Market Analysis and Insights:

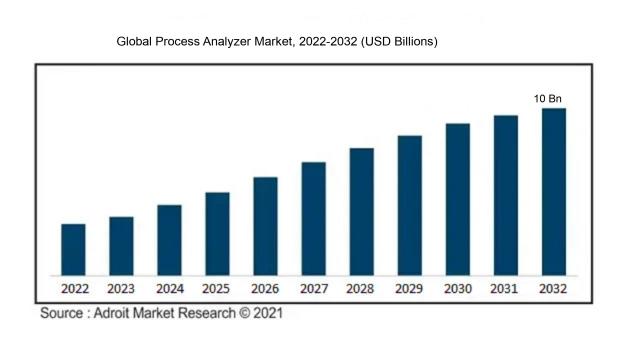

The market for Process Analyzer was estimated to be worth USD 4.42 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 7.56%, with an expected value of USD 10 billion in 2032.

The expansion of the Process Analyzer Market is fueled by various key factors contributing to its advancement. One significant driver is the escalating demand for real-time analysis and monitoring techniques across diverse industries including oil and gas, pharmaceuticals, and chemical sectors.

Process analyzers play a crucial role by providing precise and ongoing measurements of different parameters, facilitating effective process control and enhancement. Furthermore, the increasing need to adhere to strict regulatory standards in industries such as food and beverage and environmental monitoring is propelling the demand for process analyzers, ensuring compliance with quality regulations. The surge in the implementation of process automation and control systems within the manufacturing domain is also a major driver of market growth, necessitating dependable and efficient process analyzers to supervise critical parameters and maintain consistent product quality. Additionally, continuous technological advancements such as the incorporation of wireless communication and cloud-based analytics are augmenting the functionality and user-friendliness of process analyzers, further bolstering market expansion. Lastly, the growing emphasis on energy efficiency and sustainability in industries is fostering a requirement for process analyzers capable of accurately measuring energy consumption and emissions, thereby encouraging market progression. In conclusion, these factors collectively are anticipated to drive the growth trajectory of the Process Analyzer Market in the forthcoming years.

Process Analyzer Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 10 billion |

| Growth Rate | CAGR of 7.56% during 2024-2032 |

| Segment Covered | By Industry, By Gas Analyze, By Liquid Analyzer, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB, Siemens, Yokogawa Electric Corporation, Endress+Hauser, Emerson Electric Co., General Electric Company, Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., Honeywell International Inc., and Nova Biomedical. |

Market Definition

A process analyzer serves as an instrument employed to oversee, assess, and regulate different factors within an industrial operation. By delivering instantaneous data, it enables optimized and secure processes.

The Process Analyzer serves as a crucial asset across diverse sectors by significantly contributing to the enhancement of operational efficiency and the sustenance of quality standards. This advanced device effectively tracks and assesses key parameters like temperature, pressure, flow rate, and chemical composition in real-time, offering invaluable insights for process refinement and issue resolution. Through its continuous monitoring of vital metrics, the Process Analyzer is instrumental in promptly detecting deviations from established operational norms, thereby facilitating swift corrective measures to avert operational disruptions or quality discrepancies. Moreover, the precise and dependable analysis delivered by the Process Analyzer empowers precise management of chemical interactions, ensuring uniform product quality and waste reduction. Ultimately, this tool aids industries in saving time, cutting costs, and elevating overall operational productivity.

Key Market Segmentation:

Insights On Key Industry

Oil & Gas

The Oil & Gas industry is expected to dominate the Global Process Analyzer market. With the increasing demand for oil and gas globally, the need for process analyzers in this industry is significant. Process analyzers play a crucial role in monitoring and controlling various processes involved in the extraction, refining, and distribution of oil and gas. These analyzers help in optimizing production efficiency, ensuring safety standards, and reducing operational costs. Therefore, the Oil & Gas industry is expected to be the dominating part in the Global Process Analyzer market.

Petrochemical

The Petrochemical industry is another important player in the Global Process Analyzer market. Petrochemical plants involve complex manufacturing processes where process analyzers are essential for quality control, process optimization, and safety monitoring. These analyzers help in detecting impurities, ensuring product consistency, and maximizing production efficiency. With the rising demand for petrochemical products worldwide, such as plastics, rubber, and synthetic fibers, the Petrochemical industry is expected to have a significant presence in the Global Process Analyzer market.

