Railway Cybersecurity Market Analysis and Insights:

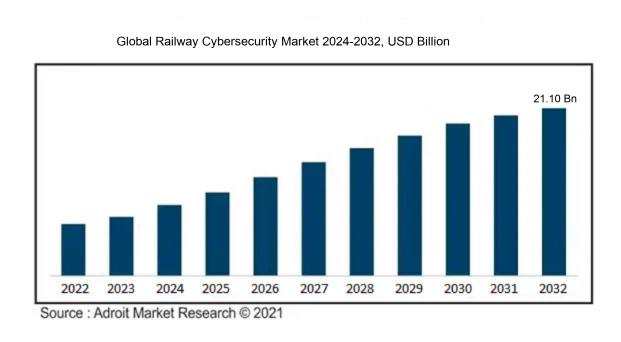

At a compound annual growth rate (CAGR) of 11.4%, the worldwide railway cybersecurity market is anticipated to reach USD 9.77 billion in 2024 and USD 21.10 billion by 2032.

The Railway Cybersecurity Market is influenced by various interrelated elements, notably the rising digitalization of rail systems, which exposes them to greater cyber threat risks. An increased emphasis on safety and security within transportation infrastructure, propelled by regulatory requirements and the necessity for effective incident response protocols, contributes to market expansion. The push towards adopting cutting-edge technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics—aimed at improving operational efficiency—demands enhanced cybersecurity protocols. Additionally, the surge in cyberattacks targeting vital infrastructure ens the necessity for comprehensive cybersecurity solutions. The transition towards automated and interconnected train systems further escalates the need for advanced cybersecurity frameworks. Moreover, initiatives from governments and regulatory agencies aimed at strengthening cybersecurity standards within the rail industry highlight the critical importance of protecting sensitive information and preserving public confidence in railway services. Together, these dynamics create a pressing demand for innovative cybersecurity solutions that adapt to the shifting railway environment.

Railway Cybersecurity Market Definition

Railway cybersecurity involves the strategies and protocols designed to defend railway networks and their data from cyber threats and attacks. This field focuses on securing essential infrastructure such as signaling systems, communication networks, and operational technologies to maintain safety and reliability in transportation services.

The importance of cybersecurity in the railway sector cannot be overstated, particularly as the trend towards greater digitization and interconnectedness of railway systems continues to rise. While such advancements can lead to improved operational efficiency, they also open up avenues for potential cyber threats. A cyberattack on these systems could have severe consequences, disrupting train services, jeopardizing safety measures, and risking the well-being of passengers. Furthermore, the integration of railway systems with essential infrastructure means that any vulnerabilities could produce significant repercussions that extend beyond the railways themselves, potentially affecting critical services like the power grid and emergency response units. As dependence on technological solutions escalates, implementing strong cybersecurity protocols becomes essential not only for safeguarding railway operations but also for ensuring public and national safety. This highlights the critical need for ongoing vigilance and the continuous enhancement of defenses in response to the evolving landscape of cyber threats.

Railway Cybersecurity Market Segmental Analysis:

Insights On Component

(Solution) Risk and Compliance Management

Risk and Compliance Management is anticipated to lead the Global Railway Cybersecurity Market. The increasing regulatory pressure and the high stakes associated with data breaches in the railway sector make this area crucial. Organizations are focusing heavily on establishing robust compliance frameworks to mitigate risks associated with cyber threats. The necessity for aligning with governmental and industry regulations drives the demand for effective risk management strategies. Moreover, investment in compliance solutions is considered essential to protect sensitive operational data and ensure continuous safety, making this sector the most significant driver of market growth.

Intrusion Detection System

Intrusion Detection Systems play a vital role in monitoring network traffic for suspicious activities and potential threats. As railway systems modernize and become increasingly interconnected, the need for real-time threat detection and response grows. These systems are essential for maintaining cybersecurity integrity in the railway infrastructure, safeguarding against unauthorized access and cyberattacks. Their criticality in the early detection of security breaches ensures that organizations can respond proactively, which ens their demand despite not being the leading category.

