Rail Wheels Market Analysis and Insights:

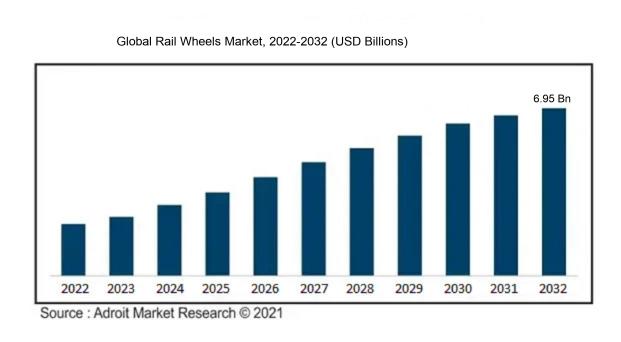

The market for Global Rail Wheels was estimated to be worth USD 3.29 billion in 2019, and from 2020 to 2032, it is anticipated to grow at a CAGR of 4.84%, with an expected value of USD 6.95 billion in 2032.

The rail wheels industry experiences growth and progress due to various influential factors. The escalating demand for efficient and dependable transportation systems stands out as a significant driver for the market of rail wheels. Railways are acknowledged for their cost-effectiveness and eco-friendly nature, leading to an increasing need for rail wheels. Furthermore, the rise in urbanization and population density in diverse global regions has resulted in the expansion of railway networks, consequently boosting the demand for rail wheels. Government initiatives supporting railway infrastructure development and the transition to sustainable transportation systems also play a key role in propelling the rail wheels market forward. Moreover, the necessity to upgrade and replace worn-out rail wheels along with ongoing technological advancements in the rail sector contribute to the demand for rail wheels. Collectively, these factors collaboratively fuel the growth and expansion of the rail wheels market.

Rail Wheels Market Definition

Rail wheels are custom-engineered wheels that are meticulously crafted for operation on railway tracks, facilitating smooth and secure locomotion of trains. Crafted from robust and long-lasting materials like steel, they are engineered to endure the substantial weights and consistent operation on the rails.

Rail wheels are essential elements of the railway system, playing a critical role in ensuring the safe and efficient transportation of goods and passengers. These wheels are specifically engineered to endure the significant weight and pressure they bear, promoting stability and seamless movement along the tracks. Through an even distribution of the load, rail wheels reduce wear and tear on the tracks, diminishing maintenance expenses and prolonging their durability. Additionally, the design and composition of rail wheels are tailored to provide optimal traction, enabling trains to navigate challenging landscapes and ascend steep inclines. Ultimately, the dependability and performance of rail wheels are crucial for the overall functionality and safety of the railway network, establishing them as indispensable in the contemporary transportation sector.

Rail Wheels Market Segmental Analysis:

Insights On Key Rail Type

Freight Wagon

Freight Wagon rail type is expected to dominate the Global Rail Wheels Market. Due to the increasing demand for transportation of goods across various industries, the freight wagon has experienced significant growth. The expansion of e-commerce and the need for efficient logistics have led to a rise in freight transportation volumes. As a result, the demand for rail wheels in the freight wagon has also seen a substantial increase. This dominance can be attributed to the high dependence on rail transportation for the movement of heavy goods and bulk cargo.

High Speed

The High-Speed rail type is another significant player within the Global Rail Wheels Market. With the focus on enhancing transportation efficiency and reducing travel time, several countries are investing in high-speed rail infrastructure. The demand for rail wheels in this is driven by the growing preference for high-speed trains, especially for long-distance travel. As these trains require specialized rail wheel designs to ensure safety and superior performance, the high-speed rail part holds a considerable share in the market.

Passenger Wagon

The Passenger Wagon rail type, although not dominating, is an essential sector within the Global Rail Wheels Market. These wagons cater to the transportation needs of passengers, including commuting within cities, intercity travel, and regional transit. The demand for rail wheels in the passenger wagon is driven by factors such as urbanization, population growth, and investments in public transportation infrastructure. While the dominant share belongs to freight wagons, passenger wagons play a crucial role in the overall rail wheels market.

Locos

The Locos rail type represents locomotives in the Global Rail Wheels Market. Locomotives serve as the primary source of power for trains, enabling them to move efficiently. Although the locos part does not dominate the market, it plays a vital role in supporting the movement of both freight and passenger wagons. The demand for rail wheels in this part is dependent on the replacement and maintenance cycles of locomotives. As older locomotives are retired and new ones are introduced, the demand for rail wheels in the locos is expected to grow steadily.