Pharmaceuticals

The Pharmaceuticals industry is another player that holds potential in the Global Process Analyzer market. Process analyzers play a critical role in pharmaceutical manufacturing by monitoring and controlling various production parameters. These analyzers help in ensuring product quality, minimizing batch-to-batch variations, and adhering to regulatory requirements. With the increasing demand for pharmaceutical products and the need for stringent quality standards, the Pharmaceuticals industry is expected to make its mark in the Global Process Analyzer market.

Water & Wastewater

The Water & Wastewater industry is another player that cannot be overlooked in the Global Process Analyzer market. Process analyzers are essential in this industry for monitoring water quality, detecting contaminants, and ensuring compliance with environmental regulations. These analyzers aid in the efficient treatment and purification of water, as well as the proper management of wastewater. With the growing concerns over water scarcity and the need for sustainable water management practices, the Water & Wastewater industry is expected to have a significant role in the Global Process Analyzer market.

Power

The Power industry is yet another player that holds relevance in the Global Process Analyzer market. Process analyzers are crucial in power plants for monitoring and controlling various parameters during the generation, transmission, and distribution of electricity. These analyzers help in optimizing power plant efficiency, ensuring safe operation, and reducing emissions. With the increasing demand for electricity and the transition towards cleaner energy sources, the Power industry is expected to contribute to the Global Process Analyzer market.

Insights On Key Gas Analyzer

Carbon Dioxide Analyzer

The Carbon Dioxide Analyzer is expected to dominate the Global Process Analyzer Market. This is due to the increasing emphasis on monitoring and reducing carbon dioxide emissions in various industries such as power generation, chemical, and oil & gas. The Carbon Dioxide Analyzer is essential in ensuring compliance with environmental regulations and optimizing process efficiency. With the growing global concerns regarding climate change and sustainability, the demand for Carbon Dioxide Analyzers is projected to witness significant growth.

Oxygen Analyzer

The Oxygen Analyzer is also expected to hold a considerable share in the Global Process Analyzer Market. Oxygen analysis is crucial in various industries, including chemical, pharmaceutical, and food & beverage, to monitor and control the oxygen content for safety, product quality, and process optimization. The continuous need for accurate oxygen measurement and control in these industries drives the demand for Oxygen Analyzers.

Moisture Analyzer

While contributing to the Global Process Analyzer Market, the Moisture Analyzer is not expected to dominate. Moisture analysis is primarily required in industries such as pharmaceutical, food processing, and paper manufacturing to ensure product quality and optimize process conditions. Although essential, the demand for Moisture Analyzers may not surpass that of other parts due to their specific application and requirement variations in different industries.

Toxic Gas Analyzer

The Toxic Gas Analyzer also plays a significant role in the Global Process Analyzer Market but is not expected to dominate. Toxic gas monitoring is critical in industries dealing with hazardous substances, such as chemical, petrochemical, and oil refineries. The need for continuous monitoring and early detection of toxic gas leaks drives the demand for Toxic Gas Analyzers. However, their market share is likely to remain below that of the dominant part.

Hydrogen Sulphide Analyzer

Similarly, the Hydrogen Sulphide Analyzer is a significant sector of the Global Process Analyzer Market but is not expected to dominate. Industries such as oil & gas production, wastewater treatment, and pulp & paper require accurate monitoring of hydrogen sulphide levels due to its toxic nature and potential risks. Although essential for safety and process optimization, the demand for Hydrogen Sulphide Analyzers may not surpass that of the dominating part.

Insights On Key Liquid Analyzer

Dissolved Oxygen Analyzer

Dissolved Oxygen Analyzer is expected to dominate the Global Process Analyzer Market. The measurement of dissolved oxygen is crucial in various industries like wastewater treatment, aquaculture, and pharmaceuticals. This part plays a vital role in maintaining water quality and ensuring process efficiency. With increasing awareness about environmental conservation and strict regulations, the demand for Dissolved Oxygen Analyzers is projected to witness significant growth. The ability to measure and monitor oxygen levels accurately makes it an essential tool for optimizing processes and ensuring product quality in industries.

PH Analyzer

PH Analyzer is another important player within the Liquid Analyzer category. The pH value measures the acidity or alkalinity of a liquid, making it a crucial parameter in numerous sectors such as food and beverage, chemical processing, and water treatment. pH Analyzers help maintain optimal conditions for various processes and ensure product quality. However, while it is a significant part, its dominance in the Global Process Analyzer market might be slightly overshadowed by the growing demand for Dissolved Oxygen Analyzers.

