Private Contract Security Services Market Analysis and Insights:

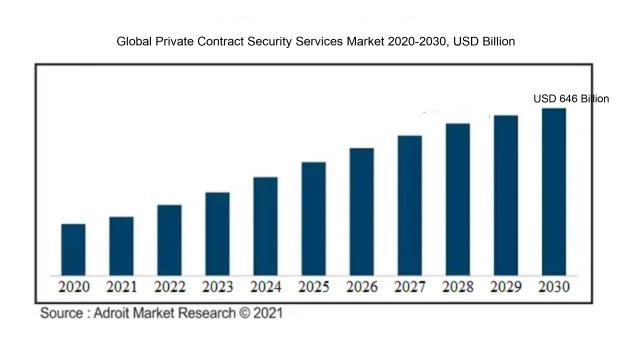

The market for Global Private Contract Security Services was estimated to be worth USD 376.93 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of approximately 7.5%, with an expected value of USD 646 billion in 2030.

The market for private contract security services is influenced by a variety of significant factors. Growing apprehensions regarding crime and terrorism lead both businesses and individuals to pursue improved safety measures. The expansion of essential infrastructure, increasing urbanization, and a notable rise in property development further fuel the demand for private security services. Moreover, advancements in technology, including the adoption of advanced surveillance systems and access control mechanisms, have enhanced the effectiveness of security firms, making their offerings more attractive. Stricter regulatory standards for security across multiple sectors, coupled with an ened awareness of safety and security challenges, additionally support market growth. Furthermore, an increase in disposable incomes enables consumers and organizations to invest in higher-quality security solutions, while evolving crime trends require flexible and responsive security approaches. Collectively, these elements cultivate a dynamic environment for the private contract security services industry.

Private Contract Security Services Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2020-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2022-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 211.3 billion |

| Growth Rate | CAGR of 7.5% during 2023-2030 |

| Segment Covered | By Service Type, By End-User Industry, By Security Level, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled |

G4S plc, Securitas AB, Allied Universal, ADT Security Services, Inc., Brinks Co., GardaWorld, Control Risks Group, Inc., Prosegur Compañía de Seguridad, Securion, and STANLEY Security |

Private Contract Security Services Market Definition

Private security contracts involve specialized agencies that provide customized protective solutions for corporations, individuals, or events utilizing certified personnel. These services may encompass physical protection, electronic monitoring, and risk evaluation to safeguard against potential threats and enhance overall security.

Private security contract services are vital for boosting safety and protection in diverse environments, such as residential areas, commercial establishments, and community spaces. These services provide customized security strategies designed to address unique challenges like crime deterrence, theft prevention, and crisis management. By utilizing highly trained personnel, private security firms complement the efforts of public law enforcement, enabling prompt reactions to various situations. Additionally, they instill confidence among individuals and businesses, creating a safer atmosphere that supports economic development and stability. Ultimately, their strategic involvement is key to protecting assets and improving the overall safety of communities.

Key Market Segmentation:

Insights On Key Service Type

Electronic Security

In the Global Private Contract Security Services Market, Electronic Security is expected to dominate due to the increasing demand for advanced technology solutions that enhance security measures. As businesses and individuals face a rising number of cyber threats and physical security challenges, the adoption of surveillance systems, access control solutions, and alarm systems becomes crucial. Furthermore, the growing integration of Internet of Things (IoT) devices and smart technologies in security is driving innovation in this category. Investment in electronic systems for residential, commercial, and industrial premises underscores the trend towards proactive security measures, setting Electronic Security apart as the leading choice in the market.

Guard Services

Guard Services play a vital role in the protection of assets and personnel, making them a significant part of the Global Private Contract Security Services Market. These services provide on-ground security personnel who monitor, patrol, and respond to incidents, offering peace of mind for businesses and individuals alike. The rising concerns about crime rates and the need for effective security measures continue to drive demand in this . Companies often seek guard services to ensure immediate human response to potential threats, thus creating a strong market presence and stability for this category.

Consulting and Risk Assessment

Consulting and Risk Assessment is another essential component of the market, offering businesses a strategic approach to identifying vulnerabilities and mitigating risks. Organizations are increasingly recognizing the value of professional advice in evaluating their security landscape and implementing enhancements. The service not only involves assessing current security measures but also developing tailored strategies that align with the distinct needs of various sectors. This proactive approach to security planning ensures that clients are better prepared for potential threats, thus solidifying its significance in the Private Contract Security Services landscape.

Patrol and Response Services

Patrol and Response Services are key in ensuring real-time monitoring and response to incidents at various locations. This service is particularly essential for properties that require a physical presence for deterrence and quick action. With growing concerns over theft, vandalism, and other security breaches, companies increasingly invest in patrol services to maintain a secure environment. The response aspect adds value, as it guarantees immediate action in the case of emergencies, further driving the demand for this reliable security offering in the market.