Encryption

Encryption is a key technology designed to secure data, ensuring that sensitive information remains confidential during transmission and storage. In the railway sector, where operational and passenger data is at risk, robust encryption methods are crucial. The impact of cyber threats has prompted railway organizations to implement strong encryption protocols to protect data against interception and unauthorized access. While important, the rapid implementation of risk and compliance frameworks gives the edge to Risk and Compliance Management over Encryption in market domination.

Firewall

Firewalls serve as a first line of defense against cyber threats by controlling incoming and outgoing traffic and preventing unauthorized access. In the context of railway cybersecurity, robust firewalls are essential for protecting critical infrastructure and IT systems from cyberattacks. As railway networks become more advanced, the importance of advanced firewalls that can mitigate sophisticated attack vectors continues to escalate. However, the broader scope and comprehensive approach offered by risk and compliance management solutions overshadow the standalone effectiveness of firewalls in this market.

Antivirus

Antivirus solutions are designed to detect and eliminate malware, safeguarding railway systems from various cyber threats. With the increasing sophistication of cyberattacks targeting transport infrastructure, the demand for effective antivirus software is growing. Nonetheless, antivirus solutions are often seen as just one component of a broader cybersecurity framework. As focus shifts toward holistic risk management strategies that encompass multiple layers of security, antivirus technologies may not achieve dominant status compared to risk and compliance management approaches in the cybersecurity market for railways.

(Services) Design and Implementation

Design and Implementation services are critical in establishing a robust cybersecurity posture for railway systems. These services ensure that the security measures are effectively integrated into existing infrastructure, aligning with the frameworks of modern railway operations. Organizations recognize the importance of these services in customizing solutions tailored to their unique needs. However, while necessary, they typically support the overarching compliance and risk management efforts, which ultimately take precedence in driving market growth.

Risk and Threat Assessment

Risk and Threat Assessment services are pivotal in identifying vulnerabilities within railway systems and evaluating potential impacts of various cyber threats. They offer organizations critical insights that inform the development of tailored cybersecurity practices. Given the ever-evolving threat landscape, these assessments are indispensable for strategic planning. Nevertheless, they mainly serve as foundational steps in the broader approach of risk and compliance management, hence gaining lesser attention in terms of market dominance but still vital for organizational safety.

Support and Maintenance

Support and Maintenance services ensure the continued effectiveness of cybersecurity solutions in railway environments. Regular updates, monitoring, and issue resolution are fundamental to maintaining the health of cybersecurity systems. These services contribute to the long-term resilience against evolving threats; however, their importance is overshadowed by the proactive nature of comprehensive risk and compliance frameworks, which drive initial and ongoing investments in cybersecurity strategies across the railway sector.

Insights On Type

Infrastructural

The Infrastructural component of the Railway Cybersecurity Market is estimated to dominate the market as it encompasses the protection of the railway's foundational systems, including signaling, communications, and control networks. While it faces challenges in terms of legacy systems and compliance with evolving security regulations, investments are being made to enhance these infrastructures against potential threats. Governments and railway organizations recognize the importance of securing infrastructure as it ensures the smooth operation of railway services. Thus, while not the dominant part, it remains an essential area driving technology advancements and strategies for comprehensive security in railways.

On-Board

With respect to On-Board security, over the years, many railway operators have prioritized implementing measures that protect the systems directly installed in trains and rolling stock. This includes cybersecurity protocols surrounding passenger data, ticketing systems, and service reliability mechanisms. The rapid evolution of technology such as connected devices and automated systems necessitates that operators remain vigilant against potential threats. Consequently, while On-Board measures are gaining attention due to their vital role in operational safety, they are currently supplemented by the need for broader infrastructural security enhancements to create comprehensive protections.

Insights On Security Type

Data Protection

Data Protection is anticipated to dominate the Global Railway Cybersecurity Market as it remains a key focus in the context of railway cybersecurity, particularly concerning sensitive passenger information, operational data, and financial records. With regulations such as GDPR emphasizing the importance of data privacy, railway operators must adopt stringent measures to ensure their data is secure against leaks and breaches. The complexity and volume of data generated within the railway ecosystem increase the necessity for specialized solutions tailored to protect such information. As public and governmental expectations grow regarding data handling practices, investment in data protection technologies is likely to see a consistent rise.