Conductivity Analyzer

Conductivity Analyzer is an essential player within the Liquid Analyzer category. It measures the ability of a solution to conduct electrical current, providing valuable information about the concentration of dissolved solids or ions in a liquid. Conductivity Analyzers find applications in various industries such as pharmaceuticals, power generation, and water treatment. While it contributes to the Global Process Analyzer market, its dominance may be relatively lower compared to Dissolved Oxygen Analyzers due to the latter's wider range of applications and regulatory requirements.

Turbidity Analyzer

Turbidity Analyzer is a player that measures the cloudiness or haziness of a liquid caused by suspended particles. It is commonly used in water treatment, wastewater management, and beverage industries. Although turbidity analysis is crucial in certain applications, its dominance in the Global Process Analyzer market might be limited due to its specific use cases compared to other parts such as Dissolved Oxygen and pH Analyzers.

Liquid Density Analyzer

Liquid Density Analyzer is a sector that measures the density or mass per unit volume of a liquid. It finds applications in industries like oil and gas, petrochemicals, and food and beverage. While liquid density analysis is important for specific applications, its dominance in the Global Process Analyzer market might be comparatively lower due to its limited range of industries and applications.

MLSS Analyzer

MLSS Analyzer is a sector that measures the concentration of mixed liquor suspended solids (MLSS) in wastewater treatment processes. It aids in optimizing the performance of biological treatment systems, ensuring efficient removal of organic compounds and pollutants. While MLSS analysis is vital in wastewater treatment plants, its dominance in the Global Process Analyzer market might be confined to this specific industry, limiting its overall market influence.

TOC Analyzer

TOC Analyzer is a sector that measures the total organic carbon content in a liquid sample. It has applications in environmental monitoring, pharmaceutical manufacturing, and water treatment. TOC analyzers help ensure compliance with regulations and monitor the efficiency of purification processes. However, their dominance in the Global Process Analyzer market might be moderate compared to other parts due to the specialized nature of TOC analysis and varying levels of importance in different industries.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Process Analyzer market. The region's dominance can be attributed to factors such as the presence of a mature industrial base, stringent regulations related to environmental and safety standards, and the focus on increasing energy efficiency in manufacturing processes. Europe's well-established industries, including oil and gas, petrochemicals, and pharmaceuticals, drive the demand for process analyzers to enhance productivity, quality control, and operational efficiency. Additionally, the region's emphasis on adopting advanced automation technologies further supports the growth of the process analyzer market in Europe. Therefore, based on the available knowledge and data, Europe is anticipated to be the dominating region in the Global Process Analyzer market.

North America

North America is projected to witness significant growth in the Process Analyzer market. The region's vast industrial sector, particularly in the oil and gas, refining, and chemicals industries, creates a substantial demand for process analyzers. Growing focus on improving process efficiency, reducing operating costs, and meeting regulatory requirements enhances the adoption of process analyzers in North America.

Latin America

Latin America is expected to experience moderate growth in the Process Analyzer market. The region's expanding chemical and pharmaceutical sectors, coupled with increasing investments in oil and gas exploration, contribute to the market's growth. However, certain economic and political uncertainties may hinder the market's potential in Latin America.

Asia Pacific

Asia Pacific is poised to witness substantial growth in the Process Analyzer market. Rapid industrialization, favorable government initiatives, and increasing foreign investments in countries like China, India, and South Korea drive the demand for process analyzers. The region's growing petrochemical, oil and gas, and power generation industries further fuel market growth in Asia Pacific.

Middle East & Africa

The Middle East & Africa region is expected to show steady growth in the Process Analyzer market. The region's strong presence in the oil and gas industry, rapid industrialization, and increasing emphasis on adopting advanced technologies support the market's growth. However, certain geopolitical and economic challenges may limit the market's expansion in the Middle East & Africa.

Company Profiles:

The primary contributors in the international Process Analyzer industry significantly impact the progression and production of cutting-edge process analytical tools, which aid in the precise monitoring and assessment of diverse industrial processes. These entities prioritize innovation and technological progress to deliver dependable and effective resolutions to global industries.

Prominent companies within the Process Analyzer Market encompass ABB, Siemens, Yokogawa Electric Corporation, Endress+Hauser, Emerson Electric Co., General Electric Company, Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., Honeywell International Inc., and Nova Biomedical.

COVID-19 Impact and Market Status:

The Global Process Analyzer market has been greatly impacted by the Covid-19 pandemic, resulting in reduced demand and supply chain disruptions caused by lockdowns and restrictions.