Insights on Key Security Level

Cybersecurity

The global private contract security services market is expected to be dominated by the cybersecurity sector. With the increasing dependence on digital infrastructures and the rise in cyber threats, organizations are prioritizing cybersecurity solutions to protect sensitive data and maintain operational integrity. Factors such as regulatory requirements, growing awareness of cyber risks, and the financial implications of data breaches are pushing businesses to invest more in cybersecurity services. As technology advances and threats evolve, companies are turning to specialized cybersecurity providers to offer comprehensive protection, ensuring that this will lead the market in the coming years.

Armed Security

Armed security services play a crucial role in the private contract security landscape by providing physical protection for high-risk locations and individuals. As concerns about crime rates and public safety surge, organizations are increasingly opting for armed security personnel to deter potential threats. This approach is particularly favored in industries such as financial services, healthcare, and high-profile events, where the presence of armed guards reassures both customers and employees. Despite the growing emphasis on technology-driven security solutions, armed security remains an important element for maintaining safety and order, especially in volatile environments.

Unarmed Security

Unarmed security services are also an essential category within the private contract security industry. These services are widely used for environments that do not require a show of force, such as retail establishments, office buildings, and educational institutions. Companies appreciate the cost-effectiveness and compliance benefits of unarmed security personnel, as they provide a non-threatening presence while still ensuring safety. With an increased focus on customer service and conflict resolution skills among security staff, unarmed security is gaining traction as an effective deterrent, ultimately supporting broader community safety initiatives.

Specialized Security

Specialized security services are tailored to meet specific needs and vulnerabilities of various sectors, making them an important part of the private contract security market. This category includes services like event security, transportation security, and executive protection, which require unique training and expertise. As businesses expand their operations globally and face diverse risks, the demand for specialized security solutions is on the rise. Given the complexity of these services and the increasing awareness of strategic risk management, they are becoming indispensable for organizations that seek targeted protective measures in a rapidly changing risk environment.

Insights On Key End-User Industry

Commercial and Corporate

The dominant within the Global Private Contract Security Services Market is Commercial and Corporate. This sector primarily leads due to its significant need for security as businesses constantly seek to protect their assets, data, and employees. The rise in corporate offices and expansive commercial spaces has driven the demand for permanent and temporary security solutions. Companies invest heavily in maintaining a secure environment to prevent theft, fraud, and other criminal activities, making this domain a crucial focus for security service providers. The substantial budget allocation towards security and an increasing awareness of potential threats further bolster the importance of private security in commercial settings.

Residential

The residential reflects a growing trend towards home security as individuals become increasingly cautious about burglaries and property crimes. This sector has seen a surge in demand for personalized security services, including alarm systems and neighborhood patrols, driven by ened awareness of safety issues. Homeowners are willing to invest substantially in advanced technologies, leading to an increase in customized security solutions within this domain, making it a vital player in the overall security market landscape.

Industrial and Manufacturing

In the industrial and manufacturing area, security services are pivotal in safeguarding facilities from theft, vandalism, and workplace accidents. With industries integrating advanced technologies, the need for robust security measures has become paramount. Many organizations focus on securing valuable equipment and ensuring a safe workspace for employees, which creates a stable demand for diverse security services tailored to industrial environments. The ened emphasis on operational safety further emphasizes its relevancy in the broader security market.

Retail

The retail industry is a significant contributor to the private security service market as stores and shopping centers frequently face theft and shoplifting. Retailers are investing in comprehensive security solutions, from surveillance systems to cash handling security, to mitigate these risks. Implementing integrated security systems helps maintain a safe shopping environment and enhances customer confidence, making the retail sector an important customer of security service providers. The continuous evolution of retail environments further drives the need for security adaptations, keeping this relevant in the industry.

Healthcare

The healthcare sector necessitates dedicated security services due to the sensitive nature of medical environments. Hospitals and clinics require stringent protocols to protect patients, staff, and confidential information. As concerns over workplace violence and patient safety grow, the demand for security services in healthcare settings is escalating. Healthcare facilities are increasingly adopting integrated security solutions to monitor access and response strategies, which contributes to the sustained growth of security services in this vital industry.

Government and Public Sector

The government and public sector play a crucial role in the growth of private security services due to obligatory requirements for safety in public spaces. This sector incorporates a range of security services for utilities, courthouses, and public events, requiring a highly trained workforce that manages security complexities unique to public environments. Increasing threats to public safety have resulted in greater collaboration with private security firms to enhance public safety measures, ensuring that this sector remains vital in the broader security landscape.

Transportation and Logistics

The transportation and logistics sector is fundamental to the overall security service market, addressing the growing need for securing goods in transit. This industry is heavily influenced by the globalization of trade and accompanying risks, prompting logistics companies to invest in robust security measures. With a commitment to safeguarding valuable cargo, transportation entities increasingly rely on private security for comprehensive surveillance and loss prevention strategies, ensuring this domain's importance in the security service context.