Network Security

Network Security is another crucial security type of Global Railway Cybersecurity Market due to the increasing threats that railway systems face from cyber attacks targeting infrastructure and data integrity. The railway sector’s reliance on interconnected systems means vulnerabilities in network security can lead to severe operational disruptions and safety hazards. As rail operations become increasingly digitized, the need for robust network protections is paramount, leading to ened investments from railway operators in advanced network security solutions. Additionally, regulatory frameworks are pushing organizations to prioritize network security, driving the demand for innovative solutions that ensure the secure flow of information across their operational landscapes.

Application Security

Application Security is crucial to ensuring the safety of the various software applications used within the railway infrastructure. Given that numerous operational tasks rely on dedicated applications, any vulnerabilities can lead to unauthorized access and potential disruptions to services. Consequently, companies are investing in methods to secure applications against threats such as code injections and data breaches. Furthermore, as applications evolve to include more integrated functionalities, organizations must adopt a proactive approach to safeguard them, making this a significant focus area in the broader context of railway cybersecurity.

End Point Security

End Point Security is essential for safeguarding the devices used within railway operations, including computers, servers, and mobile devices. As these endpoints serve as primary access points to networks, they present substantial risks if not adequately secured. The proliferation of remote and mobile work has increased the potential attack vectors, prompting the need for sophisticated end point protection measures. As a result, companies are bending towards comprehensive end point security strategies that not only mitigate threats but also enhance operational resilience against cyber attacks targeting these critical points in their infrastructure.

System Administration

System Administration plays an integral role in managing and securing network environments within the railway sector. Effective system administration ensures that configurations are optimally set and that systems are regularly updated to fend off new vulnerabilities. Skilled system administrators are vital for routine monitoring and patch management, which are essential tasks for maintaining overall system integrity. However, compared to other security facets, the focus here is often secondary since companies may prioritize more visible areas like network security and application protection, even though the importance of sound system administration is both critical and foundational to a complete cybersecurity strategy.

Insights On Application

Passenger Trains

The passenger trains category is expected to dominate the Global Railway Cybersecurity Market. This dominance is largely driven by the increasing focus on passenger safety and the rising use of advanced technologies in the transportation sector. With the proliferation of internet connectivity and smart systems on trains, the vulnerabilities to cyber threats have amplified, prompting rail operators to prioritize cybersecurity investments. Moreover, the growing number of passengers and their demand for secure, efficient, and reliable travel experiences necessitate robust cybersecurity measures. As a result, rail companies are implementing advanced security protocols and investing more heavily in technologies tailored to protect passenger infrastructure and sensitive data exchanges.

Freight Trains

Freight trains represent a significant portion of the railway ecosystem, but they do not overshadow the passenger market in terms of cybersecurity needs. While there are concerns regarding the security of cargo and logistics, the advantages of minimizing operational disruptions via cybersecurity measures are not as imperative. The focus largely remains on efficiency and cost-effectiveness rather than the extensive implementation of sophisticated cybersecurity measures, making it a secondary player in the overall market landscape. Nevertheless, increased digitization in freight operations is gradually bringing attention to cybersecurity, leading to enhanced measures over time.

Global Railway Cybersecurity Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Railway Cybersecurity market primarily due to the rapid growth of the railway infrastructure across countries such as China, India, Japan, and Australia. These nations are significantly investing in modernizing their rail networks and integrating advanced technologies, which in turn necessitates robust cybersecurity measures. The increase in cyber threats, coupled with regulatory requirements for enhanced safety protocols, is pushing railway operators to prioritize cybersecurity solutions. Furthermore, the region's booming manufacturing and technology sectors are leading to innovations in cybersecurity solutions tailored for the rail industry, establishing Asia Pacific as the most influential player in this market.

North America

North America holds a substantial position in the Global Railway Cybersecurity market, primarily due to the advanced infrastructure in the United States and Canada. Rail operators in this region routinely face sophisticated cyber threats, leading to an increased demand for cybersecurity solutions. Government initiatives promoting cybersecurity frameworks and compliance standards bolster the market further. The presence of leading technology firms and cybersecurity companies enables partnerships and innovation, ensuring that the region remains competitive despite having a significant focus on ensuring safety regulations.

