expansion potential of existing entities. Additionally, stringent regulations and the necessity to comply with rapidly changing environmental standards often introduce further complexities and expenses, which can lead to setbacks in securing project approvals.

Furthermore, the volatility of fuel prices, especially for fossil fuels, can disrupt operational budgets and pricing approaches, creating a landscape of uncertainty for investors. The growing reliance on renewable energy sources is also intensifying competition, compelling traditional power producers to either adapt or invest in greener technologies. Compounding these issues, many regions are grappling with outdated infrastructure, which raises reliability concerns and calls for significant investment in upgrades and ongoing maintenance.

Despite these challenges that may impede market advancement, they simultaneously encourage innovation and the embrace of cutting-edge technologies, steering the industry towards a more sustainable and efficient energy future. As the sector matures, the transition to environmentally friendly practices and the incorporation of renewable energy offers considerable prospects for expansion, positioning the power generation industry as an evolving field ripe for investment and progressive development.

Key Segments of the Power Generation Market

By Source

• Non Renewable

• Renewable

• Solar PV

• Others

By Application

• Commercial

• Residential

• Industrial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America