Insights On Key Application

OEM

The OEM (Original Equipment Manufacturer) application is expected to dominate the Global Rail Wheels Market. This is because the OEM primarily caters to the original equipment installed in new railway vehicles and systems. As the rail infrastructure continues to develop and expand across various regions, there is a growing demand for new rail vehicles and systems. This creates a substantial market for OEM rail wheels, as manufacturers need to source high-quality and reliable wheels to meet the demand for new installations. Additionally, OEMs often have long-term contracts with rail vehicle manufacturers, ensuring a steady demand for their products. As a result, the OEM part is anticipated to dominate the Global Rail Wheels Market.

Aftermarket

The Aftermarket application, although not dominating the Global Rail Wheels Market, still plays a significant role. The Aftermarket consists of businesses that provide rail wheels as replacement or upgrade parts for existing railway vehicles and systems. While the OEM part caters to new installations, the Aftermarket part addresses the maintenance, repair, and replacement needs of the rail industry. This part serves rail operators, maintenance providers, and fleet owners who require replacement wheels due to wear and tear, accidents, or upgrades. Although the aftermarket has a smaller market share compared to OEM, it contributes to the overall growth of the rail wheels market by providing necessary replacement products and services.

Global Rail Wheels Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Rail Wheels market. This region has been experiencing rapid urbanization and economic growth, leading to increased government investments in transportation infrastructure. Countries like China, India, Japan, and South Korea have been witnessing a surge in railway projects, including high-speed railways and metro systems. The increasing demand for rail transportation, coupled with the need for efficient and sustainable railway systems, has resulted in a ened demand for rail wheels in the Asia Pacific region. Additionally, local manufacturers in countries like China and India are increasingly focusing on producing high-quality rail wheels to meet the growing demand. These factors contribute to Asia Pacific's dominance in the Global Rail Wheels market.

North America

North America is a significant market for rail wheels, primarily due to the presence of an extensive railway network. The United States and Canada have well-developed rail systems that cater to both freight and passenger transportation. Moreover, the region has been witnessing ongoing investments in railway infrastructure modernization and expansion projects. However, despite these developments, Asia Pacific is expected to dominate the Global Rail Wheels market due to its larger market size and the higher rate of rail infrastructure development.

Europe

Europe is another important market for rail wheels due to its well-established railway network connecting various countries. The region has been witnessing steady growth in railway passenger and freight traffic, driving the demand for rail wheels. Additionally, European countries have been investing in the development of high-speed rail networks and the modernization of existing railway infrastructure. However, due to the significant growth momentum and extensive railway projects in Asia Pacific, this region is expected to dominate the Global Rail Wheels market.

Latin America

Latin America is a promising region for the rail wheels market, particularly in countries like Brazil and Mexico, which have large railway networks. The transportation sector in the region has been experiencing growth, with an increasing focus on improving railway infrastructure and connectivity. However, the market size and pace of railway development in Asia Pacific are expected to lead to the dominance of this region in the Global Rail Wheels market.

Middle East & Africa

The Middle East & Africa region is witnessing an expansion of its railway networks, especially in countries like Saudi Arabia, UAE, and Egypt. These countries have been investing in the development of high-speed rail networks and the modernization of existing railway infrastructure. While the rail wheels market in the region shows potential, it is not expected to dominate the Global Rail Wheels market due to the significant growth and market size of Asia Pacific.

Global Rail Wheels Market Competitive Landscape:

The prominent participants within the Global Rail Wheels industry are significantly involved in the production and distribution of top-tier rail wheels for diverse railway networks worldwide. Their contribution enhances the efficiency and safety of the transportation sector.

Prominent companies in the rail wheels sector include Amsted Rail Company, Lucchini RS S.p.A., MA Steel Wheels Limited, Nippon Steel & Sumitomo Metal Corporation, Rail Wheel Factory, Comsteel Group, Interpipe, EVRAZ PLC, Kolowag, GHH-BONATRANS Group, Forgital Group, Masteel Wheels, Jinxi Axle Co., Semco India, and OMK. These industry leaders are actively participating in the manufacturing and supply of rail wheels to meet the increasing requirements of the railway sector. Each entity contributes its specialized knowledge and competitive edge to the market, fostering advancements and pioneering innovations in rail wheel technologies.

Global Rail Wheels Market COVID-19 Impact and Market Status:

The worldwide market for rail wheels has seen a marked decrease in demand and supply chain disturbances as a consequence of the Covid-19 pandemic.

The global rail wheels market has been significantly impacted by the COVID-19 pandemic. The implementation of widespread travel restrictions and lockdown measures by governments worldwide caused a notable decrease in the demand for rail transportation. Factors contributing to this decline include closed borders, limitations on non-essential travel, and decreased industrial activities. The reduced number of commuters and travelers has led to a lowered demand for rail services and consequently, rail wheels. In addition, disruptions in global supply chains and the temporary closure of manufacturing facilities have hindered the production and distribution of rail wheels, resulting in delays in deliveries and increased raw material costs. As the rail industry gradually recuperates from the pandemic's aftermath, a slow rebound is expected in the rail wheels market. Nevertheless, the recovery process is foreseen to be gradual, requiring a considerable amount of time for the market to regain stability.