Europe

Europe is gradually emerging as a critical region in the Global Railway Cybersecurity market, driven by stringent regulations and safety mandates. The European Union is pushing for integrated transport networks, which increases the focus on enhancing digital security across its rail systems. Countries like Germany, France, and the UK are investing in advanced cybersecurity technologies to safeguard their critical infrastructure. The European railway sector's collaboration with technology firms aids in adopting best practices and new technologies, making the region a significant player in addressing railway cybersecurity challenges.

Latin America

Latin America is witnessing a steady growth in the Global Railway Cybersecurity market, though it lags behind other regions. The increasing adoption of railway systems, alongside rising incidents of cyber-attacks, is lending urgency to the need for cyber protection. However, economic and regulatory challenges limit investment levels in advanced cybersecurity technologies. Countries with emerging economies, such as Brazil and Argentina, are gradually recognizing the importance of cybersecurity in their rail systems, indicating a positive trend towards establishing a more secure railway environment in the long term.

Middle East & Africa

The Middle East & Africa region is currently one of the least developed markets for railway cybersecurity. Despite investments in railway infrastructure projects, cybersecurity challenges remain prevalent and often overlooked. Emerging markets in Africa are beginning to address cybersecurity, although progress is slow due to financial constraints and limited technological expertise. In contrast, the Middle East is investing in smart city initiatives and advanced transport logistics, which might stimulate future growth in the railway cybersecurity sector as these nations prioritize protecting critical infrastructure from cyber threats.

Railway Cybersecurity Competitive Landscape:

Major contributors in the global railway cybersecurity sector, comprising both technology developers and service firms, play a vital role in creating effective security measures designed to safeguard essential infrastructure against cyber hazards. Their responsibilities include evaluating risks, identifying threats, and ensuring adherence to regulations, all of which are essential for improving the safety and resilience of railway networks.

Prominent companies in the Railway Cybersecurity sector comprise ABB Ltd., Alstom SA, Cisco Systems, Inc., DLT Solutions, Fortinet, Inc., General Electric Company, IBM Corporation, Hitachi, Ltd., Siemens AG, Thales Group, Hexagon AB, Honeywell International Inc., McAfee LLC, Motorola Solutions, Inc., and NEC Corporation.

Global Railway Cybersecurity COVID-19 Impact and Market Status:

The Covid-19 pandemic hastened the allocation of resources towards cybersecurity within the worldwide railway industry, as organizations emphasized safeguarding essential infrastructure in the face of rising cyber threats.

The COVID-19 pandemic has profoundly affected the railway cybersecurity sector, catalyzing the swift integration of digital technologies and revealing weaknesses within essential infrastructure. As rail operators become more dependent on interconnected systems for their operations, there has been a marked increase in the demand for comprehensive cybersecurity strategies, driven by a growing understanding of cyber risks. The necessity for remote monitoring and management during the pandemic has led to greater investment in sophisticated cybersecurity solutions aimed at protecting systems from potential intrusions and data breaches. Initially, the economic downturn caused by the pandemic resulted in budget cuts; however, it ultimately prompted an escalation in spending as organizations acknowledged the critical need for cybersecurity resilience to ensure ongoing operations. As a result, the railway cybersecurity market is set to expand, with stakeholders focusing on strengthening security measures and incorporating cutting-edge technologies like artificial intelligence and machine learning to more effectively predict and counter cyber threats in this dynamic environment.

Latest Trends and Innovation in The Global Railway Cybersecurity Market:

- In July 2021, Siemens Mobility announced the acquisition of Nomad Digital, a UK-based company specializing in connectivity solutions for transportation. This acquisition aims to enhance the cybersecurity measures of Siemens' railway solutions through advanced digital communication technologies.

- In November 2022, Alstom unveiled its new cybersecurity solution, "Alstom Cybersécurité," designed to safeguard railway operations against cyber threats. This solution incorporates advanced data encryption techniques and machine learning algorithms, enhancing the overall security of railway systems.

- In February 2023, Honeywell launched a comprehensive cybersecurity service tailored for the railway sector, emphasizing risk management and incident response. This service aims to help railway operators detect vulnerabilities and establish robust defenses against emerging cyber threats.