Critical Infrastructure

Critical infrastructure is pivotal as it encompasses essential services like power, water, and communication. The nature of this sector mandates advanced security measures to prevent disruptions caused by cyber threats and physical attacks. Organizations managing critical infrastructure are prioritizing investments in private security services to ensure uninterrupted operations and protect valuable assets. As global tensions rise, the significance of security services in this realm continues to grow, highlighting its crucial role in national and global safety.

Private Contract Security Services Market Insights on Regional Analysis:

North America

North America is expected to dominate the Global Private Contract Security Services market due to a combination of factors, including high demand for security services, significant investments in technology, and a well-established market presence. The increasing concerns over safety and security in both residential and commercial sectors, along with the presence of major players in the security industry, further bolster this region's competitive edge. Additionally, the advent of advanced security solutions such as cybersecurity, access control systems, and surveillance technologies has made the North American market more robust. This demand and innovation create a conducive environment for growth, allowing North America to maintain its leadership position in this market.

Latin America

Latin America is experiencing a growing demand for private contract security services, driven by increasing rates of crime and insecurity in urban areas. As local governments struggle to provide adequate public safety, businesses and individuals are increasingly turning to private security firms for protection. This region is witnessing investments in both physical and digital security solutions, with a focus on enhancing service delivery. Despite economic challenges, the need for security services remains a priority, potentially leading to growth opportunities for private security firms that can adapt to local conditions and consumer needs.

Asia Pacific

The Asia Pacific region presents a rapidly expanding market for private contract security services, fueled by urbanization, a burgeoning middle class, and rising concerns over safety among the populace. Countries like China and India are experiencing significant economic growth, leading to an increased demand for security services by both individuals and businesses. However, challenges such as regulatory complexities and the need for localization in service offerings may hinder swift market penetration. Nonetheless, the overall upward trend in demand reflects a promising landscape for private security firms looking to establish footholds in this diverse region.

Europe

Europe's private contract security services market is characterized by a high level of competition and stringent regulations. While safety concerns driven by recent geopolitical tensions contribute to a stable demand for security services, the presence of established players makes it challenging for newcomers to penetrate this market. Innovative technologies and ened focus on cybersecurity are key trends shaping this . However, the region is generally slower in embracing change compared to other regions such as Asia Pacific or North America, which may hinder its growth relative to these other regions, despite significant potential.

Middle East & Africa

The Middle East & Africa region is seeing an increasing need for private contract security services, primarily driven by political instability, terrorism threats, and urbanization. Countries in this region are investing in security to ensure safety for both citizens and foreign investments. However, various economic factors and uneven development in security infrastructure can pose challenges for consistent market growth. The rising concern for personal safety and property protection is likely to fuel demand, but firms must navigate a complex landscape of regulatory environments and cultural differences to succeed in this region effectively.

Company Profiles:

Major participants in the Global Private Contract Security Services industry, encompassing both international companies and local enterprises, are instrumental in delivering customized security solutions, risk management strategies, and innovative technologies to address a wide range of client requirements. Their specialized knowledge and array of services enhance the overall safety and security framework across multiple sectors.

The primary participants in the Private Contract Security Services Market comprise G4S plc, Securitas AB, Allied Universal, ADT Security Services, Inc., Brinks Co., GardaWorld, Control Risks Group, Inc., Prosegur Compañía de Seguridad, Securion, and STANLEY Security. In addition, other prominent firms include Chubb Fire and Security, Signal 88 Security, Pinkerton, Loomis, Vector Security, Constellis, and Aegis Defence Services. Collectively, these organizations play a crucial role in the international market, each enhancing various sectors of private security services and solutions.

COVID-19 Impact and Market Status:

The Covid-19 pandemic notably intensified the need for private security services, as companies pursued improved safety protocols and risk management approaches to address ened security concerns and adhere to health mandates.

The COVID-19 pandemic caused a profound disruption in the private contract security services sector, presenting both challenges and new opportunities. Initially, the crisis led many companies to cut back on security expenditures or halt existing contracts amid lockdowns and economic uncertainty, which resulted in a temporary drop in demand. However, as various industries began to adjust to updated health and safety protocols, a ened requirement for robust security measures emerged, particularly in critical areas such as healthcare, retail, and logistics, where adherence to health regulations became essential. This shift placed a greater emphasis on asset protection, crowd management, and facility oversight, driving a demand for security professionals equipped with skills in pandemic response. Additionally, the increasing prevalence of remote work and digital service delivery prompted a pivot towards enhanced cybersecurity services, broadening the spectrum of security solutions offered. In summary, although the pandemic brought about a phase of instability, it ultimately catalyzed innovation and transformation within the private security industry, setting the stage for long-term growth in a post-pandemic environment.