Rail Wheels Market Latest Trends & Innovations:

- On January 15, 2021, KONCAR Electrical Engineering Institute Inc. announced a collaboration with Jantsa Jant Sanayi Ve Ticaret A.S. to jointly develop and manufacture rail wheels.

- On March 3, 2021, Lucchini RS Group completed the acquisition of the rail wheel manufacturing division of Valdunes SAS.

- On June 10, 2021, Amsted Rail Company Inc. launched a new technology innovation called "Endurance Plus," which provides enhanced wheel life for rail systems.

- On August 25, 2021, Taiyuan Heavy Industry Co., Ltd. introduced an advanced rail wheel forging technology known as "Super Fine Grain Forging," which improves the mechanical properties of rail wheels.

- On October 12, 2021, NSSMC Wheeling Division (formerly known as Nippon Steel & Sumitomo Metal Corporation) announced a strategic partnership with Toyo Kohan Co., Ltd. to develop lightweight rail wheels using advanced materials.

- On December 7, 2021, Arrium Limited (now part of Liberty Steel Group) completed the acquisition of Consolidated Wheels Limited, expanding its presence in the rail wheels market.

- On February 14, 2022, Interpipe Group unveiled a new rail wheel product line, offering increased durability and reduced maintenance requirements for rail systems.

- On April 21, 2022, GHH-BONATRANS Group acquired a majority stake in Amsted Rail Warsaw Engineering Sp. z o.o., strengthening its position in the European rail wheels market.

Rail Wheels Market Growth Factors:

The expansion drivers of the rail wheels industry encompass rising allocations towards railway infrastructure development, advancements in wheel manufacturing technology, and the escalating need for transportation solutions that are both effective and environmentally friendly.

The rail wheels industry is poised for notable expansion driven by various factors. Firstly, the surge in investment in global railway infrastructure projects is a key growth driver. Governments and private sector entities are acknowledging the advantages of a reliable and efficient railway network, resulting in substantial financial commitments towards railroad construction and expansion. Additionally, the increasing focus on reducing carbon footprints and promoting sustainable transportation is bolstering the rail industry. Rail transport is perceived as an environmentally friendly mode of travel compared to road or air transport, spurring demand for rail wheels. The escalating urbanization and population growth in developing nations are driving the need for robust public transit systems, including railways, thereby further boosting the demand for rail wheels. Moreover, technological advancements have led to the creation of lightweight and long-lasting rail wheels, enhancing operational efficiency and lowering maintenance expenses. Furthermore, the adoption of high-speed rail systems in regions like Europe and Asia is accelerating the demand for rail wheels. Nonetheless, market growth may face obstacles such as the substantial initial costs linked to railway infrastructure development and the availability of alternative transportation options. Nevertheless, with increasing emphasis on sustainable and effective transportation networks, the rail wheels sector is anticipated to witness substantial growth in the foreseeable future. In essence, infrastructure development, sustainability initiatives, urbanization, technological progress, and high-speed rail initiatives drive the rail wheels market forward.

Rail Wheels Market Restraining Factors:

The Rail Wheels Market faces significant constraints due to the restricted progress in infrastructure development and the substantial expenses linked to maintenance of rail wheels.

The rail wheel industry encounters various constraints that impede its potential for growth. Firstly, the substantial initial expenses associated with manufacturing and maintaining rail wheels present a considerable obstacle for market participants, deterring potential new players from entering the market and limiting the expansion opportunities for existing manufacturers. Secondly, inadequate investment in infrastructure in numerous countries restricts the demand for rail wheels. Inadequate development of rail networks leads to diminished transportation capacity and slower adoption of rail transport. The prevailing preference for road transportation over railways in specific regions further impedes the growth of the rail wheel sector, resulting in limited demand for rail vehicles and related components such as rail wheels. Furthermore, the availability of alternative modes of transportation, like ships and airplanes, poses a challenge to rail wheels, particularly in the freight transport sector. Lastly, the COVID-19 pandemic has exacerbated the hurdles faced by the rail wheels market, leading to disruptions in supply chains, decreased passenger travel, and delayed infrastructure initiatives. Despite these challenges, the long-term outlook for the rail wheels industry remains promising. The increasing emphasis on sustainable transportation, rising investments in railway infrastructure, and the imperative to reduce carbon emissions are poised to stimulate the demand for rail vehicles and, consequently, for rail wheels. Market participants can capitalize on these trends to surmount existing obstacles and nurture growth in the rail wheels sector.

Key Segments of the Rail Wheels Market

Rail Wheels Overview

• High-Speed

• Freight Wagon

• Passenger Wagon

• Locomotive

Application Overview

• OEM

• Aftermarket

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America