The outbreak of the COVID-19 pandemic has had a significant impact on the market for process analyzers. The global economic downturn, along with disruptive changes across various sectors, has influenced the demand for these analyzers. Particularly, the manufacturing industry, a key consumer of process analyzers, has experienced interruptions in production and supply chain issues, leading to reduced demand for these instruments. The enforcement of lockdown measures and social distancing protocols has further contributed to the delays or cancellations of numerous projects, thereby adversely affecting the market. Nevertheless, the pandemic has underscored the critical role of process analyzers in monitoring and managing vital processes within industries like pharmaceuticals, chemicals, and food and beverages. Consequently, there has been a growing focus on automation and process enhancement, indicating a potential resurgence in demand post-pandemic. To navigate through these challenging times, companies in the process analyzer sector must adapt to the evolving market dynamics, prioritize remote monitoring capabilities, and develop innovative solutions tailored to the changing needs of industries. These strategic approaches will not only help in mitigating the adverse effects of COVID-19 but also ensure sustainable growth in the long term.

Latest Trends and Innovation:

- In September 2020, Suez announced the acquisition of Nijhuis Industries, a process analyzer company specializing in water treatment solutions.

- In February 2021, ABB completed the acquisition of Cytiva's advanced process control and analytics business, enhancing its process analyzer portfolio.

- In March 2021, Yokogawa Electric Corporation announced the acquisition of FluidCom AG, a Switzerland-based process analyzer manufacturer.

- In June 2021, Siemens announced the acquisition of Prenova, a leading provider of energy management solutions, to strengthen its position in the process analyzer market.

- In July 2021, Emerson Electric acquired Analytical Instruments, a division of Spectris plc, expanding its process analyzer product range.

- In August 2021, Endress+Hauser introduced the Liquistation CSF48 process analyzer, featuring advanced liquid analysis capabilities.

- In October 2021, Honeywell announced the launch of the PSS 4000, a process analyzer system designed for high-performance data acquisition and control.

Significant Growth Factors:

The expansion drivers of the Process Analyzer Market encompass rising need for instantaneous data analysis and enhancement, strict mandates concerning process security and effectiveness, and progressions in automation and control technologies.

The market for process analyzers is poised for notable expansion in the foreseeable future, driven by various critical factors. An increasing emphasis on enhancing operational efficiency and automation is propelling the uptake of these analyzers across diverse industries. By facilitating real-time monitoring and analysis of crucial parameters like pressure, temperature, pH levels, and chemical composition, these tools enable companies to optimize processes, enhance efficiency, and curtail expenses. Additionally, the imposition of strict governmental regulations concerning product quality and environmental protection is fostering the demand for process analyzers. Sectors such as oil and gas, petrochemicals, pharmaceuticals, and chemicals are mandated to adhere to specific standards and protocols, necessitating the continuous employment of process analyzers for monitoring and control purposes. Furthermore, the growing focus on industrial safety is spurring the need for analyzers capable of identifying hazardous substances and overseeing vital parameters to avert accidents or emergencies.

Restraining Factors:

Constraints for the Process Analyzer Market involve the significant upfront investment required for installation and the intricate regulatory landscape.

The market for process analyzers is currently undergoing rapid expansion and innovation in response to rising demand for streamlined manufacturing processes and precise analytical measurements across various sectors. Despite this positive trend, there are several factors that could impede the market's growth trajectory. High installation and maintenance costs associated with these analyzers present a notable challenge for small and medium-sized enterprises (SMEs) operating within constrained budgetary constraints.

Moreover, the intricate nature of these devices necessitates skilled technicians and operators, which could pose difficulties in terms of availability and training resources. Additionally, stringent regulatory frameworks and compliance standards enforced by governmental bodies in different regions may hinder the widespread adoption of process analyzers, particularly if industries struggle to meet these criteria. Technical barriers, like the absence of standardized interface protocols and compatibility issues with existing equipment, could also hinder the broader uptake of these analyzers in the market.

Key Segments of the Process Analyzer Market

Industry Overview

• Oil & Gas

• Petrochemical

• Pharmaceuticals

• Water & Wastewater

• Power

• Food & Beverages

• Paper & Pulp

• Metals & Mining

• Cement and Glass

• Others

Gas Analyzer Overview

• Oxygen Analyzer

• Carbon Dioxide Analyzer

• Moisture Analyzer

• Toxic Gas Analyzer

• Hydrogen Sulphide Analyzer

Liquid Analyzer Overview

• PH Analyzer

• Conductivity Analyzer

• Turbidity Analyzer

• Dissolved Oxygen Analyzer

• Liquid Density Analyzer

• MLSS Analyzer

• TOC Analyzer

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America