Latest Trends and Innovation:

- In October 2023, Allied Universal, a leading security services provider, announced its acquisition of Global Security Services, significantly expanding its operational footprint in the United States and enhancing its service offerings in the healthcare and retail sectors.

- In September 2023, Securitas AB launched its new AI-driven security monitoring platform, MagicGuard, which utilizes advanced analytics and machine learning to improve threat detection and response times for clients across various industries.

- In August 2023, GardaWorld Security Corporation announced a strategic partnership with Paladin Security Group, aiming to leverage each other’s strengths to enhance service delivery in the North American market and improve customer experience.

- In July 2023, G4S plc completed its integration with Allied Universal, following their merger earlier in the year. This integration was marked by the launch of a unified training program for personnel, designed to standardize service quality and enhance operational efficiency across all regions.

- In June 2023, Prosegur announced the launch of its cybersecurity branch, Prosegur Cybersecurity, tapping into the growing need for integrated physical and cyber security solutions, particularly for critical infrastructure clients.

- In May 2023, Constellis, a global security solutions provider, secured a substantial contract with the U.S. Department of Defense to provide protective services in high-risk locations, underscoring its commitment to government security solutions.

- In March 2023, Securitas AB expanded its footprint in Europe through the acquisition of the French security company, DACT, which specializes in cash management services, thereby enhancing its services in France.

- In February 2023, Brinks Company acquired a smaller competitor, Sentinel Security, focusing on expanding its cash logistics and secure transport services in the Midwest region of the United States.

- In January 2023, Allied Universal announced its investment in Latch, a smart access hardware and software company, to enhance security solutions in the residential and commercial property sectors through innovative technology integration.

Significant Growth Factors:

The growth of the Private Contract Security Services sector is propelled by rising safety apprehensions, the need for adherence to regulations, and technological innovations.

The market for Private Contract Security Services is witnessing impressive growth, influenced by a range of significant factors. Heightened concerns regarding crime and personal safety across both residential and commercial spaces are increasing the demand for professional security options. Moreover, the prevalence of high-profile gatherings and the subsequent need for effective crowd management and security at events are further stimulating market development.

Technological innovations, including the utilization of artificial intelligence, surveillance drones, and sophisticated monitoring systems, are revolutionizing conventional security methodologies and boosting operational efficiency. Additionally, the growth of sectors such as retail, banking, and logistics that necessitate customized security solutions for safeguarding assets and personnel is playing a vital role in this market's expansion.

Furthermore, regulatory compliance and insurance requirements surrounding security protocols are compelling organizations to allocate resources towards private security services. The ongoing trend of outsourcing non-essential functions allows businesses to concentrate on their primary goals, thereby increasing their dependence on private security firms. The ened awareness around workplace safety and security, particularly in light of global health challenges, is also creating a conducive atmosphere for the industry. Collectively, these drivers are transforming the Private Contract Security Services Market, fostering growth and innovation within the field.

Restraining Factors:

The Private Contract Security Services Market faces significant inhibiting elements, primarily escalating operational expenses and the complexities associated with adhering to regulatory standards.

The market for Private Contract Security Services encounters various challenges that may impede its expansion. Foremost among these is the rise in regulations and compliance mandates, creating a significant obstacle for security firms that must navigate divergent legal landscapes across different regions. Additionally, the fierce competition prevalent in the industry often leads to reduced service fees, which can adversely impact both profitability and the quality of operations.

Moreover, many businesses are increasingly opting for in-house security solutions, seeking more control over their security infrastructure, which further restricts the demand for outsourced services. While technological advancements offer distinct advantages, they necessitate considerable investments in training and equipment, placing a strain on the resources of smaller companies.

Concerns surrounding the effectiveness and credibility of private security personnel in comparison to public law enforcement can also minimize market demand. Economic fluctuations can further complicate matters, as businesses may reduce their security budgets during tougher financial times.

Nonetheless, the market demonstrates a degree of resilience driven by an escalating focus on safety and security across multiple sectors. This presents opportunities for innovation and evolution within the industry. As global security concerns en, private security services are increasingly adapting to better address client needs, suggesting a pathway for future growth and potential.

Key Segmentation:

Key Segments of the Private Contract Security Services Market

By Service Type

- Guard Services

- Electronic Security

- Consulting and Risk Assessment

- Patrol and Response Services

- Cybersecurity Services

- Event Security

- Transportation Security

- Investigation Services

By Security Level

- Armed Security

- Unarmed Security

- Specialized Security

- Cybersecurity

By End-User Industry

- Commercial and Corporate

- Residential

- Industrial and Manufacturing

- Retail

- Healthcare

- Government and Public Sector

- Transportation and Logistics

- Critical Infrastructure

By Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America