- In March 2023, Thales Group partnered with the French National Railway Company (SNCF) to implement advanced cybersecurity measures in the SNCF rail network. This collaboration is focused on improving the resilience of railway operations against cyber-attacks through threat intelligence and real-time monitoring.

- In April 2023, Cisco announced the expansion of its cybersecurity portfolio specifically for critical infrastructure sectors, including railways. The update includes new features for network protection, endpoint security, and incident response tailored to the unique challenges faced by railway systems.

- In August 2023, Bombardier and IBM announced a joint venture to develop a suite of AI-driven cybersecurity tools for railway operators, aiming to proactively detect and mitigate potential cyber threats. This initiative is expected to improve the safety and reliability of rail operations globally.

- In September 2023, the UK’s Department for Transport funded a £2 million project in partnership with various railway operators and cybersecurity firms to enhance the resilience of cybersecurity practices in the railway sector amid increasing digital threats.

Railway Cybersecurity Market Growth Factors:

The expansion of the Railway Cybersecurity Market is fueled by the escalating digitization of railway infrastructures, an uptick in cyber threats, and the imperative to adhere to rigorous safety standards.

The Railway Cybersecurity Market is witnessing notable expansion driven by several pivotal elements. Primarily, an uptick in cyber threats targeting transportation systems, particularly rail networks, has ened the urgency for effective cybersecurity protocols to ensure the protection of sensitive information and the integrity of operations. In addition, the globalization of trade and the progress in digital technologies for rail systems—such as the Internet of Things (IoT) and automated train operations—demand the implementation of stronger security measures to shield interconnected systems from potential threats.

Moreover, governments around the globe are enacting rigorous regulations and compliance requirements to enhance cybersecurity within the rail sector, which in turn propels investments in defensive technologies. The increasing implementation of intelligent rail solutions aimed at boosting operational efficiency and enhancing passenger experience further escalates the need for sophisticated cybersecurity frameworks.

As awareness of the risks tied to the convergence of operational technology (OT) and information technology (IT) grows, railway operators and other stakeholders are more inclined to adopt all-encompassing cybersecurity strategies. Finally, the market's growth is bolstered by ongoing partnerships among governments, infrastructure developers, and cybersecurity companies focused on crafting innovative security solutions that address the distinct challenges faced by the rail industry. Together, these dynamics forge a conducive landscape for the ongoing development of the Railway Cybersecurity Market.

Railway Cybersecurity Market Restaining Factors:

Significant obstacles impeding the expansion of the railway cybersecurity sector encompass constrained financial resources, the intricate task of incorporating novel security solutions into pre-existing systems, and a lack of qualified cybersecurity experts.

The Railway Cybersecurity Market encounters multiple constraints that may hinder its progress and expansion. A primary obstacle is the substantial investment required for advanced cybersecurity solutions, which may discourage smaller operators from making necessary technological commitments. Moreover, many railway networks rely on outdated legacy systems that are incompatible with contemporary cybersecurity strategies, posing significant challenges to successful security integration. Additionally, a notable deficiency of skilled cybersecurity experts, especially those familiar with railway infrastructure, presents a serious issue, as organizations find it increasingly difficult to recruit the appropriate talent needed to safeguard essential assets. Complicating matters further are regulatory complexities and differing compliance standards across regions, which can result in confusion and escalate operational expenses for railway operators. Furthermore, there is often insufficient recognition of the critical importance of cybersecurity within the railway industry, leading to a lack of prioritization at the executive levels. Acknowledging these challenges opens up avenues for industry participants to collaborate and innovate, ultimately fostering the creation of customized solutions that improve the overall security framework of the railway sector and ensure safe, efficient operations for future developments.

Key Segments of the Railway Cybersecurity Market

By Component

- Solution

- Risk and Compliance Management

- Intrusion Detection System

- Encryption

- Firewall

- Antivirus

- Services

- Design and Implementation

- Risk and Threat Assessment

- Support and Maintenance

By Type

- Infrastructural

- On-Board

- By Security Type

- Network Security

- Application Security

- Data Protection

- End Point Security

- System Administration

By Application

- Passenger Trains

- Freight Trains

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America